In the dynamic world of cryptocurrencies, Bitcoin leverage trading stands out as a game-changer. Offering traders the chance to amplify their profits, it’s a strategy that’s both alluring and complex. But what exactly is it? And how can one navigate its intricate pathways to success? Let’s embark on this enlightening journey.

Table of Contents

What is Bitcoin Leverage Trading?

The Concept of Leverage in Trading

At its core, leverage in trading refers to the concept of using borrowed funds to increase one’s trading position beyond what would be available from their cash balance alone. Think of it as a tool that magnifies both potential profits and potential losses. It’s akin to using a lever to lift a heavier object; with a small amount of force (or capital), you can move a much larger object (or position).

Bitcoin Leverage Trading Unveiled

In the world of Bitcoin, leverage trading allows traders to borrow funds, often from the exchange itself, to trade a larger amount of Bitcoin than they would be able to with just their own funds. For instance, with 10x leverage, a trader with $1,000 could take a position worth $10,000. This means that for every 1% movement in the price of Bitcoin, the trader’s position would increase or decrease by 10%.

Margin and Collateral: The Backbone of Leverage

To engage in crypto leverage trading, traders need to put down a “margin,” which acts as collateral. This margin is a fraction of the full position size. For example, if a trader wants to open a position worth $10,000 with 10x leverage, they might need to provide a margin of $1,000. If the market moves against the trader’s position and the losses approach the margin amount, the position may be automatically closed by the exchange to prevent further losses. This is known as a “margin call.”

Differences Between Traditional and Crypto Leverage

While leverage is a tool used in many traditional financial markets, there are some distinctions in the cryptocurrency realm. One of the most notable differences is the amount of leverage offered. In traditional markets, leverage might range from 2x to 30x, but in the volatile world of cryptocurrencies, some exchanges offer leverage ratios as high as 100x or even more. This high leverage, combined with the inherent volatility of cryptocurrencies, can lead to rapid and significant gains, but also equally swift and substantial losses.

Benefits of Bitcoin Leverage Trading

1. Amplified Profit Potential

One of the most enticing benefits of Bitcoin leverage trading is the potential for amplified profits. With leverage, traders can control a larger position with a smaller amount of capital. For instance, using 10x leverage, a trader with $1,000 can control a position worth $10,000. If Bitcoin’s price rises by 5%, instead of a $50 profit (without leverage), the trader could gain $500 (minus fees and interest). This magnification of profit potential is the primary allure for many traders.

2. Capital Efficiency

Leverage allows traders to be more efficient with their capital. Instead of tying up a significant amount of funds in a single position, traders can use a fraction of that amount and still control a large position. This efficiency means that traders can potentially open multiple positions or diversify across different assets, maximizing the utility of their capital.

3. Access to Larger Market Exposure

With leverage, even traders with limited capital can access larger market exposure. This means that they can participate in significant market movements that would otherwise be out of reach. For new traders or those with limited funds, this provides an opportunity to engage in the market more fully.

4. Hedging Opportunities

Leverage trading can also be used as a hedging tool. Traders can open leveraged positions opposite to their existing non-leveraged positions in Bitcoin or other cryptocurrencies. This strategy can help offset potential losses in their primary positions during unfavorable market movements.

5. Flexibility in Trading Strategies

The availability of leverage gives traders more flexibility in their trading strategies. They can take advantage of both short-term and long-term market movements, capitalize on small price fluctuations, or even engage in day trading more effectively. The ability to control larger positions means that even minor price changes can result in noticeable profits (or losses).

6. Enhanced Liquidity

Leveraged trading can enhance market liquidity. As more traders engage in leveraged trading, buying and selling large positions, it can lead to increased trading volumes. Higher liquidity often results in tighter spreads and more efficient price discovery, benefiting the broader market ecosystem.

