The world of cryptocurrency is ever-evolving, and one of the most significant developments in recent years is the advent of Bitcoin ETFs. This article will delve into the importance of Bitcoin ETFs, the current state of these financial instruments, and what the future holds.

Table of Contents

Why is a Bitcoin ETF so Important?

The importance of a Bitcoin ETF lies in its potential to bridge the gap between traditional financial markets and the relatively new world of cryptocurrencies. Here are some reasons why Bitcoin ETFs are considered so crucial:

Democratizing Bitcoin Investment

One of the key benefits of ETFs is their ability to democratize investment. ETFs have a low entry threshold, meaning that they are accessible to a wide range of investors, from individuals to large institutions. By creating a Bitcoin ETF, this same accessibility can be extended to Bitcoin, a traditionally more complex and volatile investment. This could potentially bring a new wave of investors into the Bitcoin market, increasing liquidity and stability.

Enhancing Liquidity

Liquidity refers to how easily an asset can be bought or sold in the market without affecting its price. High liquidity is generally a positive attribute as it allows for easier transactional ability. Bitcoin ETFs could significantly enhance the liquidity of the Bitcoin market by allowing a larger pool of investors to buy and sell shares in the ETF, which in turn track the price of Bitcoin.

Simplifying Tax and Regulatory Compliance

Managing tax and regulatory compliance can be a significant challenge for direct Bitcoin investors, particularly given the rapidly evolving regulatory landscape for cryptocurrencies. Bitcoin ETFs, however, are subject to the same regulations as other ETFs, which are well-established and understood. This simplifies compliance for investors and could make Bitcoin ETFs a more attractive investment option.

Facilitating Price Speculation

While the ethos of Bitcoin and other cryptocurrencies often centers around their use as alternative currencies, the reality is that many people are interested in them primarily as speculative investments. Bitcoin ETFs facilitate this by allowing investors to speculate on the price of Bitcoin without needing to own the underlying asset. This can be particularly appealing to investors who wish to avoid the risks and complexities associated with storing and transacting in Bitcoin directly.

In conclusion, the importance of Bitcoin ETFs lies in their potential to make Bitcoin more accessible, liquid, and manageable as an investment. By doing so, they could play a significant role in the continued growth and maturation of the Bitcoin market.

What is Bitcoin?

Bitcoin is the first and most well-known cryptocurrency, a type of digital or virtual currency that uses cryptography for security. It was introduced in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto.

Unlike traditional currencies issued by governments (also known as fiat currencies), Bitcoin operates on a decentralized network of computers. Transactions are verified by network nodes through cryptography and recorded on a public ledger called a blockchain.

Bitcoin can be exchanged for goods, services, and other currencies, provided the other party is willing to accept it. It can also be held as an investment, with many investors attracted to its potential for high returns, despite its volatility.

What is an ETF?

An Exchange-Traded Fund (ETF) is a type of investment fund and exchange-traded product, meaning it is traded on stock exchanges much like individual stocks.

ETFs are designed to track the performance of a specific index, sector, commodity, or asset. For example, an ETF might track an index like the S&P 500, a specific sector of the market like technology or healthcare, a commodity like gold or oil, or a basket of assets.

One of the key benefits of ETFs is that they offer investors the ability to diversify their portfolios without having to buy each individual security within the index or sector. This makes them a cost-effective way for investors to attain broad exposure to entire segments of the market.

Additionally, ETFs are known for their liquidity, meaning they can be bought and sold throughout the trading day at market prices. This is in contrast to mutual funds, which can only be bought and sold at the end of the trading day at a calculated price known as the net asset value (NAV).

Overall, ETFs have become a popular investment vehicle due to their flexibility, cost-effectiveness, and accessibility.

The Intersection of Bitcoin and ETFs

The intersection of Bitcoin and ETFs represents a significant development in the financial world, merging the innovative world of cryptocurrencies with the established realm of traditional investment vehicles.

A Bitcoin ETF, in essence, is a fund that aims to track the market price of Bitcoin. Instead of buying Bitcoin directly and dealing with the challenges of storing and securing the cryptocurrency, investors can buy shares of the ETF. This allows investors to gain exposure to Bitcoin’s price movements without owning the underlying asset.

This intersection brings several benefits:

Accessibility

Bitcoin ETFs make the Bitcoin market more accessible to a broader range of investors. Some investors may be interested in the potential returns of Bitcoin but are deterred by the technical complexities of buying and storing the cryptocurrency. Bitcoin ETFs simplify this process, allowing investors to buy and sell shares through their regular brokerage accounts.

