The digital currency landscape is ever-evolving, with innovations and strategies emerging at every corner. Among these, burning crypto stands out as a captivating practice, reshaping token economies and stirring debates among enthusiasts. But what exactly is behind this fiery trend?

Table of Contents

What is Burning Crypto?

Definition of Burning Crypto

Burning crypto refers to the deliberate process of permanently removing a certain number of cryptocurrency tokens or coins from circulation. This is achieved by sending these tokens to a specific address, known as a “burn address,” from which they can never be retrieved or spent. In essence, these tokens are rendered inaccessible and are effectively “destroyed.”

🚨BREAKING: Rumors circulating that Ripple could burn the entire escrow of 50 BILLION $XRP!

— XRP whale (@realXRPwhale) October 11, 2023

THIS COULD TRIGGER A HUGE PRICE SURGE!#XRP 🚀🌖

The Burn Address

The burn address is a crucial component of the burning process. It’s a public address on the blockchain, but it’s designed in such a way that its private key is unknown and unobtainable. Without the private key, no one can access or spend the tokens sent to this address. As a result, tokens sent to the burn address are considered permanently removed from circulation.

Historical Context

While the concept of burning might seem counterintuitive, especially when compared to traditional financial systems, it has historical parallels. For instance, governments have historically recalled and destroyed physical currency notes to control inflation or introduce new denominations. In the digital realm, burning serves a similar purpose but with the added benefits of blockchain’s transparency and immutability.

The Mechanics of Crypto Burn

Cryptocurrency burning, often simply referred to as “crypto burn,” is a process by which digital tokens are permanently removed from circulation. This intentional act of destruction is a fascinating aspect of the crypto world, and understanding its mechanics is crucial for both enthusiasts and investors. Here’s a comprehensive breakdown:

1. The Basic Principle

At its most fundamental level, burning crypto means sending tokens to an address from which they can never be retrieved or spent. This “burn address” is typically a public address with a private key that is unattainable. Once tokens are sent to this address, they are effectively “burned” or destroyed, reducing the total circulating supply of that particular cryptocurrency.

2. The Process

Step 1

A decision is made by the cryptocurrency project or its crypto community to burn a specific number of tokens. This decision can be based on various factors, such as controlling inflation, rewarding token holders, or rectifying mistakes.

Step 2

Tokens are sent to the burn address. This can be done in one large transaction or multiple smaller ones over time.

Step 3

Once the tokens reach the burn address, they are out of circulation permanently. The total supply of the cryptocurrency decreases, which can lead to increased scarcity.

3. Methods of Burning

Different projects employ various methods for burning tokens:

- Scheduled Burns: Some projects, like Binance with its BNB token, have scheduled burns where a predetermined number of tokens are burned at regular intervals, such as quarterly.

- Transaction-Based Burns: In this method, a small fraction of tokens used in a transaction is burned. This can help in reducing the total supply over time as more transactions occur.

- Milestone-Based Burns: Tokens are burned when certain project milestones are achieved, ensuring that the project’s progress is tied to its token’s scarcity.

4. Impact on Tokenomics

The act of burning tokens can have several effects:

- Scarcity: As tokens are burned and removed from circulation, the remaining tokens can become more scarce, potentially leading to increased demand and value.

- Price Stability: By controlling the supply, projects can aim for more stable token prices, reducing volatility.

- Incentives: Burning can be used as a mechanism to reward long-term holders or to provide incentives for certain behaviors within a crypto ecosystem.

5. Transparency and Verification

One of the advantages of crypto burn in a blockchain environment is transparency. Every token burn can be verified by checking the blockchain. This ensures that projects remain honest about the number of tokens they’re burning and provides a level of trust to the community and investors.

Token Burning: A Deep Dive

Reasons for Token Burning

Token burning can serve a multitude of purposes, each tailored to the specific needs and goals of a cryptocurrency project. Here are some of the primary reasons:

| Reason | Description |

|---|---|

| Control Inflation | By reducing the supply of tokens, projects can combat inflation, preserving the token’s value. |

| Reward Holders | Burning can indirectly benefit token holders by increasing scarcity, potentially boosting value. |

| Rectify Mistakes | If errors occur, such as faulty smart contracts, burning can serve as a corrective measure. |

| Boost Credibility | Regular, transparent burns can enhance investor trust, signaling a project’s commitment. |

| Incentivize Participation | Some projects burn tokens to encourage certain behaviors, like using a platform or staking tokens. |

