In the ever-evolving landscape of cryptocurrency, the anonymous crypto exchange stands out as a beacon for those prioritizing privacy. But what makes these platforms so sought after? And how can you, as a trader, navigate this world safely and effectively? Let’s uncover the secrets.

Table of Contents

What Are Anonymous Crypto Exchanges?

Definition and Basic Concept

Anonymous crypto exchanges are platforms that allow users to trade cryptocurrencies without revealing their personal identity. Unlike traditional exchanges, they don’t require extensive personal information or KYC (Know Your Customer) verifications.

Distinguishing Features

While regular exchanges might offer more liquidity and established reputations, anonymous platforms prioritize user privacy, often leveraging decentralized technology to ensure anonymity.

Why Choose an Anonymous Crypto Exchange?

Privacy in the Digital Age

With data breaches becoming increasingly common, the allure of an anonymous crypto exchange is evident. These platforms provide a sanctuary for those wary of sharing personal data online.

Bypassing Regulatory Restrictions

For traders in regions with strict crypto regulations, anonymous exchanges offer a way to bypass these constraints, granting more freedom in their trading activities.

Reducing Data Breach Risks

Without storing personal data, these exchanges significantly reduce the risk of data breaches, ensuring a safer trading environment.

How Do Anonymous Crypto Exchanges Work?

The No-KYC Policy

One of the hallmarks of an anonymous crypto exchange is its No-KYC policy. This means users can start trading without undergoing rigorous identity checks.

Embracing Privacy Coins

Many such exchanges support privacy coins like Monero and Zcash, which are designed to protect user identities and transaction details.

Benefits of Using Anonymous Crypto Exchanges

Enhanced Privacy

The primary benefit is, of course, enhanced privacy. Users can trade without the fear of their data being compromised.

Swift Trading Processes

Without the need for KYC verifications, users can start trading almost instantly.

Freedom from Oversight

These platforms offer a respite from governmental oversight, giving traders more autonomy.

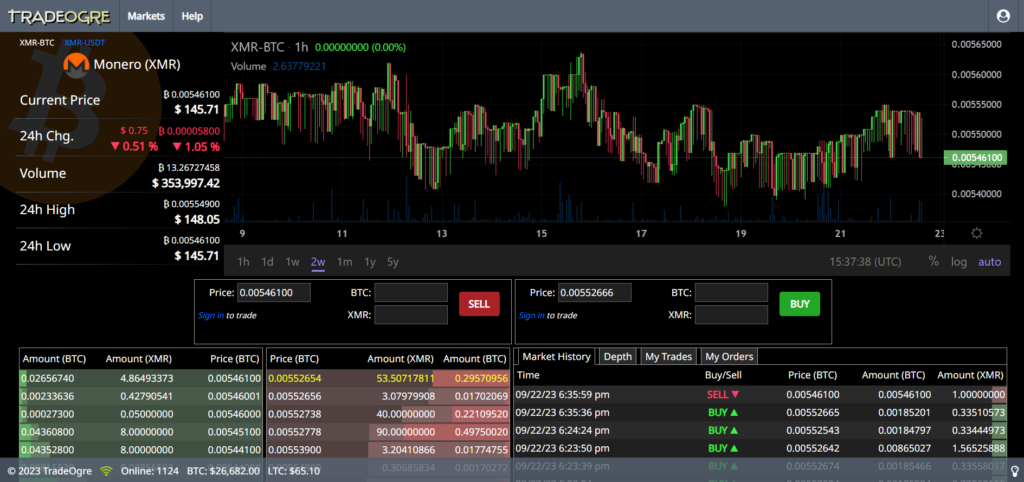

TradeOgre: The Bastion of True Anonymity in Crypto Trading

Renowned for its unwavering commitment to user privacy, TradeOgre has carved a niche for itself as the go-to platform for traders who prioritize anonymity above all else. With no KYC (Know Your Customer) requirements and an owner as mysterious as Bitcoin’s Satoshi Nakamoto, TradeOgre is a testament to the original ethos of the cryptocurrency movement.

The Enigma Behind TradeOgre

Much like the elusive Satoshi Nakamoto, the creator of Bitcoin, the owner of TradeOgre remains a mystery. This anonymity extends to the platform’s operations, reinforcing its commitment to privacy and security. The unknown ownership adds a layer of intrigue to the platform, drawing parallels with the very foundation of the cryptocurrency world.

Why TradeOgre Stands Out

No-KYC: A Truly Anonymous Experience

TradeOgre’s most distinguishing feature is its complete absence of KYC procedures. While most exchanges require some form of identity verification, TradeOgre remains steadfast in its commitment to user privacy. Traders can seamlessly create an account and start trading without divulging any personal information.

