Welcome to the age of financial innovation where real world assets are intersecting with the burgeoning cryptocurrency market. The landscape is changing and this article aims to serve as your guide through this transformative journey. We’ll delve into what these assets are, how they’ve evolved in the crypto space, and most importantly, the future implications for investors and the global economy at large.

Table of Contents

Understanding the Basics

In the ever-evolving financial world, two terms have become increasingly significant – real world assets and cryptocurrencies. Understanding these concepts and their interplay is fundamental to navigating the contemporary landscape of investments and financial operations.

What are Real World Assets?

Real world assets refer to tangible or intangible items of economic, commercial, or exchange value that exist in the physical world. Tangible assets are physical in nature and include things like real estate, commodities (gold, silver, oil), machinery, and other physical goods.

Intangible assets, on the other hand, do not have a physical form but still hold significant value. These can include intellectual property rights such as patents, copyrights, and trademarks, financial instruments like bonds and equities, or even brand recognition and goodwill.

These assets have traditionally been traded or transferred through conventional means, involving extensive paperwork, regulatory compliance, and in many cases, intermediaries.

Cryptocurrencies and Blockchain Technology Explained

Cryptocurrencies have dramatically reshaped this traditional landscape. At their core, cryptocurrencies like Bitcoin, Ethereum, and countless others, are digital or virtual currencies that use cryptography for security. This makes them immune to counterfeiting, a major concern with traditional forms of money.

Cryptocurrencies operate on blockchain technology. A blockchain is essentially a digital ledger of transactions that is duplicated and distributed across an entire network of computer systems. Each block in the chain contains a list of transactions, and every time a new transaction occurs on the blockchain, a record of that transaction is added to every participant’s ledger.

This decentralized nature of blockchain brings with it increased security, transparency, and speed of transactions, all of which have significant implications for the trading and transfer of real world assets.

How Do Real World Assets and Cryptocurrencies Interact?

This is where the concept of ‘tokenization’ comes in. When real world assets are digitized and recorded on a blockchain, they are often referred to as being ‘tokenized’. Tokenization involves converting rights to a real-world asset into a digital token.

These digital tokens, which represent ownership rights to the real-world asset, can then be bought, sold, or traded on crypto exchanges, often with fewer restrictions and lower costs than traditional asset transfers.

The tokenization of real world assets brings about a new level of liquidity, accessibility, and security to asset trading, and is set to revolutionize the way we view and interact with real world assets.

From real estate properties that can be fractionally owned, to artworks whose provenance can be indisputably verified, the integration of real world assets and cryptocurrencies opens up a world of possibilities in the financial realm. As with any groundbreaking technology, it’s important to understand the underlying concepts in order to fully leverage its benefits and navigate its challenges.

The Evolution of Crypto Assets

From the introduction of Bitcoin in 2009 to the rising tide of tokenized real world assets in recent years, the evolution of crypto assets has been a transformative journey.

The Dawn of Cryptocurrency: Bitcoin

The genesis of the crypto revolution can be traced back to 2008 when an anonymous entity known as Satoshi Nakamoto published the Bitcoin whitepaper. In early 2009, Bitcoin was launched as a peer-to-peer electronic cash system, marking the birth of the first cryptocurrency.

Bitcoin introduced the concept of a decentralized currency that operates on blockchain technology, bypassing the need for traditional banking systems and governmental oversight. This was a radical departure from the status quo and laid the groundwork for the many developments that followed.

The Advent of Smart Contracts and Ethereum

Fast forward to 2015, the advent of Ethereum added a new dimension to the crypto landscape. While Bitcoin was essentially digital money, Ethereum expanded on this concept by introducing programmable contracts, known as ‘smart contracts‘.

Smart contracts are self-executing contracts with the terms of the agreement directly written into code, stored and replicated on the blockchain. This eliminated the need for a middleman, thereby increasing the speed and reducing the costs associated with contractual transactions.

Ethereum also introduced the concept of creating other cryptocurrencies, or tokens, on its blockchain, sparking a proliferation of new crypto assets.

ICO Boom and Diversification of Crypto Assets

The years following Ethereum’s launch saw an explosion of new cryptocurrencies, thanks in large part to Initial Coin Offerings (ICOs). ICOs are essentially fundraising mechanisms, where new projects sell their underlying crypto tokens in exchange for bitcoin or ether.

