In the dynamic world of cryptocurrency, HODL has emerged as a key strategy for investors. But what is HODL, and why is it so important in the crypto world? This article will delve into the philosophy of HODL, its benefits, risks, and practical steps to start HODLing. Let’s embark on this exciting journey!

Table of Contents

Understanding Cryptocurrency and Blockchain

The story of cryptocurrency began in 2009 with the advent of Bitcoin. Since then, the crypto landscape has evolved, with over 4000 cryptocurrencies in existence today. At the heart of these digital currencies is blockchain technology, a decentralized ledger system that ensures transparency and security. Understanding these concepts is crucial for successful HODLing.

The Philosophy of HODL

The term “HODL” originated from a misspelled post on a Bitcoin forum back in 2013, where a user declared that he was “hodling” his Bitcoin, despite the significant market fluctuations. The term quickly caught on and has since become a mantra in the crypto community, symbolizing a long-term investment strategy and a certain kind of mindset.

The philosophy of HODL is rooted in the belief that cryptocurrencies, despite their volatility, will increase in value over the long term. This belief is often backed by the conviction that blockchain technology, which underpins most cryptocurrencies, has the potential to revolutionize various sectors, from finance to supply chain management, and will therefore gain widespread adoption in the future.

HODLer Meaning

A HODLer is an individual who holds onto their cryptocurrency investments for the long-term, regardless of market fluctuations, based on the belief in the future potential of cryptocurrencies.

They do not panic sell when prices drop, nor do they necessarily cash in when prices surge. Instead, they “hold on for dear life,” trusting in the long-term potential of their investments. This approach requires patience, discipline, and a high tolerance for risk, as the crypto market is known for its high volatility.

However, it’s important to note that HODLing is not about blindly holding onto a cryptocurrency regardless of changes in its fundamentals. A true HODLer stays informed about developments in the crypto space and is prepared to reassess their holdings if there are significant changes that might impact the long-term prospects of their investments.

In essence, the philosophy of HODL is a testament to the faith in the future of cryptocurrencies and blockchain technology. It’s a strategy that embraces the inherent risks and volatility of the crypto market, with the expectation of potential high rewards in the future.

The Benefits of HODLing

HODLing offers several advantages.

Potential for High Returns

Cryptocurrencies have shown a significant potential for high returns over the years. For instance, Bitcoin, the first and most well-known cryptocurrency, was worth just a few cents when it was launched in 2009. As of 2021, its value has reached tens of thousands of dollars. Investors who HODLed their Bitcoin from the early days have seen enormous returns on their investments.

Mitigation of Short-Term Market Volatility

The cryptocurrency market is known for its high volatility, with prices often experiencing large fluctuations in short periods. By HODLing, investors can ride out these short-term price swings and potentially benefit from long-term price increases.

The Power of Compound Interest

When you HODL, you give your investments the chance to grow over time. This is particularly true for cryptocurrencies that offer staking, where you can earn interest on your holdings. Over time, this can lead to compounding returns as you earn interest not just on your initial investment, but also on the interest you’ve previously earned.

Lower Transaction Costs

Frequent trading can lead to significant transaction costs, which can eat into your profits. By HODLing, you can minimize these costs as you’re not frequently buying and selling.

Less Stress and Time Commitment

Day trading requires constant monitoring of market trends and price fluctuations, which can be stressful and time-consuming. On the other hand, HODLing requires less time and effort as you’re holding onto your investments for the long term.

