In the bustling world of trading, few strategies have stood the test of time like dollar cost averaging. At Wooly, we’ve delved deep into trading intricacies, and our topical authority is evident in articles such as How to Invest in Cryptocurrency and the insightful piece on Bullish Signals. Today, we’re peeling back the layers on dollar cost averaging, a strategy that has transformed portfolios worldwide.

Table of Contents

What is Dollar Cost Averaging?

The Essence of Dollar Cost Averaging

Dollar cost averaging, often abbreviated as DCA, is a strategic approach to investing that aims to reduce the impact of market volatility on a portfolio. Instead of trying to time the market and invest a lump sum at the perceived “right moment,” DCA promotes a disciplined and consistent investment approach.

Historical Context and Origin

The concept of dollar cost averaging has been around for decades. It emerged as a response to the unpredictable nature of the markets, where prices of assets can fluctuate significantly over short periods. By spreading out investments over time, investors found they could mitigate the effects of these short-term fluctuations, leading to potentially more stable returns in the long run.

The Science Behind the Strategy

The underlying principle of DCA is straightforward: invest a fixed dollar amount at regular intervals, regardless of the asset’s price. This means that when prices are low, your fixed dollar amount will buy more of the asset, and when prices are high, it will buy less. Over time, this can result in an average cost per share that’s lower than the average market price.

DCA vs. Lump Sum Investing

To understand the true value of DCA, it’s essential to compare it with its counterpart: lump sum investing. Lump sum investing involves investing a significant amount all at once, hoping to buy at a market low. While this can lead to substantial gains if timed correctly, it also carries the risk of entering the market at a peak. DCA, on the other hand, removes the guesswork and emotional decision-making, offering a more systematic and less risky approach.

Benefits of Dollar Cost Averaging

The Psychological Edge

One of the most significant advantages of DCA is the psychological comfort it provides. Investing can be emotionally taxing, especially when markets are volatile. DCA offers a systematic approach, removing the emotional stress of trying to time the market.

Efficiency for Novice Investors

For those new to investing, DCA offers a straightforward strategy that doesn’t require constant market monitoring or intricate decision-making. By setting up a fixed, regular investment amount, beginners can ease into the world of investing without feeling overwhelmed.

Mitigation of Timing Risk

Even seasoned investors can’t consistently predict market movements. DCA reduces the risk associated with poor timing, ensuring that not all money is invested at a market peak or trough.

Flexibility and Adaptability

DCA doesn’t tie you down. If financial situations change, investors can adjust their regular investment amounts. This flexibility ensures that DCA can be tailored to individual financial circumstances.

Detailed Benefits Chart (Table):

| Benefit | Description | Example |

|---|---|---|

| Psychological Comfort | Reduces the emotional stress of market timing. | Instead of fretting over daily market news, you invest the same amount consistently. |

| Efficiency for Novice Investors | Simplifies the investment process for beginners. | A new investor can start with a small, fixed amount monthly without needing extensive research. |

| Mitigation of Timing Risk | Spreads out investments to avoid the pitfalls of poor timing. | If the market dips after a large one-time investment, it can lead to significant losses. |

| Flexibility and Adaptability | Allows for adjustments based on changing financial situations. | If you get a raise, you can increase your monthly DCA amount. If facing financial strain, you can reduce it. |

The Mechanics of Dollar Cost Average

At its core, dollar cost averaging is about discipline and consistency. Instead of attempting to predict market highs and lows, which can be a daunting task even for seasoned investors, DCA focuses on a systematic approach. By investing a predetermined amount at regular intervals, you’re essentially averaging out the cost of your investments over time.

The Power of Regularity

The beauty of DCA lies in its simplicity. Whether the market is bullish or bearish, you continue with your scheduled investments. This regularity ensures that you purchase more units when prices are low and fewer units when prices are high. Over time, this can lead to a lower average cost per unit compared to making sporadic investments.

