The term “fiat wallet” has emerged as a beacon of simplicity and security. But what exactly is a fiat wallet? And why is it becoming an indispensable tool for both crypto enthusiasts and everyday users? Let’s embark on a journey to unravel the mysteries of the fiat wallet.

Table of Contents

Historical Context

| Time Period | Milestone | Description | Key Example |

|---|---|---|---|

| 7th century BC | Age of Physical Money | Introduction of coined money as tangible representations of value. | The Lydians in ancient Turkey introduced the first coined money. |

| Renaissance Era | Birth of Banking Systems | Establishment of banks for centralized money safeguarding, loans, and large transactions. | The Medici family in Italy developed early banking systems. |

| 1960s | Advent of Electronic Banking | Transition from manual bookkeeping to electronic systems in banks. | Introduction of the first Automated Teller Machines (ATMs). |

| 1990s-early 2000s | Rise of Online Banking | With the internet’s spread, online banking emerged, allowing account access, transfers, and bill payments. | Stanford Federal Credit Union offered the first online banking services in 1994. |

| Late 1990s | Emergence of Fiat Wallets | Digital wallets arose for convenient online payments without traditional banking. | PayPal, founded in 1998, simplified online payments globally. |

| 21st century | Mobile Revolution and Wallets | Smartphones led to mobile-based fiat wallets, enabling finance management and payments on-the-go. | Apple Pay, launched in 2014, revolutionized payments via smartphones. |

What is a Fiat Wallet?

Defining the Term

At its core, a fiat wallet is a digital tool that allows users to store, manage, and transact with traditional money, like dollars, euros, or yen. It’s like your regular bank account but designed for the digital age.

Fiat vs. Crypto: The Key Differences

While both fiat and crypto wallets serve as storage, the primary distinction lies in their currency type. Fiat wallets deal with government-issued currencies, whereas crypto wallets handle cryptocurrencies like Bitcoin and Ethereum.

Types of Fiat Wallets

| Type | Description | Pros | Cons | Examples |

|---|---|---|---|---|

| Web-based Wallets | Accessible via browsers, offering convenience. | Easy access; No installation required. | Potential security risks; Reliant on web access. | PayPal, Skrill, Neteller |

| Mobile Wallets | Apps on smartphones, balancing convenience with security. | Portable; Integrated features like QR scanning. | Device dependency; Possible battery constraints. | Apple Pay, Google Wallet, Samsung Pay |

| Desktop Wallets | Software on personal computers, often more secure than web-based options. | Enhanced security; Offline access. | Limited to one device; Requires installation. | Trustwallet (for crypto but has fiat features), Exodus |

| Hardware Wallets | Physical devices like USBs, the most secure option for storing funds. | High security; Immune to online hacking attempts. | Cost involved; Physical damage risk. | Ledger, Trezor |

