In the ever-evolving world of cryptocurrency, one term has been gaining significant traction: “What is a mining pool?” For many, this concept remains shrouded in mystery. This article aims to demystify mining pools, offering a comprehensive guide to their inner workings, benefits, and potential pitfalls.

Table of Contents

What is a Mining Pool?

Definition and Purpose

A mining pool, in the context of cryptocurrency mining, refers to the pooling of resources by miners. These miners share their processing power over a network, aiming to split the rewards equally based on the amount of work they contributed to the probability of finding a block. Essentially, a “share” is awarded to members of the mining pool who present a valid partial proof-of-work. The concept of mining pools began when the difficulty of mining became so high that it could take centuries for individual miners with slower equipment to generate a block. To address this challenge, miners started pooling their resources, allowing them to generate blocks more quickly and receive a portion of the block reward on a consistent basis, rather than sporadically.

Historical Context

The history of mining pools dates back to November 2010 when the first-ever Bitcoin mining pool, known as Slush, was launched. This was followed by the era of deepbit between 2011 and 2013, which at its peak held up to 45% of the network hashrate.

The years 2013 to 2014 saw the rise of GHash.IO, which replaced deepbit after the latter failed to support the newer stratum protocol. F2Pool then took the lead between 2014 and 2015, having launched in May 2013.

The period from 2016 to 2018 was marked by the rise of Bitmain and its AntPool, with Bitmain also controlling other smaller pools like BTC.com and ViaBTC. More recently, in 2019 and 2020, Poolin and F2Pool each held about 15% of the network hashrate. In 2020, Binance launched its mining pool, followed by Huobi and OKex, and Luxor introduced a US-based mining pool.

With the rise of Ethereum and other altcoins, the cryptocurrency landscape saw a surge in the number of altcoin mining pools. This led to the birth of specialized altcoin mining pools like 2Miners,Herominers, Woolypooly, and Vipor, catering to the growing demand and diversifying the mining pool ecosystem.

How Do Mining Pools Operate?

Mining pools are a response to the increasing difficulty of cryptocurrency mining. As individual miners found it harder to mine and earn rewards, the concept of pooling resources together emerged. But how do these pools function?

Collective Effort

At its core, a mining pool is a collective of miners who combine their computational power to increase the chances of solving a block. Instead of working in isolation, miners work together, and when one of them solves a block, the reward is distributed among all participants based on their contributed computational power.

Joining a Pool

The process of joining a mining pool can vary based on the pool’s policies and the preferences of the miner. Here’s a breakdown:

1. Registration-Based Mining: Some mining pools require users to register on their platform. After registration, miners receive credentials that allow them to configure their mining software to the pool’s server.

2. Anonymous Direct Wallet Mining: Many modern mining pools offer the option of anonymous mining. In this approach, miners don’t need to create an account or register. Instead, they directly use their cryptocurrency wallet address as their username to start mining. Rewards are then sent directly to this wallet, ensuring privacy and simplicity.

