In the dynamic world of cryptocurrency, understanding the difference between an angel investors vs venture capitalists can be a game-changer. This article will delve into the roles, risks, and rewards associated with these two types of investors in the crypto space.

Table of Contents

Definition and Overview

Angel Investor

An angel investor is typically a high-net-worth individual who provides capital for a crypto startup in its early stages, usually in exchange for convertible debt or ownership equity. These investors often have a deep understanding of the crypto industry and are willing to take on the high risks associated with investing in a new and volatile market.

Angel investors in crypto might invest in a variety of ventures, such as new blockchain technologies, crypto exchanges, or innovative applications of smart contracts. They often provide more than just capital; many angel investors also offer their expertise, industry connections, and mentorship to help the startup succeed.

Roger Ver

Often referred to as “Bitcoin Jesus,” Roger Ver is one of the earliest investors in Bitcoin-related startups. His investments include Blockchain.info, a popular Bitcoin wallet and explorer; BitPay, a Bitcoin payment service; and Kraken, a Bitcoin exchange. Ver’s early adoption and advocacy for Bitcoin have made him one of the most influential figures in the crypto industry.

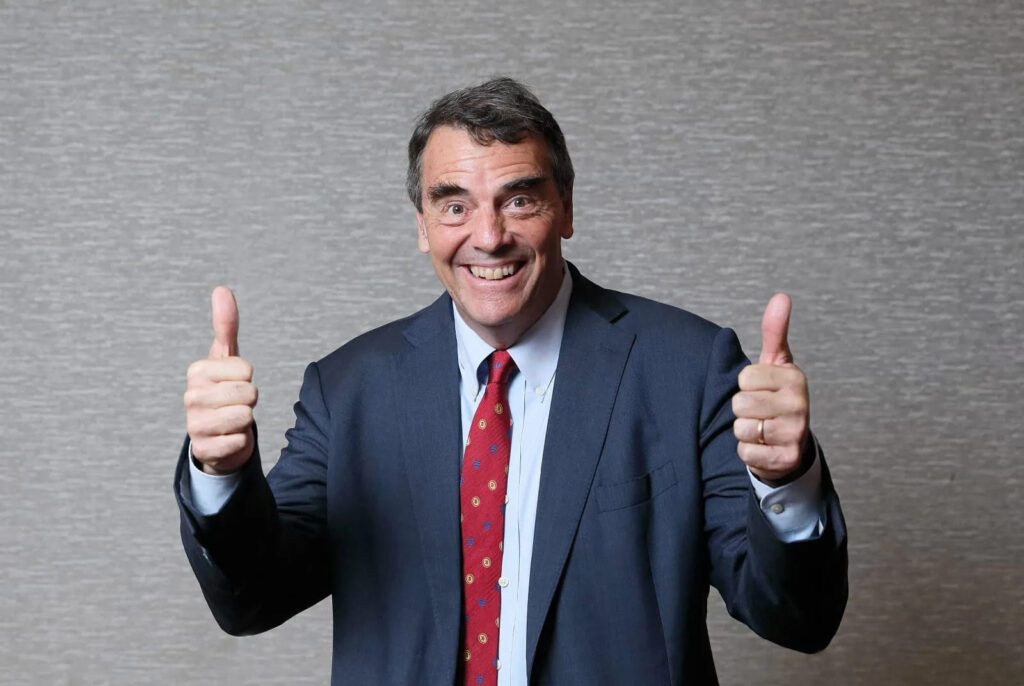

Tim Draper

Tim Draper is a venture capitalist who has made several investments in the crypto space. He is known for purchasing 30,000 Bitcoins in a 2014 US Marshals Service auction. Draper has also invested in Tezos and Bancor, among other blockchain projects.

Marc Andreessen

Marc Andreessen is a co-founder of the venture capital firm Andreessen Horowitz. He has been a proponent of Bitcoin and blockchain technology for several years and has invested in several crypto startups, including Coinbase and Ripple.

Fred Ehrsam

Fred Ehrsam is a co-founder of Coinbase and an active angel investor in the crypto space. Since leaving Coinbase, Ehrsam has invested in several crypto projects, including Polkadot and Dfinity.

Barry Silbert

Barry Silbert is the founder and CEO of Digital Currency Group (DCG), a company that invests in, builds, and supports blockchain and digital currency companies. DCG has made investments in more than 100 companies around the world. Silbert himself is a prominent figure in the crypto industry and has been an active investor in digital currencies.

Naval Ravikant

Naval Ravikant, the co-founder of AngelList, has made several investments in the crypto space. His investments include MetaStable, a cryptocurrency hedge fund; and Algorand, a blockchain platform designed to create a borderless economy. Ravikant’s influence extends beyond his investments, as he is also a well-known speaker and thought leader in the crypto industry.

Charlie Lee

Charlie Lee is the creator of Litecoin, one of the earliest Bitcoin spinoffs or “altcoins.” Beyond creating Litecoin, Lee has also invested in several other cryptocurrency-related startups. His technical expertise and early involvement in the crypto industry have made him a respected figure in the community.