Risks and Controversies

While token burning has its merits, it’s not without criticisms and potential pitfalls. Here are some of the primary concerns and controversies associated with the practice:

| Risk/Controversy | Description |

|---|---|

| Short-Term Price Manipulation | Some argue that projects might burn tokens for quick price pumps, misleading investors. |

| Centralization Concerns | If a single entity controls the burn process, it might lead to centralization, going against the decentralized ethos of crypto. |

| Economic Sustainability | Over-reliance on burning as a deflationary tool might pose long-term economic sustainability issues. |

| Lack of Transparency | Without clear communication, token burns can confuse and alienate the community and investors. |

| Regulatory Scrutiny | As governments and regulators study crypto, token burning might come under legal scrutiny. |

Examples of Successful Token Burns

Several projects have effectively utilized token burning to their advantage:

- Binance (BNB): Binance, one of the world’s leading crypto exchanges, conducts regular burns of its BNB token, aiming to eventually destroy 2 billion BNB.

- Ripple (XRP): For every transaction on the Ripple network, a small amount of XRP is burned, ensuring a steady, albeit minimal, reduction in total supply.

- Ethereum (ETH): With the introduction of EIP-1559, Ethereum has adopted a mechanism where a portion of the transaction fees is burned, introducing deflationary pressure.

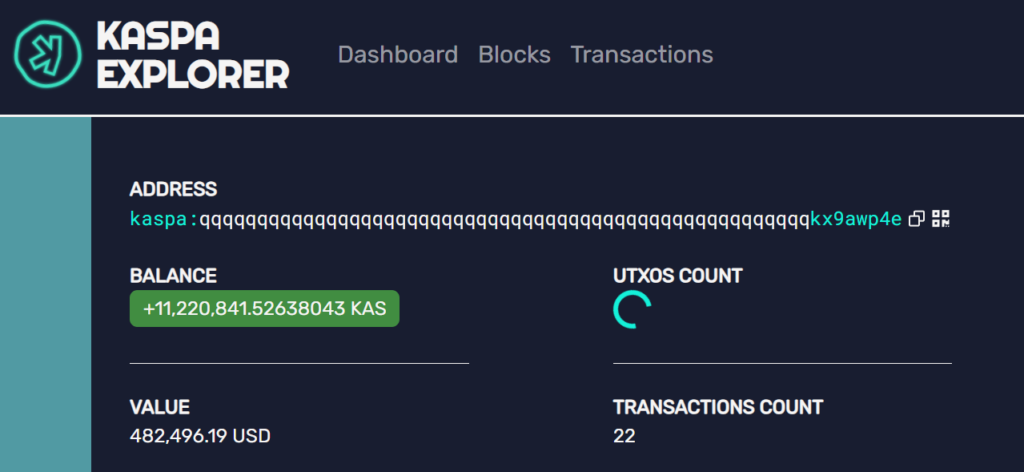

- Kaspa (KAS): Burned a significant 11 million coins that were solo mined by developer Shai during the network’s launch phase.

The Burn Wallet: A Special Repository

Often referred to as the digital equivalent of a black hole, once tokens enter the burn wallet, they never come out. But what makes this wallet so unique, and why is it so integral to the process of token burning? Let’s explore:

Definition of a Burn Wallet

A burn wallet is a specific type of cryptocurrency address to which tokens can be sent but never retrieved. It’s designed in such a way that its private key is either unknown or unobtainable. Without the private key, the tokens within the wallet remain inaccessible, effectively rendering them out of circulation permanently.

Characteristics of a Burn Wallet

Unrecoverable Private Key

The defining feature of a burn wallet is that its private key is unattainable. This ensures that tokens sent to this address are permanently locked away.

Recognizable Address

Often, burn wallets have addresses that are easily recognizable, such as a string of zeros. This makes it transparent for the community to verify when tokens are being burned.

Transparency

All transactions to the burn wallet are recorded on the blockchain, ensuring complete transparency and allowing anyone to verify the number of tokens burned.

Purpose and Usage

Token Burning

The primary use of a burn wallet is for token burning. Projects send tokens to the burn wallet to reduce their circulating supply, potentially increasing scarcity and value.

Correcting Mistakes

If a project identifies an error, such as a faulty smart contract or an accidental creation of excess tokens, they might send the erroneous tokens to a burn wallet.

Proof of Burn

Some projects use a burn wallet to demonstrate commitment. By sending tokens (sometimes even from a competing blockchain) to a burn wallet, they showcase their dedication to a new project or initiative.

