Bitcoin, the digital currency that has revolutionized the financial world, is no longer a novelty but a significant player in global transactions. Understanding Bitcoin transactions is crucial for anyone involved in this digital economy. This article will provide a comprehensive overview of how Bitcoin transactions work, their basic structure, security aspects, transaction speed and costs, common issues, and the future of Bitcoin transactions.

Table of Contents

How Bitcoin Works

Bitcoin, a decentralized digital currency, operates without a central bank or single administrator. Transactions are verified by network nodes through cryptography and recorded on a public ledger called a blockchain. Bitcoin’s unique design allows for secure peer-to-peer transactions, with the participants able to transact directly without needing an intermediary.

Basics of Bitcoin Transactions

What is a Bitcoin Transaction?

The Role of Bitcoin Addresses

A Bitcoin transaction is a transfer of value between Bitcoin wallets. These transactions get included in the blockchain. Bitcoin wallets keep a secret piece of data called a private key, used to sign transactions, providing mathematical proof that they have come from the owner of the wallet.

Bitcoin addresses are alphanumeric strings that represent the destination for a Bitcoin transaction. Essentially, if someone wants to pay you in Bitcoin, they send it to your Bitcoin address.

How Bitcoin Wallets Work

Bitcoin wallets store the information necessary to transact bitcoins. While wallets are often described as a place to hold or store bitcoins, they contain the private keys that allow you to access a bitcoin address and spend your funds.

Anatomy of a Bitcoin Transaction

Inputs and Outputs in a Bitcoin Transaction

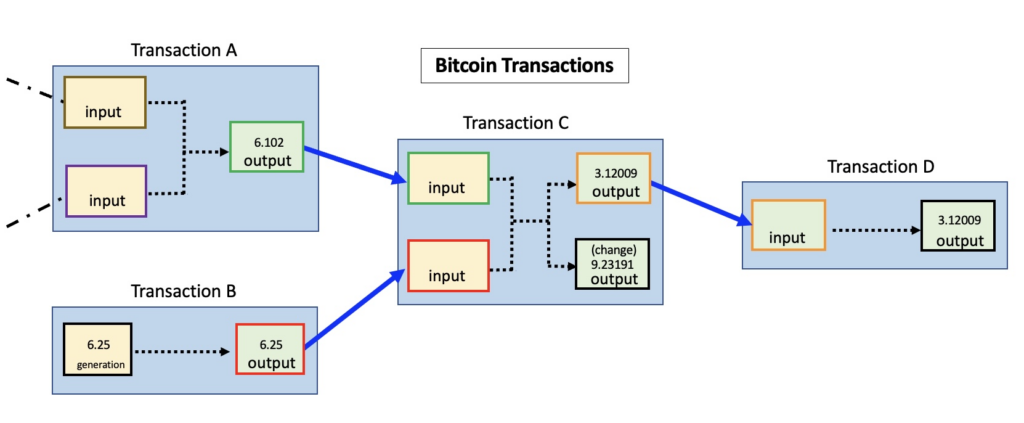

In a Bitcoin transaction, the concepts of “inputs” and “outputs” are fundamental. They represent the mechanism by which the ownership of bitcoins is transferred from one party to another. Here’s a more detailed explanation:

Inputs

An input in a Bitcoin transaction refers to the record of bitcoins that are being sent. More specifically, an input is a reference to the output of a previous transaction.

When you receive bitcoins, these bitcoins are associated with your Bitcoin address. This association is recorded as a transaction output in the Bitcoin blockchain. When you decide to spend these bitcoins, your wallet creates a transaction that references this previous output as an input.

Each input contains three main pieces of information:

- Transaction Hash (TxID): This is the identifier of the previous transaction where the bitcoins were received.

- Output Index (Vout): Since a transaction can have multiple outputs, this index specifies which output of the previous transaction is being used.

- Unlocking Script (ScriptSig): This is a cryptographic signature that proves ownership of the bitcoins being spent. It typically contains a public key and a digital signature.

Outputs

An output in a Bitcoin transaction represents the new destination of the bitcoins. It specifies the amount of bitcoins being sent and the address of the recipient.

