In the bustling world of cryptocurrency, where the digital gold rush is more alive than ever, WoolyPooly stands as a beacon of topical authority. We’ve delved deep, analyzed, and reviewed the crème de la crème of crypto exchanges for 2025. So, whether you’re a seasoned trader or just dipping your toes, this guide is your treasure map to the top 10 crypto exchange platforms.

What is a Crypto Exchange?

At its core, a crypto exchange is a digital marketplace. Here, traders can buy and sell cryptocurrencies using different fiat currencies or altcoins. But not all exchanges are made equal. There’s a divide: centralized exchanges (CEX) and decentralized exchanges (DEX). While CEXs are managed by third-party operators, DEXs operate without a central authority, offering peer-to-peer trades.

Table of Contents

Why Choosing the Right Exchange Matters

Choosing a crypto exchange is akin to selecting a trusted financial partner. It’s a decision that requires careful consideration, given the myriad of factors that can influence a trader’s experience and outcomes. To ensure a comprehensive assessment, here’s an elaboration on the key evaluation criteria:

1. Security Protocols and Track Record

Past Breaches

An exchange’s history can be telling. Has it been compromised before? If yes, how did it respond, and what measures were taken to prevent future breaches?

Current Measures

Look for features like two-factor authentication, withdrawal whitelist, and cold storage solutions. Advanced encryption techniques and regular security audits are also indicative of an exchange’s commitment to safeguarding user assets.

2. User Interface and Experience

Design and Navigation

A clean, intuitive design ensures that users can easily navigate the platform, place trades, and access essential features without unnecessary complexities.

Mobile Experience

With many traders opting for on-the-go trading, a responsive mobile app or mobile-optimized website becomes crucial.

3. Trading Volume and Liquidity

Market Depth

A deeper market depth indicates higher liquidity, ensuring that large orders can be executed without significant price slippages.

Trading Pairs

The availability of diverse trading pairs can be a sign of a well-established exchange, offering flexibility in trading strategies.

4. Fees and Transaction Costs

Trading Fees

These are fees associated with buying and selling assets. Some exchanges employ a tiered fee structure based on trading volume, while others have a flat fee.

Deposit and Withdrawal Fees

It’s essential to be aware of any costs associated with depositing or withdrawing funds from the exchange.

5. Customer Support and Community Feedback

Response Time

In a fast-paced trading environment, timely support can be invaluable. How quickly does the exchange’s support team address queries or issues?

Community Reviews

User reviews, testimonials, and community forums can provide insights into the exchange’s reputation and user satisfaction levels.

6. Regulatory Compliance and Licensing

Licensing

Some exchanges operate with licenses from financial authorities, ensuring a certain level of oversight and adherence to local regulations.

KYC and AML Policies

Know Your Customer (KYC) and Anti-Money Laundering (AML) policies indicate that the exchange is taking measures to prevent illicit activities.

7. Available Cryptocurrencies and Trading Pairs

Coin Listings

Does the exchange offer a wide range of cryptocurrencies, both popular and emerging ones?

Listing Criteria

Understanding the criteria for coin listings can provide insights into the exchange’s commitment to offering quality assets.

Decentralized vs. Centralized Exchanges

The battle of the ages: Centralized giants or the decentralized revolutionaries? Each has its merits and pitfalls. Centralized platforms offer speed and convenience, while decentralized ones promise security and control. Which side of the fence are you on?

