At the forefront of deciphering the intricate patterns of crypto cycles, our expertise shines a light on the nuanced shifts that shape the cryptocurrency landscape. This article not only explores the fundamental phases of crypto market cycles but also offers insight into their duration, influences, and the strategic identification of bull and bear periods. Whether you’re a seasoned trader or a crypto novice, understanding these cycles is crucial to mastering the market.

Table of Contents

Understanding the Fundamentals of Crypto Market Cycles

Cryptocurrency markets are notoriously volatile, yet beneath this apparent randomness lie predictable patterns known as “crypto market cycles.” These cycles reveal the natural rhythm of investor sentiment, capital flow, and market maturity that guides the crypto landscape. Comprehending these cycles is akin to decoding a complex cryptogram where each phase represents a different set of opportunities and challenges for investors.

The essence of these cycles is rooted in the collective behavior of the market participants. As investors and traders respond to external stimuli—like economic indicators, regulatory news, and technological advancements—the crypto market absorbs and reflects these reactions through its pricing and trading volume. This dynamic creates the cyclical patterns that can be observed and interpreted by astute market watchers.

Crypto market cycles are crucial for a variety of reasons:

- Investment Timing: Understanding when to enter or exit the market is paramount. Recognizing the phase of a crypto cycle helps investors make informed decisions about when it might be advantageous to buy or sell.

- Risk Management: Each phase of the cycle carries different levels of risk. By identifying these phases, investors can better manage their risk exposure by adjusting their investment strategies to suit the prevailing market conditions.

- Strategic Planning: Long-term investment strategies can be honed with an understanding of market cycles. This knowledge enables investors to anticipate shifts and prepare for potential market downturns or upswings.

- Market Sentiment Analysis: Crypto market cycles often align with shifts in investor sentiment. Understanding these cycles provides insights into broader market emotions, which can be a powerful tool for predicting future movements.

By delving into the fundamentals of crypto market cycles, investors equip themselves with the knowledge to navigate the volatile seas of cryptocurrency trading more effectively. Each cycle phase offers unique insights and strategic opportunities that, when recognized and utilized appropriately, can significantly enhance an investor’s ability to achieve successful outcomes.

What Are Crypto Market Cycles and Why Do They Matter?

Crypto market cycles are essential patterns that help investors understand the periodic ebb and flow of market sentiments and asset valuations in the cryptocurrency ecosystem. Each cycle consists of distinct phases that correlate with the overall market behavior, investor confidence, and economic signals that together shape the trading landscape. Recognizing these cycles and their phases helps investors make sense of past trends, forecast future opportunities, and make educated decisions based on more than just the immediate market conditions.