Notable Instances

Several major cryptocurrencies have utilized burn wallets:

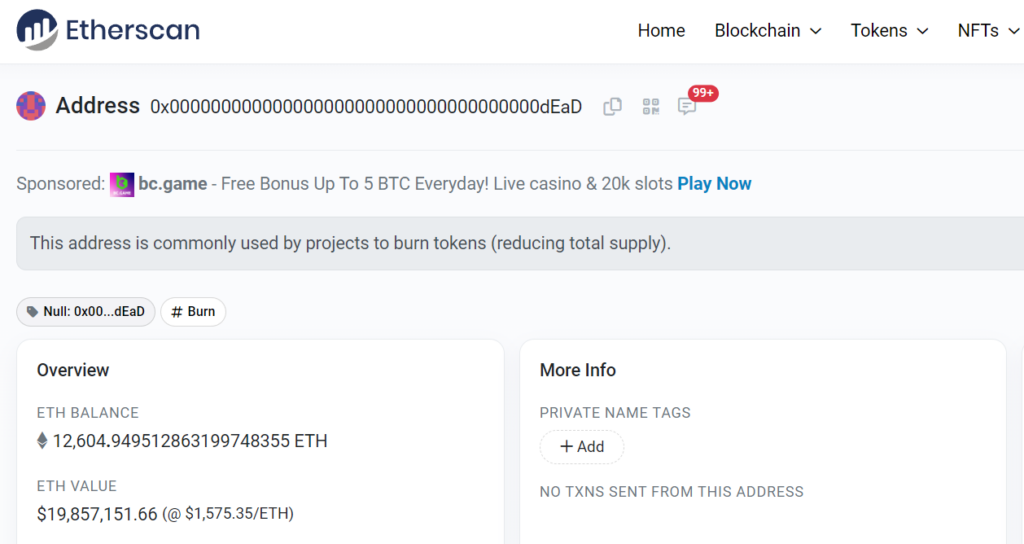

Ethereum

The Ethereum blockchain has a well-known burn address that starts with a string of zeros. Over the years, a significant amount of Ether (ETH) has been sent to this address, either intentionally for burning or accidentally.

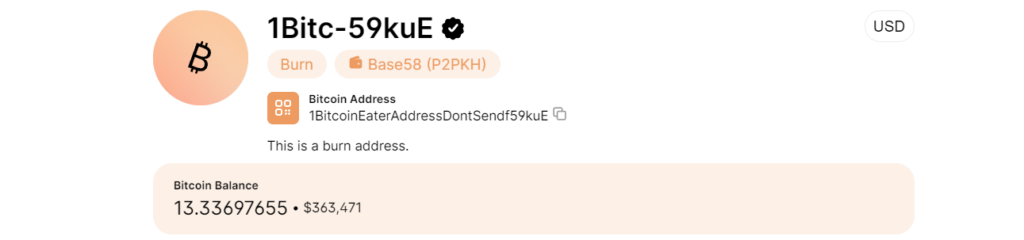

Bitcoin

While not as prevalent as in other cryptocurrencies, there have been instances where Bitcoin has been sent to burn addresses as a form of “proof of burn” for various projects. For example there’s a special BTC address people are burning their Bitcoins to, 1BitcoinEaterAddressDontSendf59kuE

