The ability to purchase cryptocurrency using traditional payment methods, such as credit cards, has become a significant advantage for many investors. This article delves deep into the crypto exchanges that accept credit cards, ensuring that both novices and experts can navigate the crypto world with ease.

Table of Contents

Why Use a Credit Card to Buy Cryptocurrency?

The integration of credit cards into the world of cryptocurrency represents a significant step towards bridging the gap between traditional finance and the burgeoning digital currency ecosystem. Here are some compelling reasons why many are opting to use credit cards for their crypto transactions:

1. Familiarity and Ease of Use:

- Well-established System: Credit cards have been around for decades and are a staple in most people’s financial toolkit. This familiarity makes them a go-to choice for many, especially those new to the crypto space.

- User-friendly Interface: Most crypto exchanges that accept credit cards have designed their platforms to be intuitive. The process of buying crypto with a credit card often mirrors online shopping experiences, making it easy even for non-tech-savvy individuals.

2. Speed and Efficiency:

- Instant Transactions: One of the most significant advantages of using a credit card is the immediacy of transactions. Unlike bank transfers, which can take several days, credit card purchases are processed almost instantly. This speed allows investors to capitalize on timely market opportunities.

- No Need for Preloaded Funds: With credit cards, there’s no need to preload or transfer funds to the exchange beforehand. You can make a purchase directly, saving time and effort.

3. Flexibility and Accessibility:

- Global Reach: Credit cards are accepted worldwide, making them a universal payment method. This global reach ensures that people from different regions can access the crypto market without the need for localized payment methods.

- Diverse Options: Many exchanges offer a variety of cryptocurrencies that can be purchased directly with a credit card, giving users a broad spectrum of investment choices.

4. Credit Card Rewards and Benefits:

- Earn While You Spend: Many credit card companies offer rewards programs, including cashback, points, or miles. Using your card to buy crypto might earn you these rewards, effectively giving you additional value for your purchase.

- Purchase Protection: Some credit cards come with purchase protection, which can be beneficial if there are issues with the transaction. This added layer of security can provide peace of mind to users.

5. Building Credit History:

- Positive Impact: Regular and responsible use of a credit card, including paying off crypto purchases on time, can contribute positively to one’s credit history. This factor is especially relevant for individuals looking to build or maintain a good credit score.

6. Emergency Access to Funds:

- Leveraging Credit: In situations where an individual doesn’t have immediate access to liquid funds but anticipates having them soon, a credit card can act as a bridge, allowing for the purchase of crypto on credit.

Top 10 Crypto Exchanges That Accept Credit Cards

| Exchange | Transaction Fee | Supported Crypto | Min Amount |

|---|---|---|---|

| MEXC | 2% | USDT, USDC | 10 USD |

| OKX | 2-3% | USDT, BTC, ETH, BAT + 50 more | 1 USD |

| Bitget | 5.5% | USDT, BTC, ETH + 10 more | 15 USD |

| Bybit | 6.5% | USDT, BTC, ETH + 20 more | 2 USD |

| Coinex | 2% | USDT | 50 USD |

| Bingx | 2-3% | USDT, BTC, ETH | 5 USD |

| HTX (Huobi) | 2% | USDT, BTC, ETH + 5 more | 10 USD |

| KuCoin | 3-4% | USDT, BTC, ETH + 20 more | 35 USD |

| Binance | 3-4% | USDT, BTC, ETH, BNB + 100 more | 15 USD |

| Gate.io | 2.5%-4% | USDT, BTC, ETH, BAT + 50 more | 30 USD |

Note: For all the exchanges listed above, undergoing a KYC (Know Your Customer) verification process is mandatory when buying cryptocurrency with a credit card.

MEXC

- Transaction Fee: 2%

- Supported Crypto: USDT, USDC

- Minimum Amount: 10 USD

- Purchasing page: https://otc.mexc.com/checkout-deposit

MEXC is a popular crypto exchange with lowest fees known for its user-friendly interface and a wide range of supported cryptocurrencies. It has a strong emphasis on security, ensuring that users’ funds are protected.

