In the dynamic world of cryptocurrency, one term that often pops up is ‘OTC trading’. But what exactly is it, and why is it so important in the crypto space? This comprehensive guide will delve into the intricacies of OTC trading, providing you with a solid foundation and actionable insights to navigate this often misunderstood aspect of cryptocurrency trading.

Table of Contents

What is OTC Trading?

Over-the-counter (OTC) trading is a type of trading that occurs directly between two parties, without the oversight of an exchange. This form of trading can take place in a decentralized manner, such as over a network or on the phone, rather than on a centralized exchange.

OTC trading can involve a wide range of assets, from commodities to financial instruments like stocks and derivatives. This form of trading is common in various markets such as forex, stock, and even cryptocurrency markets.

Here are some key aspects of OTC trading:

- Decentralization: Unlike exchange trading, where all trades are conducted on a central exchange, OTC trades are conducted directly between parties. This can be through a broker, a dealer network, or even online platforms.

- Negotiation: In OTC trading, the terms of the trade are not necessarily public knowledge. The parties involved in the trade can negotiate terms such as price, quantity, and other specifications to suit their needs. This is different from exchange trading, where the terms are standardized.

- Privacy: OTC trading can offer more privacy than exchange trading. Since the trades are not conducted on a public exchange, the details of the trade are known only to the parties involved.

- Risk: OTC trading can carry more risk than exchange trading. This is because it lacks the transparency of exchanges, and there is also the risk that one party may fail to uphold their end of the deal, known as counterparty risk.

- Large Orders: OTC trading is often used for large orders. This is because large orders on an exchange can significantly move the market price. By trading OTC, parties can potentially avoid this price slippage.

OTC trading plays a crucial role, especially for large volume trades. It allows high net worth individuals or institutions to buy or sell large amounts of cryptocurrencies in a manner that has minimal impact on the market price.

Key Terms

Before diving deeper, it’s essential to understand some commonly used terms in OTC trading:

WTB (Want To Buy)

This acronym indicates that someone is looking to purchase a specific item or asset. It’s commonly used in trading forums and platforms.

WTS (Want To Sell)

This signifies that someone is looking to sell a particular item or asset.

History of OTC Trading

Early Beginnings

The concept of over-the-counter (OTC) trading has been around for centuries, predating formal exchanges. In the early days, OTC trading was essentially a face-to-face transaction between two parties. These transactions often took place in coffee houses or other public meeting places, where brokers and dealers would gather to negotiate deals.

Advent of Technology

With the advent of telecommunication technology in the 20th century, OTC trading evolved significantly. The telephone allowed brokers and dealers to communicate and negotiate deals without being in the same physical location. This led to an increase in the volume and frequency of OTC trades, as it became easier and more efficient to conduct these transactions.

Introduction of Electronic OTC Markets

The late 20th century saw the introduction of electronic OTC markets. These are electronic platforms that facilitate the trading of financial instruments that are not listed on formal exchanges. The NASDAQ, founded in 1971, was the world’s first electronic OTC market. It started as a quotation system and did not actually trade stocks. It was not until 1982 that NASDAQ began to use automated trading systems, which allowed for electronic trades.

OTC Derivatives Market

The 1980s and 1990s saw the growth of the OTC derivatives market. Derivatives are financial contracts whose value is derived from underlying assets like stocks, bonds, or commodities. The OTC derivatives market allowed for the creation of customized contracts, which was not possible on traditional exchanges. However, the lack of transparency in this market also contributed to the financial crisis in 2008.

Over-the-Counter Trading Today

Today, OTC trading is a crucial part of the global financial system. It allows for the trading of a wide range of assets, from stocks and derivatives to commodities and cryptocurrencies. The advent of the internet and digital technology has further revolutionized OTC trading, making it more accessible and efficient.

OTC Trading in Cryptocurrency

The Role of OTC Trading in Cryptocurrency

In the world of cryptocurrencies, OTC trading plays a crucial role, especially for large volume trades. High net worth individuals or institutions often prefer to use OTC trading desks to buy or sell large amounts of cryptocurrencies. This method allows them to execute large trades at a fixed price, without causing significant price fluctuations that could occur if the trade was executed on a traditional exchange.

How OTC Trading Works in Cryptocurrency

The process of OTC trading in cryptocurrency is similar to that in traditional financial markets, but with some key differences. Here’s a step-by-step breakdown:

- Initiation: The buyer and seller agree on the details of the trade, including the type and amount of cryptocurrency, and the price per unit. This agreement can be facilitated by an OTC broker who connects buyers and sellers.

- Transaction: Once the terms are agreed upon, the seller transfers the agreed amount of cryptocurrency to an escrow account. This is a third-party account that holds the funds securely during the transaction.

- Payment: The buyer then transfers the agreed payment to the seller. This can be in the form of fiat currency or another cryptocurrency, depending on the terms of the trade.

- Completion: Once the seller confirms receipt of the payment, the cryptocurrency is released from the escrow account and transferred to the buyer’s wallet.