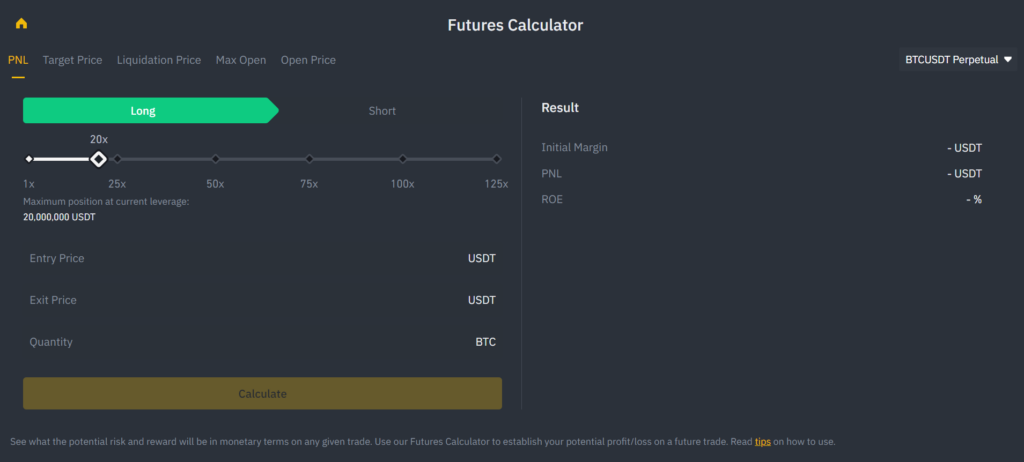

Bitcoin Leverage Trading Calculator

Understanding the Tool

A Bitcoin Leverage Trading Calculator is an essential tool for traders who engage in leveraged trading. It allows traders to determine potential profits, losses, and liquidation prices based on their entry price, leverage used, and position size. By inputting these variables, traders can get a clearer picture of potential outcomes and make more informed decisions.

Benefits of Using the Calculator

- Risk Management: By understanding potential losses, traders can set stop-loss orders more effectively.

- Profit Estimation: Traders can gauge potential profits and decide whether a particular trade aligns with their financial goals.

- Informed Decision Making: With a clear understanding of potential outcomes, traders can make decisions with greater confidence.

Built-in Calculators on Major Platforms

Most prominent leverage trading platforms like MEXC recognize the importance of such a tool and have integrated leverage trading calculators into their platforms. This integration allows traders to make calculations on-the-fly, streamlining the trading process.

Binance’s Advanced Approach

Binance, one of the world’s largest cryptocurrency exchanges, has taken the utility of this tool a step further. While they have the calculator integrated into their trading platform, they’ve also dedicated an additional page specifically for this purpose. This dedicated page offers:

- User-Friendly Interface: A clear and intuitive design that allows users to input their data quickly.

- Detailed Breakdown: Beyond just profit and loss, the calculator provides a comprehensive breakdown, including funding rates and margin details.

- Versatility: The calculator isn’t just limited to Bitcoin but caters to various other cryptocurrencies available for leverage trading on Binance.

Risks Associated with Bitcoin Leverage Trading

1. Magnified Losses

Just as leverage can amplify profits, it can also magnify losses. A small adverse movement in the market can result in significant losses when trading with high leverage. For instance, with 10x leverage, a 10% drop in the asset’s price could wipe out the entire margin amount. This risk of rapid capital erosion is one of the most significant concerns in leveraged trading.

2. Margin Calls and Liquidation

When the market moves against a leveraged position, and the losses approach the trader’s margin (the initial amount put down as collateral), the exchange may issue a margin call. This call requires the trader to deposit additional funds to maintain the position. If the trader cannot meet the margin call, the position may be forcibly closed or liquidated by the exchange, often at a significant loss.

3. High Fees and Interest Costs

Leveraged trading often involves borrowing funds, and this borrowing comes at a cost. Traders might incur daily or hourly interest on the borrowed amount, which can quickly add up, especially in high-leverage positions. Over time, these fees and interest costs can erode potential profits or exacerbate losses.

4. Market Volatility

Cryptocurrency markets, in particular, are known for their extreme volatility. When combined with high leverage, this volatility can result in rapid and significant account balance fluctuations. A sudden spike or drop in prices can lead to immediate liquidation of positions.

5. Platform and System Risks

Trading platforms and exchanges are not immune to technical glitches, system crashes, or cyber-attacks. Any such disruptions can be disastrous for leveraged traders, especially if they occur during critical market movements, preventing traders from closing or adjusting their positions.

