The quest for the best trading platform in UAE has never been more intense. With the crypto market in the UAE burgeoning, traders are on the lookout for platforms that offer not just robust security but also a seamless user experience. This guide unveils the top 7 platforms that have made a mark in 2025.

Table of Contents

Top 7 Crypto Trading Platforms in UAE

| Exchange | Coins | Trading modes | p2p | Copy trading | KYC |

|---|---|---|---|---|---|

| MEXC | 1685 | Spot + Futures | Yes (with KYC) | Yes | No (10 BTC per day) |

| OKX | 331 | Spot + Futures | Yes (with KYC) | Yes | No (10 BTC per day) |

| Bingx | 535 | Spot + Futures | Yes (with KYC) | Yes | No (50K USDT per day) |

| Bitget | 597 | Spot + Futures | Yes (with KYC) | Yes | Yes |

| Gate.io | 1758 | Spot + Futures | Yes (with KYC) | No | Yes |

| Coinex | 737 | Spot + Futures | No | No | No (10K USDT per day) |

| Tradeogre | 123 | Spot | No | No | No |

Factors to Consider When Choosing a Best Trading Platform in UAE

Choosing the right trading platform is crucial for both novice and experienced traders in UAE. Here’s an elaboration on the factors to consider when selecting a trading platform:

1. Security Features

- Encryption Protocols: Ensure the platform uses advanced encryption methods to protect user data and transactions.

- Two-factor Authentication (2FA): A platform should offer 2FA to add an extra layer of security during login and withdrawal processes.

- Cold Storage and Hot Wallets: Check if the platform keeps a majority of its funds in offline cold storage to reduce the risk of hacks.

- Regulatory Compliance: Platforms regulated by financial authorities tend to have stringent security measures.

2. User Interface and Experience

- Intuitive Design: The platform should be user-friendly, allowing traders to navigate easily and execute trades without confusion.

- Mobile and Desktop Compatibility: A good platform should be accessible on various devices, including smartphones, tablets, and desktops.

- Customization: Some platforms allow users to customize their dashboard, charts, and other tools according to their preferences.

3. Fees and Charges

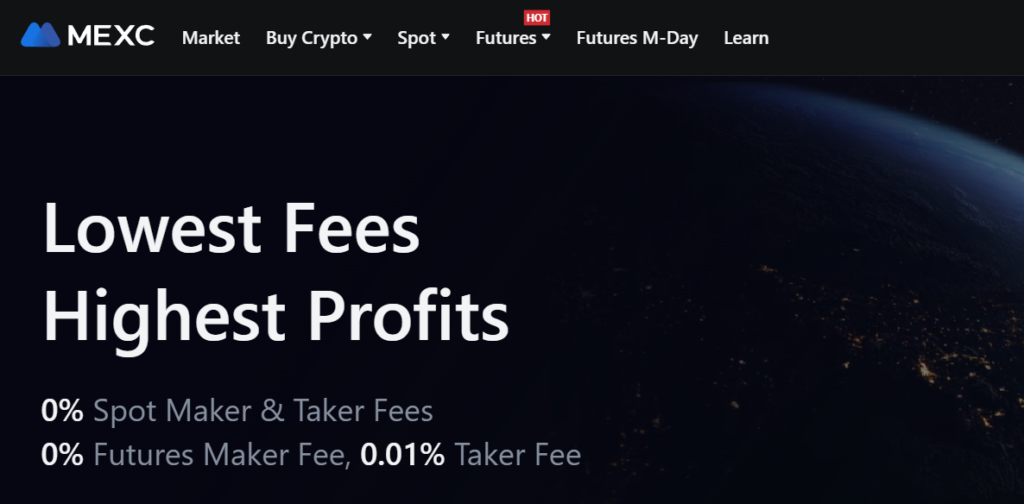

- Trading Fees: Understand the crypto exchange fee structure, including maker and taker fees. Some platforms offer fee discounts based on trading volume.

- Deposit and Withdrawal Fees: Some platforms charge fees for depositing or withdrawing funds. It’s essential to be aware of these to avoid unexpected costs.

- Hidden Charges: Always read the fine print to ensure there are no hidden charges or conditions that might affect your trading.

4. Supported Cryptocurrencies

- Variety of Coins/Tokens: While some traders might be interested only in major coins like Bitcoin and Ethereum, others might want access to altcoins and tokens.

- Fiat-to-Crypto Trading: Some platforms allow users to buy cryptocurrencies directly with fiat currencies, which can be a convenient feature for many.

