Leverage trading has emerged as a double-edged sword. While it offers the allure of magnified profits, it also brings the peril of amplified losses. But what exactly is crypto leverage trading? And how can one navigate its treacherous waters? Dive in as we demystify the world of leveraged crypto trades.

Table of Contents

What is Crypto Leverage Trading?

Crypto leverage trading, at its core, is a financial tool that allows traders to amplify their exposure to cryptocurrencies without committing the full amount of capital upfront. It’s akin to a magnifying glass: while it can enlarge both potential profits and potential losses, the underlying asset remains the same.

Mechanism

When you engage in leverage trading, you’re essentially borrowing funds to increase your trading position. The initial amount you deposit to open such a position is known as the “margin.” The ratio between the total value of the trade and the margin you’ve deposited is the “leverage.” For instance, if you use 10x leverage, you’re trading a position ten times the size of your margin.

Why is it Attractive?

The primary allure of leverage trading is the potential for higher returns. For example, if you leverage a $100 investment to control a $1,000 position and the asset's price increases by 10%, you'd gain $100 (minus fees) instead of just $10 without leverage. However, the reverse is also true: a 10% decrease would result in a $100 loss.

How Does Crypto Leverage Trading Work?

Crypto leverage trading operates on the principle of margin. Here’s a simple breakdown:

Margin and Leverage

When you engage in leverage trading, you’re essentially trading on margin. This means you’re borrowing funds to increase your trading position. The amount you put down from your own pocket is the “margin”. The ratio between the total value of the trade and the margin you put down is the “leverage”. For instance, if you’re trading with a 10x leverage, it means for every $1 of your own money, you’re borrowing $9.

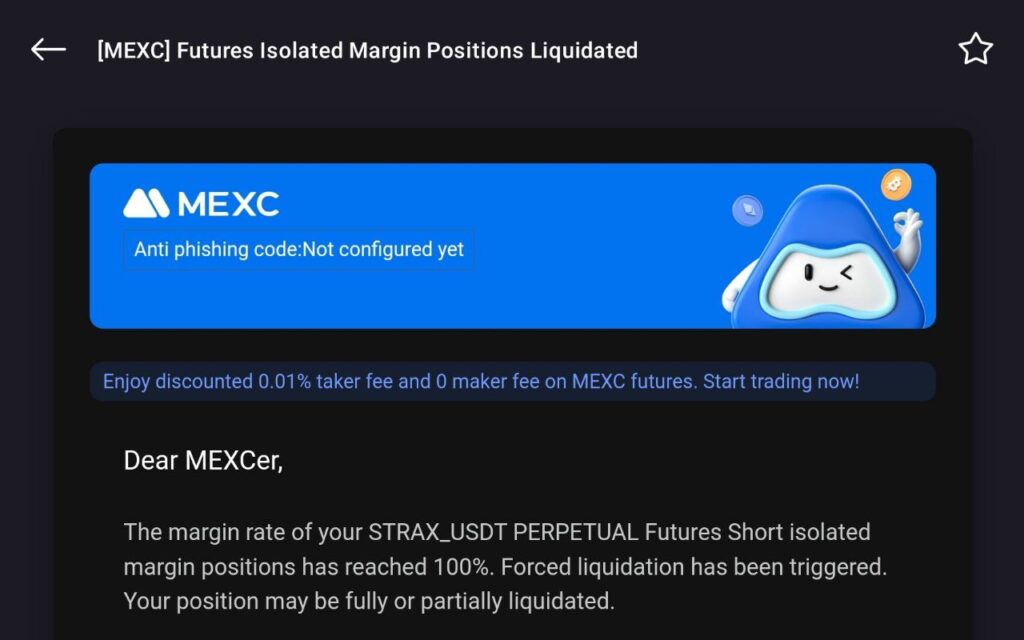

Liquidation

This is a crucial concept in leverage trading. If the market moves against your position to a certain extent where your losses equal your margin, the exchange will automatically close your position to ensure you don’t owe them money. This is known as getting “liquidated”. In our example, if Bitcoin‘s price dropped significantly and your position’s value fell to $9,000 (the amount you borrowed), you’d be liquidated, losing your initial $1,000.

Collateral

To ensure the borrowed amount is repaid, exchanges require collateral. This is typically the margin you put down. If a trade goes south and you’re at risk of not covering the borrowed amount, the exchange will use your collateral to cover the losses.

