In the vast universe of cryptocurrency trading, a select few platforms rise above the rest, setting the gold standard for excellence, security, and functionality. These are the tier 1 crypto exchanges, the elite platforms that seasoned traders and newcomers alike aspire to join. As we venture into 2025, it’s crucial to understand what makes these exchanges the pinnacle of the crypto world and which ones lead the pack. Join us as we delve into the intricacies of tier 1 crypto exchanges and spotlight the top 5 that are shaping the future of digital currency trading.

Table of Contents

What is a Tier 1 Crypto Exchange?

The term “Tier 1” isn’t just a casual label; it represents the pinnacle of excellence in the crypto exchange landscape. But what exactly sets a Tier 1 crypto exchange apart from the rest?

A Tier 1 crypto exchange is akin to the Ivy League of universities or the luxury brands in the world of fashion. It’s an elite status conferred upon those exchanges that have consistently demonstrated superior performance, reliability, and trustworthiness in the crypto community. These exchanges aren’t just platforms where you can buy or sell digital assets; they are institutions that have shaped the course of the crypto industry.

Key Features of Tier 1 Crypto Exchanges

Let’s delve deeper into the key features that set tier 1 crypto exchanges apart from the rest:

Trading Volume and Liquidity

Trading volume refers to the number of assets traded on the platform within a specific timeframe, while liquidity indicates the ease with which assets can be bought or sold without causing significant price fluctuations.

- Significance: High trading volume and liquidity are indicators of a platform’s popularity and trustworthiness. They ensure smooth and efficient trading experiences, minimizing slippage and providing better price discovery.

- Impact on Traders: Crypto traders on high-volume, high-liquidity exchanges can execute large trades without drastically affecting the asset’s price, ensuring they get the best possible deal.

Range of Cryptocurrencies Offered

This refers to the variety and number of cryptocurrencies available for trading on the platform.

- Significance: A diverse range of cryptocurrencies allows traders to diversify their portfolios, hedge risks, and capitalize on emerging market trends.

- Emerging vs. Established Cryptos: While established cryptocurrencies like Bitcoin and Ethereum are standard, tier one exchanges also list promising emerging tokens, offering traders early investment opportunities.

User Interface and Experience

This encompasses the design, layout, and overall usability of the platform.

- Significance: A user-friendly interface ensures that both beginners and seasoned traders can navigate the platform with ease, making trades efficiently.

- Customization and Tools: Many tier 1 exchanges offer customizable dashboards, live price charts, and advanced trading tools, enhancing the trading experience.

Advanced Trading Tools

These are specialized tools and features that cater to professional and advanced traders.

Types of Tools

Charting Tools

Allow traders to analyze price trends, predict future movements, and make informed decisions.

Order Types

Beyond basic market and limit orders, advanced order types like stop-loss, take-profit, and trailing stops give traders more control over their trades.

Algorithmic Trading

Some platforms offer tools or integrations for traders to implement automated trading strategies based on predefined criteria.

Significance

Advanced tools empower traders to implement sophisticated strategies, manage risks effectively, and optimize profits.

Staking and Yield Farming Opportunities

Staking involves holding and locking up a cryptocurrency to support network operations like block validation, while yield farming is a way to earn rewards by lending or providing liquidity.

- Significance: These features offer traders additional avenues to earn passive income on their holdings, maximizing their returns.

- Safety and Returns: Tier 1 exchanges prioritize user safety, ensuring that staking and yield farming opportunities are secure and offer competitive returns.

Integration with Other Platforms

This refers to the exchange’s ability to seamlessly integrate with other financial tools, platforms, or services.

- Significance: Integrations, such as with hardware wallets, payment gateways, or DeFi platforms, enhance the platform’s utility and offer users a holistic crypto experience.

- Ease of Use: Seamless integrations ensure that users can access various services without the need to move their assets frequently, reducing transaction costs and time.

These features, combined with top-notch security measures and regulatory compliance, make tier 1 crypto exchanges the preferred choice for traders seeking a reliable, efficient, and comprehensive trading experience.