While some of these projects offered novel solutions to existing problems, many were marred by a lack of regulation and oversight, leading to scams and losses for investors. Despite this, the ICO boom marked an important phase in the diversification of crypto assets.

Tokenization of Real World Assets

In the last few years, the concept of tokenizing real world assets has gained traction. Tokenization involves converting the rights to an asset into a digital token on a blockchain.

Through tokenization, assets such as real estate, artwork, commodities, and even companies’ equity can be fractionalized and traded on digital platforms. This has the potential to dramatically increase the liquidity of these assets and democratize access to investment opportunities previously available only to a select few.

As of now, we’re at a critical juncture in the evolution of crypto assets, where regulatory recognition and acceptance are shaping the future of this space. The journey thus far has been nothing short of revolutionary, and the advancements in blockchain technology indicate a future filled with infinite possibilities.

Types of Real World Assets in Crypto

The advent of blockchain technology has made it possible to tokenize almost any form of real-world assets. These digital representations of ownership can be traded, bought, and sold on blockchain networks, greatly expanding the accessibility and liquidity of these assets. Here, we dive into some of the most common types of real-world assets that are being tokenized.

| Asset Type | Example Token | Description | Key Benefits |

|---|---|---|---|

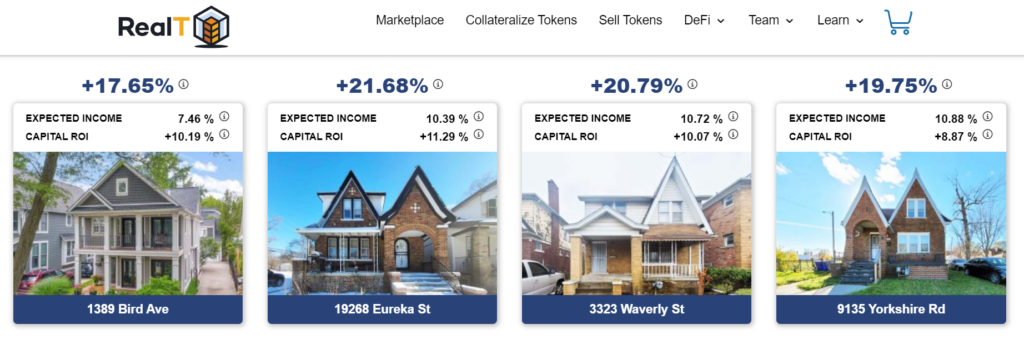

| Real Estate | RealT Tokens | Tokens representing fractional ownership of real properties | Increased market accessibility, potential for passive income (rent), enhanced liquidity |

| Precious Metals | PAX Gold (PAXG) | Each token represents ownership of one fine troy ounce of London Good Delivery Gold | Accessibility to gold investment, easier to transfer and trade, enhanced liquidity |

| Art & Collectibles | NFTs on platforms like OpenSea or Rarible | Tokens representing fractional ownership of a piece of art or collectible | Democratizes art investment, reduces forgery risk, enables artist royalties |

| Equities & Bonds | Security tokens on Tokensoft | Tokens representing ownership in a company or debt instrument | Streamlined issuance process, broader investor base, enhanced transparency and speed |

