As 2023 winds down, the crypto world stands on the brink of yet another transformative year. With the echo of past triumphs and tribulations still resonating, 2025 promises an array of bullish signals that could reshape the financial frontier. Let’s delve into these signals and unravel the mysteries of the crypto cosmos for the upcoming year.

Table of Contents

The Anticipated Role of Refinancing Rates in 2025

Surprisingly, Bitcoin, and cryptocurrencies in general, are influenced by refinancing rates. The year 2022 stood as a testament to this intricate relationship. It was a challenging year for cryptocurrencies. The refinancing rate saw an increase, triggering a capital outflow from cryptocurrencies to the traditional financial sector. This movement reflected the delicate balance and interplay between global monetary policies and the crypto ecosystem.

Why Refinancing Rates Matter

Refinancing rates, set by central banks, play a pivotal role in determining the cost of borrowing money. They influence a wide range of financial decisions, from consumer spending to corporate investments. In the context of cryptocurrencies, these rates can either stimulate or hinder market growth, making them a keenly watched parameter by crypto investors and analysts alike.

2022: A Year of Challenges

The hike in the refinancing rate in 2022 led to a shift in investor sentiment. As traditional financial avenues became more attractive, there was a notable shift of capital from the volatile crypto market. Cryptocurrencies, despite their decentralized nature, were not immune to the ripple effects of global monetary decisions.

Looking Ahead: 2025’s Potential

Forecasts suggest a potential reduction in refinancing rates for 2025. This is further accentuated by expectations that many countries might resort to money printing once again, in an attempt to boost their economies. Such a move could reverse the capital flow, bringing liquidity back into the crypto market. A lower refinancing rate, coupled with an influx of freshly printed money, could set the stage for a bullish wave in the crypto world, reinforcing its position as a formidable player in the global financial landscape.

Preparing for the Next Bitcoin Halving

Bitcoin’s halving, a foundational element of its protocol, is more than just a technical event—it’s a momentous occasion that crypto enthusiasts and investors mark on their calendars years in advance. This pre-programmed event is not just about reducing the reward miners receive; it’s a reflection of Bitcoin’s deflationary nature and its potential influence on supply and demand dynamics.

Understanding the Halving Mechanism

At its core, Bitcoin’s halving is a mechanism to ensure its scarcity. Approximately every four years, or technically, every 210,000 blocks, the reward that miners receive for adding new blocks to the blockchain is halved. This ensures that the total supply of Bitcoin will never exceed 21 million. It’s an inbuilt economic model of scarcity, designed to counteract the inflationary models of traditional fiat currencies.

Past Halvings and Their Impact

Historically, Bitcoin’s halvings have been followed by significant market activity. The first halving in 2012 saw Bitcoin’s price increase from around $11 to over $1,000 within a year. The 2016 halving witnessed Bitcoin’s price surge from around $650 to an all-time high of nearly $20,000 in late 2017. While other factors were at play, the halving events were certainly major catalysts. The 2020 halving, amidst global economic uncertainties, set the stage for Bitcoin’s bull run in late 2020 and early 2021.

Anticipating 2025’s Halving

As we inch closer to the next halving event in 2025, speculations are rife. Past events have shown a pattern: an initial slow response post-halving, followed by a significant price surge. While history is not always an accurate predictor of future events, the crypto community is abuzz with anticipation. The potential reduction in supply, coupled with increasing mainstream adoption and institutional interest, could create a supply-demand imbalance, driving prices upwards.

Miners and the Halving Challenge

For miners, halving is a double-edged sword. While the rewards are halved, a significant price increase in Bitcoin could offset their reduced earnings. However, if prices don’t surge, miners with higher operational costs might find it unprofitable, potentially leading to a decrease in mining activity. This could, in turn, affect the security and transaction processing speed of the Bitcoin network, at least temporarily.

The Rise of Spot Cryptocurrency ETFs

The evolution of financial instruments in the crypto realm has been nothing short of remarkable. Spot Cryptocurrency ETFs, particularly those focusing on Bitcoin and Ethereum, are at the forefront of this transformation. They promise to usher in a new era of investment and further legitimize the space in the eyes of traditional investors.

