Welcome to the fascinating world of cryptocurrencies, where USDT, also known as Tether, plays a pivotal role. This article will provide a comprehensive understanding of USDT, its importance in the crypto market, and its potential future.

Table of Contents

What is USDT (Tether)?

USDT, or Tether, is a type of cryptocurrency known as a stablecoin. Its value is pegged to the US dollar, meaning one USDT is always equivalent to one USD. This connection to a stable fiat currency helps mitigate the volatility typically associated with cryptocurrencies. In the crypto market, USDT serves as a bridge between fiat and cryptocurrencies, providing a stable platform for transactions.

History of USDT

Tether was first introduced in 2014, aiming to integrate the stability and trust of the USD with the flexibility and potential of cryptocurrencies. Despite several controversies and legal issues, such as debates over its full backing by USD, USDT has managed to maintain its position in the market and continues to be a significant player in the crypto world.

How Does USDT Work?

Understanding how USDT works involves delving into the technology behind it, how it maintains its peg to the USD, and the role of audits in its operation.

Blockchain Technology and USDT

At its core, USDT operates on the blockchain, the underlying technology that powers all cryptocurrencies. Specifically, Tether uses the Omni Layer Protocol, a platform that allows the creation and trading of custom digital assets and currencies. It’s built on top of the Bitcoin blockchain, which provides the robust security measures that the Bitcoin network is known for.

USDT can also be issued on other blockchains, such as Ethereum, where it operates as an ERC-20 token. This means it can interact with smart contracts and be used in decentralized applications (dApps) on the Ethereum network.

In addition to the Omni Layer Protocol and Ethereum’s ERC-20 standard, USDT is also issued on other blockchains, including TRON’s TRC-20 and Binance’s BEP-20. These different versions of USDT are interoperable, meaning they can be transferred and used across these different blockchains.

| Blockchain | Token Standard | Key Features |

|---|---|---|

| Bitcoin | Omni Layer Protocol | Allows the creation and trading of custom digital assets and currencies. Provides robust security measures of the Bitcoin network. |

| Ethereum | ERC-20 | Can interact with smart contracts and be used in decentralized applications (dApps) on the Ethereum network. |

| TRON | TRC-20 | Supports high-speed and low-cost transactions. Ideal for users who want to transfer USDT quickly and cheaply. |

| Binance Smart Chain | BEP-20 | Can interact with smart contracts and dApps on the Binance Smart Chain. Ideal for users who want to participate in various DeFi applications. |

| Polygon (Matic) | ERC-20 | Offers scalable, secure and instant Ethereum transactions using Plasma side chains and a Proof-of-Stake network. |

| Solana | SPL | Provides fast, secure, and scalable blockchain solutions. Ideal for high-performance crypto applications. |

Maintaining the USD Peg

One of the key features of USDT is its value peg to the US dollar. This peg is maintained through a method known as ‘proof of reserves’. In theory, for every USDT in circulation, there is an equivalent amount of USD held in reserves by Tether Ltd., the company behind USDT. This 1:1 ratio is intended to provide stability and trust in the value of USDT.

However, it’s important to note that the exact nature of these reserves and whether they are indeed equivalent to the number of USDT in circulation has been a subject of controversy and legal scrutiny.

The Role of Audits

To ensure transparency and build trust with users, Tether Ltd. is supposed to conduct regular audits of its reserves. These audits are meant to verify that for every USDT token, there is indeed a corresponding USD in Tether’s reserves.

However, the frequency and thoroughness of these audits have been a point of contention. Critics argue that Tether has not been transparent enough in proving that it holds enough reserves to back all the USDT in circulation.

In conclusion, USDT operates using blockchain technology, maintains its value through a peg to the USD, and relies on audits to ensure transparency. Understanding these aspects is crucial to comprehending how USDT functions in the broader cryptocurrency market.

