Know Your Customer, or KYC, is a term that’s been echoing around the financial world for years. But what does it mean in the context of the burgeoning cryptocurrency industry? This article will take you on a journey through the intricacies of KYC in the crypto world, its importance, and why it’s a topic you can’t afford to ignore.

Table of Contents

Best Non-KYC Crypto Exchanges

| Exchange | KYC Required | Withdrawal Limit Without KYC | Additional Notes |

|---|---|---|---|

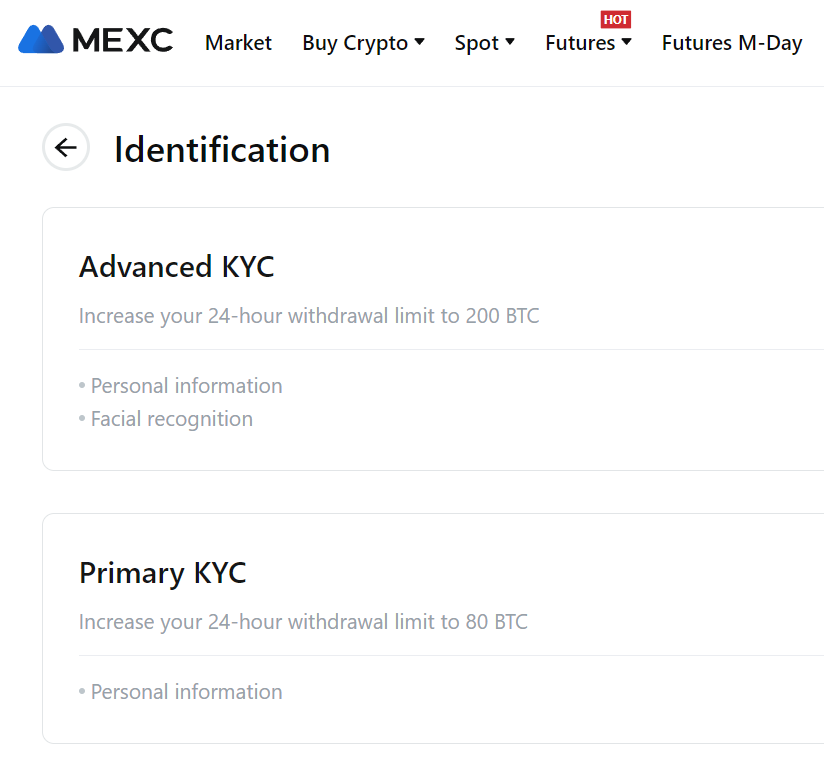

| Mexc | No | 10 BTC per day | Spot & Futures Trading, P2p |

| Coinex | No | 10 thousand USDT per day | Spot & Futures Trading |

| Tradeogre | No | No limit | Oldschool design, no KYC at all |

What is KYC?

KYC Defined

KYC, short for Know Your Customer, is a regulatory process financial institutions use to verify the identity of their clients. It’s a crucial step in preventing fraud, money laundering, and other illicit activities.

The Evolution of KYC

KYC has its roots in traditional banking, where it has been a standard practice for decades. However, with the advent of digital finance and cryptocurrencies, the KYC landscape is rapidly evolving.

KYC in Traditional Banking

In traditional banking, KYC involves collecting personal information from customers, such as their name, address, and employment status. This information is then used to assess the risk of doing business with that individual.

KYC and Cryptocurrency

The Unique Nature of Cryptocurrency

Cryptocurrencies, by their very nature, offer a level of anonymity that traditional financial systems do not. Transactions are conducted on a blockchain, a decentralized ledger that records transactions across many computers. While these transactions are transparent and can be traced on the blockchain, the individuals behind these transactions can remain anonymous if they choose to. This anonymity has been one of the major attractions of cryptocurrencies, but it also opens the door to potential misuse, such as money laundering or financing illegal activities.

The Need for KYC in Cryptocurrency

This is where KYC comes in. Crypto exchanges, which are platforms where people buy and sell cryptocurrencies, have started implementing KYC procedures to ensure they know who their customers are. This typically involves collecting personal information from users, such as their name, address, date of birth, and often requires proof of identity and address. This could be a passport or driver’s license for proof of identity, and a utility bill or bank statement for proof of address.