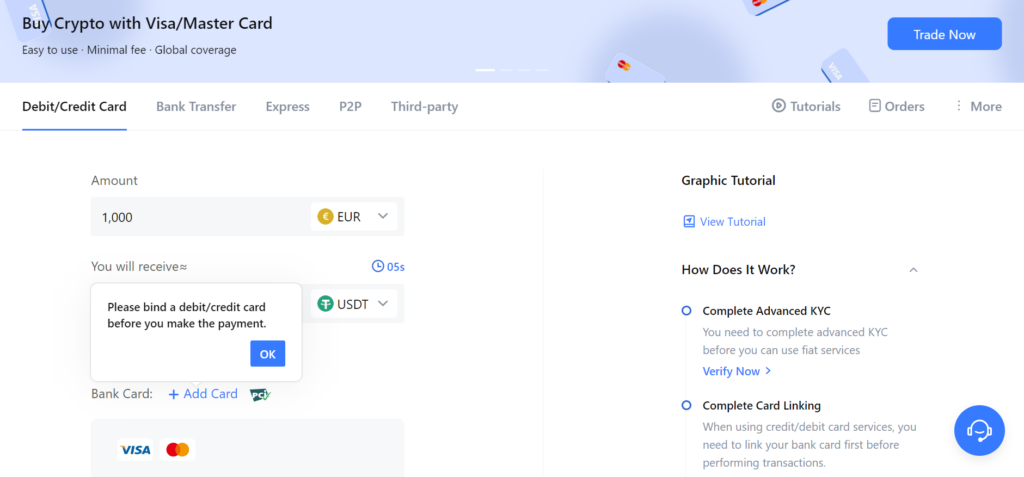

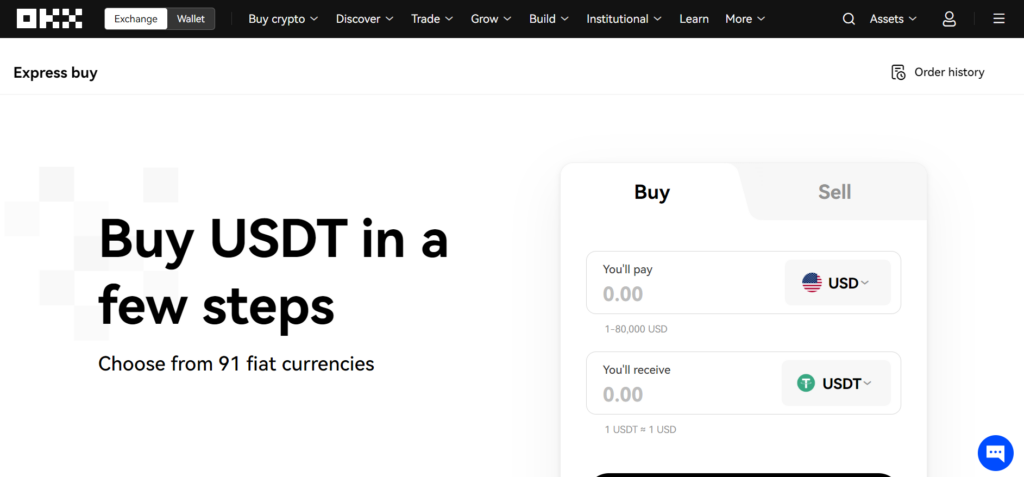

OKX

- Transaction Fee: 2-3%

- Supported Crypto: USDT, BTC, ETH, BAT + 50 more

- Minimum Amount: 1 USD

- Purchasing page: https://www.okx.com/buy-usdt

OKX is one of the world’s largest and most diverse cryptocurrency exchanges. It offers a wide range of cryptocurrencies and has advanced trading features suitable for both beginners and experienced traders. The platform is known for its liquidity and comprehensive market analysis tools.

