The debate between Kaspa vs Bitcoin has garnered significant attention. As two of the most talked-about digital currencies, understanding their nuances is crucial for both investors and enthusiasts. This article delves deep into their histories, technical specifications, and future prospects, providing a comprehensive insight into their world.

Table of Contents

Historical Background

Bitcoin: The Pioneer of Cryptocurrencies

Bitcoin, often referred to as the ‘gold standard’ of cryptocurrencies, was introduced in 2009 by the mysterious Satoshi Nakamoto. Its decentralized nature and promise of financial freedom quickly caught the world’s attention, paving the way for the crypto revolution.

Kaspa: The New Kid on the Block

Kaspa coin, while relatively newer, has made significant waves in the crypto community. Launched with the vision of addressing some of Bitcoin’s limitations, its unique approach to scalability and security has made it a notable contender in the crypto race.

Kaspa vs Bitcoin Comparison

Understanding the intricacies of each coin is paramount. The comparison between Kaspa and Bitcoin offers insights into their technical, economic, community support, regulatory landscape, and their respective strengths and weaknesses.

| Criteria | Bitcoin | Kaspa |

|---|---|---|

| Historical Background | – Introduced in 2009 by Satoshi Nakamoto – Pioneered the crypto revolution | – Newer entrant – Aims to address Bitcoin’s limitations |

| Fair Launch | Yes | Yes |

| Open Source | Yes | Yes |

| Technical Specifications | – Blockchain: Decentralized public ledger – Consensus: Proof-of-Work – Security: SHA-256 cryptographic hash function – Blocktime: 10 minutes – TPS (Transactions per Second): 7 | – Advanced DAG structure (BlockDAG) – Consensus: Enhanced PoW – Security: Advanced cryptographic techniques – Blocktime: 1 second – TPS (Transactions per Second): 300 in mainnet. Reached 3000 in testnet |

| Economic Model | – Supply Limit: 21 million – Mining Rewards: Halving every 4 years – Transaction Fees: Varies | – Supply Limit: 28.7 billion – Mining Rewards: Dynamic – Transaction Fees: Lower |

| Adoption and Use Cases | – Used for diverse transactions globally – Partnerships with major corporations | – Focus on microtransactions and online gaming – Growing community support |

| Community and Developer Support | – Large, active community – Robust developer contributions | – Vibrant, innovative community – Developer focus on scalability and efficiency |

| Regulatory and Legal Landscape | – Varies across countries – Some nations skeptical leading to challenges | – Still establishing its regulatory footing – Transparent approach to legal challenges |

| Strengths and Weaknesses | Strengths: Widespread adoption, robust security, brand recognition Weaknesses: Scalability concerns | Strengths: Advanced tech, scalability Weaknesses: Relative newness can be a challenge |

