In the dynamic world of cryptocurrency, understanding the nuances of trading mechanisms is crucial for success. One of the most critical distinctions to comprehend is “spot vs futures” trading. This article will delve into these two trading methods, providing a comprehensive guide to help you navigate the crypto trading landscape.

Key Takeaways

- Spot Trading: Spot trading involves buying or selling a cryptocurrency for immediate delivery. It’s straightforward, less risky, and suitable for beginners. However, it requires full upfront payment and exposes traders to short-term market volatility.

- Futures Trading: Futures trading involves buying or selling a contract to trade a specific amount of a cryptocurrency at a predetermined price in the future. It’s more complex, involves higher risk due to the use of leverage, but offers the potential for significant profits. It’s suitable for experienced traders who have a good understanding of the market.

- Spot Price vs Futures Price: The spot price is the current price at which a cryptocurrency can be bought or sold for immediate delivery. The futures price is the price at which the cryptocurrency can be bought or sold for delivery at a future date. The relationship between these two prices can provide insights into market expectations.

- Risk Management: Regardless of the trading method, managing risk is crucial. This can be achieved by diversifying your portfolio, using risk management tools, and never investing more than you can afford to lose.

Table of Contents

What is Crypto Trading?

Crypto trading, also known as cryptocurrency trading, is the process of buying, selling, and exchanging digital currencies through online platforms known as cryptocurrency exchanges. These platforms allow users to trade cryptocurrencies against other digital currencies or traditional fiat currencies like the US Dollar, Euro, or Yen.

Crypto trading has gained significant popularity over the past decade, primarily due to the rise of Bitcoin, the first and most well-known cryptocurrency. However, there are now thousands of different cryptocurrencies available for trading, each with its unique features and uses.

There are two main types of crypto trading:

- Spot Trading: This involves buying or selling a cryptocurrency outright, with the transaction being settled “on the spot”. This is the most straightforward form of crypto trading. When you buy a cryptocurrency in a spot market, you own the actual underlying asset and can hold it in your digital wallet.

- Derivatives Trading: This involves trading products that derive their value from the performance of an underlying cryptocurrency. These include futures contracts, options, and swaps. Derivatives trading allows traders to speculate on the future price movements of a cryptocurrency without needing to own the actual cryptocurrency.

Understanding Spot Trading

What is Spot Trading?

Spot trading, in the context of cryptocurrency, refers to the direct purchase or sale of a digital currency. The term “spot” comes from the phrase “on the spot” and signifies that the transaction is settled immediately, or “on the spot.” This means that when you buy a cryptocurrency in a spot trade, you pay for it and receive it instantly.

Spot trading is the most straightforward and common type of trading in the cryptocurrency market. It’s the type of trade that most people think of when they consider buying or selling cryptocurrencies. When you buy a cryptocurrency on a spot market, you own the actual underlying asset and can hold it in your digital wallet.

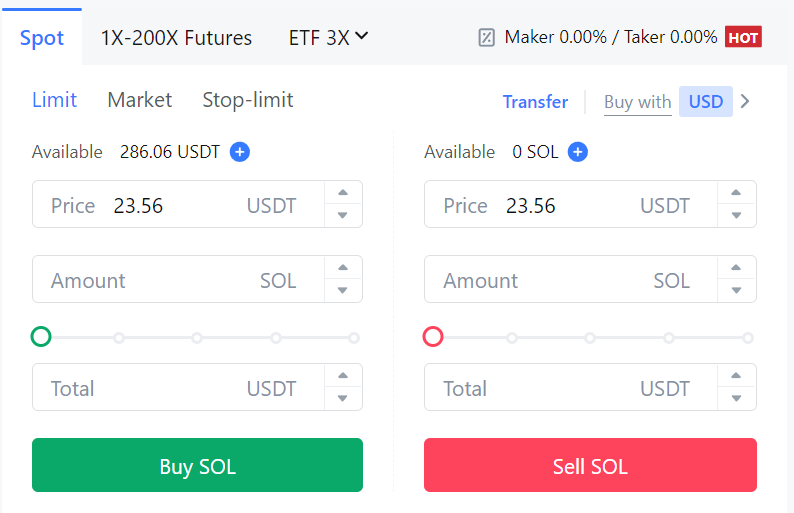

How Does Spot Trading Work in Crypto?

In a spot trade, the buyer and seller agree to trade the cryptocurrency at the current market price, also known as the “spot price.” Once the trade is executed, the ownership of the cryptocurrency is transferred immediately from the seller to the buyer.

The buyer pays for the cryptocurrency using either another cryptocurrency or a fiat currency, depending on the trading pair. For example, in a Bitcoin/Ethereum trading pair, Bitcoin is being traded for Ethereum, and vice versa. In a Bitcoin/USD trading pair, Bitcoin is being traded for US dollars, and vice versa.

