As WoolyPooly delves deep into the crypto exchange universe, our expertise has often been sought to demystify the intricacies of the industry’s titans. Having reviewed a plethora of exchanges, we’ve set our sights on the much-debated rivalry: KuCoin vs Binance. Join us as we unravel this crypto enigma, layer by layer.

Table of Contents

KuCoin

Established in 2018, KuCoin has rapidly ascended the ranks of the crypto world, distinguishing itself as a premier platform for traders and investors alike. With its headquarters rooted in the crypto-friendly environment of Singapore, KuCoin has expanded its reach, catering to millions of users across the globe.

Key Features and Offerings

- Global Presence: KuCoin proudly boasts its services in numerous countries, solidifying its position as a global crypto exchange platform.

- Diverse Cryptocurrency Portfolio: With over 720+ coins available for trading, KuCoin offers one of the most extensive cryptocurrency portfolios in the market, ensuring that traders have a wide array of options at their fingertips.

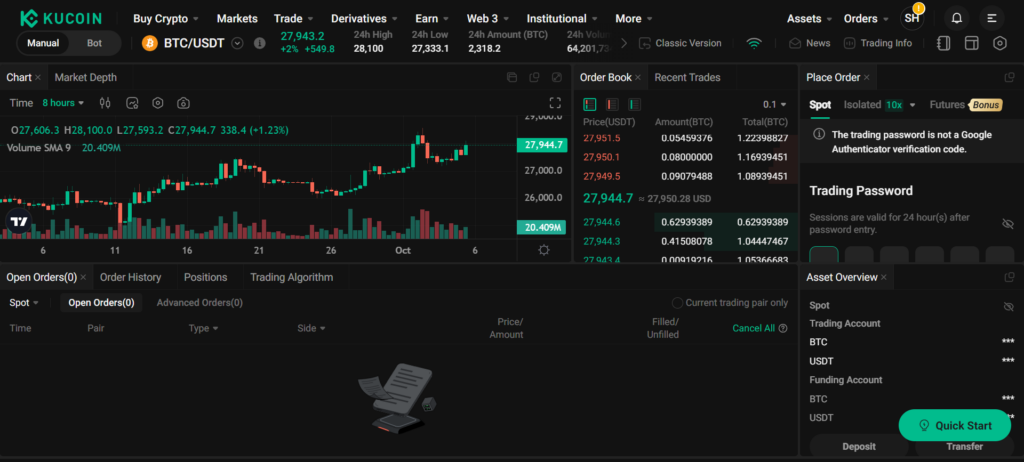

- Advanced Trading Options: KuCoin isn’t just about spot trading. The platform offers a comprehensive suite of trading options, including margin trading and futures, catering to both novice and seasoned traders.

- Unique Offerings: What sets KuCoin apart are its unique features like “KuCoin Earn,” which allows users to invest and earn steady income, and the “Trading Bot,” designed to optimize trading strategies and maximize profits.

- Competitive Fee Structure: KuCoin maintains a transparent and competitive fee structure. Spot trading fees are pegged at 0.1%, while futures trading varies with 0.02% for makers and 0.06% for takers.

- Withdrawal Fees: KuCoin’s withdrawal fees are set at 3 USDT for Tether, 0.0008 BTC for Bitcoin, and 0.0061 LTC for Litecoin, ensuring that users get the best value for their transactions.

- Robust Mobile Experience: Recognizing the shift towards mobile trading, KuCoin offers a seamless mobile app experience, allowing traders to execute trades, monitor markets, and manage their portfolios on the go.

- Unparalleled Support: KuCoin prides itself on its customer-centric approach. Whether it’s through tickets, emails, webchat, or social media, KuCoin ensures that users’ queries and concerns are addressed promptly.

Pros and Cons

| Pros | Cons |

|---|---|

| Expansive crypto offerings | Limited leverage options |

| User-centric interface | Regional restrictions |

| Competitive fee structure | Slower customer response time |

Binance

Since its inception in 2017, Binance has been a force to be reckoned with in the cryptocurrency world. Founded by Changpeng Zhao, this exchange has quickly risen to dominate the crypto market, becoming a household name for traders and investors alike. With its headquarters in Malta, Binance has expanded its operations globally, offering a plethora of services that cater to the diverse needs of its vast user base.

Key Features and Offerings

- Global Footprint: Binance’s reach is truly global, with the platform boasting over 150 million users. Its dominance is evident in its vast user base and the variety of services it offers.

- Diverse Cryptocurrency Portfolio: Binance supports over 380+ cryptocurrencies, ensuring that traders and investors have a wide range of options to choose from.

- Advanced Trading Options: Binance is not just limited to spot trading. The platform offers a variety of trading options, including margin trading and futures. With a maximum leverage level of 125x, traders have the flexibility to maximize their profits.