Fees and Interest

Leverage trading isn’t free. Exchanges charge fees for the privilege of borrowing funds. This can come in the form of a flat fee or interest on the borrowed amount. It’s crucial to be aware of these fees as they can eat into your profits, especially if you keep a leveraged position open for an extended period.

Risks and Rewards

The allure of leverage trading lies in its potential for higher returns. However, with greater potential rewards come greater potential risks. The crypto market is known for its volatility, and while this can lead to significant profits in leverage trading, it can also lead to substantial losses. It’s not uncommon for inexperienced traders to lose their entire margin in a short period.

Benefits of Crypto Leverage Trading

1. Amplified Profit Potential:

Higher Returns on Capital

One of the most enticing benefits of leverage trading is the potential for amplified profits. With leverage, traders can control a larger position with a relatively small amount of capital. This means that even small price movements in the market can lead to significant percentage gains on the margin invested.

Example

If a trader uses 10x leverage on a $1,000 investment, they control a $10,000 position. A 5% market move in their favor would result in a $500 profit, or a 50% return on their initial $1,000 investment, as opposed to a 5% return without leverage.

2. Access to More Capital:

Increased Buying Power

Leverage provides traders with increased buying power, allowing them to open positions that would be otherwise out of reach with their available capital. This can be especially beneficial for traders with limited funds who want to capitalize on specific market opportunities.

3. Diversification Opportunities:

Spread Investments

With access to more capital through leverage, traders can diversify their positions across various cryptocurrencies or other assets. Diversification can help spread risk, as the performance of individual assets can offset losses in others.

4. Hedging Possibilities:

Protecting Investments

Traders can use leverage trading as a hedging tool against potential losses in their investment portfolio. For instance, if a trader believes that a particular cryptocurrency in their portfolio might experience a short-term drop in value, they can open a leveraged short position to potentially profit from that drop, offsetting losses in their holdings.

5. Flexibility in Trading Strategies:

Long and Short Positions

Leverage trading platforms often allow traders to take both long (buying with the expectation of a price rise) and short (selling with the expectation of a price drop) positions. This flexibility means traders can profit from both rising and falling markets.

6. Potential for Lower Capital Allocation:

Efficient Use of Capital

Since traders can control larger positions with a smaller amount of money, they can potentially allocate less capital to a particular trade and use the remaining capital for other investments or to keep as reserve.

7. Promotional Offers and Bonuses for Leverage Traders:

Many exchanges roll out enticing promotions specifically tailored for leverage traders. A prime example of this is the recent initiative by MEXC:

MEXC’s Futures M-Day Event

MEXC is set to distribute a whopping 69,100 USDT future bonus in their upcoming Futures M-Day event. For traders who achieve a minimum trading volume of 45,000 USDT, they’ll be eligible to receive tickets, which could potentially win them a share of the futures bonus prize. But that’s not all! Even if your tickets aren’t selected in the main draw, there are participant awards up for grabs.

Magnifying the Markets: A Look at Popular Leverage Levels

Leverage in crypto trading acts as a magnifying glass, amplifying both potential profits and potential losses. Different exchanges offer various leverage levels, allowing traders to choose the degree of magnification they’re comfortable with. Here’s a breakdown of some of the most commonly used leverage levels in the crypto trading world:

| Leverage Level | Description | Potential Benefit | Potential Risk |

|---|---|---|---|

| 10x | Ten times the initial investment. This means for every $1 of your own, you’re trading with $10. | Moderate amplification of profits. Suitable for those looking for increased exposure without extreme risk. | Losses can be 10 times the adverse price movement. |

| 100x | A hundred times the initial investment. For every $1, you’re trading with $100. | High potential returns. Often used by experienced traders in specific market conditions. | Significant risk. A mere 1% adverse price movement can lead to a 100% loss. |

| 125x | One hundred twenty-five times the initial investment. Every $1 controls $125. | Even higher potential returns. Used by traders who are very confident in their market predictions. | Very high risk. Small market movements can lead to substantial losses. |

| 200x | Two hundred times the initial investment. A $1 position controls $200. | Maximum amplification of profits. Used by highly experienced traders in very specific scenarios. | Extremely high risk. Minute market changes can result in significant losses. |