Top 5 Tier 1 Crypto Exchanges List [2025]

A sneak peek into the best of the best. While the crypto space is dynamic, these five have consistently proven their mettle.

| Exchange | Coins | Trading Modes | P2P | Copytrading | KYC |

|---|---|---|---|---|---|

| MEXC | 1685 | Spot + Futures | Yes (with KYC) | Yes | No (30 BTC per day) |

| OKX | 331 | Spot + Futures | Yes (with KYC) | No | No (10 BTC per day) |

| BingX | 535 | Spot + Futures | Yes (with KYC) | Yes | No (50K USDT per day) |

| Bitget | 597 | Spot + Futures | Yes (with KYC) | Yes | Yes |

| Gate | 1758 | Spot + Futures | Yes (with KYC) | No | Yes |

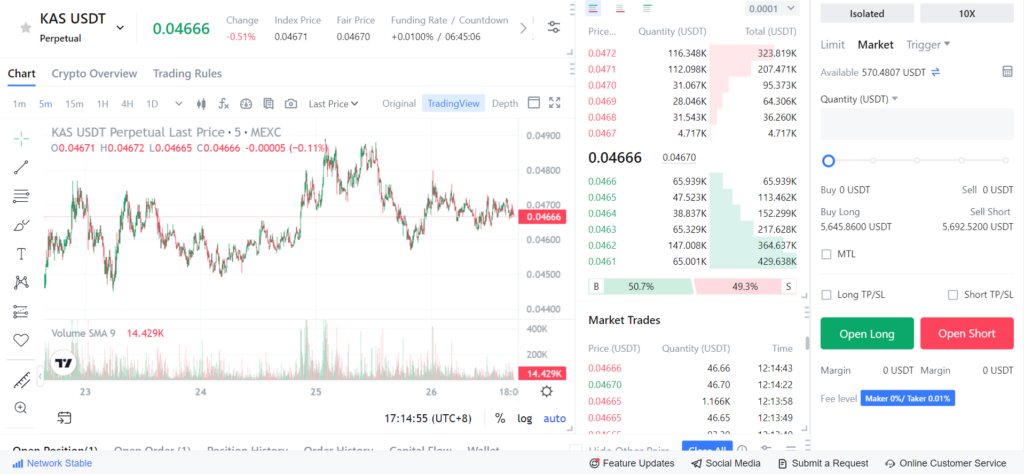

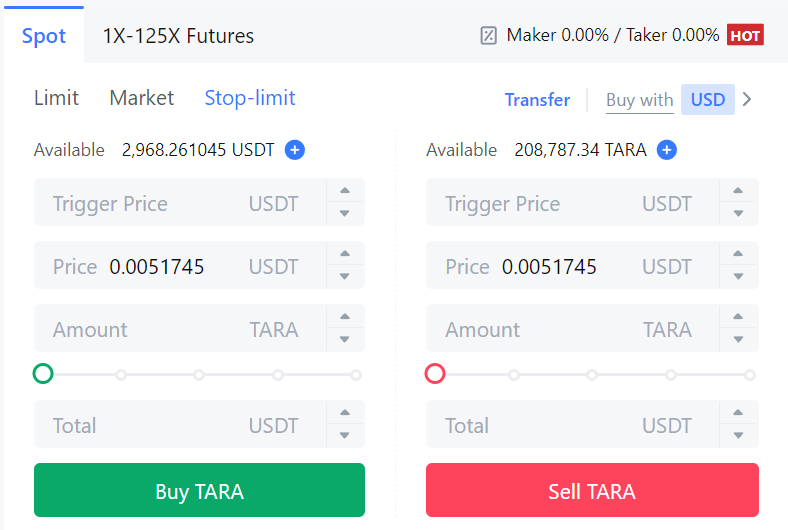

MEXC

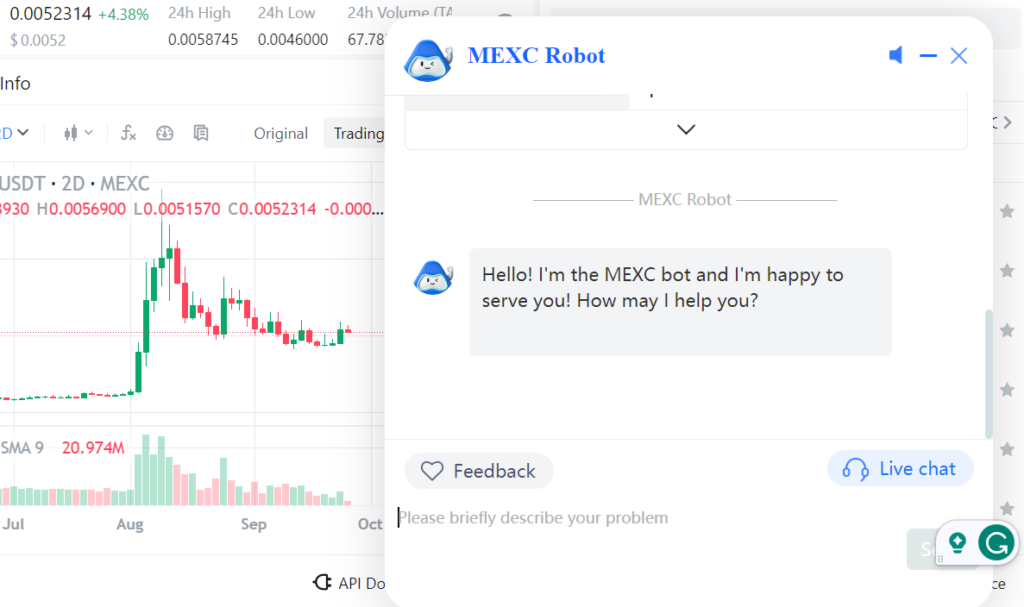

MEXC is a leading no kyc crypto exchange with a vast array of coins available for trading. Their spot and futures trading options provide flexibility for traders of all levels. Their copy trading feature is a highlight, allowing users to mimic the trades of experienced traders. Notably, they have a generous KYC-free withdrawal limit of 30 BTC per day.

OKX

OKX stands out with its efficient trading modes and a decent number of coins. Like MEXC, they offer both spot and futures trading. Their P2P trading requires KYC verification. While they lack a copytrading feature, their KYC-free withdrawal limit is set at 10 BTC per day, catering to high-volume traders.

BingX

BingX offers a balanced combination of spot and futures trading. Their P2P and copytrading features require KYC verification, ensuring added security for their users. They have a significant KYC-free withdrawal limit of 50K USDT per day, making it convenient for traders to move their assets.

Bitget

Bitget is a versatile exchange offering both spot and futures trading. They have a mandatory KYC requirement for all their features, including P2P and copytrading. This might be a deterrent for some, but it emphasizes their commitment to security and regulatory compliance.

Gate

Gate is a powerhouse in terms of the number of coins available. They offer both spot and futures trading, with a KYC requirement for their P2P feature. While they lack a copytrading option, their platform is robust and caters to both beginners and seasoned traders.

Security Measures

Security is paramount in the world of crypto exchanges. Here’s a more detailed exploration of the security measures that tier 1 crypto exchanges employ:

Cold and Hot Wallets

Cold wallets are offline storage systems for cryptocurrencies, while hot wallets are online and connected to the internet.

- Significance: Cold wallets provide an added layer of security by being immune to online hacking attempts. Hot wallets, while more vulnerable, offer quick access to funds for trading.

- Balance: Tier 1 exchanges maintain a majority of user funds in cold storage, minimizing exposure to online threats, while keeping a smaller portion in hot wallets for active trading needs.