Benefits of Using USDT

USDT offers several benefits that make it a popular choice among cryptocurrencies. Here’s a detailed chart outlining these benefits:

| Benefit | Description | Real-world Application |

|---|---|---|

| Stability | USDT provides a buffer against the volatility of the crypto market. It’s pegged to the US dollar, which helps maintain its value even when other cryptocurrencies fluctuate. | This makes USDT a safe haven during market downturns, allowing users to preserve their capital. |

| Ease of Transaction | USDT can be easily transferred between wallets, exchanged for other cryptocurrencies, or used for transactions. | This makes it a convenient tool for traders who want to quickly move funds between different crypto exchanges. |

| Global Acceptance | USDT is widely accepted in crypto exchanges around the world. | This makes it easy for users to trade and invest in various cryptocurrencies, regardless of their location. |

| Liquidity | As one of the most traded cryptocurrencies, USDT offers high liquidity. | This ensures that users can always buy or sell USDT without significantly affecting its price. |

| Interoperability | USDT is issued on multiple blockchains, making it versatile and accessible. | This allows users to interact with various DeFi applications across different blockchains. |

These benefits make USDT a powerful tool in the crypto market, providing stability, ease of transaction, global acceptance, high liquidity, and interoperability.

Risks and Controversies Associated with USDT

While USDT offers several benefits, it’s also been associated with a number of risks and controversies. Here are some of the key issues:

Transparency and Full Backing by USD

One of the main controversies surrounding USDT is the question of whether it’s fully backed by USD reserves. Tether Ltd., the company behind USDT, claims that each USDT token is backed by an equivalent amount of USD. However, critics have questioned this claim, citing a lack of transparency and regular audits.

In 2019, Tether Ltd. admitted in court that USDT was not 100% backed by USD but was instead backed by a combination of cash, cash equivalents, and other assets. This admission raised concerns about the stability and reliability of USDT.

Centralization

Another risk associated with USDT is its centralized nature. Unlike decentralized cryptocurrencies like Bitcoin, USDT is issued and controlled by a single entity, Tether Ltd. This centralization poses risks, including the potential for manipulation, the reliance on the solvency of Tether Ltd., and the potential for regulatory action against the company.

Legal and Regulatory Risks

Tether Ltd. has faced several legal challenges and regulatory scrutiny. In 2020, the company was sued by the New York Attorney General’s office for allegedly covering up a loss of $850 million in customer funds. Tether Ltd. settled the lawsuit in 2021 without admitting or denying the allegations but agreed to provide greater transparency about its reserves.

Impact of USDT Tether FUD on the Crypto Market

“FUD” stands for Fear, Uncertainty, and Doubt. In the context of cryptocurrencies, it refers to negative information, rumors, or sentiments that can cause investors to panic and sell their holdings, leading to market instability. USDT, being a major player in the crypto market, is not immune to FUD, and any negative news or controversies surrounding it can have significant impacts on the wider crypto market.

Market Volatility

USDT serves as a stable store of value in the volatile crypto market. However, if doubts arise about Tether’s ability to maintain the 1:1 peg with the USD, it can lead to significant market volatility. Investors may rush to exchange their USDT for other cryptocurrencies or fiat, causing sharp price movements.

Liquidity Concerns

USDT plays a crucial role in providing liquidity to the crypto market. Many traders use it as a safe haven to park their funds during market downturns. If there’s FUD around USDT, it could lead to liquidity issues as traders might be reluctant to use USDT, making it harder to buy and sell other cryptocurrencies.

Trust in Stablecoins

USDT is the most widely used stablecoin, and any FUD surrounding it can impact the perception of other stablecoins as well. If traders lose faith in USDT, they may become wary of other stablecoins too, even if they are not directly implicated in the controversy.

Regulatory Scrutiny

Controversies around USDT can attract regulatory scrutiny, not just for Tether, but for the entire crypto industry. This could lead to tighter regulations, which could impact the growth and development of the crypto market.

How to Buy and Store USDT

Buying and storing USDT involves a few key steps. Here’s a detailed guide:

