As the leading authority in the crypto niche, we’ve meticulously reviewed every Shiba Inu Staking platform out there. Our mission? To bring you the most accurate, up-to-date, and actionable insights on maximizing your SHIB rewards. Let’s embark on this journey together.

Table of Contents

Staking: The Golden Goose of Cryptocurrency?

In the dynamic world of cryptocurrencies, staking stands out as a potentially lucrative strategy. Drawing a parallel to the fabled golden goose, staking offers continuous rewards, much like the goose that lays golden eggs. At its core, staking involves locking up a certain amount of cryptocurrency in a digital wallet. This action supports the operations and security of a blockchain network. In return for this commitment, participants often receive additional tokens as rewards.

The allure of staking is twofold. Firstly, it provides an opportunity for passive income, as the staked coins generate rewards over time. Secondly, it enhances the security and efficiency of the blockchain network, making the entire ecosystem more robust. However, like the tale of the golden goose, it’s essential to approach staking with patience and understanding, ensuring the continuous flow of rewards without hastily “killing the goose.”

Shiba Inu: More Than Just a Meme Coin

Emerging from the playful realm of internet memes, Shiba Inu, often abbreviated as SHIB, has carved a distinct identity in the cryptocurrency market. While its inception might have been influenced by Dogecoin and the broader meme culture, Shiba Inu quickly transcended its meme status.

With a dedicated community rallying behind it, SHIB introduced innovative features, such as the ShibaSwap decentralized exchange, and positioned itself as a genuine contender in the DeFi (Decentralized Finance) space. Its tokenomics, combined with strategic burns and charitable endeavors, have showcased its potential to be more than just a fleeting internet sensation. In essence, Shiba Inu has demonstrated that while its roots may be in meme culture, its aspirations and impact reach far beyond.

The Allure of Staking Shiba Inu

Magnetic Rewards and Incentives

Staking Shiba Inu has become a focal point for many crypto enthusiasts, primarily because of the enticing rewards it promises. By staking SHIB tokens, participants can earn additional SHIB over time, creating a passive income stream. The potential returns, especially during bullish market conditions, can be substantial, making it an attractive proposition for both novice and seasoned investors.

Strengthening the SHIB Ecosystem

Beyond the immediate financial gains, staking SHIB also plays a pivotal role in fortifying the Shiba Inu ecosystem. Stakers contribute to the network’s security, stability, and overall functionality. By locking up a portion of the circulating supply, staking helps reduce market volatility and instills confidence in the token’s long-term viability. This dual benefit of individual profit and collective ecosystem enhancement is what truly drives the allure of Shiba Inu staking.

How to Stake Shiba Inu

Embarking on your staking journey? Here’s a step-by-step guide:

| Step | Description | Key Considerations |

|---|---|---|

| 1. Wallet Setup | Before you can stake SHIB, you need a compatible digital wallet to store and manage your tokens. | – Choose a wallet known for security and compatibility with SHIB. – Ensure you have backup measures, like seed phrases. |

| 2. Accumulate SHIB | Ensure you have the necessary amount of SHIB tokens for staking. Some platforms may have a minimum staking requirement. | – Purchase SHIB from reputable exchanges. – Be aware of transaction fees. |

| 3. Choose a Staking Platform | Different platforms offer SHIB staking with varying terms, rewards, and security measures. | – Research platform reputation and user reviews. – Compare staking reward rates and durations. |

| 4. Initiate Staking | Transfer your SHIB tokens to the chosen platform and follow the staking procedure. | – Double-check transaction details. – Ensure you understand the staking duration and terms. |

| 5. Monitor and Manage | Regularly check on your staked SHIB and the rewards you’re accruing. | – Use platform tools or dashboards for monitoring. – Stay updated on any changes in staking terms or rates. |

| 6. Safety Protocols | Prioritize the security of your staked assets. | – Enable two-factor authentication. – Regularly update passwords and avoid sharing account details. |

| 7. Claiming Rewards | Depending on the platform, you may need to claim your staking rewards manually. | – Understand the claiming process and frequency. – Be aware of any associated fees. |

| 8. Unstaking and Exit | If you decide to end your staking, follow the platform’s unstaking procedure. | – Check for any unstaking periods or penalties. – Ensure a safe transfer of tokens back to your wallet. |

Decoding Shiba Inu Staking Rewards and Risks

Staking, especially in popular tokens like Shiba Inu, offers a tantalizing blend of potential rewards and inherent risks. To make informed decisions, it’s crucial to understand both facets in detail.

