In the world of cryptocurrency, a bitcoin wallet is an essential tool for managing and securing your digital assets. With the increasing popularity of bitcoin, the market is flooded with various wallet options, making it challenging to choose the right one. In this comprehensive guide, we’ll explore the different types of bitcoin wallets, their features, and provide you with five essential tips for selecting the best wallet for your needs.

Table of Contents

What is a Bitcoin Wallet?

A bitcoin wallet is a digital tool that allows you to store, send, and receive bitcoins securely. It acts as a virtual bank account for your cryptocurrency, enabling you to manage your digital assets. Bitcoin wallets use cryptographic keys to authorize transactions, ensuring the security of your funds.

Types of Bitcoin Wallets

Hardware Wallets

Hardware wallets are physical devices that store your private keys offline, providing the highest level of security against online threats. These wallets are immune to hacking and malware attacks, making them an excellent choice for long-term storage of large amounts of bitcoin.

Software Wallets

Software wallets are applications that you can install on your computer or mobile device. They offer a user-friendly interface and are suitable for everyday transactions. However, they are vulnerable to malware and hacking if your device gets compromised.

Web Wallets

These are online wallets that you can access through your web browser. They’re convenient but potentially less secure due to online vulnerabilities.

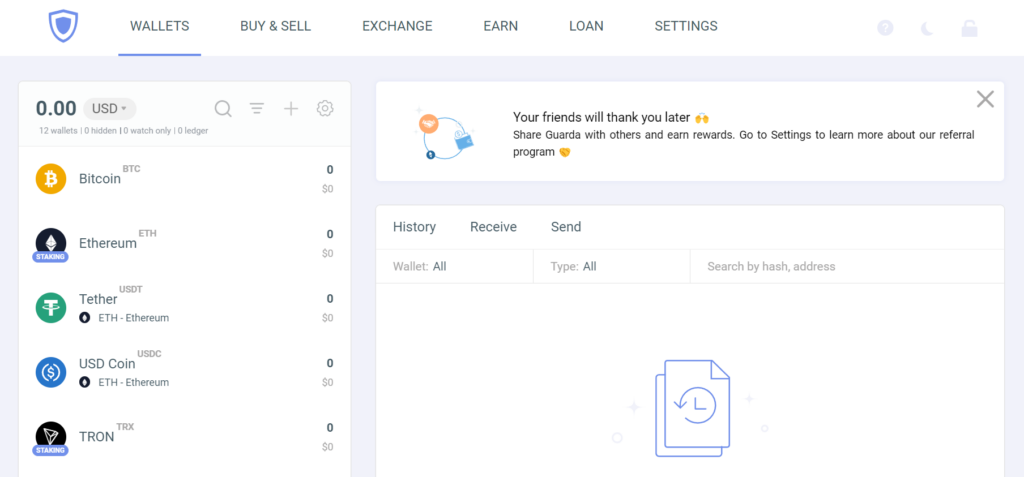

Examples: Guarda

Paper Wallets

Paper wallets are physical documents that contain your private and public keys. They are a secure option for long-term storage, as they are immune to online threats. However, they can be easily lost or damaged, so it’s essential to keep them safe.

Example Generator Sites: BitAddress, Bitcoin.com

Custodial vs. Non-Custodial Wallets

Custodial wallets are managed by third-party providers, while non-custodial wallets give you full control over your private keys. Custodial wallets are convenient but less secure, as the provider can access your funds. Non-custodial wallets offer more security but require you to manage your keys responsibly.

How to Choose the Right Bitcoin Wallet

Security Features

Choose a wallet with robust security features, such as two-factor authentication, encryption, and backup options. Hardware wallets are the most secure, followed by paper wallets and non-custodial software wallets.

User Interface

Select a wallet with an intuitive user interface, especially if you’re new to cryptocurrency. User-friendly wallets make it easier to manage your funds and perform transactions.

Supported Cryptocurrencies

If you hold multiple cryptocurrencies, choose a wallet that supports all of them. Some wallets only support bitcoin, while others support a wide range of digital assets.

Backup and Recovery Options

Ensure the wallet has backup and recovery options, so you can access your funds if you lose your device or forget your password.

Customer Support

Choose a wallet provider with responsive customer support to assist you with any issues or questions.

