In 2023, credit cards remain the primary financial reservoir for many. With the growing need to convert this capital into cryptocurrency, platforms like MEXC P2P have emerged as the go-to solution. If you’re looking to buy crypto with a credit card, here’s your essential guide.

Table of Contents

Why MEXC Platform?

A Seamless User Experience

MEXC Crypto Buying Platform is designed with the user in mind. Its intuitive interface ensures that even those new to the crypto world can navigate and execute transactions with ease. From registration to the final purchase, every step is streamlined to provide a hassle-free experience.

Competitive Rates and Low Fees

One of the standout features of MEXC P2P is its competitive pricing. Users can enjoy some of the best rates in the market, ensuring they get maximum value for their money. Additionally, the platform’s transparent fee structure means no hidden charges, providing clarity and trust.

Swift and Reliable Transactions

Time is of the essence in the volatile crypto market. MEXC OTC’s efficient transaction processing ensures that users can buy their desired cryptocurrency almost instantly, allowing them to capitalize on market trends.

Global Reach with Localized Solutions

MEXC OTC serves a global audience. Recognizing the diverse needs of its user base, the platform offers localized solutions, including support for multiple fiat currencies and regional payment methods.

Preparing for Your Purchase

Understanding the Importance of KYC

Before diving into the purchase process, it’s essential to understand the significance of the Know Your Customer (KYC) verification. KYC is a mandatory procedure for all legitimate crypto platforms, ensuring that they adhere to global anti-money laundering (AML) laws and combat financing of terrorism (CFT). By verifying the identity of its users, MEXC OTC ensures a safer and more transparent trading environment for everyone involved.

Step-by-Step KYC Process on MEXC

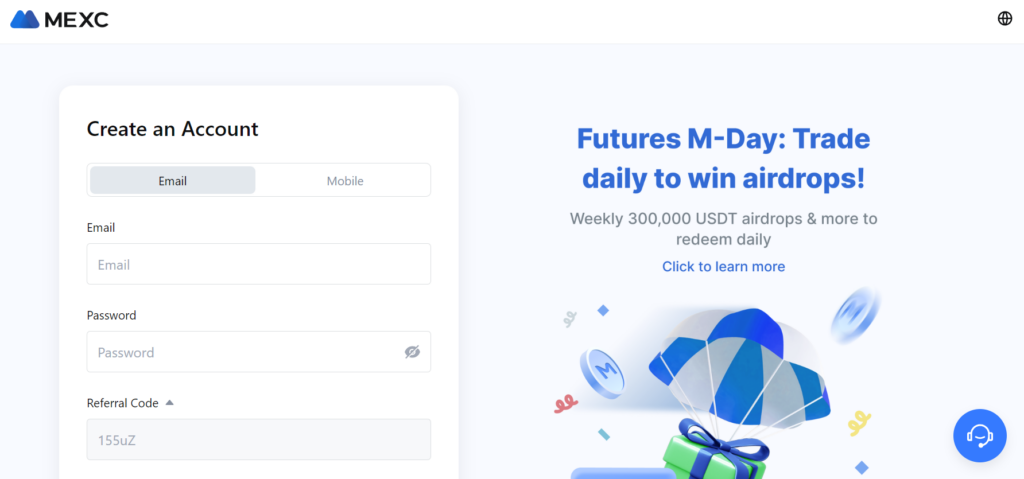

Registration

- Begin by signing up on the MEXC platform. You can use an email address or a phone number, based on your preference.

- Set a strong password, combining letters, numbers, and symbols to enhance security.

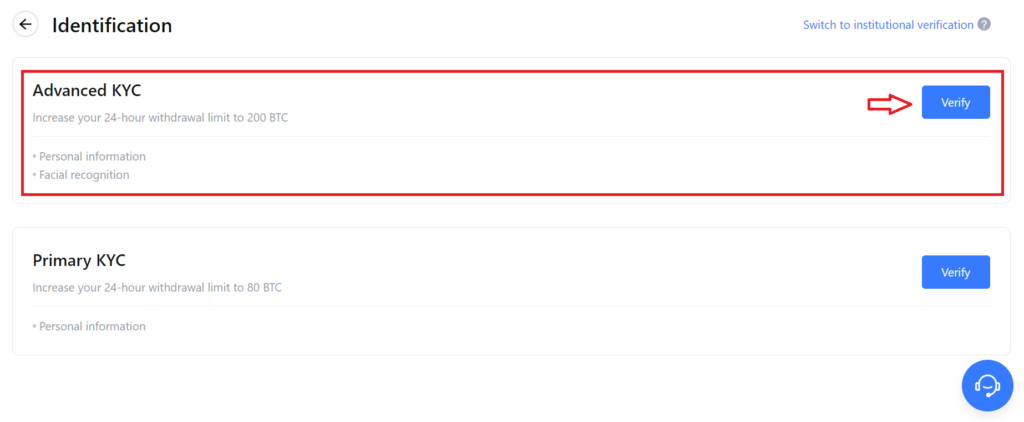

Accessing the KYC Section

- Once registered and logged in, navigate to your account or profile section.

