The world of cryptocurrency is ever-evolving, and the demand for privacy and efficiency has given rise to the “no KYC crypto exchange.” These platforms, which operate without the traditional Know Your Customer (KYC) procedures, have become a haven for traders seeking anonymity. In this comprehensive guide, we’ll delve into the top no KYC crypto exchanges, their advantages, potential risks, and the future outlook for 2025.

Table of Contents

Grasping the No KYC Crypto Exchange Phenomenon

What is a No KYC Crypto Exchange?

A no KYC crypto exchange allows users to trade cryptocurrencies without undergoing identity verification. This ensures a higher degree of privacy and a faster trading experience.

The Allure of No KYC Crypto Exchanges

Anonymity

Trade without revealing personal details.

Efficiency

Swift registration and immediate trading.

Global Access

Ideal for regions with stringent KYC norms.

Potential Pitfalls

Regulatory Scrutiny

Some countries may clamp down on such platforms.

Security Concerns

Elevated risks of cyber-attacks.

Limited Recourse

Fewer options for dispute settlements.

2025’s Leading No KYC Crypto Exchanges

Evaluating the Best Platforms

When evaluating the best no KYC crypto exchanges, it’s essential to consider several key criteria:

Reputation

Research the exchange’s reputation within the crypto community. Look for reviews, ratings, and feedback from other users to gauge the platform’s trustworthiness.

Security Protocols

Assess the exchange’s security measures, such as two-factor authentication, cold storage of funds, and encryption protocols. An exchange with robust security measures is less likely to fall victim to hacks or cyberattacks.

Trading Volume

Examine the exchange’s trading volume, as higher volume indicates greater liquidity and ease of executing trades at desired prices.

Supported Cryptocurrencies

Consider the variety of cryptocurrencies supported by the exchange. A platform with a broader selection of assets provides more trading opportunities.

User Experience

Evaluate the platform’s user interface and ease of use. A user-friendly exchange makes the trading process more efficient and enjoyable.

Top No KYC Crypto Exchanges for 2025

| Exchange | Projects Listed | Trading Modes | P2P / Buy Crypto | KYC |

|---|---|---|---|---|

| MEXC 👍 | 1650 | Spot + Futures | Yes (with KYC) | No (30 BTC per day) |

| Tradeogre 👍 | 123 | Spot | No | No |

| BingX | 530 | Spot + Futures | Yes (with KYC) | No (50K USDT per day) |

| OKX | 331 | Spot + Futures | Yes (with KYC) | No (10 BTC per day) |

| Huobi | 605 | Spot + Futures | Yes (with KYC) | No (5 BTC per day) |

| CoinEx | 659 | Spot + Futures | Yes (with KYC) | No (10K USDT per day) |

MEXC – Best No KYC Crypto Exchange Overall

Wooly’s choice! MEXC is a versatile exchange with a vast selection of cryptocurrencies. It offers both spot and futures trading, catering to a wide range of traders. While P2P trading and buying crypto require KYC, the platform allows up to 30 BTC per day in trading without KYC verification. This makes it a popular choice for traders seeking a balance between privacy and access to a broad array of assets.

Pros & Cons

| Pros | Cons |

|---|---|

| Versatile exchange with a vast selection of cryptocurrencies. | P2P trading and buying crypto require KYC. |