6. Overconfidence and Emotional Trading

The allure of amplified profits can lead traders to become overconfident, taking on excessive risk without adequate research or strategy. Emotional trading, driven by fear or greed, is exacerbated in the high-stakes environment of leverage, often leading to poor decision-making.

7. Complexity and Lack of Understanding

Leveraged trading can be complex, especially for beginners. A lack of understanding of how leverage works, including the associated fees and the mechanics of margin calls, can lead to unexpected losses. It’s not uncommon for inexperienced traders to mistakenly believe they’re only risking their margin amount, not realizing they can lose much more.

In conclusion, while leverage trading offers the potential for significant profits, it comes with equally significant risks. It’s imperative for traders to understand these risks thoroughly, employ sound risk management strategies, and continuously educate themselves. Leveraged trading is not suitable for everyone, and one should only engage in it with a clear understanding of the potential pitfalls.

How to Start with Bitcoin Leverage Trading

When diving into the world of Bitcoin leverage trading, one of the most crucial decisions a trader must make is selecting the right exchange. The choice of exchange can significantly influence a trader’s experience, profitability, and overall success. Here are some factors to consider:

Top Bitcoin Leverage Trading Platforms

| Exchange | Leverage Level | Maker Fees | Taker Fees | KYC |

|---|---|---|---|---|

| MEXC | 200x | 0% | 0.03% | No (30 BTC per day) |

| OKX | 125x | 0.02% | 0.05% | No (10 BTC per day) |

| BingX | 150x | 0.02% | 0.04% | No (50K USDT per day) |

| Bitget | 125x | 0.02% | 0.06% | Yes |

| Gate | 125x | 0.015% | 0.05% | Yes |

| Coinex | 100x | 0.02% | 0.04% | No (10K USDT per day) |

| Bybit | 100x | 0.02% | 0.04% | Yes |

1. Leverage Levels

Different exchanges offer varying levels of leverage. While higher leverage can amplify profits, it also increases potential losses. It’s essential to choose an exchange that offers a leverage level aligned with your risk tolerance and trading strategy.

2. Fees

Trading fees can quickly add up, especially when trading with high volumes or frequency. It’s crucial to understand both maker and taker crypto exchange fees as they can impact profitability. Some exchanges offer competitive rates or even zero fees for makers, which can be advantageous for certain trading strategies.

3. KYC Requirements

Know Your Customer (KYC) procedures vary across exchanges. Some platforms require comprehensive documentation and verification, while others offer more privacy, requiring minimal to no KYC, especially for specific withdrawal limits. Depending on your preference for privacy and the volume of your trades, this can be a deciding factor.

Bitcoin Leverage Trading in the USA

Regulatory Landscape

The United States has a stringent regulatory framework surrounding Bitcoin and other cryptocurrencies, especially when it comes to leverage trading. While it’s possible to engage in leverage trading in the US, the process is often more complex due to these regulations. Only a few exchanges with specific licenses, such as a FinCEN Money Service Business license, are allowed to offer margin derivatives products.

Challenges and Limitations

The regulatory environment in the US has led to a limited number of exchanges offering leverage trading services. Moreover, many exchanges require extensive Know Your Customer (KYC) procedures, which can be a deterrent for users who prioritize privacy.

MEXC Exchange: A Favorable Option

For US customers seeking a more flexible platform for Bitcoin leverage trading, the MEXC exchange emerges as a compelling choice. Here’s why:

- No Extensive KYC: MEXC is no KYC crypto exchange for users unless they withdraw more than 30 BTC per day. This feature allows traders to maintain a degree of privacy and ease of access.

- User-Friendly Interface: MEXC offers a straightforward and intuitive trading interface, making it suitable for both beginners and experienced traders.

- Security: The platform emphasizes robust security measures to protect users’ assets and data.

- Diverse Trading Options: Beyond Bitcoin, MEXC provides leverage trading options for a wide range of cryptocurrencies, allowing traders to diversify their portfolios.

The Road Ahead

As the cryptocurrency market continues to grow and evolve, exchanges like MEXC that offer flexibility and cater to the specific needs of traders will likely gain more traction. However, it’s crucial for traders to stay informed about potential regulatory changes and ensure they’re trading within the legal framework.

