Mining pool payout schemes are the backbone of the cryptocurrency mining industry. Understanding these schemes is crucial for anyone involved in crypto mining. This article will provide a comprehensive guide to mining pool payout schemes, their importance, and how they can impact your crypto earnings.

Table of Contents

Understanding Cryptocurrency Mining

Cryptocurrency mining is the process of validating transactions on a blockchain network. Miners use powerful computers to solve complex mathematical problems, which helps to secure the network and process transactions. The importance of mining in the crypto ecosystem cannot be overstated – it’s the engine that drives the blockchain.

What is a Mining Pool?

In the realm of cryptocurrency mining, a mining pool is a critical concept that every miner needs to understand.

Defining a Mining Pool

A mining pool, in its simplest terms, is a group of cryptocurrency miners who decide to combine their computational resources over a network. By pooling their resources, they increase their chances of earning cryptocurrency.

The Role of Mining Pools in Cryptocurrency Mining

Mining pools play a significant role in the cryptocurrency mining landscape. They allow individual miners to compete more effectively against large-scale mining operations, which have vast computational resources at their disposal.

When a miner joins a mining pool, their computing power is added to the total power of the pool. When the pool successfully mines a block, the reward is divided among the pool members. The division is usually based on the amount of work each miner has done, which is generally measured in ‘shares’.

The Need for Mining Pools

The need for mining pools arises from the increasing difficulty of mining cryptocurrencies. As more miners join the network, the difficulty of mining increases, making it harder for individual miners to solve the complex mathematical problems required to mine a block. By joining a mining pool, miners can pool their resources to solve these problems more quickly, increasing their chances of earning a reward.

Understanding Mining Pool Payout Schemes

Mining pool payout schemes are the methods by which mining pools distribute the rewards among their members. These schemes are a critical aspect of mining pools, as they directly influence the potential earnings of a miner.

Defining Mining Pool Payout Schemes

A payout scheme is essentially the formula or method a mining pool uses to calculate and distribute the rewards it earns from mining a block. This scheme determines how much each miner gets paid for the computational power they contribute to the pool.

Importance of Payout Schemes in Mining Pools

The importance of understanding mining pool payout schemes cannot be overstated. The payout scheme a mining pool uses can significantly impact a miner’s earnings. Different payout schemes have different methods of calculating rewards, and these can favor different types of miners.

For instance, some payout schemes favor miners who mine consistently, while others may favor miners who can provide a lot of computational power but only for short periods. Understanding these differences can help miners choose a pool that best suits their mining strategy and maximizes their earnings.

Factors Influencing Payout Schemes

Several factors can influence the choice of payout scheme a mining pool uses. These include the size of the pool, the total computational power of the pool, the pool’s fee structure, and the volatility of the cryptocurrency being mined.

Types of Mining Pools Rewards

There are several types of mining pools rewards, including:

| Reward Type | Description | Example Pools | Pros | Cons |

|---|---|---|---|---|

| Pay-Per-Share (PPS) | Miners get paid for each share they contribute, regardless of whether the pool finds a block. | F2Pool | Immediate payout for each share. Reduces variance for miners. | Pool operator assumes the risk of finding blocks, so fees are usually higher to compensate. |

| Full Pay-Per-Share (FPPS) | Similar to PPS, but also includes transaction fees in the payouts, increasing the miners’ income. | F2Pool | Includes transaction fees in the payouts. Immediate payout for each share. | Higher fees due to the risk taken on by the pool operator. |

| Pay-Per-Last-N-Shares (PPLNS) | Miners get paid based on the last N shares, regardless of round boundaries. | WoolyPooly, 2miners | Rewards loyal pool members who mine consistently over time. Can lead to higher payouts if the pool is successful in finding blocks. | Miners who only mine sporadically may receive lower payouts. |

| Pay-Per-Last-N-Time (PPLNT) | Similar to PPLNS, but the number of shares considered for payment is within a certain time frame. | Mining Pool Hub | Rewards consistent miners and can lead to higher payouts if the pool is successful. | Miners who mine sporadically or who stop mining before the end of the time frame may receive lower payouts. |

| Proportional (PROP) | The reward is distributed proportionally to the amount of work each miner has done in the round. | Herominers | Fair distribution based on contribution. | Pool hoppers can exploit the system to get more rewards by only mining at the beginning of a round. |

| Pay-Per-Share Plus (PPS+) | A combination of PPS and PROP, miners receive immediate payouts and also end-of-round payouts. | AntPool | Miners get the benefits of both PPS and PROP. | Higher fees due to the risk taken on by the pool operator. |

| Solo Mining | The entire block reward goes to the miner who found it. | Woolypooly, Solopool | If a block is found, the entire reward goes to the miner. | High variance. It could take a long time to find a block, especially for smaller miners. |

Choosing the Right Payout Scheme

When it comes to selecting the right payout scheme for your mining operation, understanding the intricacies of each option is crucial. Pay-Per-Last-N-Shares (PPLNS) is a popular choice among many miners due to its unique benefits.