| Offers both spot and futures trading. | |

| Allows up to 30 BTC per day in trading without KYC verification. |

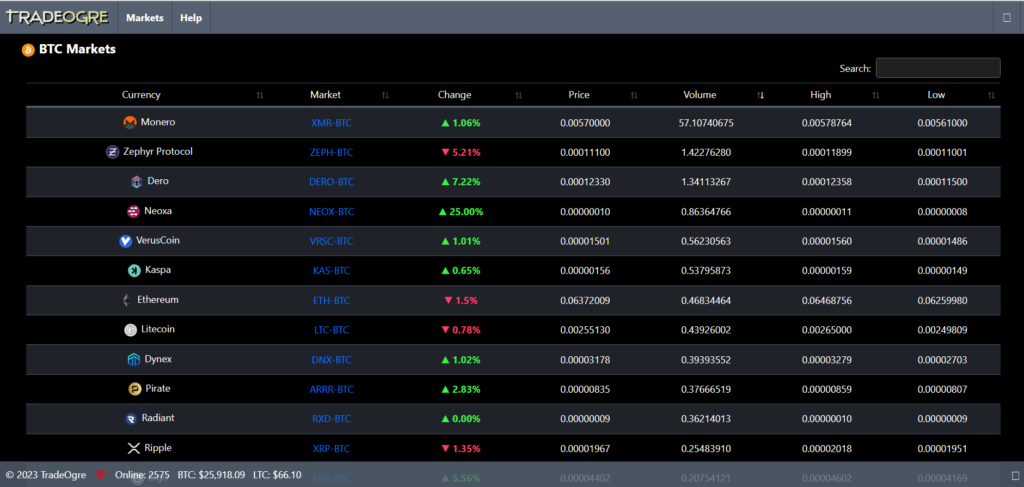

Tradeogre – Crypto Exchange Without KYC

True oldschool full NO KYC exchange. Tradeogre is a no-frills exchange known for its simplicity and privacy. With no KYC requirements and a focus on spot trading, it attracts traders who prioritize anonymity. However, it lacks P2P trading and has a smaller selection of projects compared to other exchanges.

Pros & Cons

| Pros | Cons |

|---|---|

| No KYC requirements. | Lacks P2P trading. |

| Focus on spot trading. | Smaller selection of projects compared to other exchanges. |

| Prioritizes anonymity. | No futures trading. |

BingX

BingX is a robust exchange offering both spot and futures trading. It supports a wide range of cryptocurrencies and allows up to 50K USDT per day in trading without KYC. While P2P trading and buying crypto require KYC, the platform’s diverse offerings make it a strong contender in the no KYC exchange space.

Pros & Cons

| Pros | Cons |

|---|---|

| Offers both spot and futures trading. | P2P trading and buying crypto require KYC. |

| Supports a wide range of cryptocurrencies. | |

| Allows up to 50K USDT per day in trading without KYC. |

OKX

OKX is a well-established exchange with a solid reputation. It offers spot and futures trading and supports a variety of cryptocurrencies. The platform allows up to 10 BTC per day in trading without KYC, making it a popular choice among privacy-conscious traders. However, P2P trading and buying crypto require KYC verification.

Pros & Cons

| Pros | Cons |

|---|---|

| Well-established exchange with a solid reputation. | P2P trading and buying crypto require KYC verification. |

| Offers spot and futures trading. | |

| Allows up to 10 BTC per day in trading without KYC. |

Huobi – Non KYC Exchange from Singapore

Huobi is a global exchange known for its security and extensive cryptocurrency offerings. It provides spot and futures trading and allows up to 5 BTC per day in trading without KYC. While P2P trading and buying crypto require KYC, the platform’s wide range of assets and strong reputation make it a top choice for traders.

Pros & Cons

| Pros | Cons |

|---|---|

| Global exchange known for its security. | P2P trading and buying crypto require KYC. |

| Extensive cryptocurrency offerings. | |

| Allows up to 5 BTC per day in trading without KYC. |

CoinEx – Versatile Non KYC Crypto Exchange

CoinEx is a versatile exchange with a broad selection of cryptocurrencies. It offers spot and futures trading and allows up to 10K USDT per day in trading without KYC. P2P trading and buying crypto require KYC verification. The platform’s diverse offerings and high daily limits make it an attractive option for traders seeking both variety and privacy.

Pros & Cons

| Pros | Cons |

|---|---|

| Versatile exchange with a broad selection of cryptocurrencies. | P2P trading and buying crypto require KYC verification. |

| Offers spot and futures trading. | |

| Allows up to 10K USDT per day in trading without KYC. |

Each of these exchanges offers unique features and caters to different trader preferences. While they all provide no KYC trading options, their daily limits, supported cryptocurrencies, and trading modes vary. Traders should consider their specific needs and priorities when choosing an exchange.

Buy Crypto with No KYC

Buying crypto without KYC refers to the process of purchasing cryptocurrencies without providing personal information, such as a government-issued ID or proof of address, to verify their identity.