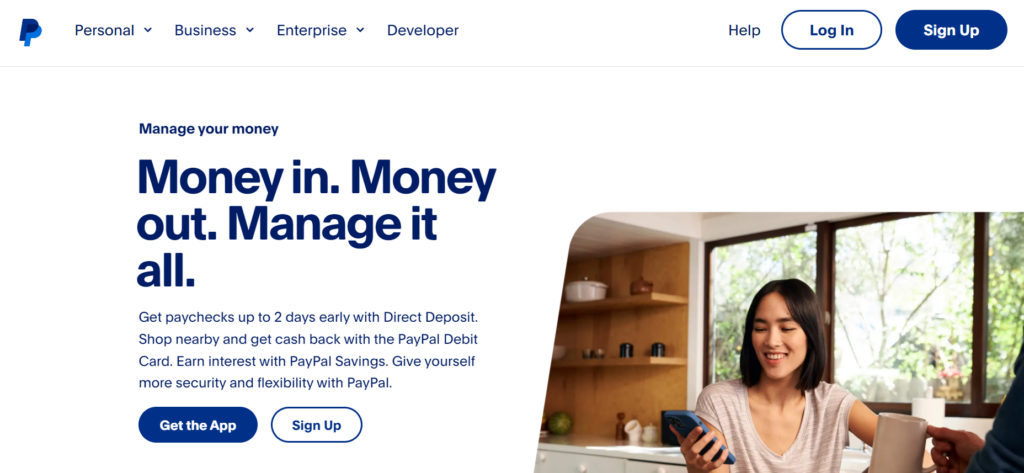

Web-based Wallets

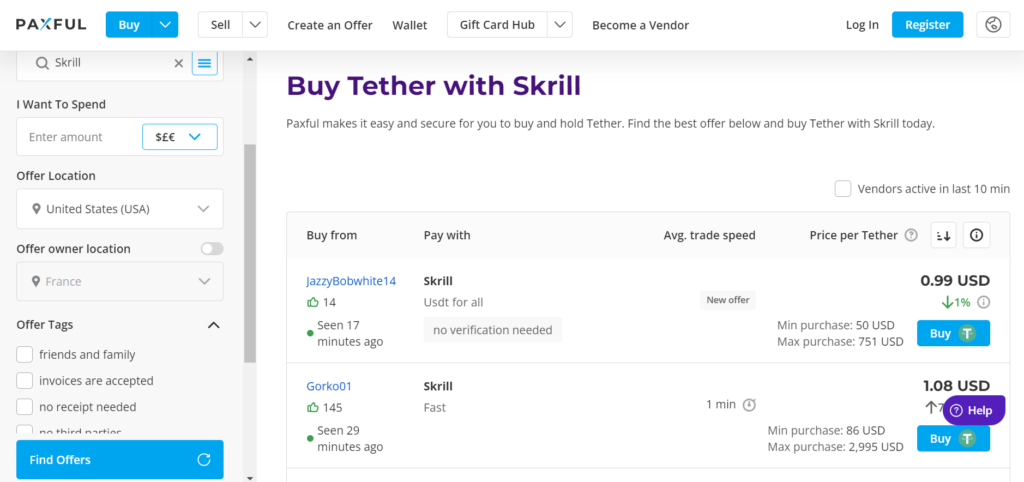

Web-based wallets are platforms accessible through internet browsers. Examples include PayPal, which allows users to store and transact in various fiat currencies, Skrill, which offers both fiat and crypto functionalities, and Neteller, known for its swift international transfers.

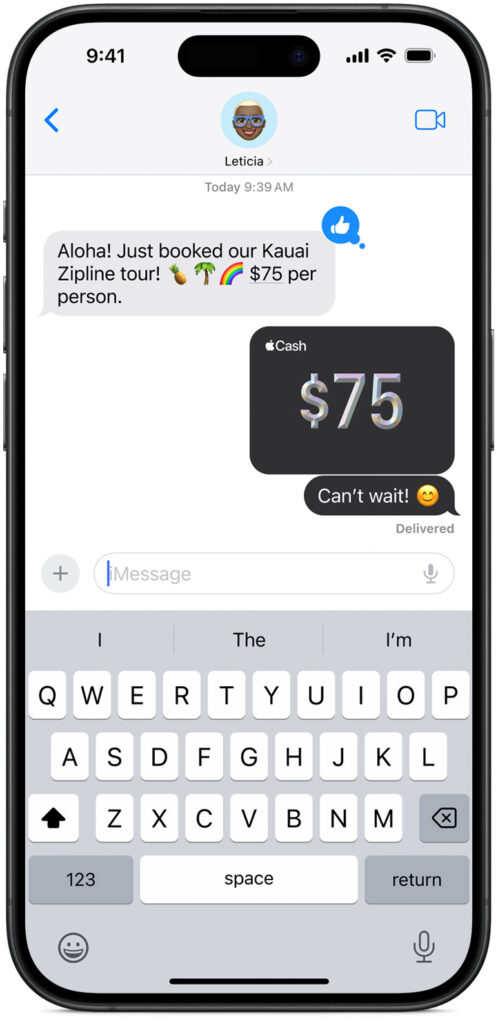

Mobile Wallets

Mobile wallets are applications designed for smartphones. Apple Pay is a prime example, allowing iPhone users to store their credit and debit card information and make payments on the go. Google Wallet offers similar functionalities for Android users, while Samsung Pay is tailored for Samsung devices, boasting compatibility with a wide range of point-of-sale systems.