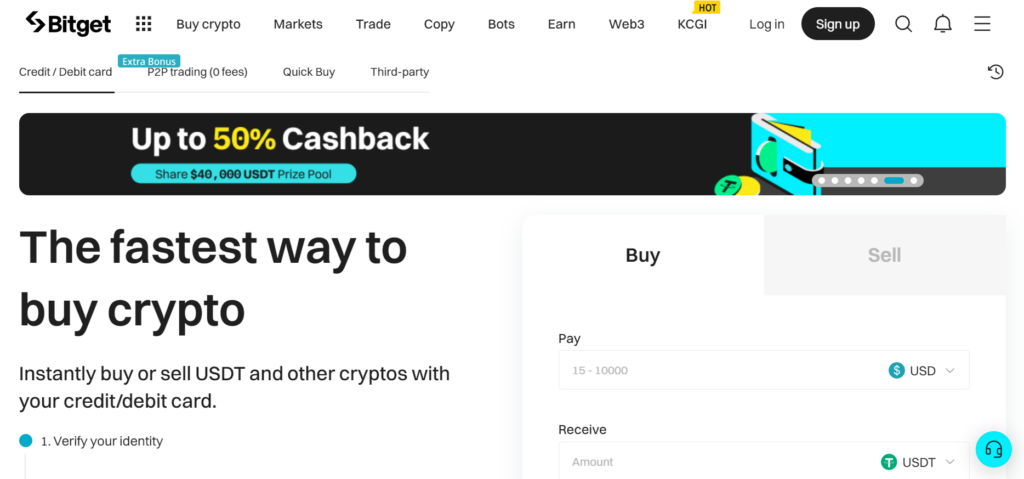

Bitget

- Transaction Fee: 5.5%

- Supported Crypto: USDT, BTC, ETH + 10 more

- Minimum Amount: 15 USD

- Purchasing page: https://www.bitget.com/buy-sell-crypto

Bitget is a global leading cryptocurrency trading platform, providing users with spot and derivatives trading. It’s recognized for its advanced matching system, robust security measures, and dedicated customer service.

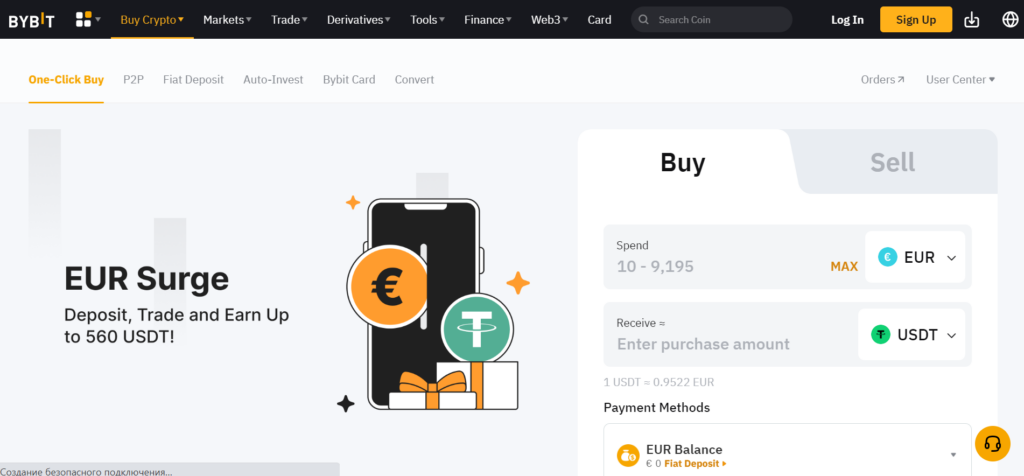

Bybit

- Transaction Fee: 6.5%

- Supported Crypto: USDT, BTC, ETH + 20 more

- Minimum Amount: 2 USD

- Purchasing page: https://www.bybit.com/fiat/trade/express/home

Bybit is a cryptocurrency derivatives exchange that offers a straightforward platform to trade various cryptocurrencies. It’s known for its intuitive interface, high liquidity, and a range of trading pairs.