Comparison Chart

| Feature/Aspect | Centralized Exchanges (CEX) | Decentralized Exchanges (DEX) |

|---|---|---|

| Control Over Funds | Held by the exchange | Held by the user |

| Trading Speed | Generally faster | Can be slower due to on-chain processes |

| Liquidity | Typically higher | Can vary; some popular DEXs have high liquidity |

| User Interface | Often more user-friendly | Can be more technical |

| Security | Vulnerable to large-scale hacks; relies on exchange’s security measures | Reduced risk of large-scale hacks; relies on individual’s security practices |

| Anonymity | Often requires KYC/AML verification | Often allows anonymous trades |

| Fees | Set by the exchange; can vary | Typically network gas fees; can be high during network congestion |

| Supported Assets | Limited to exchange’s listings | Can support a vast range of tokens |

| Regulation and Oversight | Subject to regulatory oversight | Less regulated; operates in a decentralized manner |

| Customer Support | Available; quality varies | Limited; relies on community support |

Top 10 Crypto Exchanges in the World [2025]

Crypto traders and investors are often on the lookout for platforms that align with their trading needs, security preferences, and investment strategies. To aid in this quest, we’ve compiled a detailed chart of the top 10 crypto exchanges for 2025, based on various critical parameters.

Detailed Comparison Chart

| Exchange | Liquidity | Type | Number of Coins | Spot Fees | KYC Requirement |

|---|---|---|---|---|---|

| mexc | High | CEX | 1700+ | 0% | No (30 BTC per day) |

| okx | High | CEX | 320+ | 0.1% | No (10 BTC per day) |

| bingx | Moderate | CEX | 540+ | 0.1% | No (50K USDT per day) |

| bitget | Moderate | CEX | 600+ | 0.1% | Yes |

| gate | High | CEX | 1770+ | 0.3% | Yes |

| bybit | High | CEX | 440+ | 0.1% | Yes |

| dYdX | High | DEX | 30+ | 0.05% | No |

| kucoin | High | CEX | 540+ | 0.06% | Yes |

