The digital gold rush has seen many flock to the world of cryptocurrencies, and the UK is no exception. With Bitcoin’s meteoric rise, the question on everyone’s lips is: “What is the Best Bitcoin Wallet UK?” Enter the world of Bitcoin wallets. But with a plethora of options available, which one is the best for UK residents? Let’s dive in.

Table of Contents

Why Non-Custodial Wallets are Essential

The way you store and manage your assets is paramount. Non-custodial wallets have emerged as the gold standard for many enthusiasts and experts alike. But why is there such a strong preference for them? Here’s a comprehensive breakdown:

1. True Ownership

Definition of Ownership

At its core, the primary allure of cryptocurrencies is decentralization, meaning no central authority governs or controls it. Non-custodial wallets epitomize this principle by ensuring that only the user has access to their funds.

Contrast with Traditional Banking

In traditional banking, your money is essentially an entry in the bank’s ledger. The bank has the final say on transactions, fees, and access. With non-custodial wallets, you bypass such intermediaries, granting you true ownership of your assets.

2. Enhanced Security

Reduced Centralization Risks

Centralized platforms, like exchanges, are prime targets for hackers. A breach in their security could mean millions in losses for users. Non-custodial wallets, being decentralized, don’t present a single point of failure.

Private Keys

In a non-custodial setup, only the user has access to the private keys, ensuring that they alone can authorize transactions. This contrasts with custodial solutions where the service provider holds the keys, making them vulnerable to internal fraud or external breaches.

Privacy and Autonomy

Transaction Privacy

Non-custodial wallets offer a higher degree of transaction privacy. Without intermediaries overseeing every transaction, users enjoy a level of financial privacy that’s hard to achieve with traditional systems.

No Arbitrary Limits

Many centralized platforms impose withdrawal or transaction limits. With non-custodial wallets, users have the autonomy to move their funds as they see fit, without any arbitrary caps.

4. Immunity from the UK Regulatory or Platform Changes

Platform Policies

Custodial platforms can change their terms of service or introduce new fees at their discretion. Users of non-custodial wallets aren’t subject to such sudden changes.

Regulatory Concerns

The UK regulatory changes can lead to sudden freezes or seizures of assets on centralized platforms (recent Bybit UK leave proves it). Non-custodial wallets, by design, are immune to such direct interventions.

5. Versatility and Interoperability

Cross-Platform

Many non-custodial wallets support multiple cryptocurrencies and can interact with various blockchain platforms, giving users flexibility.

Integration with DApps

Non-custodial wallets often allow seamless integration with decentralized applications (DApps), enhancing the user’s blockchain experience.

Best Bitcoin Wallets UK

| Wallet Type | Examples | Description | Security Level |

|---|---|---|---|

| Hardware | Ledger, Trezor | Physical devices storing private keys offline. Immune to online threats. | Highest |

| Software | Electrum, Exodus | Applications for computers or mobile devices. Vulnerable if the device is compromised. | Moderate |

| Web | Guarda | Online wallets accessed via browsers. Convenient but with potential online vulnerabilities. | Low to Moderate |

| Paper | BitAddress, Bitcoin.com | Physical documents with private and public keys. Offline and secure if kept safely. | High |