No Restrictions, Absolute Freedom

Beyond its no-KYC policy, TradeOgre imposes no restrictions on its users. Whether it’s deposit limits, withdrawal caps, or trading volume, users enjoy an unrestricted trading environment, making it a haven for seasoned traders and newcomers alike.

Top Anonymous Crypto Exchanges to Consider

The allure of anonymous crypto exchanges lies in their promise of privacy and freedom from stringent regulations. However, it’s essential to understand that not all “anonymous” exchanges are created equal. While some platforms may not require mandatory KYC (Know Your Customer) procedures, they might still have known ownership, and there’s always a potential risk of asset freezing. Here, we delve into three NO kyc crypto exchanges that, despite not being 100% anonymous, offer a degree of privacy and support for privacy coins.

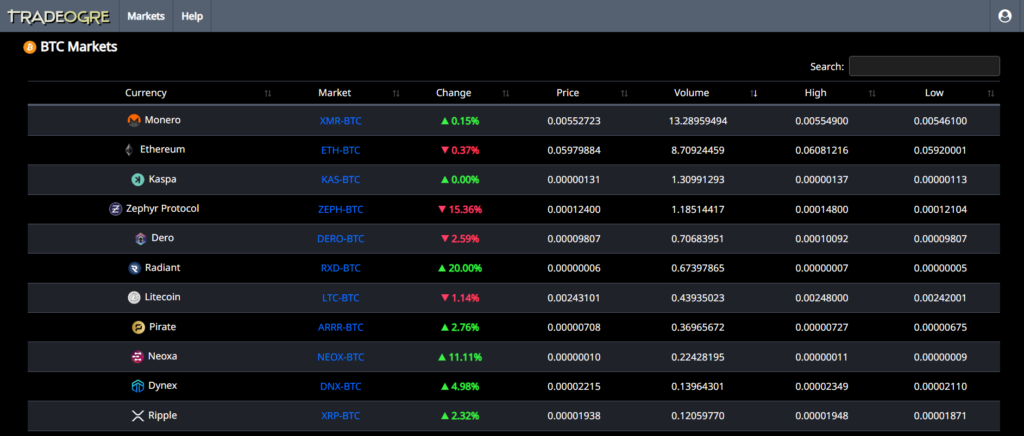

| Exchange | Trading Modes | P2P Trading | KYC Requirements | Withdrawal Limit (without KYC) |

|---|---|---|---|---|

| MEXC | Spot + Futures | Yes (with KYC) | No | 30 BTC per day |

| BingX | Spot | Yes (with KYC) | No | 50K USDT per day |

| CoinEx | Spot + Futures | No | No | 10K USDT per day |

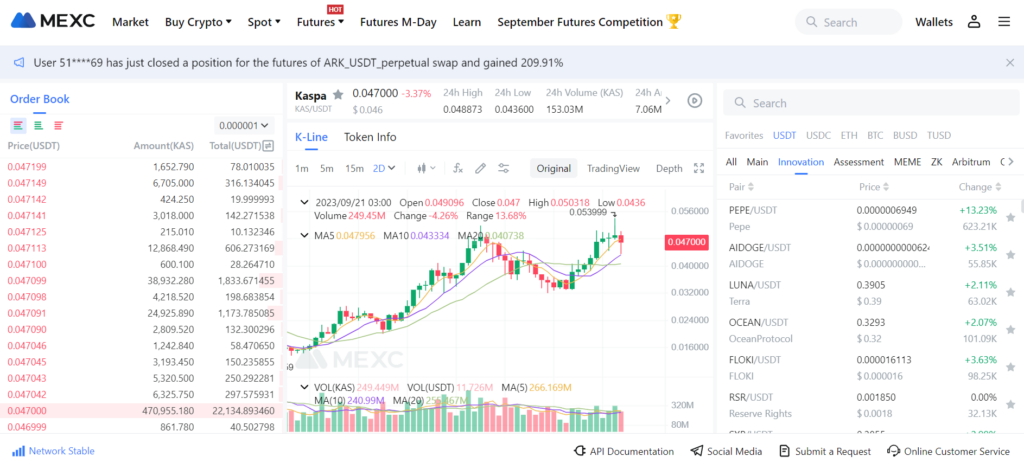

MEXC

Trading Modes

MEXC offers both Spot and Futures trading, catering to a wide range of traders, from beginners to seasoned professionals.

P2P Trading

While MEXC does support peer-to-peer (P2P) trading, it’s essential to note that KYC is required for this feature.

KYC Requirements

MEXC does not mandate KYC for its users. However, there’s a withdrawal limit of 30 BTC per day for non-KYC verified accounts.