Understanding the Rewards

Mechanism of Rewards:

Staking rewards are typically generated as compensation for participants who lock up their tokens to support the network’s operations. These rewards can be viewed as interest earned on the staked amount.

Factors Influencing Rewards:

- Amount Staked: Generally, the more tokens you stake, the higher the rewards.

- Duration: Longer staking periods might yield better rewards, as it shows commitment to the network.

- Network’s Overall Staking Rate: If more people are staking, the reward for each individual might decrease, as it’s distributed among a larger pool.

- Token’s Inflation Rate: Some networks mint new tokens as staking rewards, which can influence the token’s overall value and, consequently, the real value of the rewards.

Navigating the Risks

Market Volatility:

The value of staking rewards is tied to the token’s market value. If the token price drops, so does the real value of your rewards.

Liquidity Concerns:

Staked tokens are locked and can’t be sold immediately. If the market is crashing, you might not be able to unstake and sell your tokens in time to prevent losses.

Platform Security:

Not all staking platforms offer the same level of security. There’s a risk of losing your staked tokens if the platform is hacked or if it turns out to be a scam.

Network Changes:

Updates or changes in the network’s protocols can affect staking rewards. It’s essential to stay updated with the token’s development and news.

Impermanent Loss:

For tokens staked in liquidity pools, there’s a risk of impermanent loss. This occurs when the price of your staked token changes compared to when you deposited it in the pool, leading to potential losses when you withdraw.

Spotlight on Shiba Inu Staking Platforms

There’s a myriad of platforms where you can stake SHIB. But where to stake Shiba Inu? We’ve done the legwork and here are the top contenders:

| Platform | Platform Type | Duration | Est. APR | Reward for 1000 SHIB per Year | Min SHIB Amount |