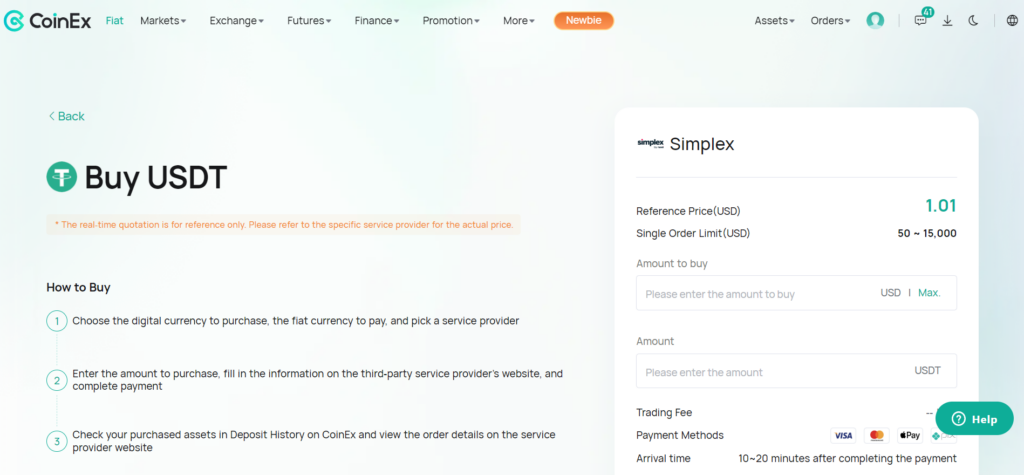

CoinEx

- Transaction Fee: 2%

- Supported Crypto: USDT

- Minimum Amount: 50 USD

- Purchasing page: https://www.coinex.com/en/trade-crypto/BUY-USDT-USD-Simplex

CoinEx, founded in December 2017, is a global and professional digital coin exchange service provider. It’s known for its high-speed matching engine, full-dimension protection, and high market depth.

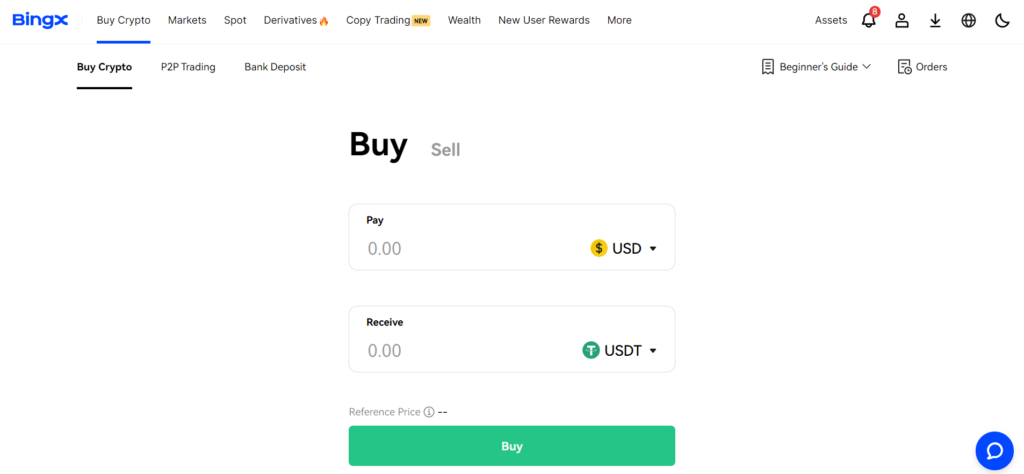

BingX

- Transaction Fee: 2-3%

- Supported Crypto: USDT, BTC, ETH

- Minimum Amount: 5 USD

- Purchasing page: https://bingx.paycat.com/en-us/

BingX is an emerging cryptocurrency exchange platform that emphasizes security, speed, and user experience. It offers a range of trading options and has been gaining traction in the crypto community for its innovative features.

