The digital currency landscape is vast and ever-evolving. At its heart, the intricate web of transactions, lies a crucial element many overlook: crypto exchange fees. These fees, often seen as just another transactional detail, can significantly impact a trader’s bottom line. Let’s embark on a journey to decode these fees and unveil strategies to make the most of every crypto transaction.

Table of Contents

Decoding Crypto Exchange Fees

understanding exchange fees is more than just a matter of cents and dollars; it’s about optimizing your trading strategy for maximum profitability. These fees, often seen as mere numbers, play a pivotal role in determining the overall cost of trading and can significantly impact a trader’s bottom line.

Why are Exchange Fees Important?

- Profit Margins: Especially for high-frequency traders or those operating with slim profit margins, even a slight variation in fees can mean the difference between a profitable trade and a loss.

- Transparency and Trust: An exchange’s fee structure can often be a reflection of its transparency and trustworthiness. Hidden fees or complicated structures might indicate a lack of transparency, which is crucial in the decentralized world of crypto.

- Budgeting and Planning: For traders, especially those managing large portfolios or operating on behalf of clients, understanding fees is essential for budgeting and financial planning.

The Imperative of Comparison

With a plethora of crypto exchanges available, each boasting its unique fee structures and incentives, making a comparison is not just beneficial—it’s a must. By comparing fees:

- Traders can identify the most cost-effective platforms for their trading style and volume.

- It allows traders to be aware of any hidden costs, ensuring there are no unpleasant surprises.

- A comparison also provides insights into the value-added services an exchange might offer, such as reduced fees for using native tokens or loyalty programs.

Top Crypto Exchanges Fees Comparison

| Exchange | Spot Trading | Futures Maker Fees | Futures Taker Fees | Withdrawal Fees (USDT TRC20, BTC, LTC) |