|---|---|---|---|---|---|

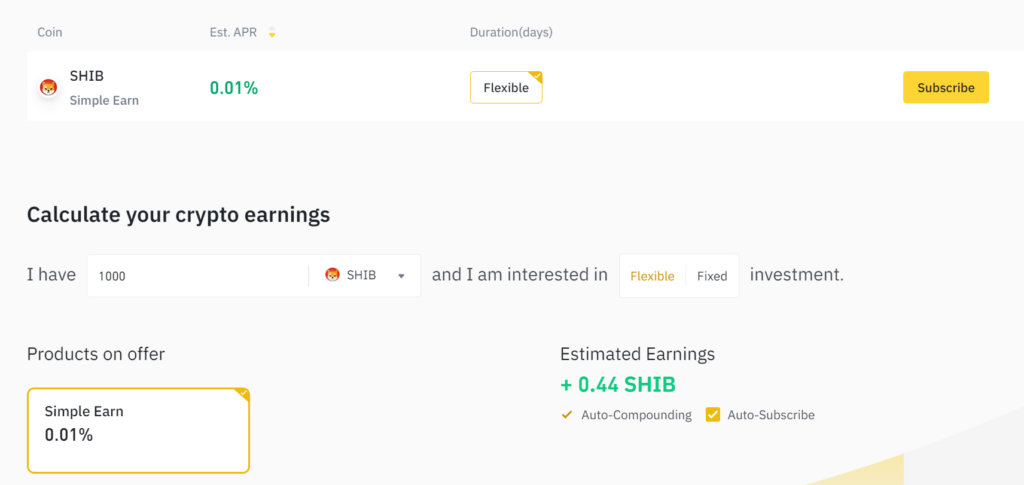

| Binance | CEX | Flexible | 0.01% | 0.14 SHIB | No minimum |

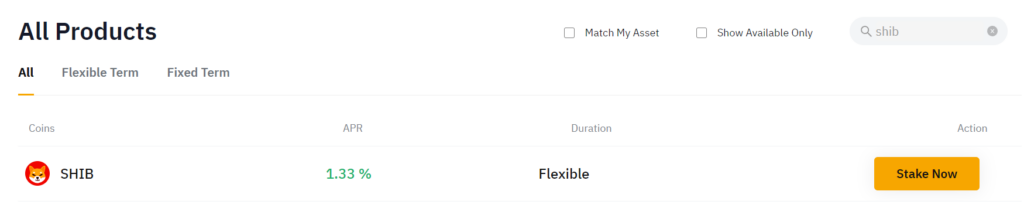

| Bybit | CEX | Flexible | 1.33% | 133 SHIB | 2 million SHIB |

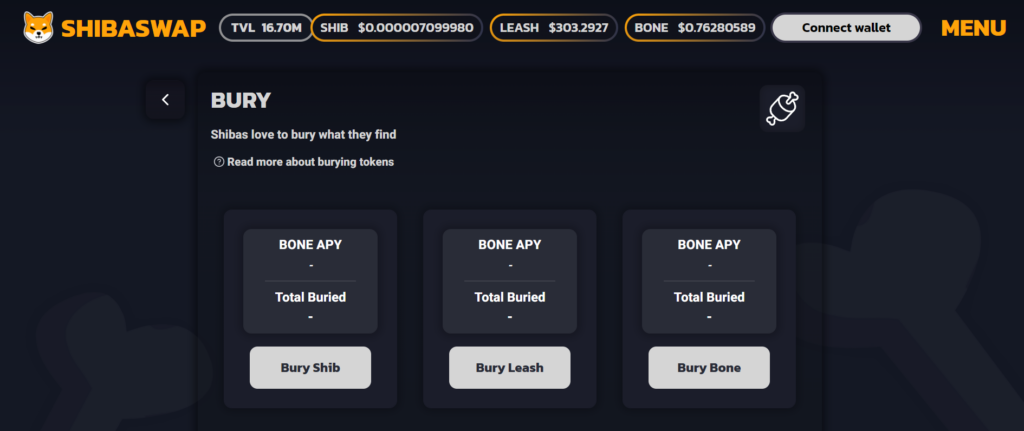

| Shibaswap | DEX | – | 0.04% | 0.4 SHIB | No minimum |

CEX (Centralized Exchange)

Platforms like Binance and Bybit are centralized, meaning they are managed by a single entity. They often provide user-friendly interfaces and robust security measures but come with the risk associated with centralization.

1. Binance

Binance, one of the world’s leading cryptocurrency exchanges, offers a dedicated platform for Shiba Inu staking. Through Binance Earn, users can stake their SHIB tokens and earn rewards. The platform is known for its user-friendly interface, robust security measures, and a wide range of supported cryptocurrencies.

Pros & Cons of Binance SHIB Staking:

| Pros | Cons |

|---|---|

| High security standards | Centralized platform |

| User-friendly interface | Potential for lower rewards due to high user base |

| Regular updates and announcements | Requires identity verification (KYC) |

| Wide range of supported cryptocurrencies | Some restrictions based on geographic location |

2. Bybit – Best Place to Stake Shiba Inu

Bybit is a tier 1 exchange that offers a range of investment products, including Shiba Inu staking. Their platform provides both flexible and fixed-term staking options, allowing users to choose based on their preferences. Bybit emphasizes its high rewards and flexibility, making it an attractive option for SHIB stakers.

Pros & Cons of Bybit SHIB Staking:

| Pros | Cons |

|---|---|

| Multiple staking options (flexible/fixed) | Centralized platform |

| Competitive APR rates | Minimum staking requirements |

| Regular promotional events with enhanced rewards | Might be complex for beginners |

| Transparent earnings calculations | Limited information without logging in |

DEX (Decentralized Exchange)

Shibaswap operates as a decentralized platform, meaning it’s not controlled by a single entity. It offers more autonomy to users and typically has fewer regulations but might be a bit more complex for beginners.

ShibaSwap

How to stake Shiba Inu on Shibaswap? ShibaSwap is a decentralized exchange built by the Shiba Inu community. It offers a unique feature called “Bury,” where users can stake (or “bury”) their SHIB tokens. Being decentralized, ShibaSwap gives users more autonomy and typically has fewer regulations, though it might be a bit more complex for beginners.

