At WoolyPooly, we’re more than observers in the crypto universe; we’re voyagers charting the intricate terrains of digital currency. From our exploration of the top 10 crypto exchanges, we’ve now distilled our insights into the elite five – each a beacon of strength in the crypto cosmos. Let’s embark on a journey through these digital marketplaces, where innovation, security, and user experience intersect.

Table of Contents

Top 5 Crypto Exchanges List

| Exchange | Spot Fees | Leverage Level | Futures Maker Fees | Futures Taker Fees | KYC | P2P | Copy Trading |

|---|---|---|---|---|---|---|---|

| MEXC | 0% | 200x | 0% | 0.03% | No (30 BTC per day) | Yes (with KYC) | Yes |

| OKX | 0.1% | 125x | 0.02% | 0.05% | No (10 BTC per day) | Yes (with KYC) | No |

| BingX | 0.1% | 150x | 0.02% | 0.04% | No (50K USDT per day) | Yes (with KYC) | Yes |

| TradeOgre | 0.2% | No | No | No | No | No | No |

| dYdX | 0.05% | 20x | 0.02% | 0.05% | No | No | No |

MEXC: The Zero-Fee Maverick

MEXC – major crypto exchange that stands out for its lowest fee structure, making it the go-to choice for cost-effective trading. It boasts the largest no-KYC withdrawal limit of up to 30 BTC per day, catering to high-volume traders. Additionally, its vast array of crypto pairs offers extensive trading opportunities, making it a versatile platform for diverse crypto investments.

Features at a Glance

- Spot Fees: 0%

- Leverage Level: 200x

- Futures Fees: Maker 0%, Taker 0.03%

- KYC: No (30 BTC per day limit)

- P2P: Available with KYC

- Copy Trading: Yes

Pros and Cons

| Pros | Cons |

|---|---|

| Zero spot trading fees | Limited global availability |

| High leverage options (200x) | |

| No KYC for withdrawals up to 30 BTC |

OKX: The Versatile Virtuoso

OKX is renowned for its no-KYC policy with a decent withdrawal limit. It offers unique trading bots for automated trading strategies, an advanced web3 wallet for secure asset management, and a Liquid Marketplace designed for big players in the crypto scene. This makes OKX a comprehensive platform for both novice and experienced traders.

Recent Update

Features at a Glance

- Spot Fees: 0.1%

- Leverage Level: 125x

- Futures Fees: Maker 0.02%, Taker 0.05%

- KYC: No (10 BTC per day limit)

- P2P: Available with KYC

- Copy Trading: Yes

Pros and Cons

| Pros | Cons |

|---|---|

| Diverse trading instruments | Higher spot and futures fees |

| Own web3 wallet and trading bots | Limited global availability |

| Liquid Marketplace for large trades |

BingX: The Community’s Choice

BingX excels with its market-leading copy trading feature, enabling users to mimic the trades of seasoned investors. It doubles as a social crypto network, fostering community interaction and knowledge sharing. Additionally, its futures market extends beyond cryptocurrencies to include commodities, offering a diverse trading portfolio.

Recent Update

- VIP Exclusive: Zero Slippage on Trigger and SL Orders.

Features at a Glance

- Spot Fees: 0.1%

- Leverage Level: 150x

- Futures Fees: Maker 0.02%, Taker 0.04%

- KYC: No (50K USDT per day limit)

- P2P: Available with KYC

- Copy Trading: Yes

Pros and Cons

| Pros | Cons |

|---|---|

| Leading social and copy trading | Higher spot and futures fees |

| Futures on commodities | Limited global availability |

| User-friendly interface | |

| Tradingview integration |

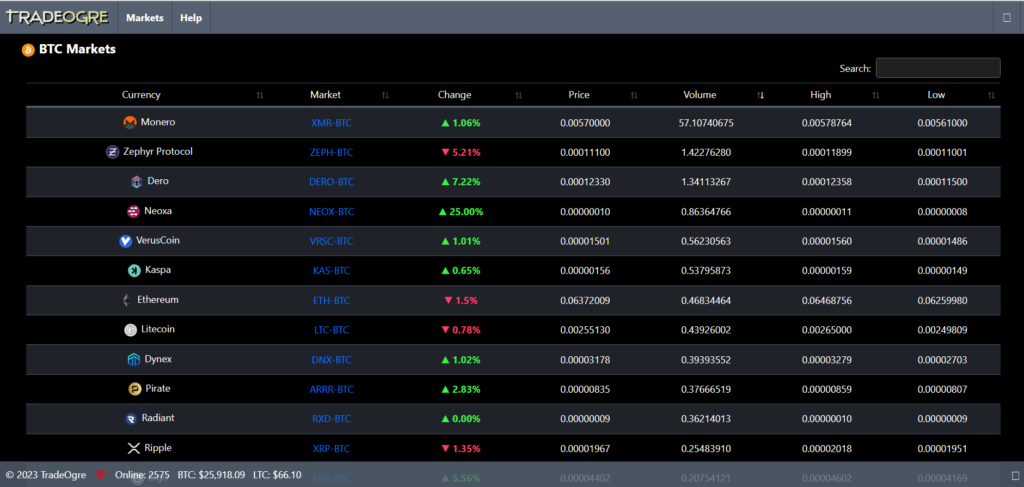

TradeOgre: The Simplistic Trailblazer

TradeOgre is a truly anonymous major crypto exchange, prioritizing privacy and simplicity. It’s the perfect choice for traders who value anonymity and want to engage in crypto trading without the complexities of KYC processes.

Features at a Glance

- Spot Fees: 0.2%

- Leverage Level: Not available

- Futures Fees: Not available

- KYC: Not required

- P2P and Copy Trading: Not available

Pros and Cons

| Pros | Cons |

|---|---|

| Fully anonymous trading | No leverage trading |

| Straightforward platform | No P2P |

dYdX: The Decentralized Major Crypto Exchange Innovator

dYdX is a fully decentralized exchange (DEX) with a strong future outlook. It offers perpetual futures with up to 20x leverage, catering to traders seeking high-risk, high-reward opportunities. As a leading DEX, it provides a secure and transparent trading environment, driven by the principles of decentralization.

Recent Update

- Release of dYdX Chain v1.0 and enhanced decentralization efforts.

Features at a Glance

- Spot Fees: 0.05%

- Leverage Level: 20x

- Futures Fees: Maker 0.02%, Taker 0.05%

- KYC: Not required

- P2P and Copy Trading: Not available

Pros and Cons

| Pros | Cons |

|---|---|

| Fully decentralized | Steeper learning curve |

| Perpetual futures with 20x leverage | Less customer support infrastructure |

Conclusion

In conclusion, each of the top 5 crypto exchanges ranked by WoolyPooly brings unique benefits and challenges, catering to different preferences and trading styles. From MEXC’s zero fees to dYdX’s decentralized framework, traders can select a platform that aligns best with their strategic goals and comfort levels. As the crypto market evolves, these exchanges adapt, constantly refining their offerings to enhance user experience and market efficiency. Whether prioritizing anonymity, low fees, or innovative trading tools, these top crypto exchanges provide the tools necessary for participants to navigate the vibrant and ever-changing crypto landscape.

FAQs

Which exchange from top 5 offers the highest leverage?

MEXC offers up to 200x leverage, standing out as the high-leverage leader.

Is KYC mandatory for trading on these top 5 crypto platforms?

KYC is optional on MEXC, OKX, and BingX up to certain limits, while TradeOgre and dYdX do not require KYC.