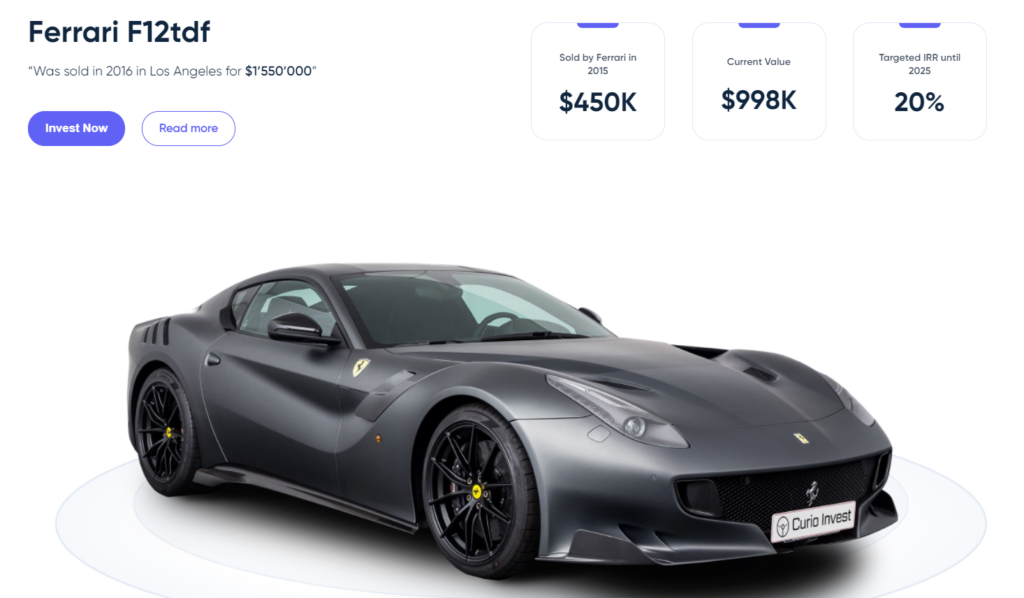

| Luxury Assets | Tokens on CurioInvest | Tokens tied to luxury, collectible cars | Lowers investment entry point, access to a unique asset class, potential for appreciation |

| Invoices/Loans | Centrifuge’s Tinlake | Businesses can tokenize real-world assets like invoices or loans for liquidity | Access to liquidity, diversifies DeFi lending and borrowing |

Real Estate

Tokenization has made significant inroads in the real estate market. Instead of buying an entire property, investors can now purchase digital tokens representing a fraction of the property. Each token essentially acts as a share in the property, allowing investors to benefit from rental income and price appreciation.

This fractional ownership model reduces the barrier to entry for real estate investment, allowing a wider range of individuals to participate in property markets worldwide. It also enhances the liquidity of real estate investments, as tokens can be bought and sold on digital exchanges.

Gold and Other Precious Metals

Precious metals such as gold, silver, and platinum have traditionally been seen as safe-haven assets. Tokenization enables these assets to be traded in a more accessible and secure manner. For example, one token might represent one gram of gold stored in a secure vault. Investors can buy these tokens as a proxy for owning physical gold, without worrying about storage or security issues.

Tokenized precious metals can be traded 24/7 on digital exchanges, providing greater liquidity and price transparency compared to traditional precious metals markets.

Art and Collectibles

The art world is another area where tokenization is making a significant impact. Similar to real estate, artwork can be tokenized to allow fractional ownership. This lowers the barrier to entry for art investment, which has traditionally been a playground for the wealthy.

In addition to paintings and sculptures, other collectibles such as rare wines, vintage cars, and sports memorabilia can also be tokenized. By providing proof of ownership and provenance tracking, blockchain technology can also help mitigate the risk of fraud and forgery in the art and collectibles market.

Equities and Bonds

Tokenization is transforming the way securities like equities and bonds are issued, traded, and settled. Tokenized securities, or security tokens, represent ownership in an underlying asset or company.

For issuers, tokenizing securities can simplify the capital raising process and extend their investor base. For investors, tokenized securities offer the potential for fractional ownership, faster settlement times, and greater transparency.

The above examples are just the tip of the iceberg when it comes to the types of real-world assets that can be tokenized. As blockchain technology continues to evolve, we can expect to see an ever-expanding range of assets being digitized and traded on blockchain networks.

Tokenization of Real World Assets

In recent years, the process of tokenization has emerged as a significant innovation in the world of finance and investment, thanks to the advent of blockchain technology. But what exactly is tokenization, and why is it so transformative? Let’s explore this concept in depth.

What is Tokenization?

In essence, tokenization is the process of converting rights to an asset into a digital token on a blockchain. This allows virtually any asset, whether tangible (like a house or a work of art) or intangible (like equity in a company), to be represented digitally.

A token, in this context, is essentially a digital contract for ownership of whatever the token represents – it could be a share of a property, a quantity of gold, or a piece of art.

These tokens can then be bought, sold, and traded on a blockchain platform. Because each token represents a unique asset and its ownership history is recorded on the blockchain, ownership claims can be transparent and secure.