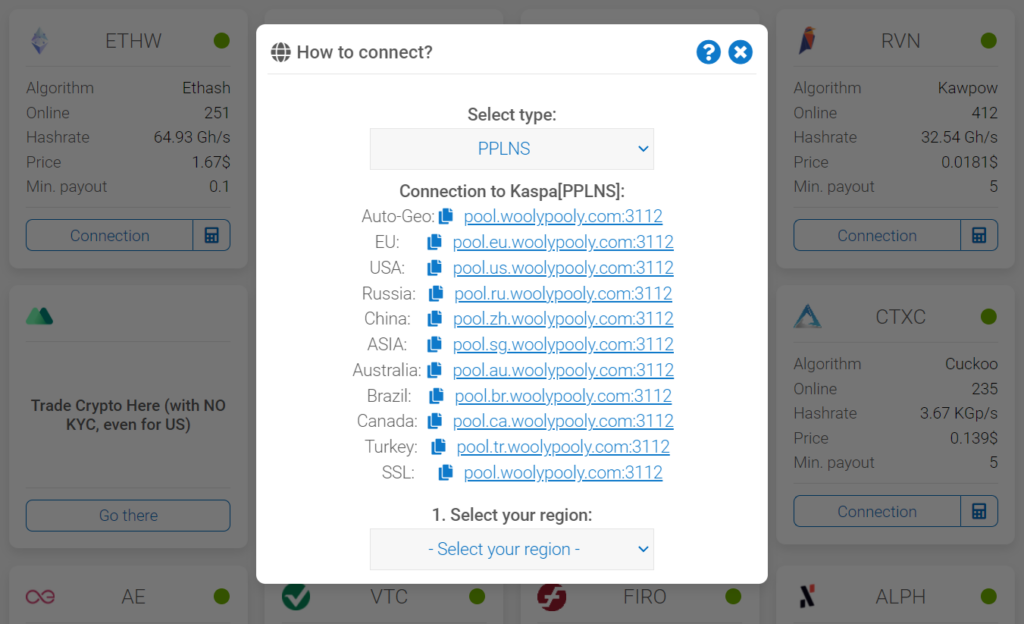

3. Hybrid Mining Options: Certain pools, like Woolypooly, provide flexibility by offering both methods. Miners can choose to mine anonymously using their wallet address or create an account for a more personalized experience.

Understanding Shares

When miners contribute their computational power to the pool, they are essentially working to solve cryptographic puzzles. For their efforts, they receive “shares.” These shares are proof of the miner’s contribution. The more computational power a miner contributes, the more shares they earn.

Reward Distribution

Different mining pools have different methods of distributing rewards:

- Pay Per Share (PPS): In this method, miners receive a set payout for each share they submit, regardless of whether the pool successfully mines a block.

- Pay Per Last N Shares (PPLNS): This method calculates payouts based on the last N shares submitted, regardless of block boundaries. It can be more volatile but potentially more rewarding than PPS.

- Proportional (PROP): Here, miners earn rewards proportional to the number of shares they’ve submitted to the pool.

Pool Fees

Operating a mining pool involves costs, such as server maintenance, security measures, and support staff. To cover these costs, pool operators often charge fees. These fees can be a fixed amount or a percentage of the miner’s earnings.

Pool Security

Security is paramount in mining pools. Operators implement measures to prevent malicious activities, such as Distributed Denial of Service (DDoS) attacks. Miners are also advised to use secure methods to access their pool accounts, like two-factor authentication.

Communication and Updates

Most mining pools have communication channels like forums, chat groups, or newsletters. These platforms allow miners to discuss strategies, share updates, and stay informed about any changes in the pool’s operation or policies.

Benefits of Mining Pools

Let’s delve into the advantages that make mining pools an attractive option for many.

Increased Probability of Earning Rewards

One of the primary benefits of joining a mining pool is the heightened chance of earning rewards. Solo miners compete against the entire network to validate a block, which can be particularly challenging given the increasing mining difficulty. In contrast, mining pools combine the computational power of multiple miners, increasing the likelihood of validating blocks and earning rewards.

Predictable and Regular Payouts

Mining pools offer a more consistent income stream. While solo miners might face long intervals between rewards due to the randomness of block discovery, mining pool participants can expect more frequent and predictable payouts based on their contributed computational power.

Reduced Variance in Earnings

Solo mining is akin to a lottery, where a miner might hit a block reward jackpot or might not earn anything for extended periods. Mining pools, on the other hand, distribute rewards among participants, ensuring that miners receive a steadier, albeit smaller, income. This reduces the financial unpredictability associated with solo mining.

Access to Advanced Mining Tools and Resources

Many mining pools offer sophisticated software and tools that enhance the mining experience. These can include real-time calculator, hardware section, etc. Additionally, pools often provide educational resources, forums, and customer support, helping miners troubleshoot issues and stay updated on industry trends.

Lower Entry Barrier for New Miners

For newcomers to the mining scene, setting up and optimizing mining operations can be daunting. Mining pools simplify this process. New miners can join a pool and start earning without the need for significant upfront investments or in-depth technical knowledge.