Pros & Cons of ShibaSwap SHIB Staking:

| Pros | Cons |

|---|---|

| Decentralized platform | Might be complex for new users |

| Direct involvement of the Shiba Inu community | Potential for higher gas fees |

| Transparency in staking data and metrics | Requires a compatible wallet for staking |

| Unique features like “Bury” and “Woof” |

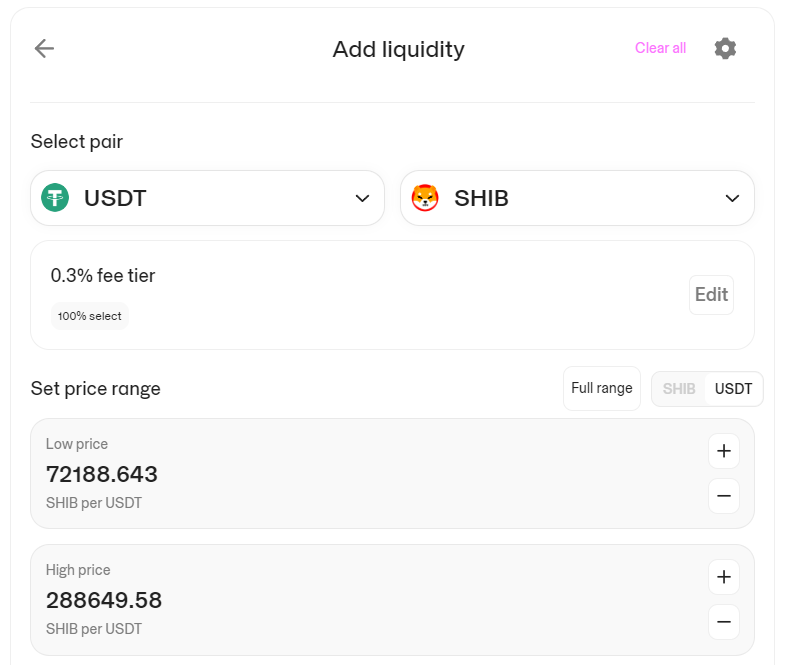

Uniswap’s Shiba Inu Staking

Uniswap presents an enticing avenue for SHIB enthusiasts to amplify their holdings, not just by staking, but by diving into the world of liquidity provision. Here’s how it unfolds:

When you opt to provide liquidity on Uniswap, you’re essentially stepping into a dual-role. Instead of just depositing SHIB, you pair it with another token, enhancing the pool’s depth. Take the SHIB/USDT pool as an illustration: to contribute, you’d deposit an equivalent value of both SHIB and USDT.

Once you’ve determined your contribution scale, you can initiate your position as a liquidity provider. The beauty of this approach? As transactions occur within the pool, a slice of the transaction fees goes into your pocket, rewarding you for bolstering the pool’s liquidity.

When choosing a platform, it’s essential to consider factors like security, user experience, and the platform’s reputation in addition to the potential rewards. Always conduct thorough research before committing your SHIB tokens to any platform.

Conclusion

After delving deep into the intricacies of Shiba Inu staking, our analysis suggests that the potential rewards might not justify the inherent risks for many investors. Here’s why:

The returns, represented by percentages, are notably low, especially when compared to other staking opportunities in the crypto realm. While staking typically offers a balance of risk and reward, the scales seem tipped unfavorably in the case of Shiba Inu.

Furthermore, the specter of impermanent loss looms large. For the uninitiated, impermanent loss occurs when the value of your staked tokens fluctuates compared to when you deposited them. In volatile markets, this can lead to significant losses, often overshadowing the meager rewards from staking.

In conclusion, while the Shiba Inu community is vibrant and the token has its merits, staking SHIB, in our opinion, might not be the most lucrative venture for many. As always, it’s crucial for investors to conduct their own research, understand their risk tolerance, and make informed decisions.

FAQs

Why are the staking rewards for Shiba Inu lower than other tokens?

The staking rewards for any token, including Shiba Inu, depend on various factors such as the total amount being staked across the network, the token’s inflation rate, and the network’s overall staking rate. Additionally, market demand and the token’s utility can influence rewards.

What is impermanent loss, and why is it a concern with Shiba Inu staking?

Impermanent loss occurs when the value of your staked tokens changes compared to when you deposited them, especially in liquidity pools. Given the volatility of Shiba Inu’s price, there’s a heightened risk of experiencing this loss, which can sometimes outweigh the benefits of staking rewards.

Can I unstake my Shiba Inu tokens anytime?

How can I mitigate the risks associated with Shiba Inu staking?

Diversification is a key strategy. Instead of staking all your SHIB tokens, consider diversifying your investments across different tokens and staking platforms. Additionally, stay informed about market trends, Shiba Inu developments, and always use secure and reputable staking platforms.