Having previously delved deep into the intricacies of Binance alternatives, our seasoned team now turns its gaze to the Coinbase horizon. As the crypto universe expands, so does the need for reliable platforms. Coinbase, a giant in its own right, isn’t the only star in the crypto galaxy. Let’s journey together through the cosmos of Coinbase alternatives, shall we?

Table of Contents

Top Coinbase Alternatives: Quick Comparison

Coinbase Alternative US

The US, being a major hub for cryptocurrency trading, has seen a surge in platforms catering to the needs of crypto enthusiasts. While Coinbase has established itself as a household name, many traders are exploring other exchanges that might better suit their specific requirements. Here’s a snapshot of some notable Coinbase alternatives available to US residents:

| Exchange | Spot Fees | Leverage Level | KYC | P2P | Copy Trading |

|---|---|---|---|---|---|

| MEXC | 0% | 200x | No (30 BTC per day) | Yes (with KYC) | Yes |

| CoinEx | 0.2% | 100x | No (10K USDT per day) | No | No |

| Kraken | 0.2% | 50x | Yes | Yes | No |

| Gemini | 0.3% | 100x | Yes | Yes | No |

| Crypto.com | 0.075% | 20x | Yes | Yes | No |

Coinbase Alternatives UK

For those in the UK seeking alternatives, there’s a plethora of options, each with its unique offerings. Here, we’ll delve into some of the top Coinbase alternatives available to UK residents:

| Exchange | Spot Fees | Leverage Level | KYC | P2P | Copy Trading |

|---|---|---|---|---|---|

| MEXC | 0% | 200x | No (30 BTC per day) | Yes (with KYC) | Yes |

| BingX | 0.1% | 150x | No (50K USDT per day) | Yes (with KYC) | Yes |

| CoinEx | 0.2% | 100x | No (10K USDT per day) | No | No |

| KuCoin | 0.06% | 100x | Yes | Yes | No |

Coinbase Alternatives Deutschland

As the cryptocurrency market continues to flourish in Deutschland, many traders and investors are on the lookout for platforms that offer diverse features and competitive rates. While Coinbase remains a popular choice, there are several other exchanges that have gained traction in the German market. Let’s take a closer look at some of these Coinbase alternatives available in Deutschland:

| Exchange | Spot Fees | Leverage Level | KYC | P2P | Copy Trading |

|---|---|---|---|---|---|

| MEXC | 0% | 200x | No (30 BTC per day) | Yes (with KYC) | Yes |

| OKX | 0.1% | 125x | No (10 BTC per day) | Yes (with KYC) | No |

| CoinEx | 0.2% | 100x | No (10K USDT per day) | No | – |

| Bybit | 0.1% | 100x | Yes | Yes (with KYC) | Yes |

| KuCoin | 0.06% | 100x | Yes | Yes | No |

Detailed Reviews of Each Alternative

MEXC – Best Coinbase Alternative Overall

MEXC is a non kyc Singapore-based cryptocurrency exchange that offers a wide range of digital assets for trading. The platform is designed to cater to both novice and professional traders, providing them with a seamless and secure trading experience. MEXC emphasizes its commitment to security, transparency, and user-friendliness. The exchange boasts a robust trading infrastructure, supporting spot trading, margin, and futures trading. Additionally, MEXC offers a variety of financial products, including savings, staking, and DeFi services, to cater to the diverse needs of its users.

Pros and Cons Chart

| Pros | Cons |

|---|---|

| Wide range of digital assets available for trading | Not as well-known as some other major exchanges |

| User-friendly interface suitable for both beginners and professionals | May require using VPN (not a cracked VPN (!) ) for US based users |

| Offers spot, margin, and futures trading | |

| Provides additional financial products like savings, staking, and DeFi services | |

| Emphasizes security and transparency | |

| Lowest trading fees | |

| No KYC under 30 BTC withdraw per day |

CoinEx

CoinEx, established in 2017, is a global cryptocurrency exchange that offers a wide array of digital assets for trading. CoinEx is committed to delivering a seamless and secure trading experience for its users. The platform emphasizes its dedication to user experience, security, and transparency. CoinEx supports various trading options, including spot and futures trading. Additionally, the exchange offers a range of financial products and services, such as AMM, Financial Account, and Pledging. With its multilingual support, CoinEx aims to cater to global traders, making crypto trading easier and more accessible.

Pros and Cons Chart

| Pros | Cons |

|---|---|

| Comprehensive range of digital assets | Not so much liquidity on platform |

| User-centric platform with a focus on security and transparency | Relatively newer compared to other established exchanges |

| Offers both spot and futures trading | May require using VPN for US based users |

| Provides additional financial products and services | |

| Multilingual support catering to global traders | |

| No KYC under 10K USDT withdraw per day |

Kraken Exchange – Best Coinbase Alternative for US

Kraken is a US-based cryptocurrency exchange and bank, founded in 2011. The platform is known for its extensive selection of cryptocurrencies and fiat currency pairs, strong security measures, and liquidity. Kraken allows users to trade various digital assets and also offers futures contracts and margin trading.