Best Crypto Leverage Trading Platforms

| Platform | Trading Volume (24h) | Leverage Level | Maker Fees | Taker Fees | KYC Requirements |

|---|---|---|---|---|---|

| MEXC | $474 million | 200x | 0% | 0.03% | No (Limit: 30 BTC per day) |

| OKX | $550 million | 125x | 0.02% | 0.05% | No (Limit: 10 BTC per day) |

| BingX | $285 million | 150x | 0.02% | 0.04% | No (Limit: 50K USDT per day) |

| Bitget | $362 million | 125x | 0.02% | 0.06% | Yes (Full KYC) |

| Gate | $445 million | 125x | 0.015% | 0.05% | Yes (Full KYC) |

| Bybit | $736 million | 100x | 0.02% | 0.04% | Yes (Full KYC) |

Analysis:

Trading Volume

Bybit leads the pack with the highest 24-hour trading volume of $736 million, indicating high liquidity and active trading on the platform. MEXC and OKX also boast substantial trading volumes, making them popular choices among traders.

Highest Leverage Crypto Trading

MEXC offers the highest leverage level of 200x (for Bitcoin leverage trading), allowing traders to amplify their positions significantly. However, higher leverage also comes with increased risks.

Fees

MEXC stands out with a 0% maker fee, which can be highly beneficial for traders who add liquidity to the market. Taker fees across the exchanges are relatively competitive, with minor variations.

KYC Requirements

MEXC, OKX, and BingX offer the advantage of trading without full KYC verification, albeit with daily withdrawal limits. In contrast, Bitget, Gate, and Bybit require full KYC verification, ensuring enhanced security and regulatory compliance.

Crypto Leverage Trading Strategy

Crafting a strategy is essential for anyone looking to delve into crypto leverage trading. Here’s an in-depth exploration of strategies and considerations for trading with leverage in the cryptocurrency market:

1. Technical Analysis:

- Chart Patterns: Learn to recognize common chart patterns that can indicate potential future price movements.

- Indicators: Familiarize yourself with technical indicators like Moving Averages, RSI, and MACD, which can provide insights into market momentum and potential trend reversals.

2. Fundamental Analysis:

- Market News: Stay updated with news that could impact the crypto market, such as regulatory changes, technological advancements, or macroeconomic factors.

- Coin Specific News: Events like software updates, partnerships, or adoption by major companies can significantly impact a specific cryptocurrency’s price.

3. Set Clear Entry and Exit Points:

- Stop-Loss and Take-Profit: Always set a stop-loss to limit potential losses and a take-profit to lock in profits at a desired price level.

- Avoid Chasing the Market: If you missed an entry point, it might be better to wait for the next opportunity rather than entering at a less favorable price.

4. Diversify:

- Spread Risk: Don’t put all your capital into one leveraged trade. Diversify across different assets or trading pairs to spread and mitigate risks.

5. Manage Your Risks:

- Position Sizing: Only allocate a small percentage of your total trading capital to a single leveraged position.

- Leverage Levels: Remember that higher leverage increases both potential profit and potential loss. Choose a leverage level that aligns with your risk tolerance.

Common Mistakes to Avoid

When it comes to crypto leverage trading, even seasoned traders can sometimes fall into certain pitfalls. Here’s a detailed elaboration on common mistakes to avoid:

1. Over-Leveraging:

- The Temptation: Just because an exchange offers high leverage doesn’t mean it’s always wise to use it. Over-leveraging can amplify losses just as it can amplify profits.

- The Solution: Always assess your risk tolerance and use leverage levels that you’re comfortable with.

2. Neglecting Stop-Loss Orders:

- The Temptation: Some traders, especially beginners, might overlook setting stop-loss orders, hoping the market will turn in their favor.

- The Solution: Always set a stop-loss to limit potential losses. It’s a safety net that can prevent catastrophic account liquidations.

3. Trading Based on Emotion:

- The Temptation: Letting emotions like fear or greed drive trading decisions can lead to impulsive actions and poor judgment.

- The Solution: Develop a clear trading strategy and stick to it. Avoid making decisions based on short-term market noise.

4. Failing to Do Research:

- The Temptation: Jumping into trades based on hearsay or following the crowd without understanding the market dynamics.

- The Solution: Always conduct thorough research. Understand the market trends, news, and analyses before making a trading decision.

5. Ignoring Fees:

- The Temptation: Overlooking the fees associated with opening, maintaining, and closing leveraged positions.

- The Solution: Be aware of all associated fees, including overnight funding rates, especially if you plan to keep a position open for an extended period.

6. Overtrading:

- The Temptation: Making excessive trades in a short period, thinking it will increase chances of profitability.

- The Solution: Quality over quantity. It’s better to make a few well-researched trades than many impulsive ones.