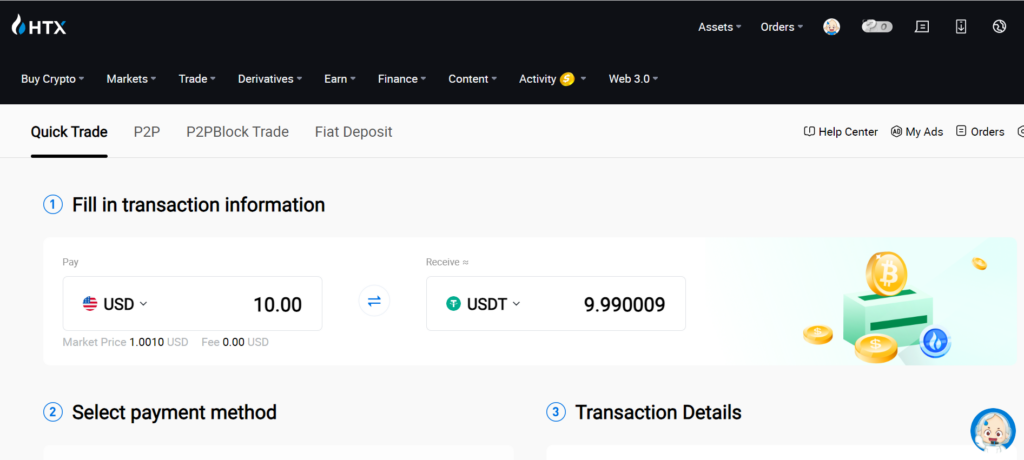

HTX (Huobi)

- Transaction Fee: 2%

- Supported Crypto: USDT, BTC, ETH + 5 more

- Minimum Amount: 10 USD

- Purchasing page: https://www.huobi.com/en-us/fiat-crypto/one-trade

Huobi is one of the world’s leading cryptocurrency exchange platforms. Founded in 2013, it has since grown to serve millions of users across over 130 countries. Huobi offers a secure and reliable service, with a wide range of crypto trading options.

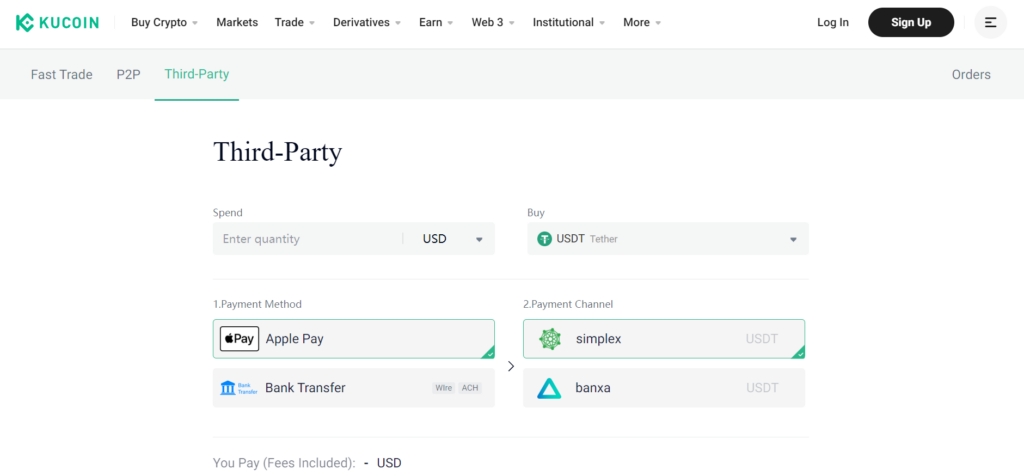

KuCoin

- Transaction Fee: 3-4%

- Supported Crypto: USDT, BTC, ETH + 20 more

- Minimum Amount: 35 USD

- Purchasing page: https://www.kucoin.com/assets/payments

KuCoin is a global cryptocurrency exchange known for its wide variety of coins and tokens. It offers advanced trading features, a secure platform, and a user-friendly interface, making it a favorite among many crypto enthusiasts.

