In the ever-evolving financial landscape, one term that has been making waves is ‘crypto loans’. This article aims to demystify the concept of cryptocryptocurrency loans, providing a comprehensive guide to understanding this revolutionary financial tool.

Key Takeaways

- Crypto Loans Provide Liquidity: Crypto loans allow holders of cryptocurrencies to access liquidity without selling their assets. This can be particularly beneficial if the value of the assets is expected to rise.

- Several Platforms Offer Crypto Loans: Platforms such as CoinRabbit, Celsius, Aave, Compound, and Nexo offer cryptocurrency loans with varying terms and conditions. It’s important to research and compare these platforms to find the one that best suits your needs.

- Crypto Loans Come with Risks: The volatility of cryptocurrencies, potential platform risks, and changing regulatory environment are all risks associated with crypto loans. It’s crucial to understand these risks before taking out a crypto loan.

- Regulation and Technology Will Shape the Future: The future of crypto loans will be influenced by regulatory developments and technological advancements. These could include clearer regulations, more sophisticated smart contracts, and increased integration with traditional finance.

- Crypto Loans are Part of the DeFi Movement: Crypto loans are a significant part of the decentralized finance (DeFi) movement, which aims to create a more open and accessible financial system.

- Do Your Research: As with any financial decision, it’s important to do your research before taking out a crypto loan. This includes understanding the terms of the loan, the platform’s reputation and security measures, and your own financial situation and risk tolerance.

Table of Contents

Unraveling the Concept of Crypto Loans

The world of finance has always been one of constant evolution, and the advent of cryptocurrencies has accelerated this change. One of the most intriguing developments in this space is the concept of crypto loans.

What are Crypto Loans?

Crypto loans are a type of digital lending that allows borrowers to use their cryptocurrency as collateral. This innovative financial model has been gaining traction due to its potential to offer quick access to liquidity without the need to sell off valuable crypto assets.

In a traditional loan, a borrower might use their house or car as collateral. In the case of a crypto loan, the collateral is cryptocurrency. This allows individuals who have invested in cryptocurrencies like Bitcoin, Ethereum, or others to leverage their investments to get a loan. The borrower can then use this loan for any number of purposes, from buying a home to paying off high-interest debt.

How Do Crypto Loans Work?

Cryptocurrency loans operate on the principle of over-collateralization. This means that the value of the cryptocurrency deposited by the borrower is higher than the value of the fiat or stablecoin they receive as a loan. This is done to protect the lender from the high volatility of the crypto market.

Here’s a step-by-step breakdown of how a typical crypto loan works:

- The borrower deposits their cryptocurrency into a smart contract. The smart contract acts as a secure, decentralized escrow. This is the collateral for the loan.

- The lender verifies the value of the collateral and lends fiat or stablecoin to the borrower. The loan amount is typically less than the value of the collateral to account for market volatility.

- The borrower can then use the loan as they see fit. Throughout the loan period, the collateral stays locked in the smart contract.

- Once the borrower repays the loan along with any interest, the smart contract releases the collateral back to the borrower.

This system allows for a secure, efficient loan process that leverages the power of blockchain technology. It’s a revolutionary way of lending that’s poised to disrupt traditional financial systems.

The Evolution of Cryptocurrency Loans

The evolution of crypto loans is a testament to the transformative power of blockchain technology in reshaping the financial landscape. This journey, though relatively short, has been marked by rapid growth and significant milestones.

A Brief History

The concept of crypto loans emerged alongside the rise of cryptocurrencies and blockchain technology. As digital currencies like Bitcoin started to gain traction around 2009, it opened up new possibilities for financial transactions, including lending and borrowing.

However, it wasn’t until around 2017-2018 that the first crypto loan platforms began to surface. These platforms offered an alternative to traditional financial systems, enabling individuals to leverage their crypto assets to secure loans. This was a game-changer, especially for those who had invested in cryptocurrencies early on and saw their value skyrocket.

Growth and Developments

Since their inception, crypto loans have experienced exponential growth. This can be attributed to several factors, including the increasing acceptance of cryptocurrencies, the rise of decentralized finance (DeFi), and the appeal of crypto loans to both borrowers and lenders.

For borrowers, crypto loans offer a way to access liquidity without selling their crypto assets. For lenders, they provide a new avenue for earning interest on their capital.

