In the ever-evolving crypto cosmos, we’ve been your guiding star for half a decade. With five years of experience under our belt, we’ve witnessed the meteoric rise and fall of countless crypto projects. The wisdom we’ve garnered? It’s simple: “Stop watering dead plants.” This age-old adage, though not originally about cryptocurrency, perfectly encapsulates the essence of our message today. Let’s embark on this enlightening journey to discern the dying crypto projects and understand when it’s time to pull the plug.

Table of Contents

Understanding the ‘Stop Watering Dead Plants’ Philosophy

The phrase “stop watering dead plants” paints a vivid picture that transcends its literal meaning. At its core, this adage is a call to recognize when our efforts, resources, and emotions are being poured into endeavors that no longer bear fruit—or perhaps never did. It’s a reminder that sometimes, no matter how much we care or how hard we try, certain things are beyond revival.

In the context of investments, especially the unpredictable world of cryptocurrencies, this philosophy becomes even more poignant. The crypto market, with its allure of high returns, often sees investors holding onto projects long past their viability, hoping against hope for a turnaround. But just as a gardener wouldn’t waste water on a plant that’s clearly dead, investors need to recognize when it’s time to redirect their resources to more promising ventures.

The “stop watering dead plants” philosophy is not about giving up at the first sign of trouble. It’s about discerning between a temporary setback, which can be overcome with effort and persistence, and a dead-end, where further investment of time and resources is futile. It’s about understanding the difference between patience and stubbornness, between optimism and denial.

The Crypto Landscape: A Brief Overview

The world of cryptocurrencies is a mesmerizing tapestry of innovation, risk, and potential. Since the inception of Bitcoin in 2009, the crypto landscape has expanded exponentially, giving birth to a plethora of digital currencies, each with its unique value proposition, technology, and vision.

The Revolutionary Rise of Cryptocurrencies

From being a fringe concept discussed in niche tech forums, cryptocurrencies have catapulted to the forefront of global finance. Bitcoin’s meteoric rise was just the beginning. Today, there are over 10,000 different cryptocurrencies, from Ethereum’s smart contracts to Kaspa coin‘s fastest payment protocol. This digital gold rush has been fueled by a combination of technological advancements, increasing mainstream acceptance, and the promise of decentralized control, free from traditional banking systems and governmental oversight.

The Double-Edged Sword of Crypto Projects

With great potential comes great risk. The crypto world is reminiscent of the Wild West, filled with incredible opportunities but also fraught with danger. For every legitimate, groundbreaking project, there are several that either lack substance or are outright scams. Initial Coin Offerings (ICOs) and new token launches happen almost daily, making it a challenge for even seasoned investors to separate the wheat from the chaff. The allure of astronomical returns often blinds individuals to the inherent risks, leading to decisions based on hype rather than solid research.

The Shadows Behind the Limelight

While success stories of crypto millionaires and revolutionary projects dominate headlines, there’s a darker side to this landscape. Failed projects, rug pulls, regulatory crackdowns, and market manipulations are all too common. The decentralized nature of cryptocurrencies, while one of its strongest assets, also makes it a fertile ground for nefarious activities. Moreover, the volatile nature of the market means that fortunes can be made or lost in the blink of an eye. This crypto volatility, driven by a combination of speculative trading, regulatory news, technological developments, and macroeconomic factors, adds another layer of complexity to the already intricate world of cryptocurrencies.

