In the ever-evolving world of cryptocurrency, the age-old question remains: “How to take profits from crypto without selling?” As we venture deeper into 2023, the crypto landscape offers more avenues than ever to secure profits without parting with your precious digital assets. This guide unveils five proven strategies to help you navigate this lucrative realm.

Table of Contents

Understanding the Basics

What Does “Taking Profits” Mean in the Crypto World?

In the crypto sphere, “taking profits” refers to the act of realizing gains from your investments. Traditionally, this meant selling a portion of your holdings. However, as you’ll discover, there are innovative ways to achieve this without selling a single coin.

Why Might Someone Want to Take Profits Without Selling?

Holding onto your crypto assets can be a strategic move. By not selling, you avoid potential tax implications, maintain a position for future growth, and can leverage these assets in various ways to generate additional income.

The Role of Crypto in a Diversified Investment Portfolio

Crypto, with its potential for high returns, has become an essential component of a diversified portfolio. By taking profits without selling, investors can reap the benefits of crypto’s growth while mitigating risks.

Traditional Methods of Taking Profits

Selling a Portion of Your Holdings

This is the most straightforward method. By selling a fraction of your crypto, you realize some profits while still maintaining a position in the market.

Setting Up Stop-Loss and Take-Profit Orders

These automated orders allow you to set predetermined prices at which your crypto will be sold, ensuring you lock in profits or limit losses.

The Tax Implications of Selling Crypto

Selling crypto can trigger capital gains tax. It’s crucial to understand your local tax regulations and how they apply to crypto transactions.

Innovative Ways to Profit Without Selling

The innovative methods to profit from crypto without selling provide a blend of passive income generation, liquidity access, and potential capital appreciation.

| Method | Description | Key Benefits | Popular Platforms |

|---|---|---|---|

| Crypto-Backed Loans | Use crypto as collateral to borrow fiat currency. | – Immediate liquidity without selling assets. – Potentially avoid tax events. – Retain potential upside of crypto. | BlockFi, Celsius, Nexo |

| Staking & Passive Income | Lock up a certain amount of crypto to support blockchain operations and earn rewards. | – Steady income generation. – Potential for high returns. | Tezos, Polkadot, Ethereum 2.0 |

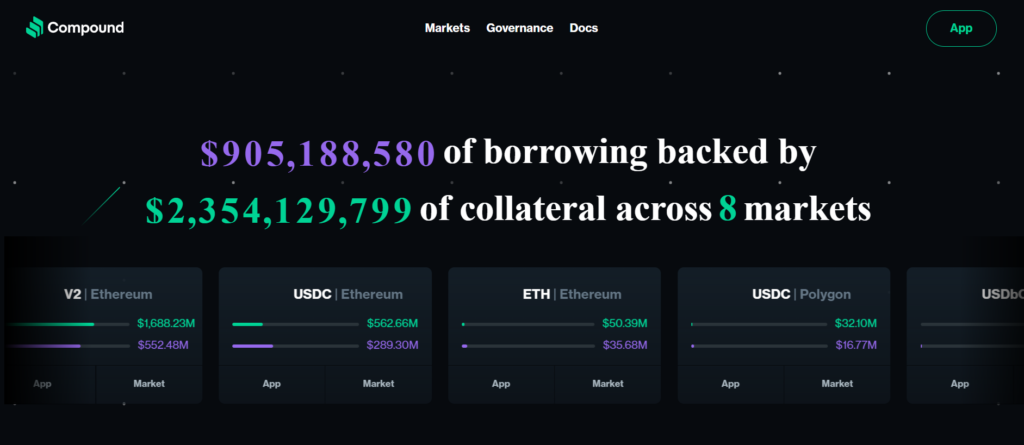

| Yield Farming & Liquidity Mining | Provide liquidity to DeFi platforms and earn returns in the form of interest and tokens. | – High potential returns. – Active participation in DeFi ecosystems. | Compound, Uniswap, SushiSwap |

| Crypto Savings Accounts | Deposit crypto to earn interest over time, similar to traditional savings accounts. | – Higher interest rates than traditional banks. – Passive income generation. | Mexc, Gate.io |

Crypto-Backed Loans

How They Work

Crypto-backed loans allow users to use their cryptocurrency as collateral to borrow fiat currency. This means you can access the value of your crypto without selling it. Once the loan is repaid, you get your collateral back, potentially benefiting from any appreciation in its value during the loan period.

Staking and Earning Passive Income

Explanation of Staking

Staking involves holding and locking up a certain amount of a cryptocurrency in a wallet to support operations like block validation, transaction verification, and security on a blockchain network. In return, participants receive additional coins as rewards.

Potential Returns and Risks

- Returns: Depending on the cryptocurrency, staking can offer attractive annual returns, sometimes even surpassing traditional investment vehicles.

- Risks: The main risks include the potential for the staked cryptocurrency to decrease in value and the potential for “slashing,” where a portion of the staked amount is taken away if the network’s protocols aren’t properly followed.

Yield Farming and Liquidity Mining

Basics of DeFi

Yield farming is a concept within decentralized finance (DeFi) where users provide liquidity to a platform, often through liquidity pools, and earn returns in the form of interest and tokens.

How It Works

Users deposit their crypto assets into a smart contract-based liquidity pool. In return, they receive interest and sometimes additional tokens as rewards for providing liquidity.

Earning Interest Through Crypto Savings Accounts

How They Work

Similar to traditional savings accounts, crypto savings accounts allow users to deposit their cryptocurrency and earn interest over time.

Benefits:

- Higher interest rates compared to traditional banks.

- Passive income generation.

Comparison with Traditional Savings

While traditional savings accounts have been offering historically low-interest rates, crypto savings accounts can offer significantly higher rates, sometimes even in the double digits.

