Copy trading, a term that has been buzzing around the crypto and finance world, is a strategy that allows traders to copy the trades of experienced and successful traders. This article will delve into the importance of copy trading, its role in crypto and traditional finance, and how you can get started.

Table of Contents

Understanding Copy Trading

What is Copy Trading?

Copy trading, also known as copytrading, is a strategy that allows traders, especially those new to the markets, to select the strategies of experienced traders and replicate them in their own trading accounts. It’s a form of automated trading where the copier’s trades mirror those of the copied trader.

The concept of copy trading is simple: when the copied trader makes a trade, the same trade is automatically executed in the copier’s account. This includes all aspects of the trade, such as the opening, managing, and closing of positions.

What is a Copy Trader?

A copy trader is an individual whose trading strategy and trades are copied by other traders. They are typically experienced and successful traders who have demonstrated consistent profitability over time.

Copy traders play a crucial role in the copy trading ecosystem. They provide the trading strategies that other traders can follow. In return, they often receive a commission or fee from the profits generated by their followers.

The Evolution of Copy Trading

Copy trading has evolved significantly over the years. It originated in the forex market, where traders sought a way to benefit from the strategies of successful forex traders. Over time, the concept has been adopted by other markets, including stocks, commodities, and most recently, cryptocurrencies.

The evolution of copy trading has been driven by advancements in technology, particularly the rise of online trading platforms and social trading networks. These platforms have made it easier than ever for traders to connect, share strategies, and copy each other’s trades.

In conclusion, copy trading is a powerful tool that can help traders navigate the complex world of financial markets. By understanding what copy trading is and the role of a copy trader, you can make informed decisions and potentially improve your trading outcomes.

The Role of Copy Trading in Crypto and Finance

Copy Trading in the Crypto Market

In the world of cryptocurrencies, copy trading has emerged as a significant trend. The volatile nature of the crypto market makes it a challenging terrain, especially for novice traders. Here, copy trading serves as a bridge, enabling less experienced traders to navigate the market by following the strategies of seasoned crypto traders.

Copy trading in the crypto market works similarly to other markets. Traders select a crypto trader whose strategies align with their investment goals and risk tolerance. Once they’ve chosen a trader to copy, their trades are automatically replicated in the copier’s account.

This strategy has democratized access to the crypto market, allowing anyone to participate and potentially profit from the market’s movements, regardless of their trading experience or knowledge.

Copy Trading in Traditional Finance

Copy trading has also found its place in traditional finance, particularly in the forex and stock markets. It has been a game-changer, allowing new traders to learn from the best and experienced traders to diversify their strategies.

In traditional finance, copy trading has made trading more accessible to the general public. It has removed the barriers to entry that once existed, such as the need for extensive market knowledge and trading experience. Now, anyone can start trading by simply copying the trades of successful traders.

Comparison between Crypto and Traditional Finance Copy Trading

While the concept of copy trading is the same in both the crypto and traditional finance markets, there are some differences. The crypto market is more volatile and operates 24/7, offering more trading opportunities but also higher risk. On the other hand, traditional finance markets, like the stock and forex markets, have specific trading hours and are generally less volatile.

Copy trading plays a crucial role in both the crypto and traditional finance worlds. It has democratized trading, making it accessible to everyone, regardless of their experience or knowledge. Whether you’re interested in the crypto market or traditional finance, copy trading offers a unique opportunity to learn from experienced traders and potentially increase your profitability.