|---|---|---|---|---|

| MEXC | 0% | 0% | 0.03% | 1 USDT 0.0003 BTC 0.001 LTC |

| OKX | 0.1% | 0.02% | 0.05% | 1 USDT 0.00007 BTC 0.001 LTC |

| BingX | 0.1% | 0.02% | 0.04% | 1 USDT 0.00035 BTC 0.00097 LTC |

| Bitget | 0.1% | 0.02% | 0.06% | 1 USDT 0.0003 BTC 0.01 LTC |

| Gate.io | 0.3% | 0.015% | 0.05% | 1 USDT 0.001 BTC 0.016 LTC |

| Coinex | 0.2% | 0.02% | 0.04% | 1 USDT 0.0001 BTC 0.001 LTC |

| Bybit | 0.1% | 0.02% | 0.04% | 1 USDT 0.000085 BTC 0.001 LTC |

MEXC

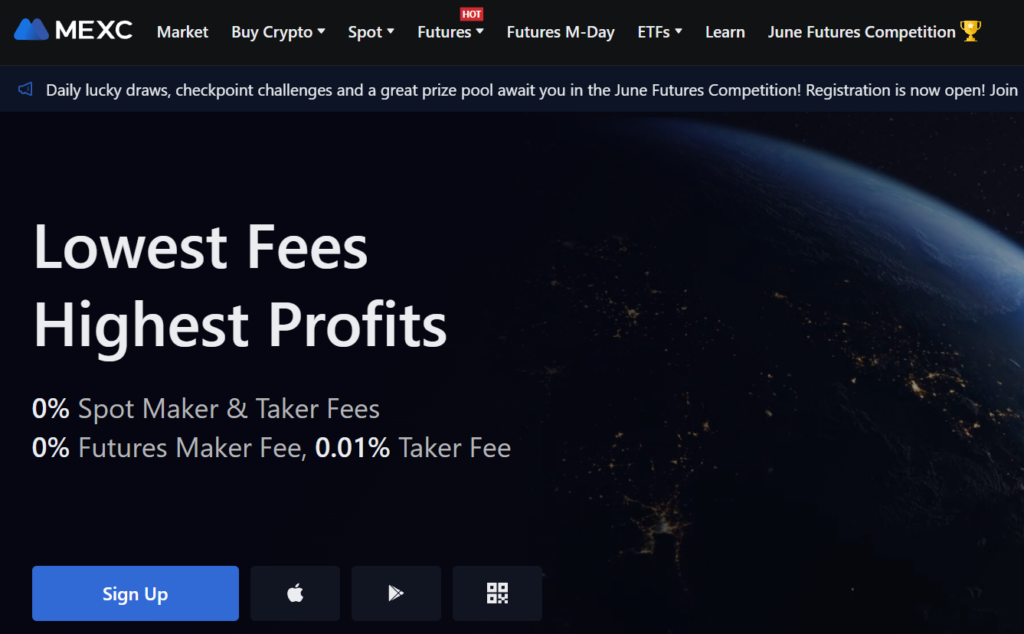

MEXC is a prominent tier 1 crypto exchange that offers a variety of trading options, including spot and futures trading. The platform boasts some of the lowest fees in the market, with 0% spot maker & taker fees and 0% futures maker fee with a 0.03% taker fee. MEXC is known for its high liquidity and has a reputation for launching new and high-quality crypto projects efficiently. The exchange also offers a wide range of cryptocurrencies and often ranks top in the quantity of crypto listed among first-tier exchanges. They have a strong community presence and offer a mobile app for trading on the go.

Crypto Exchange Fees Explanation

MEXC offers 0% fees for both spot maker and taker. For futures, the maker fee is 0%, while the taker fee is 0.03%. That is why MEXC is also the best option for crypto leverage trading. The withdrawal fees for USDT, BTC, and LTC are 1 USDT, 0.0003 BTC, and 0.001 LTC respectively.

Fees official page – https://www.mexc.com/fee

OKX

OKX stands as a leading cryptocurrency exchange, offering a plethora of trading options encompassing both spot and futures trading. The platform is renowned for its competitive fees, a robust matching engine, and powerful APIs. OKX also emphasizes user experience, providing an all-in-one app that caters to both crypto novices and seasoned traders. The app facilitates seamless transitions from trading to DeFi to NFTs. Moreover, OKX has garnered attention through collaborations with world-class partners and endorsements from notable figures in various industries.

Crypto Exchange Fees Explanation

OKX charges a 0.1% fee for spot trading. For futures, the maker fee stands at 0.02%, while the taker fee is set at 0.05%. When it comes to withdrawals, the fees for USDT, BTC, and LTC are 1 USDT, 0.00007 BTC, and 0.001 LTC, respectively.

Fees official page – https://www.okx.com/fees

BingX

BingX is a cutting-edge cryptocurrency exchange that offers a wide array of trading options, including spot, futures, and innovative features like copy trading. The platform is designed for both beginners and experienced traders, ensuring a seamless trading experience. BingX emphasizes security, boasting a 100% Proof-of-Reserves system and partnerships with top cybersecurity organizations. The exchange also offers a user-friendly mobile app, ensuring that users can trade anytime, anywhere. With a global presence, BingX is regulated and compliant in several jurisdictions, including Canada, the EU, and Australia.

Crypto Exchange Fees Explanation

BingX charges a 0.1% fee for spot trading. When it comes to futures, the maker fee is 0.02%, and the taker fee is 0.04%. For withdrawals, the fees for USDT, BTC, and LTC are 1 USDT, 0.00035 BTC, and 0.00097 LTC, respectively.

Fees official page – https://bingx.com/en-us/support/costs/

Bitget

Bitget has established itself as a premier crypto exchange platform, particularly in the realm of crypto derivatives. The platform is globally recognized for its commitment to security, ensuring a 1:1 reserve ratio of customer funds and employing advanced measures like cold storage and multi-signature wallets. Furthermore, Bitget has set aside a 300M USDT fund as an added layer of protection against potential security threats. The platform’s endorsement by international football superstar Lionel Messi as their brand ambassador speaks volumes about its reputation in the crypto space.

Crypto Exchange Fees Explanation

Bitget imposes a 0.1% fee for spot trading. In the futures segment, the maker fee is 0.02%, while the taker fee is slightly higher at 0.06%. For withdrawals, the fees for USDT, BTC, and LTC are 1 USDT, 0.0003 BTC, and 0.01 LTC, respectively.

Fees official page – https://www.bitget.com/fee

Gate.io

Gate.io stands as a leading cryptocurrency exchange, boasting a vast array of over 1,400 cryptocurrencies and stablecoins. From the well-known giants like Bitcoin and Ethereum to the emerging players, Gate.io offers a platform where users can trade swiftly, securely, and efficiently. Established in 2013, the exchange has built a reputation for stability and reliability over the years. Their commitment to transparency, cooperation, and strict regulatory compliance has made them a preferred choice for many crypto enthusiasts.

Crypto Exchange Fees Explanation

Gate.io’s fee structure is a little bit above the market. For spot trading, the exchange charges a fee of 0.3%. However, it’s essential to note that users can benefit from reduced fees by using Gate.io’s native token for payments. This not only offers a discount but also integrates the user deeper into the Gate.io ecosystem.

When it comes to withdrawals, the fees are set at 1 USDT, 0.001 BTC, and 0.016 LTC. These fees are in line with industry standards, ensuring that users don’t feel the pinch when moving their assets.

