Decentralized Applications, commonly known as DApps, are a revolutionary aspect of the crypto world. DApps are applications that run on a peer-to-peer network of computers rather than a single computer. They are a key component of the blockchain ecosystem and have the potential to disrupt traditional business models.

Table of Contents

DApps Meaning

DApps, short for decentralized applications, are a type of software program designed to exist and operate on blockchain or P2P networks instead of a single computer, and they are outside the purview and control of a single authority.

Unlike traditional, centralized applications, where the backend code runs on centralized servers, DApps run on a network of computers within the blockchain. This makes them decentralized, as they are not controlled by a single entity or located on a central server.

DApps connect users and providers directly. They are open-source, which means their code is available to all and can be vetted by users. This transparency allows users to understand the app behavior and trust the application.

One of the key features of DApps is that they use blockchain’s cryptographic technology to offer users a level of security and trust. They have tokens associated with them, which are necessary for their function. These tokens can be used to reward users for providing computing power and maintaining the network.

DApps have gained significant attention due to their potential to disrupt traditional business models across various sectors, including finance, healthcare, entertainment, and more. They are seen as a key component of Web 3.0, the next generation of internet services.

History and Evolution of DApps

The Genesis of DApps

The concept of DApps was first introduced around the same time as Bitcoin, the first cryptocurrency, in 2009. Bitcoin itself can be considered as the first DApp, designed to allow digital transactions without a centralized authority.

The Emergence of Ethereum and Smart Contracts

The real evolution of DApps began with the introduction of Ethereum in 2015. Ethereum, a blockchain-based platform, introduced the concept of smart contracts. These are self-executing contracts with the terms of the agreement directly written into lines of code. This innovation opened up the possibility for developers to create their own operations on the Ethereum blockchain, leading to the creation of more complex DApps.

The ICO Boom and DApp Development

The period from 2016 to 2018 saw an explosion in the development of DApps, fueled in part by the Initial Coin Offering (ICO) boom. ICOs provided a new way for DApp projects to raise funds by selling their native tokens to investors. This period saw the creation of many DApps across various sectors, including finance, gaming, and decentralized exchanges.

The DeFi and NFT Revolution

More recently, the DApp landscape has been dominated by the rise of Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs). DeFi applications aim to recreate traditional financial systems, such as loans and interest, in a decentralized manner on the blockchain. On the other hand, NFTs, unique digital assets verified using blockchain technology, have opened up new possibilities for digital ownership and monetization, leading to a surge in NFT-related DApps.

The Current State and Future of DApps

Today, DApps have evolved from simple transaction-based applications to complex systems capable of handling sophisticated operations. They continue to grow in number and diversity, with thousands of DApps now existing on various blockchain platforms. The future of DApps looks promising, with ongoing advancements in blockchain technology and a growing recognition of the potential benefits of decentralization.

How DApps Work

DApps, or decentralized applications, operate on the principles of blockchain technology. Here’s a step-by-step breakdown of how DApps work:

- Blockchain Technology: At the core of every DApp is blockchain technology. A blockchain is a decentralized and distributed digital ledger that records transactions across multiple computers so that any involved record cannot be altered retroactively, without the alteration of all subsequent blocks. This technology ensures that all data and transactions within the DApp are transparent and immutable.

- Smart Contracts: DApps often use smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These smart contracts automate the execution of processes in the DApp, such as transferring tokens between accounts when certain conditions are met.

- Decentralization: Unlike traditional applications that run on a centralized server, DApps run on a peer-to-peer network of computers. This means that no single entity has control over the entire network. Each node (computer) in the network works independently and the operation of the DApp continues even if some nodes fail.

- Consensus Mechanisms: DApps use consensus mechanisms to agree on the state of the blockchain. The most common consensus mechanisms are Proof of Work (PoW) and Proof of Stake (PoS). These mechanisms ensure that all transactions are verified and that all nodes agree on the order of transactions.

- Tokens: Most DApps have an associated token. These tokens can be used within the DApp for various purposes, such as rewarding users or paying for transactions and services. The tokens are often distributed to the users through a process called mining, or they can be purchased during an Initial Coin Offering (ICO).

- Interactions with Users: Users interact with DApps through a frontend user interface, just like they would with a traditional app. However, instead of interacting with a centralized server, the user’s requests are processed on the blockchain.

Types of DApps

Decentralized applications (DApps) can be categorized into three types based on their function and the blockchain network they operate on:

Type I DApps

Type I DApps have their own blockchain. Bitcoin is a prime example of a Type I DApp. It operates on its own blockchain and is used as a digital currency. Other examples of Type I DApps include other altcoins such as Litecoin and Dogecoin.