Setting Up a Bitcoin Wallet

Setting up a Bitcoin wallet is a crucial step for anyone looking to participate in the world of cryptocurrencies. Here’s a detailed guide on how to set up a Bitcoin wallet:

1. Determine Your Needs:

- Frequency of Transactions: If you plan to transact often, a mobile or desktop wallet might be more convenient.

- Amount of Storage: If you’re storing a significant amount of Bitcoin, consider more secure options like hardware or paper wallets.

- Ease of Use: Some wallets are more user-friendly but might offer fewer features.

2. Choose the Type of Wallet:

- Hardware Wallets: Physical devices like the Ledger Nano S or Trezor. They store your private keys offline, making them immune to online hacking attempts.

- Software Wallets: Digital apps for desktops or mobile devices. Examples include Electrum, Exodus.

- Web Wallets: Online wallets accessible via web browsers. Example is Guarda. They’re convenient but potentially less secure due to online vulnerabilities.

- Paper Wallets: Physical documents with your public and private keys. They’re offline and can be very secure if generated correctly and kept safe.

3. Download or Purchase the Wallet:

- Software Wallets: Visit the official website of the chosen wallet. Ensure it’s the genuine site to avoid scam versions. Download and install the application.

- Hardware Wallets: Buy from the official site or authorized dealers. Avoid second-hand devices as they might be compromised.

- Web Wallets: Sign up on the official platform. Always double-check URLs to avoid phishing sites.

- Paper Wallets: Use a trusted online generator like BitAddress. For added security, download the generator and run it offline.

4. Initialization:

- Hardware Wallets: Connect the device to a computer and follow the setup instructions. This often involves setting a PIN and writing down a recovery seed.

- Software/Web Wallets: Launch the application or log into the website. Create a new wallet, set a strong password, and note any backup seeds or phrases provided.

5. Backup Your Wallet:

- Always backup your wallet, regardless of its type. This usually involves noting down a seed phrase or private key. Store this information securely, away from prying eyes. It’s the only way to recover your funds if you lose access to your wallet.

6. Enhance Security:

- Two-Factor Authentication (2FA): Enable 2FA for added security. This requires a second verification step, usually a code sent to your phone, before accessing the wallet.

- Encryption: Ensure your wallet is encrypted with a strong, unique password.

- Regular Updates: If you’re using a software or hardware wallet, ensure it’s regularly updated to the latest version to benefit from security patches.

7. Receiving and Sending Bitcoin:

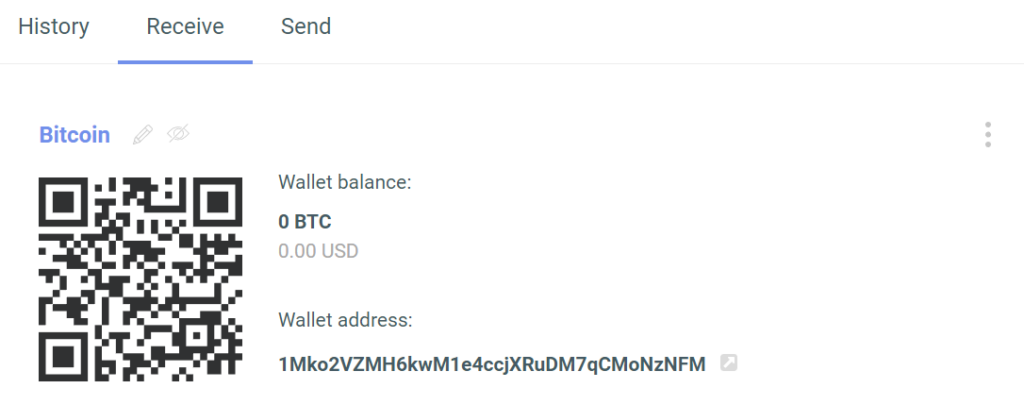

- Receiving: Share your public address (or QR code) with the sender. Never share your private key.

- Sending: You’ll need the recipient’s public address. Enter this, specify the amount, and authorize the transaction.

8. Stay Informed:

- Cryptocurrency and wallet technologies evolve. Stay updated with the latest security practices and ensure your funds are always secure.

How to Use a Bitcoin Wallet

Using a Bitcoin wallet is essential for sending, receiving, and managing your Bitcoin holdings. Here’s a detailed guide on how to use a Bitcoin wallet:

1. Accessing Your Wallet:

- Software Wallets: Launch the application on your desktop or mobile device. Enter your password or PIN to access your wallet.

- Hardware Wallets: Connect the device to your computer or a compatible mobile device. Enter the PIN you set during initialization.

