Our insightful pieces, such as Ethereum Mining Rig and How to Mine Ethereum in POS era, have previously shone a light on the intricate workings of Ethereum and Ethereum mining. Today, we delve into its powerful progeny: What is ETHW?

Table of Contents

What exactly is ETHW?

ETHW is the PoW fork of Ethereum, born out of the desire to retain the PoW consensus mechanism post Ethereum’s transition to PoS.

The Genesis of ETHW

The story of Ethereum POW (ETHW) is rooted in a pivotal moment in Ethereum’s evolution. As Ethereum embarked on its transition to version 2.0, it signaled a significant shift from the Proof of Work (PoW) consensus mechanism to the newer Proof of Stake (PoS). This change was not just technical; it represented a philosophical divergence in how the network would validate and create new blocks.

For a segment of the Ethereum community, the PoW methodology wasn’t just a technical detail—it was an ethos. They believed in its decentralized nature and the security it provided. This conviction led to a fork, preserving the original PoW mechanism and giving birth to ETHW. While ETHW carries forward the legacy of Ethereum’s initial vision, it also forges its own path, optimizing the PoW protocol for modern challenges and opportunities.

ETHW’s Blueprint

ETH vs ETHW

| Feature | Ethereum | ETHW |

|---|---|---|

| Consensus Mechanism | Proof of Stake | Proof of Work |

| Token Symbol | ETH | ETHW |

| Block Time | ~13 seconds | Same as ETH |

While both share a PoW heritage, ETHW offers a fresh perspective on the Ethereum foundation, evolving its own unique features while echoing the technical rhythms of its predecessor.

ETHW Mainnet Info

| Mainnet Info | Details |

|---|---|

| Network Name | ETHW-mainnet |

| New RPC URL | https://mainnet.ethereumpow.org |

| Chain ID | 10001 |

| Block Explorer URL (Optional) | https://mainnet.ethwscan.com |

| Block Explorer URL (Optional) | https://www.oklink.com/en/ethw |

Unearthing ETHW Mining

ETHW, staying true to its PoW roots, offers miners a realm reminiscent of Ethereum’s golden days. Yet, it’s not a mere replica; ETHW mining boasts distinct advantages, promising miners not just rewards but a sustainable future in the crypto mining landscape.

ETHPoW sticks to the same proof-of-work mechanism (ETHASH) Ethereum mainnet had been using since its inception before the Merge. The scheduled difficulty bomb has been completely removed, so ETHPoW can continue to be mined.

Best Mining Pool for ETHW

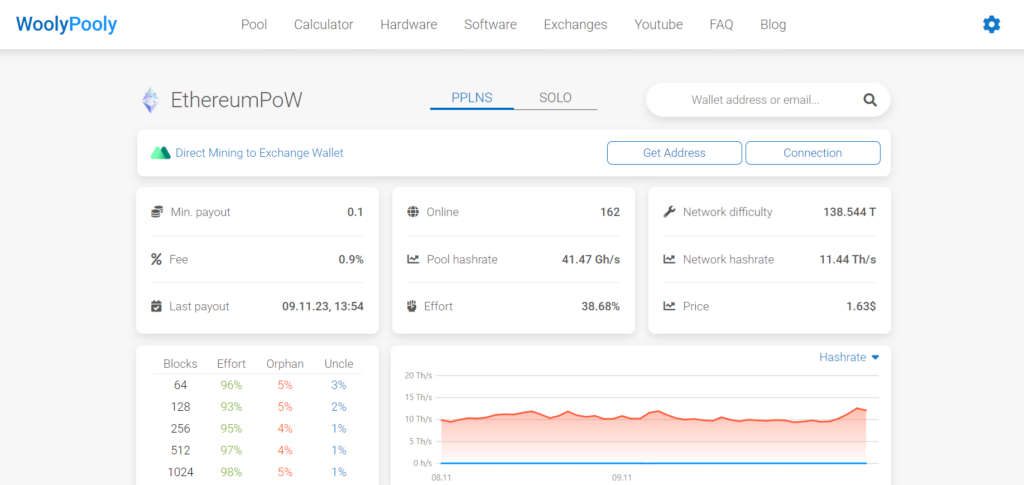

WoolyPooly is considered one of the best ETHW mining pools due to its user-friendly interface, low fees, and robust server infrastructure. It offers miners a reliable platform to pool their computational resources and increase their chances of earning mining rewards.

