“Strong Men Create Good Times” is a phrase that resonates deeply with the annals of history. It’s a reflection of the undeniable truth that formidable leaders, with their unwavering vision and determination, have the power to usher in eras of abundance and prosperity. But what lies behind this statement? What is the secret alchemy that these leaders possess, enabling them to transform challenges into opportunities, especially in the financial realm? As we embark on this exploration, we’ll uncover the essence of this phrase and the profound impact of leadership on financial success.

Table of Contents

Historical Context

The Legacy of Leadership and Prosperity

Throughout history, the world has witnessed periods of immense prosperity and growth, often under the guidance of formidable leaders. These leaders, with their vision, resilience, and determination, have played pivotal roles in shaping the economic landscapes of their times.

Origins of the Phrase

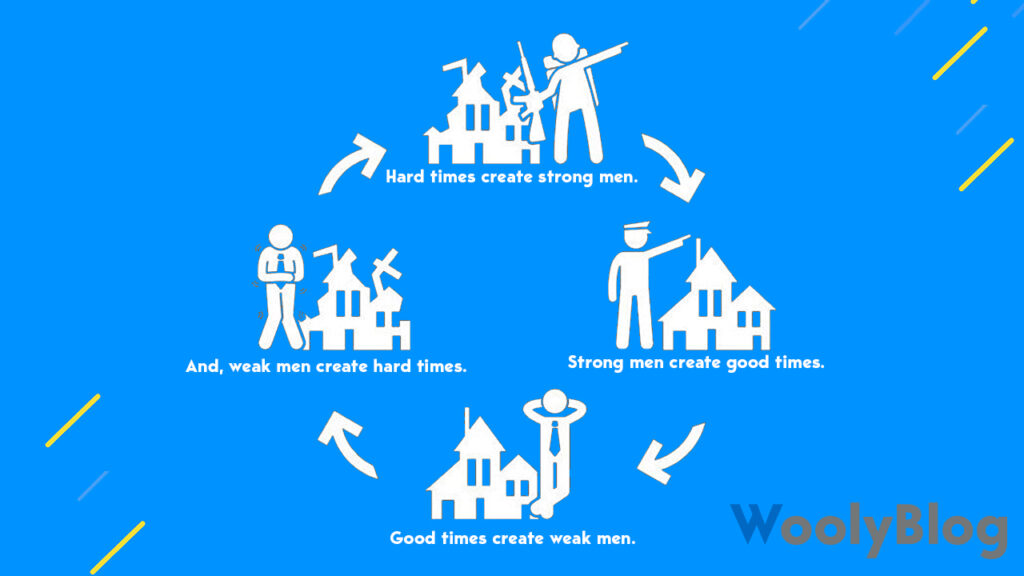

The phrase “Strong Men Create Good Times” is part of a larger proverb often cited as,

“Strong men create good times, good times create weak men, weak men create hard times, and hard times create strong men.”

G. Michael Hopf

This saying encapsulates the cyclical nature of history, emphasizing the interplay between prosperity, adversity, and leadership. While its exact origins are debated, it’s widely accepted as a reflection on the patterns of history where periods of peace and prosperity often give rise to complacency, leading to challenges that require strong leadership to overcome.

From Ancient Civilizations to Modern Empires

| Historical Period | Key Figures | Achievements & Contributions |

|---|---|---|

| Ancient Egypt | Pharaohs like Ramses II | Expanded territories and ushered in eras of architectural wonders and cultural advancements. |

| The Golden Age of Athens | Leadership of Pericles | Experienced intellectual and artistic growth, laying the foundations for Western civilization. |

| Renaissance Florence | The Medici family | As patrons of the arts and finance magnates, they played a crucial role in the Renaissance marked by advancements in art and science. |

| Industrial Revolution | Visionaries like Andrew Carnegie and John D. Rockefeller | Transformed the economic fabric of the 19th century, leading to unprecedented growth and innovation. |

Modern Financial Titans

In more recent times, figures like Changpeng Zhao, Brian Armstrong, and Mike Novogratz have exemplified how strong leadership, combined with vision and innovation, can create economic booms and redefine industries.

The Psychology of Financial Motivation

The human psyche is a complex web of desires, ambitions, and motivations. When it comes to financial motivation, it’s not just about the allure of wealth; it’s about the deeper psychological triggers that drive individuals towards economic success. Let’s delve into the intricate world of financial motivation and understand its foundational pillars.

Intrinsic vs. Extrinsic Motivation

Intrinsic Motivation

This refers to the internal drive that pushes individuals to achieve for the sheer joy of accomplishment. It’s the passion for a craft, the love for innovation, or the personal satisfaction derived from overcoming challenges.