7. Neglecting Diversification:

- The Temptation: Putting all capital into a single trade or asset.

- The Solution: Spread your trades across different assets or trading pairs to mitigate risks.

8. Failing to Stay Updated:

- The Temptation: Not keeping up with current events, technological advancements, or regulatory changes that might impact the crypto market.

- The Solution: Regularly follow crypto news sources, forums, and community discussions.

9. Not Using a Demo Account First:

- The Temptation: Diving directly into live trading without practicing on a demo account.

- The Solution: Start with a demo account to understand the platform’s mechanics and test strategies without real financial risk.

10. Overconfidence:

- The Temptation: Assuming that a few successful trades equate to mastering the market.

- The Solution: Always remain humble and cautious. The crypto market is highly volatile, and past success doesn’t guarantee future results.

Tips for Safe and Effective Crypto Leverage Trading

1. Start with a Demo Account:

- Practice Makes Perfect: Before diving into the real world of crypto leverage trading, many exchanges offer demo accounts where you can practice with virtual funds. This allows you to understand the mechanics of leverage trading, test strategies, and get familiar with the platform without risking real money.

2. Understand the Market:

- Research is Key: Stay updated with market news, trends, and analyses. DYOR. Factors like regulatory changes, technological advancements, or macroeconomic indicators can significantly impact crypto prices. Being informed helps in making better trading decisions.

3. Use Stop-Loss and Take-Profit Orders:

- Limit Potential Losses: A stop-loss order automatically closes your position once the asset price hits a predetermined level, preventing further losses.

- Lock in Profits: Similarly, a take-profit order ensures you exit the position once the asset reaches a certain price, securing your profits before market conditions can reverse.

4. Avoid Over-Leveraging:

- Manage Risk: Just because an exchange offers high leverage doesn’t mean you should use it all. Higher leverage amplifies both potential profits and potential losses. Determine the level of leverage that aligns with your risk tolerance.

5. Diversify Your Trades:

- Don’t Put All Eggs in One Basket: Instead of concentrating all your capital in a single trade, diversify across different assets or trading pairs. This can help spread and mitigate risks.

6. Stay Updated with Exchange Policies:

- Know the Rules: Different exchanges have varying policies regarding margin requirements, liquidation levels, and fees. Ensure you’re familiar with these details to avoid unexpected losses or liquidations.

7. Continuously Monitor Your Trades:

- Stay Alert: Given the volatility of the crypto market, prices can swing dramatically in short periods. Regularly check your open positions, especially when trading with high leverage.

8. Set a Budget and Stick to It:

- Trade Only What You Can Afford to Lose: Determine beforehand the amount you’re willing to risk. It’s easy to get carried away with the allure of potential profits, but always be prepared for the possibility of a loss.

9. Educate Yourself:

- Never Stop Learning: The crypto landscape is continuously evolving. Engage in webinars, courses, forums, and read books to enhance your trading skills and knowledge.

10. Emotional Discipline:

- Avoid Impulsive Decisions: Trading decisions driven by emotions like fear or greed can lead to significant losses. Develop a trading strategy and stick to it, regardless of short-term market movements.

11. Use Reliable and Secure Exchanges:

- Safety First: Ensure the platform you’re using has robust security measures in place, like two-factor authentication, withdrawal whitelist, and cold storage. Check reviews and do thorough research before committing to an exchange.

Expert Opinions on Crypto Leverage Trading

Changpeng Zhao (CZ) – CEO of Binance

CZ has highlighted the role of user demand in the introduction of leverage trading features on platforms like Binance. He believes that while leverage trading caters to a specific segment of traders looking for advanced tools, it’s essential for users to be aware of the risks.

My views on bailout and leverage, as in the current market.https://t.co/EC8WULUaOO

— CZ 🔶 Binance (@cz_binance) June 23, 2022

Case Studies on Crypto Leverage Trading

The Flash Crash of Ethereum (2017)

In June 2017, Ethereum experienced a flash crash on the GDAX exchange, plummeting from over $300 to just 10 cents within seconds. Leveraged traders with positions expecting the price to rise were automatically liquidated, leading to significant losses. This event highlighted the risks of trading with high leverage, especially in volatile markets.

Lessons Learned: Always set stop-loss orders to protect against unforeseen market movements and be cautious with the amount of leverage used.

