Tokenomics, a term that has become a cornerstone in the cryptocurrency world, refers to the study of the economic systems surrounding blockchain-based tokens. Understanding Tokenomics is not just important, it’s essential for anyone looking to invest or participate in the crypto space. In this comprehensive guide, we will delve into the intricacies of Tokenomics, its components, its importance, and how to analyze it effectively.

Table of Contents

What is Tokenomics?

Tokenomics (also known as “token based economics”), is the study of the economic systems that drive the demand, distribution, and value of blockchain tokens. It’s a crucial aspect of cryptocurrencies, as it influences everything from a token’s initial distribution to its long-term value and utility.

The role of Tokenomics in cryptocurrency is multifaceted. It not only determines how a token is distributed and used but also influences its overall value. By understanding Tokenomics, investors can make informed decisions about which cryptocurrencies to invest in.

The Importance of Tokenomics

Why is Tokenomics so crucial for investors? Simply put, it provides a roadmap to a cryptocurrency’s potential success or failure.

- Investment Decisions: For investors, understanding Tokenomics is crucial for making informed investment decisions. The economic model of a token can provide insights into its potential for growth and long-term sustainability. For instance, a token with a limited supply and high utility might be a good investment as the demand could potentially exceed the supply, driving up the price.

- Project Viability: Tokenomics can also provide insights into the viability of a blockchain project. A well-designed token economy can incentivize positive behavior, such as participation in the network or holding onto tokens for the long term. On the other hand, a poorly designed token economy could lead to issues like price volatility or lack of user engagement.

- Token Utility: Tokenomics defines the utility of a token, which can range from granting access to a service, to allowing holders to participate in governance decisions. Understanding this utility can help users and investors understand the value proposition of a token.

- Market Predictions: Tokenomics can also help in predicting market behaviors. For instance, if a large portion of a token’s supply is set to be released into the market, it could potentially lead to a drop in the token’s price due to increased supply.

- Regulatory Compliance: Understanding Tokenomics can also be important from a regulatory perspective. Depending on its design and utility, a token might be classified as a security, a commodity, or a currency, each of which has different regulatory implications.

Tokenomics plays a pivotal role in the cryptocurrency ecosystem. It influences everything from the price of a token to the success of a blockchain project, making it a crucial field of study for anyone involved in the cryptocurrency space.

Components of Tokenomics

Tokenomics. These components are the building blocks that define the economic system of a token and influence its value and utility.

Token Supply

This refers to the number of tokens that exist or will exist. It includes:

- Total Supply: The total number of tokens that currently exist.

- Circulating Supply: The number of tokens that are currently available to the public.

- Maximum Supply: The maximum number of tokens that will ever exist.

Token Distribution

This refers to how the tokens are distributed to users. It can include methods such as:

- Initial Coin Offerings (ICOs): A method of distributing tokens to initial investors.

- Airdrops: Free distribution of tokens to holders of a particular blockchain currency.

- Mining: The process of validating blockchain transactions and creating new tokens.

Token Utility

This refers to what the token can be used for. It can include functions such as:

- Governance: Some tokens allow holders to vote on changes to the blockchain.

- Staking: Some tokens can be held in a wallet to support the security and operations of a blockchain.

- Access: Some tokens are used to access certain functions of a blockchain.

Token Demand and Value

This refers to the factors that affect the demand for the token and how this demand influences the token’s value. Factors affecting demand can include the token’s utility, market sentiment, and more.

Here’s a chart that provides a visual representation of these components:

| Component | Sub-Components | Description |

|---|---|---|

| Token Supply | Total Supply, Circulating Supply, Maximum Supply | Refers to the number of tokens that exist or will exist. |

| Token Distribution | ICOs, Airdrops, Mining | Refers to how the tokens are distributed to users. |

| Token Utility | Governance, Staking, Access | Refers to what the token can be used for. |

| Token Demand and Value | Factors affecting demand, How demand affects value | Refers to the factors that affect the demand for the token and how this demand influences the token’s value. |

Understanding these components is key to analyzing Tokenomics and making informed decisions about investing in or using a particular token.

How to Analyze Tokenomics

Analyzing Tokenomics involves a comprehensive understanding of the various components of Tokenomics and how they interact with each other. Here’s a more detailed guide:

Understand the Token’s Purpose

The first step in analyzing Tokenomics is understanding what the token is designed to do. Is it a utility token that provides access to a service? Is it a governance token that allows holders to vote on decisions? Or is it a security token that represents an underlying asset? The token’s purpose will greatly influence its economic model.