Benefits and Risks

Benefits of Crypto Over-the-Counter Trading

- Opportunity to Buy Unique Crypto Before Listing: One of the unique benefits of OTC trading in the crypto world is the opportunity to buy tokens before they are listed on major exchanges. This can be particularly advantageous for investors looking to get in early on promising projects. By negotiating directly with the token issuers or early holders, investors can potentially secure a lower price before the token becomes available to the general public on exchanges. This strategy, while risky, has the potential for high returns if the token increases in value after it is listed.

- Price Stability: In OTC trading, large trades can be executed without significantly impacting the market price of the cryptocurrency. This is particularly beneficial for high-volume traders who want to avoid price slippage that can occur on traditional exchanges.

- Privacy: OTC trading offers a higher level of privacy as the details of the transactions are only known to the parties involved. This is a significant advantage for individuals or institutions that wish to keep their trading activities confidential.

- Flexibility: OTC trades can be customized to meet the specific needs of the parties involved. This includes the ability to negotiate the price and other terms of the trade, which is not possible on traditional exchanges.

- Efficiency: OTC trades can often be executed more quickly than trades on an exchange. This is because they bypass the traditional exchange order book, which relies on a buyer-seller matching system.

Risks

Counterparty Risk

This is the risk that the other party will not fulfill their end of the transaction. While this risk is mitigated to some extent by using trusted OTC brokers and escrow services, it cannot be completely eliminated.

Regulatory Risk

The regulatory environment for cryptocurrency is still evolving and varies from one jurisdiction to another. This can create uncertainty and potential legal risks for parties involved in OTC trading.

Liquidity Risk

While OTC trading is ideal for large trades, it relies on the broker being able to find a counterparty for the trade. In some cases, it may be difficult to find a buyer or seller willing to trade the desired amount of cryptocurrency, which can create liquidity risks.

Price Transparency

While OTC trading offers privacy, it also means that there is less price transparency compared to trading on an exchange. This can make it harder for traders to know if they are getting the best possible price for their trade.

How to Get Started with Crypto OTC Trading

Understanding the Basics

Before diving into OTC trading, it’s important to understand what it entails. OTC trading involves direct transactions between two parties, without the oversight of an exchange. This form of trading is particularly useful for large volume trades, as it can help avoid significant price slippage that can occur on exchanges.

Choosing a Platform

The first step to getting started is to choose a platform. There are many OTC trading desks and online platforms available today that facilitate OTC trades. Some well-known platforms include Mexc OTC, Kraken, and Binance OTC.

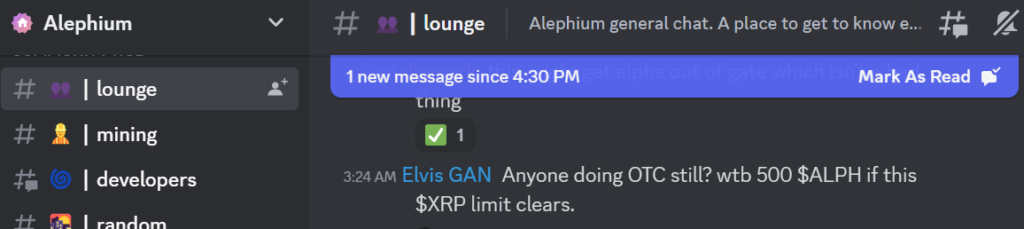

Engaging in OTC Trading on Discord

Discord, a popular communication platform, has become a hub for Over-the-Counter trading of new crypto projects. Many crypto communities have dedicated Discord servers where members can discuss the project, and OTC trades often occur here before the token is listed on any exchange. However, it’s crucial to be cautious when conducting OTC trades on Discord or similar platforms, as the risk of scams can be higher.

Working with Escrows

An escrow is a third-party that securely holds assets (in this case, cryptocurrency) during the transaction process. The use of an escrow service is common in Over-the-Counter trading to mitigate the risk of one party failing to fulfill their end of the deal. Here’s how it typically works:

- The seller transfers the agreed-upon amount of cryptocurrency to the escrow service.

- The buyer sends the agreed payment to the seller.

- Once the seller confirms receipt of the payment, the escrow service releases the cryptocurrency to the buyer.

It’s important to use a trusted escrow service to ensure the security of your assets. Some OTC platforms provide their own escrow services, or you can use a separate trusted escrow service.

Registering and Completing KYC Procedures

Once you’ve chosen a platform, you’ll need to register and complete any necessary Know Your Customer (KYC) procedures (not a must for Discord though). This typically involves providing some form of identification and may also include proof of address. KYC procedures help prevent fraudulent activities and are a requirement on most reputable OTC trading platforms.

Starting to Trade

With the preliminaries out of the way, you can now start trading. Remember, Over-the-Counter trading is a bit different from trading on an exchange. You’ll be negotiating trade terms directly with the other party, which can include the price and quantity of the cryptocurrency.