GPU Miners

For AMD GPUs:

- TeamRedMiner

- Website: TeamRedMiner

- Description: TeamRedMiner is optimized for AMD GPUs and is known for its efficiency and stability. It supports a variety of algorithms and is a popular choice among AMD GPU miners.

For Nvidia GPUs:

- T-Rex Miner

- Website: T-Rex Miner

- Description: T-Rex Miner is a versatile and high-performance miner designed for Nvidia GPUs. It is frequently updated and includes features to maximize hash rate and mining efficiency.

- GMiner

- Website: GMiner

- Description: GMiner is another powerful mining software for Nvidia GPUs, offering support for multiple algorithms and providing a balance of performance and power efficiency.

For Mixed AMD / Nvidia Rigs:

- LolMiner

- Website: LolMiner

- Description: LolMiner is designed to work well with mixed rigs that contain both AMD and Nvidia GPUs. It is user-friendly and allows for easy switching between different mining algorithms.

ASIC Miners

ETHASH ASICs:

- Description: Most ETHASH ASIC miners are capable of mining ETHW without any issues. These specialized hardware devices are designed to efficiently mine cryptocurrencies based on the ETHASH algorithm, which ETHW is expected to use.

The Economics of ETHW

The economic model of ETHW is a fascinating blend of classic cryptocurrency principles and innovative financial strategies that cater to its PoW nature.

Mining Incentives

Central to ETHW’s economic structure are the mining rewards. By sticking with PoW, ETHW aims to incentivize miners to continue their crucial role in transaction validation and network security. The reward system is structured to ensure that miners who invest in the network’s health are compensated fairly, fostering a stable mining community.

Supply Mechanics

ETHW’s supply dynamics are designed with a deflationary perspective. With a capped supply limit, similar to Ethereum’s pre-EIP-1559 model, it introduces scarcity into the equation, potentially enhancing the value proposition over time as demand increases.

Transaction Fees

ETHW modifies transaction fee mechanics by adopting a transparent fee market, which helps users estimate costs better and allows miners to prioritize transactions effectively. This economic design is critical in balancing network congestion and maintaining reasonable transaction costs.

Financial Governance

The governance of ETHW extends to its economic policies. The community-driven governance model allows stakeholders to propose and vote on changes that could impact inflation rates, miner incentives, and other economic factors, ensuring that ETHW adapts to the evolving financial landscape of the crypto world.

Market Positioning

ETHW’s economic blueprint is not just about sustaining the network; it’s also geared towards establishing a strong position in the competitive market. By aligning the interests of miners, developers, and users, ETHW seeks to create a robust economic ecosystem that can attract investment and nurture growth.

Navigating ETHW’s Landscape

The ETHW’s Landscape is a curated collection of platforms and services that form the backbone of the Ethereum World (ETHW) ecosystem. This ecosystem encompasses a wide array of functionalities tailored to the needs of the ETHW community, ranging from NFT marketplaces that enable the trading and minting of non-fungible tokens, to wallets for secure asset management, bridges facilitating interoperability between different blockchains, tools providing auxiliary services for crypto users, and decentralized exchanges (DEX) that offer peer-to-peer trading without the need for intermediaries. Each category within the ecosystem serves a unique role, ensuring that users have access to a comprehensive suite of services for engaging with the ETHW blockchain and its assets.