- Unique Features: Binance stands out with its unique offerings such as Asset Conversion, SAFU (Secure Asset Fund for Users), and a vast P2P platform with over 800+ options for buying and selling cryptocurrencies.

- Competitive Fee Structure: Binance’s fee structure is competitive, with spot trading fees set at 0.1%. For futures trading, the fees are 0.02% for makers and 0.04% for takers.

- Withdrawal Fees: Binance has set its withdrawal fees at 1 USDT for Tether, 0.000097 BTC for Bitcoin, and 0.001 LTC for Litecoin.

Pros and Cons

| Pros | Cons |

|---|---|

| Robust security measures | Controversies with regulators |

| Comprehensive educational resources | Higher trading fees |

| Global outreach | Limited altcoin offerings |

Comparative Analysis: KuCoin vs Binance

The crypto world is no stranger to competition, with exchanges vying for the top spot. But when giants like KuCoin and Binance clash, the tremors are felt industry-wide. Let’s dissect these behemoths.

| Criteria | Binance | KuCoin |

|---|---|---|

| Established | 2017 | 2018 |

| Number of Coins | 380+ | 720+ |

| Trading Options | Spot Trading, Margin, Futures | Spot Trading, Margin, Futures |

| Max Leverage Level | 125x | 100x |

| Unique Features | Asset Conversion, SAFU, 800+ P2P Options | KuCoin Earn, Trading Bot |

| Spot Trading Fees | 0.1% | 0.1% |

| Futures Fees | 0.02% maker, 0.04% taker | 0.02% maker, 0.06% taker |

| Withdrawal Fees | 1 USDT, 0.000097 BTC, 0.001 LTC | 3 USDT, 0.0008 BTC, 0.0061 LTC |

| Copy Trading | Yes | Yes |

| KYC | Yes | Yes |

| P2P / Buy Crypto | Yes | Yes |

| Mobile App | Yes | Yes |

| Support | Ticket, Email, Webchat, Social Media | Ticket, Email, Webchat, Social Media |

| Prohibited Countries (with KYC) | The US, Canada, Malaysia, Netherlands | The US, Canada, Japan, China, South Korea, and Vietnam |

User Interface and Experience: KuCoin vs Binance

When it comes to user interface and experience, both KuCoin and Binance have their strengths and areas of improvement. Here’s a breakdown based on user reviews from Trustpilot:

Kucoin

Positive Feedback:

- User-Friendly Interface: Some users have praised KuCoin for its user-friendly interface, especially for those who are new to the crypto world.

- Comprehensive Features: KuCoin’s platform is noted for its comprehensive features, offering users a wide range of tools and options to enhance their trading experience.

- Mobile App: KuCoin’s mobile app has been described as efficient and easy to navigate, allowing users to trade on the go.

Negative Feedback:

- Customer Support: Several users have expressed dissatisfaction with KuCoin’s customer support, stating that it can be slow to respond or sometimes unhelpful.

- KYC Requirements: KuCoin’s Know Your Customer (KYC) requirements have been a point of contention for some users, with complaints about the complexity and time-consuming nature of the process.

- Platform Changes: Some users have mentioned that they do not appreciate frequent changes to the site’s interface, as it requires them to re-familiarize themselves with the platform.

Binance:

Positive Feedback:

- Robust Platform: Binance is often praised for its robust and comprehensive trading platform, offering a wide range of tools and features.

- Mobile App: Binance’s mobile app is noted for its user-friendly interface and smooth performance, making trading on the go a breeze.

- Diverse Trading Options: Binance offers a plethora of trading options, catering to both novice and experienced traders.

Negative Feedback:

- Customer Support: Like KuCoin, Binance has also received criticism for its customer support, with some users feeling that the support team is not responsive or helpful.

- Platform Glitches: Some users have reported occasional glitches on the platform, affecting their trading experience.

- KYC and Account Freezes: Binance has faced criticism for freezing accounts and stringent KYC requirements, causing inconvenience to some users.

Alternative to Binance and KuCoin

While Binance and KuCoin have made significant names for themselves, there are other noteworthy platforms that traders might consider. One such platform is MEXC.com.

MEXC.com Overview:

Established

Tier 1 exchange, MEXC was established in 2018, making it relatively young in the crypto exchange world. However, in a short span, it has managed to garner attention due to its unique offerings.

Number of Coins

With a staggering 1690+ coins available for trading, MEXC.com offers one of the most extensive lists of cryptocurrencies in the market. This vast array provides traders with a plethora of options and opportunities.