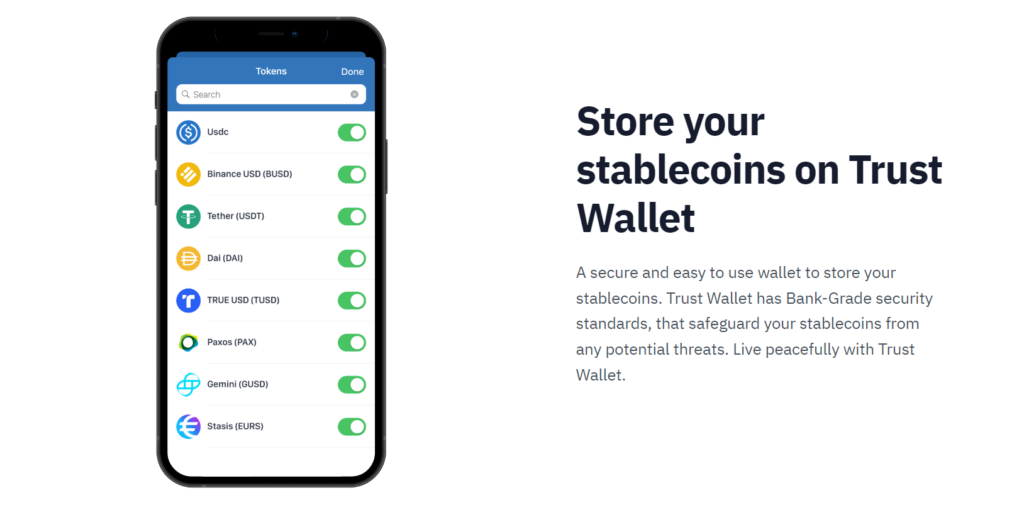

Desktop Crypto Fiat Wallets

Desktop wallets are software programs installed on personal computers. Trustwallet is primarily a crypto wallet but has features that can be integrated with fiat functionalities. Exodus supports fiat-pegged digital currencies like USDT (Tether). USDT is a stablecoin, meaning its value is pegged to a stable asset, in this case, the US Dollar.

Hardware Crypto Wallets

Hardware wallets are physical devices designed for utmost security. Ledger Nano S Plus is a popular choice, known for its sleek design and robust security features. Trezor is another trusted name in the industry, offering a user-friendly interface and compatibility with multiple currencies.

Why Use a Fiat Wallet?

The digital age has transformed the way we handle money, and fiat wallets have emerged as a pivotal tool in this transformation. Here’s why:

1. Enhanced Security:

Digital Safeguarding

Fiat wallets employ advanced encryption techniques, ensuring that your funds are protected from unauthorized access. Unlike carrying physical cash, which can be lost or stolen, digital fiat offers a layer of protection that’s hard to breach.

Example

Many fiat wallets use two-factor authentication (2FA), where users receive a one-time code on their mobile devices to confirm transactions, adding an extra layer of security.

2. Speed and Efficiency:

Instant Transactions

Gone are the days of writing checks or waiting in bank queues. With fiat wallets, transactions, whether it’s sending money to a friend or paying for a service, are almost instantaneous.

Example

Platforms like PayPal allow users to send money across borders in a matter of seconds, making international business and personal transactions seamless.

3. Integration with Crypto Exchanges:

Bridging the Gap

As the world warms up to cryptocurrencies, having a fiat wallet that integrates with crypto exchanges can be invaluable. It allows users to easily convert their traditional money into crypto and vice versa.

Example

Paxful offers a Skrill integrated feature where users can buy and sell a range of cryptocurrencies directly from their fiat balance, eliminating the need for multiple platforms.

4. Cost-Effective:

Minimal to No Fees

Many fiat wallets offer transactions with minimal to no fees, especially when compared to traditional banking systems or money transfer services that often charge hefty amounts for simple transactions.