The Role of KYC in Crypto Exchanges

The implementation of KYC in crypto exchanges serves several purposes. First, it helps prevent identity theft, fraud, and money laundering. By verifying the identity of users, exchanges can ensure that their platform is not being used for illegal activities. Second, it helps the exchanges comply with regulatory requirements. Many jurisdictions require financial institutions, including crypto exchanges, to perform KYC checks. Non-compliance can result in hefty fines and other penalties. Finally, it enhances the trust and credibility of the exchange. Users are more likely to trust a platform that takes their security seriously.

The KYC Process in Crypto Platforms

Registration

The first step in the KYC process on most crypto platforms is registration. This typically involves creating an account using a valid email address. The user will also be asked to create a secure password and, in some cases, set up two-factor authentication for added security.

Providing Personal Information

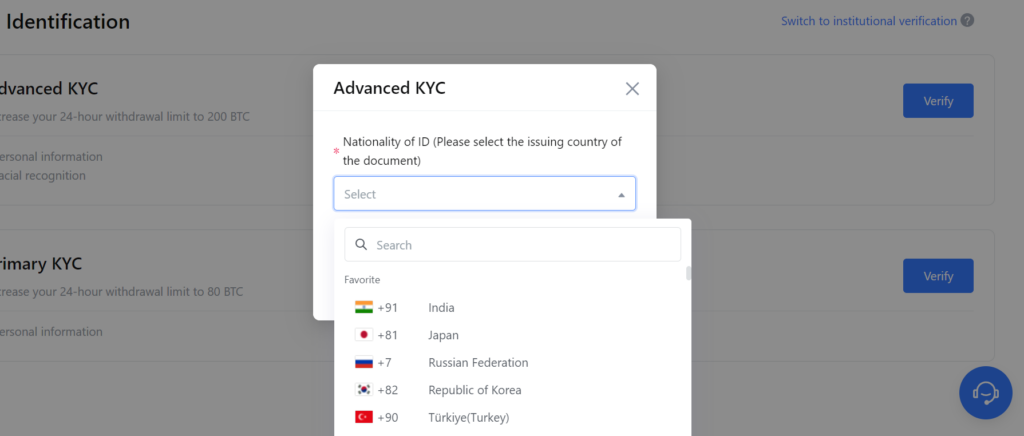

Once the account is created, the user will be asked to provide personal information. This usually includes their full name, address, date of birth, and nationality. The exact requirements may vary depending on the platform and the jurisdiction in which it operates. This information is necessary to verify the user’s identity and to ensure compliance with local laws and regulations.

Document Verification

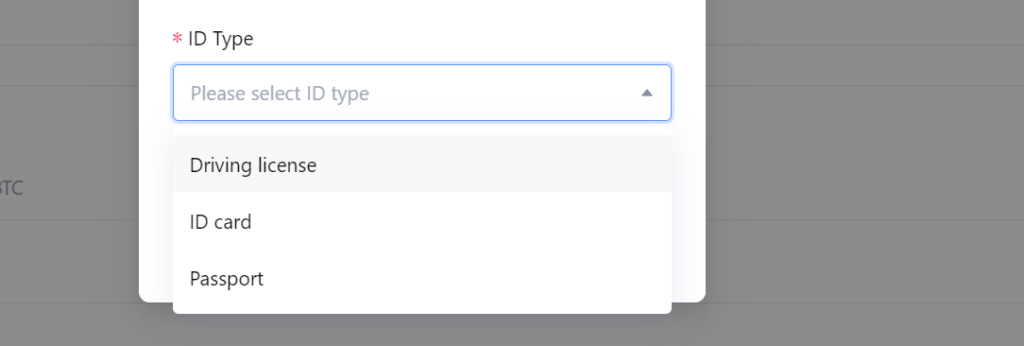

After providing personal information, the user will be asked to submit documents to verify the information.

The documents and information required for KYC in crypto platforms typically include:

- Full name

- Date of birth

- Address

- Proof of identity (e.g., passport, driver’s license)

- Proof of address (e.g., utility bill, bank statement)

Some platforms may also require a selfie or a video for facial verification.

Verification Process

Once the documents are submitted, the platform will review them to verify the user’s identity. This process can take anywhere from a few minutes to several days, depending on the platform and the volume of requests they are handling. The user will usually receive an email notification once the verification process is complete.

Post-Verification Access

After the user’s identity has been verified, they will have full access to the platform’s services. This typically includes the ability to deposit and withdraw funds, trade cryptocurrencies, and use any other services the platform offers.

Ongoing Monitoring

It’s important to note that the KYC process doesn’t end after the initial verification. Crypto platforms usually conduct ongoing monitoring of their users’ activities to detect any suspicious behavior. If a user’s activity raises any red flags (like any of AML red flags), the platform may require additional information or documents from the user.