Recognizing the Signs of a Dying Crypto Project

In the vast universe of cryptocurrencies, not every star shines bright. Some projects, despite their initial promise, start to fade away, either due to internal issues, market dynamics, or external pressures. Recognizing the signs of a dying crypto project early on can save investors both time and money. Here’s an in-depth exploration of the warning signs:

Chart: Warning Signs of a Dying Crypto Plants

| Sign | Description | Example |

|---|---|---|

| Declining Community Engagement | Decrease in active forum discussions, social media interactions, or unanswered crypto community concerns. | A once-active Telegram group now has minimal posts. |

| Silence from Project Teams | Lack of updates, missed deadlines, or no communication from the project’s core team. | A promised software update is delayed without explanation. |

| Financial Concerns | Consistent drop in token value, lack of project funds, or transparency issues. | The project’s token value has dropped 80% in three months with no market-wide downturn. |

| Technological Stagnation | No new features, updates, or technological advancements compared to competitors. | Competing projects have launched new features, but this project hasn’t updated in a year. |

| Regulatory and Legal Challenges | Legal issues, regulatory crackdowns, or inability to comply with new regulations. | The project is banned in multiple countries due to regulatory concerns. |

The True Cost of Clinging to Dead Projects

Particularly within the volatile crypto sector, hope can sometimes cloud judgment. The emotional attachment, combined with the sunk cost fallacy, often leads investors to cling to projects long after they’ve shown signs of decay. However, the repercussions of holding onto dying crypto projects extend far beyond mere financial losses. Let’s delve deeper into the multifaceted costs of such decisions:

The Financial Abyss

The most immediate and palpable cost of holding onto a failing project is financial. As the value of the project’s token or coin plummets, investors see their holdings diminish, sometimes drastically. But there’s more to it than just the decreasing value of a particular asset. Every moment spent on a dying project is a missed opportunity elsewhere. The funds tied up in a failing project could have been invested in other, more promising ventures, leading to potential gains. This concept, known as opportunity cost, is a significant factor that many overlook.

The Emotional Quagmire

Beyond the numbers, there’s a profound emotional and psychological toll. The stress of watching an investment spiral downwards, the anxiety of uncertainty, and the weight of decision-making can be mentally exhausting. Moreover, the longer one clings to hope without any positive signs, the harder it becomes to accept the reality and make rational decisions. This emotional rollercoaster can lead to decision paralysis, where the fear of making the wrong move results in no move at all.

Time: The Irrecoverable Asset

Time, once spent, can never be regained. The hours spent monitoring the project, seeking updates, participating in community discussions, and strategizing potential recovery plans are all time that could have been utilized elsewhere. Whether it’s researching other investment opportunities, focusing on personal growth, or simply enjoying leisure, the time lost to a dead project is a cost that’s often underestimated.

The Ripple Effect of Reputation

For those who actively promote or endorse crypto projects, especially influencers or thought leaders in the space, backing a failing project can have reputational consequences. The crypto community values trust and credibility. Continuously supporting or promoting a project that’s clearly failing can erode that trust. It’s not just about the immediate backlash but the long-term perception that might deter followers from heeding future advice or endorsements.

The Domino Effect on Overall Portfolio

A failing project can also impact an investor’s overall portfolio balance and strategy. As the value of one asset drops, it can skew the balance of the portfolio, leading to overexposure in other areas. This imbalance can increase the portfolio’s risk profile, making it more susceptible to market volatilities.

Great Started Crypto Projects That Went South

Cryptocurrencies have been a revolutionary force in the financial world, offering decentralized alternatives to traditional banking systems. While many have succeeded, some promising projects have faced challenges that hindered their growth or even led to their downfall. Here are a couple of examples:

Grin Coin

Grin Coin, launched in January 2019, quickly gained attention for its unique approach to privacy and scalability. Built on the Mimblewimble protocol, it offers confidential transactions and a reduced blockchain size. Grin was developed by anonymous developers inspired by the Mimblewimble whitepaper released in 2016. It emphasized privacy, scalability, and decentralization.

Key Features:

- Innovative Privacy: Uses the Mimblewimble protocol for enhanced privacy.

- Scalability: Addresses scalability issues through transaction aggregation.

- Community-Driven Development: Open-source and accessible to everyone.

- Unique Tokenomics: Linear emission rate and no maximum supply cap.

- Growing Adoption: Driven by its unique features.