ETHW NFT Marketplaces

NFT Marketplaces within the ETHW ecosystem provide platforms where users can buy, sell, or trade non-fungible tokens (NFTs). These marketplaces support the burgeoning economy of digital collectibles and art on both Layer 1 and Layer 2 solutions, offering a space for creators and collectors to interact.

| Website | Description |

|---|---|

| yayasea.com | An NFT marketplace operating on both Layer 1 and Layer 2 of the blockchain, facilitating the trade of digital collectibles. |

| nswap.com | A platform dedicated to the exchange of NFTs, providing a marketplace for users to buy and sell unique digital items. |

| nuwton.io | Another NFT marketplace that allows for the trading and minting of non-fungible tokens within the ETHW ecosystem. |

Wallets

Wallets are essential tools for anyone interacting with the ETHW blockchain. They offer secure storage for cryptocurrencies and digital assets, with some providing additional features like multi-signature security. Wallets in the ETHW ecosystem may also offer educational resources to help users make the most of their features.

| Website | Functionality | Additional Info |

|---|---|---|

| Metamask | Wallet | Tutorial |

| wafebox.com | Multi-sig asset management platform | RugDoc Review |

| bitkeep.com | Wallet | Tutorial |

| foxwallet.com | Wallet | Tutorial |

| guarda.com | Wallet | Tutorial |

Bridges

Bridges serve as critical infrastructure in the ETHW ecosystem, enabling the transfer of assets between different blockchains. They enhance the interoperability of the ETHW blockchain with other chains, allowing for more fluid movement of assets and expanding the reach of ETHW’s native tokens.

| Website | Functionality | Additional Info |

|---|---|---|

| app.bridgetech.network | Bridge | User Guide |

| camelark.com | Bridge between ETHW L1 and L2 | |

| chainge.finance | Bridge & Cross-chain Swap | Tutorial |

| changenow.io | Cross-chain Swap |

Decentralized Exchanges (DEX)

Decentralized Exchanges within the ETHW ecosystem are platforms that allow users to engage in trading without the need for a central authority. They offer various services, including liquidity pools, farming, staking, and NFT trading. DEXs are pivotal for maintaining the liquidity and accessibility of assets in the ETHW ecosystem.

| Website | Functionality | Additional Info |

|---|---|---|

| zergswap.com | DEX on L1 and L2 | RugDoc Review |

| lfgswap.finance | DEX | RugDoc Review, Tutorial |

Tools

This category includes a variety of crypto tools that serve different purposes, such as token creation, management, and analytics. These tools are designed to support the operational needs of the ETHW ecosystem, providing users with the resources to track, manage, and create digital assets.

| Website | Functionality |

|---|---|

| cointool.app | Crypto toolbox |

| coinon.org | Token creation & management |

| defillama.com | DeFi TVL aggregator |

| dexscreener.com | Crypto Price Charts |

Conclusion

In our exploration of “what is ETHW”, we have traversed through the technical intricacies, economic frameworks, and the community-driven ethos that underpin this intriguing addition to the blockchain landscape. ETHW emerges not merely as a fork but as a testament to the diversity and adaptability inherent to the crypto ecosystem. It carries the torch of proof-of-work, upholding the principles that many miners and enthusiasts hold dear, particularly in the face of the broader shift towards proof-of-stake models.

What is ETHW, if not a reflection of the community’s voice in the ongoing narrative of blockchain evolution? It’s a platform that demonstrates the undying value of consensus and the democratic process in cryptocurrency governance. With its robust economic model, dedication to network security through mining, and a governance framework that puts the power in the hands of its community, ETHW represents more than just an alternative—it’s a choice for those who envision a different path for the future of blockchain.

As the crypto world continues to expand and diversify, ETHW stands as a pivotal development, offering lessons in resilience and the importance of aligning technology with the community’s will. Whether you are a miner, developer, investor, or simply a curious observer, the journey of understanding what is ETHW offers valuable insights into the dynamism and complexity of cryptocurrency.

In conclusion, ETHW is not just another asset to add to the portfolio; it is a movement, a piece of the larger puzzle of blockchain’s future. It invites us to question, to participate, and above all, to understand the myriad ways in which technology and community values intertwine in the ever-evolving narrative of digital currency.