Example Chart (Table):

| Month | Investment Amount | Asset Price | Assets Purchased |

|---|---|---|---|

| Jan | $100 | $10 | 10 |

| Feb | $100 | $8 | 12.5 |

| Mar | $100 | $12 | 8.33 |

Factors Influencing DCA Success

While DCA is a powerful strategy, its effectiveness can be influenced by several factors:

Frequency of Investment

Whether you choose to invest weekly, bi-weekly, or monthly can impact your returns. The more frequent your investments, the closer you adhere to the true essence of DCA.

Market Volatility

In highly volatile markets, DCA can be especially beneficial as it reduces the risk of investing a large sum just before a market downturn.

Investment Horizon

DCA is typically a long-term strategy. The longer you stick with it, the more pronounced its benefits become, as the effects of market fluctuations are smoothed out over extended periods.

DCA in Different Asset Classes

While commonly associated with stocks, DCA can be applied to various asset classes, including bonds, mutual funds, and even cryptocurrencies. The principle remains the same: regular investments over time, regardless of price.

DCA Trading: A Deep Dive

DCA in the World of Trading

Trading, by its very nature, is a dynamic activity where assets are bought and sold frequently, often in response to short-term market movements. While many traders rely on technical analysis and market predictions, DCA offers a contrasting approach. Instead of chasing short-term gains, DCA trading focuses on long-term accumulation and growth.

Stocks vs. Cryptocurrencies: DCA’s Role

Dollar cost averaging has been a staple in the stock market for decades. However, with the rise of digital assets, DCA has found a new playground in the world of cryptocurrencies. Here’s how DCA plays out in both arenas:

Stocks

With their long history and relatively stable nature, stocks are prime candidates for DCA. By investing a fixed amount regularly, traders can accumulate shares and benefit from long-term growth and dividends.

Cryptocurrencies

Given the volatile nature of cryptocurrencies, DCA can be a risk-mitigation strategy. Instead of trying to time the market, traders can accumulate digital assets over time, potentially reducing the impact of sharp price drops.

Benefits of DCA in Trading

Risk Reduction

By spreading out investments, traders can reduce the potential damage of a poorly timed trade.

Budget-Friendly

Especially for those with limited capital, DCA allows for participation in the market without the need for a significant upfront investment.

Compounding Effect

Regular investments can lead to compound growth, especially when dividends or crypto staking rewards are reinvested.

Challenges and Considerations

While DCA offers numerous benefits, it’s essential to be aware of potential challenges:

Missed Opportunities

If the market sees a prolonged upward trend, DCA might result in a higher average purchase price compared to a lump sum investment at the start of the trend.

Transaction Costs

Regular investments might lead to increased transaction fees, especially if the trading platform charges per transaction.

Mastering the Dollar Cost Averaging Strategy

Before diving deep into mastering DCA, it’s crucial to have a firm grasp of its foundational principles. At its core, DCA is about consistent, regular investments over time, irrespective of market conditions. This systematic approach aims to mitigate the risks associated with market timing.

Setting Clear Goals

Every successful strategy starts with a clear objective. Are you saving for retirement, a significant purchase, or building general wealth? Your goals will dictate the duration and amount of your DCA strategy. For instance, saving for a short-term goal might involve a more aggressive DCA approach than a long-term retirement plan.

Choosing the Right Frequency

While monthly investments are common, DCA is flexible. Depending on your financial situation and goals, you might opt for weekly, bi-weekly, or even quarterly contributions. The key is consistency.