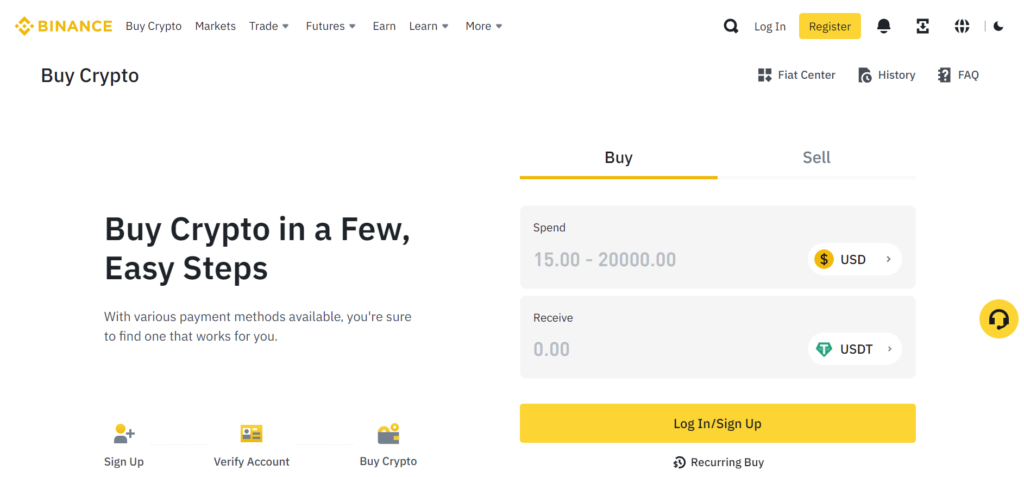

Binance

- Transaction Fee: 3-4%

- Supported Crypto: USDT, BTC, ETH, BNB + 100 more

- Minimum Amount: 15 USD

- Purchasing page: https://www.binance.com/en/crypto/buy/USD/USDT

Binance is one of the most prominent names in the cryptocurrency world. Founded in 2017, it quickly rose to become the largest crypto exchange in terms of trading volume. Binance offers a vast array of trading pairs, advanced trading tools, and a user-friendly experience.

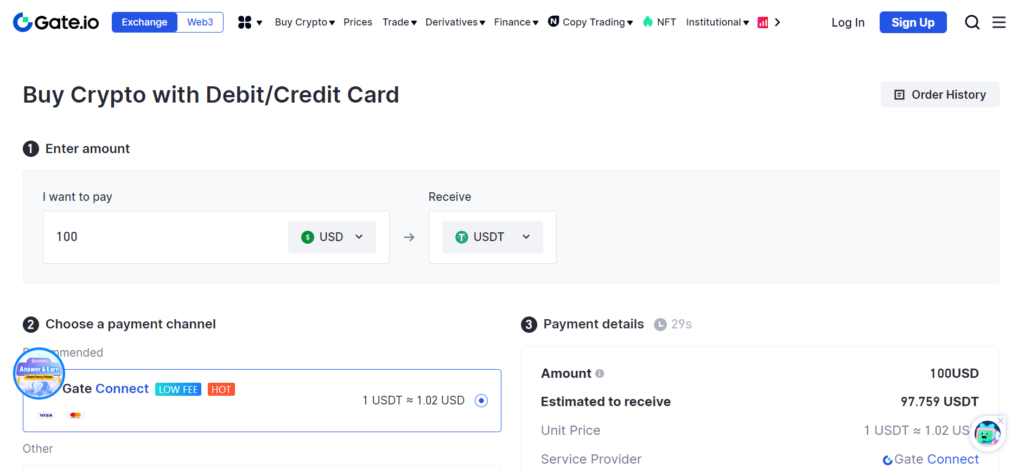

Gate.io

- Transaction Fee: 2.5%-4%

- Supported Crypto: USDT, BTC, ETH, BAT + 50 more

- Minimum Amount: 30 USD

- Purchasing page: https://www.gate.io/buy_crypto

Gate.io is a trading platform that offers a wide variety of cryptocurrencies. It’s known for its security measures, ensuring that users’ funds are safe. The platform also offers advanced trading tools and a comprehensive market analysis.