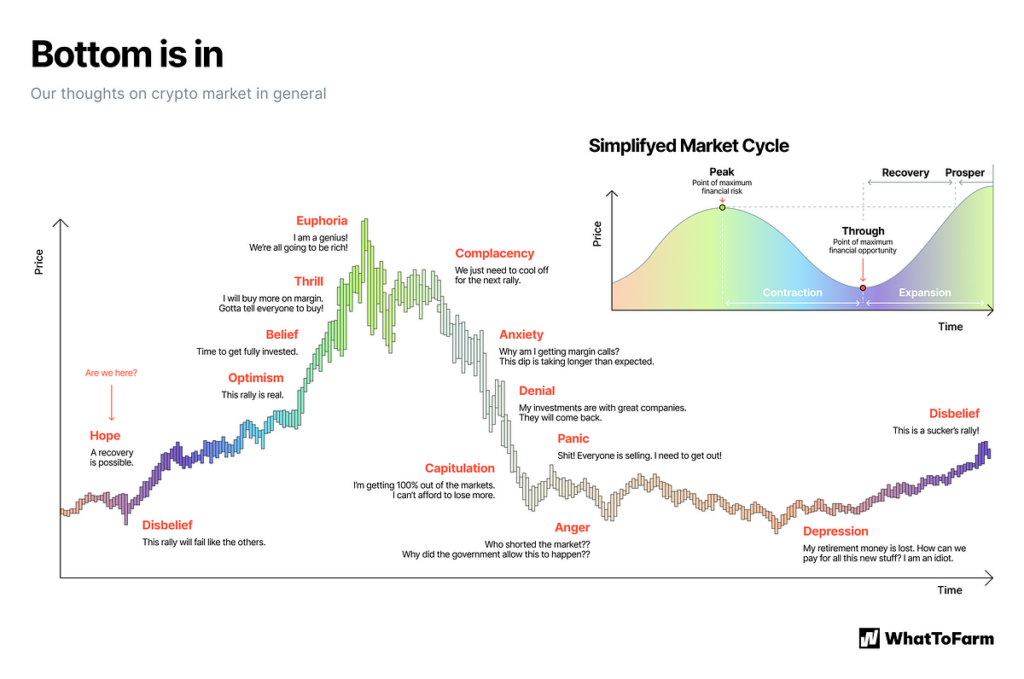

The Accumulation Phase (Hope – Disbelief)

This initial phase is characterized by investor optimism at a subdued level, where savvy individuals and entities begin to accumulate assets, often quietly and over a prolonged period. Prices are typically low and stable during this phase, as the market recovers from a previous downturn. The accumulation phase is marked by a lack of significant mainstream attention to cryptocurrencies, making it a prime time for informed investors to enter the market.

The Markup Phase (Optimism – Complacency)

Following accumulation, the markup phase signals the start of rising prices. This phase gains momentum as more investors notice the upward trend and begin investing, driven by the fear of missing out (FOMO). The increased demand pushes prices higher, often resulting in media coverage and public attention, which further fuels the market’s upward trajectory.

The Distribution Phase (Anxiety – Denial)

The distribution phase typically follows a peak in market prices. During this phase, early investors and those looking to take profits start selling their holdings. While prices may still reach new highs, they do so amidst increased volatility and selling pressure, as more participants in the market look to cash in on the gains. This phase can be turbulent, as conflicting signals and uncertainty about the continuation of the growth trend begin to surface.

The Markdown Phase (Capitulation – Depression)

Eventually, the market enters the markdown phase, where prices decline sharply. This downturn can be triggered by various factors, including widespread panic selling, adverse news, or simply the natural progression after a period of overvaluation. Prices often fall to or below their pre-accumulation levels. This phase often culminates in a period of market consolidation, setting the stage for the next accumulation phase to begin.

How Long Is a Crypto Market Cycle? Cryptocurrency Life Cycle

The cryptocurrency market is characterized by its high volatility and rapid valuation changes, making the understanding of its market cycles crucial for effective trading and investment strategies. Typically, these cycles span approximately 2 to 4 years, though this can vary based on several influential factors. Each cycle encompasses phases of accumulation, markup, distribution, and markdown, which together form a complete market cycle reflecting the general health and trends within the cryptocurrency ecosystem.

The 2-4 Year Cycle: Factors and Influences

The 2 to 4-year timeline for crypto market cycles is not arbitrary; it mirrors the underlying dynamics of technology adoption, investor behavior, and regulatory environments that impact the cryptocurrency markets:

Technological Milestones

Significant technological advancements or updates to blockchain infrastructures can dramatically influence the duration of a crypto market cycle. For instance, major updates like Ethereum’s transition to proof of stake, or the implementation of scalability solutions such as sharding or layer-2 protocols, can initiate new cycles of investment and interest, potentially shortening or extending existing cycles.

Bitcoin Halving Events

Occurring approximately every four years, Bitcoin halvings reduce the reward for mining new blocks by half. This significant event typically leads to reduced supply and increased demand, often sparking a new bull market phase. Halvings are pivotal moments that can shift the entire cryptocurrency market into new cycles of accumulation and markup.

Regulatory Landscapes

Cryptocurrencies operate in a rapidly evolving regulatory environment. Positive developments, such as the approval of new crypto exchange-traded funds (ETFs) or favorable legal clarifications regarding crypto, can compress or extend cycles by altering investor confidence and market participation rates.