Type II DApps

Type II DApps are protocols and have tokens that are necessary for their function. They use the blockchain of a Type I DApp. These DApps are a protocol and have tokens that are necessary for their function. They are a kind of “software program” that are built on top of Type I DApps. An example of a Type II DApp is the Omni Protocol, which is built on top of the Bitcoin blockchain.

Type III DApps

Type III DApps use the protocol of a Type II DApp and are protocols with tokens that are necessary for their function. They are the general applications that users directly interact with. They are built on top of a protocol that is built on a blockchain. An example of a Type III DApp is the SAFE Network, a decentralized data storage and communications network that is built on the Omni Protocol.

Each type of DApp has its own unique features and uses. Type I DApps provide the foundational blockchain layer, Type II DApps provide the protocol or framework for functionality, and Type III DApps are the user-facing applications that provide specific services.

Comparison Chart

| Type | Description | Blockchain | Example |

|---|---|---|---|

| Type I | Have their own blockchain | Their own | Bitcoin |

| Type II | Protocols and have tokens that are necessary for their function | Use the blockchain of a Type I DApp | Omni Protocol |

| Type III | Use the protocol of a Type II DApp and are protocols with tokens that are necessary for their function | Built on top of a protocol that is built on a blockchain | SAFE Network |

Ethereum DApps

Ethereum DApps are decentralized applications that are built on the Ethereum blockchain. Ethereum is one of the most popular platforms for DApp development due to several unique features it offers:

Smart Contracts

Ethereum introduced the concept of smart contracts to the blockchain world. Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. They automatically execute transactions when certain conditions are met, eliminating the need for a middleman. This feature is fundamental to the operation of DApps, as it allows for the creation of decentralized applications that can automate complex processes.

Ethereum Virtual Machine

The Ethereum Virtual Machine (EVM) is a powerful tool that allows developers to create and execute smart contracts on the Ethereum blockchain. The EVM is Turing-complete, meaning it can run any algorithm given enough resources. This makes Ethereum a versatile platform for DApp development.

ERC-20 and ERC-721 Tokens

Ethereum has standard protocols for creating tokens on its platform, namely ERC-20 and ERC-721. ERC-20 is the standard for fungible tokens, which are interchangeable and identical to each other. This standard is widely used for ICOs (Initial Coin Offerings). On the other hand, ERC-721 is the standard for non-fungible tokens (NFTs), which are unique and not interchangeable. This has allowed for the creation of DApps like CryptoKitties, where each token represents a unique digital asset.

Popular Ethereum DApps

There are thousands of DApps built on Ethereum, spanning various sectors. Some of the most popular Ethereum DApps include:

- Uniswap: A decentralized exchange that allows for the trading of ERC-20 tokens directly from a user’s wallet.

- CryptoKitties: A game where users can buy, breed, and sell virtual cats. Each cat is a unique NFT.

- MakerDAO: A decentralized credit platform that supports DAI, a stablecoin pegged to the US dollar.

Ethereum has been a pioneer in the DApp space, providing a robust and flexible platform for developers to create decentralized applications. Its support for smart contracts, the EVM, and token standards have made it a popular choice for DApp development.

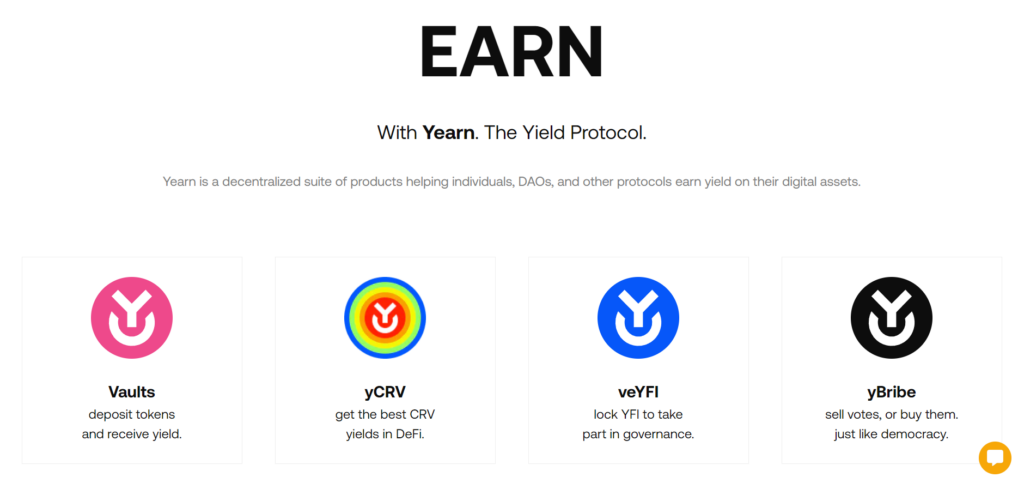

Defi DApps

Decentralized Finance, or DeFi, refers to the use of blockchain technology to recreate and improve upon traditional financial systems. DeFi DApps are decentralized applications that provide financial services in a decentralized manner, including lending and borrowing platforms, decentralized exchanges, stablecoins, prediction markets, and more. These services aim to recreate traditional financial systems in a decentralized and transparent manner.