| Project Website | https://bitcoin.org/ | https://kaspa.org/ |

| Project “Father” | Uknown, “Satoshi Nakamoto” | Yonatan Sompolinsky |

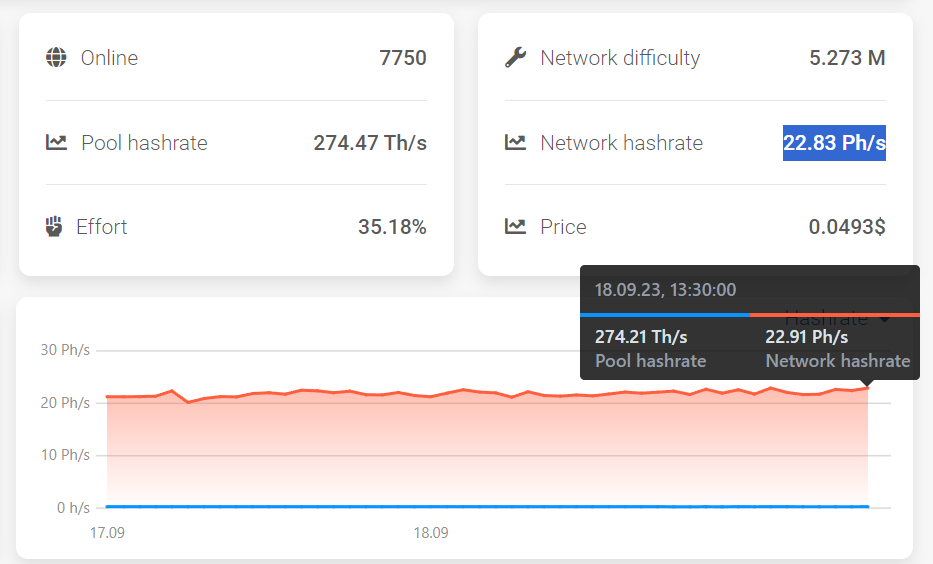

Kaspa vs Bitcoin Networks Hashrate Analysis

Hashrate is a critical metric in the world of cryptocurrencies. It represents the computational power of a network and is a direct indicator of its security and mining power. Let’s delve into the hashrates of both Kaspa and Bitcoin networks as of today, 18th September.

Bitcoin Network Hashrate:

- BTC Hashrate: 445.52 EH/s (Exahashes per second)

- Antminer S19 XP BTC Asic Hashrate: 140.00 Th/s (Terahashes per second)

To determine the approximate number of Antminer S19 XP BTC ASICs in the Bitcoin network:

Number of ASICs = (445.52 million Th/s) divided by (140 Th/s/ASIC)

Approximately, there are 3,182,286 Antminer S19 XP BTC ASICs operating in the Bitcoin network.

Kaspa Network Hashrate:

- KAS Hashrate: 22.99 Ph/s (Petahashes per second)

- Iceriver KS3 Kaspa Asic Hashrate: 8.00 Th/s (Terahashes per second)

To determine the approximate number of Iceriver KS3 Kaspa ASICs in the Kaspa network:

Number of ASICs = (22.99 thousand Th/s) divided by (8 Th/s/ASIC)

Approximately, there are 2,874 Iceriver KS3 Kaspa ASICs operating in the Kaspa network.

Conclusion

The Bitcoin network, being the pioneer and the most established cryptocurrency, boasts a staggering hashrate of 445.52 EH/s, powered by an estimated 3.18 million Antminer S19 XP BTC ASICs. This immense computational power underscores Bitcoin’s dominance and its robust security infrastructure.

On the other hand, Kaspa, a newer entrant in the crypto space, has a hashrate of 22.99 Ph/s, supported by an estimated 2,874 Iceriver KS3 Kaspa ASICs. While Kaspa’s hashrate is significantly lower than Bitcoin’s, it’s essential to consider its relative newness in the market. The growing adoption and technological advancements could see an increase in its hashrate in the future.

In essence, while Bitcoin remains the behemoth in terms of network security and mining power, Kaspa is carving a niche for itself, showcasing potential for growth and development in the coming years.

Price Analysis and Market Performance

Bitcoin

Historical Price Performance:

- Bitcoin, since its inception in 2009, has witnessed a roller-coaster ride. From being virtually worthless in its early days to reaching an all-time high in late 2017, and then again in 2020 and 2021, its price trajectory has been nothing short of phenomenal.

- Notable price milestones include surpassing the $1,000 mark in 2013, the $20,000 mark in 2017, and the staggering $60,000 mark in 2021.

Current Price, Marketcap and Volume:

Kaspa

Historical Price Performance:

- Being a relatively newer entrant, Kaspa’s price history is shorter. However, since its launch, it has shown promising growth, attracting attention from investors looking for the ‘next big thing’ in crypto.

- Its price has been influenced by its technological promises, especially its scalability solutions and lower transaction fees.

Current Price, Marketcap and Volume:

Balancing the Scales: Diversifying with Bitcoin and Kaspa

The Dual Portfolio Advantage

Why does it make sense to have both Bitcoin and Kaspa in one’s portfolio, rather than leaning heavily towards one? The volatile nature of the crypto market underscores the importance of diversification. By holding both Bitcoin and Kaspa, investors can potentially harness the unique strengths of each, while offsetting their individual vulnerabilities.