| uniswap (v3) | Moderate | DEX | 770+ | 0.03% | No |

| huobi | High | CEX | 600+ | 0.2% | No (5 BTC per day) |

1. MEXC – One of Top 10 Crypto Exchanges

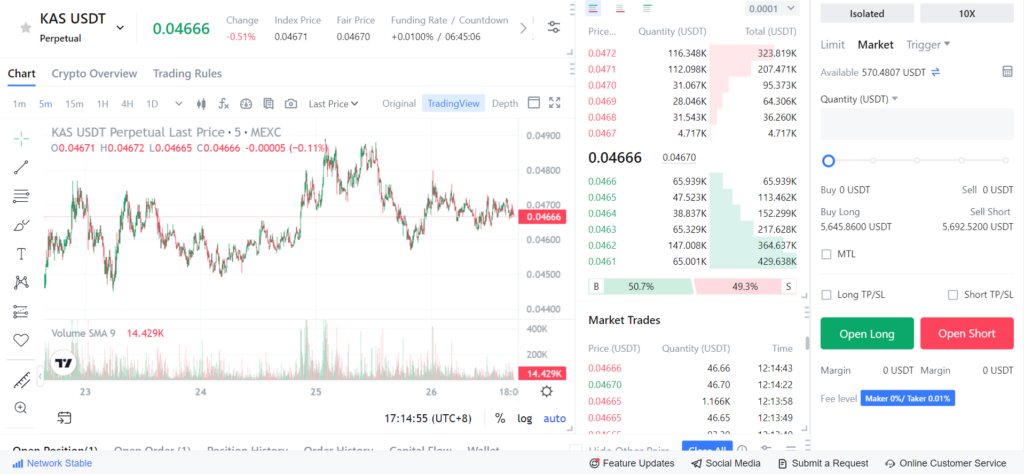

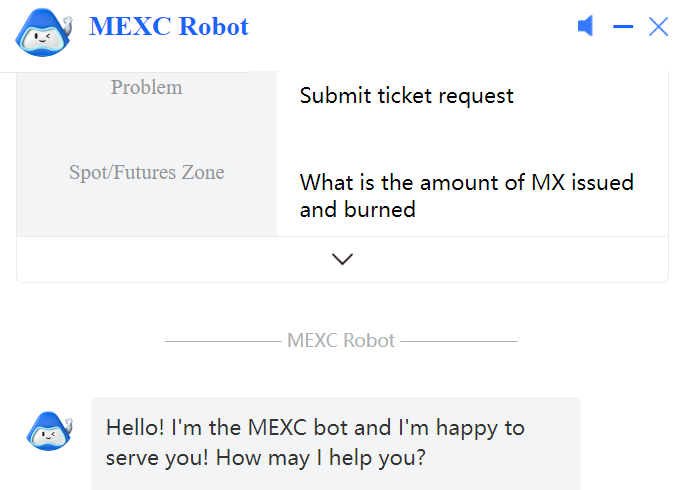

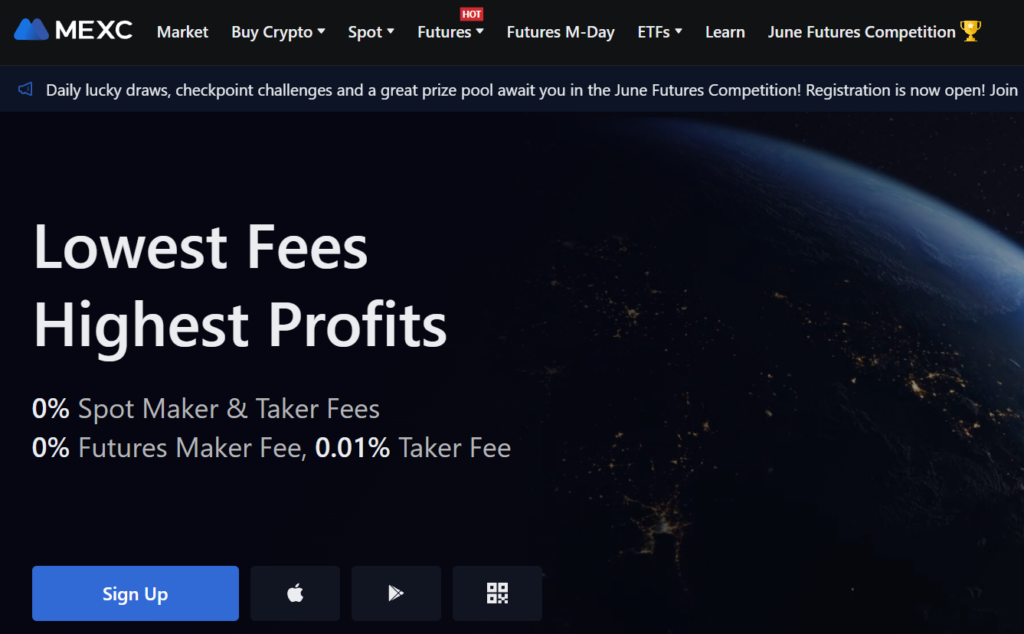

MEXC is a prominent tier 1 crypto exchange that offers a wide range of services to its users. The platform boasts some of the lowest fees in the market and provides exceptional liquidity. MEXC is known for its world-class security system, ensuring that users’ funds and data are protected. The exchange offers both futures and spot trading, with the former being highlighted for its top liquidity and zero maker fees.

MEXC is also recognized for its fast crypto listing, ranking high in the quantity of cryptocurrencies listed among top-tier exchanges. The platform is user-friendly and offers a comprehensive app available on iOS, Android, and Windows, allowing users to manage their portfolios with ease and trade on the go.

Pros & Cons of MEXC Exchange

| Pros | Cons |

|---|---|

| Lowest fees in the market | Limited access in certain regions |

| Exceptional liquidity | – |

| World-class security system | – |

| Offers both futures and spot trading | – |

| Fast crypto listing | – |

| Comprehensive app support (iOS, Android, Windows) | – |

2. OKX Exchange Overview

OKX is a renowned cryptocurrency exchange that has carved a niche for itself in the crypto trading world. The platform is celebrated for its low fees, robust matching engine, and powerful APIs, making it a favorite among both novice and professional traders. OKX offers a diverse range of services, from traditional trading to DeFi and even NFTs, all under one roof. The platform’s commitment to innovation and user experience is evident in its partnerships with world-class entities and personalities. For those who prefer trading on the move, OKX provides a comprehensive mobile app, ensuring a seamless trading experience across devices.