Example

Mobile wallets like Apple Pay or Google Wallet often don’t charge users any fees for making everyday transactions, making them a cost-effective alternative.

5. Accessibility and Convenience:

Anytime, Anywhere

Whether you’re traveling, at a cafe, or in the comfort of your home, fiat wallets give you the power to manage your finances anytime, anywhere, as long as you have internet access.

Example

With mobile wallets, even if you forget your physical wallet at home, you can still make purchases, pay bills, or even book tickets using just your phone.

6. Enhanced Features:

More than Just a Wallet

Modern fiat wallets come packed with features. From splitting bills with friends, setting up recurring payments, to even investing in stocks or mutual funds, these wallets are evolving into comprehensive financial tools.

Example

Apps like Venmo not only allow users to send and receive money but also come with features like the Venmo card, which users can use to make purchases or even withdraw cash.

How Do Fiat Wallets Work?

The mechanics behind fiat wallets might seem complex, but at their core, they’re designed to simplify the process of managing and transacting traditional money in a digital format. Here’s a breakdown:

1. Account Creation and Verification:

Initial Setup

To start using a fiat wallet, users typically need to create an account. This process involves providing personal details, setting up security measures like passwords or PINs, and often undergoing a verification process to ensure authenticity.

Example

Platforms like PayPal require users to verify their identity by linking a bank account or credit card and confirming small test transactions.

2. Depositing Funds:

Loading Your Wallet

Once set up, users can deposit funds into their fiat wallet. This can be done by transferring money from a bank account, using credit or debit cards, or even through cash deposits at specific locations.

Example

Mobile wallets like Google Wallet allow users to deposit funds directly from their linked bank accounts or by using their credit or debit cards.

3. Making Transactions:

Digital Payments

With funds in the wallet, users can make payments to merchants, send money to other users, or even pay bills. Transactions are authenticated using security measures like passwords, biometrics, or 2FA.

Example

With Apple Pay, users can make contactless payments at stores by simply authenticating the transaction using Face ID or Touch ID.

4. Withdrawing Funds:

Cashing Out

If users wish to convert their digital balance back to physical cash or transfer it to a bank account, they can initiate a withdrawal. Depending on the platform, this can involve fees and might take some time to process.

Example

With platforms like Skrill, users can withdraw their balance directly to their bank accounts or even request a physical check.

5. Security Protocols:

Guarding Your Money

Fiat wallets employ a range of security measures to protect user funds and data. This includes encryption, secure sockets layer (SSL) protocols, and regular security audits.

Example

Ledger, known for its hardware wallets, uses a secure chip to ensure that user data remains confidential and protected from potential breaches.

6. Integration and Syncing:

Seamless Connectivity

Many fiat wallets offer integration with other financial tools, apps, or platforms. This allows for a seamless flow of funds and data across different ecosystems.

Example

Some fiat wallets can be integrated with accounting software, allowing businesses to sync their transactions and financial data automatically.

Choosing the Right Fiat Wallet

In the vast landscape of digital finance, selecting the right fiat wallet can seem daunting. However, with a clear understanding of your needs and the features offered by different platforms, you can make an informed decision. Here’s a guide to help you navigate your choices:

1. Determine Your Needs:

Personal vs. Business

Are you an individual looking to manage daily expenses or a business aiming to streamline transactions? Some wallets cater specifically to business needs with features like invoicing, while others are tailored for personal use.

Example

PayPal offers both personal and business accounts, each designed to cater to the specific needs of the user.

2. Prioritize Security:

Safety First

The security of your funds should be paramount. Look for wallets that employ advanced encryption, two-factor authentication, and other security measures.

Example

Hardware wallets like Trezor or Ledger Nano S are renowned for their robust security features, making them a top choice for those prioritizing safety.

3. Consider the User Experience:

Ease of Use

A user-friendly interface can make all the difference. Opt for wallets that are intuitive, easy to navigate, and offer responsive customer support.

Example

Mobile wallets like Apple Pay or Google Wallet are designed with simplicity in mind, ensuring a smooth user experience.