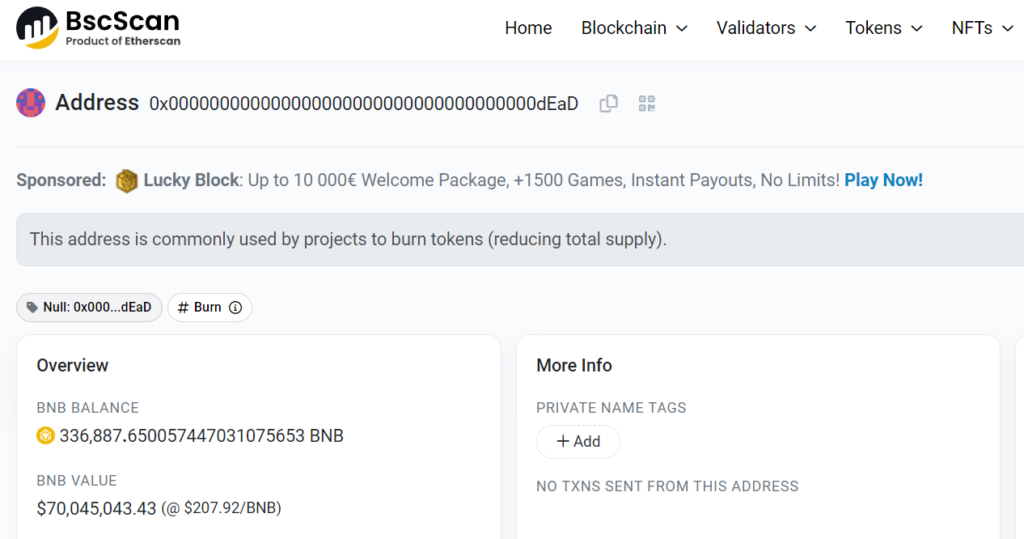

Binance Coin (BNB)

Binance regularly conducts token burns, sending BNB to a burn address, as part of their commitment to reduce the total supply.

Kaspa (KAS)

During its nascent stages, to ensure the robustness and security of the network, Shai, one of the lead developers of Kaspa, took on the task of solo mining. This endeavor resulted in the mining of a whopping 11 million coins. Instead of distributing or holding onto these coins, the Kaspa community, in a unanimous voice, chose to burn the entire 11 million coins mined by Shai.

The Future of Crypto Burning

Crypto burning, as a mechanism, has gained significant traction in recent years. As the cryptocurrency landscape continues to evolve, the role and nuances of token burning are expected to shift and adapt. Here’s a comprehensive look at the potential future of crypto burning:

Predictions and Trends

- Widespread Adoption: As more projects recognize the benefits of controlling token supply and incentivizing user behavior, token burning might become a standard practice across various cryptocurrencies.

- Innovative Burning Mechanisms: Beyond the traditional methods, we might see the emergence of new, innovative ways to burn tokens, tailored to the unique needs of individual projects.

- Integration with DeFi: Decentralized Finance (DeFi) platforms, which have seen explosive growth, might incorporate token burning as a mechanism to stabilize their native tokens or as a part of yield farming strategies.

The Role of Regulatory Bodies

- Increased Scrutiny: As governments and regulatory bodies become more involved in the crypto space, token burning practices might come under increased scrutiny. This could lead to guidelines or even restrictions on how and when tokens can be burned.

- Legal Implications: There might be legal debates on whether burned tokens could be considered as “destroyed assets” and how that impacts taxation or project valuations.

Innovations and Evolutions

- Smart Burns: We might see the rise of “smart burns,” where tokens are burned based on real-time data or specific triggers within the blockchain, ensuring more strategic and effective burns.

- Community-Driven Decisions: Decentralized Autonomous Organizations (DAOs) and community governance might play a larger role in deciding burn rates, amounts, and timings, ensuring that the wider community has a say in the token’s economics.

- Environmental Considerations: With increasing focus on the environmental impact of cryptocurrencies, especially Proof-of-Work systems, projects might adopt token burning as a less energy-intensive alternative to traditional mining rewards.

Challenges and Concerns

- Over-reliance: Projects might face criticism for over-relying on token burns as a way to artificially prop up token prices, leading to concerns about the long-term sustainability of such practices.

- Market Manipulation: There might be concerns about projects using token burns to manipulate market sentiment in the short term, especially if not done transparently.

- Economic Models: As token burning becomes more prevalent, economists and crypto analysts might develop new models to better predict and understand the long-term implications of reducing token supply on price, demand, and market dynamics.

Conclusion

The practice of burning crypto, while a fiery topic, holds the potential to reshape token economies. As we’ve seen with projects like Kaspa, it’s not just about controlling supply or boosting value; it’s also a testament to a project’s commitment to transparency and its community. As the crypto landscape evolves, understanding the nuances of token burning becomes crucial. It’s not just about the tokens that vanish but the underlying principles and intentions that drive such actions. As enthusiasts and investors, staying informed and discerning the genuine intent behind such practices will be key in navigating the ever-complex world of cryptocurrencies.

FAQs

What does it mean to burn crypto?

To burn crypto means to permanently remove a certain number of cryptocurrency tokens or coins from circulation, rendering them inaccessible and unusable.

What is the primary purpose of burning crypto?

To reduce token supply, potentially increasing its value and controlling inflation.

Is burning crypto always beneficial for a token’s value?

Not necessarily. Other factors, like market sentiment and project credibility, play a role.

How is a burn wallet different from a regular wallet?

Tokens sent to a burn wallet are permanently removed and can’t be retrieved.