Understanding PPLNS

PPLNS stands for Pay-Per-Last-N-Shares. Under this scheme, miners are rewarded based on the number of valid shares they contributed during the last N shares, regardless of round boundaries. This means that the reward a miner receives is directly proportional to the amount of computational power they contributed to the pool during the last N shares.

Benefits of PPLNS

There are several reasons why a miner might choose a PPLNS payout scheme:

- Loyalty Rewards: PPLNS rewards miners who contribute to the pool consistently over time. If you’re planning to mine consistently, PPLNS could potentially offer higher rewards compared to other payout schemes.

- Protection Against Pool Hopping: PPLNS is designed to prevent pool hopping, a practice where miners switch from pool to pool to maximize their rewards. With PPLNS, miners who leave before the end of the round may not receive their full potential payout, discouraging pool hopping.

- Potentially Higher Rewards: If the pool is successful in finding blocks consistently, PPLNS can offer higher rewards compared to other payout schemes like Pay-Per-Share (PPS).

Considerations When Choosing PPLNS

While PPLNS has several benefits, it’s important to consider a few factors before choosing this payout scheme:

- Variance: PPLNS can have higher variance compared to other payout schemes. This means that your rewards can fluctuate more from round to round.

- Consistent Mining: PPLNS is most beneficial for miners who can mine consistently. If your mining operation is sporadic, you might not reap the full benefits of PPLNS.

Case Studies of Mining Pool Payout Schemes

Examining real-world examples can provide valuable insights into how different mining pool payout schemes work in practice. Let’s explore a few case studies that illustrate the impact of various payout schemes on miners’ earnings.

Case Study 1: Pay-Per-Share (PPS) at F2Pool

F2Pool, one of the largest mining pools globally, uses a Pay-Per-Share (PPS) payout scheme. This means that miners are rewarded for each share they contribute, regardless of whether the pool mines a block.

For instance, consider a miner who contributes 10% of the shares in a round. Under the PPS scheme, they would receive 10% of the rewards, regardless of whether the pool successfully mines a block. This provides a steady and predictable income for miners, making it an attractive option for those who prefer stability over potentially higher, but less predictable, earnings.