While no KYC crypto exchanges allow users to trade cryptocurrencies without identity verification, there is one significant bottleneck when it comes to buying crypto without KYC: purchasing with a credit card. Due to regulatory requirements and the risk of fraud, all legitimate platforms require users to pass KYC verification before buying cryptocurrencies with a credit card.

It’s essential to note that while some platforms may claim to offer no KYC crypto purchases with a credit card, they may not be legitimate or trustworthy. Engaging with such platforms can expose users to risks such as scam, fraud, loss of funds, or identity theft.

Navigating No KYC Crypto Exchanges

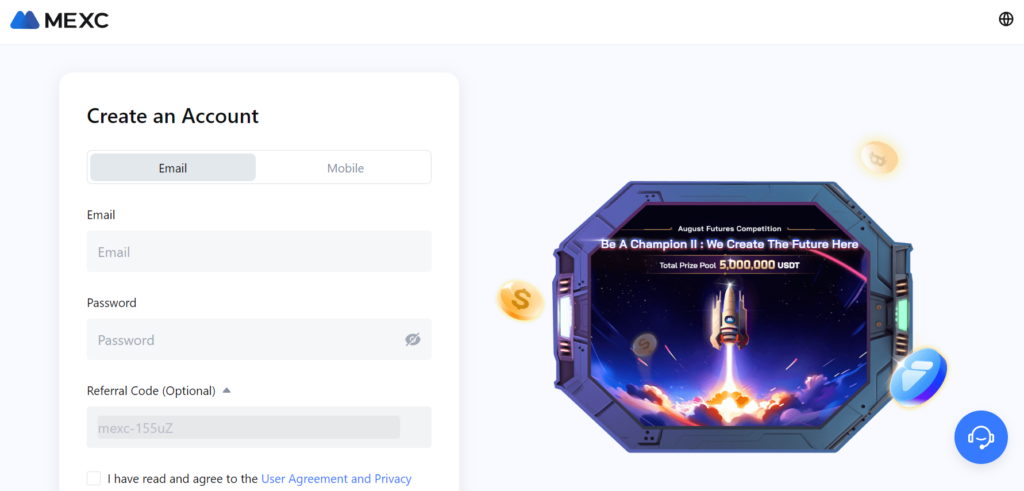

Navigating no KYC crypto exchanges can be a seamless process if you follow the right steps. Here’s a step-by-step guide to help you navigate no KYC crypto exchanges, using mexc.com as an example:

1. Create an Account:

- Visit the MEXC website and click on the “Sign Up” or “Register” button.

- Enter a valid email address and create a strong password. Follow any additional registration steps, such as verifying your email address.

- Note that mexc.com allows trading without KYC verification up to a certain limit (e.g., 10 BTC per day). However, if you wish to use P2P trading or buy crypto with a credit card, you will need to complete KYC verification.

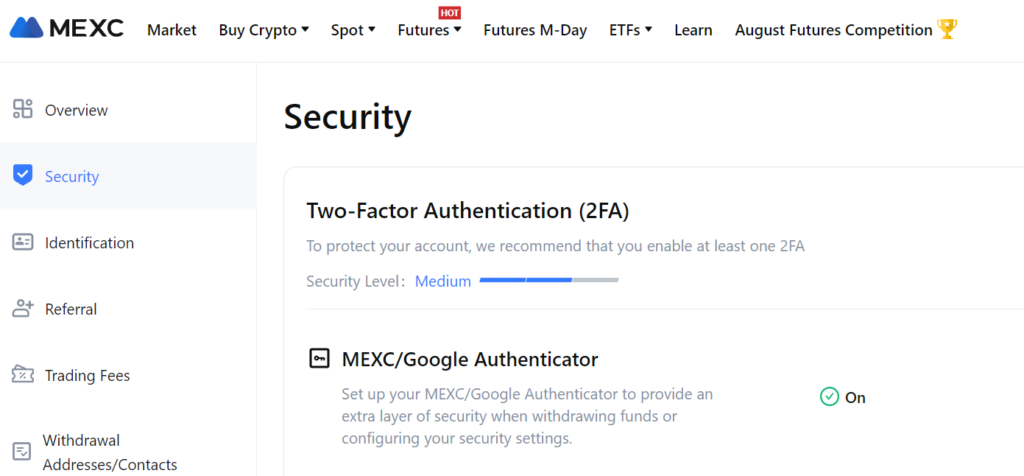

2. Secure Your Account:

- Enable Two-Factor Authentication (2FA) to add an extra layer of security to your account. This typically involves using an authentication app on your mobile device to generate one-time codes.