5. Customer Support

- Availability: Look for platforms that offer 24/7 customer support, ensuring you can get assistance whenever needed.

- Response Time: Efficient customer support should respond promptly to user queries and concerns.

- Support Channels: Multiple channels like email, live chat, and phone support can be beneficial.

- Language Support: For traders in different regions, platforms that offer support in multiple languages can be a significant advantage.

6. Trading Modes and Features

- Spot Trading vs. Futures: Depending on your trading strategy, you might want a platform that offers both spot and futures trading.

- Leverage and Margin Trading: Some platforms allow traders to borrow funds to amplify their trades, but this comes with increased risk.

- Copytrading and Social Trading: These features allow less experienced traders to replicate the trades of successful traders.

7. Liquidity

High liquidity means that there’s a significant amount of trading activity on the platform, ensuring that traders can execute their trades at their desired prices without significant slippage.

8. Regulatory Compliance and Reputation

- Regulation: Platforms regulated by recognized financial authorities tend to be more trustworthy.

- Reputation: Check reviews, ratings, and news about the platform. A platform with a good reputation in the crypto community is generally more reliable.

9. Additional Tools

- Technical Analysis Tools: Features like charting tools, indicators, and real-time data can help traders make informed decisions.

- API Integration: For advanced traders, the ability to integrate third-party tools and bots via APIs can be a valuable feature.

Regulatory Landscape for Crypto Trading in UAE

The regulatory landscape for crypto trading in the UAE has evolved over the years, reflecting the country’s progressive approach to financial innovation and its commitment to ensuring a secure environment for investors. Here’s an elaboration on the regulatory landscape for crypto trading in the UAE:

1. Initial Stance on Cryptocurrencies

- Historically, the UAE Central Bank had been cautious about cryptocurrencies, primarily due to concerns related to money laundering, financial stability, and consumer protection.

- In its 2017 regulatory framework for stored values and electronic payment systems, the Central Bank seemed to prohibit virtual currencies. However, it later clarified that the regulations did not apply to bitcoin and other cryptocurrencies, blockchain, or any other financial technology.

2. ADGM (Abu Dhabi Global Market) Framework

- The Financial Services Regulatory Authority (FSRA) of ADGM introduced a comprehensive regulatory framework for crypto asset activities in 2018.

- The framework covers exchanges, wallet services, and other related activities. It emphasizes the importance of anti-money laundering (AML) and counter-terrorist financing (CTF) measures, consumer protection, and technology governance standards.

3. Dubai’s Approach

- Dubai Multi Commodities Centre (DMCC) has been proactive in fostering blockchain and crypto-related businesses. In 2018, DMCC started licensing firms trading in cryptocurrencies.

- The DMCC’s crypto regulations focus on AML and CTF policies, ensuring that businesses adhere to strict compliance standards.

4. Securities and Commodities Authority (SCA)

- In 2020, the UAE’s SCA issued a resolution on the regulation of crypto assets, providing a structured framework for issuing and trading crypto assets in the country.

- The resolution covers various aspects, including the procedures for registering crypto assets, licensing those involved in crypto activities, and the standards for disclosure and investor protection.

5. UAE’s National Blockchain Strategy 2021

- The UAE government launched its National Blockchain Strategy in 2018, aiming to become a global leader in the adoption of blockchain technology.

- While the strategy primarily focuses on government services, it indirectly boosts the crypto environment by fostering a positive attitude towards blockchain, the underlying technology of cryptocurrencies.

6. Collaboration with Saudi Arabia

- The UAE and Saudi Arabia have collaborated on a pilot cryptocurrency initiative. This joint project aims to understand the implications of blockchain technology and facilitate cross-border payments between the two countries.

7. Future Outlook

- The UAE continues to position itself as a hub for fintech and blockchain innovation. With the Expo 2020 in Dubai and other initiatives, there’s an expectation of further regulatory clarity and support for crypto enterprises.

- The country’s regulators are likely to continue monitoring global crypto trends and best practices to ensure that the UAE remains at the forefront of financial innovation while ensuring investor protection and financial stability.

Tips for Safe and Effective Crypto Trading

Trading cryptocurrencies can be both exciting and profitable, but it also comes with its risks. Here’s an elaboration on tips for safe and effective crypto trading in the UAE:

1. Educate Yourself

- Stay Updated: The crypto market is dynamic. Regularly read news, updates, and analyses related to cryptocurrency.

- Understand the Basics: Familiarize yourself with basic trading concepts, such as market orders, limit orders, stop-loss orders, and more.