| DeFi DApp | Description | Link |

|---|---|---|

| Uniswap | A decentralized trading protocol that allows for automated trading of decentralized finance tokens. | Uniswap |

| MakerDAO | A decentralized credit platform on Ethereum that supports DAI, a stablecoin whose value is pegged to the US dollar. | MakerDAO |

| Compound | An algorithmic, autonomous interest rate protocol built for developers, to unlock a universe of open financial applications. | Compound |

| Aave | A decentralized non-custodial money market protocol where users can participate as depositors or borrowers. | Aave |

| Yearn.Finance | A suite of products in Decentralized Finance (DeFi) that provides lending aggregation, yield farming, and insurance on the Ethereum blockchain. | Yearn.Finance |

Benefits of DApps

DApps offer numerous advantages over traditional applications.

Decentralization

One of the primary benefits of DApps is decentralization. Unlike traditional applications, DApps are not controlled by a single entity or organization. This means that no single party can control the data, manipulate the system, or shut it down. This decentralization also makes DApps resistant to censorship.

Security and Transparency

DApps are built on blockchain technology, which is inherently secure and transparent. All transactions on a DApp are recorded on the blockchain and are visible to all participants. This transparency builds trust among users. Additionally, the decentralized nature of DApps makes them less prone to hacking and data breaches.

Interoperability

Many DApps are built on common blockchain platforms like Ethereum, which allows them to be compatible with each other. This interoperability means that new DApps can leverage existing services and protocols, creating an interconnected ecosystem of applications.

Incentivization

Most DApps have a native token or cryptocurrency associated with them. These tokens can be used to incentivize and reward users for contributing to the network, such as validating transactions, providing storage, or participating in the community.

Disruption of Traditional Industries

DApps have the potential to disrupt traditional industries by providing decentralized alternatives to existing services. For example, decentralized finance (DeFi) DApps are challenging traditional financial systems by offering peer-to-peer financial services without the need for intermediaries like banks. Similarly, DApps in the supply chain, healthcare, and entertainment industries are providing new ways of doing business and interacting with technology.

Challenges and Limitations of DApps

Technical Challenges

Developing DApps can be technically challenging. Blockchain technology is still relatively new, and there are limited resources and tools available for developers. Additionally, DApps require a different approach to architecture and security compared to traditional applications, which can be a steep learning curve for developers.

Scalability Issues

One of the most significant challenges facing DApps is scalability. As the number of users and transactions on a DApp increases, it can become increasingly difficult for the underlying blockchain to process transactions quickly and efficiently. This can lead to slower transaction times and higher costs, which can impact the user experience.

User Experience

Many DApps struggle with providing a user experience that is as smooth and intuitive as traditional applications. Issues such as slow transaction times, the need to pay gas fees, and the complexity of managing private keys can make DApps challenging for non-technical users.

Regulatory and Legal Considerations

The regulatory environment for DApps is uncertain in many jurisdictions. Issues such as data privacy, consumer protection, and legal responsibility are still being worked out. This uncertainty can make it risky to develop and use DApps, particularly for applications that handle sensitive data or financial transactions.

Adoption and Awareness

Despite the growing interest in blockchain and DApps, awareness and understanding of these technologies remain low among the general public. This lack of awareness and understanding can hinder the adoption of DApps.

Case Studies of Successful DApps

Several DApps have achieved significant success. For instance, CryptoKitties, a game on Ethereum, gained massive popularity. Uniswap, a decentralized exchange, and MakerDAO, a decentralized credit platform, are other examples of successful DApps.

CryptoKitties

CryptoKitties is one of the earliest and most well-known DApps. Launched on the Ethereum blockchain in 2017, CryptoKitties is a game that allows users to purchase, collect, breed, and sell virtual cats. Each cat is unique and is represented as a non-fungible token (NFT) on the Ethereum blockchain. CryptoKitties gained significant attention for its innovative use of blockchain technology in gaming, and at one point, it became so popular that it congested the Ethereum network.

Uniswap

Uniswap is a decentralized exchange (DEX) built on the Ethereum blockchain. It allows users to trade Ethereum tokens directly from their wallets, without the need for an intermediary. Uniswap uses an automated market maker model, where liquidity is provided by users, and prices are determined by a mathematical formula. Uniswap has become one of the most popular DApps due to its simplicity, transparency, and the ability to earn fees by providing liquidity.