Verification Timeframe

The timeframe for KYC verification can vary from one platform to another. However, it typically takes between 24 to 72 hours.

Benefits of KYC in Cryptocurrency

1. Fraud Prevention

One of the most prominent benefits of KYC is that it helps prevent fraudulent activities. Through identity verification, cryptocurrency exchanges and platforms can ensure that the individuals making transactions are who they claim to be. This reduces the risk of fraud and keeps the platform safe for all users.

2. Anti-Money Laundering (AML)

KYC procedures assist in identifying suspicious activities that might be related to money laundering. By enforcing KYC, cryptocurrency platforms can ensure that they are not unwittingly involved in the transfer or storage of illicitly obtained funds.

3. Regulatory Compliance

Many jurisdictions around the world have introduced regulations for cryptocurrencies to prevent their misuse. These regulations often require crypto platforms to implement KYC procedures. By doing so, these platforms can avoid potential legal penalties and maintain their operations.

4. Investor Protection

KYC also protects the interests of investors. By ensuring the legitimacy of users on a platform, it minimizes the risk for investors who could otherwise fall prey to fraudulent schemes or dubious transactions.

5. Increased Trust and Credibility

By adhering to KYC procedures, a cryptocurrency platform can demonstrate its commitment to maintaining a safe, secure, and transparent environment for its users. This can help build trust among existing users, attract new users, and enhance the platform’s overall credibility.

6. Access to Banking Services

Cryptocurrency businesses that adhere to KYC norms are more likely to gain access to banking services. Many banks are reluctant to offer services to crypto businesses due to the risks involved. However, those that can demonstrate adherence to regulations and compliance standards, such as KYC, are more likely to establish successful banking relationships.

Challenges and Controversies Surrounding KYC in Cryptocurrency

KYC (Know Your Customer) policies are not without challenges and controversies, particularly within the cryptocurrency sector. These mainly stem from the inherent qualities of cryptocurrency and the principles upon which it was founded.

1. Privacy Concerns

A significant controversy surrounding KYC in cryptocurrency is the issue of privacy. Cryptocurrencies were originally designed to offer anonymous, peer-to-peer transactions, and many users value this high level of privacy. The implementation of KYC often requires the disclosure of sensitive personal information, which contradicts the privacy-centric ethos of many cryptocurrencies.

2. Implementation Difficulties

Performing KYC checks in the realm of cryptocurrencies can be challenging. Verifying the identities of users around the globe, each with different forms of identification and varying levels of technological competence, can be a daunting task.

3. Cost and Resource Implications

Implementing robust KYC processes can be expensive and resource-intensive. Crypto startups and smaller platforms may struggle to bear these costs, which could hinder their growth or even viability.

4. Reduced Accessibility

For individuals in countries with less developed banking and identity systems, fulfilling KYC requirements can be very difficult, effectively barring these potential users from participating in the crypto economy. This runs counter to the idea of cryptocurrencies as a democratizing force in finance.

5. Security Risks

While KYC procedures are designed to increase security, the storage of sensitive user information can also present new security risks. If a crypto platform is hacked, user data obtained from KYC procedures could be exposed, leading to serious privacy breaches.

6. Slowing Transaction Speed

One of the major benefits of cryptocurrencies is their potential for quick transactions. However, the need for KYC verification can slow down this process, making cryptocurrencies less advantageous compared to traditional banking in some cases.

7. Potential Misuse of Information

There’s a risk that information collected through KYC procedures could be misused, either by the platform itself or by third parties, leading to a breach of trust and potential legal complications.

Case Studies: KYC in Major Crypto Platforms

Coinbase

Coinbase, one of the largest cryptocurrency exchanges globally, has a comprehensive KYC process. When a user signs up, they are required to provide their full name, email address, and password. They are also asked to agree to the terms and conditions of the platform.

Once the account is created, the user is required to verify their email address and phone number. The next step is identity verification, where the user is asked to submit a government-issued ID. This can be a passport, driver’s license, or national ID card. The user is required to take a photo of the ID using their webcam or mobile camera. Coinbase then verifies the ID using advanced algorithms and manual reviews.

Binance

Binance, another leading cryptocurrency exchange, also has a robust KYC process. When a user creates an account, they are given a basic account with withdrawal limits. To increase these limits and fully use the platform’s features, the user needs to complete the KYC process.

