Welcome to the exciting world of crypto trading! As a potential crypto trader, you’re about to embark on a journey that could be filled with thrilling highs, challenging lows, and immense learning. This comprehensive guide will walk you through the essential steps to become a successful crypto trader, from understanding the basics of cryptocurrency to mastering advanced trading strategies.

Table of Contents

Understanding Cryptocurrency

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of a central bank and is based on blockchain technology, which ensures transparency and decentralization.

The Evolution of Cryptocurrency

The history of cryptocurrency began in 2009 with the launch of Bitcoin, the first decentralized cryptocurrency. Since then, thousands of diverse cryptocurrencies, such as Ethereum and Ripple, have emerged, each with its unique features and uses.

The Role of Blockchain Technology

Blockchain technology is the backbone of cryptocurrency. It’s a decentralized ledger that records all transactions across a network of computers, ensuring transparency and security in the crypto world.

Getting Started with Crypto Trading

The Basics of Crypto Trading

Crypto trading is the act of speculating on cryptocurrency price movements via a trading account, or buying and selling the underlying coins via an exchange. Here are the basic concepts you need to understand:

- Cryptocurrency Exchanges: These are platforms where you can buy and sell cryptocurrencies. Some popular exchanges include Binance, Coinbase, and Kraken. Each exchange has its own interface, fees, and features, so it’s important to choose one that suits your needs.

- Trading Pairs: When trading cryptocurrencies, you’re actually trading a pair of currencies. For example, if you’re trading Bitcoin against the US Dollar, the trading pair would be BTC/USD. The first currency (BTC in this case) is the base currency, and the second one (USD) is the quote currency.

- Orders: When you trade, you place orders. The most common types are ‘market’ and ‘limit’ orders. A market order is an order to buy or sell a cryptocurrency immediately at the best available price. A limit order, on the other hand, is an order to buy or sell a cryptocurrency at a specific price (or better).

- Price Charts: Price charts are a trader’s best friend. They provide a visual representation of the price movements of a cryptocurrency over a specific period. Traders use them to analyze trends and patterns which can help predict future price movements.

- Technical Analysis: This is a trading discipline used to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Traders use indicators and patterns to create a strategy.

- Risk Management: This is an essential aspect of trading. It involves setting a budget, defining your risk tolerance, setting stop losses and take profits, and not investing more than you can afford to lose.

- Trading Strategy: A trading strategy is a set of rules that guide a trader’s decisions. It can be based on technical analysis, fundamental analysis, or both. It defines when to enter and exit trades, what assets to trade, and how much to invest in each trade.

Remember, crypto trading involves significant risk. It’s important to start with a demo account or paper trading to practice without risking real money. Once you’re comfortable with your trading strategy, you can start live trading. Check our how to trade article to get more info.

Setting Up Your Trading Account

To start trading, you’ll need a crypto wallet and an account on a crypto exchange. The wallet stores your cryptocurrencies, while the exchange is the platform where you can buy and sell them.

Learning about Crypto Markets

Understanding Market Trends and Indicators

Successful crypto trading requires a solid understanding of market trends and indicators. These include price patterns, trading volume, and market sentiment, which can help predict future price movements.

The Importance of Market Research

Market research is crucial in crypto trading. It involves analyzing market trends, understanding the factors that influence price movements, and staying updated with news and events that could impact the crypto market.

Crypto Trading Strategies

Overview of Trading Strategies

There are various trading strategies that crypto traders can adopt, including day trading, swing trading, and scalping. Each strategy has its pros and cons and is suitable for different trading styles and risk tolerance levels.

| Strategy | Description | Risk Level | Time Commitment | Potential Return |

|---|---|---|---|---|

| Day Trading | Involves making multiple trades within a single trading day. Profits are made from short-term price fluctuations. | High | High | High |

| Swing Trading | Traders hold positions for days or weeks, aiming to profit from price swings. | Medium | Medium | Medium-High |

| Scalping | A form of day trading where traders aim to profit from very small price changes. Trades are held for minutes or seconds. | High | Very High | Medium |

| HODLing | Stands for ‘Hold On for Dear Life’. Involves buying and holding a cryptocurrency for long-term gains. | Low-Medium | Low | High (Long-term) |

| Trend Trading | Traders take positions that align with the current trend (up or down) and hold until they believe the trend has reversed. | Medium | Medium | High |

| Breakout Trading | Traders buy after the price breaks above resistance or sell after it falls below support. | Medium-High | Medium | High |

Choosing Your Trading Strategy

Choosing the right trading strategy depends on your trading goals, risk tolerance, and time commitment. It’s important to choose a strategy that aligns with your personal trading style.