Each output contains two main pieces of information:

- Value: This is the amount of bitcoins being sent.

- Locking Script (ScriptPubKey): This is a cryptographic puzzle that specifies the conditions that must be met to spend the bitcoins in the future. It typically contains a Bitcoin address.

A Bitcoin transaction can have multiple inputs and outputs. For example, if you want to send bitcoins to multiple addresses, you can do so by creating a transaction with multiple outputs. Similarly, if you want to send more bitcoins than any single output you have received, you can do so by creating a transaction with multiple inputs.

It’s also worth noting that the sum of bitcoins in the inputs must be equal to or greater than the sum of bitcoins in the outputs. If the input sum is greater, the difference is considered a transaction fee, which is collected by the miner who confirms the transaction.

In summary, inputs and outputs in a Bitcoin transaction represent the mechanism by which the ownership of bitcoins is transferred. Inputs refer to the source of the bitcoins being sent, and outputs specify the destination of the bitcoins.

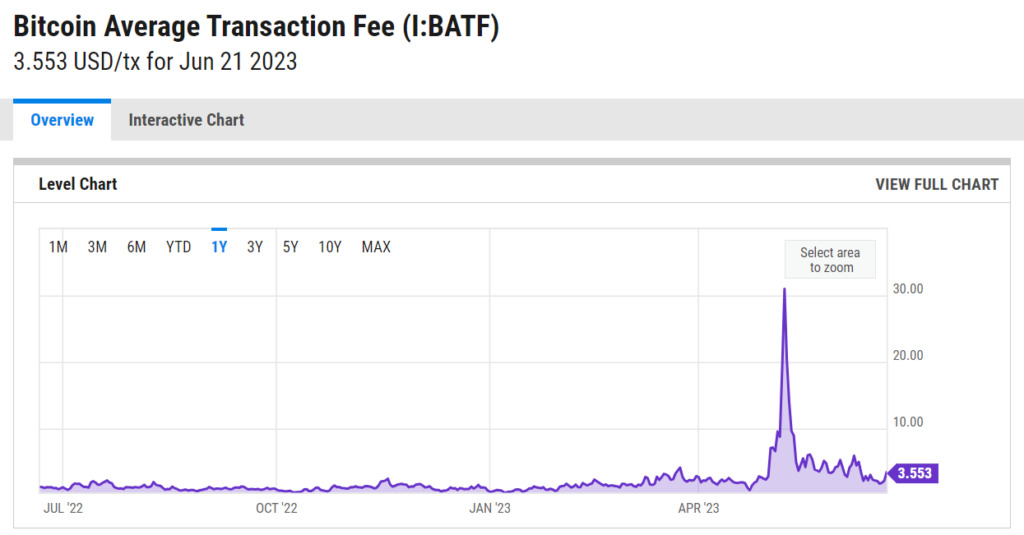

Transaction Fees

Transaction fees in Bitcoin are a form of incentive for miners to include your transaction in the block they’re mining. They serve as a sort of ‘priority service’ fee: the higher the fee you’re willing to pay, the more likely your transaction will be included in the next block, thus getting confirmed faster.

Here’s a more detailed explanation:

Why Transaction Fees Exist

Bitcoin miners use computational power to solve complex mathematical problems that allow them to add a new block of transactions to the blockchain. This process, known as mining, requires significant computational resources and electricity.

To incentivize miners to continue this process, they are rewarded with newly minted bitcoins (known as the block reward) and transaction fees from the transactions included in the new block. As the block reward halves approximately every four years, transaction fees become increasingly important for miners’ profitability.

How Transaction Fees are Calculated

Transaction fees are not fixed and depend on several factors:

- Transaction Size: Bitcoin transactions are composed of inputs and outputs, and the more there are, the larger the transaction. Larger transactions take up more space in a block and thus incur higher fees.

- Network Congestion: If many people are sending transactions at the same time, miners will prioritize transactions with higher fees. Therefore, during times of high network usage, you may need to pay a higher fee for your transaction to be processed in a timely manner.