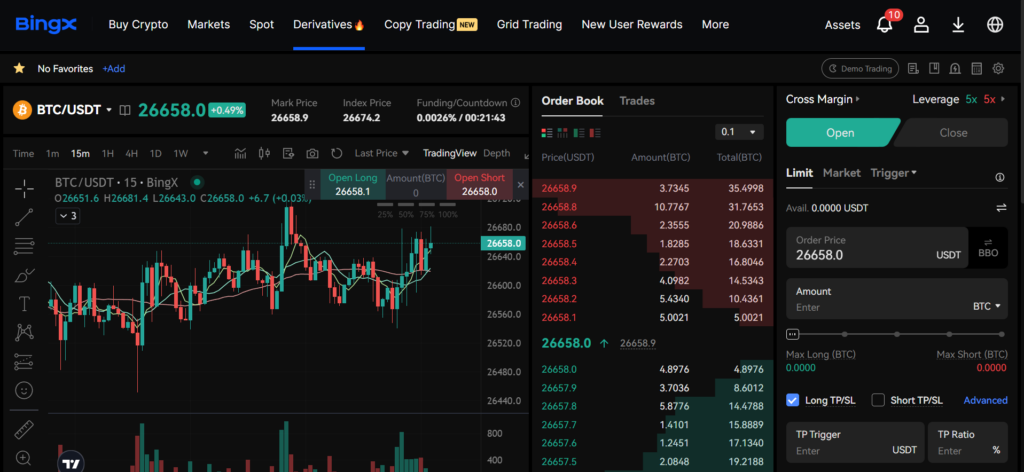

BingX

Trading Modes

BingX primarily focuses on Spot trading, making it suitable for traders looking for straightforward crypto-to-crypto exchanges.

P2P Trading

BingX offers P2P trading, but similar to MEXC, KYC is required to access this feature.

KYC Requirements

While BingX does not enforce mandatory KYC for its users, there’s a withdrawal cap of 50K USDT per day for accounts that haven’t undergone KYC verification.

CoinEx

Trading Modes

CoinEx provides its users with both Spot and Futures trading options, ensuring a comprehensive trading experience.

P2P Trading

CoinEx does not support P2P trading, which might be a limitation for those looking for direct trades with other users.

KYC Requirements

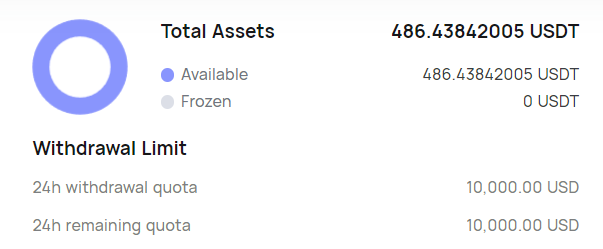

CoinEx stands out for not requiring KYC, with a generous withdrawal limit of 10K USDT per day for non-verified accounts.

Potential Risks and Drawbacks

Anonymous crypto exchanges, while offering unparalleled privacy and freedom, are not without their challenges. As the crypto landscape evolves, it’s crucial for traders to be aware of the potential risks associated with these platforms. Here’s a deep dive into the potential pitfalls and concerns:

1. Limited Liquidity

Newer or lesser-known anonymous exchanges do not have the same trading volume as their mainstream counterparts. Limited liquidity can lead to challenges in executing large trades without significantly impacting the price.

2. Vulnerability to Scams

The allure of anonymity can sometimes be a double-edged sword. Since these platforms don’t require extensive personal details, they can become hotspots for fraudulent activities or scam. There have been instances of fly-by-night exchanges disappearing overnight, taking user funds with them.

3. Regulatory Concerns

Operating in the gray area of regulations, anonymous exchanges can face sudden clampdowns from regulatory bodies. This can lead to unexpected platform shutdowns or freezing of assets, leaving traders in a lurch.

4. Lack of Recourse in Disputes

Given their anonymous nature, resolving disputes or issues can be more challenging. If a trader faces issues with their funds or transactions, the lack of a clear regulatory framework can make redressal difficult.

5. Potential for Poor Security Measures

Not all anonymous exchanges invest in top-tier security measures. Traders risk losing their assets to hacks or unauthorized breaches, especially on platforms that don’t prioritize user security.

6. Limited Features and Tools

Some anonymous exchanges, in their bid to maintain simplicity and privacy, might not offer advanced trading tools, charts, or features that professional traders seek.

7. Price Disparities

Due to lower liquidity and trading volumes, there might be significant price disparities between assets on anonymous exchanges and more mainstream platforms. This can lead to traders either overpaying or underselling their assets.

8. Uncertain Future

As regulations around the world become more defined, the future of many anonymous exchanges remains uncertain. Traders risk potential loss of assets if these platforms are forced to shut down abruptly.