Pros & Cons of OKX Exchange

| Pros | Cons |

|---|---|

| Competitive fee structure | Limited access in certain regions |

| High liquidity | – |

| Comprehensive mobile app support | – |

| Diverse range of services (DeFi, NFTs) | – |

| Robust matching engine and powerful APIs | – |

| Active community engagement and partnerships | – |

3. BingX – One of Top 10 Crypto Exchange

BingX is a dynamic cryptocurrency exchange platform that has been making waves in the crypto community. The platform is designed to cater to both beginners and seasoned traders, offering a range of features and tools to enhance the trading experience. BingX emphasizes its commitment to security, transparency, and compliance, ensuring that users’ assets and data are safeguarded.

The platform boasts a global presence with branch offices in Canada, the EU, and Australia and adheres to the regulatory standards of the countries it operates in. BingX also offers innovative features like copy trading, allowing users to replicate the strategies of elite traders. With over 600+ coins available for trading and a user-friendly interface, BingX aims to provide a seamless and efficient trading environment.

Pros & Cons of BingX Exchange

| Pros | Cons |

|---|---|

| Comprehensive range of over 600+ coins | Limited access in certain regions |

| Innovative features like copy trading | – |

| Strong emphasis on security and compliance | – |

| Global presence with branch offices in multiple countries | – |

| Transparent operations with 100% Proof-of-Reserves | – |

| Active community engagement and participation in global crypto events | – |

4. Bitget Exchange Overview

Bitget has positioned itself as a trustworthy crypto exchange in the digital currency landscape. With a focus on security, Bitget goes above and beyond to ensure the safety of its users’ assets. The platform boasts features such as Proof of Reserves, Cold Storage, and a Protection Fund, emphasizing its commitment to safeguarding customer funds. Bitget’s reputation is further enhanced by its association with international football superstar, Lionel Messi, as its brand ambassador.

The platform offers a wide range of trading options, including spot, futures, and margin trading. With a 24h trading volume of 10 billion USDT, over 550+ cryptocurrencies listed, and a user base of 20 million registered users, Bitget stands as a formidable player in the crypto exchange arena.

Pros & Cons of Bitget Exchange

| Pros | Cons |

|---|---|

| Strong emphasis on security with features like Proof of Reserves and Cold Storage | Limited advanced trading tools for professional traders |

| Association with Lionel Messi as brand ambassador | Requires KYC |

| Comprehensive range of over 550+ coins | – |

| High trading volume and large user base | – |

| User-friendly interface suitable for both beginners and professionals | – |

| Competitive transaction fees | – |

5. Gate.io Overview

Gate.io is a leading cryptocurrency exchange that has been in operation since 2013. It offers a platform for users to trade over 1,700 cryptocurrencies in a safe, quick, and efficient manner. The exchange emphasizes its commitment to security, boasting both centralized and decentralized methods of protection. They have invested millions in security and law funds to ensure the safety of user assets.

The platform is known for its efficient trading system and instant deposit/withdrawal services. Over the years, Gate.io has built a reputation for stability, reliability, and transparency. They pride themselves on their strict adherence to regulations and their stance against market manipulation.