The KYC process on Binance involves submitting a government-issued ID and a selfie. Binance uses facial recognition technology to verify that the person in the ID and the selfie are the same. The platform also uses machine learning algorithms to verify the authenticity of the ID.

Bybit

Bybit, a popular cryptocurrency exchange known for its security features, also requires users to complete a KYC process. The process involves providing personal information, such as name, address, and date of birth. Users are also required to submit a government-issued ID and a proof of residence. In some cases, Bybit may also ask for additional documents, such as a tax ID number or a social security number.

These case studies illustrate how major crypto platforms implement KYC procedures to ensure the security of their platforms and comply with regulatory requirements. Despite the variations in the process, the goal is the same: to verify the identity of users and prevent illicit activities.

Future of KYC in Cryptocurrency

As cryptocurrencies continue to grow in popularity and usage, KYC processes will likely become more integrated and sophisticated. The future of KYC in cryptocurrency is likely to be shaped by several key trends:

Regulatory Evolution

Regulations surrounding cryptocurrencies are rapidly evolving. As countries continue to refine their legal frameworks for digital currencies, the role and requirements of KYC in cryptocurrency will change accordingly. There may be increased global efforts to establish standard guidelines for KYC procedures within the crypto space.

Technological Advancements

Emerging technologies, such as artificial intelligence (AI) and machine learning, are increasingly being used to streamline and improve KYC procedures. For example, AI can potentially automate the verification process, making it faster and more accurate. Similarly, advancements in biometrics could provide new methods for identity verification that are both secure and user-friendly.

Privacy-Preserving KYC Solutions

In response to privacy concerns, there are efforts underway to create privacy-preserving KYC solutions. For instance, zero-knowledge proofs and other cryptographic techniques can potentially prove a user’s identity without revealing their personal information. These kinds of solutions could address privacy concerns while still meeting KYC requirements.

Decentralized Identity Verification Systems

Blockchain and decentralized technologies could be used to create a decentralized identity verification system. Users could have a verified digital identity that they control and can use across different platforms, reducing the need for repeated KYC checks.

Increased Collaboration

As the crypto space grows, there will likely be more collaboration between different stakeholders, including crypto platforms, regulatory bodies, and traditional financial institutions. These collaborations could lead to more robust and efficient KYC procedures.

Conclusion

KYC is a crucial aspect of the cryptocurrency world. It helps protect users and platforms from fraud and money laundering, enhances trust and credibility, and ensures regulatory compliance. Despite the challenges and controversies, the future of KYC in cryptocurrency looks promising, with technological advancements paving the way for more efficient and secure processes.

Remember, the world of cryptocurrency is exciting, but it’s also a world where security should never be compromised. Stay safe, stay informed, and happy crypto journey!

FAQs

What does KYC mean?

KYC stands for “Know Your Customer”. It’s a process used by financial institutions and businesses to verify the identity of their clients to ensure they are who they claim to be.

What is KYC verification?

KYC verification involves validating a customer’s identity by verifying their personal and financial information. This process typically requires customers to provide documents like government-issued identification and proof of address.

What is KYC crypto?

KYC in crypto refers to the Know Your Customer verification process implemented by cryptocurrency platforms and exchanges. It’s used to identify users, mitigate fraud, and ensure compliance with anti-money laundering (AML) laws.

What are KYC documents?

KYC documents typically include a government-issued ID (like a passport or driver’s license) and proof of address (like a utility bill or bank statement). The specific documents required can vary based on jurisdiction and the specific requirements of the institution.

Why is KYC important?

KYC is important because it helps prevent fraud, money laundering, and other illegal activities. It protects both businesses and customers, ensures compliance with laws and regulations, and helps maintain the integrity of financial systems.

What is KYC AML?

KYC (Know Your Customer) and AML (Anti-Money Laundering) are related concepts used in financial industries to prevent illegal activities. KYC involves verifying a customer’s identity, while AML involves monitoring transactions to identify and prevent money laundering activities.

How long does KYC verification take?

The duration of KYC verification can vary widely depending on the platform and the specific circumstances. Some platforms can verify customers within a few hours, while others may take a few days. In complex cases, it can take even longer.

Under which category does KYC fall?

KYC generally falls under the category of compliance and risk management in financial services. It is a key part of regulatory compliance in the financial industry.

How to buy crypto without KYC?

Some decentralized exchanges, OTC platforms, and peer-to-peer marketplaces allow users to buy crypto without KYC. However, it’s important to note that this may come with increased risk, and in some jurisdictions, it may not comply with local regulations. Always be sure to understand the risks and legal requirements before buying crypto without KYC.