As WoolyPooly, known for our insightful exchange comparisons, we’re excited to present our latest face-off: Bingx vs Mexc. While we’ve previously compared Mexc with giants like Binance and Kucoin, Bingx steps into our analytical arena for the first time, promising an intriguing matchup. However, both Bingx and Mexc are included in our ranked top 5 crypto exchanges list.

Table of Contents

Bingx: An Overview

Bingx, established in 2018, is more than just a cryptocurrency exchange. It differentiates itself by integrating social elements into its trading platform, creating a unique blend of finance and community. This innovative approach positions Bingx not just as a place for transactions but as a vibrant social network for crypto enthusiasts.

Trading Options and Innovations

Bingx offers an array of trading options including spot trading, margin trading, and futures. But what sets it apart is its implementation of Tradingview integration. This feature enhances the user experience by providing comprehensive charting tools and real-time data analysis, crucial for informed trading decisions.

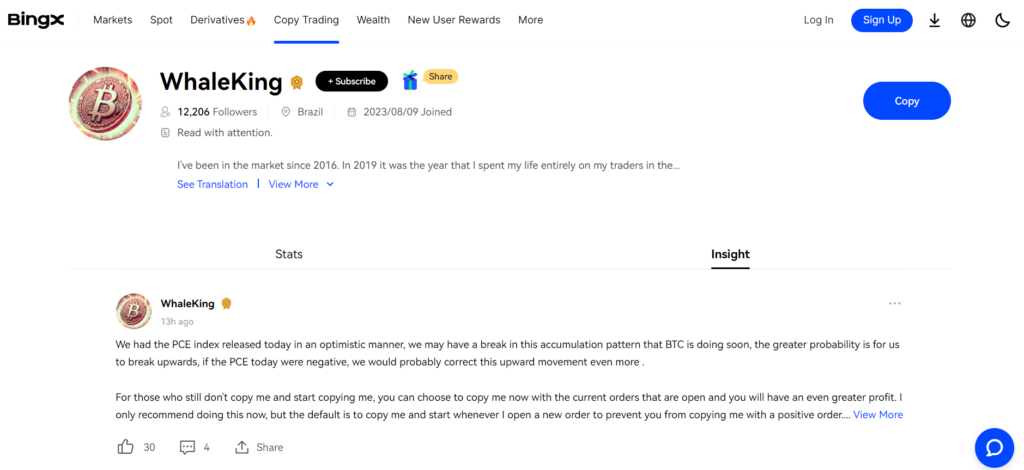

Social Crypto Network: A Unique Twist

The platform’s standout feature is its Social Crypto Network. This component allows users to follow and interact with other traders, share insights, and even copy trades. It’s a significant leap towards community-driven trading, where learning and sharing strategies become integral to the trading experience.

Simplified Trading with No Mandatory KYC

For casual or low-volume traders, Bingx offers a simplified experience with no mandatory KYC (Know Your Customer) for daily withdrawals up to 50K USDT. This feature makes it accessible for beginners or those cautious about sharing personal information.

Pros and Cons

| Pros | Cons |

|---|---|

| Tradingview Integration | Limited Leverage Compared to Mexc |

| Social Crypto Network | Higher Futures Fees |

| No KYC for Low Volume Trading | Restricted in Many Countries |

| Varied Trading Options | Lower Daily Withdrawal Limit without KYC |

Mexc: The Contender

Mexc, established in 2018, has swiftly risen to prominence in the world of cryptocurrency exchanges. Renowned for its vast selection of cryptocurrencies and competitive fee structure, Mexc caters to both novice and seasoned traders.

Vast Selection of Cryptocurrencies

One of Mexc’s most significant advantages is its extensive range of available cryptocurrencies. With over 1690+ coins listed, the platform provides users with an unparalleled variety of trading options. This diversity not only caters to those looking to trade popular cryptocurrencies but also offers opportunities in lesser-known, potentially high-growth altcoins.

Competitive Fee Structure

Mexc distinguishes itself with its fee strategy. The platform boasts one of the lowest fee structures in the industry, with zero spot trading fees. This is a compelling feature, especially for active traders, as it can significantly reduce the cost of frequent transactions.