The Rise of DeFi Platforms (2020-2021)

Decentralized Finance (DeFi) platforms like dYdX and Aave began offering decentralized leverage trading, allowing users to take leveraged positions using smart contracts. While these platforms reduced the need for intermediaries, they also faced challenges, including smart contract vulnerabilities.

Lessons Learned: Decentralized platforms offer transparency and reduced counterparty risk, but it’s essential to ensure the underlying smart contracts have been thoroughly audited and are secure.

The Bitcoin Bull Run (2020-2021)

During Bitcoin’s meteoric rise to its all-time highs, many crypto traders used leverage to maximize their profits. However, when Bitcoin experienced sharp corrections, those using high leverage faced significant liquidations.

Lessons Learned: While bull markets can be tempting for leverage trading, they also come with increased volatility. It’s crucial to manage risks and not get carried away by market euphoria.

The Future of Crypto Trading with Leverage

The future of crypto trading with leverage is a topic of great interest given the rapid evolution of the cryptocurrency market. Here’s an in-depth look into what the future might hold:

1. Regulatory Landscape:

- Increased Oversight: As crypto leverage trading grows in popularity, it’s likely to attract more attention from regulatory bodies. Countries might introduce or tighten regulations to protect investors and ensure market integrity.

- Standardization: With clearer regulations, we might see a more standardized approach to leverage trading across platforms and countries, leading to a safer environment for traders.

2. Technological Advancements:

- Improved Trading Platforms: As technology evolves, trading platforms will become more user-friendly, secure, and feature-rich. This will enhance the trading experience and might attract more participants to the market.

- Integration with Traditional Finance: We might see more integration between traditional financial systems and crypto leverage trading platforms, making it easier for traders to move funds and manage their portfolios.

3. Enhanced Security Measures:

- Protection Against Hacks: With the increasing number of cyber threats, exchanges will invest more in security infrastructure to protect user funds and data.

- Decentralized Trading Platforms: The rise of decentralized exchanges (DEXs) might lead to decentralized leverage trading platforms, reducing the risks associated with centralized entities.

4. Education and Awareness:

- Increased Resources: As the market matures, there will be a greater emphasis on educating traders. This will include webinars, courses, and resources to help traders make informed decisions.

- Risk Management: Platforms might introduce more tools and features to help traders manage their risks effectively.

5. Product Diversification:

- Variety of Financial Instruments: Beyond the standard leverage trading, we might see the introduction of more complex financial instruments like options, futures, and ETFs in the crypto space.

- Cross-Asset Trading: Platforms might offer leverage trading across different asset classes, combining traditional assets like stocks or commodities with cryptocurrencies.

6. Competitive Landscape:

- More Players: The lucrative nature of crypto leverage trading will attract more players to the market, leading to increased competition.

- Innovative Offerings: To stand out, platforms will come up with innovative offerings, better fee structures, and unique features to attract and retain traders.

7. Community and Social Trading:

- Copy Trading: Platforms might introduce features where novice traders can copy the strategies of experienced traders, benefiting from their expertise.

- Community Discussions: Enhanced crypto community features where traders can discuss strategies, share insights, and collaborate on trades.

Conclusion

Crypto leverage trading, while a powerful financial instrument, is not without its complexities and risks. As we’ve explored, it offers traders the potential to amplify their profits, but this comes hand-in-hand with the possibility of amplified losses. Expert opinions from industry leaders and real-world case studies underscore the importance of a well-informed and cautious approach.

For both newcomers and seasoned traders, the key lies in continuous education and risk management. Leveraging the insights of experts, learning from past market events, and employing sound trading strategies can make the difference between success and setbacks.

Moreover, as the crypto landscape continues to evolve, so too will the tools and platforms available for leverage trading. Whether it’s the rise of decentralized trading platforms or the introduction of new regulatory guidelines, traders must stay agile, adapting to the ever-changing environment.

In closing, while the allure of high returns is undeniable, it’s paramount to remember the inherent risks. As with all investment ventures, it’s always wise to tread with caution, ensuring that decisions are driven by knowledge rather than emotion. The world of crypto leverage trading is vast and dynamic, offering both challenges and opportunities in equal measure. Navigate it with care, and it can prove to be a rewarding journey.

FAQs

What is the maximum leverage offered by most exchanges?

200x, offered by MEXC for Bitcoin leverage trading.

Is crypto leverage trading legal everywhere?

No, regulations vary by country. Always check local regulations before trading.

How can I reduce my risks in leverage trading?

Using stop-loss orders, diversifying your portfolio, and continuous learning can help mitigate risks.