- Here, you’ll find an option or a prompt for KYC verification. You need to pass Advanced KYC. Click on it to start the process.

Document Submission

- MEXC typically requires users to submit a government-issued identification document. This could be a passport, driver’s license, or any other valid ID.

- Some regions or specific user cases might also require additional documents, such as a utility bill or bank statement, to verify the user’s address.

- A selfie is requested to match the face to the ID provided, ensuring the person undergoing verification is the ID’s rightful owner.

Awaiting Approval

- After submitting the necessary documents, they are sent for review. MEXC’s verification team assesses the authenticity and clarity of the documents.

- The approval time can vary. While many users get verified within hours, it can sometimes take a couple of days, especially during high registration periods or if there’s a need for additional verification.

Buying Crypto on MEXC

Step-by-Step Guide

Accessing MEXC Platform

- Start by logging into your verified MEXC account.

- Navigate to the OTC section, which can be found on the main menu or dashboard. Alternatively, you can directly visit MEXC.

Choosing Your Desired Cryptocurrency

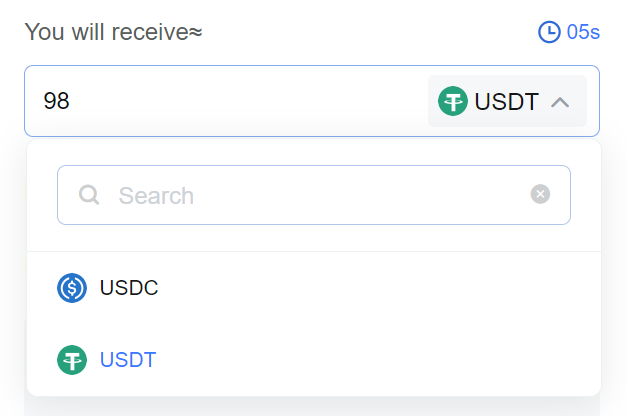

MEXC offers 2 types of stablecoins – USDT and USDC. From the dropdown menu or the listed options, select the cryptocurrency you wish to buy.