Venture Capitalist

Venture capitalists, on the other hand, are typically firms that invest in more mature crypto startups during their growth stages. They usually offer larger amounts of funding compared to angel investors, often in the millions or tens of millions of dollars.

Venture capitalists are attracted to crypto startups that have a proven track record and a clear path to profitability. They often take a more hands-on approach to their investments compared to angel investors, expecting a significant share in the company and often a seat on the board.

Venture capitalists in crypto might invest in a range of ventures, from blockchain infrastructure projects to crypto financial services. They provide not only capital but also strategic guidance, helping the startup navigate the complex regulatory landscape and scale up its operations.

Union Square Ventures

Union Square Ventures is a New York-based venture capital firm that has made several investments in the crypto space. Some of their notable investments include Coinbase, Polkadot, and Algorand.

Sequoia Capital

Sequoia Capital is a venture capital firm that has been active in the crypto space. They have invested in several crypto startups, including Blockstack and Bitmain.

Ripple Labs

Ripple Labs is the company behind the XRP cryptocurrency. They have a venture arm, Xpring, which invests in companies that use the XRP ledger and the digital asset XRP.

Galaxy Digital

Galaxy Digital is a diversified financial services firm dedicated to the digital asset, cryptocurrency, and blockchain technology industry. Led by Mike Novogratz, the firm operates asset management, trading, investment banking, and principal investment divisions.

Andreessen Horowitz

Andreessen Horowitz (a16z) is a Silicon Valley-based venture capital firm that has been a major player in the crypto industry. The firm has a dedicated crypto fund and has made investments in a number of high-profile crypto startups, including Coinbase and Ripple.

Blockchain Capital

Blockchain Capital is one of the oldest and most active venture investors in the blockchain technology sector. They have invested in more than 90 companies, protocols, and tokens since its inception, including major players like Kraken and Ripple.

Coinbase Ventures

Coinbase Ventures is the investment arm of Coinbase, one of the largest cryptocurrency exchanges in the world. They invest in companies building the open financial system, with a portfolio that includes Compound, Etherscan, and many others.

Digital Currency Group

In addition to being led by angel investor Barry Silbert, Digital Currency Group is also a major venture capital player in the crypto space. They have invested in numerous blockchain and cryptocurrency companies, helping to build and support the growth of the industry.

Polychain Capital

Polychain Capital is a hedge fund that invests in a diverse range of blockchain assets. They are known for their investments in projects like Tezos, Dfinity, and MakerDAO.

Pantera Capital

Pantera Capital is an investment firm focused exclusively on ventures, tokens, and projects related to blockchain tech, digital currency, and crypto assets. They have been involved in several successful projects, including Zcash, Ripple, and Circle.

Difference Between Venture Capitalist and Angel Investor

| Investor Type | Typical Investment Range | Stage of Investment | Risk and Return | Influence and Control |

|---|---|---|---|---|

| Angel Investor | $25,000 – $100,000 | Seed stage | High risk, high potential return | Less control, provides advice and guidance |

| Venture Capitalist | $1 million – $10 million | Growth stage | Lower risk compared to angel investors, high potential return | More control, often has a board seat and influences major decisions |

Amount of Investment

The amount of investment that angel investors and venture capitalists bring to the table can vary significantly.

Angel investors are typically high-net-worth individuals who provide smaller amounts of funding, usually ranging from $25,000 to $100,000. They often invest their personal funds and are willing to take on riskier ventures in the early stages of a startup. In the crypto industry, this could mean funding a new blockchain technology or a novel digital currency.

Venture capitalists, on the other hand, are usually firms that pool funds from various sources. They invest larger amounts, typically between $1 million and $10 million, into startups that have shown some level of growth and stability. In the crypto world, venture capitalists might invest in a crypto startup that has a proven technology and is ready to scale up.

Stage of Investment

The stage of investment is another key difference between angel investors and venture capitalists.

Angel investors usually get involved during the seed stage of a crypto startup. This is when the startup is still in its infancy, with perhaps just an idea or a prototype. The angel investor provides the necessary capital to get the business off the ground, helping it grow from an idea into a viable company.

Venture capitalists, however, usually step in during the growth stage of a startup. This is when the startup has a proven business model, a growing customer base, and is ready to scale up. The venture capitalist provides the necessary capital to fuel this growth, helping the startup expand its operations and market reach.

Risk and Return

Investing in the crypto industry comes with significant risks, given the market’s volatility. However, the potential returns can be substantial, which is what attracts both angel investors and venture capitalists.

Angel investors, with their early-stage investments, stand to gain immensely if the startup becomes a success. They take on a high level of risk, as many startups fail in their early stages. However, if the startup succeeds, especially in the high-reward crypto industry, the angel investor could see a substantial return on investment.

Venture capitalists, while investing larger sums, also have the potential for high returns. They usually invest in startups that have shown some level of growth and stability, reducing their risk compared to angel investors. If the startup goes public or is acquired, the venture capitalist could see a significant return on investment.