Tips for Safe and Effective Trading on Anonymous Exchanges

While the allure of anonymous crypto exchanges is undeniable, ensuring a safe and effective trading experience is paramount. Here are some pivotal tips to navigate these platforms with confidence:

1. Extensive Research is Key

Before diving into any exchange, it’s crucial to DYOR. Familiarize yourself with its reputation and history. Platforms with a longstanding positive track record are generally more reliable. Additionally, stay updated with crypto news outlets and forums, as any significant issues or concerns related to an exchange will likely surface there.

2. Security Should Be Your Top Priority

Always enable Two-Factor Authentication (2FA) on your accounts. This additional layer of security ensures that even if someone obtains your password, they can’t access your account without the second verification step. Furthermore, always trade using a secure and private internet connection. If you’re on the move, consider using a VPN (Virtual Private Network) for enhanced security.

3. Diversification is Essential

Avoid putting all your assets in one place. Diversify your crypto holdings across various currencies and platforms. This strategy not only mitigates risks but also provides a safety net against unforeseen issues on a single platform.

4. Stay Cautious of Overly Attractive Offers

If an exchange promotes bonuses or returns that seem too good to be true, approach with caution. Overly generous offers can sometimes be bait to attract and deceive unsuspecting users.

5. Be Aware of Platform Limitations

Many anonymous exchanges impose withdrawal limits, especially for users who haven’t undergone KYC procedures. Familiarize yourself with these limits to prevent unexpected liquidity issues. Additionally, keep abreast of the regulatory landscape in your region to avoid potential legal complications.

6. Safeguard Your Recovery Information

Always have backups for recovery phrases, codes, and other essential data. Store this information securely, preferably offline, ensuring you can regain account access if you lose your primary access credentials or face device issues.

7. Embrace Privacy Coins for Added Anonymity

For traders seeking an extra layer of privacy, consider trading with privacy coins like Monero or Zcash. These coins offer more anonymous transactions, further shielding transaction details and enhancing user privacy.

The Future of Anonymous Crypto Exchanges

The cryptocurrency landscape is in a constant state of flux, with technological advancements and regulatory changes shaping its future. Anonymous crypto exchanges, which have been a cornerstone for those prioritizing privacy, are at the forefront of these shifts. Let’s delve into what the future might hold for these platforms.

The Regulatory Challenge

As the crypto industry matures, regulatory bodies worldwide are paying closer attention, aiming to strike a balance between fostering innovation and ensuring user protection. With increasing regulations, anonymous exchanges face challenges, especially those operating in regions with stringent crypto-related laws. The primary concern for regulators is the potential misuse of these platforms for illicit activities, given the anonymity they offer.

The TradeOgre Paradigm

TradeOgre stands as a beacon of hope in this changing landscape. With over five years of operation, it has demonstrated resilience and adaptability. While many platforms might buckle under regulatory pressures, the hope is that stalwarts like TradeOgre, with their deep-rooted commitment to user privacy, will navigate these challenges and continue to serve their user base.

Technological Advancements

Despite regulatory hurdles, the crypto industry continues to innovate. We can expect anonymous exchanges to leverage emerging technologies to enhance user privacy further. Developments in zero-knowledge proofs, ring signatures, and other cryptographic techniques could bolster the anonymity features of these platforms.

The Rise of Decentralized Platforms

Decentralized exchanges (DEXs) are gaining traction, offering peer-to-peer trading without a central authority. These platforms can potentially offer higher levels of anonymity and are less susceptible to regulatory clampdowns, given their decentralized nature. As technology evolves, DEXs might become the preferred choice for those seeking both anonymity and security.

Conclusion

The world of anonymous crypto exchanges is both intriguing and complex. These platforms, with their promise of unparalleled privacy and freedom, represent the very ethos of the cryptocurrency movement. However, as with all things in the financial realm, they come with their own set of challenges and considerations.

Regulatory pressures, security concerns, and the ever-evolving landscape of the crypto world mean that traders must tread with caution. Platforms like TradeOgre, with their longstanding reputation and commitment to user privacy, offer a glimmer of hope in this intricate maze. Yet, it’s essential for traders to remain vigilant, always prioritizing their security and staying informed.

The future of anonymous exchanges, while uncertain in the face of tightening regulations, is also ripe with potential. As technology continues to advance, and as the crypto community grows and adapts, there’s hope that these platforms will find ways to thrive, offering users the perfect blend of privacy, security, and freedom.

In essence, the journey through the world of anonymous crypto exchanges is one of empowerment, caution, and continuous learning. As we navigate this path, it’s the balance of these elements that will determine our success and safety in the decentralized financial future.

FAQs

Are all anonymous crypto exchanges decentralized?

Not necessarily. While many are decentralized, some operate on centralized networks but still prioritize user privacy.

How can I ensure my transactions remain private?

Use privacy coins, trade on reputable anonymous platforms, and employ security measures like VPNs.