Extrinsic Motivation

This is driven by external rewards, such as bonuses, promotions, or recognition. While powerful, it’s essential to strike a balance, ensuring that external rewards don’t overshadow intrinsic passion.

The Role of Dopamine

Dopamine, often dubbed the “reward molecule,” plays a pivotal role in financial motivation. When we achieve a financial goal or receive a monetary reward, our brain releases dopamine, creating a sense of pleasure and reinforcing the behavior that led to that reward. This cycle can drive individuals to continuously seek financial success.

Goal Setting and Achievement

Setting clear, measurable financial goals acts as a roadmap guiding individuals towards success. The process of setting, pursuing, and achieving these goals can significantly boost motivation. The satisfaction derived from ticking off a financial milestone can be a powerful motivator in itself.

The Fear of Loss vs. The Joy of Gain

Two primary forces drive financial decisions: the fear of losing money and the joy of gaining it. While the joy of gain can motivate individuals to take risks and seek opportunities, the fear of loss can be a grounding force, ensuring cautious and informed decisions.

Social Comparisons and Financial Aspirations

Humans inherently compare themselves to peers. Witnessing someone in one’s circle achieve financial success can act as a potent motivator. It can spark ambition, drive competition, and set new benchmarks for personal financial goals.

The Power of Recognition

Beyond tangible rewards, recognition can be a profound motivator. Being acknowledged for one’s financial acumen, strategies, or successes can boost confidence and drive further ambition.

Case Studies

From Visionaries to Billionaires: The Leaders Shaping the Digital Gold Rush.

The world of cryptocurrency has given rise to a new breed of financial leaders. These individuals, through their foresight, innovation, and risk-taking, have not only amassed significant wealth but have also played pivotal roles in shaping the crypto landscape. Let’s delve into the journeys of some of these crypto magnates.

Changpeng Zhao – Binance’s Beacon

The CEO of Binance, Changpeng Zhao, often referred to as CZ, has been a tech enthusiast since his younger days.

Achievements

After taking a significant risk by selling his apartment in 2014 and investing heavily in his vision, CZ transformed Binance into a crypto behemoth with over 150 million users and more than 600 cryptocurrencies. Today, he holds about 30% of the company, making him one of the richest players in the crypto world.

Will try to keep 2023 simple. Spend more time on less things. Do's and Don'ts.

— CZ 🔶 Binance (@cz_binance) January 2, 2023

1. Education

2. Compliance

3. Product & Service

4. Ignore FUD, fake news, attacks, etc.

In the future, would appreciate if you can link to this post when I tweet "4". 🙏

Brian Armstrong – Coinbase’s Cornerstone

Co-founder and CEO of Coinbase, Brian Armstrong‘s venture has left an indelible mark on the US crypto market.

Achievements

With Coinbase generating an annual revenue of $1 billion, Armstrong’s stake in the company and his vision has solidified his position as a top crypto trader and leader.

1/ I'm sharing the 10 ideas I'm most excited about in crypto right now. If you're building something in crypto or thinking about doing so – check it out.

— Brian Armstrong 🛡️ (@brian_armstrong) August 30, 2023

We’re building lots at Coinbase, but we don't have time to tackle everything. So I figured I'd share these. Bear markets are… pic.twitter.com/XKzCkMaOOT

Vitalik Buterin – Ethereum’s Prodigy

One of the youngest crypto billionaires, Vitalik co-founded Ethereum, bringing smart contracts and decentralized applications to the forefront.

Motivation truly is important. You can keep going longer and focus harder on the mission if you can internally narrativize your intellectual life as a glorious search for freedom, enfranchisement of the weak, human progress, etc. Such energies can't be thrown away completely.

— vitalik.eth (@VitalikButerin) July 7, 2022

Achievements

Beyond Ethereum, Vitalik has been an active voice in the crypto community, sharing insights and contributing to various projects.

Tyler and Cameron Winklevoss – Gemini’s Dynamic Duo

Known for their legal battle with Facebook’s Mark Zuckerberg, the Winklevoss twins ventured into the crypto world with their exchange, Gemini.

Achievements

Both Tyler and Cameron have been instrumental in promoting crypto adoption, with Gemini playing a significant role in the industry.

Mike Novogratz – Galaxy’s Guiding Star

CEO of Galaxy Investment Partners, Mike Novogratz, has been a vocal advocate for cryptocurrency.

Achievements

With 85% of his income stemming from the crypto industry, Novogratz’s investments and insights have made him a key figure in the space.

Joseph Lubin – Ethereum’s Pillar & Consensys’ Creator

Co-founder of Ethereum and contributor to the Consensys project, Joseph Lubin has been a driving force in the crypto ecosystem.

