200x leverage trading strategy attracts both seasoned professionals and daring newcomers. The sheer potential to turn $100 into $20,000 in a single trade pulls traders into its high-risk, high-reward orbit. Yet for every story of sudden riches, there are many tales of accounts wiped out in seconds. Why does this strategy captivate so many despite its obvious dangers? What do the successful traders know that others don’t?

In this deep dive, we’ll uncover the most critical elements of the 200x leverage trading strategy: from its jaw-dropping advantages to the often-ignored fatal risks. If you’re considering testing your skills — or your luck — this is essential reading.

Table of Contents

What Is 200x Leverage Trading Strategy?

Understanding Leverage Trading Basics

Leverage trading allows you to borrow capital to increase your market exposure. For example, with 200x leverage, $1 of your own funds controls $200 in the market.

- Example: $100 deposit × 200 leverage = $20,000 trading position.

How Does the 200x Leverage Trading Strategy Work?

When using a 200x leverage trading strategy, the smallest market move can have an oversized impact:

- A 0.5% move in your favor = 100% profit.

- A 0.5% move against you = total loss.

That’s why many exchanges limit 200x leverage to ultra-liquid markets like BTC/USDT or ETH/USDT.

Why Traders Love the 200x Leverage Trading Strategy

1. Lightning-Fast Profits

For experienced traders, 200x leverage can turn short scalping moves into meaningful profits. Instead of holding a position for hours, some use it for trades lasting mere seconds.

2. Minimal Capital, Maximum Exposure

Many small-capital traders adopt the 200x leverage trading strategy because it allows them to operate in larger markets they wouldn’t normally afford.

3. Flexibility Across Markets

From cryptocurrencies to forex, commodities to indices, 200x leverage is available across various asset classes. This versatility allows traders to apply the strategy to their preferred markets, whether they’re betting on Bitcoin’s next rally or the euro’s dip against the dollar.

The 7 Fatal Risks of 200x Leverage Trading Strategy

Why 200x Leverage Trading Strategy Can Be Deadly?

| Risk No. | Risk Factor | Description |

|---|---|---|

| 1 | Instant Liquidation | Even a 0.2–0.5% price move can fully wipe out your position. |

| 2 | Emotional Trading & FOMO | Fear and greed lead to impulsive trades, magnifying losses. |

| 3 | Exchange Reliability Issues | Platform lag, slippage, or downtime can cause unintended liquidations. |

| 4 | Overtrading Addiction | The thrill of high leverage can turn into gambling behavior. |

| 5 | Misjudging Market Volatility | Flash crashes and whale moves can destroy positions without warning. |

| 6 | Fee Drain | High-frequency trades accumulate fees and funding costs, reducing profits. |

| 7 | False Confidence After Wins | Early success may cause overconfidence and larger, riskier positions. |

1. Instant Liquidation Risk

With leverage that high, even a minor fluctuation can trigger liquidation. Market wicks as small as 0.2% can clean out an entire position.

2. Emotional Trading & FOMO

Traders chasing pumps or dumps while using 200x leverage often find themselves reacting emotionally, leading to FOMO, rash decisions and rapid losses.

3. Exchange Reliability Issues

Not all exchanges handle ultra-high leverage well. Slippage, lagging order books, or system outages at critical times can wipe out positions.

4. Overtrading Addiction

The rapid nature of 200x leverage trading can create a gambling-like rush. Over time, many traders suffer burnout, addiction, and financial distress.

5. Misjudging Market Volatility

Markets can turn faster than expected. Even high liquidity doesn’t protect against flash crashes or unexpected whale moves.

6. Fee Drain

Ultra-high leverage trades might look profitable, but trading fees and funding rates can quietly eat away at capital — especially in perpetual contracts. These costs can eat into your profits, especially if you hold positions for extended periods.

7. False Confidence After Wins

Early lucky wins create overconfidence, often leading to larger bets and inevitable catastrophic losses.

Proven Wins: How Smart Traders Succeed With 200x Leverage Trading Strategy

Can You Really Win Using a 200x Leverage Trading Strategy?

Risk Management is Everything

Even the most aggressive 200x leverage traders rely on strict risk controls:

- Max 1% of capital per trade: Even if wiped out, the account survives.

- Tight Stop-Loss Orders: Essential for survival.

- Take-Profit Discipline: Don’t hold out for moonshots — close trades on small wins.

Mastering One Market Only

Traders who specialize in just one pair (e.g., BTC/USDT) tend to outperform. Familiarity with its behavior, timing, and liquidity provides an edge.

Automation and Bots

Many professionals use algorithmic bots set to scalp tiny moves with laser precision, avoiding emotional trading pitfalls. However, it’s important to note that not all exchanges support trading bots. Some platforms explicitly prohibit their use and may suspend or ban accounts found using automation tools. Always review your exchange’s terms of service before integrating bots into your 200x leverage trading strategy.