- Urgency: If you need your transaction to be confirmed as soon as possible, you can choose to pay a higher fee to incentivize miners to prioritize your transaction.

Bitcoin wallets usually suggest the transaction fee you should pay based on the current network conditions. Some wallets also allow you to choose between different fee levels (e.g., low, medium, high priority) depending on how quickly you need the transaction to be confirmed.

Change and Transaction Fees

If the sum of your transaction inputs exceeds the amount you want to send, the difference is returned to you as ‘change’ through a change output. However, if you don’t explicitly set a transaction fee, miners may take the difference as a fee. Therefore, it’s important to set your transaction fee correctly to avoid overpaying.

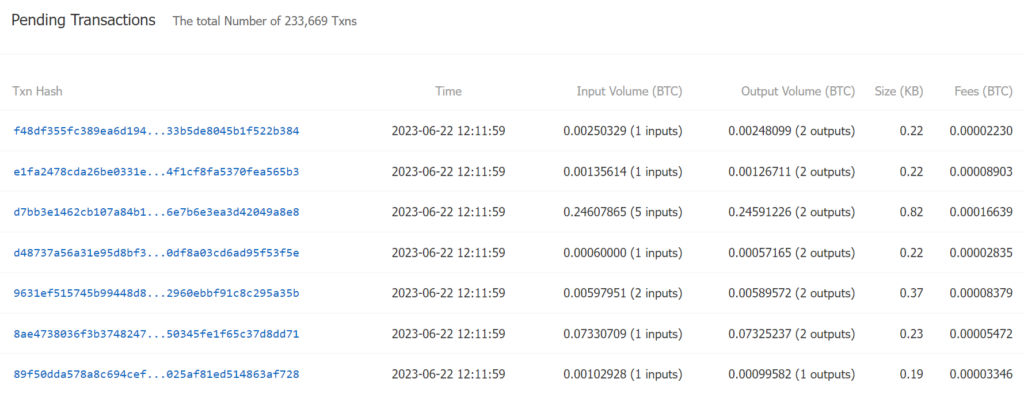

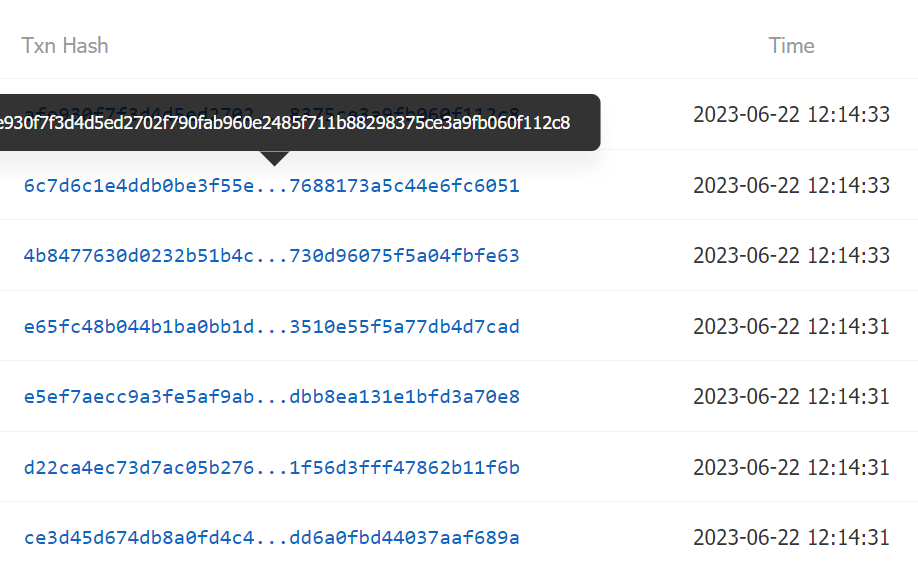

Transaction ID (TXID)

A TXID is essentially a unique receipt for a Bitcoin transaction. It is a hash that is computed from the transaction data, and it uniquely identifies the transaction on the Bitcoin network. No two transactions, even if they involve the same parties and the same amount of Bitcoin, will ever have the same TXID.

How is a TXID Generated?