Here’s a detailed chart summarizing these benefits:

| Benefits of HODLing | Description |

|---|---|

| Potential for High Returns | Cryptocurrencies have shown significant growth over the years, leading to high potential returns for HODLers. |

| Mitigation of Short-Term Market Volatility | HODLing allows investors to ride out short-term price swings and potentially benefit from long-term price increases. |

| The Power of Compound Interest | HODLing, especially with staking cryptocurrencies, can lead to compounding returns over time. |

| Lower Transaction Costs | HODLing minimizes transaction costs associated with frequent trading. |

| Less Stress and Time Commitment | HODLing requires less constant monitoring of the market compared to day trading, leading to less stress and time commitment. |

Risks Associated with HODLing

However, HODLing is not without risks. The crypto market is notoriously volatile, and there’s always a potential for loss. Predicting long-term trends can be challenging, and risk management is essential. It’s crucial to only invest what you can afford to lose and diversify your portfolio.

- Market Volatility: The cryptocurrency market is known for its high volatility. Prices can skyrocket or plummet in a short period, and long-term trends can be difficult to predict. While HODLing can mitigate the impact of short-term volatility, the risk of long-term price declines remains.

- Potential for Loss: Given the volatility and unpredictability of the crypto market, there’s always a risk that the value of your investments could decrease over time. Some cryptocurrencies may even become worthless if they fail to achieve their goals or if they are superseded by more successful projects.

- Regulatory Risks: Cryptocurrencies operate in a relatively new and rapidly evolving regulatory environment. Changes in regulations or a crackdown on cryptocurrencies by governments could negatively impact the value of your investments.

- Technology Risks: Cryptocurrencies are based on complex technologies. If a critical bug or vulnerability is discovered in the technology underlying a cryptocurrency, it could lead to a loss of funds.

- Lack of Consumer Protections: Unlike traditional financial systems, most cryptocurrencies do not offer consumer protections. If your cryptocurrencies are stolen from your digital wallet or if you send your cryptocurrencies to the wrong address, it’s unlikely you’ll be able to recover your funds.

- Illiquidity: Some cryptocurrencies are not widely traded and can be difficult to sell, especially in large amounts. This could be a problem if you need to liquidate your holdings quickly.

How to Choose Cryptocurrencies for HODLing

Understanding Different Cryptocurrencies

Before you can choose which cryptocurrencies to HODL, you need to understand the different types of cryptocurrencies available. These range from Bitcoin, the first and most well-known cryptocurrency, to altcoins (all cryptocurrencies other than Bitcoin), and tokens, which are cryptocurrencies that are built on top of another blockchain. Each type of cryptocurrency has its own unique features and uses, and understanding these can help you make informed investment decisions.

Evaluating Cryptocurrency Fundamentals

When choosing a cryptocurrency for HODLing, it’s important to evaluate its fundamentals. This includes the technology behind the cryptocurrency, its use case, and the team behind it. A strong, innovative technology and a clear use case can indicate a higher likelihood of long-term success. The team behind the cryptocurrency is also crucial, as experienced and reputable team members can increase the chances of the project’s success.

Considering Market Capitalization and Liquidity

Market capitalization, or the total value of all coins in circulation, is a key factor to consider when choosing a cryptocurrency for HODLing. Generally, cryptocurrencies with larger market caps are considered more stable and less risky, but they may also offer lower potential returns. Liquidity, or how easily a cryptocurrency can be bought and sold, is also important. Cryptocurrencies with higher liquidity are generally easier to sell when you decide to cash out your investments.

Diversifying Your Investments

Just like with traditional investments, it’s important to diversify your cryptocurrency holdings. This means investing in a variety of cryptocurrencies, rather than putting all your money into one. Diversification can help to mitigate risk, as even if one cryptocurrency performs poorly, others may perform well.

Staying Informed

The cryptocurrency market is highly dynamic and can change rapidly. Therefore, it’s important to stay informed about market trends and developments in the crypto space. This can help you to spot promising new cryptocurrencies to HODL, as well as to identify when it might be time to sell.

Practical Steps to Start HODLing

Ready to start HODLing? First, you’ll need a cryptocurrency wallet to store your digital assets. Next, you can purchase cryptocurrencies from exchanges using fiat or other cryptocurrencies.