- Challenges: Despite its potential, Grin faced regulatory concerns due to its privacy features. It also had to compete with established privacy coins like Monero and Zcash. Technological hurdles and monetary policy criticisms were other challenges.

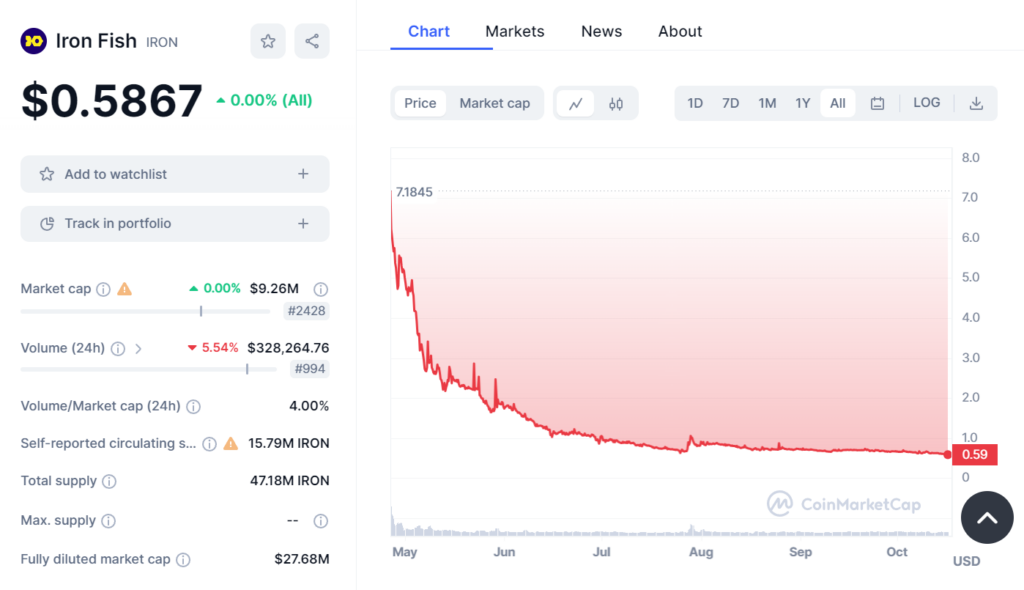

Iron Fish

Iron Fish emphasizes encrypting every transaction, shielding sensitive asset information from public view. It aims to be a seamless, safe crypto platform for users and developers.

Key Features:

- Privacy without Compromise: Built with zk-SNARK technology for maximal security.

- Decentralization: Powered by a global network of miners and nodes, making it resilient and censorship-resistant.

- Compliance: Users receive view keys for read-only access to their transactions, aiding in compliance.

These projects, despite their innovative approaches and features, faced challenges that impacted their trajectory. It’s a reminder that the crypto landscape is dynamic, and even promising projects can face unforeseen obstacles.

Navigating Away from the Crypto Quicksand

The allure of high returns often draws investors into projects that, upon closer inspection, might be more quicksand than solid ground. However, with the right strategies and a discerning eye, one can navigate this landscape safely and profitably. Let’s explore the strategies that can act as a lifeline in the crypto quagmire:

Chart: Strategies to Navigate the Crypto Landscape Safely

| Strategy | Description | Benefit |

|---|---|---|

| Comprehensive Research | Delve deep into project details, assess whitepapers, and understand tokenomics. | Make informed decisions and identify legitimate projects. |

| Portfolio Diversification | Spread investments across multiple crypto projects. | Mitigate risks and cushion potential losses. |

| Setting Clear Goals | Define specific investment targets and milestones. | Provide direction and clarity in decision-making. |

| Staying Updated | Keep abreast of the latest crypto news, regulations, and technological advancements. | Avoid surprises and adapt to changing market dynamics. |

| Community Engagement | Engage with fellow investors, seek expert opinions, and participate in crypto forums. | Gain broader insights and identify potential red flags or opportunities. |