Examine the Token Supply

Look at the total supply, circulating supply, and maximum supply. A token with a limited supply might increase in value over time due to scarcity, while a token with an unlimited supply might have its value diluted. Also, consider how new tokens are created and how this rate might change over time.

Assess the Token Distribution

How are the tokens distributed? Are they sold in an Initial Coin Offering (ICO), given as rewards for staking, or mined? The distribution method can affect who holds the tokens and how they might use them. Also, consider any lock-up periods or vesting schedules that might affect when tokens enter the circulating supply.

Evaluate the Token Utility

What can the token be used for? If it has strong utility, demand for the token might increase, driving up its value. Consider both current and potential future uses of the token.

Consider the Demand and Value Factors

What factors might affect the demand for the token? This could include the token’s utility, the popularity of the project, market trends, and more. Also, consider how demand might affect the token’s value. If demand exceeds supply, the token’s value could increase.

Look at the Governance Model

If the token allows for governance, who gets to vote and how are decisions made? A token with a fair and transparent governance model might be more attractive to investors.

Analyze the Security Measures

How secure is the token? Consider the blockchain’s security measures and any potential vulnerabilities. A token on a secure blockchain might be more trustworthy and thus more valuable.

Consider Regulatory and Legal Aspects

Is the token compliant with relevant regulations? Legal issues could affect the token’s value and longevity.

Use Analytical Tools

Tokenomics websites like CoinMarketCap, CoinGecko, and others can provide valuable data for your analysis. These platforms provide information about a token’s price history, trading volume, market cap, and more.

| Tool | Data Provided | Special Features |

|---|---|---|

| CoinMarketCap | Price, volume, market cap, token supply, and distribution data for thousands of cryptocurrencies | Also provides data on cryptocurrency exchanges |

| CoinGecko | Price, volume, market cap, developer activity, community growth, and public interest data for each cryptocurrency | Also provides a portfolio tracking feature |

| Etherscan | Detailed data on Ethereum transactions, addresses, and tokens | Useful for analyzing Ethereum-based tokens and smart contracts |

| BscScan | Detailed data on Binance Smart Chain transactions, addresses, and tokens | Useful for analyzing Binance Smart Chain-based tokens and smart contracts |

| CryptoCompare | Global cryptocurrency market data, detailed data on individual cryptocurrencies, exchanges, and wallets | Also provides a portfolio tracking feature |

Stay Updated

The cryptocurrency market is highly dynamic, and conditions can change rapidly. Stay updated with the latest news and developments related to the token and the broader crypto market.

Bitcoin Tokenomics

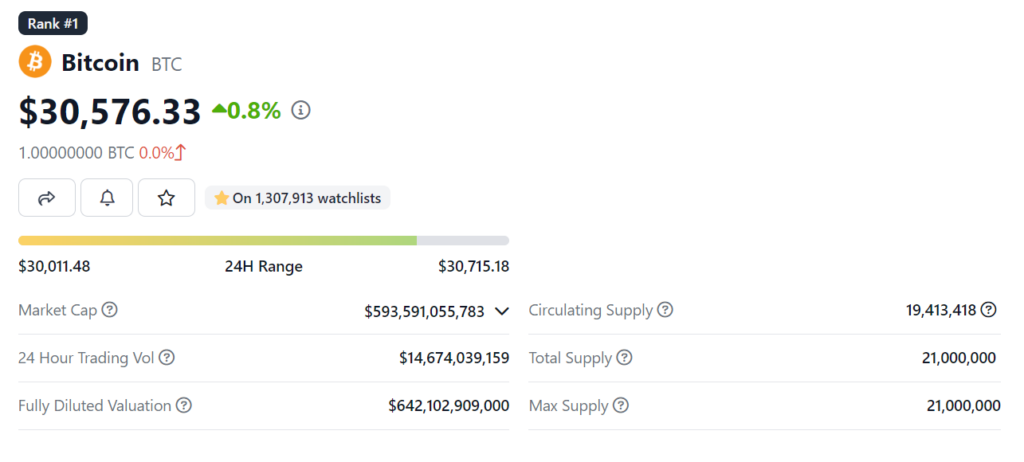

Bitcoin‘s Tokenomics, particularly its limited supply and distribution through mining, have played a significant role in its rise as a valuable asset. Understanding these factors is crucial for anyone interested in investing in or using Bitcoin.