Influence and Control

The level of influence and control that an investor has over a startup can vary depending on the type of investor.

Angel investors, given their smaller investment size, usually have less control over the startup’s operations. They may provide advice and guidance, but the day-to-day decisions are usually left to the startup’s management team.

Venture capitalists, due to their larger investment and often a board seat, have a more significant say in the company’s direction. They may influence major decisions, such as hiring key executives or strategic planning. In the crypto industry, this could mean guiding the startup’s blockchain strategy or its approach to regulatory compliance.

Weaknesses of Angel Investment vs. Venture Capital

Angel Investment

- Limited Funds: Angel investors are individuals investing their own money, so they may not have as much to invest as a venture capital firm. This could limit the growth potential of the startup.

- Lack of Additional Support: While some angel investors offer mentorship and guidance, they might not provide the same level of strategic support, industry connections, and resources that a venture capital firm can.

- High Risk: Angel investors typically invest in the early stages of a startup, which is often the riskiest phase. There’s a high chance of failure, and thus, a high risk of losing their investment.

Venture Capital

- High Expectations for Return: Venture capitalists invest large sums of money and therefore expect high returns. This can put pressure on the startup to perform and deliver results quickly.

- Loss of Control: Venture capitalists often demand a seat on the board and a significant say in the company’s decisions, which could lead to a loss of control for the founders.

- Longer Due Diligence Process: The process of securing venture capital can be long and rigorous, with intense due diligence. This could slow down the momentum of the startup.

Here’s a comparison chart based on the above points:

| Type of Investment | Limited Funds | Lack of Additional Support | High Risk | High Expectations for Return | Loss of Control | Longer Due Diligence Process |

|---|---|---|---|---|---|---|

| Angel Investment | Yes | Yes | Yes | No | No | No |

| Venture Capital | No | No | No | Yes | Yes | Yes |

Case Studies

Here are two case studies of successful crypto startups backed by angel investors and venture capitalists:

Case Study 1: Connext

Connext is a Layer 2 scaling solution for Ethereum. It allows users to transfer ERC20 tokens between different Ethereum addresses quickly and at a low cost. The company recently raised $7.5 million in a Series A funding round in June 2023. The round was participated by several venture capital firms, demonstrating the faith institutional investors have in Connext’s technology and potential.

Case Study 2: Poko

Poko is a crypto startup that recently raised $4.5 million in a seed funding round in June 2023. The company is developing a decentralized platform for online gaming, allowing players to earn crypto tokens as they play. The seed funding round was likely participated by angel investors who saw potential in Poko’s unique approach to integrating cryptocurrency with online gaming.

Case Study 3: Bitmain

Bitmain is one of the leading producers of ASIC, specialized in cryptocurrency mining hardware. The company has received multiple rounds of funding from venture capital firms. For instance, in 2018, Bitmain raised $400 million in a pre-IPO funding round from Sequoia Capital China, EDBI, and Coatue Management, among others.

Case Study 4: MoonX

MoonX is a crypto exchange that has built a suite of algorithmic trading tools for digital assets. The company raised $29 million in a venture round in July 2018, with Bitmain as one of the investors.

These case studies illustrate how both angel investors and venture capitalists play crucial roles in the growth and success of crypto startups. They provide the necessary capital for these companies to innovate, expand, and ultimately succeed in the rapidly evolving crypto industry.

Conclusion

Understanding the differences between angel investors and venture capitalists in the crypto industry is crucial for startups seeking funding and investors looking to enter the space. While both offer unique advantages, the choice between the two will depend on the specific needs and stage of the startup.

What is the main difference between an angel investor and a venture capitalist?

The main difference between an angel investor and a venture capitalist lies in the stage of investment, amount of capital invested, and level of involvement in the startup. Angel investors are typically individuals who invest their personal funds in the early stages of a startup, often providing mentorship and guidance but generally having less control over the startup’s operations. On the other hand, venture capitalists are usually firms that invest larger amounts during the growth stage of a startup, often demanding a significant share in the company and a seat on the board.

At what stage do angel investors vs vc typically invest in a crypto startup?

Angel investors typically invest during the seed stage of a crypto startup, providing the necessary capital to get the business off the ground. Venture capitalists, however, usually step in during the growth stage, when the startup has a proven business model and is ready to scale up.

What are the risks and potential returns for angel investors vs venture capitalists in crypto?

Both angel investors and venture capitalists face significant risks in the volatile crypto market. However, the potential returns can be substantial. Angel investors, with their early-stage investments, stand to gain immensely if the startup becomes a success. Venture capitalists, while investing larger sums, also have the potential for high returns, especially if the startup goes public or is acquired.

How much control do angel investors and venture capitalists have in a crypto startup?

Angel investors, given their smaller investment size, usually have less control over the startup’s operations. They may provide advice and guidance, but the day-to-day decisions are usually left to the startup’s management team. Venture capitalists, due to their larger investment and often a board seat, have a more significant say in the company’s direction. They may influence major decisions, such as hiring key executives or strategic planning.