MakerDAO

MakerDAO is a decentralized credit platform on Ethereum that supports DAI, a stablecoin whose value is pegged to the US dollar. Users can lock up collateral (like ETH) to generate DAI. The system is managed by MKR token holders who vote on key decisions, including the system’s risk parameters. MakerDAO has been influential in the rise of Decentralized Finance (DeFi), demonstrating how blockchain can be used to create complex financial systems.

Decentraland

Decentraland is a virtual reality platform powered by the Ethereum blockchain. In Decentraland, users can create, experience, and monetize content and applications. What makes it unique is that users have full control over the virtual land they own, represented by non-fungible tokens on the Ethereum blockchain. This has led to a bustling virtual economy, with users trading land and other virtual goods on the marketplace.

These case studies highlight the diverse range of applications for DApps, from gaming and exchanges to finance and virtual reality. They demonstrate the potential of DApps to disrupt traditional industries and create new forms of online interaction and economy.

Future of DApps

The future of DApps looks promising with emerging trends such as DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and DAOs (Decentralized Autonomous Organizations).

Emerging Trends in DApps

The future of DApps looks promising with several emerging trends. One of the most significant trends is the rise of Decentralized Finance (DeFi). DeFi DApps aim to recreate traditional financial systems, such as loans and interest, in a decentralized manner on the blockchain. This has the potential to democratize finance and provide services to those who are currently unbanked or underbanked.

Another trend is the growth of Non-Fungible Tokens (NFTs). NFTs are unique digital assets on the blockchain, and they have opened up new possibilities for digital ownership and monetization. This has led to a surge in NFT-related DApps, particularly in the art and entertainment sectors.

Potential Impact on Various Industries

DApps have the potential to impact various industries. In the financial sector, DApps could disrupt traditional banking and finance systems. In the supply chain industry, DApps could provide transparent and efficient tracking systems. In the entertainment industry, DApps could change the way content is created and monetized.

Expert Predictions and Speculations

Experts predict that the use of DApps will continue to grow in the coming years. As blockchain technology matures and becomes more mainstream, it’s expected that more and more developers will start building DApps. Furthermore, as more people become aware of the benefits of decentralization, the demand for DApps is likely to increase.

However, it’s also important to note that the future of DApps will depend on several factors, including regulatory developments, technological advancements, and market dynamics. Despite the potential challenges, the future of DApps looks bright, and they are likely to play a significant role in the future of technology and digital interactions.

Conclusion

As we conclude this exploration into the world of DApps, it’s clear that these decentralized applications represent a significant shift in the way we think about and interact with digital platforms. From their inception alongside the advent of Bitcoin, through their evolution with Ethereum and smart contracts, to the present day where they’re disrupting traditional industries, DApps have come a long way.

The potential of DApps is immense. Their inherent benefits of decentralization, security, transparency, and the ability to incentivize user participation make them a powerful tool for a wide range of applications. However, like any emerging technology, DApps face significant challenges. Technical difficulties, scalability issues, and regulatory uncertainties are hurdles that need to be overcome for DApps to reach their full potential.

In conclusion, DApps represent a fascinating and transformative aspect of the blockchain and crypto world. As we move forward, it will be interesting to see how DApps evolve and continue to shape the digital landscape.

FAQs

What are DApps?

DApps are decentralized applications that run on a peer-to-peer network of computers rather than a single computer.

What does DApps stand for?

DApps stands for Decentralized Applications.

What are DApps in crypto?

In the context of cryptocurrency, DApps are applications that are built on top of blockchain technology. They use smart contracts to automate processes and have associated tokens for transactions within the DApp. Examples of DApps in crypto include decentralized exchanges, games, and financial services.

How do DApps make money?

DApps can generate revenue in several ways. Some DApps have a native token or cryptocurrency, and they can make money by selling these tokens to users. Other DApps may charge transaction fees or offer premium features or services for a fee.

How do DApps work?

DApps work by utilizing the principles of blockchain technology, including decentralization, transparency, and immutability. They use smart contracts to automate processes and have associated tokens for transactions within the DApp.

How to create DApps?

Creating a DApp involves several steps. First, you need to design your DApp and define its functionality. Then, you need to write the smart contracts that will govern your DApp’s operations. These smart contracts are then deployed to a blockchain. Finally, you need to build a user interface for users to interact with your DApp.

How to get DApps on Trust Wallet?

Trust Wallet has a built-in DApp browser that you can use to access DApps. To use a DApp on Trust Wallet, you simply need to navigate to the DApp’s website using the DApp browser, and then follow the instructions provided by the DApp.