Trading Options

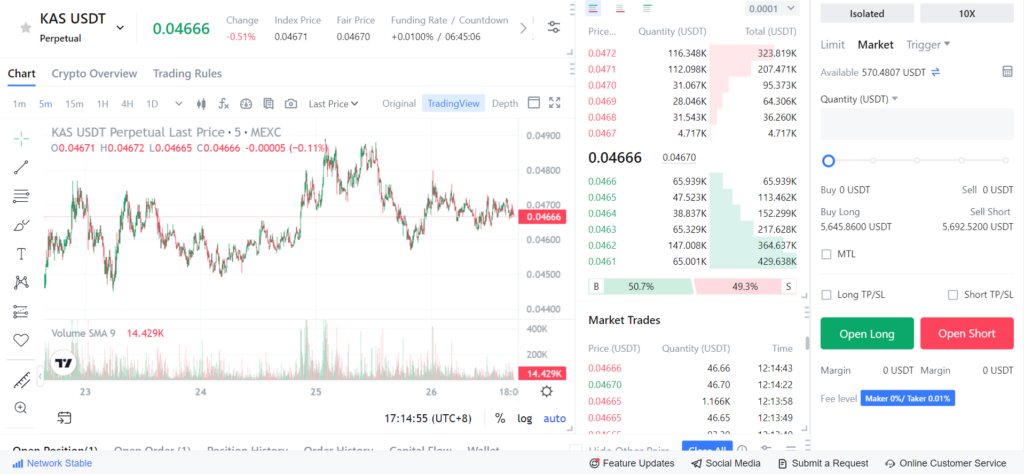

Like Binance and KuCoin, MEXC.com offers spot trading, margin trading, and futures trading. This comprehensive range of trading options caters to both novice and experienced traders.

Max Leverage Level

MEXC.com offers a maximum leverage trading level of 200x, which is significantly higher than both Binance and KuCoin. This high leverage can be both an opportunity and a risk, depending on the trader’s strategy and risk tolerance.

Fees:

- Spot Trading Fees: One of the standout features of MEXC.com is its 0% spot trading fees. This is incredibly competitive, especially when compared to most other exchanges in the market.

- Futures Fees: MEXC.com offers 0% maker fees and a mere 0.03% taker fee for futures trading. This low fee structure can be particularly attractive for high-frequency traders.

- Withdrawal Fees: The withdrawal fees for MEXC.com are set at 1 USDT, 0.0003 BTC, and 0.001 LTC. These fees are in line with industry standards and are competitive.

No Mandatory KYC

One of the significant advantages of MEXC.com is its no KYC policy. For traders who prioritize privacy, this feature can be a major draw. It allows users to trade without undergoing extensive identity verification processes.

Conclusion

The “KuCoin vs Binance” debate is more than just a comparison of two crypto giants; it’s a reflection of the dynamic and ever-evolving world of cryptocurrency trading. Both platforms, with their unique strengths and offerings, have carved significant niches in the crypto landscape. KuCoin, with its user-centric approach and extensive coin offerings, appeals to a broad spectrum of traders. On the other hand, Binance, with its global dominance and robust features, continues to set industry standards.

Choosing between KuCoin and Binance is not a matter of which is objectively better, but rather which aligns more closely with individual trading needs and preferences. As the crypto world continues to grow and evolve, the “KuCoin vs Binance” discussion serves as a testament to the importance of informed decision-making in the realm of digital assets. Whether you’re a seasoned trader or just starting out, it’s essential to align with a platform that resonates with your trading goals and values.

FAQs

How do Binance and KuCoin compare in terms of their establishment and global presence?

Binance was established in 2017 and has since become a dominant force in the crypto world with a vast global presence. KuCoin, on the other hand, was founded in 2018 and has quickly risen to prominence, catering to users worldwide with its diverse offerings.

Which platform, Binance or KuCoin, offers a wider range of cryptocurrencies for trading?

While both Binance and KuCoin offer an extensive range of cryptocurrencies, KuCoin boasts a portfolio of over 720+ coins, whereas Binance supports over 380+ coins.

Are there any unique features that differentiate Binance from KuCoin?

Yes, Binance offers unique features such as Asset Conversion, SAFU, and a vast P2P platform. KuCoin differentiates itself with offerings like “KuCoin Earn” and a “Trading Bot.”

How do the trading fees of Binance and KuCoin compare?

Both Binance and KuCoin have competitive fee structures. For spot trading, both platforms charge a fee of 0.1%. However, there are slight differences in futures trading fees, with Binance charging 0.02% for makers and 0.04% for takers, while KuCoin charges 0.02% for makers and 0.06% for takers.

Are there any alternative platforms to Binance and KuCoin that offer competitive features and fees?

Yes, MEXC.com is a notable alternative to both Binance and KuCoin. Established in 2018, MEXC offers over 1690+ coins, a range of trading options, and boasts competitive fees with 0% spot trading fees and futures fees of 0% for makers and 0.03% for takers.