Hardware Bitcoin Wallets

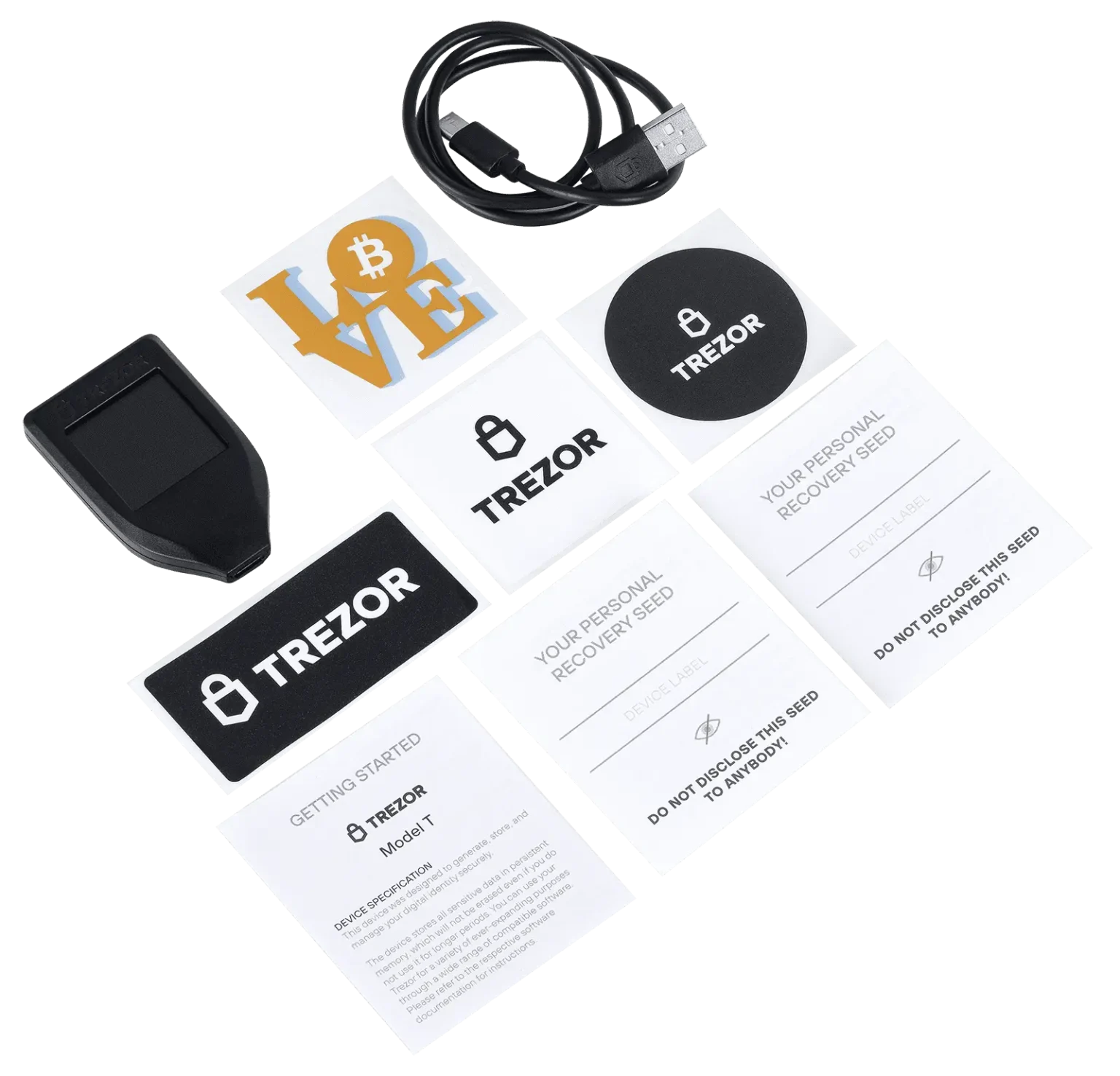

Ledger & Trezor

Hardware wallets like Ledger and Trezor are tangible devices that store your private keys in an offline environment. This makes them highly resistant to online hacking attempts. They are often considered the gold standard for storing significant amounts of Bitcoin due to their enhanced security features. Transactions are signed on the device and then broadcast, ensuring private keys never touch an internet-connected device.