Exiting with Grace and Wisdom

The crypto journey is as much about knowing when to step out as it is about diving in. While the allure of a turnaround or the fear of admitting a misstep can make exiting a project challenging, sometimes it’s the wisest move. Exiting a project doesn’t necessarily denote failure; it can be a strategic decision based on various factors. Let’s delve into the art of graceful exits in the crypto realm:

Acceptance: The First Step

The initial step towards a graceful exit is acceptance. Recognizing that a project is no longer viable or doesn’t align with one’s investment goals is crucial. This acceptance isn’t about conceding defeat but about understanding that the crypto landscape is dynamic. What seemed promising yesterday might not hold the same potential today. Accepting this reality allows investors to approach the exit process rationally, minimizing losses and emotional turmoil.

Lessons from the Ashes

Every investment, whether successful or not, offers invaluable lessons. Instead of viewing an exit as a loss, it can be seen as a learning opportunity. What signs were missed? What could have been done differently? Reflecting on these questions equips investors with insights that can guide future investment decisions. It’s about turning setbacks into setups for future successes.

The Art of Reinvestment

Exiting a project frees up resources, both financial and mental. These resources can be redirected towards more promising ventures. The crypto world is vast, with new projects and opportunities emerging regularly. By reallocating resources, investors can capitalize on these opportunities, turning the page on past ventures and looking forward to new horizons.

Transparent Communication: A Sign of Integrity

For investors who’ve publicly endorsed or promoted a project, communication is key. It’s essential to be transparent about the reasons for exiting, especially if a community or followers have been influenced by one’s endorsements. This transparency not only maintains credibility but also strengthens trust within the community. It’s about owning decisions, being accountable, and prioritizing the well-being of the community.

Strategic Timing and Methodology

The timing and method of exit are crucial. Instead of panic selling during a market downturn, it’s wise to have a pre-defined exit strategy. This strategy can be based on specific triggers, such as a certain price point, project milestones, or market conditions. Additionally, considering factors like tax implications, transaction fees, and market liquidity can ensure a smooth and beneficial exit.

Conclusion

The adage “Stop Watering Dead Plants” resonates deeply, not just within the intricate realms of the crypto world, but in the broader tapestry of life itself. At its core, this phrase encapsulates the essence of recognizing when it’s time to let go, to redirect our energies, and to focus on endeavors that truly hold the potential for growth and fulfillment.

In the volatile and ever-evolving landscape of cryptocurrencies, this wisdom is particularly poignant. It serves as a reminder to investors and enthusiasts to continuously evaluate the viability and potential of their investments. But beyond the digital coins and blockchain ledgers, the lesson is universal. Whether it’s a stagnant career, a relationship that’s lost its spark, or a hobby that no longer brings joy, the courage to stop watering what’s no longer alive can pave the way for new beginnings.

Life, much like the crypto market, is filled with opportunities. But to seize these opportunities, we must first create space by letting go of what no longer serves us. It’s about understanding that our time, energy, and resources are finite, and they’re best invested in places where they can truly make a difference.

So, as we navigate the complexities of investments and life choices, let’s carry with us the profound simplicity of this phrase. Let’s be discerning, let’s be brave, and most importantly, let’s recognize when it’s time to stop watering dead plants and start nurturing what truly has the potential to bloom.

FAQs

How can one differentiate between a temporary setback and a dying project?

Temporary setbacks are often followed by clear communication from the project team, a roadmap for recovery, and visible efforts to overcome challenges. In contrast, dying projects show consistent decline, lack of updates, and dwindling community interest.

Why is community engagement crucial for crypto projects?

Community engagement is a testament to a project’s viability and potential for growth. A vibrant community indicates trust, interest, and active participation.

What are the most common reasons for crypto project failures?

Common reasons include lack of innovation, poor financial management, regulatory issues, and lack of transparency.