| Criteria | Crypto Copy Trading | Traditional Finance Copy Trading |

|---|---|---|

| Market Hours | Operates 24/7, providing continuous trading opportunities. | Operates during specific market hours, which vary depending on the market (e.g., Forex, Stocks). |

| Volatility | High volatility, which can lead to significant gains or losses. | Generally less volatile compared to the crypto market, providing more stability. |

| Asset Variety | Primarily focused on cryptocurrencies, which are numerous but can be less familiar to some traders. | Includes a wide variety of familiar assets such as stocks, forex, commodities, etc. |

| Regulation | Less regulated, which can increase risk but also provides opportunities for high returns. | Highly regulated, providing a level of protection for traders but also limiting potential returns. |

| Accessibility | Highly accessible due to the decentralized nature of cryptocurrencies. | Accessibility can be limited in some regions due to regulatory restrictions. |

| Speed of Transactions | Transactions can be executed quickly due to the digital nature of cryptocurrencies. | Transaction speed can vary and may be slower due to the need for intermediaries. |

| Risk Level | Higher risk due to market volatility and lack of regulation. | Lower risk due to regulation and less volatility. |

This chart provides a clear comparison between crypto and traditional finance copy trading. However, it’s important to note that both have their advantages and disadvantages, and the choice between the two should be based on individual trading goals, risk tolerance, and market knowledge.

Benefits of Copy Trading

Learning Opportunity

One of the most significant benefits of copy trading is the learning opportunity it provides. For beginners, it’s an excellent way to learn about the markets, trading strategies, and risk management. By copying the trades of experienced traders, beginners can observe and learn from their strategies, decision-making processes, and how they manage their trades and risk.

Diversification

Copy trading allows traders to diversify their trading strategies and risk. By copying different traders who employ various strategies and trade different assets, copiers can spread their risk across multiple trades and markets. This diversification can help to mitigate risk and potentially improve returns.

Saves Time

Copy trading can save traders a significant amount of time. Instead of spending hours analyzing the markets, developing strategies, and monitoring trades, traders can simply copy the trades of others. This can be particularly beneficial for part-time traders or those who do not have the time to dedicate to trading.

Access to Experienced Traders

Copy trading gives traders access to experienced and successful traders that they might not otherwise have. This access can be invaluable, particularly for novice traders who are still learning the ropes. By copying experienced traders, they can benefit from their knowledge, experience, and proven strategies.

Potential for Profit

While there are no guarantees in trading, copy trading can potentially increase a trader’s chances of making a profit. By copying the trades of successful traders, copiers can potentially share in their success and profits.

Potential Risks of Copy Trading

Dependence on the Copied Trader

One of the main risks of copy trading is the dependence on the copied trader. If the copied trader makes poor decisions or their strategy starts to fail, it can lead to losses for the copier. Therefore, it’s crucial to choose the right trader to copy, one with a consistent track record of profitability and a trading style that aligns with your risk tolerance.

Lack of Control

With copy trading, you give up a certain degree of control over your trades. Since the trades are automatically copied, you may not have the opportunity to intervene or make adjustments in response to market changes. This lack of control can be a disadvantage, especially in volatile markets.

Risk of Misunderstanding

Copy trading can lead to a misunderstanding of risk. Just because a strategy is profitable for one trader doesn’t mean it will be profitable for another. Each trader has a different risk tolerance, and a strategy that works for one trader might be too risky for another.

Reliance on Technology

Copy trading relies heavily on technology. If there’s a glitch in the trading platform or a delay in copying trades, it can lead to losses. Therefore, it’s important to use a reliable trading platform that offers robust copy trading features.

Risk of Scams

Unfortunately, the copy trading space is not immune to scams. Some unscrupulous individuals may pose as successful traders to attract copiers and then profit from their losses. It’s crucial to do your due diligence and choose a reputable copy trading platform.

How to Get Started

Choosing the Right Platform

The first step in getting started with copy trading is choosing the right platform. There are many platforms available, each with its own features, fees, and selection of traders to copy. When choosing a platform, consider factors such as its reputation, user reviews, customer support, and the transparency of its trading data.