Buying USDT

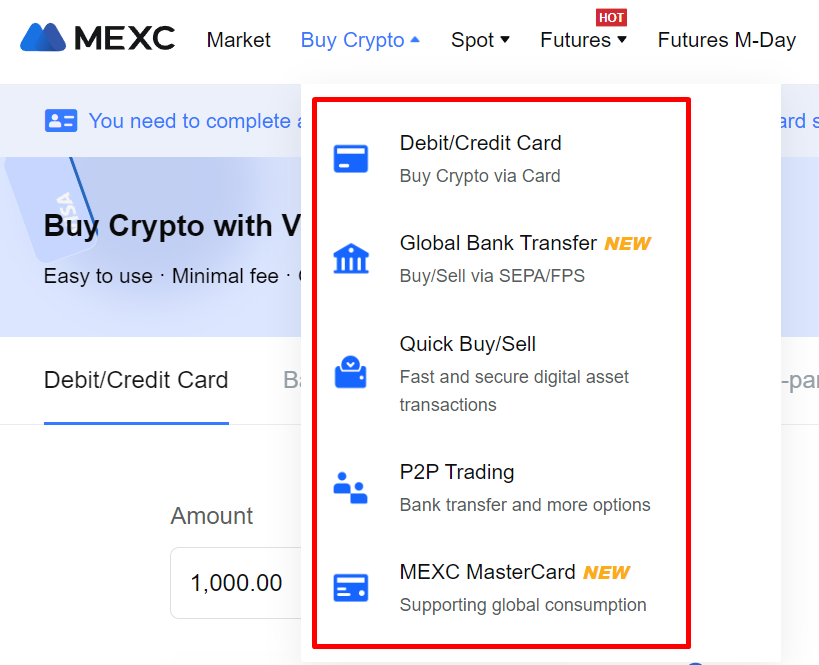

Choose a Crypto Exchange

The first step to buying USDT is to choose a cryptocurrency exchange. Some popular exchanges where you can buy USDT include Mexc, Binance, Gate.io, OKX. The choice of exchange may depend on factors like fees, user interface, customer support, and the user’s location.

| Platform | Pros | Cons |

|---|---|---|

| MEXC | User-friendly interface, wide range of cryptocurrencies, lowest crypto exchange fees, advanced trading features | Platform may be complex for beginners, slow customer service response times |

| Binance | Large number of cryptocurrencies, advanced trading features, high liquidity, user-friendly interface | Reports of delayed customer service responses, potential target for hackers |

| Gate.io | Wide range of cryptocurrencies, advanced trading features, user-friendly interface, educational resources for beginners | Higher trading fees, does not support fiat currency deposits or withdrawals |

| OKX | Large number of cryptocurrencies, advanced trading features, competitive fees, user-friendly interface, educational resources for beginners | Reports of account freezes without prior notice, slow customer service response times |

| BingX | Advanced trading features, high leverage, ability to copy trades from successful traders, user-friendly interface | Smaller selection of cryptocurrencies, less liquidity due to smaller user base |

Create an Account

Once you’ve chosen an exchange, you’ll need to create an account. This usually involves providing some personal information and going through a verification process.

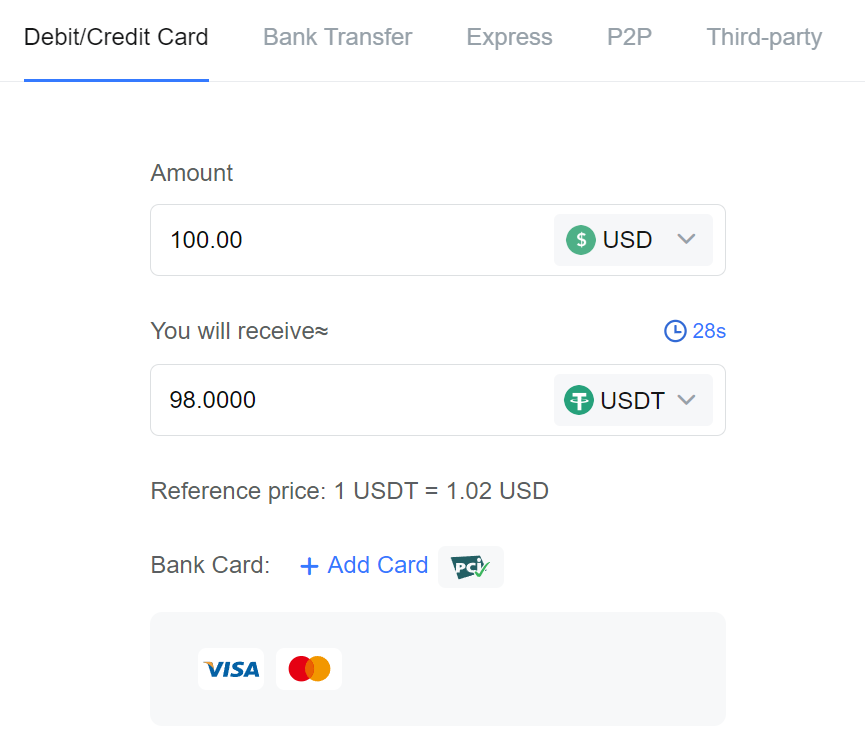

Deposit Funds

After setting up your account, you’ll need to deposit funds into it. Most exchanges like MEXC allow you to deposit funds using traditional fiat currencies like USD, EUR, or GBP. Some exchanges also allow you to deposit other cryptocurrencies like Bitcoin or Ethereum, which you can then trade for USDT.