The growth of the crypto loan industry has also been fueled by technological advancements and regulatory developments. The use of smart contracts has made the loan process more secure and efficient, while regulatory clarity in some jurisdictions has helped to legitimize the practice and attract more participants.

To illustrate the growth trajectory of the crypto loan industry, consider the following data:

| Year | Estimated Market Size |

|---|---|

| 2018 | $100 Million |

| 2019 | $1 Billion |

| 2020 | $10 Billion |

| 2021 | $25 Billion |

| 2022 | $50 Billion |

| 2023 | $100 Billion |

These figures highlight the rapid expansion of the crypto loan market. However, it’s important to note that the industry is still in its early stages, and its future growth will likely be influenced by various factors, including regulatory developments, market dynamics, and technological advancements.

Types of Crypto Loans

As the crypto lending space has evolved, different types of crypto loans have emerged, each with its unique characteristics and use cases. Understanding these different types can help borrowers and lenders make informed decisions.

There are primarily two types of crypto loans: centralized and decentralized.

Centralized Crypto Loans

Centralized crypto loans are offered by centralized platforms or companies. These platforms act as intermediaries between borrowers and lenders. When a borrower applies for a loan, the platform matches them with a lender from their pool of users. The platform also handles the loan agreement, collateral management, and loan repayment.

Examples of centralized crypto loan platforms include Coinrabbit, BlockFi, Celsius, and Nexo. These platforms often offer features like interest accounts where users can earn interest on their crypto holdings.

One of the main advantages of centralized crypto loans is that they often provide a user-friendly experience, which can be especially helpful for those new to crypto lending. They also typically offer customer support, which can provide additional peace of mind.

However, centralized loans also come with risks. Since the platform holds your crypto assets, it’s crucial to choose a reputable platform with strong security measures.

Decentralized Crypto Loans

Decentralized crypto loans, also known as DeFi loans, operate on decentralized platforms or protocols. These loans are facilitated by smart contracts on the blockchain, eliminating the need for an intermediary.

When a borrower applies for a DeFi loan, they interact directly with the smart contract. The contract locks in the borrower’s collateral and disburses the loan. The entire process is automated and operates on pre-set rules encoded in the smart contract.

Examples of DeFi lending platforms include MakerDAO, Compound, and Aave.

One of the main advantages of DeFi loans is that they offer a high degree of transparency and control. Since the loans are managed by smart contracts, users can audit the contract’s code and verify its functionality.

Flash Loans

Flash loans are a unique type of decentralized crypto loan that have been gaining significant attention in the DeFi sector. They offer a powerful financial tool that allows users to borrow cryptocurrency without collateral, provided the loan is returned within the same transaction block. This feature has opened up a plethora of opportunities, from arbitrage opportunities to collateral swapping.

A flash loan is a feature in the DeFi sector that allows users to borrow cryptocurrency without collateral, provided the loan is returned within the same transaction block. This is a stark contrast to traditional loans, which typically require collateral as a form of security. The concept of flash loans was first introduced by the DeFi platform Aave in 2020, and it quickly gained traction due to its innovative approach to lending and borrowing.

For more detailed information about flash loans, you can refer to this comprehensive guide.

However, DeFi loans also come with their own set of risks. Smart contract vulnerabilities can lead to loss of funds, and the complexity of DeFi platforms can be daunting for beginners.

Comparison Chart

| Feature | Centralized Crypto Loans | Decentralized Crypto Loans |

|---|---|---|

| Control | Centralized platforms control the loan process and set the terms. | Decentralized platforms use smart contracts to automate the loan process. |

| Interest Rates | Rates are set by the platform and can be fixed or variable. | Rates are often determined by supply and demand dynamics in the market. |

| Security | Centralized platforms are responsible for security, but they can be targets for hacking. | Decentralized platforms rely on the security of the blockchain, but smart contracts can have vulnerabilities. |

| Privacy | Centralized platforms often require KYC procedures, which can impact privacy. | Decentralized platforms can offer more privacy, as loans can be issued without KYC procedures. |

| Loan Terms | Loan terms are set by the platform and can be less flexible. | Loan terms can be more flexible, as they are often determined by smart contracts. |

| Access to Funds | Access to funds can be quicker, as centralized platforms can streamline the process. | Access to funds can take longer, as transactions need to be confirmed on the blockchain. |

| Regulation | Centralized platforms are more likely to be regulated and comply with financial laws. | Decentralized platforms can be less regulated, which can increase risks but also offer more freedom. |

This chart provides a general comparison between centralized and decentralized crypto loans. However, the specifics can vary greatly between different platforms and jurisdictions. Always DYOR before deciding on a crypto loan platform.