- Token Supply: Bitcoin has a maximum supply of 21 million coins. This limit was set by Bitcoin’s creator, Satoshi Nakamoto, and is enforced through the Bitcoin code. As of now, not all 21 million coins have been mined. The rate at which new Bitcoins are created is halved approximately every four years in an event known as a “halving“. This decreasing supply rate contributes to Bitcoin’s scarcity, which is a key aspect of its value.

- Token Distribution: Bitcoin is distributed through a process known as mining. Miners use powerful computers to solve complex mathematical problems. When a problem is solved, the miner adds a new block of transactions to the Bitcoin blockchain and is rewarded with a certain number of Bitcoins. This reward is halved during each halving event.

- Token Utility: Bitcoin was created as a digital currency, intended to be a medium of exchange that is independent of any central authority. Over time, it has also become a store of value, often referred to as “digital gold”. Some also use Bitcoin for remittances, as it can be cheaper and faster than traditional money transfer services, especially for international transfers.

- Token Demand and Value: The value of Bitcoin is determined by supply and demand dynamics. The demand for Bitcoin can be influenced by a variety of factors, including its utility as a medium of exchange or store of value, speculative trading, and macroeconomic factors. For example, during times of economic uncertainty, demand for Bitcoin may increase as investors seek safe-haven assets.

Altcoin Tokenomics

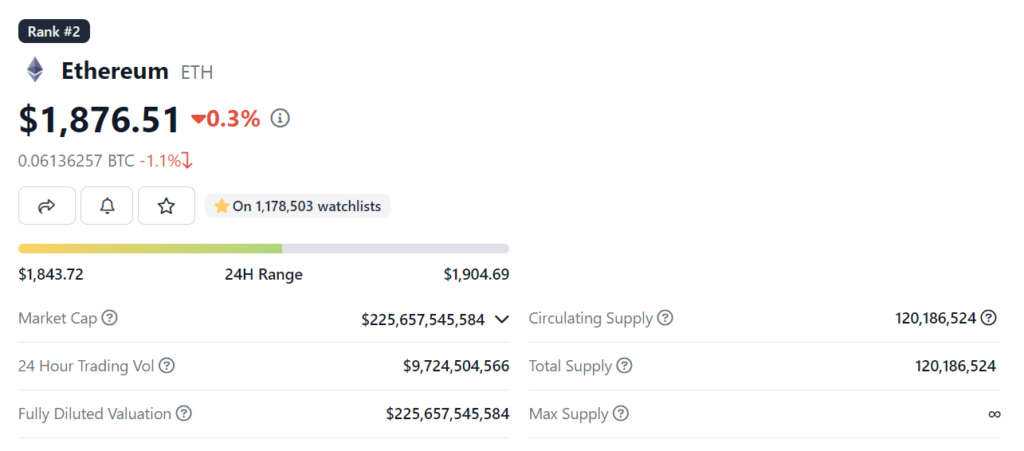

Ethereum (ETH)

- Token Supply: Unlike Bitcoin, Ethereum doesn’t have a maximum supply limit. This means that theoretically, an infinite number of ETH could be produced. However, Ethereum’s recent upgrade to Ethereum 2.0, which changed its consensus mechanism from Proof of Work (PoW) to Proof of Stake (PoS), could potentially lead to a decrease in the creation of new ETH, affecting its supply dynamics.

- Token Distribution: With the Ethereum 2.0 upgrade, the distribution method has shifted from mining to staking. In this system, validators are chosen to create a new block based on the amount of ETH they hold and are willing to ‘stake’ as collateral. Validators are rewarded with ETH for proposing and attesting to blocks.

- Token Utility: ETH is used to pay for transactions and computational services on the Ethereum network. It’s also used for staking in Ethereum 2.0, where validators need to stake 32 ETH to participate in the network. Furthermore, ETH is used in many DeFi (Decentralized Finance) applications that run on the Ethereum network.

- Token Demand and Value: The demand for ETH is driven by its utility within the Ethereum network and the broader DeFi ecosystem. As more applications are built on Ethereum, the demand for ETH to pay for transactions and computational services increases. The shift to PoS could also increase demand, as users need to hold and stake ETH to participate as validators.