The Benefits of Tokenization

Tokenization offers a range of benefits, both for asset owners and for investors:

- Increased Liquidity: Traditional assets, such as real estate or artwork, are often illiquid due to their high cost and the complexities involved in transferring ownership. By allowing for fractional ownership, tokenization can dramatically increase the liquidity of these assets.

- Greater Accessibility: The fractionalization enabled by tokenization lowers the barrier to entry for investment, making previously inaccessible markets available to a broader group of investors.

- Faster and Cheaper Transactions: By removing the need for intermediaries and reducing the paperwork involved, blockchain transactions can be faster and cheaper than traditional methods.

- Transparency and Security: The immutable nature of blockchain ensures that ownership information is accurate and tamper-proof, providing increased transparency and security.

Real-World Examples of Tokenization

From property to precious metals, tokenization is opening up new opportunities across a range of asset classes:

- In real estate, property owners can issue tokens representing shares in a property, allowing investors to buy a ‘piece’ of a property rather than the whole thing.

- In the art world, tokenization allows investors to own a fraction of a painting or sculpture, making art investment more accessible.

- Gold and other precious metals can also be tokenized, with each token representing a certain amount of the metal stored in a secure vault.

As we move forward, the potential for tokenization to democratize access to investment opportunities and enhance the efficiency of asset markets is truly immense. It is an innovation that is set to revolutionize the way we view and interact with real-world assets.

Key Players in Real World Assets Crypto Space

The confluence of cryptocurrencies and real-world assets has garnered significant attention from various stakeholders in the finance and tech sectors. This burgeoning industry has given rise to a number of key players who are pushing the boundaries of how we understand and engage with financial assets. Here are some of the standouts:

Anchorage

Anchorage is a digital asset platform that provides secure storage, trading, and tokenization services for a variety of cryptocurrencies and other digital assets. It offers custody solutions for institutional investors and a robust platform for managing digital asset portfolios.

CurioInvest

Specializing in the tokenization of luxury assets, CurioInvest enables investors to buy and sell tokens tied to collectible cars. It allows users to invest in rare, high-value vehicles they might not be able to afford outright, making such investments more accessible.

RealT

RealT is a blockchain-based platform for investing in U.S. real estate properties. Through tokenization, investors can buy fractions of properties and earn rental income based on their share.

Centrifuge

Centrifuge is a decentralized platform that connects businesses who need to borrow money with investors looking for stable returns. Businesses can tokenize their real-world assets (like invoices or loans) to use as collateral and access liquidity.

These are just a few of the many innovative companies working at the intersection of blockchain technology and real-world assets. As the sector continues to grow and mature, we can expect to see even more players entering the space, further expanding the possibilities for tokenization and digital asset investment.

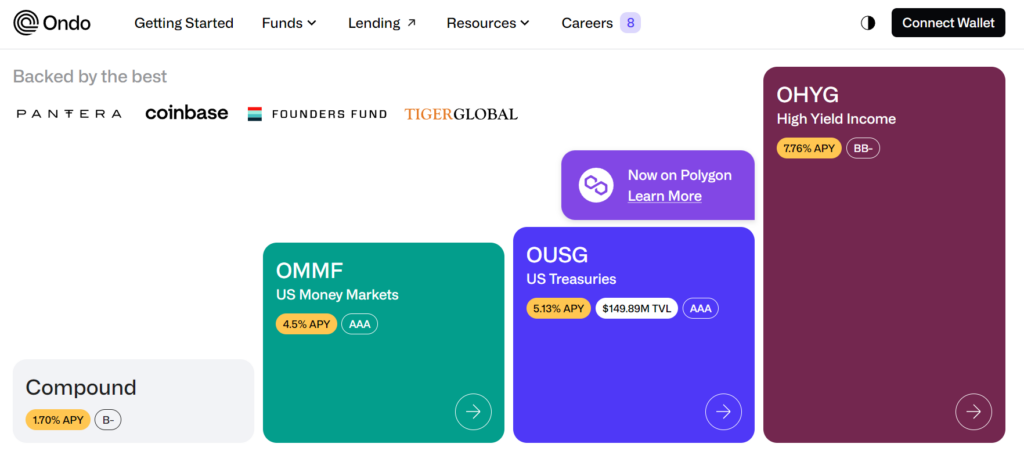

Ondo

Ondo is a financial platform built on Ethereum and Polygon that allows users to invest in tokenized Treasury bonds, money markets, and short-term promissory notes from the United States. This platform uses innovative smart contract designs to provide secure and flexible options for investors looking to diversify their portfolios with low-risk, real-world assets.