Fees official page – https://www.gate.io/fee

Bybit

Bybit stands out as a top-tier cryptocurrency exchange platform, emphasizing a seamless and elevated trading experience. Catering to a wide range of traders, Bybit offers a diverse array of trading options, including spot and futures trading. The platform is particularly recognized for its innovative features, such as copy trading, which allows users to mimic the trades of experienced traders. Bybit’s commitment to security is evident in its triple-layer asset protection, ensuring user funds are securely stored offline in cold wallets. Moreover, the platform’s association with global events and its recent endorsement by international celebrities highlight its growing influence in the crypto space.

Crypto Exchange Fees Explanation

Bybit has a competitive fee structure designed to cater to a broad spectrum of traders. For spot trading, the platform charges a fee of 0.1%. The futures segment sees a maker fee of 0.02% and a taker fee of 0.04%. When it comes to withdrawals, Bybit has set its fees at 1 USDT, 0.000085 BTC, and 0.001 LTC. These fees are transparent and in line with industry standards, ensuring users get value for their trades.

Bybit fees official page – https://learn.bybit.com/bybit-guide/bybit-trading-fees/

Coinex

CoinEx, established in 2017, has rapidly ascended the ranks to become a notable name in the cryptocurrency exchange landscape. With a mission to make crypto trading easier, CoinEx offers a plethora of trading options, ensuring both novice and seasoned traders find tools tailored to their needs. The platform is renowned for its commitment to security, boasting a full-dimensional security protection mechanism and a 100% reserve guarantee. This dedication to safeguarding user assets is evident, as CoinEx has had no security incidents since its inception. Furthermore, the platform extends its services to over 200 countries and regions, emphasizing a global reach and multilingual support.

Crypto Exchange Fees Explanation

CoinEx has structured its fees to be both competitive and transparent. For spot trading, the platform levies a 0.2% fee. In the futures trading arena, the maker fee is set at 0.02%, while the taker fee stands at 0.04%. As for withdrawals, CoinEx has standardized its fees for USDT, BTC, and LTC at 1 USDT, 0.0001 BTC, and 0.001 LTC respectively.

Coinex fees off page – https://www.coinex.com/en/fees

The Many Faces of Fees

Cryptocurrency exchanges have a myriad of fees that traders and investors need to be aware of. These fees can significantly impact the profitability of trades, especially for high-frequency traders. Here’s a comprehensive breakdown:

Detailed Fee Chart

| Fee Type | Description | Typical Range |

|---|---|---|

| Maker Trading Fee | Charged for orders adding liquidity to the market | 0.05% – 0.2% |

| Taker Trading Fee | Charged for orders taking away liquidity from the market | 0.1% – 0.25% |

| Deposit Fee (Crypto) | Fee for depositing cryptocurrencies into the exchange | 0 – 0.0005 BTC |

| Deposit Fee (Fiat) | Fee for depositing fiat currencies like USD, EUR, etc. | $0 – $10 or 0.1% – 4% |

| Withdrawal Fee (Crypto) | Fee for withdrawing cryptocurrencies from the exchange | 0.0001 – 0.001 BTC |

| Withdrawal Fee (Fiat) | Fee for withdrawing fiat currencies to bank accounts or other methods | $5 – $50 or 0.5% – 2% |

| Listing Fee | Fee for a new cryptocurrency to be listed on the exchange | $5,000 – $1,000,000+ |

| Margin Fee | Fee associated with borrowing funds for margin trading | 0.01% – 0.03% per day |

Note: The “Typical Range” values are illustrative and can vary based on the exchange and market conditions. Always consult individual exchange platforms for precise fee information.

Trading Fees

These are the fees that exchanges charge when you buy or sell cryptocurrencies. They can be categorized into:

Maker Fees

These are fees charged for orders that add liquidity to the market. They’re called “maker” fees because they “make” the market. Typically, these are orders that don’t fill immediately, like limit orders placed below the current market price (for buys) or above the current market price (for sells).

Taker Fees

These are fees charged for orders that take away liquidity from the market. These orders “take” from the orders already in the order book. Market orders, which fill immediately at the best available price, are usually considered taker orders.

Deposit and Withdrawal Fees

These are fees associated with adding funds to or removing funds from an exchange.

Deposit Fees

Some exchanges charge a fee when you deposit funds, whether it’s fiat currency or cryptocurrency.

Withdrawal Fees

These are fees charged when you withdraw funds from the exchange. They can vary based on the method of withdrawal (e.g., bank transfer, credit card, or blockchain transaction).