- Web Wallets: Visit the wallet provider’s website and log in using your credentials.

- Paper Wallets: To use a paper wallet, you’ll typically need to “sweep” or “import” the funds into a software or web wallet using the private key.

2. Receiving Bitcoin:

- Locate Your Public Address: In your wallet, navigate to the section labeled ‘Receive’ or similar. Here, you’ll find your public address, which is a long string of alphanumeric characters. Some wallets also provide a QR code for easier sharing.

- Share Your Public Address: Give this address to the person sending you Bitcoin. Remember, your public address is meant to be public, so it’s safe to share.

- Wait for Confirmation: Once someone sends Bitcoin to your address, you’ll see an unconfirmed transaction in your wallet. After the transaction gets a certain number of confirmations on the blockchain (typically 6), it’s considered secure.

3. Sending Bitcoin:

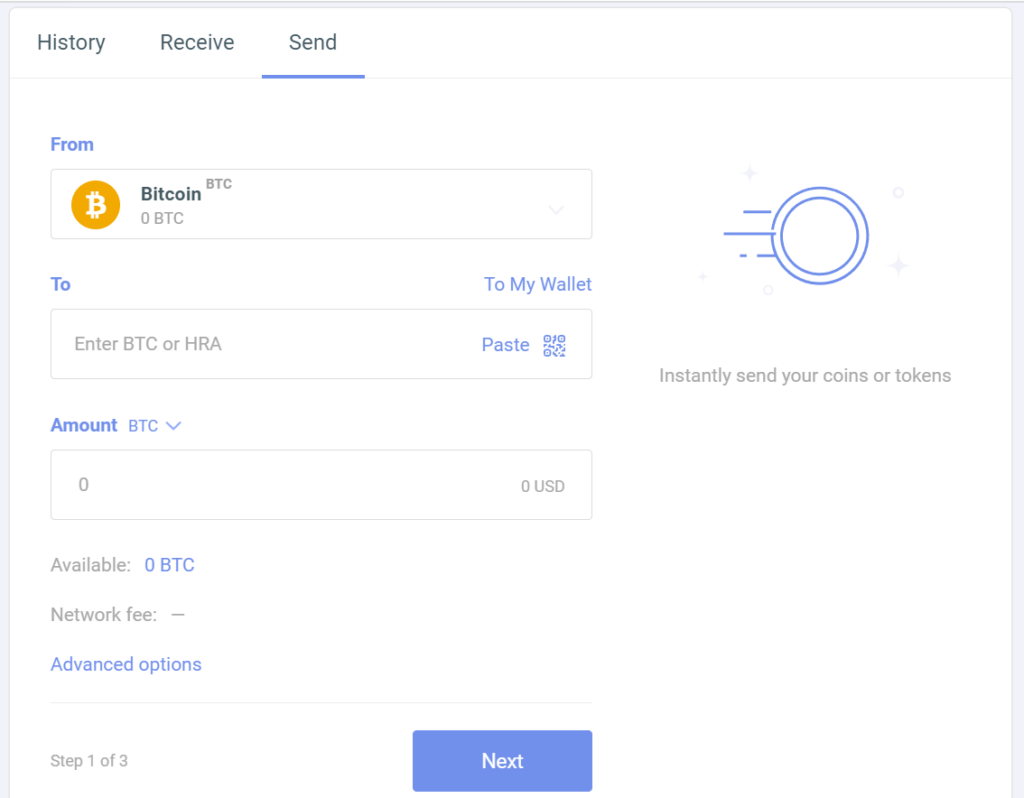

- Navigate to ‘Send’: In your wallet, find the section labeled ‘Send’ or similar.

- Enter Recipient’s Address: Input the public address of the person you’re sending Bitcoin to. Always double-check to ensure the address is correct.

- Specify Amount: Enter how much Bitcoin you want to send. Some wallets allow you to enter the amount in your local currency, and they’ll do the conversion for you.

- Set Transaction Fee (Optional): Some wallets allow you to choose the transaction fee. A higher fee typically means faster confirmation, but it can be more costly.

- Review and Confirm: Double-check all details, especially the recipient’s address. Once you’re sure, authorize the transaction.

4. Checking Your Balance:

- Most wallets display your balance on the main dashboard. You can see both your available balance and any amounts that are pending confirmation.

5. Enhancing Transaction Privacy:

- Use a New Address: For improved privacy, generate a new receiving address for each transaction. Most modern wallets do this automatically.