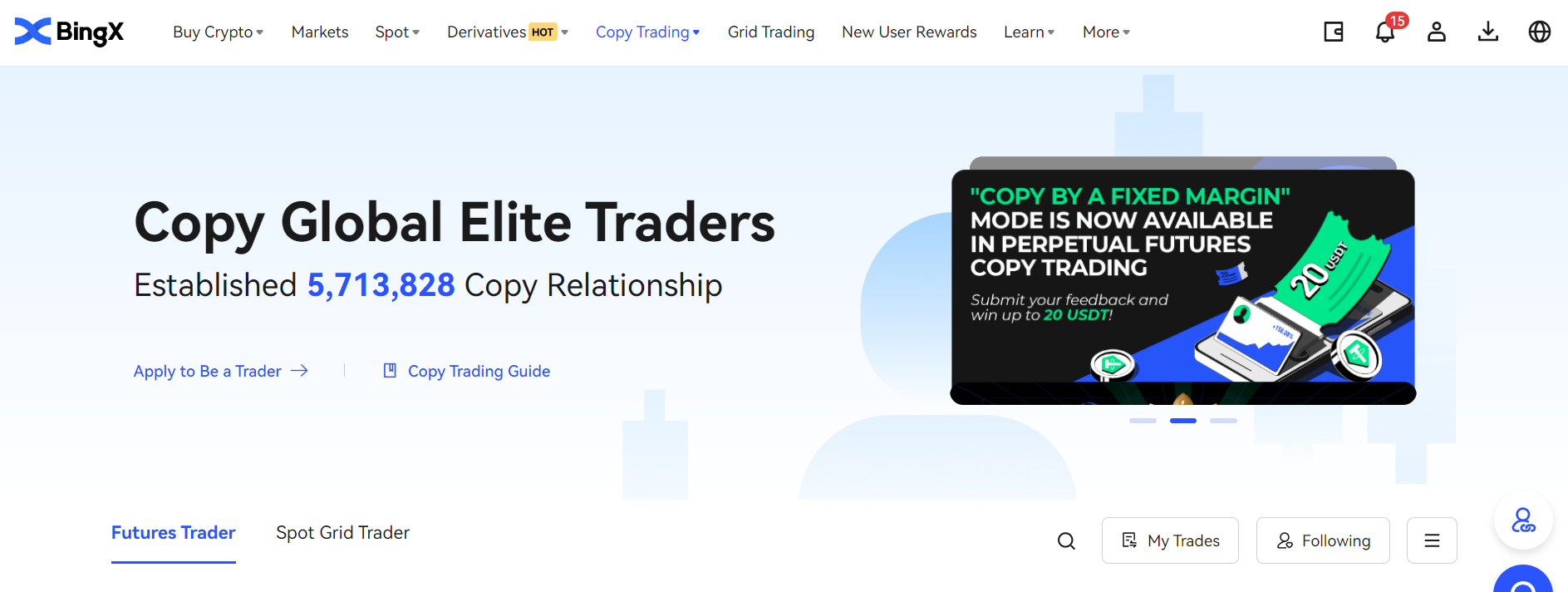

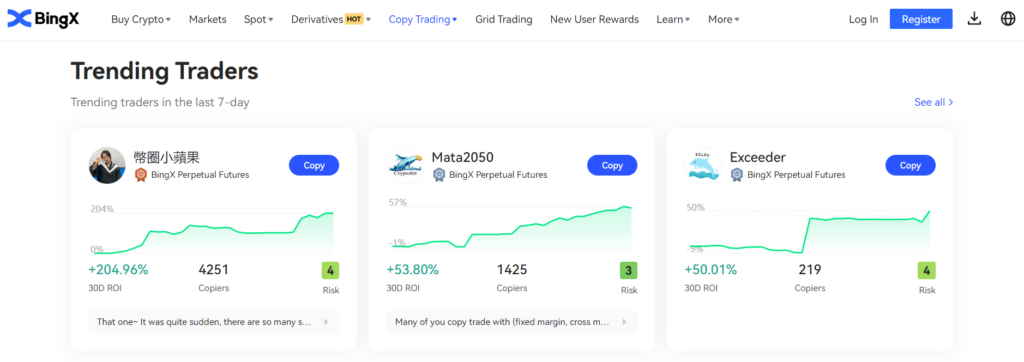

Among these platforms, BingX stands out as a pioneer in the field of copy trading. BingX has established itself as a powerful platform with a large number of copy traders. Its innovative approach and commitment to providing a user-friendly, secure, and transparent trading environment make it a top choice for many traders looking to explore copy trading. Therefore, we have chosen BingX as our preferred platform for this guide.