Spot ETFs: Bridging Traditional Finance and Crypto

For those unfamiliar, ETFs, or Exchange-Traded Funds, are a type of investment fund and exchange-traded product. In essence, they provide a way for investors to buy a broad portfolio of assets. A detailed breakdown of ETFs and their implications for Bitcoin can be found in our previous article here. In a nutshell, the introduction of spot cryptocurrency ETFs means major financial players gain access to the cryptocurrency market. Additionally, ETF operators will be mandated to hold a significant amount of the cryptocurrency, ensuring a direct link between the ETF and the underlying asset.

Awaiting SEC Approval

The crypto community is currently on tenterhooks as we await the U.S. Securities and Exchange Commission’s (SEC) decision on spot ETFs for Bitcoin and Ethereum. The decision, initially expected earlier, has been postponed to January 2025. This move has generated immense speculation, as the approval could potentially be a game-changer for the crypto industry.

Recent Market Response

In a recent turn of events, a misreport from Cointelegraph mistakenly indicated the approval of one such spot ETF. The market’s reaction was instantaneous: Bitcoin’s price experienced a sharp surge, highlighting the immense potential and market sentiment surrounding such financial products.

Implications for the Crypto Market

The approval of spot cryptocurrency ETFs could have far-reaching implications. For one, it would attract institutional investors, leading to increased liquidity. Moreover, the requirement for ETF operators to hold the underlying cryptocurrency could reduce the available supply in the market, possibly driving prices upward. It also signifies a step towards the mainstream acceptance of cryptocurrencies, weaving them into the fabric of traditional financial systems.

Growth of the RWA (Real World Asset) Sector in Crypto

The integration of Real World Assets (RWA) within the crypto ecosystem is revolutionizing the way we perceive traditional financial markets and blockchain. As the crypto industry matures, the melding of these two realms is not just a trend, but a necessity that promises to shape the future of global finance.

Blockchain Adoption and RWA

One of the most significant outcomes of RWA’s integration with crypto is the accelerated adoption of blockchain technology. By tokenizing tangible assets, blockchain’s potential is expanded beyond the digital sphere, paving the way for mainstream acceptance and understanding of its capabilities.

Liquidity and Capitalization

The incorporation of RWA into the crypto landscape opens up a fresh channel of liquidity and capitalization. Traditional assets, including bonds and stocks, can now be used to generate revenue within the Decentralized Finance (DeFi) sector. This fusion not only diversifies investment options but also fortifies the financial prowess of the crypto industry.

Accessibility and Reduced Entry Barriers

For retail investors, the merging of RWA with crypto reduces the barriers of entry into conventional markets. With tokenized assets, even those previously perceived as out of reach or too complex, become easily accessible. This democratization of finance is a testament to the inclusivity that blockchain technology and cryptocurrency can bring to the table.

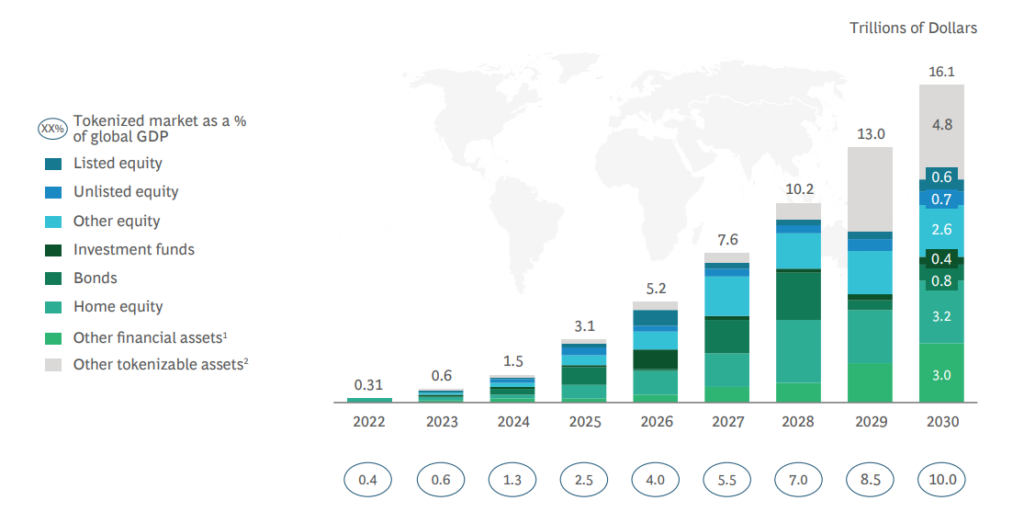

The Trillion-Dollar Potential

According to a report by Boston Consulting Group, the tokenization of global illiquid assets is projected to be a staggering $16 trillion business opportunity by 2030. Such figures underline the immense potential and the broad horizons that the fusion of RWA and crypto can unlock.