Listing Fees

These are fees that new cryptocurrencies might have to pay to be listed on an exchange. It’s a way for exchanges to monetize their platform and cover the costs associated with integrating a new coin or token.

Miscellaneous Fees

Margin Fees

For traders who engage in margin trading, there might be fees associated with borrowing funds.

Influencers of Exchange Fees

The fees levied by cryptocurrency exchanges aren’t arbitrary. They are the result of a combination of internal and external factors that determine how much users are charged for their transactions. Here’s a comprehensive look at the key influencers:

Operational Costs

Running a cryptocurrency exchange is a complex endeavor that involves various costs:

Infrastructure

This includes the cost of servers, data centers, and other hardware necessary to ensure the platform runs smoothly. As the user base grows, the infrastructure needs to be scaled up, incurring additional costs.

Security Measures

Given the high value of assets and the constant threat of hacks, exchanges invest heavily in security protocols, encryption methods, and other protective measures.

Personnel

From customer support teams to technical experts and regulatory compliance officers, exchanges need a wide range of professionals to operate efficiently.

Licensing and Compliance

In many jurisdictions, exchanges need licenses to operate. Obtaining and maintaining these licenses, along with adhering to regulatory requirements, can be costly.

Competitive Landscape

The crypto exchange market is fiercely competitive, with numerous platforms vying for users:

Market Position

Established exchanges with a large user base might have the leeway to charge higher fees due to their reputation and trustworthiness. In contrast, newer exchanges might lower fees as an incentive to attract users.

Unique Features

Exchanges offering unique features, advanced trading tools, or niche market pairs might adjust their fees based on the value they provide.

User Experience

Platforms that offer a superior user experience, faster transaction times, or better customer support might feel justified in charging slightly higher fees.

User Volume and Liquidity

The amount of trading activity on an exchange plays a significant role in determining fees:

Economies of Scale

Exchanges with high trading volumes can afford to charge lower fees per transaction, as they make up for it in volume.

Liquidity Incentives

To ensure there’s enough liquidity (i.e., enough buy and sell orders on the platform), exchanges might offer reduced fees or even rebates for market makers.

Special Promotions or Loyalty Programs

To attract and retain users, exchanges often run promotions or loyalty programs:

Discounted Fees

Some exchanges offer temporary fee discounts to attract new users or to celebrate milestones.

Loyalty Programs

Regular traders or those holding a certain amount of the exchange’s native token might be eligible for reduced fees.

External Market Conditions

The broader crypto market conditions can also influence fees:

Volatility

During times of high volatility, there’s an increased trading activity. Some exchanges might adjust their fees based on market conditions.

Regulatory Changes

If a government introduces new regulations or taxes related to crypto trading, exchanges might adjust their fees to account for the increased compliance costs.

Hidden Costs: The Silent Profit Eroders

While most crypto traders focus on the explicit fees charged by exchanges, there are several hidden costs in the world of cryptocurrency trading. These costs, though they might seem negligible at first glance, can accumulate over time and eat into a trader’s profits. Here’s a comprehensive exploration:

Slippage

Slippage is the difference between the expected price of a trade and the price at which the trade is executed.

Causes

Slippage can occur due to market volatility, low liquidity, or large order sizes. For instance, if a trader places a large market order in a thinly traded market, it can cause the price to move, leading to slippage.

Impact

While slippage can sometimes work in a trader’s favor (positive slippage), it often results in a less favorable execution price, especially in highly volatile markets.

Spread Costs

The spread is the difference between the buying (ask) and selling (bid) price of a cryptocurrency.

Bid-Ask Dynamics

A wider spread means that a trader is buying at a higher price and selling at a lower price, which can impact profitability, especially for short-term traders.

Factors Influencing Spread

Spreads can vary based on the exchange’s liquidity, the specific cryptocurrency being traded, and market conditions. In general, more liquid markets have tighter spreads.

Network Fees

When transferring cryptocurrencies between wallets or exchanges, users often have to pay network fees.

Why They Exist

These fees compensate miners or validators for processing and confirming transactions on a blockchain.

Variability

Network fees can vary based on the congestion of the network. For instance, when many users are sending transactions on the Bitcoin network, fees can spike.

Latency Costs

Latency refers to the delay between placing an order and its execution.

Causes

Latency can be due to technical issues, server delays, or even the trader’s internet connection.

Impact on High-Frequency Trading

For traders who rely on rapid order execution, latency can lead to missed opportunities or potential losses, especially in volatile markets.

Opportunity Costs

While not a direct fee, opportunity costs refer to potential profits a trader misses out on due to holding a particular asset or waiting too long to make a trade.