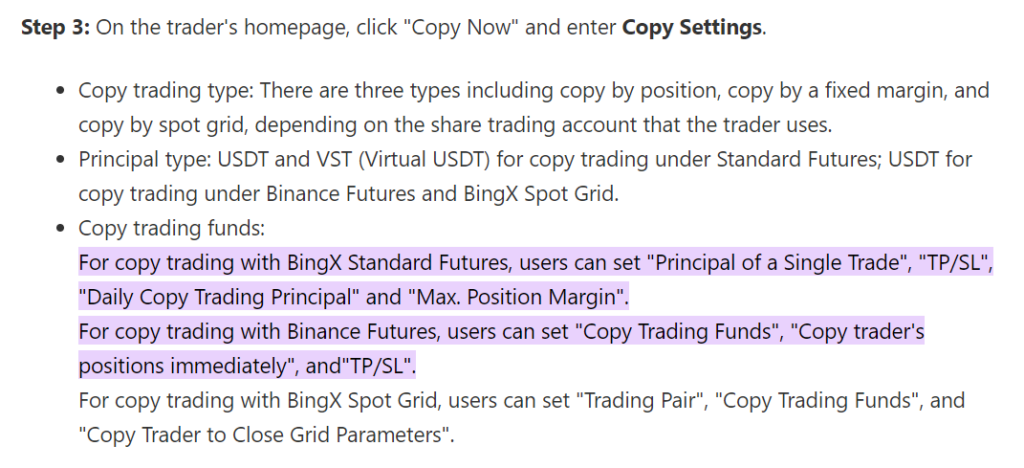

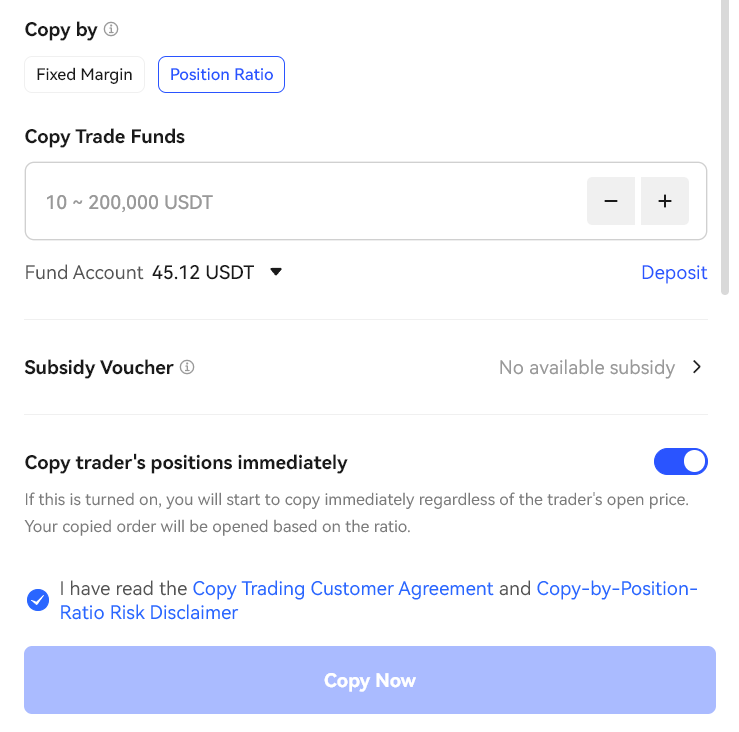

Understanding the Platform

Once you’ve chosen a platform, take the time to understand how it works. This includes understanding how to copy trades, how to manage your risk, and how to monitor and adjust your copy trading portfolio. Many platforms offer demo accounts where you can practice copy trading with virtual money before risking real money.

