Bitcoin, the pioneering cryptocurrency, has revolutionized the financial world with its unique approach to currency and investment. One of the most intriguing aspects of Bitcoin is the concept of “Bitcoin halving.” This article will delve into the intricacies of Bitcoin halving, its implications for the market, miners, and investors, and its role in shaping the future of Bitcoin.

Table of Contents

What is Bitcoin Halving?

The Basics of Bitcoin Halving

Bitcoin (BTC) halving is a key event in the lifecycle of this cryptocurrency. It’s a process that occurs approximately every four years, or more specifically, after every 210,000 blocks have been mined. During this event, the reward for mining new blocks is cut in half, hence the term “halving.”

The Purpose of Bitcoin Halving

The primary purpose of halving is to control the supply of bitcoins and prevent inflation. Bitcoin’s creator, Satoshi Nakamoto, designed Bitcoin with a maximum supply of 21 million coins to mimic the scarcity of a precious resource like gold. The halving event ensures that the release of new bitcoins into the market is slowed down over time, maintaining the scarcity and value of the existing bitcoins.

The Process of Bitcoin Halving

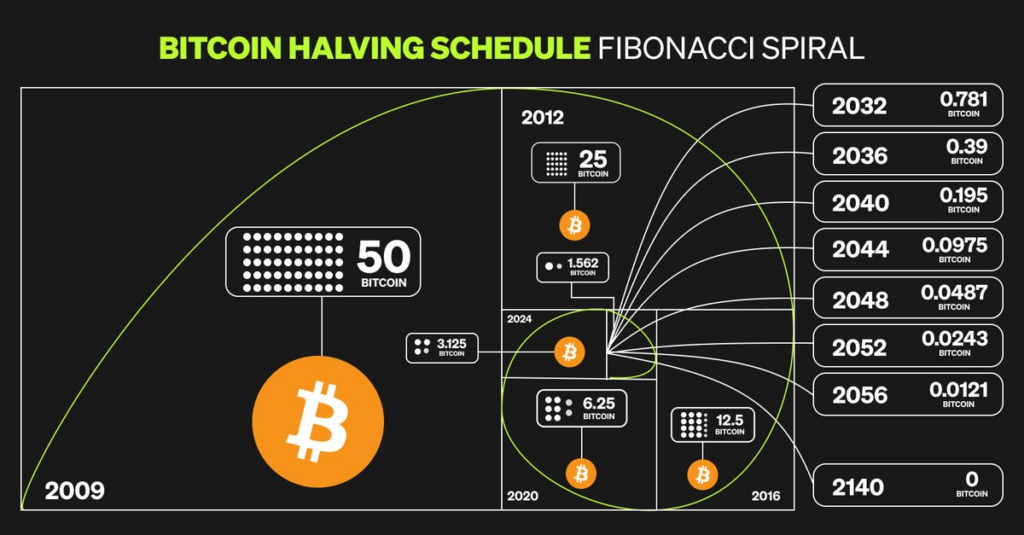

When a Bitcoin miner successfully mines a new block, they are rewarded with a certain number of bitcoins. When Bitcoin was first launched in 2009, this reward was 50 bitcoins. However, after the first halving event in 2012, this reward was reduced to 25 bitcoins. The most recent halving in 2020 reduced the mining reward to 6.25 bitcoins. This halving process will continue approximately every four years until all 21 million bitcoins have been mined.

Why Does Bitcoin Halving Happen?

Halving: A Mechanism to Control Inflation

Bitcoin halving is essentially a built-in monetary policy that’s designed to prevent inflation. Traditional fiat currencies can suffer from inflation when governments decide to print more money, thereby increasing the supply and reducing the value of the currency. Bitcoin, on the other hand, was designed with a finite supply of 21 million coins to prevent this kind of inflation.

The Scarcity Principle and Bitcoin Halving

The concept of Bitcoin halving is closely tied to the principle of scarcity. Just like gold, which has a limited amount on Earth, Bitcoin was designed to have a limited supply. The halving event ensures that the release of new bitcoins into the market is slowed down over time, maintaining the scarcity and value of the existing bitcoins. This is why Bitcoin is often referred to as ‘digital gold’.

Concept of Digital Gold

The halving mechanism contributes to the perception of Bitcoin as ‘digital gold’. Just like gold miners are rewarded with gold for their efforts, Bitcoin miners are rewarded with bitcoins. However, as the available gold in a mine decreases, the remaining gold becomes harder to extract and therefore more valuable. Similarly, as the reward for mining bitcoins decreases (through the halving process), the remaining bitcoins become more valuable.