- Learn Technical Analysis: While not foolproof, understanding chart patterns, indicators, and market trends can help in making informed trading decisions.

2. Choose a Reputable Trading Platform

| Exchange | Coins | Trading modes | p2p | Copy trading | KYC |

|---|---|---|---|---|---|

| MEXC | 1685 | Spot + Futures | Yes (with KYC) | Yes | No (10 BTC per day) |

| OKX | 331 | Spot + Futures | Yes (with KYC) | Yes | No (10 BTC per day) |

| Bingx | 535 | Spot + Futures | Yes (with KYC) | Yes | No (50K USDT per day) |

| Bitget | 597 | Spot + Futures | Yes (with KYC) | Yes | Yes |

| Gate.io | 1758 | Spot + Futures | Yes (with KYC) | No | Yes |

| Coinex | 737 | Spot + Futures | No | No | No (10K USDT per day) |

| Tradeogre | 123 | Spot | No | No | No |

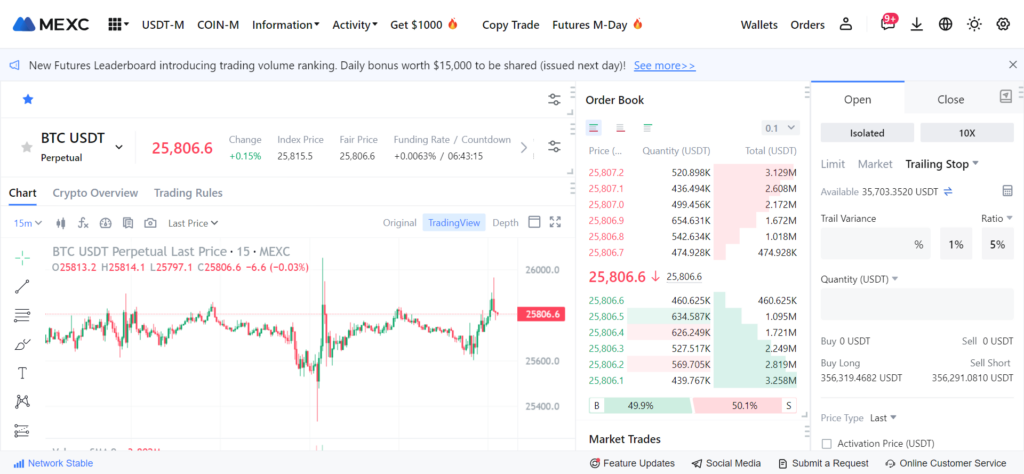

- Research: Before committing to a platform, research its reputation, security features, fees, and user reviews. MEXC is the best no KYC crypto exchange we do recommend for UAE users.

- Regulatory Compliance: Opt for platforms that comply with UAE’s regulatory guidelines to ensure a safer trading environment.

3. Prioritize Security

- Use Two-Factor Authentication (2FA): Always enable 2FA on your trading accounts for an added layer of security.

- Cold Storage: Consider storing significant amounts of cryptocurrencies in offline wallets or cold storage to minimize the risk of hacks.

- Beware of Phishing: Always double-check URLs and be cautious of unsolicited emails or messages asking for your credentials.

4. Diversify Your Investments

- Spread the Risk: Don’t put all your capital into one cryptocurrency. Diversifying across multiple assets can spread the risk.

- Research Before Investing: Before diversifying, ensure you understand the potential and utility of the cryptocurrencies you’re investing in.

5. Set Clear Goals and Limits

- Define Your Strategy: Whether you’re a day trader, swing trader, or long-term investor, have a clear strategy in place.

- Use Stop-Losses: Determine a threshold at which you’ll sell a cryptocurrency to avoid significant losses. Read our best stop loss strategy guide to know more.

- Don’t Let Emotions Drive Decisions: The crypto market can be volatile. Avoid making impulsive decisions based on fear or greed.

6. Stay Updated on UAE’s Regulatory Landscape

- Know the Laws: The UAE’s regulatory stance on crypto trading is evolving. Stay updated on any new guidelines or regulations.

- Tax Implications: While the UAE doesn’t impose taxes on personal income, it’s essential to understand any potential tax implications related to crypto trading.

7. Avoid FOMO (Fear of Missing Out)

- Be Rational: Just because a particular cryptocurrency is surging doesn’t mean you should impulsively invest in it.

- Research: Always base your trading decisions on research and analysis rather than hype or fear.

8. Network with Other Traders

- Join Local Crypto Communities: Engaging with other traders can provide insights, tips, and updates that you might have missed.