How to Buy Cryptocurrency with a Credit Card: Step-by-Step Guide

Buying cryptocurrency with a credit card has become increasingly straightforward due to the user-friendly interfaces of most exchanges. However, for those unfamiliar with the process, here’s a detailed step-by-step guide:

1. Research and Choose a Reputable Crypto Exchange:

- Reputation and Reviews: Start by researching various crypto exchanges that accept credit card payments. Look for user reviews, security features, and any reported issues.

- Supported Cryptocurrencies: Ensure the exchange supports the specific cryptocurrency you’re interested in purchasing.

2. Create an Account:

- Registration: Visit the chosen exchange’s website and sign up for a new account. This usually involves providing an email address, setting a password, and agreeing to the terms of service.

- Verification: Most exchanges will require you to verify your email address by clicking on a link they send to your inbox.

3. Complete KYC (Know Your Customer) Verification:

- Personal Details: Due to regulatory requirements, many exchanges require users to complete a KYC process. This involves providing personal details such as your full name, address, and date of birth.

- Document Submission: You may need to upload identification documents, such as a passport, driver’s license, or utility bill. Ensure you have these documents on hand and that they are clear and legible.

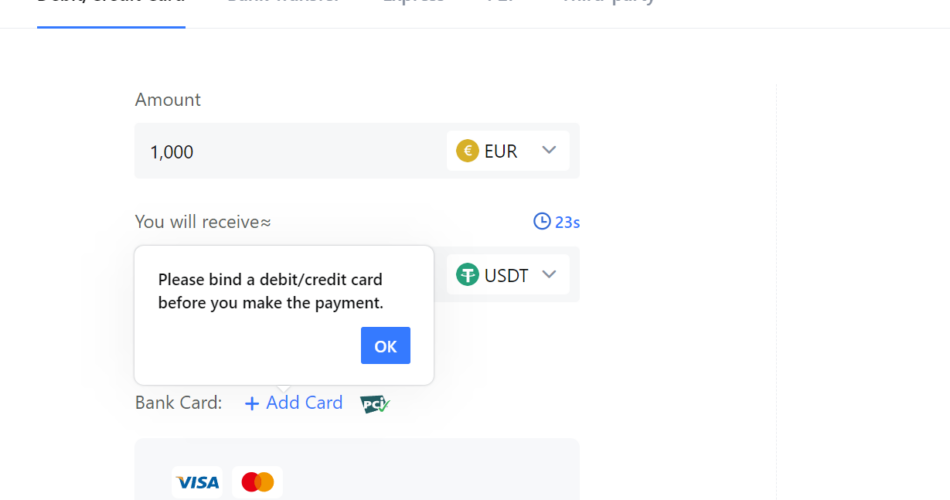

4. Link Your Credit Card:

- Add Payment Method: Navigate to the payment methods section and choose the option to add a credit card.

- Enter Details: Provide your credit card number, expiration date, CVV, and billing address. Some exchanges might require additional verification, such as a small test transaction or a code sent to your mobile number.

5. Make the Purchase:

- Select Cryptocurrency: Navigate to the buy/sell section of the exchange. Choose the cryptocurrency you wish to purchase.

- Enter Amount: Specify the amount you want to buy, either in fiat currency (e.g., USD) or in crypto (e.g., 0.5 BTC). The system will display the equivalent amount based on the current exchange rate.

- Confirm Payment: Review the transaction details, including any fees. Confirm the purchase, and the exchange will process the transaction using your credit card.

6. Secure Your Investment:

- Enable Two-Factor Authentication (2FA): For added security, enable 2FA on your exchange account. This provides an extra layer of protection against unauthorized access.

- Transfer to a Private Wallet: While you can store your cryptocurrency on the exchange, it’s safer to transfer it to a private wallet, especially if it’s a significant amount. This way, you have full control over your funds and are less vulnerable to exchange hacks.

Potential Drawbacks

1. Purchase Limits:

- Capped Spending: Some crypto exchanges impose limits on the amount of cryptocurrency you can purchase via credit cards. These limits might be restrictive for users looking to make significant investments or capitalize on market opportunities.

2. Risk of Debt Accumulation:

- Overspending Concerns: The ease of using credit cards can sometimes lead to impulsive buying decisions, especially during volatile market conditions. If not managed wisely, users might accumulate significant debt, leading to financial strain.