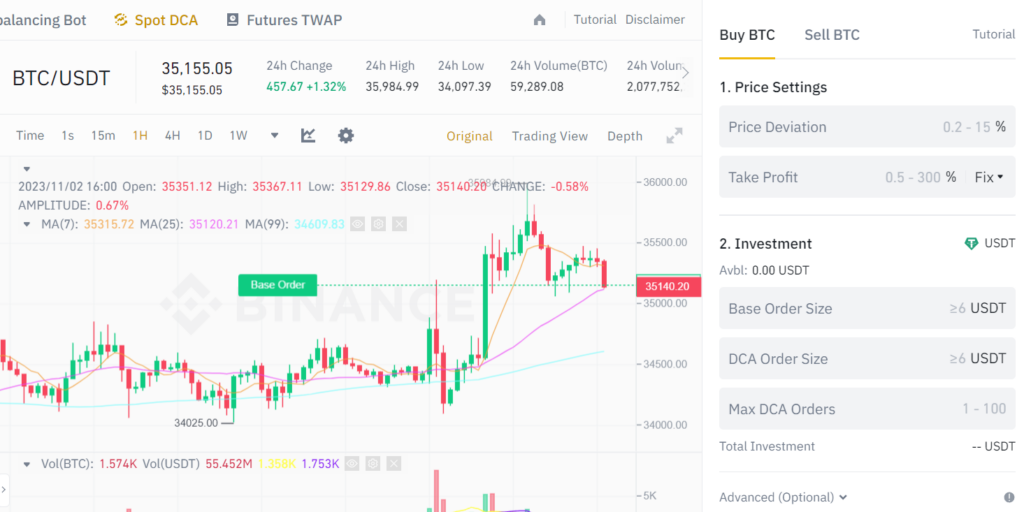

Automate Your Investments

Many platforms (like Binance, OKX) allow for automated investments. By setting up automatic transfers and purchases, you ensure consistency in your DCA approach, removing the potential for human error or hesitation.

Stay the Course, But Review Regularly

One of the challenges of DCA is the temptation to deviate from the strategy, especially during volatile market conditions. While it’s essential to stay the course, it’s equally crucial to review your approach periodically. Economic conditions, personal financial situations, and investment goals can evolve, necessitating adjustments to your DCA strategy.

Diversify Within DCA

While DCA inherently reduces some investment risks, diversifying your investments further mitigates potential pitfalls. Instead of allocating all your funds to a single asset, consider spreading them across various assets or sectors. This approach ensures that you’re not overly reliant on a single asset’s performance.

Dollar Cost Average Investing: Long-Term Perspective

The Long Game of DCA

Dollar cost averaging isn’t about quick wins; it’s a marathon, not a sprint. The strategy is rooted in the belief that markets, despite their short-term volatility, tend to rise over extended periods. By consistently investing over the long term, DCA investors aim to capture this overarching growth trend.

Compound Interest: The Eighth Wonder of the World

Albert Einstein famously said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” When combined with DCA, the power of compound interest truly shines. As you invest regularly, not only do your principal amounts grow, but the returns on those investments also start generating their own returns. Over decades, this can lead to exponential portfolio growth.

Case Studies: The Proof is in the Pudding

Historical data provides compelling evidence of DCA’s long-term benefits:

1. Proton’s DCA Journey with BTC

Russian crypto influencer Proton embarked on a DCA journey with Bitcoin, sharing his results after the 31st week:

- Total Investment: 1,771,376 rubles or 21,700 USDT (217 days at $100/day)

- Total Coins Acquired: 0.853 BTC

- Average USDT Purchase Rate: 81.63 rubles (current rate: 96.65 rubles)

- Average BTC Purchase Price: $26,046 (current price: $29,050)

- Return on Investment: 14.2% in dollars (or 23.89% annually) or 35.22% in rubles (or 59.23% annually)

Proton’s results showcase the potential of DCA, even in volatile markets like cryptocurrency. His experiment continues, highlighting the ongoing nature of DCA.

2. The “$10 Buffett” Experiment

On October 31, 2017, an experimental portfolio was launched, dubbed the “$10 Buffett.” The premise was simple: invest $10 in various cryptocurrencies and observe the growth.

- Total Invested in Different Coins: $21,600

- Profit Over 6 Years: $40,608

- Profit Percentage: +188%

- Total Portfolio Value: $62,208

- Number of Different Cryptocurrencies: ~168

The “$10 Buffett” experiment underscores the potential of diversifying investments across multiple cryptocurrencies using a consistent investment strategy.