Software UK Bitcoin Wallets

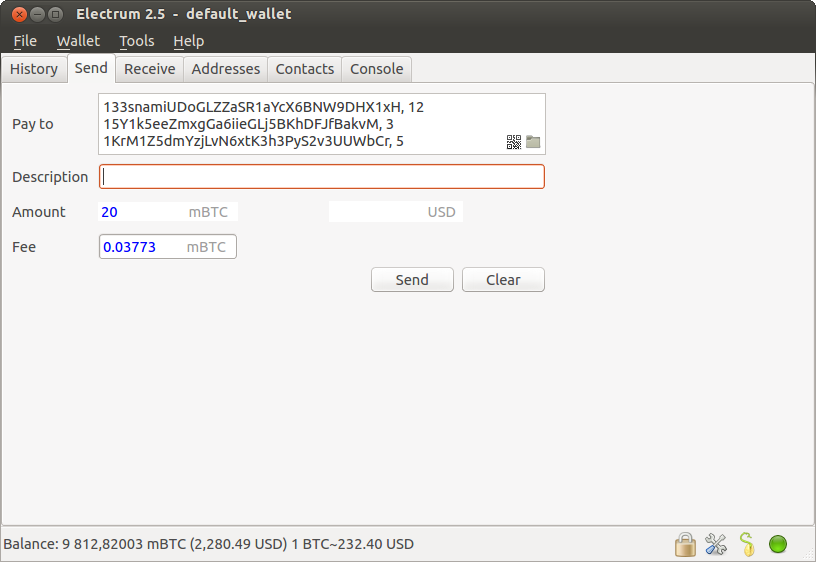

Electrum

Electrum is a lightweight Bitcoin client that’s been around since 2011. It offers a balance between convenience and security. With its feature-rich environment, it’s suitable for both beginners and advanced users. While it provides a good level of security, it’s essential to ensure the device it’s installed on is free from malware.

Exodus

Exodus is a multi-cryptocurrency wallet with a user-friendly interface and built-in exchange feature. It supports a wide range of cryptocurrencies and is known for its live charts and portfolio features. However, being a hot wallet, it’s crucial to keep your computer secure when using Exodus.

Web Wallets

Guarda

Guarda is an online wallet that provides a seamless interface for managing multiple cryptocurrencies. It’s accessible through any web browser, making it highly convenient for quick transactions. However, since it’s online, it’s essential to ensure strong passwords and enable two-factor authentication to enhance security.

Paper Wallets

Paper wallets, generated from sites like BitAddress and Bitcoin.com, are physical documents that display your private and public keys. They offer an offline method of storage, making them immune to online hacks. However, the real challenge is ensuring the physical document’s safety. It should be kept away from potential damage like water, fire, or wear and tear. Moreover, when transferring funds from a paper wallet, it’s often recommended to transfer the entire amount rather than a portion to ensure security.

This detailed elaboration provides insights into various Bitcoin wallet options available for users in the UK, emphasizing their features and security levels. Always remember to conduct personal research and consider your specific needs when choosing a wallet.

The Misconception: Holding Bitcoin on Exchanges

The world of cryptocurrencies, while revolutionary, is still relatively new to many. As a result, misconceptions abound, and one of the most prevalent is the idea of holding Bitcoin directly on exchanges. Here’s a comprehensive breakdown of this misconception:

1. The Allure of Convenience

Ease of Access

For many, the primary draw of keeping Bitcoin on an exchange is the convenience it offers. With funds directly on the platform, trading becomes instantaneous, eliminating the need to transfer Bitcoin from an external wallet.

Integrated Features

Exchanges often come with a suite of tools and features, from advanced trading options to analytics, making them attractive for both novice and seasoned traders.

2. The Underlying Risks

Centralization Vulnerabilities

Exchanges, by their very nature, are centralized platforms. This centralization makes them prime targets for hackers. Over the years, several high-profile exchanges have been compromised, leading to significant losses for users.

Lack of Control

When you hold Bitcoin on an exchange, you’re essentially entrusting the platform with your private keys. This means you’re giving up direct control over your assets. In the world of cryptocurrencies, the mantra “Not your keys, not your Bitcoin” highlights this very concern.

Regulatory and Operational Risks

Exchanges can be subject to sudden regulatory changes, which might affect your ability to access or use your funds. Additionally, operational issues, like outages, can temporarily render your assets inaccessible.

3. The Illusion of Safety

Misleading Perceptions

For many, the professional interfaces and established names of big exchanges create an illusion of safety. However, no matter how reputable, all exchanges carry inherent risks.