A TXID is generated by hashing the transaction data twice using the SHA-256 cryptographic hash function. This process takes the transaction data as input and produces a fixed-size string of characters, which is the TXID.

What is a TXID Used For?

A TXID is used to locate a transaction within the blockchain. By searching for a TXID, you can find the details of the transaction, including the amount of Bitcoin transferred, the sender’s and recipient’s addresses, the number of confirmations, and the time of the transaction.

How to Find a TXID

After you send or receive a Bitcoin transaction, you can find the TXID in your Bitcoin wallet. Most wallets will provide a list of your recent transactions, including the TXID. You can also find the TXID by searching for the transaction on a blockchain explorer, which is a search engine for the blockchain.

| Blockchain Explorer | URL |

|---|---|

| Blockchain.com | https://www.blockchain.com/explorer |

| BlockCypher | https://live.blockcypher.com/ |

| Blockchair | https://blockchair.com/bitcoin |

| BTC.com | https://btc.com/ |

| SoChain | https://sochain.com/ |

How Bitcoin Transactions Work

Processing a Bitcoin Transaction: Step-by-Step

Step 1: Transaction Creation

The process begins when a sender decides to send bitcoins. The sender creates a transaction using their Bitcoin wallet. This transaction includes the amount of Bitcoin to be sent and the recipient’s Bitcoin address. The sender’s wallet then signs this transaction with the sender’s private key, which serves as a mathematical proof that the transaction has come from the owner of the wallet.

Step 2: Transaction Broadcast

Once the transaction is created and signed, it’s broadcasted to the Bitcoin network. This means that the transaction is sent to all the nodes in the Bitcoin network so that it can be included in the blockchain.

Step 3: Transaction Verification

The transaction is then picked up by Bitcoin miners. These miners verify the transaction, checking that the sender has enough Bitcoin to send the specified amount and that the transaction has been correctly signed. This process of verification ensures that the same Bitcoin can’t be spent twice, a problem known as double-spending.

Step 4: Block Mining

Once the transaction is verified, it’s included in a block of transactions. Miners then compete to solve a complex mathematical problem in a process known as proof-of-work. The first miner to solve the problem gets to add the new block, including the new transaction, to the blockchain. This process is known as mining.

Step 5: Transaction Confirmation

Once the block is added to the blockchain, the transaction is considered confirmed. This means that the Bitcoin has officially been transferred from the sender to the recipient. The recipient can now spend the Bitcoin they received.

It’s important to note that while a transaction is typically considered confirmed once it’s included in one block, more security-conscious recipients might wait for the transaction to be included in additional blocks before considering the transaction fully confirmed. This is because the more blocks that are added on top of the block containing the transaction, the harder it becomes for a malicious actor to reverse the transaction.

The Role of Miners in Bitcoin Transactions

Miners validate new transactions and record them on the global blockchain (Steps 3-5). For their effort, they are rewarded with new bitcoins and transaction fees.

The new bitcoins are created in a process known as block reward halving, which happens approximately every four years. The transaction fees are an incentive for miners to include transactions in the blocks they mine.

Security Aspects of Bitcoin Transactions

Bitcoin transactions are secured through a combination of cryptographic techniques and a consensus mechanism. Here’s a more detailed explanation:

Cryptographic Security

Bitcoin uses a form of cryptography known as public key cryptography. Each Bitcoin wallet has a pair of cryptographic keys: a public key, which is shared publicly, and a private key, which is kept secret.

When you send bitcoins, you ‘sign’ the transaction with your private key, which generates a digital signature. This signature is unique to each transaction and cannot be reused. It provides mathematical proof that the transaction has come from you and hasn’t been tampered with.

On the receiving end, anyone can use your public key to verify that your digital signature matches the transaction, confirming that the transaction is authentic and hasn’t been tampered with. However, they cannot reverse-engineer your private key from this information, keeping your wallet secure.

Blockchain Security

Once a Bitcoin transaction is confirmed and added to the blockchain, it becomes nearly impossible to alter or remove. This is because each block on the blockchain contains a cryptographic hash of the previous block, creating a chain of blocks.