- Set up security questions or additional verification methods to enhance account security.

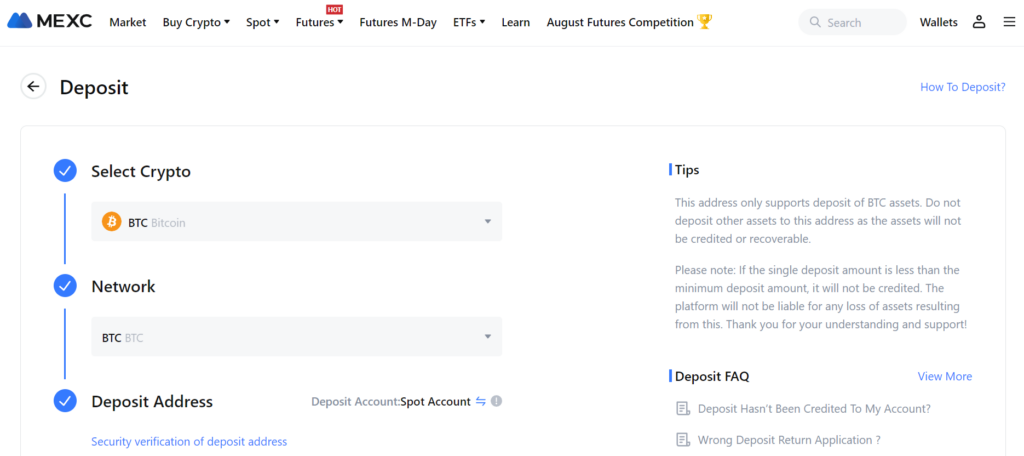

3. Deposit Funds:

- Navigate to the “Deposit” section of the exchange.

- Select the cryptocurrency you wish to deposit and copy the provided deposit address.

- Use this address to transfer funds from your external wallet to your MEXC account.

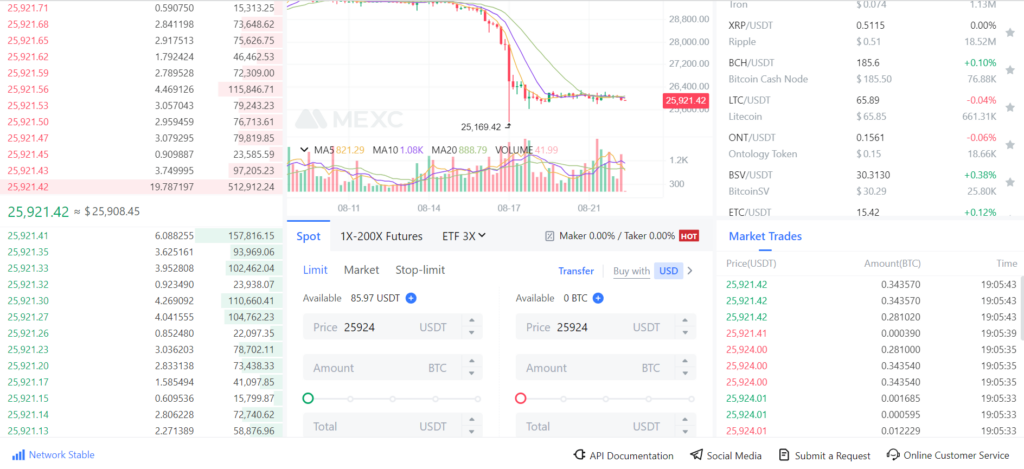

4. Explore the Trading Interface:

- Familiarize yourself with the trading interface. This typically includes sections for spot trading, futures trading, order book, price charts, and trading history.

- Understand the different order types available, such as market orders, limit orders, and stop-loss orders.