4. Evaluate Fees and Charges:

Cost Implications

While many fiat wallets offer free services, some might charge fees for specific transactions, currency conversions, or withdrawals. It’s essential to be aware of any associated costs.

Example

While Skrill might offer free peer-to-peer transfers, they do charge fees for currency conversions.

5. Check for Integration Capabilities:

Connectivity

If you’re using other financial tools or platforms, it might be beneficial to choose a wallet that integrates seamlessly with them.

Example

Some fiat wallets can be directly linked to accounting software like QuickBooks, simplifying financial tracking for businesses.

6. Research Reviews and Reputation:

Word of Mouth

Often, the experiences of other users can provide valuable insights. Look for reviews, ratings, and any reported issues to gauge the reliability and performance of the wallet.

Example

Platforms like Trustpilot offer user reviews on various fiat wallets, giving potential users a glimpse into the pros and cons of each option.

7. Flexibility and Features:

Beyond Basics

Some wallets offer additional features like investment options, bill payments, or even loyalty rewards. Depending on your needs, these added benefits can be a deciding factor.

Example

Platforms like Revolut not only function as a fiat wallet but also offer features like stock trading and cryptocurrency exchange.

Best Practices for Using a Fiat Wallet

Navigating the digital financial landscape with a fiat wallet can be both empowering and challenging. To ensure a smooth and secure experience, it’s essential to adhere to certain best practices. Here’s a comprehensive guide:

1. Regularly Update Your Wallet Software:

Stay Current

Just like any other software, fiat wallet applications receive updates to enhance functionality and patch any vulnerabilities. Ensure you regularly update to the latest version.

Example

If you’re using a mobile wallet app, enable automatic updates from the app store to ensure you always have the latest security patches.

2. Use Strong, Unique Passwords:

Fortify Access

Avoid using easily guessable passwords or the same password across multiple platforms. Opt for a combination of letters, numbers, and symbols to enhance security.

Example

Instead of using “password123”, consider using a password manager to generate and store a complex password like “j4!7^Lp9$”.

3. Enable Two-Factor Authentication (2FA):

Double the Defense

2FA adds an additional layer of security by requiring a second form of verification beyond just a password.

Example

Many wallets send a one-time code to your mobile device or email during login, ensuring that even if someone knows your password, they can’t access your account without the second verification.

4. Be Wary of Phishing Attempts:

Stay Alert

Cybercriminals often use fake emails or websites to trick users into providing their login details. Always double-check URLs and be skeptical of unsolicited communication.

Example

If you receive an email from “PayPall” instead of “PayPal” asking for your login details, it’s likely a phishing attempt.

5. Regularly Backup Your Wallet:

Safety Net

In case of software failures or unforeseen issues, having a backup ensures you can restore your wallet and access your funds.

Example

Some desktop wallets allow users to create a backup passphrase or seed phrase, which can be used to recover the wallet on another device.

6. Avoid Public Wi-Fi for Transactions:

Secure Your Connection

Public Wi-Fi networks are often less secure, making them prime targets for hackers. Always use a secure, private connection when accessing your fiat wallet.

Example

If you need to access your wallet in public, consider using a VPN to encrypt your connection.

7. Monitor Your Transactions:

Stay Informed

Regularly review your transaction history to spot any unauthorized or suspicious activity. If something seems amiss, contact your wallet provider immediately.

Example

Set up notifications or alerts for large transactions or withdrawals to keep track in real-time.

8. Educate Yourself:

Knowledge is Power

The digital finance landscape is constantly evolving. Stay updated with the latest trends, threats, and safety measures to protect your assets.

Example

Join online forums, attend webinars, or follow trusted financial tech news sources to stay informed.

The Future of Fiat Wallets

As the world becomes increasingly digitized, the role of fiat wallets is set to evolve, reflecting the changing needs and technologies of the times. Here’s a glimpse into what the future might hold for these digital financial tools:

1. Integration with Decentralized Finance (DeFi):

Bridging Traditional and Decentralized Finance

The rise of DeFi platforms, which aim to recreate traditional financial systems (like loans and interest) on blockchain, suggests a future where fiat wallets could seamlessly integrate with these platforms, offering users the best of both worlds.