How to Secure a Crypto Loan

Securing a crypto loan might seem daunting at first, especially if you’re new to the world of cryptocurrencies and decentralized finance. However, the process is relatively straightforward once you understand the steps involved. Here’s a step-by-step guide on how to secure a crypto loan.

Choose a Crypto Loan Platform

The first step is to choose a platform that offers crypto loans. There are numerous platforms available, each with its unique features, advantages, and disadvantages. Check next section to find the platform that suits you better.

When choosing a platform, consider factors such as the platform’s reputation, security measures, interest rates, loan terms, and the types of cryptocurrencies it accepts as collateral.

Create an Account

Once you’ve chosen a platform, the next step is to create an account. This usually involves providing some basic information and going through a verification process. For decentralized platforms, you’ll need to connect a wallet like MetaMask or Trust Wallet.

Deposit Your Cryptocurrency

After setting up your account, you’ll need to deposit the cryptocurrency that you’ll be using as collateral. The platform will provide you with a unique wallet address where you can send your cryptocurrency.

Remember, the value of the cryptocurrency you deposit will determine the amount you can borrow. Most platforms require over-collateralization, meaning the value of your collateral should be higher than the loan amount to account for the volatility of cryptocurrencies.

Apply for the Loan

Once your collateral is in place, you can apply for the loan. You’ll need to specify the amount you want to borrow and the terms of the loan. Some platforms offer flexible loan terms, allowing you to choose the duration of the loan and the interest rate.

Receive Your Loan

After your loan application is approved, the loan amount will be transferred to your account. Depending on the platform, you might receive the loan in a stablecoin like USDT, USDC, or in fiat currency.

Repay the Loan

Finally, you’ll need to repay the loan according to the agreed terms. This typically involves paying back the principal along with any accrued interest. Once the loan is fully repaid, your collateral will be released back to you.

Remember, failing to repay the loan could result in the liquidation of your collateral. Therefore, it’s crucial to understand the terms of your loan and ensure that you can meet the repayment obligations.

Securing a crypto loan can be a great way to leverage your cryptocurrency assets without selling them. However, like any financial decision, it’s important to do your research and understand the risks involved. Always borrow responsibly and consider seeking advice from a financial advisor if you’re unsure.

Top 5 Crypto Loan Platforms

Here are the best crypto loans platforms that have been recognized for their robust features, security, and user-friendly interfaces.

| Platform | Interest Rate | Fees | Loan Duration | Other Features |

|---|---|---|---|---|

| Nexo | As low as 0% | Varies | Flexible | Instant credit lines, no fixed repayment schedule, Nexo Card, high security, excellent user reviews |

| CoinRabbit | 1.2% per month | No fees | Unlimited | Non-KYC approach, high security |

| Celsius | Up to 17% APY | No fees | Varies | Available on web and app, weekly interest payout |

| AAVE | Varies | Varies | Varies | Decentralized protocol, interest on deposits |

| Compound | Varies | Varies | Varies | Own COMP token, interest on deposits |

Nexo

Description

Nexo is a popular platform for crypto loans, offering a variety of features that make it a strong contender in the crypto loan market. Here are some key details:

- Instant Crypto Credit Lines: Nexo offers instant crypto credit lines, allowing users to borrow without selling their crypto. The platform offers rates as low as 0% with no extra fees. Once users top up their account, their credit line is immediately available.

- Flexibility: Nexo offers a highly flexible crypto credit line. Users can borrow as much or as little as they want, whenever they want. The platform supports more than 30 fiat currencies and allows users to borrow instantly using USDT or USDC.

- Multiple Assets as Collateral: Users can borrow against not just one cryptocurrency, but their whole digital asset portfolio. This includes Bitcoin, Ethereum, NEXO Token, USDT, USD Coin, and many more.