Insurance Misunderstandings

While tier one crypto exchanges offer insurance on user funds, the specifics can be murky. Often, these insurance policies cover only a fraction of the platform’s total holdings, and individual users might not be fully reimbursed in the event of a loss.

4. The Importance of Self-Custody

Empowerment and Autonomy

Holding Bitcoin in a personal, non-custodial wallet empowers users by granting them full control over their assets. This autonomy aligns with the decentralized ethos of cryptocurrencies.

Enhanced Security

Non-custodial wallets, especially hardware ones, offer a level of security that exchanges can’t match. By keeping private keys offline and in the user’s hands, the risk of hacks is significantly reduced.

The Exception: Using MEXC.com for Trading

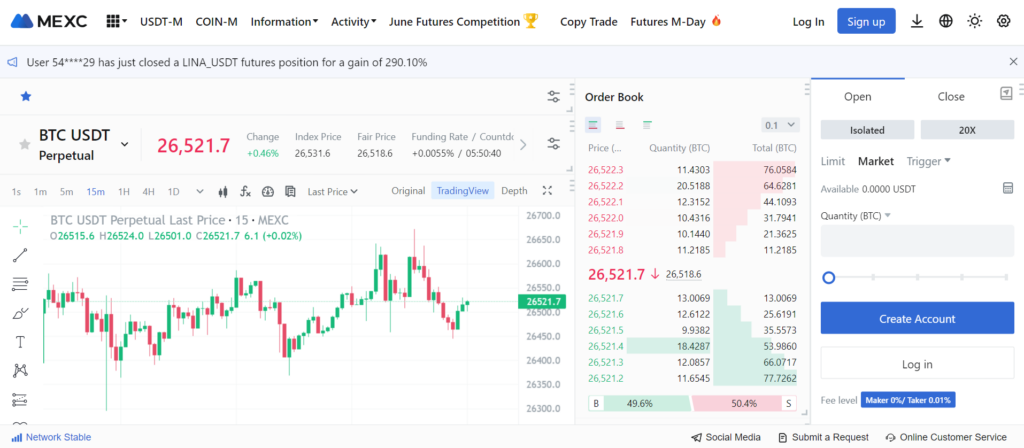

While the general advice leans towards avoiding the storage of Bitcoin on exchanges, there are always exceptions to the rule. MEXC.com stands out as one of these exceptions, especially for those who are actively trading. Here’s a comprehensive look at why:

1. What Makes MEXC.com Stand Out?

Robust Security Measures

MEXC.com places a premium on user security. With advanced encryption techniques, cold storage solutions, and two-factor authentication, it offers a fortified environment for traders.

User-Friendly Interface

For traders, time is of the essence. MEXC.com’s intuitive interface ensures that users can execute trades swiftly, access essential tools, and navigate the platform with ease.

High Liquidity

Liquidity is a trader’s best friend. MEXC.com boasts a high trading volume, ensuring that large trades can be executed without significant price slippage.

Competitive Fees

One of the standout features of MEXC.com is its competitive fee structure. Among its peers, it is the crypto exchange with lowest fees, making trading more profitable for its users.

Bitcoin Leverage Trading

For those looking to amplify their trading strategies, MEXC.com offers Bitcoin leverage trading with up to 200x leverage. This allows traders to potentially magnify their profits, though it’s essential to understand the risks associated with high leverage.

2. Trading Wallet vs. Storage Wallet

Purpose-Driven Use

It’s essential to differentiate between a trading wallet and a storage wallet. MEXC.com is designed for the former. While it offers enhanced security features, it’s primarily for those who trade frequently and need quick access to the market.

Short-Term vs. Long-Term

If you’re looking to hold onto your Bitcoin for the long haul, consider transferring it to a non-custodial wallet after trading. But for short-term trading activities, MEXC.com provides a reliable platform.

3. Precautions to Take

Regular Withdrawals

If you’ve made profits or want to secure a portion of your holdings, consider withdrawing to a non-custodial wallet regularly.