If someone were to try to alter a transaction, they would have to alter the block containing the transaction and all subsequent blocks, as altering one block would change its hash and break the chain. Given the amount of computational power required to do this, it’s practically impossible, especially as new blocks are being added to the blockchain all the time by miners.

Consensus Mechanism

Bitcoin uses a consensus mechanism known as proof-of-work (PoW). This is the process by which miners compete to add new blocks to the blockchain. The PoW mechanism ensures that no single entity can take control of the Bitcoin network and validates the transactions on the network.

Importance of Transaction Signatures

Transaction signatures are a critical component of Bitcoin’s security and the functioning of its blockchain network. They serve as a proof of authenticity and prevent unauthorized transactions. Here’s a more detailed explanation:

Proof of Ownership

A transaction signature, also known as a digital signature, is a cryptographic mechanism that allows a user to prove ownership of their Bitcoin. When a user sends Bitcoin, they must provide a signature that corresponds with the Bitcoin address from which they are sending. This signature is generated using their private key and is unique to each transaction.

Authentication and Non-Repudiation

The signature serves two primary purposes: authentication and non-repudiation. Authentication ensures that the transaction was indeed created by the owner of the address, and non-repudiation prevents the sender from denying that they initiated the transaction.

Preventing Double Spending

Transaction signatures also play a crucial role in preventing double spending. Double spending is a potential flaw in a digital cash scheme in which a single digital token can be spent more than once. Because the signature is unique to each transaction and includes a reference to the previous transaction, it’s impossible for a spender to send the same Bitcoin to two different recipients.

Security Against Theft

Finally, because the signature requires the private key to generate, and the private key is only known to the owner of the Bitcoin wallet, transaction signatures provide security against theft. Even if someone else knows your Bitcoin address (public key), they can’t generate a valid signature without the private key.

Understanding Transaction Speed and Costs

Factors Affecting Transaction Speed

The speed of a Bitcoin transaction can be influenced by several factors. Here’s a more detailed explanation:

Transaction Size

The size of a Bitcoin transaction, measured in bytes, affects how quickly it gets processed. Larger transactions take up more space in a block and may take longer to process. The size of a transaction is determined by the number of inputs and outputs it has, not the amount of Bitcoin being sent.

Transaction Fee

The transaction fee you choose to pay can significantly impact the speed of your transaction. Miners prioritize transactions that offer higher fees because they receive these fees as a reward. Therefore, if you want your transaction to be processed faster, you can choose to pay a higher fee.

Network Congestion

The overall congestion of the Bitcoin network also affects transaction speed. If many people are sending transactions at the same time, it can take longer for your transaction to be confirmed, especially if you’re paying a lower fee. This is similar to how a highway can get congested if many people are driving at the same time.

Block Time

Bitcoin blocks are added approximately every 10 minutes. If you’re lucky and a new block is found right after you broadcast your transaction, your transaction could be confirmed quickly. However, if a block was just found and you just missed it, you’ll have to wait for the next one.

Protocol Features

Certain protocol features can also affect transaction speed. For example, SegWit (Segregated Witness) is a protocol upgrade that increases block capacity, allowing for more transactions to be processed at once. Transactions from SegWit-enabled wallets can therefore get confirmed faster, especially during times of high network congestion.

Transaction Costs and How They are Calculated

Transaction costs, also known as transaction fees, are an integral part of the Bitcoin network. They serve as an incentive for miners to include your transaction in the block they’re mining. Here’s a more detailed explanation:

Why Transaction Costs Exist

Bitcoin miners use computational power to solve complex mathematical problems that allow them to add a new block of transactions to the blockchain. This process, known as mining, requires significant computational resources and electricity.

To incentivize miners to continue this process, they are rewarded with new bitcoins (known as the block reward) and transaction fees from the transactions included in the new block. As the block reward halves approximately every four years, transaction fees become increasingly important for miners’ profitability.

How Transaction Costs are Calculated

Transaction costs are not fixed and depend on several factors:

- Transaction Size: Bitcoin transactions are composed of inputs and outputs, and the more there are, the larger the transaction. Larger transactions take up more space in a block and thus incur higher fees.