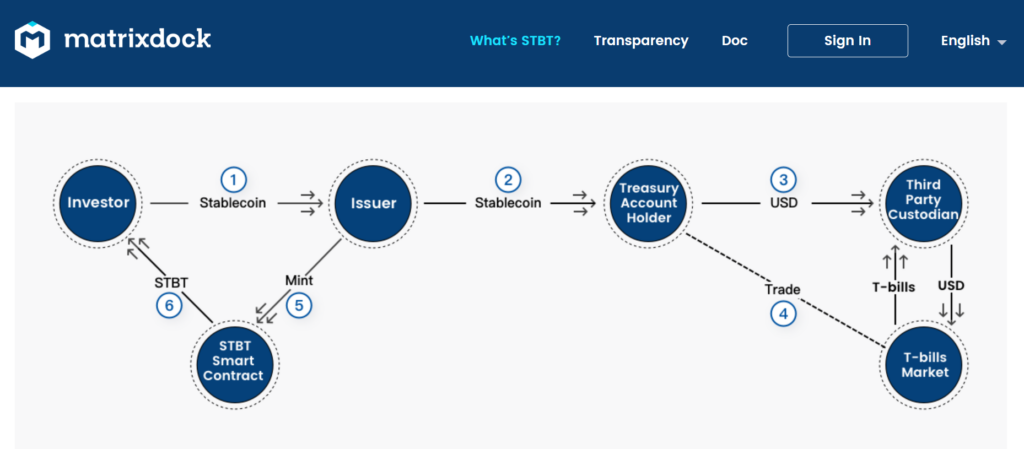

MatrixDock

MatrixDock is another Ethereum-based platform that offers access to short-term U.S. Treasury bills. This platform aims to bridge the gap between the traditional finance world and the digital asset space by offering investors a simple, streamlined way to invest in low-risk government securities using cryptocurrency.

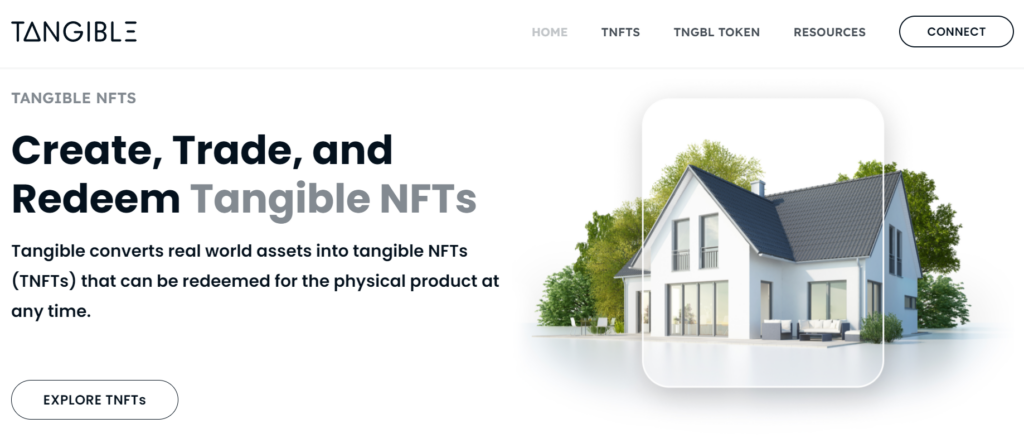

Tangible

Tangible is an NFT platform operating on the Polygon network, where users can earn from tokenized real estate. It simplifies the process of investing in real estate, a traditionally illiquid and capital-intensive asset class, by allowing for fractional ownership. Users can purchase NFTs representing a fraction of a property and earn returns from rental income or price appreciation.