Risks and Considerations

While the innovative methods to profit from crypto without selling offer enticing opportunities, they also come with their own set of risks and considerations. It’s crucial for investors to be aware of these potential pitfalls to make informed decisions. Let’s delve deeper into these risks:

Market Volatility

Explanation

Cryptocurrencies are known for their price volatility. Rapid and significant price fluctuations can occur within short periods, which can impact the value of your holdings or collateral.

Considerations

If using crypto as collateral for a loan, a sharp drop in its value might trigger a margin call, requiring you to add more collateral or face liquidation.

Regulatory and Tax Considerations

Explanation

The regulatory landscape for cryptocurrencies is still evolving. Changes in regulations can impact the viability of certain profit strategies.

Tax Implications

Even if you’re not selling your crypto, certain actions, like receiving staking rewards or interest, might be considered taxable events in some jurisdictions.

Considerations

Always stay updated on local regulations and consult with a tax professional to understand potential liabilities.

Smart Contract Risks in DeFi Platforms

Explanation

Decentralized Finance (DeFi) platforms rely on smart contracts. These are self-executing contracts with the terms of the agreement directly written into code.

Risks

If there’s a bug or vulnerability in the smart contract code, it could be exploited, leading to loss of funds. There have been instances where flaws in smart contracts led to significant losses for users.

Considerations

Before engaging with a DeFi platform, it’s essential to ensure that their smart contracts have been audited and are deemed secure.

Platform and Custody Risks

Explanation

When you deposit your crypto into a platform, whether for staking, lending, or earning interest, you’re often trusting that platform to safeguard your assets.

Risks

The platform could be hacked, mismanage funds, or face solvency issues. There’s also the risk of “rug pulls” in less reputable platforms, where developers abandon the project and run away with users’ funds.

Considerations

Always research a platform’s reputation, security measures, and track record before depositing your crypto. Using platforms with insurance can also provide an added layer of protection.

Liquidity Risks

Explanation

Some profit strategies might require you to lock up your crypto for a certain period, during which you cannot access or sell it.

Risks

If you suddenly need funds or want to exit a position due to market conditions, you might be unable to do so until the lock-up period ends.

Considerations

Ensure you’re comfortable with the lock-up terms and have sufficient liquidity elsewhere before committing your crypto.

Interest Rate and Reward Fluctuations

Explanation

The interest rates for crypto loans or the rewards for staking and yield farming can be variable, changing based on market conditions.

Risks

You might enter a position expecting a certain return rate, only to find it drops significantly after some time.

Considerations

Diversifying your strategies and not putting all your crypto into one platform or method can help mitigate this risk.

Case Studies

John’s Venture with Crypto-Backed Loans

Background

John had been an early adopter of Bitcoin, accumulating a significant amount over the years. In 2020, he had an idea for a tech startup but lacked the fiat capital to get it off the ground.

Strategy

Instead of selling his Bitcoin, John used it as collateral to secure a crypto-backed loan, giving him the fiat capital he needed.

Outcome

John’s startup was a success, and he repaid the loan over time. By the time he repaid the loan, Bitcoin’s value had also risen. Not selling his Bitcoin initially allowed him to benefit from its appreciation, and he still had his original Bitcoin holdings intact.

Sarah’s Passive Income through Staking

Background

Sarah had a diverse crypto portfolio, including a substantial amount of Ethereum. She was looking for ways to earn passive income without selling her assets.

Strategy

Sarah decided to stake her Ethereum, locking it up to support the Ethereum 2.0 upgrade.

Outcome

Through staking, Sarah earned additional Ethereum as rewards. The passive income from staking, combined with the appreciation of Ethereum’s value over time, significantly increased her overall holdings without selling any of her original assets.

Alex’s Dive into Yield Farming

Background

Alex was a crypto enthusiast always on the lookout for the next big opportunity. He had heard about the potential returns from yield farming and wanted to give it a try.

Strategy

Alex provided liquidity to a DeFi platform, depositing both Ethereum and USDC into a liquidity pool. In return, he received interest and additional tokens as rewards.

Outcome

Initially, Alex enjoyed substantial returns from yield farming. However, he also faced some challenges, such as impermanent loss. Over time, by diversifying his yield farming strategies and staying updated with market trends, Alex managed to optimize his returns.

Conclusion

In the dynamic world of cryptocurrency, the question of “how to take profits from crypto without selling?” has become more pertinent than ever. As we’ve journeyed through this guide, it’s evident that the crypto landscape of 2023 offers a myriad of innovative strategies to realize gains without parting with your digital assets.

From leveraging the power of crypto-backed loans, which provide immediate liquidity, to diving into the world of staking and earning passive income, the opportunities are as vast as they are lucrative. The rise of DeFi platforms has further expanded the horizon, with yield farming and liquidity mining presenting avenues for both seasoned and novice investors to grow their portfolios.

However, as with any investment, it’s crucial to tread with caution. Our exploration into the associated risks and the fictional case studies underscore the importance of due diligence, continuous learning, and staying updated with market trends.

In essence, the crypto realm is no longer just about buying low and selling high. The strategies to profit have evolved, and with the right knowledge and approach, one can navigate this space to maximize returns while retaining their holdings. As the crypto ecosystem continues to mature, it’s exciting to envision what other innovative profit-taking strategies the future might hold.

Remember, the key lies not just in understanding “how to take profits from crypto without selling?” but in implementing these strategies wisely, with a clear understanding of both the rewards and the risks.

FAQs

Is it always better to take profits without selling?

No, the best strategy depends on individual financial goals and market conditions.

How do I choose the best method for me?

DYOR, understand the risks, and consider consulting with a financial advisor.