Potential Drawbacks and Risks

While mining pools offer numerous advantages, they are not without their challenges. Just as they simplify and amplify the mining process, they also introduce certain risks and potential downsides. It’s essential for miners to be aware of these drawbacks when considering joining a mining pool.

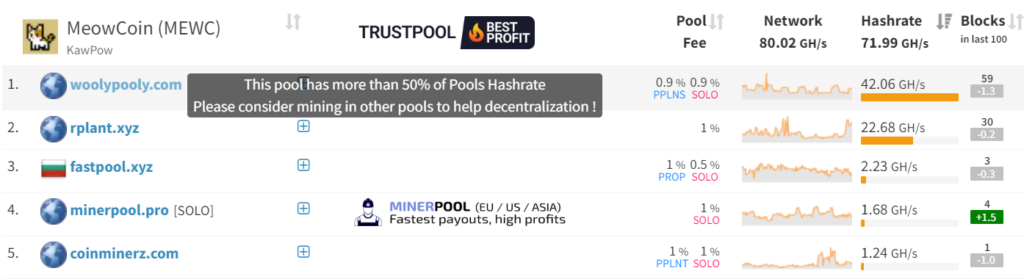

Centralization Concerns

One of the foundational principles of cryptocurrencies is decentralization. However, when a few large mining pools control a significant portion of the network’s total hashing power, it raises concerns about centralization. This concentration of power can potentially threaten the security and integrity of the blockchain, as it might make the network more vulnerable to a 51% attack, where a single entity gains control over the majority of the network’s mining power.

Hidden Charges

To maintain their infrastructure and offer services, mining pool operators often charge fees. These fees can vary widely between pools and can significantly impact a miner’s net earnings. Some pools might have transparent fee structures, while others might have hidden charges or high fees that can eat into miners’ profits.

Trustworthiness and Reliability

Not all mining pools operate with the same level of transparency and integrity. There have been instances where pool operators have been accused of withholding rewards or engaging in unfair practices. It’s crucial for miners to research and choose reputable pools to avoid potential scams or dishonest operators.

Potential for Pool-Hopping

Pool-hopping is a strategy where miners switch between pools to maximize their profits. While this might be beneficial for the individual miner, it can destabilize the pool’s overall hashing power and affect the regularity of rewards for other members. Some pools have implemented measures to deter pool-hopping, but it remains a concern.

Security Risks

Although many reputable pools invest in security, the pooling of resources can make them attractive targets for hackers. If a pool’s security is compromised, it can lead to the loss of earnings for its members.

Mining Pool Varieties

The cryptocurrency mining landscape is diverse, and so are the types of mining pools available to enthusiasts and professionals alike. Each type of mining pool caters to different needs and preferences, offering unique features and benefits. Let’s delve into the various kinds of mining pools and what sets them apart.

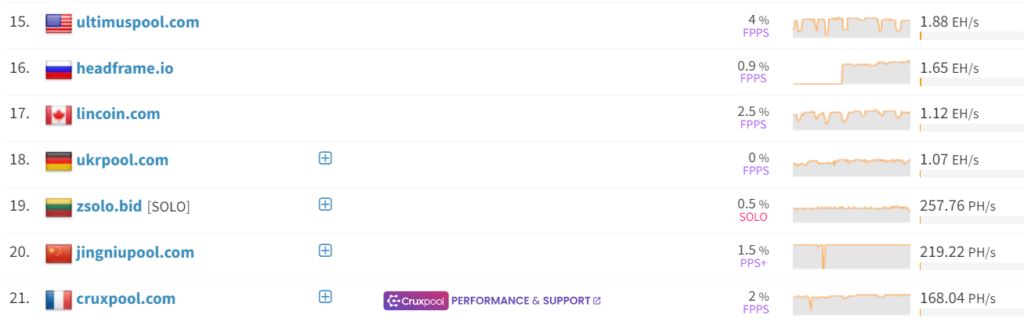

Geographically-Based Pools

These pools cater specifically to miners from certain regions or countries. The primary advantage of such pools is reduced latency due to proximity to the pool’s servers, leading to more efficient mining. Examples include pools that specifically serve the Asian, European, or North American markets.