3. The “$5 A Day” Stock Experiment

A YouTuber documented his journey of investing $5 every day for a year in different stocks. Link to the video

- Investment Strategy: Daily investments of $5 in various stocks.

- Outcome: A loss of 2% by the end of the year.

Conclusion: Investing daily can be excessive, especially in the stock market, which doesn’t exhibit the same volatility levels as cryptocurrencies. While DCA emphasizes regular investments, the frequency should be tailored to the asset class and market conditions. In this case, daily investments proved to be too frequent, leading to suboptimal results.

These case studies highlight the nuances of the DCA strategy. While the core principle remains consistent, the outcomes can vary based on the asset, frequency, and market conditions. The key takeaway is the importance of tailoring the DCA approach to align with individual goals and the specific investment landscape.

The Emotional Stability of Long-Term DCA Investing

Beyond the financial benefits, there’s an emotional aspect to consider. Watching markets fluctuate can be nerve-wracking. However, with a long-term DCA strategy, short-term market dips become less concerning. Investors can rest easy knowing they’re playing the long game, reducing the emotional toll often associated with market investments.

Diversification and DCA: A Perfect Pair

For long-term investors, diversification is a key principle. By spreading investments across various assets and sectors, they reduce risk. DCA complements this approach beautifully. As you invest regularly, you can diversify your purchases, ensuring you’re not overly reliant on a single asset’s performance.

Tools and Platforms for Effective DCA

Choosing the Right DCA Calculator and Tracker

The right DCA calculator or tracker can make a significant difference in understanding and optimizing your investment strategy. Here are some of the platforms that offer DCA calculators and trackers:

Detailed Platforms Chart (Table):

| Platform/Tool | Features | Best For |

|---|---|---|

| Uphold‘s Dollar-Cost Averaging Calculator | – Calculate potential returns with DCA. – Choose an asset, deposit amount, frequency, and dates. – Understand the benefits of DCA. | Investors looking to visualize potential returns using DCA in crypto. |

| DCA Signals Calculator | – Shows potential portfolio gains using a regular purchase plan. – Focus on accumulating and saving in Bitcoin. | Crypto enthusiasts aiming to understand potential Bitcoin gains through DCA. |

| DCA Tracker in Google Sheets (YouTube) | – Video guide on creating a DCA tracker. – Utilizes Google Sheets for tracking. | DIY investors wanting to create their own DCA tracker using Google Sheets. |

| Stackly | The DCA tool for crypto investors & DAOs. Stack your fav coins at any frequency, reduce risk & build a stable portfolio | Crypto investors who wants to use both DCA and staking strategies. |

Common Misconceptions about Dollar Cost Averaging

Like many investment strategies, dollar cost averaging is not immune to myths and misconceptions. These often arise from misunderstandings or oversimplifications of the strategy. Let’s debunk some of the most common myths.

Detailed Misconceptions Chart (Table):

| Misconception | Reality | Explanation |

|---|---|---|

| DCA Guarantees Profits | No investment strategy, including DCA, can guarantee profits. | While DCA can reduce risks associated with market timing, it doesn’t ensure positive returns. |

| DCA is Only for Novice Investors | DCA is suitable for both beginners and seasoned investors. | Experienced investors also value DCA for its systematic approach and risk mitigation benefits. |

| DCA Means You’ll Always Buy at a Discount | DCA doesn’t ensure you buy assets at a low price; it averages out the purchase price over time. | There will be times when you buy at higher prices and times when you buy at lower prices. |

| Lump Sum Investing is Always Inferior to DCA | Both strategies have their merits and are suitable for different scenarios. | Lump sum can outperform DCA if invested at the right time, but it comes with higher timing risk. |

| DCA Requires Large Amounts of Money | DCA is flexible and can be tailored to various budget sizes. | Whether you’re investing $50 or $5,000 regularly, DCA can be adapted to fit your financial circumstances. |

Expert Tips for Maximizing Profits with DCA

The Wisdom of the Ages

From legendary investors like Warren Buffett to modern-day financial gurus, many have recognized the value of dollar cost averaging. Their collective wisdom offers invaluable insights for those looking to maximize the benefits of DCA.