3. Cash Advance Fees:

When you directly borrow cash from your credit card provider, it’s termed as a cash advance. Typically, you’d be charged a fee ranging from 3-5% of the borrowed amount. For example, if you took a cash advance of $200, you’d face fees between $6 and $10.

It’s essential to note that certain cryptocurrency transactions made via credit cards are treated as cash advances. A notable example is American Express, which categorizes crypto transactions in this manner. In such cases, you’d be charged either $5 or 10% of the transaction value, depending on which amount is higher. To put it in perspective, a cryptocurrency purchase worth $1,000 could potentially result in a $100 fee levied by your credit card company.

Always be aware of these additional costs when using a credit card for cryptocurrency transactions to avoid unexpected charges.

4. Impact on Credit Score:

- Credit Utilization Ratio: Large purchases can increase your credit utilization ratio, which is the percentage of your credit limit that you’re using. A high ratio can negatively impact your credit score, especially if you’re unable to pay off the balance promptly.

5. Chargebacks and Fraud Concerns:

- Double-edged Sword: While credit card chargebacks can protect consumers from fraudulent transactions, they pose a risk for exchanges. As a result, some platforms might be hesitant to support credit card transactions or might implement stringent verification processes to mitigate this risk.

6. Potential for Account Freezes:

- Suspicious Activity: Some credit card providers might flag cryptocurrency purchases as suspicious, leading to temporary account freezes or additional verification requirements. This can cause inconvenience and delay in accessing funds.

Tips for Securely Using Your Credit Card on Crypto Exchanges

- Always ensure the exchange website starts with “https”.

- Opt for exchanges with strong user reviews and security measures.

- Enable two-factor authentication for added security.

- Regularly monitor your credit card statements.

Conclusion

The cryptocurrency landscape has evolved significantly over the past few years, with a plethora of exchanges now available for users to buy and trade digital assets. Our analysis of the top 10 crypto exchanges that accept credit cards reveals a diverse range of platforms, each with its unique offerings, fee structures, and supported cryptocurrencies.

Key Takeaways:

- Diverse Fee Structures: Transaction fees among the top exchanges vary, ranging from 2% to as high as 6.5%. While lower fees might be enticing, it’s crucial to consider other factors such as security, user experience, and the range of supported cryptocurrencies.

- Broad Range of Supported Cryptocurrencies: While all exchanges support popular cryptocurrencies like USDT, BTC, and ETH, some platforms offer an extensive list of over 100 different digital assets. This diversity allows users to explore and invest in a wide range of cryptocurrencies based on their preferences and risk appetite.

- Minimum Purchase Amounts: The minimum purchase amounts differ across exchanges, with some allowing users to start with as little as 1 USD, while others have higher thresholds. This flexibility ensures that both novice investors and seasoned traders can find a platform that suits their investment needs.

- Mandatory KYC: It’s noteworthy that all the top exchanges require KYC (Know Your Customer) verification for buying crypto with a credit card. This mandatory step underscores the industry’s commitment to ensuring secure and compliant transactions.

- Potential Cash Advance Fees: An essential consideration for credit card users is the possibility of incurring cash advance fees. Some credit card providers might treat crypto purchases as cash advances, leading to additional charges. It’s advisable for users to check with their card providers before making transactions.

In conclusion, while the allure of the cryptocurrency world is undeniable, it’s imperative for users to conduct thorough research and choose an exchange that aligns with their needs and financial goals. Factors such as fees, supported cryptocurrencies, security measures, and user experience should all play a role in this decision-making process. As the crypto ecosystem continues to mature, users can expect even more features, enhanced security, and improved user experiences from these platforms in the future.

FAQs

Can I earn rewards using my credit card on crypto exchanges?

Yes, depending on your card’s reward program.

Are there hidden fees when using credit cards?

Always check the exchange’s fee structure before making a transaction.

How can I dispute a fraudulent transaction?

Contact your credit card provider immediately and follow their dispute resolution process.