Cryptocurrency Regulation: Paving the Way for Mass Adoption

As the days go by, the cryptocurrency market continues to expand, drawing the attention of regulatory bodies worldwide. This evolving landscape of regulation brings with it a semblance of security for cryptocurrency users. Should a trading platform or service falter, users may now have a safety net, a far cry from the earlier days of crypto where uncertainty reigned supreme. This integral step towards regulation is pivotal for the mass adoption of cryptocurrencies across the globe, pushing the boundaries of its popularity and solidifying its place in the mainstream financial ecosystem.

Diving deeper, here are some of the primary regulatory trends to keep an eye on in the coming years:

Mica Regulations (EU)

The Markets in Crypto Assets (MiCA) regulation has been introduced by the European Union to provide a clear regulatory framework for crypto assets and their service providers. Aimed at ensuring consumer protection and financial stability, these rules are set to play a significant role in shaping the European crypto landscape. More on this can be found at the official ESMA site.

US Cryptocurrency Regulation Initiative

The US, not wanting to be left behind in the crypto evolution, has been actively working on its regulatory stance. The introduction of the ‘Fit for the 21st Century Act of 2023’ is a testament to their commitment to understanding and integrating crypto assets into the broader financial system. Details of this initiative can be accessed here.

Hong Kong’s Regulatory Framework

Hong Kong has been at the forefront of financial innovation for years. Recognizing the potential and risks of cryptocurrencies, the region has been working diligently on creating a balanced regulatory environment, ensuring that both investors and the general public are protected while fostering innovation.

In conclusion, the spotlight on regulation signals a maturing market, setting the stage for wider acceptance, increased trust, and an even brighter future for cryptocurrencies.

The Macroeconomic Environment and Its Influence on Crypto

The complex dance between global economies and the cryptocurrency domain is one of intrigue and interdependence. As decentralized entities, cryptocurrencies were initially conceived to operate somewhat independently of traditional economic factors. However, as they’ve grown in adoption and integration, their susceptibility to macroeconomic shifts has become more pronounced.

Crypto in 2025’s Macroeconomy

The year 2025 has marked significant strides in the integration of cryptocurrencies within the broader macroeconomy. With several nations exploring Central Bank Digital Currencies (CBDCs) and institutional adoption on the rise, the role of crypto has expanded beyond mere speculation. Here’s an overview of its impact and position in 2025’s global economic landscape:

Mainstreaming of Cryptocurrencies

Traditional financial institutions, from banks to hedge funds, have integrated cryptocurrency holdings and transactions into their portfolios. This widespread acceptance has led to increased stability in the crypto market.

CBDCs and National Economies

Several countries have rolled out or are in advanced stages of testing their CBDCs. These digital currencies, backed by central banks, have provided nations with a new monetary tool, allowing for more efficient and transparent transactions.

Economic Recovery and Cryptocurrency

Post-pandemic economic recovery efforts have been complemented by the rise of decentralized finance (DeFi) platforms, offering alternative lending and borrowing avenues. This has led to a democratization of financial services, especially in regions with limited traditional banking infrastructure.

Geopolitical Tensions and Cryptocurrency

A new “trigger” for Bitcoin and crypto in general, as experts noted, is wartime inflation. With rising instability on the world stage, military conflicts pose significant threats to the global economy. However, these very conflicts can also lead to a rapid surge in inflation. This dynamic plays in favor of safe-haven assets like gold, while also benefiting riskier investments such as Bitcoin.

Russia and Ukraine Conflict

The prolonged tensions and hostilities between Russia and Ukraine have led to an influx of capital into cryptocurrencies. With sanctions imposed and traditional banking channels disrupted, both individuals and businesses have turned to cryptocurrencies for wealth preservation, remittances, and trade. This has further underscored crypto’s role as a hedge against geopolitical risks and its utility in bypassing traditional financial systems during times of conflict.

Israel and Palestine Dispute

The ongoing conflict in the Middle East, particularly between Israel and Palestine, has highlighted the importance of decentralized financial systems. In regions where access to traditional banking is limited due to blockades or economic restrictions, cryptocurrencies have provided an alternative means for transactions and international funding.

Potential China-Taiwan Issues

The brewing tensions between China and Taiwan have brought about uncertainties in the global financial markets. Investors, wary of the potential fallout from any escalation, have diversified their portfolios to include cryptocurrencies, viewing them as uncorrelated assets that can act as a safe haven in times of geopolitical unrest.