Advantages and Disadvantages of Spot Trading

Spot trading has several advantages and disadvantages that traders need to consider:

| Advantages | Disadvantages |

|---|---|

| Immediate Ownership: Once a spot trade is executed, the buyer owns the cryptocurrency and can use it however they wish. | Full Upfront Payment: Spot trades require the buyer to pay the full price of the cryptocurrency upfront. |

| Lower Risk: Compared to futures trading, spot trading is less risky because it does not involve leverage. | Limited Leverage: Spot trading does not offer the potential for leveraged returns that futures trading does. |

| Simplicity: Spot trading is straightforward and easy to understand, making it suitable for beginners. | Short-Term Volatility: Spot traders can be exposed to short-term market volatility, which can lead to potential losses. |

Understanding Futures Trading

What is Futures Trading?

Futures trading is a form of financial trading where a buyer and a seller enter into a contract to exchange an asset, in this case, a cryptocurrency, at a predetermined price at a specific future date. Unlike spot trading, where the transaction is settled immediately, futures contracts are settled at a later date.

In the world of cryptocurrency, futures trading allows traders to speculate on the future price of a cryptocurrency. If a trader believes the price of a particular cryptocurrency will rise in the future, they can buy a futures contract, and if they believe the price will fall, they can sell a futures contract.

How Does Futures Trading Work in Crypto?

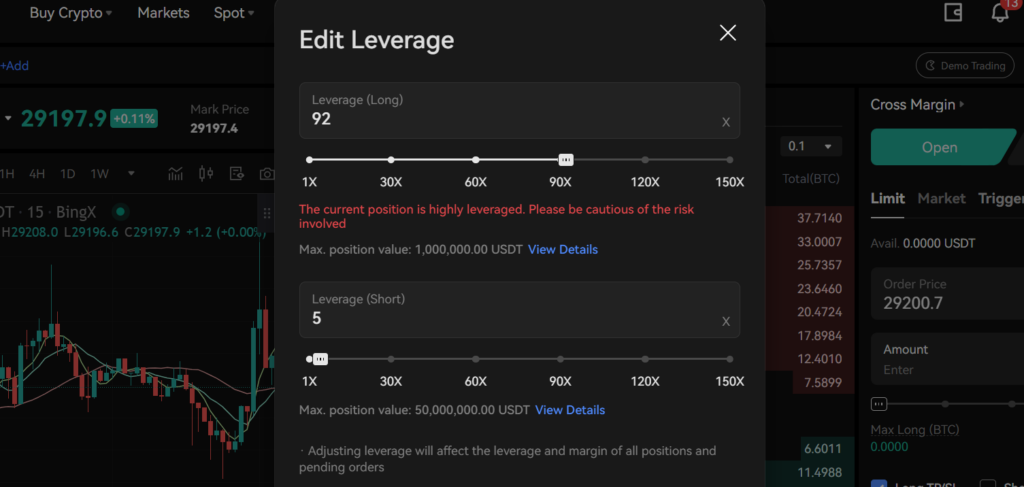

In a futures contract, the buyer agrees to buy, and the seller agrees to sell a specific amount of a cryptocurrency at a predetermined price on a specific future date, regardless of what the actual market price is at the contract’s expiration date.

For example, if a trader buys a Bitcoin futures contract at $50,000, they are agreeing to buy Bitcoin at $50,000 on the contract’s expiration date, even if the actual market price of Bitcoin is higher or lower.

Futures contracts can be traded on futures exchanges, and the price of a futures contract is constantly changing based on the market’s perception of the future price of the underlying asset.

Advantages and Disadvantages of Futures Trading

Futures trading offers several advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Potential for High Profits: If a trader’s prediction about the future price of a cryptocurrency is correct, they can make a significant profit. | High Risk: Futures trading is complex and carries a high level of risk. If a trader’s prediction about the future price of a cryptocurrency is incorrect, they can incur significant losses. |

| Leverage: Futures contracts allow traders to leverage their position, meaning they can potentially achieve higher returns with a smaller initial investment. | Complexity: Futures trading is more complex than spot trading and requires a good understanding of the market and trading strategies. |

| Profit in Both Rising and Falling Markets: Traders can make a profit in both rising and falling markets by buying or selling futures contracts. | Potential for Significant Losses: If the market moves against a trader’s position, they can lose more than their initial investment due to leverage. |

As you see, futures trading is a more advanced form of crypto trading that allows traders to speculate on the future price of a cryptocurrency. It offers the potential for high returns but also carries a high level of risk.

Spot vs Futures Trading: A Comparative Analysis

Detailed comparison chart “Spot vs Futures Trading”

| Spot Trading | Futures Trading | |

|---|---|---|

| Definition | Buying or selling a cryptocurrency for immediate delivery and settlement. | Buying or selling a contract to trade a specific amount of a cryptocurrency at a predetermined price in the future. |

| Settlement | Immediate | At a specific future date |

| Ownership | Immediate ownership of the cryptocurrency | No ownership of the cryptocurrency until the contract’s expiration date |

| Risk Level | Lower risk as it does not involve leverage | Higher risk due to the use of leverage |

| Potential Profit | Profit potential is limited to the rise in the asset’s price | Profit can be made from both rising and falling markets |

| Payment | Full payment required upfront | Margin (a fraction of the total value) is required upfront |

| Suitability | Suitable for beginners and those who prefer lower risk | Suitable for experienced traders who are comfortable with higher risk |

| Complexity | Less complex, straightforward | More complex, requires a good understanding of the market |

| Leverage | No leverage | Leverage is available, allowing for potentially higher returns |

Differences Between Spot and Futures Trading

The primary difference between spot and futures trading lies in the timing of the transaction and the risk involved.