Strategies for Successful Bitcoin Leverage Trading

1. Fundamental Analysis

Fundamental analysis involves evaluating Bitcoin’s intrinsic value by examining related economic, financial, and other qualitative and quantitative factors. For Bitcoin leverage trading, this could mean:

- Monitoring news related to Bitcoin regulations, adoption rates, technological advancements, and macroeconomic factors.

- Analyzing the overall sentiment in the cryptocurrency market.

- Keeping an eye on events that could influence Bitcoin’s demand and supply, such as halving events or major institutional investments.

2. Technical Analysis

Technical analysis involves studying price charts and using statistical measures to predict future price movements. This method is particularly popular in Bitcoin leverage trading. Key elements include:

- Identifying support and resistance levels.

- Recognizing chart patterns like head and shoulders, double tops, and triangles.

- Utilizing indicators like Moving Averages, Bollinger Bands, and the Relative Strength Index (RSI) to gauge market momentum and trends.

3. Risk Management

Effective risk management is crucial in Bitcoin leverage trading due to the amplified potential for both gains and losses. Strategies include:

- Setting Stop-Loss and Take-Profit Orders: This allows traders to set predetermined levels at which positions will be automatically closed to lock in profits or limit losses.

- Only Using a Fraction of Capital: Instead of leveraging the entire capital, use only a fraction to ensure that not all funds are at risk at once.

- Diversifying Strategies: Don’t put all your eggs in one basket. Diversify trading strategies to spread risk.

4. Continuous Learning and Adaptation

The cryptocurrency market is continuously evolving, and what worked yesterday might not work today. Successful traders often:

- Stay updated with the latest trading tools and technologies.

- Regularly review and adjust their trading strategies based on performance and market changes.

- Engage in continuous learning through courses, webinars, and forums.

5. Keeping Emotions in Check

Emotional decisions can be a trader’s downfall, especially in a volatile market. It’s essential to:

- Stick to the trading plan and not make impulsive decisions based on fear or greed.

- Take breaks, especially after a streak of losses, to avoid revenge trading.

- Maintain a trading journal to review decisions and understand the emotional triggers.

6. Backtesting

Before applying a strategy in real-time, it’s beneficial to backtest it using historical data. This process helps:

- Understand the potential effectiveness of a strategy.

- Identify possible flaws or areas of improvement.

- Gain confidence in the strategy before applying it with real funds.

Common Mistakes to Avoid

1. Over-leveraging

One of the most frequent pitfalls in leverage trading is using excessive leverage. While high leverage can amplify profits, it also magnifies potential losses. Traders, especially beginners, often get lured by the prospect of high returns without fully understanding the associated risks. Using maximum leverage available can quickly lead to significant losses, especially in volatile markets.

2. Neglecting Stop-Loss Orders

Failing to set stop-loss orders can be catastrophic in leverage trading. Stop-loss orders automatically close a position once it reaches a predetermined loss level, helping to cap potential losses. Without these, unfavorable market movements can result in devastating losses, especially when trading with high leverage.

3. Trading Based on Emotion

Emotional trading, driven by fear or greed, often leads to impulsive decisions. Whether it’s chasing a losing trade in the hopes it will turn around or jumping into a trend without analysis, emotional decisions rarely end well.

4. Failing to Conduct Proper Research

Skipping research or relying solely on hearsay is a recipe for disaster. Successful leverage trading requires a combination of fundamental and technical analysis. Jumping into trades based on rumors or without understanding the market dynamics can lead to poor decisions.

5. Ignoring Fees and Transaction Costs

Every trade comes with associated costs, such as fees and interest on borrowed funds. Especially in leveraged trading, these costs can accumulate quickly and eat into potential profits. Not accounting for them can lead to miscalculations in profitability.

6. Overconfidence

A few successful trades can lead traders to become overconfident, making them believe they’ve mastered the market. This overconfidence can result in taking on excessive risk or neglecting research and analysis.