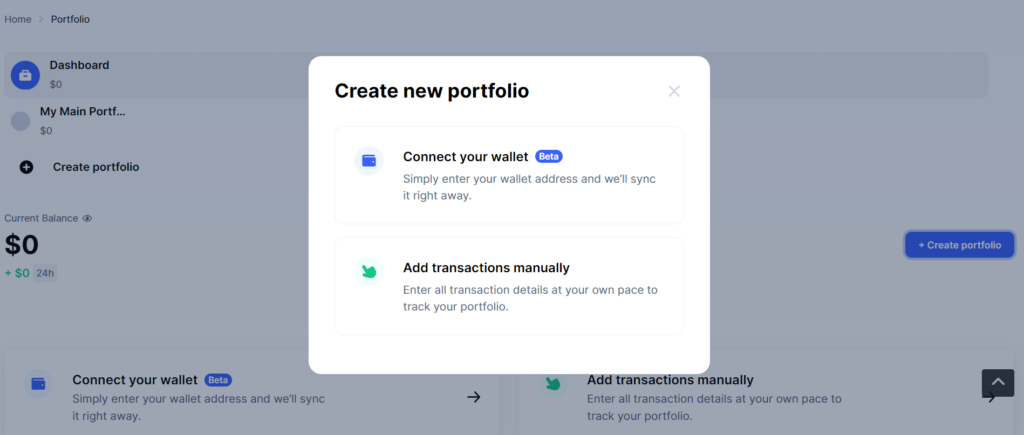

Setting Up a Cryptocurrency Wallet

The first step to start HODLing is to set up a cryptocurrency wallet. This is a digital wallet where you can store, send, and receive cryptocurrencies. There are various types of wallets available, including online wallets, mobile wallets, desktop wallets, and hardware wallets. Each type has its own advantages and disadvantages in terms of convenience and security, so it’s important to choose one that suits your needs.

| Digital Wallet | Key Features | Link |

|---|---|---|

| Trezor Model T | High security, supports 14 cryptocurrencies, open-source software | Trezor Model T |

| Ledger Nano X | Secure cold storage, connects via Bluetooth or USB, supports over 5,500 cryptocurrencies | Ledger Nano X |

| Electrum | Customizable transaction fees, high security, only works for Bitcoin | Electrum |

| Exodus | Built-in exchange, good for beginners, supports cold storage | Exodus |

| MetaMask | A crypto wallet & gateway to blockchain apps, supports token exchange | MetaMask |

| Trust Wallet | Supports a wide range of tokens, built-in exchange, secure and private | Trust Wallet |

| Coinbase Wallet | Supports a wide range of tokens, secure and private, integrates with Coinbase | Coinbase Wallet |

| Tangem Wallet | Card-shaped self-custodial cold wallet, supports 6000+ coins and tokens | Tangem Wallet |

Purchasing Cryptocurrencies

Once you have a wallet, the next step is to purchase cryptocurrencies. You can do this on a cryptocurrency exchange, which is a platform where you can buy and sell cryptocurrencies. Some of the most well-known exchanges include Binance, Coinbase, and Kraken. When choosing an exchange, consider factors such as security, fees, and the range of cryptocurrencies available.

Safe Storage and Security Practices

After purchasing cryptocurrencies, it’s crucial to ensure they are stored safely. If you’re using an online wallet, make sure to use strong, unique passwords and enable two-factor authentication. For larger amounts, consider using a hardware wallet, which is a physical device that stores your cryptocurrencies offline, providing an additional layer of security.

Understanding Your Investment

Before you start HODLing, make sure you understand the cryptocurrency you’re investing in. This includes understanding its technology, use case, and market trends. Stay informed about developments in the crypto space and be prepared to reassess your holdings if there are significant changes that might impact the long-term prospects of your investments.

Patience and Discipline

Finally, remember that HODLing is a long-term strategy. It requires patience and discipline to resist the urge to sell during market fluctuations. Stick to your investment plan and only sell when it aligns with your long-term investment goals.