5. Execute Trades:

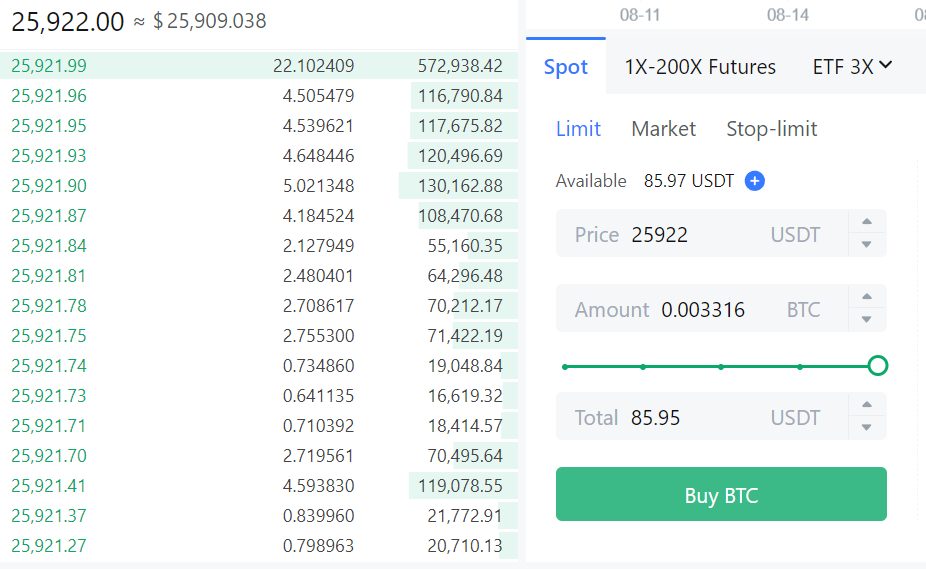

- Select the trading pair you wish to trade (e.g., BTC/USDT).

- Choose the order type and enter the desired amount and price.

- Review and confirm your order. Once executed, your trade will appear in the trading history section.

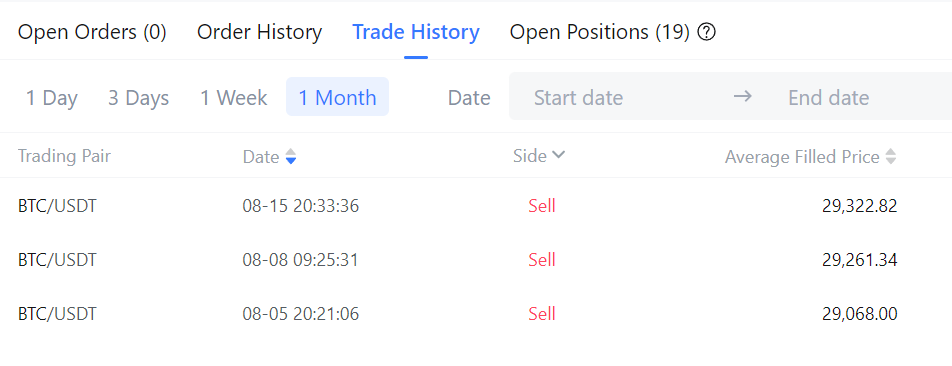

6. Monitor Your Trades:

- Keep track of your open orders, trade history, and account balance.

- Adjust your trading strategy based on market trends and your investment goals.

7. Withdraw Funds:

- Navigate to the “Withdraw” section of the exchange.

- Select the cryptocurrency you wish to withdraw and enter the destination wallet address and amount.

- Review and confirm the withdrawal. Ensure that the destination address is correct to avoid losing funds.

8. Stay Informed:

- Keep up-to-date with the latest news, updates, and announcements from MEXC. This may include information about new listings, promotions, or changes to the platform.

9. Practice Safe Trading:

- Be cautious of phishing attempts, scams, and fraudulent schemes. Always verify information and avoid sharing personal details with unknown parties.

- Implement risk management strategies and conduct thorough research before making trading decisions.

Regulatory Landscape and Compliance

The regulatory landscape and compliance requirements for no KYC crypto exchanges vary significantly across different jurisdictions. As the cryptocurrency industry continues to evolve, regulators worldwide are grappling with how to strike a balance between fostering innovation and protecting consumers. Here are some key points to consider:

Regulatory Landscape:

- Diverse Approaches: Different countries have adopted varying approaches to regulating no KYC crypto exchanges. Some countries have embraced these platforms, while others have imposed restrictions or outright bans.