Achievements

Lubin’s ventures, including EthSuisse and Consensys, have contributed significantly to blockchain solutions and the broader industry.

The Role of Financial Education

Financial education, often overlooked in traditional schooling systems, plays a pivotal role in shaping an individual’s economic future. It’s not just about understanding money; it’s about making informed decisions, mitigating risks, and harnessing opportunities. Let’s delve deeper into the significance of financial education and its multifaceted impact.

Foundation for Financial Independence

- Understanding Money: At its core, financial education teaches individuals about the value of money, its functions, and its potential.

- Budgeting and Saving: Equipped with knowledge, individuals can create budgets, prioritize spending, and cultivate saving habits, laying the groundwork for financial stability.

Risk Management and Investment

- Informed Decision Making: With proper financial education, individuals can assess investment opportunities, understanding potential returns and associated risks.

- Diversification: Knowledge empowers individuals to diversify their investment portfolios, spreading risks and maximizing potential returns.

Debt Management

- Understanding Debt: Financial education demystifies concepts like interest rates, equipping individuals to make informed borrowing decisions.

- Avoiding Debt Traps: With a solid understanding, individuals can avoid predatory lending practices, exorbitant interest rates, and unfavorable loan terms.

Planning for the Future

- Retirement Planning: Financial education emphasizes the importance of early and consistent retirement planning, ensuring a comfortable future.

- Estate Planning: Knowledgeable individuals can effectively plan the distribution of assets, ensuring their loved ones are taken care of.

Consumer Rights and Protection

- Awareness of Rights: Financially educated individuals are aware of their rights as consumers, ensuring they aren’t exploited.

- Fraud Prevention: Knowledge acts as a shield, protecting individuals from scams, fraudulent schemes, and phishing attacks.

Economic Growth and Community Development

- Informed Voting: A financially literate populace can make informed decisions during elections, choosing leaders with sound economic policies.

- Community Upliftment: Financially educated individuals often give back to their communities, either through financial advice, community projects, or local investments.

Challenges and Criticisms

While the narrative of “Strong Men Create Good Times” is compelling, it’s essential to understand that this journey is not without its hurdles. Strong leadership, especially in the financial realm, faces a myriad of challenges and criticisms. Let’s delve into these aspects through a detailed chart that encapsulates the complexities faced by leaders in their quest for financial greatness.

| Challenges / Criticisms | Description | Examples / Implications | Potential Solutions |

|---|---|---|---|

| Over-reliance on a Single Leader | Depending too much on one individual can lead to a lack of diverse perspectives and potential blind spots. | Companies facing downturns after the departure of a visionary leader. | Encourage collaborative leadership and foster a culture of shared responsibility. |

| Resistance to Change | Strong leaders often bring transformative ideas, but these can face resistance from traditionalists or those benefiting from the status quo. | Traditional banks resisting fintech innovations. | Effective communication of the vision and benefits, and involving stakeholders in the change process. |

| Ethical Dilemmas | The drive for financial success can sometimes lead to ethical compromises, tarnishing the reputation of leaders and organizations. | Financial scandals, insider trading, or exploitative practices. | Implementing robust ethical guidelines and ensuring transparency in operations. |

| Economic Volatility | External factors like market crashes, geopolitical events, or pandemics can challenge even the most competent leaders. | The 2008 financial crisis impacting global markets. | Diversification of assets, continuous risk assessment, and having contingency plans in place. |

| Criticism of Wealth Concentration | Strong leaders amassing significant wealth can lead to criticisms about income inequality and the concentration of power. | Billionaires facing criticism for not contributing enough to societal welfare. | Philanthropic initiatives, fair wage practices, and community development projects. |

| Overconfidence and Complacency | Success can sometimes lead to overconfidence, resulting in leaders underestimating challenges or becoming complacent. | Tech startups failing after initial success due to lack of innovation or adaptability. | Continuous learning, seeking feedback, and staying grounded. |

| Balancing Stakeholder Interests | Leaders often have to juggle the interests of various stakeholders, from shareholders and employees to customers and the community. This can lead to conflicts and decision-making dilemmas. | Decisions benefiting shareholders but negatively impacting employees or the environment. | Open dialogue with stakeholders, ethical decision-making, and prioritizing long-term sustainability over short-term gains. |

| Adapting to Technological Disruptions | The rapid pace of technological advancements can render existing business models obsolete, challenging leaders to adapt or risk irrelevance. | Traditional retailers struggling with the rise of e-commerce platforms. | Investing in R&D, fostering a culture of innovation, and continuous upskilling of the workforce. |

| Cultural and Geopolitical Sensitivities | As businesses expand globally, leaders must navigate diverse cultural landscapes and geopolitical sensitivities, which can be complex. | International brands facing backlash due to cultural insensitivity in advertising campaigns. | Cultural sensitivity training, local collaborations, and understanding geopolitical landscapes. |

| Sustainability and Environmental Concerns | The increasing emphasis on sustainability means leaders must consider the environmental impact of their financial decisions, facing criticism if they don’t prioritize this. | Industries like fossil fuels facing challenges due to environmental concerns. | Adopting sustainable practices, investing in green technologies, and aligning with global sustainability goals. |