Coin-Specific Pools

As the name suggests, these pools are dedicated to mining a particular cryptocurrency. Whether it’s Bitcoin, Ethereum, Litecoin, or any other coin, these pools optimize their operations for the specific requirements and algorithms of that cryptocurrency. Miners who want to focus on a single coin often choose these pools.

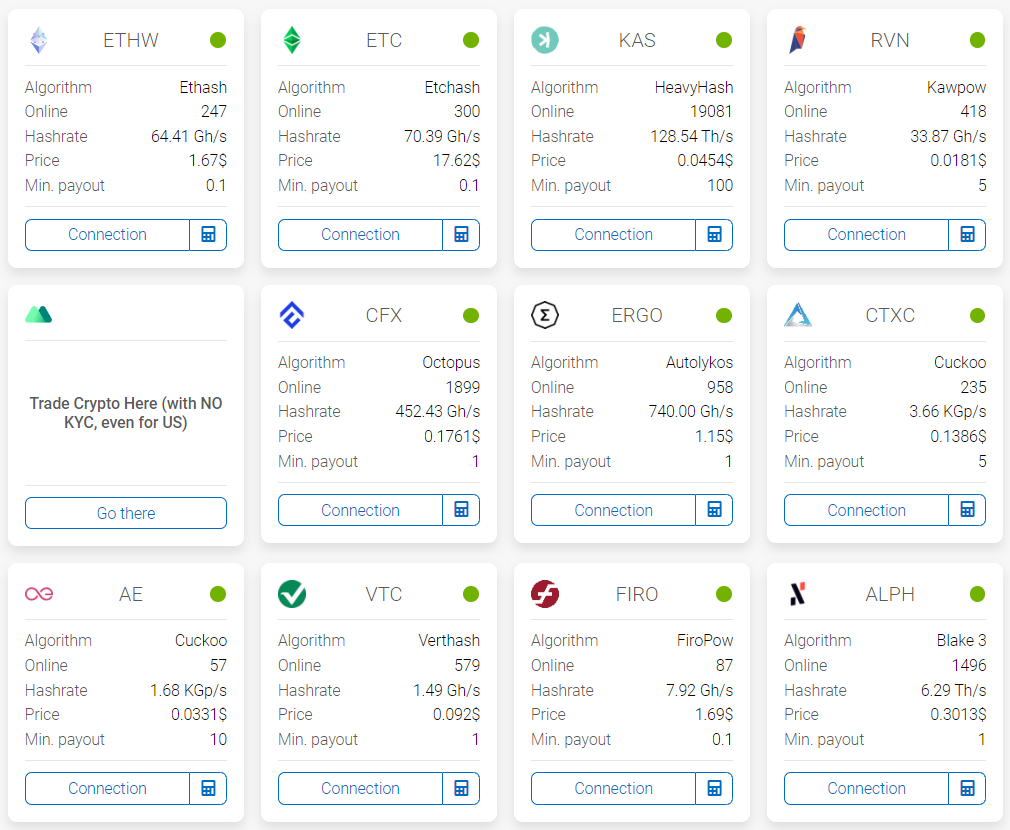

Multi-Currency Pools

These pools offer flexibility by allowing miners to mine multiple cryptocurrencies within the same pool. They often have systems in place that automatically switch to mining the most profitable coin based on real-time market conditions. This approach can maximize profitability, especially in volatile markets.

Private vs. Public Pools

- Private Pools: These are invite-only pools where only a select group of miners can participate. They might be set up by a group of friends, a business consortium, or any closed group. The exclusivity can offer benefits like more consistent rewards or specific community goals.

- Public Pools: Open to anyone, these pools allow miners to join freely without an invitation. They are more common and have a broader base of participants, leading to more significant combined hashing power.

Merged Mining Pools

Merged mining allows miners to mine two or more cryptocurrencies simultaneously without any additional computational effort. This is possible when two coins are based on different algorithms (one uses core and the other memory). Miners receive rewards in both cryptocurrencies, maximizing their earning potential.