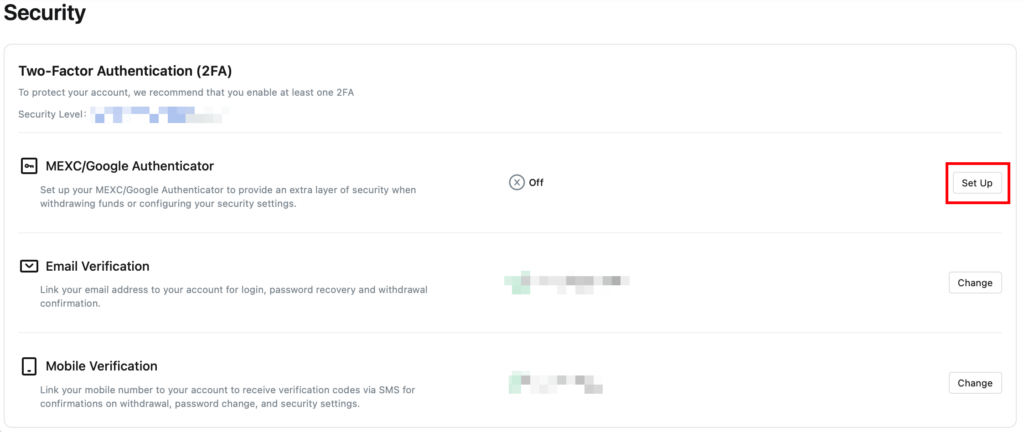

Two-Factor Authentication (2FA)

2FA is a security process where users provide two different authentication factors to verify their identity.

- Significance: It adds an extra layer of security, ensuring that even if a malicious actor obtains a user’s password, they would still need another verification method (like a code sent to a phone) to access the account.

- Implementation: Most tier 1 exchanges mandate 2FA for withdrawals and setting changes, ensuring that funds and account settings remain secure.

Withdrawal Whitelists

A feature that allows users to set specific, trusted withdrawal addresses.

- Significance: Even if an account is compromised, funds can only be withdrawn to a whitelisted address, adding an extra layer of protection.

- User Control: Users have the ability to add, remove, or modify whitelisted addresses, but changes typically involve a waiting period and additional verification for security.

Regular Security Audits

Periodic evaluations of the exchange’s systems and practices by external security experts.

- Significance: These audits identify potential vulnerabilities and ensure that the exchange’s security measures are up-to-date and robust.

- Transparency: Many tier one exchanges publish audit results or summaries, reinforcing trust with their user base.

Encryption Protocols

Techniques that encode data, ensuring that even if intercepted, the information remains unreadable without the decryption key.

- Significance: Encryption protects sensitive user data, such as personal details and transaction histories, from potential breaches.

- Types: Tier 1 exchanges employ advanced encryption protocols, like Transport Layer Security (TLS) for data in transit and AES-256 for data at rest.

Anti-Phishing Measures

Tools and practices to prevent phishing attacks, where malicious actors attempt to steal user information by masquerading as a trustworthy entity.

- Significance: Phishing is a common attack vector in the crypto world. Anti-phishing measures help users distinguish genuine communications from the exchange versus fraudulent ones.

- Implementation: This can include unique anti-phishing codes in every official email, regular user education, and warnings about known phishing sites.

DDoS Protection

Measures to mitigate Distributed Denial of Service (DDoS) attacks, where multiple systems flood a targeted system, causing it to crash.

- Significance: DDoS attacks can cripple an exchange’s operations and erode user trust. Protection ensures platform stability and uninterrupted service.

- Methods: Tier 1 exchanges employ various methods, including rate limiting, traffic analysis, and specialized infrastructure, to fend off DDoS attacks.

Regulatory Compliance and Licensing

Importance of Regulatory Compliance

Regulatory compliance refers to the adherence of an organization to laws, regulations, guidelines, and specifications relevant to its business processes.

- Significance: For crypto exchanges, compliance ensures the safety of users’ funds, prevents illicit activities like money laundering, and fosters trust among users and institutional investors.

Licensing and Its Role

Licensing involves obtaining official permission from regulatory bodies to operate in a particular jurisdiction.

- Significance: A license demonstrates that the exchange meets the stringent criteria set by regulators, ensuring a level of accountability and transparency.

Global Landscape of Crypto Regulations

- Variability: Crypto regulations vary significantly across countries. While some nations have embraced cryptocurrencies, others have imposed strict regulations or outright bans.

- Challenges for Exchanges: Navigating this complex global landscape requires exchanges to be agile, adapting to regulatory changes and ensuring compliance across multiple jurisdictions.

Binance’s Regulatory Challenges

- Historical Context: Binance, one of the world’s largest crypto exchanges, has faced regulatory scrutiny in various countries. Concerns have ranged from operating without a license to not having adequate measures against money laundering.

- Recent Issues: As of the last update in 2022, Binance had faced challenges in countries like the US, UK, Japan, and Canada, among others. They’ve been working to address these issues by enhancing their compliance measures and engaging with regulators.