Bitcoin Halving Dates

| Halving Number | Date/Estimated Date | Block Height | Reward Before Halving (BTC) | Reward After Halving (BTC) |

|---|---|---|---|---|

| 1st | November 28, 2012 | 210,000 | 50 | 25 |

| 2nd | July 9, 2016 | 420,000 | 25 | 12.5 |

| 3rd | May 11, 2020 | 630,000 | 12.5 | 6.25 |

| 4th (Estimated) | 2024 | 840,000 | 6.25 | 3.125 |

| 5th (Estimated) | 2028 | 1,050,000 | 3.125 | 1.5625 |

| 6th (Estimated) | 2032 | 1,260,000 | 1.5625 | 0.78125 |

This chart provides a comprehensive view of Bitcoin halving events, including the dates, block heights, and the rewards before and after each halving. The estimated dates for future halvings are based on the pattern of a halving event approximately every four years, or every 210,000 blocks.

The Impact of BTC Halving on the Market

Historical Impact

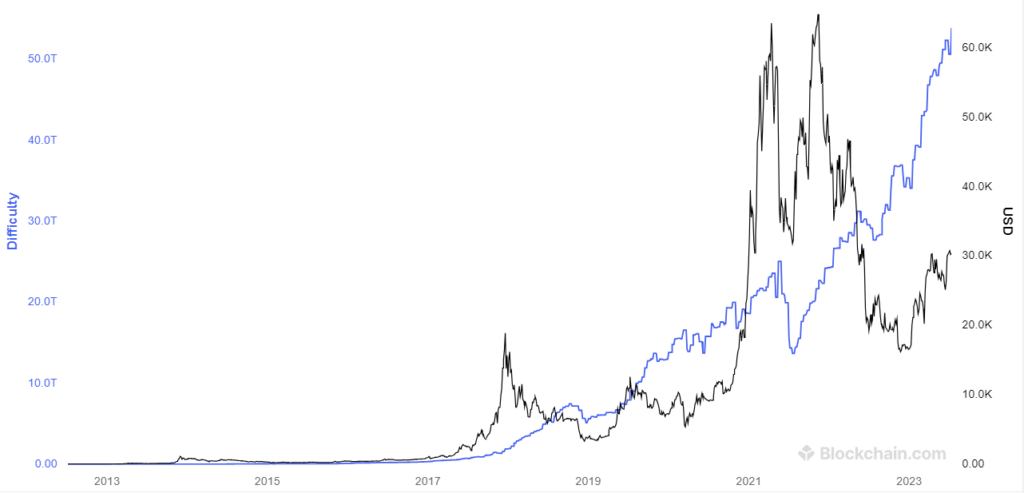

Historically, Bitcoin halving events have had a significant impact on the cryptocurrency’s price. In the months leading up to and following a halving, the price of Bitcoin has typically experienced a substantial increase. For instance, a year after the first halving in 2012, Bitcoin’s price rose from around $12 to over $1,000. Similarly, after the second halving in 2016, the price surged from around $650 to nearly $20,000 by the end of 2017.

Market Speculation

Market speculation plays a significant role in the price movements associated with Bitcoin halving. As the halving event approaches, there’s often increased buying activity as investors anticipate a potential price increase, leading to a self-fulfilling prophecy of sorts. However, this speculative buying can also lead to increased volatility and potential price corrections.

Market Predictions

Predicting the exact impact of a BTC halving on the market is challenging due to the multitude of factors influencing Bitcoin’s price. While historical data suggests a price increase, each halving event occurs in a unique market environment. Therefore, while many investors and analysts may predict a price increase following a halving, it’s essential to consider other market factors and trends.

Bitcoin Halving and Miners

Bitcoin Halving: A Direct Impact on Miners

BTC halving directly affects miners as it reduces the reward they receive for successfully mining a block. When Bitcoin was first launched, the reward was 50 bitcoins per block. After the first halving in 2012, this was reduced to 25 bitcoins, and it has continued to decrease with each subsequent halving. As of the last halving in 2020, the reward stands at 6.25 bitcoins per block.

Changes in Mining Rewards and Profitability

The reduction in mining rewards due to halving can significantly impact the profitability of mining operations, especially for miners with higher operational costs. This is because the cost of mining (in terms of hardware, electricity, etc.) may remain the same, but the rewards are reduced. As a result, some miners may find it unprofitable to continue mining, leading to a potential decrease in the number of active miners.

Halving and Mining Difficulty

Halving can also affect the difficulty of mining. The Bitcoin network is designed to adjust the difficulty of mining new blocks approximately every two weeks, depending on how quickly blocks are being mined. If many miners exit the network after a halving event due to decreased profitability, blocks would be mined more slowly, and the network would adjust by decreasing the mining difficulty.