Remember, while HODLing can be a profitable strategy, it’s also important to be aware of the risks and to only invest what you can afford to lose. Always do your own research before making investment decisions.

Maintaining Your HODL Portfolio

Maintaining your HODL portfolio involves regular review and rebalancing. Market fluctuations are inevitable, but don’t let short-term volatility sway your long-term investment strategy.

Regular Review and Rebalancing

Just like any investment portfolio, a HODL portfolio needs regular review and rebalancing. This involves assessing the performance of your cryptocurrencies and adjusting your holdings as needed. For example, if one cryptocurrency has performed particularly well and now makes up a larger portion of your portfolio than you’d like, you might decide to sell some of it to rebalance your portfolio.

Dealing with Market Fluctuations

The cryptocurrency market is known for its volatility, with prices often experiencing large fluctuations. As a HODLer, it’s important to stay calm during these fluctuations and stick to your long-term investment strategy. Remember, HODLing is about resisting the urge to sell during short-term market downturns and holding onto your investments for the long term.

Knowing When to Sell

While the philosophy of HODLing involves holding onto your cryptocurrencies for the long term, there may be times when it makes sense to sell. This could be when a cryptocurrency has reached your target price, or when there are significant changes in the market or the fundamentals of a cryptocurrency. It’s important to have a clear exit strategy and to be prepared to reassess your holdings when necessary.

Staying Informed

The cryptocurrency market is dynamic and can change rapidly. Therefore, it’s important to stay informed about market trends and developments in the crypto space. This can help you to make informed decisions about when to rebalance your portfolio or when to sell.

Remember, while HODLing can be a profitable strategy, it’s also important to be aware of the risks and to manage them effectively. This could involve diversifying your investments, using secure methods to store your cryptocurrencies, and staying informed about developments in the crypto space.

Conclusion

In the dynamic and often unpredictable world of cryptocurrencies, HODLing has emerged as a strategy that embodies a long-term perspective and a steadfast belief in the future of digital currencies. It’s a philosophy that encourages investors to look beyond short-term market fluctuations and focus on the potential long-term value of their investments.

HODLing is not without its challenges. It requires a deep understanding of the crypto market, careful selection of cryptocurrencies, and a high tolerance for risk. It also calls for patience and discipline, as the rewards of HODLing are often reaped over years, not weeks or months.

However, for those who are willing to navigate these challenges, HODLing can offer substantial rewards. The exponential growth of cryptocurrencies like Bitcoin and Ethereum has shown the potential for high returns that HODLing can offer. Moreover, by mitigating the impact of short-term volatility, HODLing can provide a smoother and less stressful investment journey.

In conclusion, HODLing is more than just an investment strategy; it’s a testament to the faith in the future of cryptocurrencies. As we look ahead, the future of the crypto market remains uncertain and full of possibilities. But one thing is clear: for those who are willing to hold on for dear life, the journey is just beginning.

FAQs

What does HODL stand for?

HODL stands for “Hold On for Dear Life,” a phrase that originated from a misspelled forum post and has since become a mantra for long-term cryptocurrency investors.

What does HODL mean?

HODL is a term used in the cryptocurrency community that refers to holding onto a cryptocurrency rather than selling it, even during market fluctuations.

What is a HODLer?

A HODLer is an individual who practices the HODL strategy, meaning they hold onto their cryptocurrency investments for the long term, regardless of market volatility.

What does the future HODL?

“What does the future HODL?” is a phrase often used in the crypto community to ask about the future prospects of a particular cryptocurrency or the crypto market as a whole. It’s a play on words, using “HODL” instead of “hold” to imply a long-term perspective.

What does HODL mean in stocks?

While the term HODL originated in the cryptocurrency community, it can also be applied to stocks. In this context, HODLing means holding onto a stock for the long term, regardless of market fluctuations.