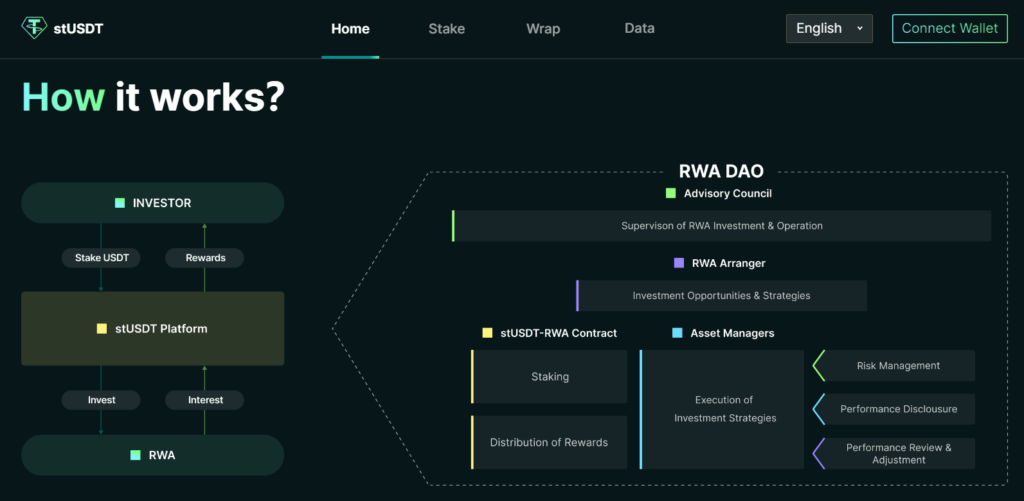

stUSDT

stUSDT operates on the TRON blockchain, offering a platform for investments in real-world assets using USDT (Tether), a popular stablecoin. The platform aims to democratize access to investment opportunities in real estate, precious metals, and other asset classes by lowering the barriers to entry that are typically associated with these markets.

The Potential of Real World Assets in Crypto

The potential of real world assets (RWA) in the realm of cryptocurrency and blockchain technology is immense. An indication of this potential can be seen in the significant rise in the Total Value Locked (TVL) from $120 million at the beginning of 2023 to a whopping $800 million. This rapid growth represents almost a sevenfold increase, illuminating the burgeoning interest and escalating demand within this space.

Tokenizing real-world assets provide a novel way to bring liquidity and accessibility to traditionally illiquid markets. This has the effect of democratizing access to a wide array of assets, from real estate to collectibles, allowing for greater financial inclusivity.

Moreover, tokenization can simplify and streamline the process of buying and selling assets, removing the need for intermediaries and reducing costs. It can also provide a higher degree of transparency and security through the use of immutable, tamper-proof blockchain technology.

This burgeoning segment is just beginning to gain momentum. If the trend of real-world assets ‘coming’ onto the blockchain continues, Ethereum is likely to emerge as the predominant platform for them. Ethereum is currently the most secure and decentralized platform for smart contracts, which are fundamental to the process of tokenization.

Through smart contracts, Ethereum allows for the creation of complex programmable money that can encapsulate the rules and structures of traditional financial products in code. This capability, combined with Ethereum’s wide adoption and robust security, positions it ideally to accommodate the continued growth of real-world assets in the crypto space.

How to Invest in Real World Asset Cryptocurrencies

Investing in real world asset cryptocurrencies may appear daunting at first, especially for newcomers. However, with some basic understanding of the processes involved, it can be a rewarding way to diversify your investment portfolio. Here’s a simple step-by-step guide to get you started:

- Educate Yourself: As with any form of investment, it’s critical to understand what you’re investing in. Learn about the fundamentals of blockchain, cryptocurrencies, and tokenization. Understand how tokenization brings real-world assets into the crypto space and how these tokens derive their value from the underlying assets.

- Choose the Right Asset Class: Real world assets in the crypto world span a wide range, from real estate to art, precious metals to debt instruments. Each comes with its own set of risks and rewards. Based on your risk tolerance, investment goals, and interests, decide which asset class aligns best with your investment strategy.

- Select a Reliable Platform: Different platforms offer different real-world asset tokens. Research various platforms like RealT, CurioInvest, or Centrifuge to understand what kind of assets they offer, their security measures, fees, and customer support. Ensure the platform you choose is reputable and secure.