- Network Congestion: If many people are sending transactions at the same time, miners will prioritize transactions with higher fees. Therefore, during times of high network usage, you may need to pay a higher fee for your transaction to be processed in a timely manner.

- Urgency: If you need your transaction to be confirmed as soon as possible, you can choose to pay a higher fee to incentivize miners to prioritize your transaction.

Bitcoin wallets usually suggest the transaction fee you should pay based on the current network conditions. Some wallets also allow you to choose between different fee levels (e.g., low, medium, high priority) depending on how quickly you need the transaction to be confirmed.

Tips for Reducing Transaction Costs

Reducing transaction costs can be beneficial for Bitcoin users, especially those who frequently transact in Bitcoin. Here are some strategies to help reduce transaction costs:

Consolidate Transactions

If you have many small inputs in your Bitcoin wallet (perhaps from receiving many small transactions), you might want to consolidate them into a single larger output. This can be done by sending all your Bitcoin to yourself in a single transaction. While you’ll have to pay a transaction fee for this, it can make future transactions cheaper because they’ll require fewer inputs.

Use SegWit Addresses

SegWit, or Segregated Witness, is a protocol upgrade that increases block capacity by changing how transaction data is stored. Transactions from SegWit-enabled wallets are typically cheaper because they use less block space. If your wallet supports it, you should use SegWit addresses (which start with “3” or “bc1”) to reduce your transaction costs.

Transact During Off-Peak Times

Transaction fees rise during times of high network congestion because more people are competing for the limited space in a block. If your transaction isn’t urgent, you can try sending it during off-peak times when fewer people are transacting. This might allow your transaction to be included in a block with a lower fee.

Use a Wallet That Allows Fee Customization

Some Bitcoin wallets allow you to customize your transaction fee. If you’re not in a hurry, you can choose to pay a lower fee. However, keep in mind that miners prioritize transactions with higher fees, so your transaction might take longer to confirm.

Use a Transaction Fee Estimator

There are several online services that estimate the optimal transaction fee based on current network conditions. These can help you choose a fee that is low but still likely to get your transaction confirmed in your desired timeframe.

Common Issues and Solutions in Bitcoin Transactions

| Issue | Description | Solution |

|---|---|---|

| Unconfirmed Transactions | Sometimes, a transaction can remain unconfirmed for a long period. This usually happens when the transaction fee paid is too low, and miners prioritize other transactions with higher fees. | To avoid this issue, ensure you’re paying a sufficient transaction fee. If your transaction is stuck, some wallets offer a “Replace by Fee” (RBF) option, allowing you to increase the fee after sending. |

| Double Spending | Double spending is when someone attempts to send the same bitcoins to two different recipients at the same time. This is generally prevented by the Bitcoin network’s confirmation process. | The best way to avoid being a victim of double spending is to wait for at least one confirmation before considering a transaction complete. For larger amounts, waiting for six confirmations is generally considered secure. |

| Lost or Stolen Bitcoins | If your private keys are lost or stolen, your bitcoins can be permanently lost or stolen too. | Always keep your private keys secure. Use hardware wallets for large amounts of Bitcoin, and consider using multi-signature wallets for added security. Regularly backup your wallet to ensure you can recover your bitcoins if you lose access to your device. |

| High Transaction Fees | During times of high network congestion, transaction fees can become quite high. | To reduce transaction fees, consider using SegWit addresses, transacting during off-peak times, and using a wallet that allows fee customization. Also, consider consolidating your inputs when possible. |

Future of Bitcoin Transactions

The future of Bitcoin transactions is a topic of ongoing discussion and development within the cryptocurrency community. Here’s a look at some potential future developments:

Scalability Solutions

As Bitcoin continues to grow in popularity, scalability solutions will become increasingly important to handle a larger volume of transactions. One such solution is the Lightning Network, a “second layer” protocol that operates on top of the Bitcoin blockchain. The Lightning Network allows for faster and cheaper transactions by creating payment channels between users, reducing the need for every single transaction to be recorded on the blockchain.