- Coin Mixing (Advanced): Some wallets offer coin mixing or CoinJoin features, which combine your transaction with others to obfuscate the transaction trail.

6. Backup and Security:

- Regularly back up your wallet to ensure you can recover your funds if needed. Store backups in multiple secure locations.

- Always keep your software updated to the latest version.

- Use strong, unique passwords and enable two-factor authentication (2FA) if your wallet supports it.

7. Monitoring Transactions:

- Most wallets have a ‘Transaction History’ or ‘Recent Transactions’ section where you can view details of your past transactions, including the amount, date, recipient/sender address, and confirmation status.

8. Exporting & Importing Private Keys (Advanced):

- If you need to move your funds to another wallet or recover funds, you might need to export or import your private keys. Handle private keys with extreme caution. Anyone with access to your private key can access your funds.

Common Bitcoin Wallet Myths and Misconceptions

The world of Bitcoin and cryptocurrencies is filled with myths and misconceptions, especially when it comes to Bitcoin wallets. Let’s debunk some of the most common myths surrounding Bitcoin wallets:

1. “Bitcoin Wallets Store Physical Bitcoins”:

- Truth: Bitcoin wallets don’t store “coins” in any physical form. Instead, they manage cryptographic keys: a public key, which is an address that others can see and send bitcoins to, and a private key, which is known only to the owner and is used to sign transactions and access their bitcoins.

2. “If I Lose My Wallet, I Lose My Bitcoins Forever”:

- Truth: While it’s true that losing access to your wallet can mean losing your bitcoins, it’s not the end if you’ve taken precautions. If you’ve backed up your wallet or written down the recovery seed phrase (a series of words given when you first set up your wallet), you can restore your wallet and access your funds.

3. “All Bitcoin Wallets Are the Same”:

- Truth: There are various types of Bitcoin wallets, including hardware, software, web, and paper wallets. Each has its own set of features, security levels, and use cases. For instance, hardware wallets are considered more secure for long-term storage, while mobile wallets are convenient for daily transactions.

4. “Bitcoin Wallets Are Completely Anonymous”:

- Truth: Bitcoin transactions are pseudonymous, not anonymous. Every transaction is recorded on the public ledger (the blockchain), and while names aren’t associated with wallet addresses, with enough analysis, transactions can potentially be traced back to individuals. Some wallets offer enhanced privacy features, but it’s a misconception that all Bitcoin activity is entirely anonymous.

5. “Web Wallets Are Just as Secure as Hardware Wallets”:

- Truth: Web wallets are convenient, but they come with risks. They are often targets for phishing attacks, and if the platform is compromised, your funds could be at risk. Hardware wallets, on the other hand, store your private keys offline, making them immune to online hacks.

6. “Using a Bitcoin Wallet Is Too Complicated for the Average Person”:

- Truth: While there’s a learning curve, many modern Bitcoin wallets are designed with user-friendliness in mind. With intuitive interfaces, clear instructions, and community support, even those new to technology can learn to use a Bitcoin wallet effectively.

7. “Paper Wallets Are Old-fashioned and Not Secure”:

- Truth: When generated securely and stored properly, paper wallets can be one of the most secure methods for holding bitcoins. They are immune to online hacks since they’re entirely offline. However, they must be kept safe from physical damage or loss.

8. “You Need to Buy a Whole Bitcoin to Use a Bitcoin Wallet”:

- Truth: Bitcoin is divisible, and the smallest unit is called a “satoshi,” which is 0.00000001 of a Bitcoin. You can store, send, or receive small fractions of a Bitcoin in a wallet, making it accessible for all, regardless of investment size.

Conclusion

Choosing the right bitcoin wallet is crucial for managing and securing your digital assets. By considering factors such as security, user interface, and supported cryptocurrencies, you can select the best wallet for your needs. Remember to practice safe cryptocurrency management and stay informed about the latest developments in the crypto world.

FAQs

What is the best bitcoin wallet for beginners?

Software wallets with user-friendly interfaces are suitable for beginners.

Are hardware wallets worth the investment?

Yes, hardware wallets offer the highest security for long-term storage.

Can I use multiple bitcoin wallets?

Yes, you can use multiple wallets for different purposes, such as trading and long-term storage.

Is it safe to store all my bitcoins in one wallet?

It’s advisable to diversify your holdings across multiple wallets for added security.