Selecting the Ideal Mining Pool

Choosing the right mining pool is crucial for maximizing profitability, ensuring security, and having a seamless mining experience. WoolyPooly.com stands out as an ideal choice for miners, and here’s why:

1. Profitability

WoolyPooly prides itself on being one of the most profitable pools in the industry. With the PPLNS and SOLO reward systems, miners have the flexibility to choose their preferred reward distribution method. The low commission fee of just 0.9% ensures that miners retain a significant portion of their earnings.

2. Unique Features

- Vardiff: This feature automatically adjusts the difficulty of shares submitted by miners based on their hashing power, ensuring efficiency.

- Detailed Stats: Miners can access comprehensive statistics about their mining performance, helping them make informed decisions.

- Mining on Account: This feature offers a personalized mining experience, allowing miners to track their activities and rewards.

- Flexible Payouts: Miners can customize their payout thresholds and frequencies, providing them with better control over their earnings.

3. Exceptional Customer Service

WoolyPooly understands the importance of support. They offer multi-language assistance through various platforms:

- Discord: A platform where miners can interact, ask questions, and get real-time support.

- Telegram: Another platform for instant communication and support.

- Telegram Ru: Dedicated support for Russian-speaking miners.

4. Reliable Team

The team behind WoolyPooly is its backbone. Comprising:

- Experienced Mining Pool Supporters: Professionals who understand the intricacies of pool mining and are dedicated to ensuring smooth operations.

- Miners: Team members who have hands-on mining experience, ensuring that the pool caters to the real needs of miners.

- Entrepreneurs: Visionaries who drive the pool’s growth, innovation, and sustainability.

5. Top-Notch Infrastructure

WoolyPooly operates on dedicated servers, ensuring optimal performance and an excellent connection. This robust infrastructure minimizes downtime and maximizes mining efficiency.

6. Quality Coin Selection

WoolyPooly is discerning about the coins it supports. They list only those projects that have a promising short and long-term perspective, ensuring that miners are investing their resources in coins with good volume, a competent team, and a solid overall product.

Top Mining Pools Today

While the landscape is ever-changing, some pools have consistently ranked among the best. Stay tuned for our upcoming deep dive into these top contenders!

today:

| Mining Pool | Description | Key Features | Supported Coins |

|---|---|---|---|

| F2Pool | One of the oldest mining pools, supporting multiple cryptocurrencies. | Mobile app, daily payouts, multi-currency support. | BTC, LTC, XVG, HNS, CFX and others |

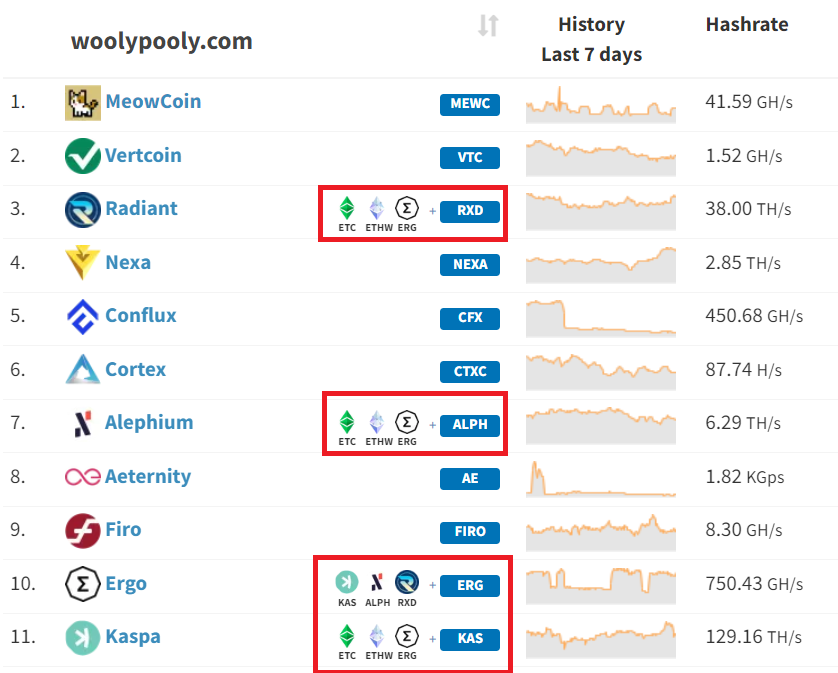

| WoolyPooly | A versatile mining pool that supports various coins and offers both direct and account-based mining. | PPLNS & SOLO mining, multiple coins, merge mining, instant payouts, telegram bot, mining calculator. | ETHW, ETC, RVN, CFX, KAS, NEXA, RXD and others |