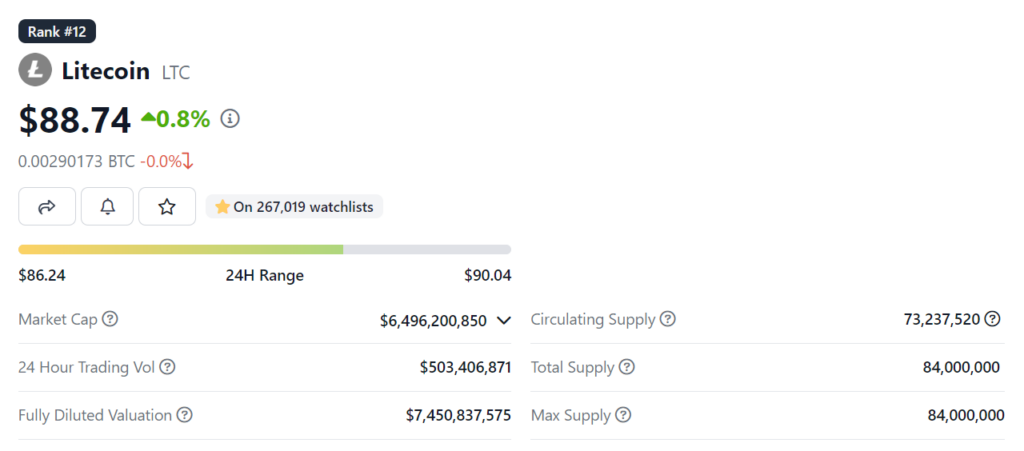

Litecoin (LTC)

- Token Supply: Litecoin has a maximum supply limit of 84 million coins, which is four times greater than Bitcoin’s supply limit. This larger supply limit was designed to create a more accessible and usable currency for everyday transactions.

- Token Distribution: Like Bitcoin, Litecoin is distributed through mining. However, Litecoin uses a different hashing algorithm (Scrypt) that is intended to be more accessible to users with less powerful computing hardware.

- Token Utility: Litecoin was designed to be a “lite” version of Bitcoin, with a focus on providing a viable medium of exchange for everyday transactions. It offers faster block generation times and a larger total supply compared to Bitcoin, making it more suitable for small, frequent transactions.

- Token Demand and Value: The demand for Litecoin is driven by its utility as a medium of exchange and its accessibility for mining. As a well-established cryptocurrency, Litecoin’s value is also influenced by broader market trends and investor sentiment.

Here’s a chart summarizing the Tokenomics of Ethereum and Litecoin:

| Component | Ethereum | Litecoin |

|---|---|---|

| Token Supply | No maximum supply limit. Creation of new ETH may decrease with PoS. | Maximum supply of 84 million coins. |

| Token Distribution | Distributed through staking in Ethereum 2.0. | Distributed through mining, with a more accessible algorithm than Bitcoin. |

| Token Utility | Used for transactions, computational services, and staking on the Ethereum network. Widely used in DeFi applications. | Designed as a “lite” version of Bitcoin for everyday transactions. Offers faster block generation times and a larger total supply. |

| Token Demand and Value | Demand driven by utility within the Ethereum network and DeFi ecosystem. Value influenced by these factors and broader market trends. | Demand driven by utility as a medium of exchange and accessibility for mining. Value influenced by these factors and broader market trends. |

NFT Tokenomics

NFTs are unique digital assets that are stored on a blockchain. They can represent a wide range of tangible and intangible items, from digital art and music to virtual real estate and virtual goods in video games.

- Token Supply: The supply of an NFT is typically very limited, often to a single copy, which is a stark contrast to cryptocurrencies like Bitcoin or Ethereum where multiple identical units exist. This uniqueness and scarcity are part of what gives NFTs value.

- Token Distribution: NFTs are typically distributed by the creator of the asset. This could be an artist who creates a piece of digital art, a musician who creates a digital track, or a game developer who creates a unique in-game item. The distribution usually happens through NFT marketplaces, where creators can list their NFTs for sale.

- Token Utility: The utility of an NFT depends on what it represents. For example, an NFT representing a piece of digital art might not have much utility beyond being viewed and appreciated, while an NFT representing an in-game item might provide specific benefits or abilities in that game. Some NFTs also provide ownership rights or royalties to their holders.

- Token Demand and Value: The demand and value of an NFT are largely subjective and can be influenced by a variety of factors. These can include the reputation of the creator, the uniqueness and quality of the asset, and market trends. For example, an NFT created by a famous artist or representing a popular game item might be in high demand and have a high value.

The Future of Tokenomics

Predicted trends in Tokenomics include increased focus on utility and governance, as well as the potential impact of regulatory changes. These trends could significantly affect the cryptocurrency market, making an understanding of Tokenomics even more vital for investors.