Stay Updated

Ensure that you’re using the latest version of the platform and have all security measures, like two-factor authentication, activated.

Educate Yourself

MEXC.com offers various resources, from market analyses to educational content. Leveraging these can help you make informed trading decisions.

Tips for Safeguarding Your Bitcoin

Ensuring the safety of your Bitcoin is paramount. Here’s a comprehensive breakdown of the best practices to keep your Bitcoin secure:

1. Regular Backups

Importance of Frequency

Just like backing up important files on your computer, it’s crucial to regularly back up your Bitcoin wallet. This ensures that even if your device fails or is compromised, you can restore your wallet and access your funds.

Multiple Locations

Don’t put all your eggs in one basket. Store backups in multiple locations, both digital (isolated laptops, USB drives) and physical (printed QR codes, written recovery phrases).

2. Hardware Wallets: The Fort Knox of Bitcoin

What are they?

Hardware wallets are physical devices that store your private keys offline. They are immune to online threats and are often considered the safest storage method for significant Bitcoin holdings.

Usage

When making transactions, the hardware wallet is connected to a computer or smartphone, but the private keys never leave the device, ensuring a secure transaction environment.

3. Beware of Phishing and Scams

Phishing Explained

Phishing attacks involve tricking individuals into providing sensitive information, like private keys or wallet passwords, usually through fake websites or emails that mimic legitimate platforms.

Staying Safe

Always double-check URLs, especially when accessing your web wallet or exchange. Be wary of unsolicited emails or messages asking for personal information or urging you to click on links. Don’t be scammed.

4. Keep Software and Wallets Updated

Why Updates Matter

Developers regularly release updates for wallet software to patch vulnerabilities and enhance security features. Using outdated software can expose you to known vulnerabilities.

Regular Checks

Periodically check the official website of your wallet provider or software to ensure you’re using the latest version.

5. Use Strong, Unique Passwords

The Power of Complexity

A strong password, combining uppercase and lowercase letters, numbers, and symbols, can be a formidable defense against potential breaches.

Avoiding Repetition

Never use the same password for multiple platforms or services. If one gets compromised, all your accounts could be at risk.

6. Enable Two-Factor Authentication (2FA)

What is 2FA?

2FA adds an extra layer of security by requiring two types of identification before accessing an account. Typically, this involves something you know (password) and something you have (a code sent to your phone).

Implementation

Most reputable exchanges and wallets offer 2FA. Ensure it’s activated for an added layer of protection.

Conclusion

The choices we make regarding the storage, management, and trading of our assets can have profound implications. As we’ve navigated through the intricacies of Bitcoin wallets in the UK, the importance of non-custodial solutions becomes abundantly clear. They embody the very essence of what cryptocurrencies represent: autonomy, security, and decentralization.

However, as with all things, exceptions exist. Platforms like MEXC.com challenge the norm, showcasing that with the right security measures, user-centric features, and a commitment to transparency, centralized platforms can also offer significant value, especially to the active trader. Their competitive fees and high leverage options further underscore the potential benefits they bring to the table.

Yet, it’s crucial to approach the world of cryptocurrencies with a discerning eye. The allure of convenience, whether from keeping assets on exchanges or opting for web wallets, should always be weighed against potential risks. Regular backups, the use of hardware wallets, and a vigilant stance against phishing and scams are not just best practices; they’re necessities.

Moreover, the cryptocurrency landscape is not static. As technology advances and the ecosystem matures, new solutions, challenges, and opportunities will emerge. Staying informed, continuously educating oneself, and making decisions grounded in both knowledge and prudence will be the guiding lights for any crypto enthusiast.

In closing, the journey through the cryptocurrency realm is as much about safeguarding our assets as it is about embracing the financial revolution. By making informed choices, we not only protect our investments but also contribute to the broader vision of a decentralized financial future.

FAQs

Is it safe to keep all my Bitcoin in one wallet?

Diversifying storage can reduce risks, but it’s essential to manage multiple backups. Don’t forget about the UK man who lost his Bitcoin laptop.