- No Installments: Nexo does not require fixed payment schedules. Users can pay off their balance partially or fully whenever they want.

- Easy Repayment: Users can choose between fiat, crypto, or a combination of both to repay their credit line.

- Nexo Card: Nexo offers a card linked to the user’s credit line, allowing them to spend their credit line at over 90 million merchants.

- Security: Nexo uses military-grade 256-bit encryption for user accounts and stores assets in Class III vaults through leading blockchain custodians, including Ledger Vault, Bakkt, and others. It also has insurance from its custodial partners via Lloyd’s of London and Marsh & Arch.

- Interest Rate: The interest rate on Nexo depends on the user’s Loyalty Tier, which is determined by the ratio between the value of their NEXO Tokens against the rest of their portfolio. The interest rate can be as low as 0% for Platinum clients with an LTV below or equal to 20%.

Users Reviews

Based on the reviews from Trustpilot, Nexo has an “Excellent” rating with a score of 4.7 out of 5, based on 11,579 reviews. Here are some highlights from the reviews:

- Ease of Use: Many users praised Nexo for its user-friendly platform. They found it easy to navigate and manage their crypto assets.

- Customer Support: Nexo’s customer support received positive reviews for their quick and helpful responses. Users appreciated the support team’s efforts in resolving their issues.

- Loan System and Nexo Card: Users found Nexo’s loan system and Nexo Card to be very convenient. They appreciated the ability to spend their credit line at millions of merchants worldwide.

- Interest Rates: Users were happy with the interest rates offered by Nexo. They found the rates to be competitive and the daily interest earnings enjoyable.

- Security: Users felt safe with Nexo, citing the platform’s robust security measures and insurance on custodial assets.

CoinRabbit

Description

CoinRabbit is a simple and fast solution for crypto lending. It offers a non-KYC approach, requiring only an email or phone number to create an account. The platform pays much attention to the security of clients’ funds, carrying out multiple security and AML checks. The APR is just 1.2% per month, supplemented by completely free withdrawals available anytime and unlimited time frames for your loans. CoinRabbit is a great choice for both beginners and experts who value their time.

Users Reviews

Overall, CoinRabbit seems to be a reliable platform for crypto loans, but users should be aware of potential fees and the risks associated with market volatility. For more detailed reviews, you can visit the Trustpilot page for CoinRabbit.

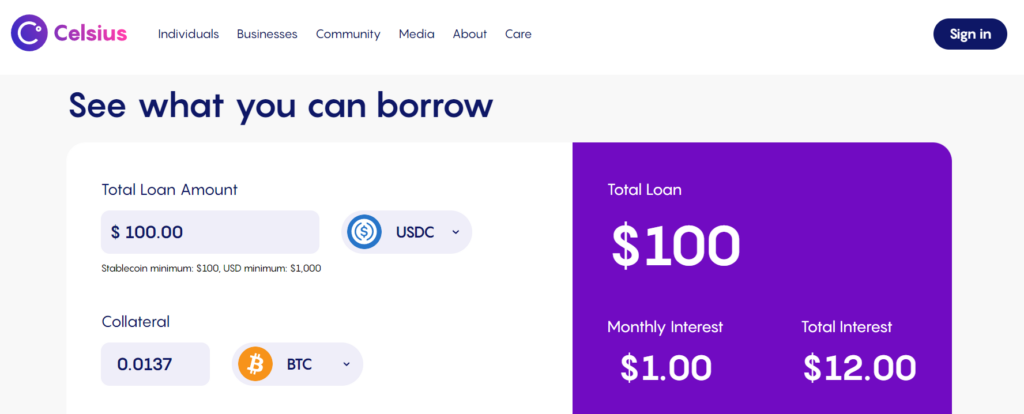

Celsius

Description

Celsius is a big name in the world of crypto lending and borrowing. It offers up to a 17% yield when you lend crypto on the Celsius network. There are no fees, whether borrowing, lending, or transferring the coins. Celsius is available on both web and application formats, making it a convenient choice for users. Visit Celsius for more information.

Users Reviews

Based on the reviews from Trustpilot, Celsius Network has a “Poor” rating with a score of 2.7 out of 5, based on 65 reviews. Here are some highlights from the reviews:

- High Interest Rates: Some users praised Celsius Network for offering high interest rates on crypto assets and regular promotional codes.