Practical Tips for Aspiring Leaders

Leadership, especially in the realm of finance, is not just about innate talent; it’s a skill that can be honed and developed. Aspiring leaders looking to make their mark and create good times in the financial world can benefit from understanding the strategies and mindsets of past and present financial leaders. Here’s a deep dive into actionable insights for those aiming to carve their path to leadership excellence.

Embrace Continuous Learning

- Stay Updated: The financial world is ever-evolving. Regularly update yourself with the latest trends, technologies, and market dynamics.

- Formal Education: Consider advanced degrees or certifications in finance, business, or leadership to build a strong foundational knowledge.

- Workshops and Seminars: Attend leadership workshops, webinars, and seminars to gain insights from industry experts.

Cultivate Emotional Intelligence

- Self-awareness: Recognize your strengths and weaknesses. This self-awareness can guide your leadership journey, helping you leverage your strengths and work on areas of improvement.

- Empathy: Understand and resonate with the emotions of your team. An empathetic leader can build stronger, more trusting relationships.

Build a Strong Network

- Mentorship: Seek mentors who have treaded the path you aim to walk. Their guidance can be invaluable.

- Networking Events: Attend industry events, conferences, and seminars. Building relationships with peers, competitors, and industry veterans can open doors to opportunities and collaborations.

Foster a Growth Mindset

- Embrace Failures: Instead of fearing failures, view them as learning opportunities. Analyze what went wrong, learn from it, and iterate.

- Encourage Innovation: Promote a culture where new ideas are welcomed and explored. This fosters creativity and can lead to groundbreaking financial strategies.

Effective Communication

- Clarity: Whether it’s conveying a vision or discussing financial strategies, ensure your communication is clear and concise.

- Active Listening: Listen more than you speak. Understand concerns, feedback, and insights from your team, stakeholders, and clients.

Ethical Leadership

- Integrity: In the financial world, trust is paramount. Always operate with the highest levels of integrity and honesty.

- Transparency: Be open about your decisions, strategies, and the reasons behind them. This builds trust and respect among your team and stakeholders.

Adaptability

- Stay Agile: The financial landscape can change rapidly. Being adaptable ensures you can pivot strategies when required, seizing new opportunities or mitigating risks.

- Continuous Feedback: Regularly seek feedback from your team, peers, and mentors. This helps in course correction and ensures you’re on the right path.

Conclusion

The journey of financial leadership, as encapsulated by the phrase “Strong Men Create Good Times,” is a testament to the transformative power of visionary leadership. Throughout history, from ancient civilizations to the modern crypto titans, strong leaders have consistently demonstrated the ability to shape economic landscapes, drive innovation, and usher in periods of prosperity. However, this journey is not without its challenges. From navigating the complexities of global markets to addressing ethical dilemmas and societal criticisms, leaders must tread with caution, wisdom, and adaptability.

Financial education, a deep understanding of historical contexts, and a commitment to continuous learning are pivotal in this endeavor. As we’ve explored, the psychology of financial motivation, the importance of adaptability in the face of technological disruptions, and the need for ethical and sustainable decision-making are all integral components of this leadership journey.

In essence, “Strong Men Create Good Times” is more than just a statement—it’s a philosophy, a call to action, and a reminder of the responsibilities that come with leadership. As we move forward in this ever-evolving financial landscape, it’s imperative for aspiring leaders to imbibe the lessons from the past, harness the opportunities of the present, and shape a future where prosperity is not just an outcome but a sustained legacy.

FAQs

Why is strong leadership crucial for financial success?

Strong leadership provides direction, instills confidence, and fosters a culture of achievement, all vital for financial growth.

Are financial incentives the only way to motivate?

No, recognition, growth opportunities, and a sense of purpose are equally, if not more, motivating.

Who said strong men create good times?

The phrase “Strong men create good times” is part of a larger proverb that describes the cyclical nature of history: “Strong men create good times, good times create weak men, weak men create hard times, and hard times create strong men.” The phrase is often attributed to G. Michael Hopf, especially in the context of its use in his post-apocalyptic novel, “Those Who Remain.” While variations of the sentiment have been expressed throughout history, G. Michael Hopf popularized this specific phrasing in his book.