Pros and Cons Chart

| Pros | Cons |

|---|---|

| Strong security measures | No copy trading features |

| Low spot and futures fees | Potentially complex UI for beginners |

| High leverage options (up to 50x) | Higher fees for some services |

| Wide range of cryptocurrencies | |

| KYC-compliant and offers P2P trading |

Gemini Exchange

Gemini is a private New York trust company founded in 2014 by Cameron and Tyler Winklevoss. It’s a cryptocurrency exchange and custodian that allows customers to buy, sell, and store digital assets. Gemini is known for its strong compliance with U.S. regulations and security measures.

Pros and Cons Chart

| Pros | Cons |

|---|---|

| User-friendly interface | Higher spot fees compared to others |

| Strong compliance and security | Limited advanced trading options |

| Available in all U.S. states | Complicated fee system |

Crypto.com Exchange

Crypto.com is a cryptocurrency exchange platform that offers trading, investing, and spending services for a wide range of cryptocurrencies. It also provides additional services like a crypto credit card, a standalone crypto wallet, and an NFT marketplace.

Pros and Cons Chart

| Pros | Cons |

|---|---|

| Large selection of crypto assets | Higher fees for credit transactions |

| Offers advanced financial services | Additional costs for certain services |

| Competitive maker/taker fees | |

| NFT marketplace available |

OKX Exchange

OKX, formerly known as OKEx, is a Seychelles-based cryptocurrency exchange that provides a platform for trading various cryptocurrencies. It was founded in 2017 and is known for offering a wide range of trading pairs, including spot and derivative products.

Pros and Cons Chart

| Pros | Cons |

|---|---|

| Low trading fees | Complicated fee structure |

| High trade volume and liquidity | Customer service issues reported |

| Advanced security features | |

| Broad educational resources | |

| Great OKX Web3 wallet |

BingX Exchange

BingX is a social trading cryptocurrency exchange established in 2018. It offers traditional spot trading as well as innovative features like copy trading, where users can follow the trades of experienced traders.

Pros and Cons Chart

| Pros | Cons |

|---|---|

| Regulated in multiple jurisdictions | Limited fiat deposit/withdrawal options |

| Low trading fees | Customer service quality concerns |

| Offers copy trading | |

| Wide cryptocurrency selection |

Bybit Exchange

Bybit is a cryptocurrency derivatives trading platform that offers leverage trading up to 100x. Established in 2018, it’s become one of the most popular platforms for derivative and margin trading in cryptocurrencies.

Pros and Cons Chart

| Pros | Cons |

|---|---|

| Very low trading fees | Not available in U.S. and other regions |

| High leverage options (up to 100x) | Steep learning curve for new users |

| Strong security record | |

| Passive earning opportunities |

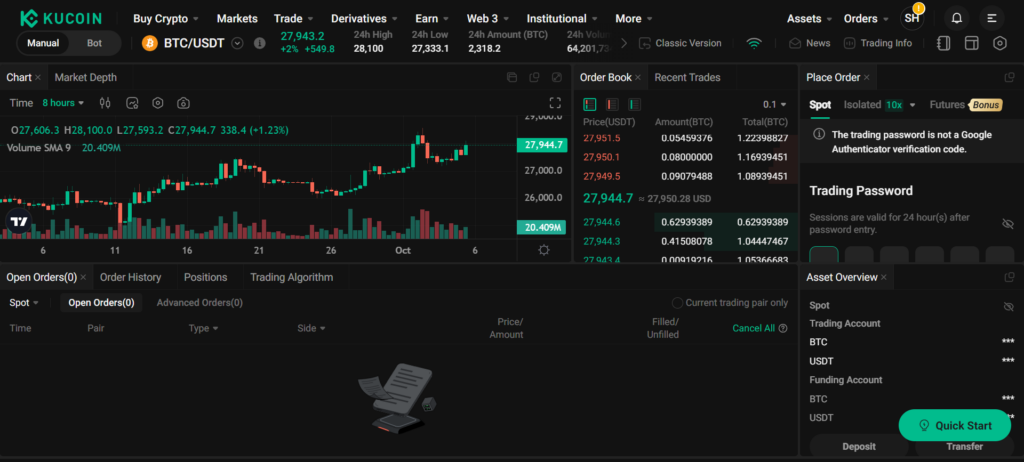

KuCoin Exchange

KuCoin is a global cryptocurrency exchange that offers a wide range of cryptocurrencies and services such as spot and margin trading, staking, and lending. It’s known for its user-friendly interface and community-driven approach.