- Customer Support: The customer support of Celsius Network received mixed reviews. Some users appreciated the support team’s efforts, while others criticized the lack of one-on-one communication and slow response times.

- Withdrawal Issues: Several users reported issues with withdrawing their funds from Celsius Network. Some users claimed that their funds were locked on the platform for extended periods.

- Regulatory Changes: A few users mentioned changes in the laws that only allow accredited investors to invest, limiting the platform’s accessibility for new users.

- Bankruptcy Allegations: Some users alleged that Celsius Network is facing bankruptcy and legal issues, comparing the platform to a Ponzi scheme. These users claimed to have lost significant amounts of money.

Overall, the reviews suggest that while some users have had positive experiences with Celsius Network, others have faced significant issues, particularly with withdrawals and customer support. For more detailed reviews, you can visit the Trustpilot page for Celsius Network.

AAVE

Description

AAVE is a well-known decentralized liquidity protocol. It allows users to earn interest on their crypto deposits and also borrow funds by staking their assets. AAVE has a well-developed liquidity protocol with plenty of features other than lending and borrowing crypto assets. Check out AAVE to explore its offerings.

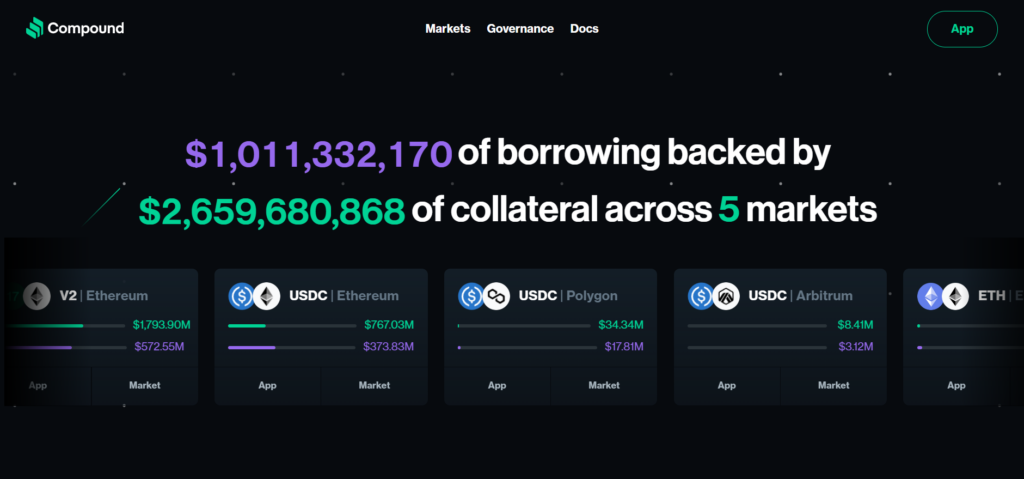

Compound

Compound is another big name in the world of crypto protocols for lending and borrowing. It offers a variety of cryptocurrencies for deposit or borrowing. Compound also has its own COMP token that can yield better returns while lending your crypto to the platform to provide liquidity. Visit Compound to learn more.

These platforms have been recognized for their robust features, security, and user-friendly interfaces. However, it’s important to do your own research and consider factors such as interest rates, platform risks, fees, deposit limits, and lending duration when choosing a platform for crypto loans.

Risks and Benefits of Crypto Loans

Like any financial instrument, crypto loans come with their own set of risks and benefits. Understanding these can help you make informed decisions and maximize the potential of your crypto assets.

Potential Benefits

- Access to Liquidity: Crypto loans allow you to access liquidity without having to sell your crypto assets. This can be particularly beneficial if you believe your assets will appreciate in value over time.

- No Credit Checks: Traditional loans often require credit checks and a good credit score. With crypto loans, your loan is secured by your crypto collateral, so credit checks are typically not required.

- Ownership of Assets: When you take out a crypto loan, you retain the ownership of your crypto assets. If your assets appreciate in value during the loan term, you benefit from the price increase once you repay the loan and retrieve your collateral.

- Fast and Global Access: Crypto loans can be accessed quickly, often within minutes of your loan request. They are also not bound by geographical restrictions, making them accessible to people worldwide.