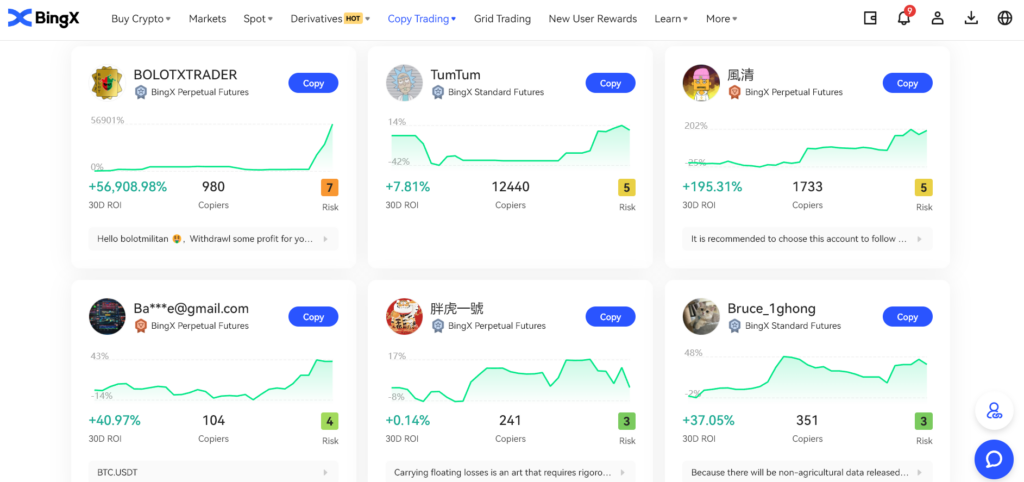

Copytrading

As a beginner stepping into the dynamic world of cryptocurrency, you might consider starting with copytrading as your first step. This approach allows you to understand the workings of the crypto market by mirroring the trades of experienced traders. It serves as a practical learning tool, providing insights into trading strategies and market trends, thus helping you navigate the complexities of the crypto market.

In copytrading, whenever the trader you’re copying makes a trade, the same trade is automatically executed in your account. You can usually decide how much of your portfolio you want to dedicate to copytrading and select multiple traders to copy to diversify your risk.

However, it’s important to remember that while copytrading can be a useful tool, it doesn’t guarantee profits. Even experienced traders can make mistakes or experience losses.

Risk Management in Crypto Trading

The Importance of Risk Management

Risk management is a crucial aspect of successful crypto trading. It involves identifying potential risks, taking steps to mitigate them, and being prepared to deal with losses that may occur.

Risk Management Strategies

Some common risk management strategies include diversification (investing in a variety of cryptocurrencies), setting stop losses (automatically selling when the price drops to a certain level), and only investing money that you can afford to lose.

Building Your Crypto Portfolio

Building a crypto portfolio involves more than just buying a single type of cryptocurrency. It’s about diversifying your investments across different cryptocurrencies to spread risk and increase potential returns. Here’s how you can build your crypto portfolio.

Diversifying Your Portfolio

Diversification involves spreading your investments across a variety of cryptocurrencies toreduce risk. A well-diversified portfolio can help you weather market volatility and increase your chances of long-term success.

Risk Assessment

Different cryptocurrencies come with different levels of risk. Bitcoin and Ethereum, for example, are considered relatively stable compared to newer, less established cryptocurrencies. It’s important to assess your risk tolerance and allocate your investments accordingly.

Portfolio Rebalancing

Rebalancing involves adjusting your portfolio periodically to maintain your desired level of risk and return. It’s a crucial part of portfolio management that can help you stay on track with your trading goals.