Economic Conditions

Broad economic factors, including recessionary periods, inflation rates, and interest rate changes, also play a critical role in shaping the duration of crypto cycles. For example, economic downturns may lead to longer bear phases as investment capital dries up, while bullish economic conditions might shorten accumulation phases as more investors are willing to take risks.

Market Sentiment and Adoption

The rate at which new technologies are adopted and the overall sentiment in the market can also influence the length of a cycle. Rapid adoption by both retail and institutional investors can drive quicker transitions between phases, particularly moving from accumulation to markup phases as demand increases.

Cryptocurrency Life Cycle Specifics

Within these broader market cycles, individual cryptocurrencies may experience their unique life cycles influenced by their specific market cap, utility, community support, and technological robustness. Newer or less established cryptocurrencies might cycle through these phases quicker due to lower market capitalization and higher volatility, whereas established ones like Bitcoin and Ethereum may demonstrate more prolonged phases due to their large market presence and greater stability.

The Impact of Bull and Bear Phases on Crypto Investors

Crypto market cycles are fundamentally characterized by their cyclical bull and bear phases, each having a profound impact on investor behavior, strategy, and outcomes. Understanding how these phases affect investments is crucial for both novice and seasoned crypto enthusiasts to make informed decisions and manage risks effectively.

Identifying Bull and Bear Phases in Crypto Market Cycles

Impact of Bull Phases on Crypto Investors

Bull phases, marked by rising prices and positive sentiment, can significantly influence investor behavior and decision-making. During these periods:

- Increased Investment Returns: Investors see appreciable gains in their portfolios as the value of crypto assets generally rises.

- Higher Market Entry: The fear of missing out (FOMO) often leads to increased buying activity from both existing and new investors.

- Speculative Investments: The lure of quick returns can encourage higher risk-taking with new and less-known cryptocurrencies.

- Expansion of Market Activities: Bull markets usually see an expansion in related activities such as ICOs, token launches, and increased venture capital interest.

Impact of Bear Phases on Crypto Investors

Conversely, bear phases are characterized by falling prices and a pessimistic outlook, which affect investors as follows:

- Capital Preservation Concerns: Investors focus on protecting their capital, which can lead to rapid sell-offs and reduced trading volumes.

- Decreased Portfolio Values: The value of investments drops, sometimes significantly, which can cause financial stress and a reevaluation of investment strategies.

- Increase in Short Selling: More experienced investors might engage in short selling to profit from falling prices, adding to the market’s downward pressure.

- Cautious Investment Approaches: Both potential and existing investors become more cautious, prioritizing stable assets and diversification.

Detailed Chart: Bull and Bear Phase Impacts on Crypto Investors

| Market Phase | Impact on Investors | Typical Behaviors | Market Activities |

|---|---|---|---|

| Bull Phase | High optimism and increased portfolio values. | – FOMO-driven buying – High risk-taking | – Surge in ICOs and token launches – Increased venture capital funding |

| Bear Phase | Pessimism and focus on capital preservation. | – Rapid sell-offs – Adoption of defensive strategies | – Reduced market activities – Increased interest in stablecoins and hedging options |

Conclusion

Understanding the nuances of market cycles is not just advantageous – it’s imperative for achieving sustained success. Each phase of the crypto market cycle, from accumulation to markdown, offers unique opportunities and challenges that, when navigated wisely, can lead to significant gains and protection against potential losses.

Investors who grasp the rhythm of bull and bear phases, and align their strategies accordingly, can mitigate risks and capitalize on the market’s inherent volatility. The key is not merely to react to market changes but to anticipate them, equipped with a deep understanding of how cycles operate and influence market behavior.

FAQs

What is the first sign of entering a new phase in a crypto cycle?

The first sign often involves a notable shift in market sentiment and trading volume.

Can the length of a crypto market cycle be predicted accurately?

While predicting the exact length is challenging, analyzing past trends and current market conditions can provide useful insights.

What strategies should investors adopt during the markdown phase?

Investors might consider diversifying their portfolios or buying into the market cautiously, aiming to leverage lower prices.