Example

Imagine a fiat wallet where users can directly invest their traditional money into DeFi projects, earning interest or even taking out crypto loans.

2. Enhanced Security Measures:

Beyond Passwords

As cyber threats become more sophisticated, the security measures of fiat wallets will likely see innovations. Biometric verifications, AI-driven anomaly detection, and quantum encryption are just a few possibilities.

Example

Future wallets might use heartbeat patterns or brainwave signatures, unique to every individual, as a form of authentication.

3. More Than Just a Wallet:

Financial Hubs

Fiat wallets could evolve into comprehensive financial management tools, offering services ranging from investment advice to tax management, all integrated into one platform.

Example

Your fiat wallet could analyze your spending habits, offer savings tips, suggest investment opportunities, or even auto-file your taxes.

4. Global Interoperability:

Cross-border Seamlessness

The future might see fiat wallets that can effortlessly handle multiple currencies, making international transactions as simple as local ones, without exorbitant fees or long waiting times.

Example

A single wallet where you can store USD, EUR, JPY, and more, and make instant transfers worldwide without currency conversion hassles.

5. Integration with Internet of Things (IoT):

Connected Finances

As everyday devices become smarter and interconnected, your fiat wallet could integrate with them, facilitating automated payments and financial tasks.

Example

Your smart fridge could automatically order and pay for groceries when they run low, directly from your fiat wallet.

6. Regulatory Challenges and Opportunities:

Navigating the Legal Landscape

As fiat wallets become more mainstream, they’ll likely attract more regulatory attention. This could mean stricter safety standards, which is beneficial for users, but also potential challenges in terms of privacy and global interoperability.

Example

Governments might implement standardized security protocols for fiat wallets but could also require more stringent KYC (Know Your Customer) processes.

7. Environmental and Social Considerations:

Sustainable Finance

With growing awareness of environmental and social issues, future fiat wallets might incorporate features that allow users to understand the carbon footprint of their spending or invest in socially responsible ways.

Example

A feature in the wallet that calculates the environmental impact of your purchases or suggests eco-friendly alternatives.

Conclusion

The digital transformation of our world has reshaped many facets of our daily lives, and the realm of finance is no exception. Fiat wallets, as we’ve explored, stand at the intersection of traditional finance and digital innovation. They offer a blend of convenience, efficiency, and security, making them an indispensable tool for modern-day transactions.

From their historical roots in ancient coinage to the sophisticated digital platforms of today, the journey of fiat wallets mirrors humanity’s relentless pursuit of progress. As we’ve seen, choosing the right fiat wallet requires a blend of understanding one’s needs and being informed about the available options. While they offer numerous advantages, it’s also crucial to follow best practices to ensure the safety and security of one’s assets.

Looking ahead, the future of fiat wallets is bound to be dynamic. With advancements in technology, evolving user needs, and the global shift towards a more interconnected digital economy, these wallets will likely play an even more integral role in our financial ecosystems. Whether you’re a seasoned digital finance enthusiast or someone just starting to explore the world of fiat wallets, one thing is clear: they represent not just the future of money management, but also a testament to human ingenuity and adaptability in the face of change.

In essence, as we navigate the digital age, fiat wallets serve as both a tool and a symbol, reminding us of where we’ve been, where we are, and the exciting possibilities of where we might go next.

FAQs

How to transfer from crypto wallet to fiat wallet?

Sell your cryptocurrency on a crypto exchange platform for fiat currency (USDT Tether). Once sold, transfer the fiat funds to your fiat wallet.

Is fiat wallet safe?

Generally, fiat wallets are safe, especially when using reputable providers. However, like all digital tools, they can be vulnerable if not used with proper security measures.

How to set up fiat wallet on crypto.com?

Download the Crypto.com app and sign up. Navigate to the ‘Assets’ section, then deposit, then choose one of the fiat currencies like USDT. Always refer to the platform’s official guides for detailed steps.