These geopolitical events, coupled with the inherent properties of cryptocurrencies, have underscored the sector’s resilience and versatility. In times of global uncertainty, the decentralized and borderless nature of cryptocurrencies offers an alternative financial avenue, further integrating them into the macroeconomic landscape of 2025.

Crypto’s Role in Global Trade

With faster transaction times and reduced costs, many international businesses have adopted cryptocurrencies for cross-border trade, bypassing traditional banking systems and their associated fees.

The Push for Reduced Transaction Fees

As blockchain platforms strive for mass adoption, ensuring cost-effective and swift transactions becomes paramount. While Ethereum remains the linchpin of the DeFi world, challenges associated with its transaction costs have paved the way for innovations and the emergence of promising alternatives. Let’s delve deeper into the dynamics of transaction fees, their implications, and the transformative solutions on the horizon.

Ethereum’s Dominance in DeFi

Ethereum stands as a pivotal blockchain platform for the DeFi sector, with more than 50% of locked coins in the market attributed to its network. However, its dominance comes with challenges. Even in periods of market stagnation, the cost of a single transaction on the Ethereum network hovers between 1-2 USDT (in equivalent), making it a costly endeavor for many users. As the market expands, these transaction fees are anticipated to climb even higher.

Layer 2 Solutions & EIP-4844

The development of second-layer networks (also named as nested blockchain) offers a beacon of hope for users yearning for reduced transaction fees. These solutions aim to handle transactions off the main Ethereum blockchain, thereby alleviating congestion and reducing costs. The deployment of EIP-4844 (Ethereum Improvement Proposal) is another step in this direction. It is projected to play a pivotal role in decreasing transaction fees and enhancing Ethereum’s throughput, making transactions swifter and more cost-effective.

Rising Stars: Solana

While Ethereum continues to play a leading role in the DeFi space, other blockchain projects are positioning themselves as formidable competitors. Solana, for instance, has garnered attention due to its extremely low transaction fees. Its significance is further underscored by projections from financial giants like VanEck, who believe that Solana’s price could surge to $3,211 by 2030.

Our Solana Valuation by 2030: Base, Bear, Bull Case piece dropped in time for @SolanaConf. 🔗https://t.co/5jijxItZip

— VanEck (@vaneck_us) October 27, 2023

Such predictions highlight the potential of Solana to reshape the DeFi landscape and offer a more cost-efficient alternative to Ethereum.

In essence, the push for reduced transaction fees is not just a matter of cost-saving but also about ensuring the inclusivity and democratization of the DeFi space. High transaction fees can serve as barriers for many potential users, especially those in regions with lower purchasing power. As the crypto industry matures, the collective efforts of developers, network architects, and the broader community will be essential in making DeFi more accessible and affordable for all.

Elon Musk and His “X” Aim to Revolutionize Finance

Elon Musk, a visionary entrepreneur, has always been at the forefront of technological advancements. Now, he has set his sights on reshaping the financial sector. Musk has articulated a vision to transform his platform into a financial hub, with a roadmap for introducing innovative features by the end of 2025. As he pushes the boundaries of traditional finance, many are intrigued by what this could mean for the future of money and transactions. His ambition suggests a future where users can manage their entire financial life through this platform.

Conclusion

As we stand on the precipice of 2025, the air is thick with anticipation. The crypto world is brimming with potential bullish signals, each promising a year of innovation, growth, and unprecedented opportunities. While the dance of numbers and predictions continues, one thing remains certain: the crypto revolution is unstoppable. From the intricate interplay of refinancing rates and their impact on the crypto ecosystem to the much-anticipated Bitcoin halving, the stage is set for a transformative year. The rise of Spot Cryptocurrency ETFs, the integration of Real World Assets (RWA) in the crypto realm, and the ever-evolving regulatory landscape further underscore the maturing market. As geopolitical tensions shape the macroeconomic environment, the resilience and versatility of cryptocurrencies come to the fore. With visionaries like Elon Musk aiming to revolutionize finance, the future of money and transactions is poised for a paradigm shift. As we embark on this journey, let us embrace the challenges, seize the opportunities, and be part of the crypto renaissance that promises to redefine the financial frontier.

FAQs

What are bullish signals in crypto?

Bullish signals indicate positive market momentum, suggesting potential growth in cryptocurrency values.