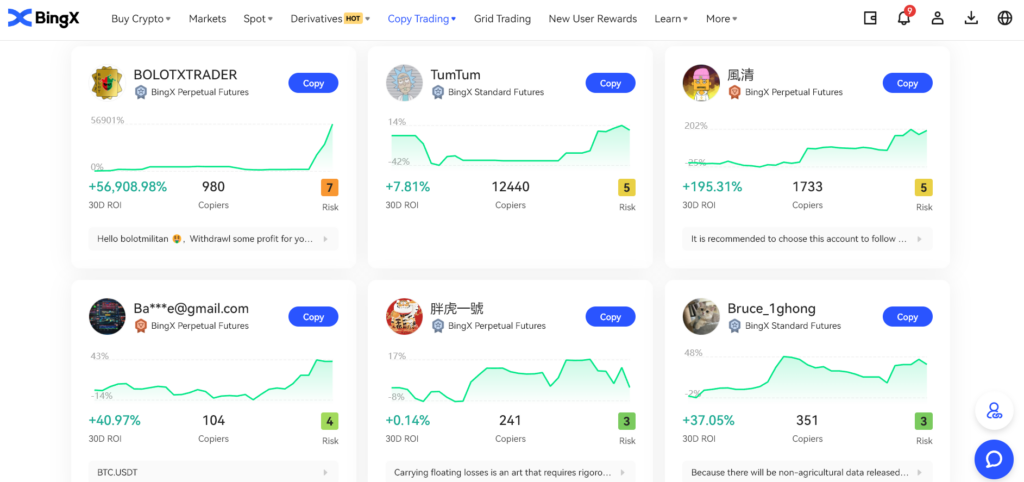

Selecting the Right Traders to Copy

Choosing the right traders to copy is crucial to your success in copy trading. Look for traders with a consistent track record of profitability, a trading style that aligns with your risk tolerance, and a good understanding of the markets they trade in.

Setting Up Your Copy Trading Portfolio

Once you’ve chosen the traders to copy, the next step is to set up your copy trading portfolio. This involves deciding how much money to allocate to each trader and setting up any risk management measures, such as stop losses or take profit levels.

Monitoring Your Portfolio

After you’ve set up your copy trading portfolio, it’s important to monitor it regularly. This includes reviewing the performance of the copied traders, making adjustments as necessary, and ensuring that your portfolio remains aligned with your trading goals and risk tolerance.

Top 5 Copy Trading Platforms in Crypto and Finance

| Platform | Key Features | Assets Available | Unique Selling Point |

|---|---|---|---|

| BingX | Copy trading, high security, user-friendly interface | Cryptocurrencies | Emphasizes user experience and security |

| MEXC | Spot trading, futures, copy trading, wide range of cryptocurrencies | Cryptocurrencies | Offers a wide range of services and cryptocurrencies |

| Bitget | Futures trading, spot trading, copy trading, detailed trader information | Cryptocurrencies | Provides detailed information about each trader |

| eToro | Social trading, wide range of assets, user-friendly interface | Stocks, commodities, forex, cryptocurrencies | Known for its social trading feature |

| ZuluTrade | Copy trading, advanced customization options, focus on forex | Forex, some other assets | Popular among forex traders, offers advanced customization options |

Selecting the Right Copy Traders

Here’s a flowchart to illustrate the process of selecting the right copy traders:

- Start: Begin your search for a trader to copy.

- Check Profitability: Look at the trader’s track record. Have they been consistently profitable?

- If yes, move to the next step.

- If no, continue your search for another trader.