The Future of Bitcoin Mining Post-Halving

The future of Bitcoin mining post-halving is a topic of much discussion. Some believe that as the reward for miners decreases, only those with the most efficient operations will remain profitable, potentially leading to increased centralization of mining power. Others argue that technological advancements and the potential for increased Bitcoin prices can offset the reduced block rewards, ensuring the continued decentralization and security of the network.

How Does Bitcoin Halving Affect Investors?

Bitcoin Halving: A Double-Edged Sword for Investors

For investors, Bitcoin halving can be seen as a double-edged sword. On one side, the halving event can create opportunities for substantial gains. This is because the reduced supply of new bitcoins entering the market can lead to increased prices, especially if demand remains strong or increases. This potential for price appreciation can attract investors looking for high returns.

On the other side, Bitcoin halving can also introduce risks. The anticipation of a price increase can lead to speculative buying, driving up the price before the halving. However, if the price doesn’t increase as much as expected or if it decreases, investors could face losses. Additionally, the increased attention on Bitcoin around halving events can lead to heightened price volatility, which can be risky for investors.

Investment Strategies Around Bitcoin Halving

Given the potential risks and rewards associated with Bitcoin halving, investors often adopt specific strategies around these events. Some investors may choose to buy Bitcoin in the months leading up to a halving, hoping to benefit from a potential price increase. Others may choose to sell their Bitcoin holdings before a halving, especially if they believe the price has been overly inflated due to speculation.

Long-term investors, or “HODLers” as they’re known in the crypto community, may choose to hold onto their Bitcoin through the halving event, viewing any short-term price volatility as less relevant to their long-term investment strategy.

Future of Bitcoin Post-Halving

Predicting the Post-Halving Landscape of Bitcoin

The future of Bitcoin post-halving is a topic of much debate among experts and enthusiasts alike. Some believe that as the reward for miners decreases, the cost of mining will become prohibitive for many, leading to a decrease in the security of the Bitcoin network. This is because fewer miners could make the network more susceptible to attacks.

On the other hand, others argue that the decrease in supply will lead to an increase in price, keeping the network secure. This is based on the economic principle of supply and demand: when the supply of an asset decreases while demand remains the same or increases, the price tends to rise.

Impact of Halving on the Long-Term Value of Bitcoin

From a long-term perspective, each halving event underscores the scarcity of Bitcoin. This built-in scarcity is a key feature that differentiates Bitcoin from traditional fiat currencies, which can be printed in unlimited quantities by central banks. As such, each halving event could potentially reinforce the perception of Bitcoin as ‘digital gold’ and drive its value up over the long term.

Sustainability of Bitcoin Mining Post-Halving

Another important aspect to consider is the sustainability of Bitcoin mining post-halving. As the mining reward decreases, the energy efficiency of mining operations becomes increasingly important. Miners will need to find ways to reduce their energy consumption or switch to renewable energy sources to maintain profitability. This could lead to innovations in mining technology and practices, which could have implications for the broader cryptocurrency industry.

FAQs

What is Bitcoin halving?

Bitcoin halving is an event that occurs approximately every four years, where the reward for mining Bitcoin transactions is cut in half.

Why does Bitcoin halving happen?

Bitcoin halving happens to control the inflation rate of the cryptocurrency, mimicking the extraction of gold from a mine.

How does BTChalving affect the market?

Historically, BTC halving has led to a price increase, although the magnitude of the increase varies.

When was the last Bitcoin halving?

The last Bitcoin halving occurred on May 11, 2020.

Conclusion

Bitcoin halving is a fundamental aspect of the Bitcoin protocol, designed to control the supply of bitcoins, maintain their value, and prevent inflation. It’s an event that has far-reaching implications for miners, investors, and the broader cryptocurrency market.

For miners, the halving event directly impacts their rewards and can influence the profitability and difficulty of mining. For investors, Bitcoin halving can create opportunities for substantial gains due to the potential increase in Bitcoin’s price. However, it also introduces risks, including price volatility and speculative buying.

The future of Bitcoin post-halving is a topic of much debate. Some believe that as the reward for miners decreases, only those with the most efficient operations will remain profitable, potentially leading to increased centralization of mining power. Others argue that technological advancements and the potential for increased Bitcoin prices can offset the reduced block rewards, ensuring the continued decentralization and security of the network.

Expert opinions on Bitcoin halving vary, with some seeing it as a catalyst for long-term price increases and others cautioning that other factors, such as regulatory developments and broader market trends, play a more significant role in Bitcoin’s price movements.

In conclusion, Bitcoin halving is a pivotal event in the cryptocurrency world that has the potential to shape the future trajectory of Bitcoin. As we approach the next halving event, it will be interesting to see how the market reacts and what new developments emerge in the Bitcoin ecosystem.