- Attend Workshops and Seminars: Regularly attending crypto-related events in the UAE can enhance your knowledge and expand your network.

9. Regularly Review and Adjust Your Strategy

- Market Analysis: The crypto market is ever-evolving. Regularly review your strategy to ensure it aligns with current market conditions.

- Learn from Mistakes: If a trade doesn’t go as planned, analyze what went wrong and adjust your strategy accordingly.

10. Never Invest More Than You Can Afford to Lose

- Be Cautious: The value of cryptocurrencies can be highly volatile. Only invest money that you can afford to lose without affecting your financial stability.

The Future of Trading Platforms in UAE

The UAE, with its forward-thinking approach to technology and finance, has been making significant strides in the cryptocurrency domain. Here’s an elaboration on the potential future of crypto trading in the UAE:

1. Regulatory Evolution

- Clearer Guidelines: As the crypto industry matures globally, the UAE is expected to continue refining its regulatory framework, providing clearer guidelines for businesses and investors. This will likely foster a safer and more transparent trading environment.

- Federal-Level Regulations: With the recent introduction of federal-level regulations for virtual assets, the UAE is positioning itself as a leader in crypto governance. Future regulations might focus on specific aspects of the industry, such as DeFi (Decentralized Finance) or NFTs (Non-Fungible Tokens).

2. Technological Advancements

- Blockchain Integration: The UAE’s National Blockchain Strategy 2021 indicates a strong commitment to integrating blockchain technology into public and private sectors. This could indirectly boost the crypto environment by fostering a positive attitude towards the underlying technology of cryptocurrencies.

- Innovation Hubs: Areas like the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) might evolve into innovation hubs, attracting global crypto and blockchain startups.

3. Financial Products and Services

- Diversified Offerings: As the market matures, traders and investors in the UAE can expect a broader range of financial products and services related to cryptocurrencies, such as crypto-backed loans, staking services, and more sophisticated trading tools.

- Institutional Participation: With clearer regulations in place, institutional investors might become more active in the UAE’s crypto space, leading to the introduction of products like crypto ETFs (Exchange Traded Funds) or crypto index funds.

4. Education and Awareness

- Increased Crypto Literacy: As crypto trading becomes more mainstream, there will likely be a surge in educational initiatives, workshops, and seminars aimed at increasing crypto literacy among residents.

- University Collaborations: Higher education institutions in the UAE might introduce more courses and research programs focused on blockchain and cryptocurrency.

5. International Collaborations

- Cross-Border Initiatives: The UAE might engage in more cross-border blockchain and crypto initiatives, similar to its collaboration with Saudi Arabia on a pilot cryptocurrency.

- Global Partnerships: The UAE could form partnerships with global crypto hubs, fostering knowledge exchange and collaborative projects.

6. Consumer Adoption

- Mainstream Acceptance: As regulations become clearer and the benefits of cryptocurrencies more evident, mainstream consumer adoption is likely to increase. This could manifest in more businesses accepting crypto payments or offering crypto-related services.

- Integration in Daily Life: Residents might see more integration of crypto in daily life, from paying for utilities with digital currencies to using blockchain for property transactions.

7. Challenges and Risks

- Market Volatility: Like global markets, the UAE’s crypto traders will continue to face challenges related to market volatility. Proper education and risk management tools will be crucial.

- Security Concerns: As the industry grows, so will the threats. Ensuring top-notch security standards will be paramount to protect investors and the integrity of the market.

Conclusion

The cryptocurrency landscape in the UAE has witnessed a transformative evolution, driven by progressive regulations, technological advancements, and a commitment to fostering innovation. As the market matures, the quest for the best trading platform in UAE becomes even more critical. Traders and investors are not just seeking platforms for potential profits but are looking for platforms that offer a blend of security, user-friendliness, and a wide range of financial products. The UAE, with its forward-thinking approach, is poised to become a global hub for crypto trading, attracting both novice and seasoned traders. The emphasis is not just on high returns but on trust, transparency, and ensuring that the users have the best tools at their disposal. As the crypto ecosystem in the UAE continues to flourish, the title of the “best trading platform in UAE” will be ever-evolving, reflecting the dynamic nature of the market and the ever-growing needs of its participants.

FAQs

What is the best trading platform in UAE?

The best trading platform in UAE is the MEXC exchange, recommended for its low fees, optional no-KYC feature, excellent customer support, and user-friendly interface.

How do UAE regulations impact trading platforms?

UAE regulations aim to protect traders while promoting a healthy trading environment.