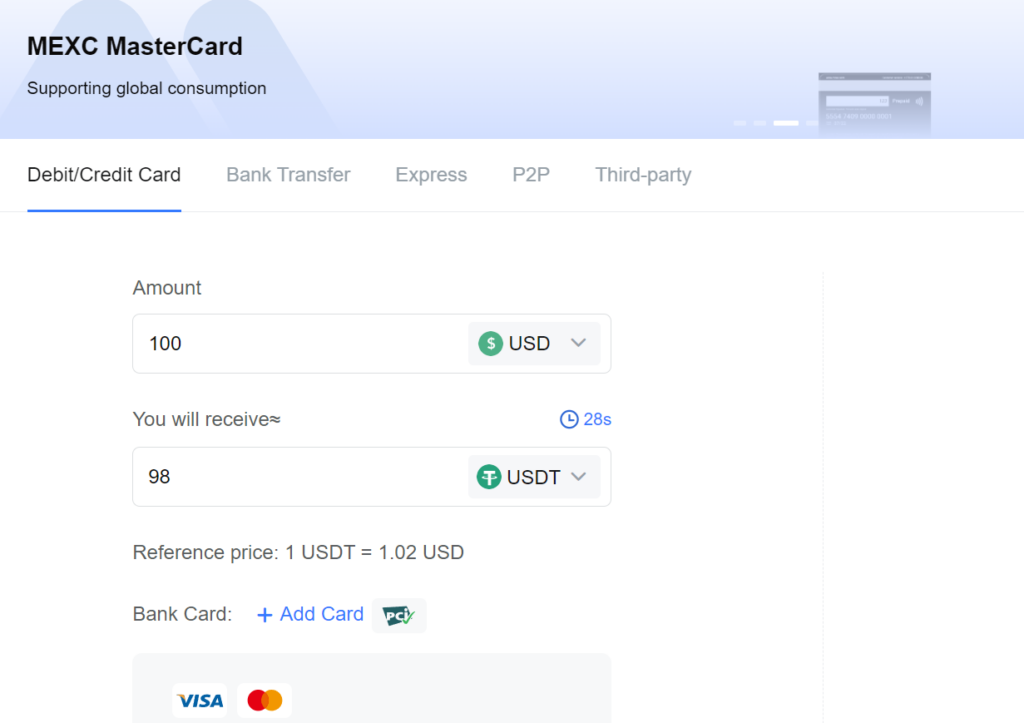

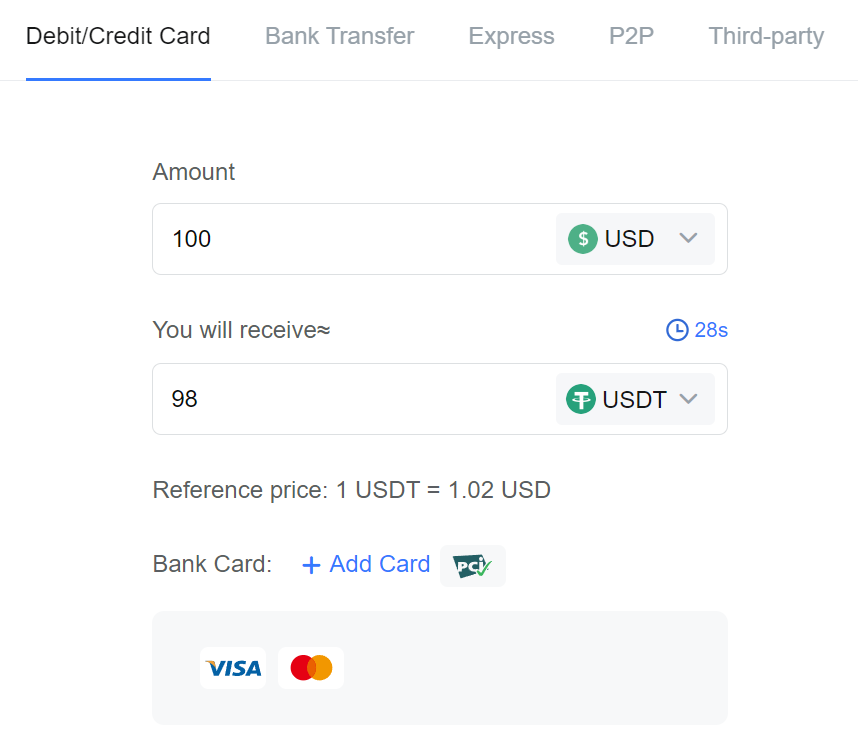

Inputting Purchase Details

- Specify the amount you want to invest. This can be inputted as the amount of fiat currency you’re spending or the amount of cryptocurrency you wish to receive.

- The platform will automatically provide a real-time conversion rate, showing you the exact amount of crypto you’ll receive for your specified fiat amount.

Selecting Payment Method

Choose “Credit Card” as your preferred payment method. Ensure that the credit card has sufficient funds for the transaction.

Reviewing Transaction Details

- Before confirming the purchase, review all transaction details. This includes the amount of crypto you’re buying, the conversion rate, any associated fees, and the total amount charged to your credit card.

- It’s crucial to double-check these details to avoid any misunderstandings or errors.

Completing the Transaction

- Once you’ve reviewed and are satisfied with the transaction details, proceed to confirm the purchase.

- Follow the on-screen prompts, which may include inputting your credit card details and verifying the transaction through a one-time password (OTP) or other security measures provided by your bank.

Receiving Your Cryptocurrency

- After the transaction is successfully processed, the purchased cryptocurrency will be credited to your MEXC wallet.

- It’s advisable to check your MEXC wallet to confirm the receipt of the funds.

Safety Tips When Buying Crypto

Understanding the Digital Landscape

Before delving into specific safety tips, it’s crucial to understand the digital landscape of cryptocurrencies. Unlike traditional banking systems, crypto operates in a decentralized environment, making it essential for individual users to be proactive about their security.

Secure Internet Connection

- Always ensure you’re using a secure and private internet connection when making transactions or accessing your crypto wallet. Public Wi-Fi networks can be vulnerable to attacks and eavesdropping.

- Consider using a Virtual Private Network (VPN) for an added layer of security.

Use Official and Reputable Platforms

- Only buy crypto from well-known, reputable platforms or exchanges like MEXC.

- Always double-check the website’s URL to ensure you’re not on a phishing site. Look for “https://” at the beginning of the web address and verify the platform’s SSL certificate.

Enable Two-Factor Authentication (2FA)

- 2FA provides an additional layer of security beyond just a password. Even if someone knows your password, they won’t be able to access your account without the second verification method.

- Most platforms offer 2FA via SMS, authentication apps, or hardware tokens. Using authentication apps or hardware tokens is generally more secure than SMS.

Be Wary of Phishing Attempts

- Always be skeptical of unsolicited communications asking for your credentials, personal information, or urging you to click on suspicious links.

- Regularly update and run antivirus and anti-malware software on your devices.

Keep Software and Wallets Updated

- Ensure that your device’s operating system, software, and any crypto-related applications or wallets are regularly updated. Updates often contain security patches for known vulnerabilities.