Regulatory Compliance

Bitcoin ETFs are subject to the same regulations as other ETFs. This regulatory clarity can be appealing to investors who are wary of the uncertain and rapidly evolving regulatory landscape for cryptocurrencies.

Risk Management

Investing in a Bitcoin ETF can potentially reduce some of the risks associated with investing in Bitcoin directly. For example, investors in a Bitcoin ETF do not need to worry about losing their Bitcoin to theft or a lost private key, a unique kind of password needed to access Bitcoin holdings.

The Current State of Bitcoin ETFs

As of now, the landscape of Bitcoin ETFs is still developing, with several key developments and trends shaping the space.

Futures-Based Bitcoin ETFs

In the United States, the existing Bitcoin ETFs operate based on futures rather than actual Bitcoin. These ETFs do not directly buy and hold Bitcoin. Instead, they invest in Bitcoin futures contracts, which are agreements to buy or sell Bitcoin at a specific price on a specific future date. This allows these ETFs to gain exposure to Bitcoin’s price movements without owning the underlying asset.

The Anticipation for Spot Bitcoin ETFs

The market is currently buzzing with anticipation for spot Bitcoin ETFs. Unlike futures-based ETFs, spot ETFs would directly buy and hold Bitcoin, providing a more direct exposure to the cryptocurrency’s price movements.

Recent Applications for Spot Bitcoin ETFs

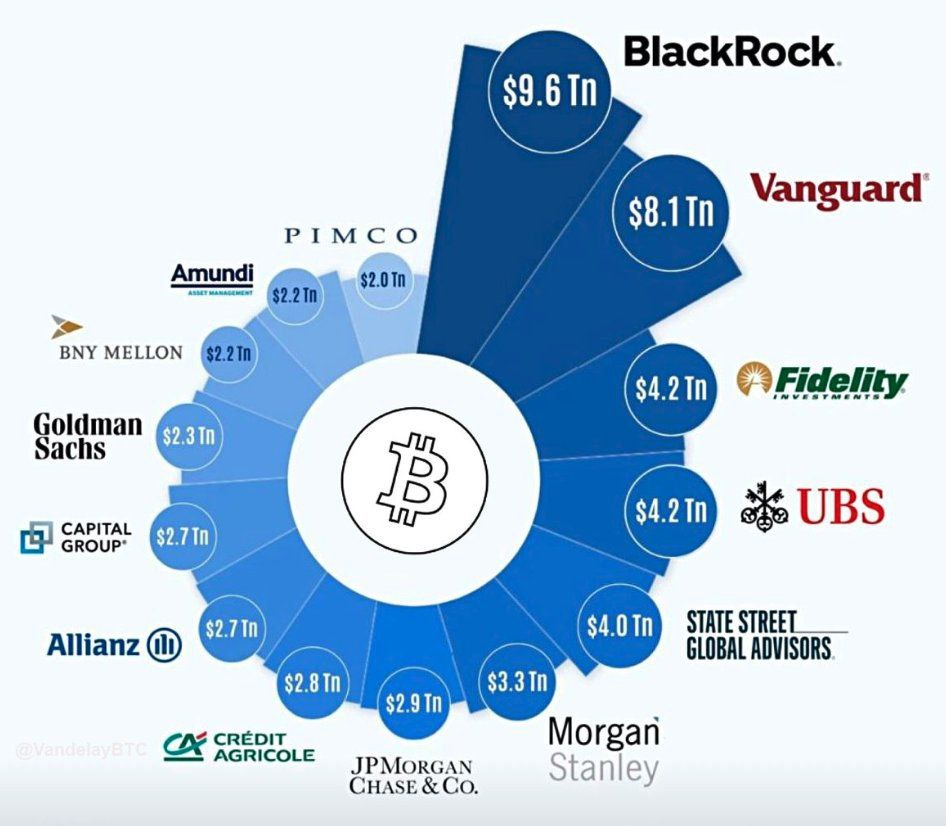

Several well-known companies have recently applied to launch spot Bitcoin ETFs. These include Invesco, Bitwise, WisdomTree, and BlackRock. The approval of these applications could significantly impact the Bitcoin ETF landscape, potentially leading to increased liquidity and investment in the Bitcoin market.

The Role of BlackRock in the Bitcoin ETF Landscape

Adding to the narrative, Larry Fink, the CEO of BlackRock, has expressed his belief that Bitcoin could revolutionize the finance industry. His comments have added further fuel to the speculation surrounding the potential approval of BlackRock’s Bitcoin ETF application.