Privacy Enhancements

While Bitcoin transactions are pseudonymous (linked to public addresses, not directly to identities), they are not entirely private. All transactions are publicly recorded on the blockchain, which means that with enough effort, transactions can potentially be traced back to individuals. Future developments may focus on enhancing the privacy of Bitcoin transactions, such as through techniques like CoinJoin, which mixes transactions together to obscure their origins.

Smart Contracts

While Bitcoin currently supports basic scripting functionality, future developments may introduce more complex smart contract capabilities, similar to what Ethereum offers. This could open up a wide range of possibilities, from decentralized finance (DeFi) applications to tokenization and more.

Interoperability

Interoperability, or the ability for different blockchain networks to interact and transact with each other, is another area of potential development. This could allow Bitcoin to be used more easily across different blockchain platforms and applications.

Regulatory Developments

Finally, the future of Bitcoin transactions will also be shaped by regulatory developments. As governments around the world grapple with how to regulate cryptocurrencies, their decisions could impact how Bitcoin transactions are conducted.

Conclusion

Understanding Bitcoin transactions is essential for anyone involved in the cryptocurrency space. From the creation and signing of a transaction, through its verification and confirmation, to its recording on the blockchain, each step is a testament to the robust security and innovative technology behind Bitcoin.

Bitcoin transactions are secured through cryptographic signatures, ensuring that only the rightful owner of the Bitcoins can initiate a transaction. Miners play a crucial role in processing these transactions, maintaining the integrity and security of the Bitcoin network.

However, like any technology, Bitcoin transactions come with their own set of challenges. Issues like unconfirmed transactions, double spending, and high transaction fees are ongoing concerns. But with the continuous development in the Bitcoin protocol and the broader cryptocurrency ecosystem, solutions are being developed to address these issues.

Looking ahead, the future of Bitcoin transactions is promising. With advancements in scalability solutions like the Lightning Network, potential enhancements in privacy, the possibility of more complex smart contracts, and increasing interoperability with other blockchains, Bitcoin transactions are set to become faster, cheaper, and more efficient.

As we navigate this exciting landscape, it’s important for users to stay informed and understand the mechanics behind Bitcoin transactions. This knowledge not only helps users to use Bitcoin more effectively and safely, but also contributes to the collective development and maturation of the Bitcoin ecosystem.

Whether you’re a seasoned Bitcoin user or a curious newcomer, we hope this article has provided valuable insights into the world of Bitcoin transactions. As always, we encourage you to continue learning and exploring the fascinating world of Bitcoin and cryptocurrencies.

What is a Bitcoin transaction?

A Bitcoin transaction is a transfer of Bitcoin value that is broadcasted to the network and collected into blocks. It typically involves the sender creating a transaction, signing it with their private key, and broadcasting it to the Bitcoin network.

How are Bitcoin transactions verified?

Bitcoin transactions are verified by miners. Miners check that the transaction is valid, meaning that the inputs and outputs balance out and the transaction has been correctly signed with the sender’s private key.

What is a transaction fee and why is it necessary?

A transaction fee is a small amount of Bitcoin included in a transaction as an incentive for miners to add the transaction to the blockchain. Transaction fees are necessary to incentivize miners to continue mining, which secures the network and processes transactions.

Why is my Bitcoin transaction taking so long to confirm?

Bitcoin transactions can take a long time to confirm if the network is congested or if the transaction fee paid was too low. Miners prioritize transactions with higher fees, so if you pay a low fee, your transaction might take longer to confirm.

How can I check the status of my Bitcoin transaction?

You can check the status of your Bitcoin transaction by looking it up on a blockchain explorer. You’ll need the transaction ID (TXID), which you can get from your Bitcoin wallet.

Is it possible to reverse a Bitcoin transaction?

Once a Bitcoin transaction is confirmed and added to the blockchain, it is nearly impossible to reverse. This is because changing a transaction would require changing all subsequent blocks in the blockchain, which would require an enormous amount of computational power.

What are some ways to reduce transaction fees?

You can reduce transaction fees by using SegWit addresses, transacting during off-peak times, using a wallet that allows fee customization, and consolidating your inputs when possible.