Market Movements

If a trader hesitates to enter or exit a position, and the market moves unfavorably in the meantime, the potential profit that could have been made is considered an opportunity cost.

Minimize Those Pesky Fees

Crypto exchange fees can quickly erode profits. However, with a bit of knowledge and strategy, traders can significantly reduce these costs. Here’s a detailed exploration of how to keep those fees to a minimum:

1. Use Limit Orders

Limit orders allow traders to specify the price at which they wish to buy or sell a cryptocurrency.

Control Over Price

Unlike market orders, which execute immediately at the best available price, limit orders only fill when the market reaches the trader’s specified price. This can often secure a better price and lower fees.

Avoiding Market Volatility

By setting a specific price, traders can avoid buying or selling during short-term price spikes or dips.

2. Loyalty Programs and Exchange Tokens

Many exchanges offer loyalty programs or the option to pay fees using their native tokens, which can lead to significant discounts.

Exchange Tokens

Platforms like gate.io, mexc.com, and bitget have their native tokens. By holding or using these tokens to pay for transaction fees, users can often enjoy reduced costs. For instance, paying fees with the exchange’s token might offer a 25% discount compared to paying with Bitcoin or Ethereum.

Holding Benefits

Some exchanges offer tiered benefits based on the amount of their native token held in a user’s account. Higher tiers might come with even more significant fee reductions or other perks.

Take Advantage of Fee Discounts & Promotions

Exchanges frequently run promotions or offer temporary fee discounts to attract new users or incentivize trading.

Stay Updated

Regularly checking the announcements or promotions page of your preferred exchanges can alert you to any ongoing fee discounts.

Referral Programs

Some platforms offer crypto affiliate programs and payback in crypto for users who refer new traders to the platform.

4. Choose the Right Time to Transact

Timing can play a crucial role in the fees you end up paying.

Avoiding Peak Times

Transacting during times of high network congestion can lead to higher fees, especially for on-chain transactions. It might be more cost-effective to wait for a lull.

Market Volatility

If the market is particularly volatile, spreads might widen, and the risk of slippage increases. Waiting for more stable conditions can reduce these hidden costs.

5. Transfer Between Wallets Strategically

When moving funds between wallets or exchanges, a bit of strategy can save costs.

Batch Transactions

Instead of making multiple small transfers, batch your transactions into fewer, larger ones. This can reduce the cumulative network fees.

Use Exchange Partnerships

Some exchanges have partnerships that allow free or reduced-fee transfers between them. If you trade on multiple platforms, it’s worth checking if any of your exchanges have such partnerships.

Conclusion

Understanding the fee structures of exchanges is paramount. As we’ve delved into the intricacies of various platforms, it’s evident that each exchange offers its unique blend of fees, benefits, and features. From MEXC’s zero fees for spot trading to Bybit’s innovative trading features, the landscape is diverse and caters to a wide range of trader preferences.

However, beyond the numbers, it’s essential to recognize the value of transparency, security, and user experience. While fees play a significant role in determining where to trade, the overall reliability and reputation of an exchange are equally crucial. As traders, it’s not just about minimizing costs but also about maximizing the value received in return.

Moreover, the trend of exchanges offering reduced fees when using their native tokens, as seen with gate.io, mexc.com, and bitget, showcases the innovative ways platforms are incentivizing user loyalty and participation. It’s a testament to the dynamic nature of the crypto world, where exchanges continuously adapt and evolve to meet user needs.

In conclusion, as the crypto market continues to grow and mature, traders equipped with the right knowledge and awareness will be best positioned to make informed decisions. By understanding the fee structures and the nuances of each platform, one can optimize their trading strategy, ensuring maximum returns and a seamless trading experience.

FAQs

Which crypto exchange has the lowest fees?

MEXC offers 0% fees for both spot and futures trading, making it the lowest among the mentioned exchanges.

Which crypto exchange has the lowest withdrawal fees?

For BTC withdrawals, OKX has the lowest fee at 0.00007 BTC. However, fees can vary depending on the specific cryptocurrency.

Where to find crypto exchange platform fees?

You can find the fee structure on the official website of the crypto exchange, typically under sections labeled “Fees,” “Pricing,” or “Fee Schedule.”

How to transfer money into a crypto exchange without fees?

Nowadays all tier one exchanges offer zero crypto deposit fees. You pay only for network transaction broadcasting. You can not avoid it.

Do I pay fees when transferring my crypto from an exchange to a hard wallet?

Yes, transferring crypto from an exchange to a hard wallet usually incurs a network fee, which compensates miners or validators for processing the transaction. The fee can vary based on the specific cryptocurrency and network congestion.