Buy USDT

Once you have funds in your account, you can use them to buy USDT. This usually involves finding the USDT trading pair (like USDT/USD or USDT/BTC), entering the amount of USDT you want to buy, and executing the trade.

Storing USDT

Choose a Tether Wallet

To store USDT, you’ll need a digital wallet that supports it. There are many types of wallets to choose from, including online wallets, mobile wallets, desktop wallets, and hardware wallets. The choice of wallet may depend on factors like security, convenience, and personal preference.

| Wallet Name | Type | Supported USDT Chains | Link |

|---|---|---|---|

| Ledger | Hardware | Omni, ERC20, TRC20 | Visit Ledger |

| Trezor | Hardware | Omni, ERC20 | Visit Trezor |

| Exodus | Software | Omni, ERC20, TRC20 | Visit Exodus |

| Trust Wallet | Software | ERC20, TRC20, BEP20 | Visit Trust Wallet |

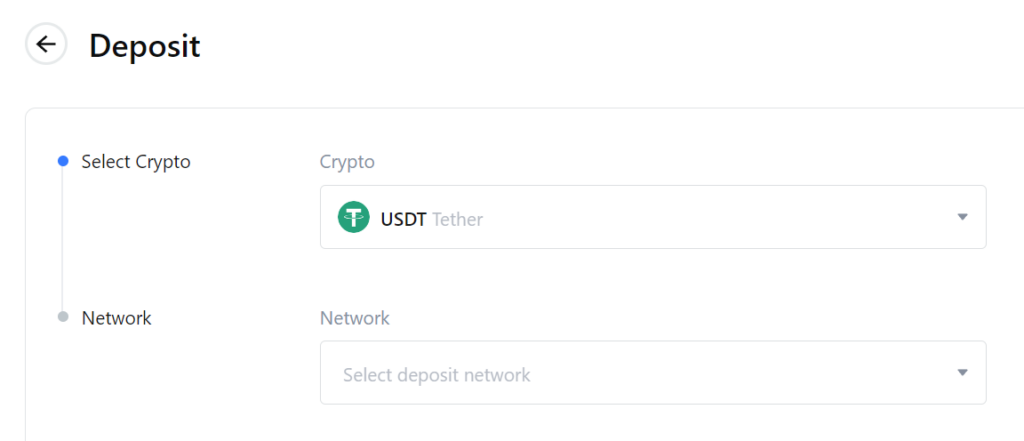

Transfer USDT to Your Wallet

Once you’ve chosen a wallet, you’ll need to transfer your USDT from the exchange to your wallet. This usually involves generating a receiving address in your wallet, entering this address when withdrawing from the exchange, and confirming the transaction.

Secure Your Wallet

After transferring your USDT to your wallet, it’s important to secure it. This might involve creating a strong password, enabling two-factor authentication, and making a backup of your wallet.

USDT and DeFi (Decentralized Finance)

Decentralized Finance, or DeFi, refers to the use of blockchain technology to offer traditional financial services like lending, borrowing, and trading in a decentralized manner, without the need for intermediaries like banks. USDT plays a crucial role in the DeFi space due to its stability and wide acceptance.

USDT as a Stable Asset in DeFi

In the volatile world of cryptocurrencies, stablecoins like USDT provide a much-needed stability. They serve as a stable asset that users can hold, trade, or use as collateral in DeFi applications without worrying about price fluctuations. This stability makes USDT a popular choice for many DeFi applications.

USDT in DeFi Lending and Borrowing

One of the key applications of DeFi is lending and borrowing platforms. These platforms allow users to lend their cryptocurrencies to earn interest or borrow cryptocurrencies against collateral. USDT, with its stable value, is a popular choice for both lenders and borrowers on these platforms. Lenders can earn a stable return on their USDT, while borrowers can get a loan in a stable currency.