- Assess Risk Management: Does the trader have a sound approach to managing risk?

- If yes, move to the next step.

- If no, continue your search for another trader.

- Evaluate Trading Style: Does the trader’s style align with your trading goals and risk tolerance?

- If yes, move to the next step.

- If no, continue your search for another trader.

- Ensure Transparency: Is the trader transparent about their strategies and trades?

- If yes, move to the next step.

- If no, continue your search for another trader.

- Communication: Does the trader communicate regularly with their followers?

- If yes, consider copying this trader.

- If no, continue your search for another trader.

Consistent Profitability

Look for traders who have a consistent track record of profitability. While past performance is not a guarantee of future results, it can provide an indication of the trader’s skill and strategy effectiveness.

Risk Management

Consider the trader’s approach to risk management. Traders who take excessive risks might achieve high returns in the short term, but they could also lead to significant losses.

Trading Style

Make sure the trader’s style aligns with your own trading goals and risk tolerance. For example, if you are risk-averse, you might want to avoid traders who engage in high-risk strategies.

Transparency

The best traders to copy are those who are transparent about their strategies and trades. They should provide clear explanations for their trading decisions, which can be educational for copiers.

Communication

Good traders often communicate regularly with their followers, providing updates and insights into their trading process. This can be a valuable source of learning and insight for copiers.

Copy Trading Strategies

Copy trading strategies can vary widely, but they often involve the following elements:

Diversification

One of the key strategies in copy trading is diversification. This involves copying trades from a variety of traders who employ different trading strategies and trade different assets. Diversification can help to spread risk and potentially improve returns.

Risk Management

Risk management is crucial in copy trading. This can involve setting a maximum drawdown limit for each copied trader, using stop losses to limit potential losses, and regularly reviewing and adjusting your copy trading portfolio.

Choosing the Right Traders

As mentioned earlier, choosing the right traders to copy is a key part of a successful copy trading strategy. Look for traders with a consistent track record of profitability, a trading style that aligns with your risk tolerance, and a good understanding of the markets they trade in.

Continuous Monitoring

Copy trading is not a set-and-forget strategy. It requires continuous monitoring and adjustment. This includes reviewing the performance of the copied traders, making adjustments as necessary, and ensuring that your portfolio remains aligned with your trading goals and risk tolerance.

Learning from Copied Traders

One of the benefits of copy trading is the opportunity to learn from experienced traders. Use this opportunity to understand their strategies, decision-making processes, and how they manage their trades and risk. This can help you to improve your own trading skills and knowledge.

A successful copy trading strategy involves diversification, risk management, choosing the right traders, continuous monitoring, and learning from copied traders. It’s important to remember that while copy trading can potentially increase your chances of making a profit, it also comes with risks. Always do your own research and consider your own trading goals and risk tolerance when developing your copy trading strategy.

The Future of Copy Trading

Copy trading has grown significantly over the past few years, and it’s likely to continue evolving in the future. Here are some trends and predictions for the future of copy trading:

Increased Adoption

As more people become aware of the benefits of copy trading, it’s likely that we’ll see increased adoption of this strategy. This could be particularly true in the crypto market, where the volatility and complexity of the market can make it challenging for novice traders.

Technological Advancements

Technological advancements will likely continue to drive the evolution of copy trading. This could include improvements in the algorithms used to copy trades, the development of more sophisticated risk management tools, and the integration of artificial intelligence and machine learning to help identify the best traders to copy.

Regulation

As copy trading becomes more popular, it’s likely that we’ll see increased regulation in this area. This could include rules around transparency, the vetting of traders who can be copied, and the protection of copiers’ funds. While increased regulation could pose challenges for some platforms, it could also help to increase trust and safety in copy trading.

Greater Transparency

In the future, we may see greater transparency in copy trading. This could include more detailed information about the strategies and performance of traders who can be copied, as well as clearer disclosure of the risks involved in copy trading.