- Create an Account: Once you’ve selected a platform, you’ll need to create an account. This will likely involve a process known as KYC (Know Your Customer), where you’ll have to provide some personal information to verify your identity.

- Buy Cryptocurrency: Most platforms will require you to purchase real-world asset tokens using cryptocurrencies like Ethereum (ETH) or stablecoins like USDT. You can buy these from a cryptocurrency exchange using traditional money (fiat currency).

- Invest in Real World Asset Tokens: With cryptocurrencies in your wallet, you can now buy the real-world asset tokens of your choice. This process will differ slightly from platform to platform, but generally involves selecting the asset token you want and making a purchase transaction.

- Safe Storage: After your purchase, ensure your tokens are stored safely. While some may prefer to keep their tokens in their accounts on the platform, it’s generally safer to transfer them to a private, secure wallet where you control the private keys.

- Monitor & Manage: Keep track of market trends and the performance of your investments. Remember, investing isn’t a one-time event but an ongoing process. Be prepared to adjust your portfolio as necessary.

Remember, investing in real-world asset cryptocurrencies comes with risk, like any other investment. Always do your research, and only invest money that you can afford to lose. Consulting with a financial advisor is always a good idea when venturing into new investment areas.

Conclusion

In summary, the integration of real world assets into the crypto space is not just a trend, but a powerful revolution that is poised to significantly alter the landscape of global finance. This integration combines the stability and inherent value of physical assets with the agility, efficiency, and borderless nature of blockchain technology, ultimately bridging the divide between traditional and decentralized finance.

As evidenced by the impressive growth of the Total Value Locked (TVL) within a relatively short period, there is burgeoning interest and escalating demand in this space. This meteoric rise signifies a shift towards democratizing access to various forms of wealth, fostering financial inclusion, and creating a more equitable global economy.

Furthermore, the ability of blockchain technology to tokenize a vast array of assets, from real estate to precious metals, art to equities, and even luxury goods, has expanded investment opportunities and made them accessible to anyone with internet access. This unprecedented level of access is transforming the investment landscape and creating new paths to wealth generation.

Nevertheless, as with all investments, it’s crucial to approach this field with a thorough understanding and a healthy amount of caution. Potential investors must take time to educate themselves about this nascent field, understand the risks involved, and possibly seek professional financial advice.

Lastly, if the current trend of real-world assets ‘coming’ onto the blockchain continues, it is highly probable that Ethereum, with its secure, decentralized platform and smart contract functionality, will become the predominant platform for these assets. As such, the continued growth of real-world assets in crypto is a development worth watching for anyone interested in the future of finance.

With each passing day, the boundaries between the tangible and digital, the old and new, continue to blur. This convergence points to an exciting future, one where real-world assets and cryptocurrency not only coexist but synergize to create a more efficient, accessible, and inclusive global financial system.

FAQs

What are Real World Assets in Crypto?

Real world assets in crypto refer to physical or tangible assets that have been tokenized and put on a blockchain. This includes things like real estate, art, precious metals, and other forms of assets. The value of the tokenized asset mirrors the value of the underlying real-world asset.

How does the Tokenization of Real World Assets work?

Tokenization involves the process of issuing a blockchain token (specifically, a security token) that digitally represents a real tradable asset. These tokens can then be bought, sold, or traded on a blockchain platform.

What are the benefits of Real World Asset Tokenization?

Tokenization of real-world assets provides numerous benefits. It increases liquidity of traditionally illiquid assets, democratizes access to investment opportunities, reduces transaction times, and provides better transparency and security.

Which platforms offer Real World Asset Cryptocurrencies?

There are many platforms offering real-world asset cryptocurrencies. Some of the key players include Ondo, MatrixDock, Tangible, stUSDT, and Centrifuge. Each platform offers different types of real-world assets, so it’s important to explore each one to see which fits your investment interests.

Can I store Real World Asset Tokens in my regular Crypto Wallet?

Yes, most real-world asset tokens can be stored in a regular crypto wallet. However, it’s always important to double-check the compatibility with your chosen wallet. Keeping your investment in a secure, private wallet can help ensure the security of your tokens.