BlackRock is not just another player in the investment field. As the world’s largest investment company and a dominant force in the U.S. ETF market, boasting a 35% market share, its application for a spot Bitcoin ETF has drawn significant attention.

BlackRock’s application stands out among those from other companies such as Invesco, Bitwise, and WisdomTree, which have previously submitted applications but were denied. Given BlackRock’s dominant position in the investment world, many investors are hopeful that the Securities and Exchange Commission (SEC) might approve their application for a spot Bitcoin ETF.

If approved, this could significantly alter the Bitcoin ETF landscape and potentially lead to an influx of investment in the Bitcoin market. However, the approval process is not immediate, and it could take several months before a decision is reached. As such, the market is watching closely, waiting in anticipation for the SEC’s decision on BlackRock’s application.

The Pros and Cons of Bitcoin ETFs

Like any investment, Bitcoin ETFs come with their own set of advantages and disadvantages. Understanding these can help investors make informed decisions.

Pros of Bitcoin ETFs

Accessibility and Convenience

One of the main advantages of Bitcoin ETFs is that they provide an easy way for investors to gain exposure to Bitcoin without having to buy, store, and secure the cryptocurrency themselves. This can be particularly appealing to less tech-savvy investors or those who prefer to keep their investments within traditional brokerage accounts.

Diversification

Bitcoin ETFs can also provide diversification benefits. By adding a Bitcoin ETF to a portfolio, investors can potentially improve their portfolio’s risk-return tradeoff, given that Bitcoin’s price movements are often uncorrelated with those of other asset classes.

Liquidity

ETFs are traded on exchanges just like individual stocks, meaning they can be bought and sold throughout the trading day at market prices. This provides a level of liquidity that can be advantageous for investors.

Cons of Bitcoin ETFs

Market Volatility

Bitcoin is known for its price volatility. While this can lead to high returns, it can also result in significant losses. Investors in Bitcoin ETFs are exposed to this volatility, which can increase the risk of their investment.

Regulatory Risks

The regulatory environment for Bitcoin and other cryptocurrencies is still evolving. Changes in regulations can impact the price of Bitcoin and, by extension, Bitcoin ETFs. This regulatory risk is something that investors need to consider.

Costs

While Bitcoin ETFs provide a convenient way to invest in Bitcoin, they do come with costs. These include management fees, which can eat into returns. Investors need to weigh these costs against the potential benefits of investing in a Bitcoin ETF.

While Bitcoin ETFs offer a convenient way to gain exposure to Bitcoin, they are not without risks. As always, investors should carefully consider their own risk tolerance and investment goals before investing in Bitcoin ETFs.

The Future of Bitcoin ETFs

The future of Bitcoin ETFs is a topic of intense discussion and speculation among investors and financial analysts. Here are some key points to consider:

Potential Approval of a Spot Bitcoin ETF

One of the most eagerly anticipated developments in the Bitcoin ETF space is the potential approval of a spot Bitcoin ETF in the United States. As mentioned earlier, BlackRock, the world’s largest investment company and a leader in the US ETF market, has applied to launch a spot Bitcoin ETF. If approved, this could significantly impact the Bitcoin ETF landscape, potentially leading to increased liquidity and investment in the Bitcoin market.

Regulatory Developments

The regulatory landscape for Bitcoin and other cryptocurrencies is rapidly evolving. Regulatory bodies around the world are grappling with how to regulate these new and innovative financial instruments while ensuring investor protection. These regulatory developments could have a significant impact on the future of Bitcoin ETFs.

Market Adoption and Investor Sentiment

The future of Bitcoin ETFs will also be influenced by market adoption and investor sentiment. As more investors become comfortable with the idea of investing in Bitcoin through ETFs, demand for these products could increase. However, negative sentiment or a lack of investor interest could hinder the growth of Bitcoin ETFs.

How to Invest in Bitcoin ETFs

Investing in Bitcoin ETFs is a process that involves several steps. Here’s a basic guide to help you get started:

Step 1: Understand What a Bitcoin ETF Is

Before investing, it’s crucial to understand what a Bitcoin ETF is and how it works. A Bitcoin ETF is a fund that aims to track the market price of Bitcoin. Instead of buying Bitcoin directly, investors can buy shares of the ETF, gaining exposure to Bitcoin’s price movements without owning the underlying asset.

Step 2: Choose the Right ETF

There are several Bitcoin ETFs available, and it’s important to choose the one that best fits your investment goals and risk tolerance. Consider factors such as the ETF’s performance history, its management fees, and the methodology it uses to track Bitcoin’s price.