Integration with Social Trading

Social trading, where traders share their strategies and trades with a community, is becoming increasingly popular. In the future, we may see more integration between social trading and copy trading, with copiers able to interact more directly with the traders they copy.

The future of copy trading looks promising, with increased adoption, technological advancements, regulation, greater transparency, and integration with social trading all likely to shape its evolution. However, as with all trading strategies, it’s important for traders to stay informed, understand the risks, and make decisions that align with their trading goals and risk tolerance.

Conclusion

Copy trading is a powerful tool in the world of crypto and finance. It offers a unique opportunity for traders to learn from the best and potentially increase their profitability. However, like any investment strategy, it comes with its risks. Therefore, it’s crucial to do your research, choose the right platform and trader to copy, and continuously monitor your investments.

The world of copy trading is vast and constantly evolving. From understanding what copy trading is and its role in crypto and traditional finance, to exploring its benefits and potential risks, and learning how to get started, we’ve covered a lot of ground in this article. We’ve also looked at some of the top copy trading platforms and discussed the future of copy trading.

Whether you’re a beginner looking to dip your toes into the trading world or an experienced trader looking to diversify your strategies, copy trading offers a wealth of opportunities. It’s a strategy that has democratized trading, making it accessible to everyone, regardless of their experience or knowledge.

However, it’s important to remember that successful copy trading requires more than just copying the trades of successful traders. It requires understanding, diligence, and a well-thought-out strategy. It’s about learning from others while also understanding your own trading goals and risk tolerance.

As we look to the future, it’s clear that copy trading will continue to play a significant role in the trading landscape. With advancements in technology and increased regulation, the world of copy trading is set to become even more transparent, accessible, and user-friendly.

In conclusion, copy trading is not just a trend, but a significant shift in the way trading is conducted. It’s a strategy that has the potential to empower traders of all levels, offering a unique blend of learning, earning, and community. As we navigate this exciting landscape, it’s important to stay informed, stay safe, and, most importantly, enjoy the journey. Happy trading!

FAQs

What is copy trading?

Copy trading is a strategy where traders, especially beginners, replicate the trades of experienced and successful traders automatically. When the copied trader makes a trade, the same trade is executed in the copier’s account. This strategy allows less experienced traders to benefit from the knowledge and success of more seasoned traders in the market.

What is a copy trader?

A copy trader is an individual who allows their trades to be copied by other traders. They are typically experienced and successful traders.

How to copy trade?

To copy trade, you first need to choose a trading platform that offers a copy trading feature. Once you’ve registered and funded your account, you can browse through a list of experienced traders available for copying. These traders usually have their trading performance and statistics publicly available. After selecting a trader whose strategy aligns with your investment goals and risk tolerance, you can allocate a certain amount of your funds to copy their trades. From this point, every trade they make will be automatically replicated in your account proportionally to the amount of funds you’ve allocated.

How does copy trading work?

Copy trading works by automatically replicating the trades of a chosen trader in your own trading account. When the trader you’ve chosen to copy executes a trade, the same trade is made in your account proportionally to the amount of funds you’ve allocated to copy them. This includes all aspects of the trade, such as opening, managing, and closing positions. The goal of copy trading is to allow less experienced traders to benefit from the strategies and success of more experienced traders.

What is copy trading in crypto?

Copy trading in crypto is a strategy where traders automatically replicate the trades of experienced cryptocurrency traders. When the copied trader executes a trade in their account, the same trade is automatically made in the copier’s account. This allows less experienced traders to navigate the volatile crypto market by leveraging the knowledge and strategies of more seasoned traders.

What is mirror trading?

Mirror trading is a strategy where traders automatically replicate the trades or trading strategies of other traders or trading algorithms. The term is often used interchangeably with copy trading. However, mirror trading traditionally refers to the automated copying of trades from pre-selected strategies, often developed by algorithmic trading systems, rather than individual traders.