Pros & Cons of Gate.io

| Pros | Cons |

|---|---|

| Comprehensive protection with both centralized and decentralized methods | Does not offer services to US users |

| Efficient trading and instant deposit/withdrawal services | Some users might find the platform’s interface complex |

| Stable and reliable with a decade-long track record | Mandatory KYC |

| Transparent operations with no history of market manipulation | Fees are higher compared to some competitors |

6. Bybit Exchange Overview

Bybit is a globally recognized cryptocurrency exchange that has been serving the crypto community since 2018. The platform is known for its advanced trading features, high liquidity, and commitment to user security. Bybit offers a range of trading options, including derivatives and spot trading, and has recently expanded its offerings to include NFTs. With a 24-hour trading volume exceeding 8 billion USD and over 877 cryptocurrencies listed, Bybit has established itself as a major player in the crypto trading world. The platform’s dedication to user experience is evident in its 24/7 customer support, comprehensive educational resources, and continuous efforts to enhance platform security.

Pros & Cons of Bybit Exchange

| Pros | Cons |

|---|---|

| High liquidity ensures smooth trading | Limited fiat-to-crypto options |

| Advanced trading features for professionals | Some users report a steep learning curve |

| Strong emphasis on user security | Mandatory KYC |

| Expansive range of cryptocurrencies | – |

| Active community engagement and regular promotions | – |

| Comprehensive educational resources for traders | – |

7. dYdX

dYdX is a cutting-edge decentralized exchange that has rapidly gained traction in the crypto community. Established with the vision of making powerful financial tools accessible to everyone, dYdX offers a platform that is both open and powerful. The exchange is known for its Layer 2 solution, which provides users with low fees, no gas costs, and lightning-quick trades. This Layer 2 solution, powered by StarkWare, ensures increased security and privacy through zero-knowledge rollups.

The platform also boasts fast withdrawals, mobile-friendly design, and cross-margining, allowing users to access leverage across multiple markets from a single account. With a 24-hour trading volume exceeding $500 million and the trust of over 25,000 traders, dYdX stands as a testament to the potential of decentralized finance.

Pros & Cons of dYdX Exchange

| Pros | Cons |

|---|---|

| Decentralized platform ensuring user control | Limited range of cryptocurrencies compared to centralized exchanges |

| Layer 2 solution with low fees and no gas costs | Might have a learning curve for users new to decentralized platforms |

| Lightning-quick trades with blockchain confirmation within hours | – |

| Mobile-friendly design | – |

| Enhanced security & privacy via zero-knowledge rollups | – |

| Trusted by over 25,000 traders | – |

8. KuCoin Exchange Overview

KuCoin is a global cryptocurrency exchange that has been serving the crypto community since 2017. With a presence in over 19 countries and catering to 3 million global investors, KuCoin has made a significant mark in the crypto world. The platform is known for its vast selection of coins, with over 540+ cryptocurrencies available for trading.

KuCoin emphasizes its commitment to security, with features such as Proof of Reserves, ensuring that they have the funds to cover all user assets. The platform also boasts a 24-hour trading volume of $200+ million, showcasing its popularity and trustworthiness among traders. With a user-friendly interface and a focus on transparency, KuCoin aims to provide a seamless trading experience for all its users.

Pros & Cons of KuCoin Exchange

| Pros | Cons |

|---|---|

| Wide selection of over 67+ cryptocurrencies | Limited access based on IP restrictions |

| Strong emphasis on security with Proof of Reserves | Some users report occasional system overloads during peak trading times |

| High trading volume showcasing its popularity | Mandatory KYC |

| User-friendly interface suitable for both beginners and professionals | – |

| Active community engagement and regular promotions | – |

| Comprehensive educational resources for traders | – |

9. Uniswap (v3) Exchange Overview

Uniswap (v3) is a decentralized exchange that operates on the Ethereum blockchain. As one of the pioneers in automated market maker (AMM) protocols, Uniswap has revolutionized the way users trade cryptocurrencies. The platform allows anyone to swap ERC-20 tokens without relying on traditional order books. Instead, it uses liquidity pools where users can earn fees by supplying the pool with tokens.

Uniswap’s v3 iteration brought about concentrated liquidity, giving liquidity providers more control over the price ranges in which they provide liquidity, leading to potential increased returns. With its permissionless nature, anyone can create a new token pair, making it a hub for both popular and emerging tokens.