- Impact: These challenges have underscored the importance of regulatory compliance in the crypto industry. Binance’s proactive approach to addressing these issues demonstrates their commitment to providing a secure and compliant trading environment.

- Anonymous Exchanges: While some exchanges like Binance face regulatory challenges, there are platforms that operate with a focus on anonymity. For more insights into anonymous trading, you can read this article on anonymous crypto exchange.

Fee Structures

Fee structures are a critical component of the crypto trading ecosystem. They not only determine the exchange’s profitability but also influence user decisions and trading strategies.

Understanding Fee Structures

Fee structures outline the various charges that users incur while using a crypto exchange. These fees are a primary revenue source for exchanges.

- Variability: Different exchanges have different fee structures, and they can vary based on the user’s trading volume, membership status, and other factors.

Common Types of Fees

Trading Fees

- Maker and Taker Fees: These are the most common types of trading fees. Makers add liquidity to the market, while takers remove it. Typically, taker fees are higher than maker fees.

- Significance: Trading fees are essential for exchanges as they facilitate trades and ensure market liquidity.

Deposit and Withdrawal Fees

Charges incurred when users deposit or withdraw funds from the exchange.

- Factors Influencing Fees: The type of cryptocurrency, transaction speed, and network congestion can influence these fees.

- Purpose: These fees often cover the transaction costs on the blockchain network and serve as an additional revenue stream for exchanges.

Listing Fees

Fees charged to cryptocurrency projects to list their tokens or coins on the exchange.

- Significance: For new or lesser-known projects, getting listed on a major exchange can provide significant exposure and credibility.

Fee Discounts and Loyalty Programs

- Token-based Discounts: Some exchanges offer their native tokens, which users can hold or use to pay for transaction fees at a discounted rate.

- Loyalty Programs: Regular traders or high-volume traders might receive reduced fees or other benefits as part of loyalty or VIP programs.

Transparency and User Awareness

- Importance: Transparent fee structures ensure that users are aware of all potential charges, fostering trust and long-term loyalty.

- User Education: It’s crucial for users to understand the fees they’re paying, as this can significantly impact their trading profitability and overall experience.

Revenue Models of Crypto Exchanges

- While fee structures are a primary revenue source, exchanges have multiple avenues to generate income. For a comprehensive understanding of how these platforms monetize their services, delve into this detailed article on How do crypto exchanges make money.

Customer Support and Community

An exchange’s commitment to its users and community is evident in its customer support and community engagement efforts. These elements not only enhance the user experience but also solidify the exchange’s position as a trusted and user-centric platform.

The Gold Standard of Customer Support

Customer support in tier 1 exchanges is not just about resolving issues; it’s about providing a seamless, efficient, and positive experience for every user interaction.

- Significance: Tier 1 exchanges understand that in the competitive world of crypto trading, top-notch customer support can be a significant differentiator. It’s not just about retaining users but also about building trust, loyalty, and a strong reputation in the industry.

- Channels of Excellence

- Live Chat: Tier 1 exchanges often have dedicated teams available 24/7, ensuring that users from all time zones receive real-time assistance.

- Email Support: Responses are not only swift but also comprehensive, addressing user queries in depth.

- Help Centers & FAQs: These resources are regularly updated, reflecting the latest features, policies, and user concerns, ensuring users have access to current and accurate information.

- Phone Support: Many tier 1 exchanges offer direct phone lines, emphasizing their commitment to immediate and personalized support.

Community: The Heartbeat of Tier 1 Exchanges

For tier 1 exchanges, the community is not just an audience but a collaborative partner. These exchanges actively engage, listen, and evolve based on community feedback.

Significance

A robust and engaged community amplifies the exchange’s reach, credibility, and innovation. Tier 1 exchanges invest significantly in community-building initiatives, recognizing the long-term value it brings.

Community-Centric Initiatives

- Exclusive Events: Tier 1 exchanges often host exclusive webinars, workshops, and meet-ups, fostering a sense of belonging and engagement among community members.

- Feedback Loops: These exchanges prioritize community feedback, often implementing features or changes based on popular demand.

- Rewards & Recognition: Active community members, contributors, and advocates might receive rewards, further incentivizing positive community participation.