Use Strong, Unique Passwords

- Avoid using easily guessable passwords like “password123” or “admin.”

- Consider using a passphrase, a combination of random words, or a mix of letters, numbers, and symbols. Password managers can help store and generate strong passwords.

Post-Purchase Tips

Transaction Records

Always keep a record of your transactions. MEXC will provide a transaction receipt or summary, which can be useful for future references or tax purposes.

Security

Consider transferring your purchased cryptocurrency to a private wallet, especially if it’s a significant amount. Hardware wallets or secure software wallets with two-factor authentication are recommended.

Stay Updated

Cryptocurrency prices can be volatile. Stay updated with market trends, news, and any platform-specific updates.

Credit Cards and Cryptocurrencies: What Lies Ahead?

Revolut Leading the Charge

Revolut, a renowned digital bank, has already integrated cryptocurrency support into its app. This move signifies a significant shift in the banking sector, with traditional financial institutions recognizing the growing importance and demand for cryptocurrencies. Users can now seamlessly buy, sell, and hold various cryptocurrencies alongside their traditional fiat currencies, all within a single platform.

Emergence of New Players and Integrations

While Revolut has been a pioneer, other financial institutions and fintech companies are not far behind. The integration of credit card payments with cryptocurrencies is becoming more prevalent, with several platforms offering services that bridge the gap between traditional finance and the crypto world.

For instance:

Visa’s Crypto Partnerships

Visa has been actively partnering with cryptocurrency exchanges and platforms, facilitating card deals that allow users to spend their crypto holdings seamlessly. Such collaborations are expected to boom, making crypto spending as straightforward as using a traditional credit card.

Mobile Wallets and Contactless Payments

Digital wallets like Apple Pay, Google Pay, and Samsung Pay are continuously evolving. With the rise of contactless payments, integrating cryptocurrency support is a logical next step. Users can expect to make crypto payments using NFC technology soon, tapping their phones to complete transactions.

Buy-Now-Pay-Later (BNPL) and Crypto

The BNPL model, which allows consumers to purchase products and pay over time in installments, is gaining traction. Integrating this model with cryptocurrencies can revolutionize online shopping, offering more flexibility and payment options to consumers.

Security Enhancements

As the integration between credit cards and cryptocurrencies deepens, security remains a top priority. Innovations like tokenization, where credit card information is encrypted, and the use of biometric authentication methods, such as fingerprinting and facial recognition, are being implemented to ensure safe transactions.

Regulatory Landscape and Cryptocurrencies

The rise of cryptocurrencies as a mainstream payment method brings regulatory challenges. Governments and financial regulators worldwide are working on frameworks to ensure that crypto transactions are transparent, secure, and compliant with anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations.

Conclusion

The decision to buy crypto with a credit card represents more than just a transaction; it’s a reflection of the evolving synergy between traditional finance and the burgeoning world of digital currencies. As we’ve seen, platforms like MEXC are at the forefront of this integration, offering users a seamless bridge between their familiar banking methods and the vast potential of cryptocurrencies.

In recent years, the option to buy crypto with credit card has transformed from a novelty to a standard, driven by consumer demand for convenience and immediacy. This shift is emblematic of a broader trend: the fusion of the old and the new, where established financial practices meet the disruptive force of blockchain technology.

However, as with all financial endeavors, the journey to buy crypto with a credit card comes with its challenges, particularly in the realms of security and regulation. It’s a testament to the industry’s resilience and adaptability that these challenges are met with innovation and stringent safety measures, ensuring that users can navigate this space with confidence.

In conclusion, as we stand at the crossroads of a financial revolution, the ability to buy crypto with a credit card is not just a convenience but a symbol of progress. It’s a clear indication that the world of finance is not static but ever-evolving, ready to embrace change and forge a path into the future.

FAQs

How to buy crypto with a credit card?

Register on a platform like MEXC, complete the KYC process, select your desired cryptocurrency, enter the purchase amount, choose the credit card payment method, and confirm the transaction.

Where can I buy crypto with a credit card?

You can buy crypto with a credit card on platforms like MEXC, which offers a secure and user-friendly interface for such transactions.

What cryptocurrency can I buy with a credit card?

On MEXC, you can directly buy stablecoins like USDT and USDC using a credit card. Once you have these stablecoins, you can easily trade them for any other cryptocurrency available on the platform.

Why can’t I buy crypto with a credit card?

Some banks or credit card providers have restrictions or policies against cryptocurrency purchases. Ask you bank support.

How to buy crypto with a credit card in the US or Canada?

MEXC operates in both the US and Canada. Simply register on the MEXC platform, complete the necessary KYC verifications, and follow the platform’s procedure to buy crypto using your credit card.