Consistency is Key

One of the foundational principles of DCA is regularity. By maintaining a consistent investment schedule, you can truly harness the power of DCA. Whether the market is up or down, stick to your predetermined investment amounts and intervals.

Stay Informed, But Don’t Overreact

While DCA is a systematic approach, it’s essential to stay informed about market trends and potential economic shifts. However, avoid making impulsive decisions based on short-term news. Remember, DCA is a long-term strategy.

Reinvest Dividends and Returns

To truly maximize the compounding effect, consider reinvesting any dividends or returns you receive. This can accelerate portfolio growth over time.

Review and Adjust Periodically

While consistency is crucial, it’s also wise to review your DCA strategy periodically. As your financial situation, goals, or market conditions change, adjustments might be necessary. Maybe you can increase your regular investment amount, or perhaps diversify into new assets.

Diversify Your DCA Approach

Don’t put all your eggs in one basket. Consider applying the DCA strategy across various assets or sectors. This diversification can further mitigate risks and offer broader exposure to potential growth areas.

Seek Expert Advice

While DCA is a relatively straightforward strategy, consulting with a financial advisor can provide personalized insights tailored to your unique situation. They can help fine-tune your approach, ensuring it aligns with your long-term objectives.

Conclusion

Dollar Cost Averaging (DCA) stands as a testament to the power of consistency in the unpredictable world of investing. By removing the guesswork and emotional turmoil often associated with market timing, DCA offers a systematic and disciplined approach that can be tailored to fit any investor’s goals and financial situation.

Whether you’re venturing into the realms of stocks, cryptocurrencies, or other assets, DCA provides a structured pathway. It’s a strategy that emphasizes the long game, focusing on potential growth over extended periods rather than short-term market fluctuations. This approach not only can lead to a more balanced and diversified portfolio but also offers the psychological comfort of knowing you’re investing with a method that has stood the test of time.

For those new to investing, DCA serves as a gentle introduction, minimizing risks while ensuring participation in potential market gains. For seasoned investors, it offers a way to continually grow wealth while mitigating the inherent uncertainties of the financial markets.

In a world where financial news can change by the minute and market predictions can be as uncertain as the weather, having a strategy like DCA in your arsenal can be invaluable. It’s a reminder that in the world of investing, sometimes the tortoise does beat the hare, and steady, consistent steps can lead to long-term financial growth and stability.

FAQs

What is dollar cost averaging for dummies?

Dollar cost averaging (DCA) is a simple investment strategy where you invest a fixed amount of money at regular intervals, regardless of the asset’s price.

What is dollar cost averaging in crypto?

DCA in crypto means investing a consistent amount of money into a cryptocurrency at regular intervals, irrespective of its price fluctuations.

What is dollar cost averaging in stocks?

DCA in stocks involves buying a fixed dollar amount of a particular stock at regular intervals, regardless of its price at each purchase.

How does dollar cost averaging work?

DCA works by spreading out your investments over time. By investing regularly, you buy more of an asset when its price is low and less when its price is high, potentially reducing the average cost over time.

How to start dollar cost averaging?

To start DCA, decide on the amount you want to invest, choose the asset (like stocks or crypto), set a regular interval (like weekly or monthly), and then consistently invest that amount at each interval.

How to calculate dollar cost averaging?

To calculate DCA, divide the total amount invested over a period by the total number of shares or units purchased during that period. This gives you the average cost per share or unit.

How often to contribute for dollar cost averaging?

The frequency of contributions for DCA can vary based on preference and financial situation, but common intervals include weekly, bi-weekly, or monthly.