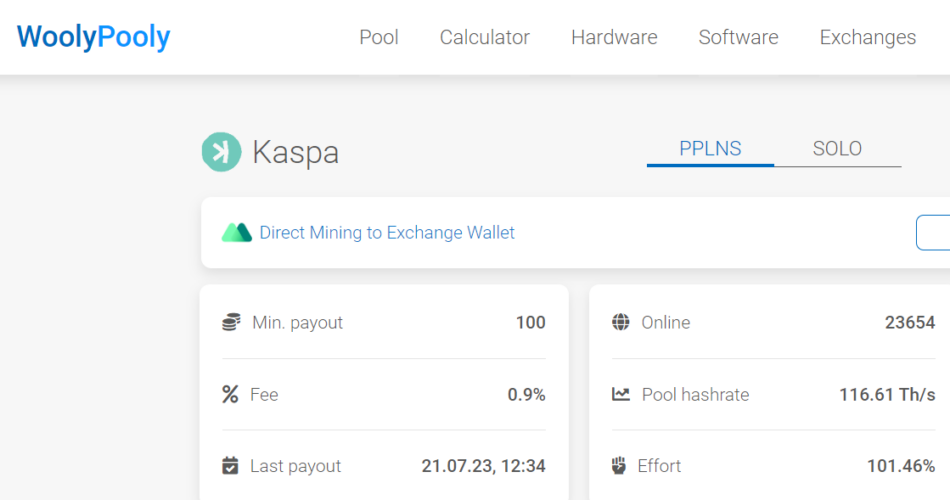

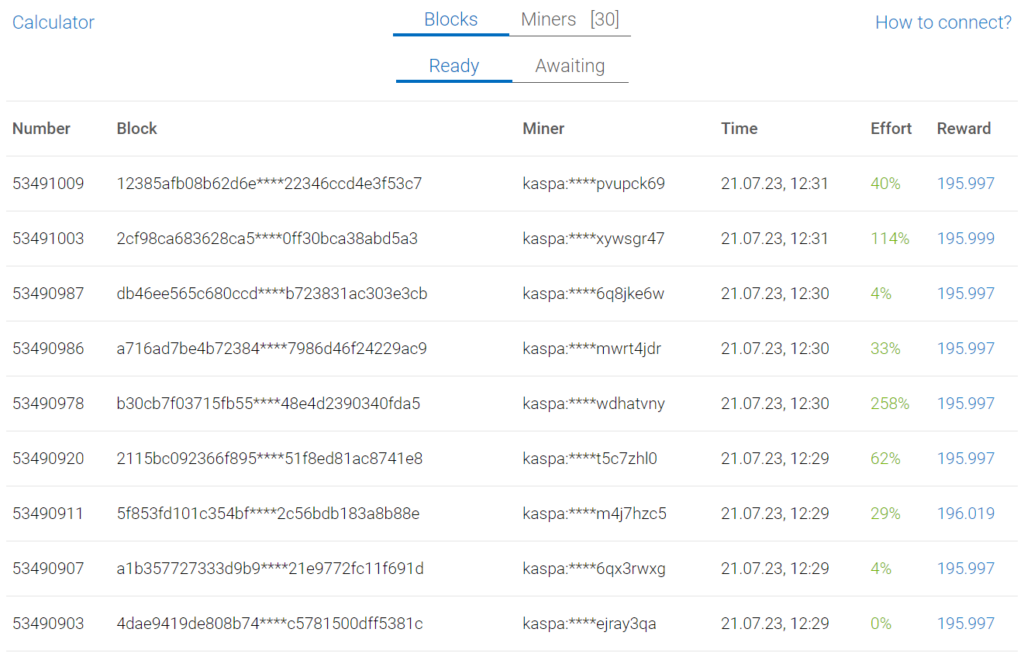

Case Study 2: Pay-Per-Last-N-Shares (PPLNS) at WoolyPooly

WoolyPooly uses a Pay-Per-Last-N-Shares (PPLNS) payout scheme. Under this scheme, miners are rewarded based on the number of shares they contributed during the last N shares.

For example, if a miner contributed 20% of the shares during the last N shares, they would receive 20% of the rewards when the pool mines a block. This scheme rewards miners who contribute consistently over time, making it an attractive option for loyal miners who mine regularly.

Case Study 3: Pay-Per-Share Plus (PPS+) at AntPool

AntPool, another large mining pool, uses a Pay-Per-Share Plus (PPS+) payout scheme. This scheme combines the features of PPS and Proportional (PROP) payout schemes.

Under PPS+, miners receive immediate payouts for each share they contribute, like PPS. They also receive end-of-round payouts based on the number of shares they contributed during the round, like PROP. This hybrid scheme provides the stability of PPS and the potential for additional earnings from PROP, making it an attractive option for many miners.

These case studies illustrate how different payout schemes can impact miners’ earnings. The best payout scheme for a miner depends on their individual circumstances, including their mining goals, risk tolerance, and the size and consistency of their mining operation.

Future Trends in Mining Pool Payout Schemes

As the cryptocurrency landscape continues to evolve, so too will the strategies and mechanisms behind mining pool payout schemes. Here are a few potential trends that could shape the future of these schemes.

Increased Transparency

As the crypto industry matures, there’s an increasing demand for transparency in all aspects of the ecosystem, including mining pool payout schemes. We can expect to see more mining pools providing clear, detailed information about their payout schemes, fees, and other operational aspects. This transparency can help miners make more informed decisions and potentially lead to more equitable payout schemes.

Hybrid Payout Schemes

Hybrid payout schemes, like Pay-Per-Share Plus (PPS+), combine the features of different payout schemes to provide more flexibility and potential earnings for miners. As mining pools continue to innovate and compete for miners, we can expect to see more hybrid payout schemes emerging.

Influence of Regulatory Changes

Regulatory changes can significantly impact the crypto mining industry, including mining pool payout schemes. For instance, stricter regulations could lead to changes in how mining pools operate and distribute rewards. On the other hand, regulatory clarity could foster more innovation and growth in the industry.

Adoption of Decentralized Mining Pools

Decentralized mining pools, which operate without a central authority, could become more popular in the future. These pools could offer new types of payout schemes that are more equitable and resistant to manipulation.

Conclusion

Understanding mining pool payout schemes is a critical aspect of successful cryptocurrency mining. These schemes determine how the rewards from mining a block are distributed among the miners in a pool, directly impacting a miner’s potential earnings.

Throughout this article, we’ve explored the different types of payout schemes, including Pay-Per-Share (PPS), Full Pay-Per-Share (FPPS), Pay-Per-Last-N-Shares (PPLNS), and more. Each of these schemes has its own set of advantages and disadvantages, and the best choice depends on a miner’s individual circumstances and mining goals.

We’ve also examined real-world case studies of these payout schemes in action, providing valuable insights into how these schemes work in practice. These case studies illustrate the importance of choosing a payout scheme that aligns with your mining strategy.

Looking ahead, the landscape of mining pool payout schemes is likely to continue evolving. Trends such as increased transparency, the emergence of hybrid and decentralized mining pools, and the impact of regulatory changes and technological advancements will all play a role in shaping the future of these schemes.

In conclusion, mining pool payout schemes are a complex but crucial part of cryptocurrency mining. By understanding these schemes and staying informed about industry trends, miners can make strategic decisions that maximize their earnings and contribute to the overall health and success of the cryptocurrency ecosystem.

FAQs

What is a mining pool payout scheme?

A mining pool payout scheme is the method a mining pool uses to distribute rewards among its members

Why is understanding mining pool payout schemes important?

Understanding mining pool payout schemes is important because they determine how much a miner can earn for their efforts.

What are the different types of mining pool payout schemes?

The different types of mining pool payout schemes include Pay-per-Share (PPS), FPPS, PPS+, Proportional (PROP), SOLO and Pay Per Last N Shares (PPLNS).