Continuous Improvement

Tier 1 exchanges are in a constant state of evolution, always seeking to enhance the user experience. This drive for excellence is significantly influenced by user feedback and community interactions.

- Significance: By placing users at the forefront of their decision-making, tier 1 exchanges ensure that their offerings remain relevant, user-friendly, and ahead of the curve.

- Iterative Approach

- Regular Surveys: These exchanges often conduct surveys to gauge user satisfaction, gather feedback, and identify areas of improvement.

- Beta Testing with Community: Before rolling out major features, many tier 1 exchanges involve the community in beta testing, ensuring that the final product is polished and meets user expectations.

Future of Tier 1 Crypto Exchanges

The future of tier 1 crypto exchanges promises innovation, adaptability, and a continued commitment to serving the evolving needs of the global crypto community.

Embracing New Trading Paradigms

- Decentralization: While many tier 1 exchanges are centralized, there’s a growing trend towards decentralized exchange (DEX) models. DEXs offer enhanced privacy and reduced censorship. As the technology matures, tier 1 exchanges may integrate DEX features or even launch their decentralized platforms.

- Integration with Traditional Finance: Cryptocurrencies are increasingly intersecting with traditional finance. Tier 1 exchanges are poised to bridge this gap, offering services like crypto-backed loans and integrating with traditional stock exchanges.

Security and Technological Advancements

- Evolving Security Measures: Tier 1 crypto exchanges will continuously upgrade their security to counter evolving cyber threats. This includes future-proofing against potential quantum computing vulnerabilities.

- Expanding Asset Offerings: Beyond just cryptocurrencies, we can expect tier 1 exchanges to offer tokenized versions of traditional assets like stocks and real estate. The integration or partnership with booming Non-Fungible Token NFT marketplaces is also on the horizon.

Navigating the Regulatory Landscape and Global Expansion

- Regulatory Adaptation: As crypto regulations become more defined globally, tier 1 exchanges will ensure compliance while also playing a role in shaping these regulations.

- Global Presence: Tier 1 exchanges will continue to expand their footprint, entering new markets and tailoring their services to cater to regional needs and preferences.

Sustainability and User-Centric Initiatives

- Eco-friendly Focus: With the crypto industry under scrutiny for its environmental impact, tier 1 exchanges will prioritize sustainable practices and might even champion eco-friendly crypto assets.

- Enhanced User Experience: Leveraging technologies like AI, exchanges will offer personalized trading experiences. Additionally, to foster informed trading and adoption, they will ramp up their educational content and resources.

Conclusion

The emergence of numerous exchanges catering to the diverse needs of traders. Amidst this vast landscape, the term “Tier 1 crypto exchange” has become synonymous with the gold standard of trading platforms. These exchanges don’t merely offer a place to buy or sell digital assets; they represent the epitome of reliability, innovation, and excellence in the crypto world.

Choosing the right platform can be a daunting task for both novice and seasoned traders. However, opting for a Tier 1 crypto exchange ensures not just a seamless trading experience but also peace of mind. These platforms have consistently demonstrated their commitment to user security, technological advancement, and global accessibility, setting them leagues apart from their counterparts.

As the cryptocurrency industry continues to evolve, the role of Tier 1 crypto exchanges will undoubtedly become even more pivotal. They will not only shape the future of digital trading but also play a crucial role in mainstreaming cryptocurrencies. For traders, whether individuals or institutions, aligning with a Tier 1 crypto exchange is a strategic move, ensuring they are with a platform that is at the forefront of the crypto revolution.

In essence, the journey of cryptocurrencies is still in its nascent stages, and as it unfolds, the significance of Tier 1 crypto exchanges will only amplify, guiding users through the intricate maze of digital finance with expertise and trust.

FAQs

What sets a tier 1 crypto exchange apart from others?

They boast high trading volumes, stringent security measures, and a wide range of cryptocurrencies, among other features.

Are tier 1 crypto exchanges safe?

While no platform is immune to threats, these exchanges prioritize security through measures like 2FA, regular audits, and cold storage.

How do I choose the best tier 1 crypto exchange for me?

Consider factors like fees, available cryptocurrencies, user experience, and customer support.

Is gate.io tier 1 exchange?

Yes, it is.