Bitcoin: The Time-Tested Titan

With Bitcoin, it’s straightforward. It’s the primary coin, globally recognized, and has stood the test of time. Its price cyclicality, especially due to its unique emission structure changes (halvings), makes it a staple in many portfolios.

Kaspa: The Innovative Newcomer

Kaspa represents innovation, possibly even a revolution, in the transaction block recording structure (blockDAG). It aims to address the scalability issues present in Bitcoin. While it holds immense potential, it also carries higher risks and needs time to prove its mettle.

Synergy Over Singularity

Individually, each coin has its merits. Bitcoin, with its established reputation, offers stability and recognition. Kaspa, with its innovative approach, offers potential growth and solutions to existing crypto challenges. However, when combined, they can offer a more balanced risk-reward profile.

Research suggests that adding riskier assets with low correlation to existing ones can reduce overall risk and potentially increase final returns. For those interested in the mathematical intricacies of this, channels like “Evidence-Based Investing” provide deep dives into the topic.

In simple terms, having a BTC + KAS portfolio seems more rational than holding just one of the coins. As for the exact proportions, that’s a personal choice. Even a 50/50 split seems like a reasonable option:

Should something unforeseen happen with Kaspa, Bitcoin can act as a safety net against significant losses. Conversely, if Kaspa thrives, the overall portfolio returns could be impressive.

Of course, one cannot rule out scenarios where both coins face challenges. However, such a scenario seems highly unlikely. If Bitcoin were to falter, other altcoins, including Kaspa, would likely face even more significant challenges.

Conclusion

The debate between Kaspa and Bitcoin is emblematic of the broader evolution occurring within the cryptocurrency sector. As we’ve delved into their histories, technical underpinnings, economic models, and market performances, a few salient points emerge that could shape the trajectory of these digital assets in the coming years.

- Legacy vs Innovation: Bitcoin, as the first cryptocurrency, has the advantage of legacy. It introduced the world to the concept of decentralized digital currency and remains a symbol of the broader crypto movement. Kaspa, on the other hand, represents the wave of innovation that seeks to address some of the perceived limitations of earlier cryptocurrencies. Its focus on scalability and efficiency showcases the industry’s continuous drive for improvement.

- Market Dynamics: While Bitcoin’s dominance in market capitalization is undeniable, the crypto market has always been dynamic. New entrants like Kaspa, with their unique value propositions, have the potential to carve out significant niches for themselves. The market’s receptivity to Kaspa will be a testament to its appetite for innovation.

- Regulatory Landscape: The regulatory environment will play a pivotal role in the future of both coins. As governments and institutions grapple with the implications of decentralized currencies, their policies could significantly impact the adoption and value of both Bitcoin and Kaspa.

- Community and Ecosystem: The strength of a cryptocurrency often lies in its community and ecosystem. Bitcoin’s vast and active community has been a cornerstone of its success. Kaspa, though newer, is rapidly building a vibrant community. The support, innovations, and applications emerging from these communities will be instrumental in the coins’ future trajectories.

- The Broader Vision: Beyond the technical and economic comparisons, it’s essential to recognize the broader vision these cryptocurrencies represent. They challenge traditional notions of currency, value transfer, and financial autonomy. Whether one views Bitcoin as the flag-bearer of this revolution or sees Kaspa as the next evolutionary step, both coins contribute to a larger narrative of financial decentralization and empowerment.

In wrapping up our exploration, it’s evident that the Kaspa vs Bitcoin debate is more than a mere comparison of two digital assets. It’s a reflection of the crypto industry’s journey, its challenges, its innovations, and its aspirations. As the digital currency landscape continues to evolve, both Bitcoin and Kaspa will undoubtedly play significant roles, each carving its unique path in the annals of financial history.

FAQs

What is the main difference between Kaspa and Bitcoin?

Kaspa uses an advanced DAG structure, while Bitcoin relies on a traditional blockchain.

Is Kaspa more scalable than Bitcoin?

Yes, Kaspa’s design allows for enhanced scalability compared to Bitcoin.

Which coin has a higher transaction fee?

Bitcoin’s transaction fees tend to be higher, while Kaspa aims to offer lower fees.