Long-term vs Short-term

Decide on your investment horizon. If you’re in it for the long haul, you might invest in coins with solid technology and long-term potential. If you’re looking for short-term gains, you might engage in day trading or swing trading.

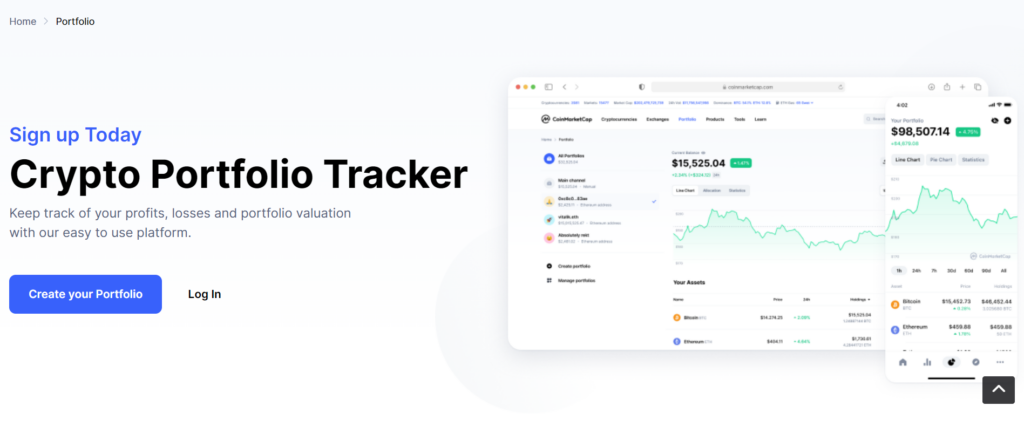

Portfolio Tracking

There are several platforms where you can track your crypto portfolio:

- CoinMarketCap: Offers a simple way to track the performance of various cryptocurrencies. It provides data on price, volume, market cap, and more.

- Delta: Another portfolio tracking app that provides information on over 7,000 cryptocurrencies and sends personalized notifications.

- CryptoCompare: Provides a comprehensive overview of the market and your portfolio. It also offers insights into the performance of other users’ portfolios.

Continuous Learning and Improvement

Staying Updated with Crypto Trends

The crypto market is dynamic and constantly evolving. Staying updated with the latest news and trends is crucial for making informed trading decisions.

Resources for Continuous Learning

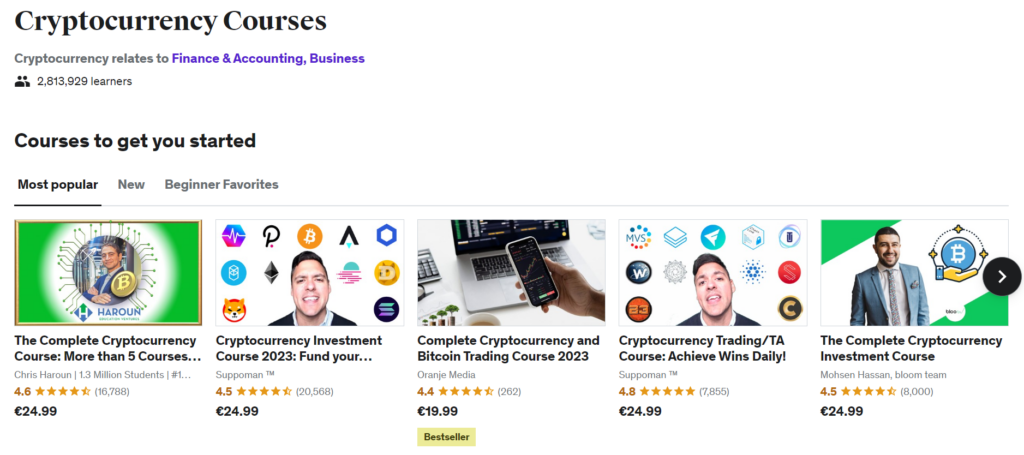

The crypto market is dynamic and constantly evolving. To stay ahead, continuous learning is crucial. Here are some resources that can help you stay informed and improve your trading skills:

- Online Courses: Websites like Coursera, and Udemy offer courses on cryptocurrencies and blockchain technology. These courses can help you understand the basics and delve into more complex topics.