Case Studies of Successful Crypto OTC Trades

Case Study 1: Large Bitcoin Transaction

One of the most notable examples of successful OTC trades in the crypto world involves a large Bitcoin transaction. In this case, a high-net-worth investor wanted to purchase a significant amount of Bitcoin without causing a major price movement on the exchange. The investor used an OTC trading desk to find a seller willing to trade a large amount of Bitcoin at a fixed price. The trade was executed smoothly, demonstrating the effectiveness of OTC trading for large volume trades.

Case Study 2: Wooly’s Alephium Trade

I was an early miner of Alephium, a sharded blockchain platform. I managed to mine around 2000-3000 Alephium coins before the coin was listed on any major exchange.

Recognizing the potential value of these coins, I decided to sell them through Over-the-Counter trading. I used the Alephium Discord server, a community platform for Alephium enthusiasts, to find potential buyers. After negotiating the price and terms of the trade, I successfully sold my Alephium coins (not all ;).

This case study highlights the potential of OTC trading for early adopters and miners of new crypto projects.

Case Study 3: Multi-Million Dollar Ethereum Trade

In another instance, a multi-million dollar Ethereum trade was conducted over an OTC trading desk. The buyer, an institutional investor, wanted to invest a significant amount in Ethereum but was concerned about the potential impact on the market price. By using an OTC trading desk, the investor was able to execute the trade at a fixed price, avoiding price slippage and maintaining privacy.

These case studies highlight the potential benefits of OTC trading in the crypto world, particularly for large volume trades and early-stage tokens. However, it’s important to remember that every trade carries risks, and OTC trading should be approached with a clear understanding of these risks.

Future of OTC Trading in Crypto

Growing Demand

As the cryptocurrency market continues to mature and attract more institutional investors, the demand for OTC trading is expected to grow. Institutional investors often prefer OTC trading for large volume trades due to the benefits of price stability and privacy. As more institutions enter the crypto space, we can expect to see an increase in the volume of OTC trades.

Impact of Regulatory Changes

The regulatory environment for cryptocurrency is evolving, and these changes could have a significant impact on OTC trading. For instance, increased regulatory oversight could lead to more transparency, which could help reduce counterparty risk. However, stricter regulations could also pose challenges, such as increased compliance costs.

Technological Innovations

Technological advancements could also shape the future of OTC trading in crypto. For example, the development of decentralized exchanges (DEXs) could provide a new platform for OTC trades. DEXs operate on blockchain technology and allow for direct peer-to-peer trades without the need for an intermediary. This could potentially make OTC trading more accessible and efficient.

Integration of DeFi and OTC Trading

The integration of Decentralized Finance (DeFi) and Over-the-Counter trading could be another trend in the future. DeFi applications aim to recreate traditional financial systems with cryptocurrency, and they could provide new ways to facilitate OTC trades. For instance, smart contracts could be used to automate the escrow process in OTC trades, reducing the risk and increasing the efficiency of these transactions.

Conclusion

Over-the-counter (OTC) trading has carved out a significant niche in the cryptocurrency world. Its ability to facilitate large volume trades with minimal impact on market price, coupled with the privacy it offers, makes it a preferred choice for many high-net-worth individuals and institutional investors.

From understanding the basics of OTC trading to exploring its benefits and risks, and from delving into real-life case studies to envisioning its future, we’ve taken a comprehensive look at this crucial aspect of the crypto trading landscape.

As we’ve seen, Over-the-Counter trading is not without its challenges. Counterparty risk, regulatory uncertainties, and the need for trusted intermediaries are all factors that traders need to consider. However, the potential benefits – price stability, privacy, and the opportunity to negotiate trade terms – often outweigh these risks for many traders.

Looking ahead, the future of OTC trading in crypto appears bright. With growing institutional interest in cryptocurrencies, evolving regulatory landscapes, and rapid technological advancements, OTC trading is poised to adapt and grow. The integration of DeFi and OTC trading, in particular, offers exciting possibilities for making OTC trading more accessible and efficient.

As we navigate this dynamic and often complex world of crypto trading, understanding OTC trading equips us with another tool in our trading arsenal. Whether you’re a seasoned trader or a newcomer to the crypto world, the knowledge of OTC trading can open up new opportunities and strategies in your trading journey.

FAQs

What is OTC trading?

OTC trading, or Over-the-Counter trading, is a type of trading that occurs directly between two parties, without the oversight of an exchange. This form of trading can involve a wide range of assets, from commodities to financial instruments like stocks and derivatives.

What is OTC trading in crypto?

OTC trading in crypto refers to the direct trading of cryptocurrencies between two parties, outside of a traditional exchange. This is often used for large volume trades, as it can help avoid significant price slippage and provide a higher level of privacy.

Traditional OTC trading vs Crypto?

Traditional OTC trading and crypto OTC trading share the basic principle of direct trading between two parties. However, crypto OTC trading often involves digital platforms or chat groups for connecting buyers and sellers, and may use escrow services for secure transfer of assets. Additionally, crypto OTC trading can offer more privacy and is often used for large trades to avoid impacting the market price.