USDT in Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) are another important part of the DeFi ecosystem. These exchanges allow users to trade cryptocurrencies directly with each other, without the need for an intermediary. USDT is often used as a base currency in these exchanges due to its stability and wide acceptance.

USDT in Yield Farming and Liquidity Mining

Yield farming and liquidity mining are advanced DeFi strategies where users provide liquidity to DeFi protocols to earn rewards. USDT is commonly used in these strategies due to its stable value and high liquidity.

Future of USDT

The future of USDT, like any cryptocurrency, is subject to a variety of factors, including regulatory developments, technological advancements, market dynamics, and the overall adoption of cryptocurrencies. Here are some potential future scenarios for USDT:

Increased Adoption

As the crypto market continues to grow, we can expect to see increased adoption of USDT. Its stability makes it a popular choice for traders and investors looking to hedge against volatility. Moreover, as more businesses start accepting cryptocurrencies, USDT could become a preferred choice due to its stable value.

Greater Regulatory Scrutiny

Given the controversies surrounding USDT, it’s likely that it will face greater regulatory scrutiny in the future. How Tether Ltd. responds to this scrutiny and whether it can provide greater transparency about its reserves could significantly impact USDT’s future.

Role in the DeFi Ecosystem

As the DeFi ecosystem continues to evolve, USDT is likely to play an increasingly important role. Its stability and wide acceptance make it a key component of many DeFi applications, from lending and borrowing platforms to decentralized exchanges.

Technological Advancements

As blockchain technology continues to advance, we can expect to see new features and improvements in USDT. This could include faster transaction times, lower fees, and enhanced security features.

Conclusion

USDT, or Tether, has emerged as a cornerstone of the cryptocurrency market. Its unique proposition as a stablecoin pegged to the US dollar offers a degree of stability in the otherwise volatile world of cryptocurrencies. This stability, combined with its widespread acceptance and versatility across multiple blockchains, has made it a popular choice for traders, investors, and DeFi applications.

However, like any financial instrument, USDT is not without its risks and controversies. Questions about its full backing by USD reserves, its centralized nature, and legal challenges have cast a shadow over its operations. These issues highlight the importance of transparency and regulatory compliance in the cryptocurrency space.

Looking ahead, the future of USDT will likely be shaped by a variety of factors, including regulatory developments, technological advancements, and the overall growth of the crypto and DeFi markets. As these markets continue to evolve, USDT is poised to play a crucial role in their development.

In conclusion, whether you’re an investor, a trader, or simply a crypto enthusiast, understanding USDT is key to navigating the complex world of cryptocurrencies. As we continue to explore this exciting new frontier, USDT will undoubtedly be a part of the journey.

FAQs

What is tethering?

Tethering, in the context of USDT, refers to the practice of tying the value of the cryptocurrency to a stable asset, usually a fiat currency like the US dollar. This is done to mitigate the volatility often associated with cryptocurrencies.

How to buy USDT?

To buy USDT, you need to create an account on a cryptocurrency exchange that supports USDT, like Mexc or Binance. Deposit funds into your account, then use these funds to purchase USDT.

What is USDT payment?

A USDT payment refers to a transaction made using USDT. Because USDT is a stablecoin, it can be used to make payments in a way that avoids the volatility of other cryptocurrencies.

Is USDT safe?

USDT is generally considered safe to use as a medium of exchange and store of value. However, like any cryptocurrency, it’s not without risks. It’s important to use a secure wallet, be wary of phishing attempts, and keep up to date with any news or controversies surrounding Tether Ltd.

How to short Tether?

Shorting, or betting that the price of an asset will fall, is not typically done with stablecoins like USDT because their value is designed to remain stable. However, if you believe that USDT will break its peg with the USD, you could theoretically short it by borrowing USDT, selling it for another asset, and then buying back USDT at a lower price in the future.

What is USDT coin?

USDT, or Tether, is a type of cryptocurrency known as a stablecoin. Its value is pegged to the US dollar, meaning one USDT is always equivalent to one USD. This connection to a stable fiat currency helps mitigate the volatility typically associated with cryptocurrencies.

Where to buy Tether?

What is USDT contract address?

The USDT contract address is a unique identifier that specifies the location of the USDT token on the blockchain. The address varies depending on the blockchain. For example, on the Ethereum blockchain, the USDT contract address is ‘0xdAC17F958D2ee523a2206206994597C13D831ec7’. Always verify the contract address from a trusted source before making a transaction.