High Leverage and Copy Trading

Offering a maximum leverage level of 200x, Mexc is one of the best crypto leverage trading platforms. Additionally, like Bingx, Mexc provides a copy trading feature, allowing users to emulate the trades of experienced investors, which is particularly beneficial for beginners.

User-Friendly Interface and Robust Security

The platform is designed with a user-friendly interface, making it accessible for newcomers to the crypto space. Alongside this, Mexc places a strong emphasis on security, employing industry-leading practices to ensure the safety of users’ funds and data.

Unique Kickstarter Feature

Mexc’s Kickstarter feature is another notable aspect. This program allows users to participate in various projects and potentially gain rewards, adding an innovative dimension to the traditional trading experience.

Pros and Cons

| Pros | Cons |

|---|---|

| Massive Coin Selection | No Tradingview Integration |

| Lowest Fees in Industry | |

| High Leverage Options | |

| Copy Trading Feature |

Comparative Analysis: Bingx vs Mexc

When comparing Bingx and Mexc, it’s crucial to delve into the specifics of what each platform offers. Both established in 2018, they have developed unique features and services catering to various traders’ needs. Let’s break down their offerings in detail.

Detailed Comparative Chart

| Feature | Bingx | Mexc |

|---|---|---|

| Establishment Year | 2018 | 2018 |

| Number of Coins | 540+ | 1690+ |

| Trading Options | Spot Trading, Margin, Futures | Spot Trading, Margin, Futures |

| Max Leverage Level | 150x | 200x |

| Unique Features | Tradingview Integration, Social Crypto Network | Lowest Fees, Kickstarter |

| Spot Trading Fees | 0.1% | 0% |

| Futures Fees (Maker/Taker) | 0.02% / 0.04% | 0% / 0.03% |

| Withdrawal Fees (USDT/BTC/LTC) | 1 USDT, 0.00035 BTC, 0.00097 LTC | 1 USDT, 0.0003 BTC, 0.001 LTC |

| Copy Trading | Yes | Yes |

| KYC Requirement for Daily Limit | No (50K USDT per day) | No (30 BTC per day) |

| P2P / Buy Crypto | Yes | Yes |

| Mobile App | Yes | Yes |

| Customer Support | Ticket, Email, Webchat, Social Media | Ticket, Email, Webchat, Social Media |

| Prohibited Countries | Afghanistan, Burundi, CAR, Congo, Mainland China, Hong Kong, Macau, Singapore, Ethiopia, Guinea, Guinea-Bissau, Iraq, Iran, North Korea, Lebanon, Sri Lanka, Libya, Netherlands, Serbia, Sudan, Somalia, South Sudan, Syria, Thailand, Tunisia, Trinidad and Tobago, Uganda, Venezuela, Yemen, Zimbabwe, Cuba, USA, Canada | North Korea, Cuba, Sudan, Syria, Iran, Crimea, Mainland China, Indonesia, Singapore, Venezuela, USA, Canada |

Analysis of Key Differences

Cryptocurrency Diversity

Mexc offers a significantly larger selection of cryptocurrencies (1690+) compared to Bingx (540+). This variety can be crucial for traders looking to diversify their portfolios or explore less mainstream coins.

Trading Costs

Mexc takes the lead in terms of trading fees, offering zero spot trading fees compared to Bingx‘s 0.1%. However, Bingx‘s futures fees are competitively low, which might appeal to futures traders.

Leverage Opportunities

With a maximum leverage of 200x, Mexc provides higher leverage options than Bingx‘s 150x. This could be a deciding factor for traders seeking high leverage trading.

Unique Selling Points

Bingx boasts a unique combination of Tradingview integration and a social crypto network, enhancing the trading experience through community engagement and advanced analysis tools. On the other hand, Mexc‘s standout features include the lowest fees in the industry and the Kickstarter program, offering novel investment opportunities.

User Accessibility

Both platforms offer copy trading and no mandatory KYC for substantial daily withdrawal limits, making them accessible to a broad range of traders. Their mobile app availability and multi-channel customer support further enhance user accessibility.

Geographical Restrictions

Both have a list of prohibited countries, but the specifics vary. It’s essential for potential users to check whether their country is listed.

Alternative to Bingx and Mexc

For those exploring alternatives to Bingx and Mexc, several other cryptocurrency exchanges offer varied features and fee structures. These alternatives, like OKX, Bitget, Gate, Coinex, and Bybit, provide different benefits that might suit various trading needs and preferences. Let’s take a closer look at each of these alternatives.