Associated Risks

- Market Volatility: Cryptocurrencies are known for their price volatility. If the value of your crypto collateral drops significantly, you might face a margin call or risk having your collateral liquidated.

- Smart Contract Risks: For decentralized crypto loans, the loan agreements are managed by smart contracts. While these contracts are secure, they are not immune to bugs or exploits, which could potentially lead to loss of funds.

- Regulatory Risks: The regulatory environment for cryptocurrencies and crypto loans is still evolving. Changes in regulations could impact the value of your crypto assets or the viability of your loan.

- Platform Risks: The platform you choose for your crypto loan could face security risks, such as hacking, or operational risks, such as bankruptcy. These risks could potentially impact your loan or collateral.

The Future of Crypto Loans

The future of crypto loans looks promising, with several trends and developments shaping the landscape. Here’s a look at what we can expect in the coming years.

Increased Adoption

As more people become aware of the benefits of crypto loans, we can expect to see increased adoption. This includes both individual users, who may use crypto loans to leverage their assets and access liquidity, and businesses, which may use crypto loans for a variety of purposes, including working capital, investment, and more.

Regulatory Developments

The regulatory environment for crypto loans is still evolving. As regulators around the world gain a better understanding of cryptocurrencies and blockchain technology, we can expect to see more comprehensive and clear regulations. This could help to increase trust and stability in the market, attracting more users and investors.

Technological Advancements

Blockchain technology is constantly evolving, and these advancements will likely impact the crypto loan market. For example, the development of more sophisticated smart contracts could allow for more complex loan agreements, including variable interest rates, multi-collateral loans, and more.

Integration with Traditional Finance

As the crypto market matures, we’re likely to see more integration with traditional finance. This could include partnerships between crypto loan platforms and traditional banks, the development of hybrid products that combine elements of crypto and traditional finance, and more.

Decentralized Finance (DeFi)

Decentralized finance, or DeFi, is a major trend in the crypto world, and it’s likely to have a significant impact on crypto loans. DeFi platforms allow for peer-to-peer loans without the need for an intermediary, which could lower costs and increase accessibility.

Conclusion

Crypto loans, both centralized and decentralized, are reshaping the landscape of financial services by providing innovative ways to access liquidity. They offer a unique proposition to crypto asset holders to unlock the value of their assets without selling them.

Centralized platforms like CoinRabbit, Celsius, and Nexo offer a more traditional structure, providing users with a familiar experience. They manage the loan process, set the terms, and are generally more regulated. However, they also require more personal information and can be targets for hacking.

On the other hand, decentralized platforms like Aave and Compound represent a new paradigm in finance. They offer more privacy and flexibility, with loan terms often determined by smart contracts and market dynamics. However, they can also be more complex to use and less regulated.

The choice between centralized and decentralized loans depends on individual needs and risk tolerance. It’s important to understand the differences, do your own research, and possibly seek advice from a financial advisor.

The future of crypto loans is promising, with technological advancements, regulatory developments, and increased adoption expected to drive growth in this sector. As the market matures, we can expect to see more innovations, more integration with traditional finance, and new opportunities for investors and borrowers.

In conclusion, crypto loans are an exciting development in the world of finance, offering new possibilities for leveraging crypto assets. As with any financial decision, it’s important to understand the associated risks and rewards. With careful consideration and research, crypto loans can be a valuable tool in a savvy investor’s toolkit.

FAQs

What are crypto loans?

Crypto loans are a type of loan where borrowers can use their cryptocurrency assets as collateral to secure a loan. The loan can be in the form of fiat currency or other cryptocurrencies. This allows crypto asset holders to access liquidity without having to sell their assets.

How do crypto loans work?

Crypto loans work by using cryptocurrency as collateral. A borrower deposits their cryptocurrency into a smart contract or a lending platform, which then provides the loan. The loan amount is typically less than the value of the deposited crypto to protect the lender from price fluctuations. Once the borrower repays the loan along with any interest, they get their collateral back.

How to get crypto loans?

To get a crypto loan, you first need to choose a crypto loan platform that suits your needs. Once you’ve chosen a platform, you can apply for a loan by depositing your crypto assets as collateral. The platform will then provide you with a loan based on the value of your collateral. The specific process can vary between platforms, so it’s important to read and understand the terms and conditions of each platform.