Step 3: Open a Brokerage Account

To buy shares in a Bitcoin ETF, you’ll need to open a brokerage account if you don’t already have one. There are many online brokers to choose from, each with its own features and fee structures.

| Broker | Commission on Cryptocurrencies | Account Minimum | Features |

|---|---|---|---|

| Robinhood | $0 | $0 | Commission-free trades, easy-to-use app |

| Interactive Brokers | 0.12-0.18% of trade value; $5 per Bitcoin futures contract | $0 | Access to Bitcoin and Ethereum, 24/7 crypto trading |

| Webull | $0 | $1 to trade crypto | Commission-free trades, several cryptocurrencies available |

| TradeStation | 0.025-0.6% | $0, but futures margin depends on contract | Direct currency trading, substantial volume trading discounts |

| Coinbase | 0.05% on Advanced Trade | $0 | Access to more than 200 cryptocurrencies |

| Kraken | 1.5%, or 0.9% for stablecoins (lower with Kraken Pro) | $1 | Access to dozens of digital currencies |

| Charles Schwab | $2.25 per contract | $0, futures margin depends on contract | Trading in Bitcoin futures |

| TD Ameritrade | $2.25 per contract | $1,500 for futures | Access to Bitcoin futures |

Step 4: Buy Shares in the ETF

Once your brokerage account is set up, you can buy shares in the Bitcoin ETF just like you would buy shares in any other ETF or stock. Simply search for the ETF’s ticker symbol, enter the number of shares you want to buy, and execute the trade.

Step 5: Monitor Your Investment

After investing in a Bitcoin ETF, it’s important to monitor your investment regularly. Keep an eye on the ETF’s performance and on developments in the broader Bitcoin market.

Considerations Before Investing

Before investing in a Bitcoin ETF, it’s important to consider the risks. Bitcoin is known for its price volatility, and investing in a Bitcoin ETF exposes you to this volatility. Also, consider the costs associated with investing in the ETF, including management fees. As with any investment, it’s crucial to do your research and consider seeking advice from a financial advisor.

Conclusion

Bitcoin ETFs represent a significant development in the cryptocurrency world, providing a bridge between traditional financial markets and the burgeoning world of digital assets. They offer a unique opportunity for investors to gain exposure to Bitcoin’s potential rewards while mitigating some of the risks associated with direct Bitcoin ownership.

The current state of Bitcoin ETFs is one of anticipation and potential. With several companies, including BlackRock, having applied for a spot Bitcoin ETF, the approval of such an ETF could significantly impact the Bitcoin and broader cryptocurrency market.

However, like any investment, Bitcoin ETFs come with their own set of risks and challenges. These include the inherent volatility of Bitcoin, regulatory uncertainties, and the costs associated with ETFs. Therefore, it’s crucial for investors to do their due diligence and possibly seek advice from financial advisors before investing in Bitcoin ETFs.

Looking ahead, the future of Bitcoin ETFs is likely to be shaped by a variety of factors, including regulatory developments, market adoption, and investor sentiment. Despite the uncertainties, the potential for Bitcoin ETFs to bring a new level of accessibility and liquidity to the Bitcoin market makes them a fascinating area to watch.

In conclusion, whether you’re a seasoned investor or a beginner, understanding Bitcoin ETFs is crucial in today’s digital age. As the landscape of Bitcoin ETFs continues to evolve, staying informed will be key to making the most of this exciting investment opportunity.

FAQs

What is a Spot ETF?

A spot ETF is an exchange-traded fund that directly buys and holds the underlying asset it tracks. In the context of a Bitcoin spot ETF, the fund would directly purchase and hold Bitcoin, providing investors with more direct exposure to the cryptocurrency’s price movements.

What is a Bitcoin ETF?

A Bitcoin ETF is an investment fund that aims to track the market price of Bitcoin. Instead of buying Bitcoin directly and dealing with the challenges of storing and securing the cryptocurrency, investors can buy shares of the ETF. This allows investors to gain exposure to Bitcoin’s price movements without owning the underlying asset.

How to Invest in a Bitcoin ETF?

Investing in a Bitcoin ETF involves several steps:

1. Understand what a Bitcoin ETF is and how it works.

2. Choose the right ETF that fits your investment goals and risk tolerance.

3. Open a brokerage account with a platform that offers the Bitcoin ETF you’ve chosen.

4. Buy shares in the ETF through your brokerage account.

5. Monitor your investment regularly to keep track of performance and make adjustments as needed.