Comparative Chart of Alternative Exchanges

| Exchange | Spot Trading Fees | Futures Maker Fees | Futures Taker Fees | Withdrawal Fees (USDT/BTC/LTC) |

|---|---|---|---|---|

| OKX | 0.1% | 0.02% | 0.05% | 1 USDT, 0.00007 BTC, 0.001 LTC |

| Bitget | 0.1% | 0.02% | 0.06% | 1 USDT, 0.0003 BTC, 0.01 LTC |

| Gate | 0.3% | 0.015% | 0.05% | 1 USDT, 0.001 BTC, 0.016 LTC |

| Coinex | 0.2% | 0.02% | 0.04% | 1 USDT, 0.0001 BTC, 0.001 LTC |

| Bybit | 0.1% | 0.02% | 0.04% | 1 USDT, 0.000085 BTC, 0.001 LTC |

Key Aspects of Each Alternative

OKX

Known for its comprehensive trading options, OKX offers competitive fees for both spot and futures trading. Its low withdrawal fees for BTC make it an attractive option for Bitcoin traders.

Bitget

Bitget stands out with its competitive futures maker and taker fees. However, its higher LTC withdrawal fee might be a consideration for some traders.

Gate

Although Gate has higher spot trading fees compared to others, it offers very competitive futures maker fees. Its higher withdrawal fees for BTC and LTC might be a downside for frequent withdrawers.

Coinex

Coinex offers a balanced fee structure across spot and futures trading. It has moderate withdrawal fees, making it a middle-ground option among these alternatives.

Bybit

With competitive fees in both spot and futures trading, Bybit is a popular choice among traders. It also maintains reasonable withdrawal fees, particularly for BTC.

Conclusion

In the competitive and ever-evolving world of cryptocurrency exchanges, choosing between Mexc and Bingx is not just about picking a platform; it’s about aligning with an ecosystem that resonates with your trading philosophy and requirements. Our comprehensive comparison of Mexc vs Bingx sheds light on the unique offerings, strengths, and limitations of each, providing a guide to help you make an informed decision.

The Decision-Making Process

When deciding between Mexc and Bingx, consider:

- Trading Preferences: Are you looking for a wide range of cryptocurrencies or specific trading tools and social features?

- Fee Structure: How important are trading and withdrawal fees in your overall trading strategy?

- Trading Style: Do you prefer a more community-oriented platform or one that focuses on individual trading with a vast selection of assets?

- Geographical Constraints: Ensure that your region is supported by the exchange you choose.

- Future Prospects: Consider each platform’s vision and how they align with your future trading plans.

Final Thoughts

Both Mexc and Bingx have carved their niches in the crypto exchange world, each offering unique features and experiences. While Mexc appeals with its extensive coin selection and low fees, Bingx attracts users seeking a more integrated and community-focused trading environment. Your choice should be informed by your personal trading needs, preferences, and the specific features you value most in a trading platform.

In the Mexc vs Bingx debate, there is no one-size-fits-all answer. It ultimately boils down to what you prioritize and value in your crypto trading journey. As the market continues to evolve, staying informed and adaptable will be key in navigating the dynamic world of cryptocurrency trading.

FAQs

What sets Bingx apart from Mexc in terms of user experience?

Bingx differentiates itself with its unique integration of a social crypto network and Tradingview. This not only facilitates a more community-oriented trading experience but also offers enhanced analytical tools directly within the platform. Mexc, while offering a straightforward and efficient trading interface, lacks these social and integrated analytical features.

How do the withdrawal limits of Bingx and Mexc compare for users without KYC?

Bingx offers a daily withdrawal limit of 50K USDT for users without KYC, while Mexc sets its limit at 30 BTC per day. This difference is crucial for traders who prefer to trade anonymously and could influence the choice between the two platforms based on individual withdrawal needs.

Are there any unique investment opportunities on Bingx similar to Mexc’s Kickstarter program?

While Bingx doesn’t offer a direct equivalent to Mexc’s Kickstarter program, its unique feature lies in its social crypto network, which allows traders to engage with, learn from, and even copy the trades of experienced users. This social aspect can be considered a different kind of investment opportunity, as it provides a platform for knowledge and strategy sharing.