- Increased Focus on Utility: As the cryptocurrency market matures, we’re likely to see an increased focus on the utility of tokens. Tokens that provide real value and utility to their holders, beyond just speculative investment, are likely to be more successful in the long run. This could include tokens that offer access to specific services, tokens that provide governance rights, or tokens that can be staked to earn rewards.

- More Sophisticated Token Models: As the field of Tokenomics evolves, we can expect to see more sophisticated and innovative token models. This could include new methods of distribution, new forms of utility, and new ways to incentivize positive behavior within the network.

- Regulatory Impact: The regulatory landscape for cryptocurrencies is still being defined and changes in regulations could have a significant impact on Tokenomics. For example, regulations could affect how tokens are distributed, what kind of utility they can offer, and how they are taxed. It’s important for anyone involved in the cryptocurrency space to stay informed about regulatory developments.

- Integration with Traditional Finance: As cryptocurrencies become more mainstream, we’re likely to see more integration with traditional financial systems. This could lead to new token models that mimic traditional financial instruments, such as tokens that represent shares in a company or tokens that pay interest over time.

- Sustainability and Social Impact: There’s a growing focus on sustainability and social impact in the world of finance, and this is likely to extend to the cryptocurrency space as well. We might see more tokens that are designed to incentivize sustainable behavior, or tokens that contribute to social causes.

- Decentralized Finance (DeFi): DeFi is one of the fastest-growing sectors in the cryptocurrency space, and it’s likely to have a significant impact on Tokenomics. DeFi projects often have their own tokens, which can be used for governance, staking, or accessing specific services. The growth of DeFi could lead to new and innovative token models.

- Interoperability: As the blockchain ecosystem grows, there’s a growing need for different blockchains to be able to communicate and interact with each other. This could lead to new token models that facilitate interoperability between different blockchains.

The future of Tokenomics is likely to be dynamic and exciting, with new developments and trends shaping the way tokens are designed and used. As always, staying informed and understanding these trends will be key to navigating the future of the cryptocurrency market.

Conclusion

In conclusion, Tokenomics plays a pivotal role in the cryptocurrency ecosystem. It’s the economic framework that determines a token’s supply, distribution, utility, and demand, all of which influence its value and potential for growth. Understanding Tokenomics is crucial for anyone involved in the cryptocurrency space, whether you’re an investor, a developer, or a user.

From the clear utility of a token to its fair distribution, sustainable supply, and security, each aspect of Tokenomics contributes to the success of a cryptocurrency. Moreover, with the rapid evolution of the crypto space, the importance of Tokenomics is only set to increase. As we’ve seen with the rise of NFTs and DeFi, new token models are continually being developed, each with its own unique Tokenomics.

However, it’s important to remember that good Tokenomics alone is not enough to guarantee the success of a project. The quality of the technology, the strength of the team, market conditions, and regulatory compliance are also key factors to consider.

As we continue to navigate the complex and exciting world of cryptocurrencies, a solid understanding of Tokenomics will undoubtedly remain a crucial part of the journey.

FAQs

What is Tokenomics?

Tokenomics is the study of the economic systems that drive the demand, distribution, and value of blockchain tokens.

Why is Tokenomics important for investors?

Tokenomics provides a roadmap to a cryptocurrency’s potential success or failure. By understanding a token’s supply, distribution, and utility, investors can predict how its value might change over time.

What are the components of Tokenomics?

The key components of Tokenomics include token supply, token distribution, token utility, and token demand and value.

How can I analyze Tokenomics?

Analyzing Tokenomics involves evaluating the token’s supply, distribution, utility, and factors affecting its demand and value. Tools like CoinMarketCap and CoinGecko can provide valuable data for this analysis.

What is the future of Tokenomics?

Predicted trends in Tokenomics include increased focus on utility and governance, as well as the potential impact of regulatory changes.

Table: Components of Tokenomics

| Component | Description |

|---|---|

| Token Supply | Includes total supply, circulating supply, and maximum supply |

| Token Distribution | Methods of distribution such as ICOs, airdrops, and mining |

| Token Utility | Functions of the token such as governance, staking, and access |

| Token Demand and Value | Factors affecting demand and how demand affects value |

In the ever-evolving world of cryptocurrency, understanding Tokenomics is akin to holding a compass in an intricate maze. It’s not just about understanding the current landscape, but also about predicting future trends and making informed decisions. As we continue to explore the digital frontier, the study of Tokenomics will undoubtedly remain a crucial part of the journey.