Pros and Cons Chart

| Pros | Cons |

|---|---|

| Low trading fees | Not fully licensed in the U.S. |

| Wide range of cryptocurrencies | Can be complex for beginners |

| No mandatory KYC for basic features | |

| User-friendly and community-driven |

Factors to Consider When Choosing a Crypto Exchange

| Factor | Description | Why It Matters |

|---|---|---|

| Security and Trustworthiness | Advanced security protocols like 2FA, cold storage, and encryption. | Protects funds and ensures the exchange operates with integrity. |

| Fee Structure | Understanding trading, withdrawal, and deposit fees. | Hidden or high fees can impact profitability. |

| Supported Coins and Tokens | Range of cryptocurrencies supported by the exchange. | Allows diversification of investments. |

| User Experience and Customer Support | User-friendly interface and responsive support. | Prevents trading errors and ensures timely resolution of issues. |

| Liquidity and Trading Volume | Ease of buying/selling without significant price fluctuations. | Ensures orders are executed at desired prices. |

| Geographical Availability | Regions or countries where the exchange operates. | Avoids legal complications and ensures accessibility. |

This detailed chart and elaboration provide a comprehensive guide for traders when evaluating and choosing a crypto exchange that aligns with their needs.

Advantages of Diversifying Your Crypto Exchanges

By understanding advantages of Coinbase alternatives, traders can make informed decisions about diversifying their crypto exchanges. Not only does it offer a safety net against unforeseen issues, but it also provides opportunities for better profitability and access to a wider range of assets.

Risk Mitigation

By diversifying across multiple exchanges, traders can spread their assets and reduce the risk associated with any single platform. This strategy can protect traders from potential losses due to exchange-specific issues, such as hacks, technical glitches, or regulatory challenges.

Why it matters

In the volatile world of cryptocurrencies, it’s always wise to minimize risks. Diversifying exchanges can act as a safety net, ensuring that one’s entire portfolio isn’t vulnerable to issues on a single platform.

Access to Various Coins

Different exchanges might offer different sets of cryptocurrencies. By diversifying, traders can access a broader range of coins and tokens, allowing them to tap into emerging opportunities or niche markets.

Why it matters

Diversification can open up new investment avenues. Being on multiple platforms ensures that traders don’t miss out on potential opportunities presented by lesser-known coins or tokens.

Better Fee Structures

Each exchange has its fee structure. By diversifying, traders can optimize their trades based on which platform offers the most favorable fees for specific transactions.

Why it matters

Over time, even small differences in fees can accumulate, impacting overall profitability. By diversifying, traders can ensure they always get the best deal.

Avoiding Platform-Specific Downtimes

Exchanges can occasionally experience downtimes due to maintenance, technical issues, or high traffic. By having accounts on multiple platforms, traders can continue their activities uninterrupted.

Why it matters

In the fast-paced world of crypto trading, time is of the essence. Downtimes can lead to missed opportunities or potential losses. Diversifying ensures that traders always have an alternative platform to turn to.

Common Concerns with Crypto Exchanges

Being aware of these concerns can help traders make informed decisions and choose platforms that align with their needs and priorities.

| Concern | Description | Why It Matters |

|---|---|---|

| Security Breaches and Hacks | Potential for loss of assets due to hacking. | Protecting investments and ensuring the safety of assets. |

| Withdrawal Issues | Challenges in accessing or withdrawing assets. | Ensuring liquidity and timely access to one’s funds. |

| Hidden Fees | Unapparent costs associated with trading or platform use. | Avoiding unexpected costs and ensuring profitability. |

| Customer Support Delays | Slow or inadequate resolution of issues. | Timely resolution can prevent financial losses and enhance user experience. |

Final Thoughts

Having a reliable platform like Coinbase has been invaluable for many traders. However, as the market matures and diversifies, the search for an alternative to Coinbase has become increasingly prevalent. This shift is driven by traders’ desires to explore platforms that might offer better fee structures, a wider range of cryptocurrencies, or more advanced trading tools.

While Coinbase has set a high standard in the crypto exchange world, several alternatives are emerging, each with its unique offerings and advantages. Whether you’re a novice trader just starting out or a seasoned professional looking for more advanced features, there’s likely a Coinbase alternative out there that fits your needs.

By doing so, you can ensure you’re getting the best features, fees, and opportunities the market has to offer. As the world of cryptocurrency continues to grow and evolve, so too will the platforms that support it.

FAQs

Who is an alternative to Coinbase?

MEXC is the best alternative to Coinbase.

What is the best alternative to Coinbase using a credit card?

For the best alternatives to Coinbase that accept credit cards, check out our review here.

Why should I search for Coinbase alternatives?

Searching for Coinbase alternatives can provide you with more diverse trading options, potentially better fee structures, and access to different cryptocurrencies. It also allows you to spread your risk across multiple platforms.