In spot trading, the transaction is settled “on the spot” with immediate delivery of the cryptocurrency. The buyer pays the current market price, and the seller delivers the cryptocurrency instantly. Spot trading is straightforward and involves lower risk compared to futures trading, making it suitable for beginners and those who prefer to avoid high-risk scenarios.

On the other hand, futures trading involves buying or selling a contract to trade a specific amount of a cryptocurrency at a predetermined price in the future. This allows traders to speculate on price movements and potentially profit from both rising and falling markets. However, futures trading is more complex and involves higher risk due to the use of leverage.

Similarities Between Spot and Futures Trading

Despite their differences, spot and futures trading share some similarities. Both are methods used in the crypto market to profit from price fluctuations. Both require a deep understanding of the market and strategic decision-making. In both types of trading, the goal is to predict future price movements and make trades that will result in profit.

When to Use Spot Trading and When to Use Futures Trading

The decision to use spot trading or futures trading depends on several factors, including your trading goals, risk tolerance, and market understanding.

Spot trading is generally recommended for those who want immediate ownership of the cryptocurrency and are willing to pay the full price upfront. It’s also suitable for those who prefer a straightforward and less risky trading method.

Futures trading, on the other hand, is suitable for more experienced traders who are comfortable with higher risk levels. If you’re willing to take on more risk for potentially higher returns and have a good understanding of the market, futures trading might be the right choice for you.

Best Crypto Exchanges for Spot & Futures Trading

| Exchange | KYC Required | Withdrawal Limit Without KYC | Additional Notes |

|---|---|---|---|

| Mexc | No | 10 BTC per day | Spot & Futures Trading, P2p |

| Coinex | No | 10,000 USDT per day | Spot & Futures Trading |

| Bingx | No | 50,000 USDT per day | Spot, Perpetual Futures, Copytrading |

Tips for Successful Crypto Trading

Successful crypto trading requires a combination of knowledge, strategy, and discipline. Here are some tips for both spot and futures trading:

Best Practices for Spot Trading

- Understand the Market: Before you start spot trading, take the time to understand the cryptocurrency market. This includes understanding how different cryptocurrencies work, the factors that influence their prices, and the latest market trends.

- Start Small: As a beginner, it’s advisable to start with a small investment that you can afford to lose. This will allow you to gain experience without risking too much.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Invest in a variety of cryptocurrencies to spread your risk.

- Use a Secure Wallet: Store your cryptocurrencies in a secure wallet to protect them from hackers and thieves.

- Stay Updated: Keep up with the latest news and developments in the crypto world. This can help you make informed trading decisions.

Best Practices for Futures Trading

- Understand How Futures Work: Futures trading is more complex than spot trading. Make sure you understand how futures contracts work, including the concept of leverage, margin requirements, and contract expiration.

- Use Risk Management Tools: Most futures exchanges offer risk management tools like stop-loss orders and limit orders. Use these tools to manage your risk and protect your investment.

- Monitor the Market Regularly: Futures prices can change rapidly. Regularly monitor the market and adjust your trading strategy as needed.

- Don’t Invest More Than You Can Afford to Lose: Due to the high risk of futures trading, never invest more than you can afford to lose.

- Keep Learning: The crypto market is constantly evolving. Keep learning and updating your knowledge to stay ahead.

Remember, successful trading involves careful planning and disciplined execution. Always do your research, manage your risks, and never invest more than you can afford to lose.

Conclusion

In the volatile world of cryptocurrency trading, understanding the nuances between spot and futures trading is crucial. Both trading methods offer unique advantages and cater to different trading styles and risk tolerance levels.

Spot trading, with its immediate settlement and lower risk profile, is ideal for beginners and those who prefer straightforward transactions. It offers the benefit of actual ownership of the cryptocurrency and is less complex than futures trading.

On the other hand, futures trading allows for speculation on the future price of a cryptocurrency, offering the potential for significant profits, especially in volatile markets. However, this comes with a higher level of risk and complexity, making it more suitable for experienced traders.

Choosing between spot and futures trading ultimately depends on your individual trading goals, risk tolerance, and understanding of the market. By equipping yourself with the knowledge of these two trading methods, you can make more informed decisions and navigate the crypto trading landscape with greater confidence.

Remember, regardless of the trading method you choose, it’s important to stay updated with market trends, manage your risks effectively, and continuously learn and adapt. Crypto trading is a journey, and with the right knowledge and strategies, it can be a rewarding one.

FAQs

What is the main difference between spot and futures trading?

The main difference is the timing of the transaction. Spot trading involves immediate transactions and delivery, while futures trading involves a contract for future delivery at a set price.

Is spot trading or futures trading better for beginners?

Spot trading is generally better for beginners due to its simplicity and lower risk compared to futures trading.

Can I do both spot and futures trading?

Yes, many traders engage in both spot and futures trading to diversify their strategies and manage risk.