- Books: There are numerous books that provide valuable insights into the world of cryptocurrencies. Some popular ones include “Mastering Bitcoin” by Andreas M. Antonopoulos, “The Age of Cryptocurrency” by Paul Vigna and Michael J. Casey, and “Cryptoassets” by Chris Burniske and Jack Tatar.

- Podcasts: Podcasts are a great way to stay updated on the go. “Unchained,” “The Pomp Podcast,” and “Crypto 101” are some popular crypto-focused podcasts.

- Forums and Social Media: Platforms like Reddit, Twitter, and Telegram host a wealth of information where individuals share their experiences and insights. Subreddits like r/CryptoCurrency and r/Bitcoin can be particularly useful.

- News Websites: Websites like CoinDesk, Cointelegraph, and CryptoSlate offer the latest news and analysis in the crypto world.

- Research Papers and Whitepapers: For a deep dive into specific cryptocurrencies or blockchain technology, consider reading research papers and whitepapers. Most cryptocurrencies publish a whitepaper explaining the technology and ideology behind their project.

- Trading Platforms: Many trading platforms offer resources for learning, such as eToro’s Trading Academy and Binance Academy. These platforms provide articles, videos, and webinars on various topics related to crypto trading.

- Crypto Communities: Joining crypto communities can be a great way to learn from experienced traders and enthusiasts. These communities often host discussions, AMAs (Ask Me Anything), and share resources for learning.

Remember, the crypto market is highly volatile and risky. While these resources can provide valuable information, always do your own research before making any trading decisions.

The Role of Patience and Persistence

Crypto trading is not a get-rich-quick scheme. It requires patience, persistence, and a willingness to learn from mistakes. Remember, every successful trader was once a beginner.

Conclusion

Becoming a successful crypto trader is a journey that requires understanding, strategy, and continuous learning. This guide has provided you with the essential steps to start your journey. Remember, the key to success in crypto trading lies not in chasing quick profits, but in developing a solid trading strategy, managing your risks effectively, and continuously improving your trading skills. So, are you ready to embark on your crypto trading journey?

FAQs

What is a crypto trader?

A crypto trader is an individual who buys and sells cryptocurrencies on a digital exchange with the aim of making a profit. They can trade on short-term price fluctuations (day trading) or hold onto their investments for a longer period (swing trading or hodling).

How to be a crypto trader?

To become a crypto trader, you need to understand the basics of cryptocurrencies and blockchain technology. Then, set up a crypto wallet and an account on a crypto exchange. Learn about market trends, indicators, and different trading strategies. Always manage your risks effectively and continuously improve your trading skills.

Who is the best crypto trader?

It’s hard to definitively say who the best crypto trader is, as trading strategies and success can vary greatly among individuals. However, some well-known figures in the crypto trading world include Erik Finman, Charlie Shrem, and Brian Armstrong.

How to become a crypto day trader?

To become a crypto day trader, you need to understand the basics of day trading, which involves buying and selling cryptocurrencies within the same trading day. You’ll need to be able to analyze market trends quickly, make fast decisions, and be comfortable with taking risks. It’s also important to set a daily trading budget and stick to it.

What is Trader Joe Crypto?

Trader Joe is a one-stop decentralized trading platform operating on the Avalanche network. It offers a range of services including:

Trading: Users can swap tokens with low fees.

Pooling: Users can provide liquidity and earn fees.

Staking: Users can stake JOE tokens and earn rewards.

NFT Marketplace: Users can buy and sell NFTs (Non-Fungible Tokens).

Trader Joe also offers automated pools for providing liquidity and earning fees. They have a section called “Joepegs” where users can explore popular collections of NFTs.

How to become a successful crypto trader?

To become a successful crypto trader, you need to have a solid understanding of the crypto market and trading strategies. Risk management is crucial, as is the ability to stay updated with the latest market trends. Patience, persistence, and continuous learning are key. It’s also important to develop a trading plan and stick to it.

How can I manage risk in crypto trading?

You can manage risk in crypto trading by diversifying your portfolio, setting stop losses, and only investing money that you can afford to lose.