Pros & Cons of Uniswap (v3) Exchange

| Pros | Cons |

|---|---|

| Decentralized and permissionless | Primarily limited to ERC-20 tokens |

| No need for order books; uses AMM | Can have high gas fees during network congestion |

| Concentrated liquidity in v3 | Might be complex for new users unfamiliar with DEXs |

| High degree of control for liquidity providers | Slippage can be an issue for large trades |

| Access to a wide range of tokens, including emerging ones | – |

| Transparent and auditable smart contracts | – |

Huobi Exchange Overview

Huobi is a well-established cryptocurrency exchange that has been serving the global crypto community since 2013. With a presence in multiple countries, Huobi has become a trusted platform for millions of users worldwide. The exchange offers a broad spectrum of services, from spot trading to futures, and boasts a 24-hour trading volume exceeding $2.3 billion.

Huobi is known for its commitment to security, transparency, and user experience. The platform lists over 700 prime virtual assets, making it a top choice for traders looking for a diverse range of cryptocurrencies. Additionally, Huobi offers a mobile app for both iOS and Android, ensuring that users can trade anytime, anywhere.

Pros & Cons of Huobi Exchange

| Pros | Cons |

|---|---|

| Vast selection of over 700 cryptocurrencies | The platform’s interface might be complex for beginners |

| High liquidity with a 24-hour trading volume exceeding $2.3 billion | Limited advanced trading tools for professional traders |

| Strong emphasis on security and user protection | Some users report occasional system overloads during peak trading times |

| Mobile app available for both iOS and Android | Requires KYC |

| Active community engagement and regular promotions | – |

| Comprehensive educational resources for traders | – |

Tips for Safe Crypto Trading

Trading cryptocurrencies can be both exciting and profitable, but it’s essential to prioritize safety to protect your investments. Here’s a detailed chart offering tips for ensuring a secure crypto trading experience:

| Safety Tips | Description |

|---|---|

| Use Strong Passwords | Always use complex passwords that combine uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessable passwords like “password123” or “admin”. |

| Enable Two-Factor Authentication (2FA) | 2FA adds an extra layer of security by requiring not only a password and username but also something that only the user has access to (like a code sent to a phone). |

| Regularly Update Software | Ensure that your computer, smartphone, and trading applications are always updated. Hackers often exploit vulnerabilities in outdated software. |

| Avoid Phishing Websites | Always double-check the URL of the exchange and ensure it starts with ‘https’. Be wary of websites that have misspellings or look suspicious. |

| Use Hardware Wallets for Large Amounts | If you’re holding a significant amount of cryptocurrency, consider storing it on a hardware wallet. These are physical devices that are immune to online hacking attempts. |

| Be Wary of Pump and Dump Schemes | Avoid falling for “too good to be true” price pumps. These are often orchestrated schemes to inflate a coin’s value artificially and then sell it off at a high. |

| Research Before Investing | Always do your due diligence before investing in any cryptocurrency. Understand the project, its team, and its roadmap. |

| Use Trusted Exchanges | Stick to reputable and well-known exchanges. Check reviews, the exchange’s security measures, and its history of breaches or issues. |

| Never Share Your Private Keys | Your private keys are the keys to your funds. Never share them with anyone or leave them in easily accessible places. |

| Stay Informed | Regularly follow crypto news, join forums, and engage with other traders. Being informed will help you make safer trading decisions. |

Future of Top 10 Crypto Exchanges

The future of the top 10 crypto exchanges is poised to be dynamic, influenced by technological advancements, regulatory shifts, and evolving market demands. Here’s an in-depth look at the potential trajectory of these leading platforms:

Technological Innovations:

- Blockchain Upgrades: As blockchain technology evolves, exchanges will likely adopt faster and more scalable solutions, enhancing user experience and transaction speeds.