7. Lack of a Clear Trading Plan

Trading without a clear strategy or plan is akin to navigating without a map. A well-defined trading plan includes entry and exit strategies, risk management techniques, and clear objectives. Trading without one can lead to haphazard decisions.

8. Not Reviewing and Adapting

The market is dynamic, and what worked once might not work again. Not periodically reviewing trading strategies or failing to adapt to changing market conditions can lead to continued mistakes.

9. Ignoring Market News and Events

Especially in the cryptocurrency market, news and events can have a significant impact on prices. Ignoring or being unaware of major announcements, regulatory changes, or macroeconomic factors can result in unexpected market movements catching traders off guard.

The Future of Bitcoin Leverage Trading

1. Technological Advancements

As the world of cryptocurrencies evolves, so does the technology that supports it. We can expect more sophisticated trading platforms with advanced tools to aid traders. These might include better predictive algorithms, more user-friendly interfaces, and enhanced security measures to protect traders’ assets and data.

2. Regulatory Changes

The cryptocurrency market, including Bitcoin leverage trading, operates in a relatively new and often undefined regulatory environment. As governments and financial institutions worldwide grapple with the rise of cryptocurrencies, we can anticipate more defined regulations. These might include:

- Stricter requirements for cryptocurrency exchanges offering leverage.

- Caps on the maximum leverage allowed.

- Enhanced transparency and reporting requirements.

3. Increased Institutional Participation

As Bitcoin and other cryptocurrencies gain legitimacy, more institutional investors are likely to enter the leverage trading arena. Their participation could bring more significant capital inflows, more advanced trading strategies, and potentially more stability to the market.

4. Education and Awareness

As more people become interested in Bitcoin leverage trading, the demand for education and awareness will grow. We can expect more courses, webinars, and resources dedicated to helping traders understand the intricacies of leverage trading in the Bitcoin ecosystem.

5. Evolution of Risk Management Tools

Given the high risks associated with leverage trading, the future will likely see the development of more advanced risk management tools. These could include more sophisticated stop-loss mechanisms, AI-driven predictive tools to gauge market sentiment, and even decentralized platforms that reduce the risks of exchange failures.

6. Global Market Dynamics

Bitcoin leverage trading doesn’t operate in isolation. Global economic factors, such as interest rates, inflation rates, and geopolitical events, can influence the cryptocurrency market. As Bitcoin becomes more integrated into the global financial system, its leverage trading landscape will be more intertwined with global market dynamics.

7. Decentralized Finance (DeFi) Integration

Decentralized Finance (DeFi) is revolutionizing the traditional financial system. In the future, we might see more integration of Bitcoin leverage trading with DeFi platforms, offering decentralized leverage trading solutions without intermediaries.

Conclusion

In the dynamic world of Bitcoin leverage trading, the choice of exchange plays a pivotal role in shaping a trader’s journey. From the flexibility of leverage levels to the intricacies of fee structures, each exchange offers a unique blend of features tailored to different trading needs. While the allure of high leverage might seem enticing, it’s crucial to remember that with greater potential rewards come increased risks.

The importance of understanding fee structures cannot be overstated. Even seemingly minor differences in fees can have a significant impact on profitability, especially for high-frequency traders. Moreover, the KYC requirements of an exchange can influence a trader’s decision, especially for those who prioritize privacy and swift transaction processes.

The comparison chart provided serves as a snapshot, highlighting the diverse offerings of various exchanges. However, beyond these tangible factors, traders should also consider the platform’s security measures, user interface, customer support, and overall reputation in the community.

In essence, the journey to successful Bitcoin leverage trading begins with a well-informed choice of exchange. It’s not just about numbers but also about aligning with a platform that resonates with your trading ethos, risk appetite, and long-term goals. As the crypto landscape continues to evolve, staying informed, adaptable, and vigilant will remain the cornerstones of success. Happy trading!

FAQs

What is the maximum leverage offered in Bitcoin trading?

Bitcoin maximim leverage level is 200x, offered by MEXC exchange.

Is Bitcoin leverage trading suitable for beginners?

While enticing, it’s recommended that beginners first understand the basics of trading before diving into leverage.

How can I protect myself from significant losses?

Setting stop-loss orders and diversifying your strategies can help mitigate risks.