The Psychological Trap of 200x Leverage Trading Strategy

Why Does the 200x Leverage Trading Strategy Feel So Addictive?

The mix of adrenaline, fast profits, and near-instant feedback loops creates a psychological cycle similar to gambling. Some traders have reported experiencing withdrawal-like symptoms when attempting to stop trading 200x leverage.

Signs of Leverage Trading Addiction

- Spending more time watching charts than sleeping.

- Increasing position sizes after losses.

- Hiding trading activity from friends and family.

If these symptoms sound familiar, it might be time to pause and reassess.

Which Exchanges Support 200x Leverage?

Not all crypto exchanges offer 200x leverage. Below are some popular platforms that do, along with key fee details:

| Exchange | Pairs with 200x Leverage | Maker Fee | Taker Fee |

|---|---|---|---|

| MEXC | BTC, ETH, WLD, DOT, SOL, etc. | 0% | 0.01% |

| Bybit | BTC, ETH | 0.02% | 0.04% |

Is the 200x Leverage Trading Strategy Suitable for You?

Who Should Avoid It?

- Beginners lacking experience with lower leverage.

- Anyone prone to emotional decision-making.

- Traders without a defined risk management plan.

Who Might Benefit From It?

- Scalpers with strict systems.

- Professionals using bots.

- Traders looking to experiment with a small “high-risk” portion of their portfolio.

Practical Tips for Using the 200x Leverage Trading Strategy Safely

Golden Rules for Survival

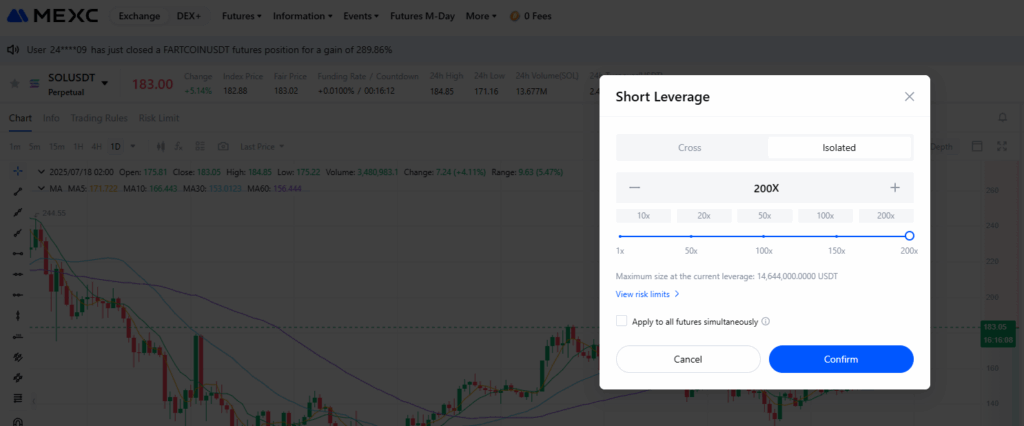

- Use Isolated Margin, Never Cross: Protect your remaining balance.

- Practice First With Demo Accounts: Many exchanges offer paper trading for high leverage.

- Keep Position Sizes Tiny: Risking less helps preserve capital for future opportunities.

Conclusion: Is the 200x Leverage Trading Strategy Worth It?

The 200x leverage trading strategy is not inherently evil nor magical. It’s simply a tool — dangerous in the wrong hands, potentially profitable in disciplined ones. The difference between fortune and ruin lies entirely in your approach.

If you decide to try 200x leverage, remember: respect the power, follow strict rules, and never risk what you can’t afford to lose.

FAQ

Can beginners use a 200x leverage trading strategy?

It is strongly discouraged. Beginners lack the experience and risk management discipline needed to survive the extreme volatility associated with such high leverage. Starting with lower leverage is recommended.

How much capital should I use with a 200x leverage trading strategy?

Professional traders suggest risking no more than 1% of your trading account per position. Many also advise using only a small portion of your overall capital for high-leverage trading.

Which markets are suitable for 200x leverage trading?

Primarily ultra-liquid pairs such as BTC/USDT, ETH/USDT, and similar high-volume cryptocurrency markets. Illiquid markets can cause slippage and increase risk.

Do all exchanges offer 200x leverage?

No. Some exchanges limit maximum leverage to lower levels such as 50x or 100x to protect users from extreme losses. Always check leverage options before choosing a trading platform.

How can I manage risk with a 200x leverage trading strategy?

Use isolated margin, tight stop-loss orders, small position sizes, and avoid overtrading. Psychological discipline is just as important as technical skill in managing extreme leverage.