- AI & Machine Learning: These technologies can be integrated to predict market trends, detect fraudulent activities, and offer personalized trading suggestions to users.

Regulatory Landscape:

- Global Standards: As cryptocurrencies gain mainstream acceptance, global regulatory standards may emerge, leading to more uniformity and clarity for exchanges.

- Local Regulations: Exchanges will need to adapt to country-specific regulations, which might differ significantly across borders.

Security Enhancements:

- Advanced Protocols: With cyber threats becoming more sophisticated, exchanges will invest in advanced security protocols, including quantum-resistant algorithms.

- Decentralized Exchanges (DEXs): The rise of DEXs might challenge centralized exchanges, pushing them to adopt hybrid models combining the best of both worlds.

User Experience (UX) Improvements:

- Intuitive Interfaces: Exchanges will focus on offering more user-friendly platforms, making crypto trading accessible to the masses.

- Educational Resources: To cater to new entrants in the crypto world, exchanges will likely offer comprehensive educational resources, tutorials, and webinars.

Diversified Offerings:

- New Financial Products: Beyond simple trading, exchanges might introduce more complex financial instruments like options, futures, and ETFs.

- Integration with Traditional Finance: We might see more collaborations between crypto exchanges and traditional financial institutions, bridging the gap between fiat and digital currencies.

Global Expansion:

- Emerging Markets: Exchanges will likely target emerging markets, where the adoption of cryptocurrencies is still in its nascent stages.

- Local Partnerships: To navigate regulatory and cultural nuances, exchanges might form partnerships with local entities.

Sustainability:

- Green Initiatives: With increasing focus on the environmental impact of cryptocurrencies, exchanges might adopt more sustainable practices and even offer “green” tokens or incentives.

- Social Responsibility: Exchanges could engage in more community-driven projects, emphasizing corporate social responsibility.

Interoperability:

- Cross-Chain Solutions: As the number of blockchains grows, exchanges will invest in solutions that allow seamless trading across multiple chains.

- Integration with DeFi: Exchanges might offer more integrations with decentralized finance (DeFi) platforms, allowing users to access a broader range of financial products.

Community Engagement:

- Decentralized Governance: Some exchanges might adopt DAO (Decentralized Autonomous Organization) models, allowing the community to have a say in the platform’s direction.

- Feedback Loops: Exchanges will likely establish more robust feedback mechanisms, incorporating user suggestions into their development roadmap.

Economic Factors:

- Market Volatility: Exchanges will need to adapt to market fluctuations, ensuring they have the infrastructure to handle high trading volumes during volatile periods.

- Competitive Fee Structures: As competition intensifies, exchanges might offer more competitive fee structures to attract and retain users.

Conclusion

The world of cryptocurrencies is ever-evolving, and at its core lie the platforms that facilitate these digital transactions – the crypto exchanges. The Top 10 Crypto Exchanges have not only set the standard for security, user experience, and innovation but have also played a pivotal role in bringing cryptocurrencies to the mainstream. Their influence extends beyond mere trading platforms; they act as gateways, educators, and innovators in the crypto realm.

As we’ve delved into the intricacies of these exchanges, from their unique features to their future prospects, it’s evident that they are more than just transactional hubs. They are the epicenters of a financial revolution. Their commitment to technological advancements, regulatory compliance, and user-centricity ensures that they remain at the forefront of the crypto movement.

In the years to come, as the crypto landscape continues to shift and expand, these Top 10 Crypto Exchanges will undoubtedly lead the charge, adapting, innovating, and setting new benchmarks for the industry. For traders, investors, and crypto enthusiasts, these platforms will remain the trusted pillars in a dynamic digital economy.

FAQs

Why are crypto exchange top 10 rankings important?

They offer a snapshot of the best in the business, helping traders make informed decisions.

How often should I review exchange rankings?

With the dynamic nature of the crypto world, it’s wise to review every quarter.