| 2Miners | A pool designed for both beginners and professionals, offering regular payments and tutorials. | PPLNS & SOLO mining, regular payouts every 2 hours, supports multiple coins, telegram bot. | ETHW, ETC, RVN, KAS and others |

| Hiveon | Primarily an Ethereum Classic mining pool, known for its stability. | PPS+ reward system, daily earnings calculator. | ETC, RVN, KAS |

| Luxor | Offers a range of services for bitcoin miners, including a mining pool, firmware, and more. | Catalyst service for altcoin to BTC conversion, advanced monitoring, and customizable payouts. | BTC, ZEC, ZEN and others |

| Braiins (Slush) | The first-ever mining pool, now rebranded as Braiins. Has mined over 1.2M BTC since 2010. | Advanced payout system, worker management, and monitoring, multilingual support, and a focus on transparency. | BTC |

Mining Pools: What Lies Ahead?

The world of cryptocurrency is dynamic, with new technologies, regulations, and market forces continually shaping its trajectory. Mining pools, as a crucial component of this ecosystem, are not immune to these changes. As we look to the future, several trends and challenges are poised to redefine the landscape of mining pools.

Technological Advancements

As blockchain technology evolves, so will the tools and techniques used in mining pools. We can expect more efficient mining algorithms, advanced security measures, and innovative reward distribution methods. These advancements will aim to optimize the mining process, enhance security, and ensure fairer reward distribution.

Decentralization Efforts

One of the criticisms of current mining pools is the potential for centralization, where a few large pools control a significant portion of the network’s hashing power. The community is actively working on solutions to further decentralize mining efforts, reducing the risk of 51% attacks and ensuring the foundational principle of decentralization in cryptocurrencies remains robust.

Regulatory Landscape

As governments and regulatory bodies around the world grapple with the implications of cryptocurrencies, mining pools might face new regulations. These could relate to energy consumption, taxation, or even the legality of certain mining activities. Mining pools will need to adapt to these regulations, ensuring compliance while still maintaining profitability.

Environmental Concerns

The environmental impact of cryptocurrency mining, particularly Bitcoin, has been a topic of debate. The energy consumption of large mining operations is significant. As environmental concerns become more pronounced, mining pools might face pressure to adopt greener technologies or to offset their carbon footprint.

Rise of New Cryptocurrencies

The introduction of new cryptocurrencies can influence the mining pool landscape. As new coins with potentially more efficient or eco-friendly algorithms emerge, mining pools might shift their focus or diversify their operations to include these new opportunities.

Enhanced Security Measures

With increasing threats from hackers and malicious entities, mining pools will likely invest more in security measures. This includes protection against DDoS attacks, advanced encryption techniques, and regular audits to ensure the safety of miners’ earnings and the integrity of the pool.

Community and Collaboration

The future of mining pools will likely see a stronger emphasis on community building and collaboration. As the crypto space grows, fostering a sense of community among miners can lead to shared knowledge, collaborative problem-solving, and a more inclusive mining environment.

FAQs

What is a mining pool?

A mining pool is a collective group of cryptocurrency miners who combine their computational resources to increase their chances of validating blocks and earning rewards. Instead of mining individually, they work together and share the rewards based on their contributed computational power.

How to join a mining pool?

To join a mining pool, you typically need to:

* Choose a reputable mining pool.

* Register on the pool’s website (if required).

* Configure your mining software with the pool’s server details and your credentials.

* Start your mining software to begin mining with the pool.

How do I choose the best mining pool for my needs?

Research, engage with the community, and understand the pool’s technical and financial aspects.