- AML/CFT Regulations: Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations are a significant concern for regulators. No KYC exchanges, which allow users to trade without identity verification, can potentially be used for illicit activities. As a result, many countries require crypto exchanges to implement AML/CFT measures, including KYC procedures.

- Consumer Protection: Regulators are also focused on protecting consumers from fraud, scams, and other risks associated with cryptocurrency trading. This includes ensuring that exchanges have adequate security measures in place to safeguard users’ funds and personal information.

- Licensing and Registration: Some jurisdictions require crypto exchanges to obtain licenses or register with regulatory authorities. These requirements can vary depending on factors such as the exchange’s location, services offered, and trading volume.

Compliance and Risks:

- Adherence to Local Regulations: It’s crucial for users of no KYC crypto exchanges to be aware of and comply with local regulations. Engaging in activities that violate local laws can result in legal consequences.

- Due Diligence: Users should conduct thorough research before using a no KYC crypto exchange. This includes verifying the exchange’s reputation, security measures, and compliance with relevant regulations.

- Risk Management: Trading on no KYC crypto exchanges can be risky due to factors such as regulatory uncertainty, security concerns, and market volatility. Users should implement risk management strategies, such as diversifying their investments and setting stop-loss orders.

- Privacy vs. Regulation Trade-off: While no KYC crypto exchanges offer greater privacy, they may also be subject to regulatory scrutiny and potential restrictions. Users should weigh the benefits of privacy against the potential risks associated with regulatory non-compliance.

Best Practices for Secure Trading

When trading on no KYC crypto exchanges, it’s essential to follow best practices to ensure secure and successful trading. Here are some key best practices to consider:

1. Enhance Security Measures:

- Two-Factor Authentication (2FA): Enable 2FA on your exchange account to add an extra layer of security. This requires you to provide a second form of verification, such as a one-time code sent to your mobile device, in addition to your password.

- Hardware Wallets: Use hardware wallets to store your cryptocurrencies offline. These devices provide a secure way to store your private keys, making it difficult for hackers to access your funds.

- Regularly Update Passwords: Change your exchange account passwords periodically and use strong, unique passwords that are difficult to guess.

2. Protect Your Privacy:

- Use VPNs: Virtual Private Networks (VPNs) can help protect your privacy by encrypting your internet connection and masking your IP address. This makes it harder for third parties to track your online activities.

- Avoid Sharing Personal Information: Be cautious about sharing personal information on no KYC exchanges, especially if the platform does not require identity verification. This can help protect your privacy and reduce the risk of identity theft.

- Privacy-Focused Cryptocurrencies: Consider using privacy-focused cryptocurrencies, such as Beam, Monero (XMR) or Zcash (ZEC), which offer enhanced privacy features compared to other cryptocurrencies.

3. Implement Risk Management Strategies:

- Diversify Your Investments: Avoid putting all your funds into a single cryptocurrency. Diversifying your investments across multiple assets can help spread risk and reduce the impact of market volatility on your portfolio.

- Set Stop-Loss Orders: Use stop-loss orders to automatically sell a cryptocurrency when its price falls to a certain level. This can help limit potential losses in a volatile market.

- Stay Informed: Keep up-to-date with market trends, news, and developments in the cryptocurrency industry. This can help you make informed trading decisions and anticipate market movements.

4. Conduct Due Diligence:

- Research Exchanges: Before using a no KYC crypto exchange, conduct thorough research to verify its reputation, security measures, and compliance with relevant regulations.

- Verify Cryptocurrency Projects: Before investing in a cryptocurrency, research the project, its team, use case, and market potential. Avoid projects that lack transparency or have red flags, such as unrealistic promises or a lack of technical details.

5. Be Cautious of Scams and Fraud:

- Verify Information: Be skeptical of unsolicited offers, promotions, or investment opportunities. Verify information from multiple sources before making any decisions.

- Avoid Phishing Attempts: Be cautious of emails, messages, or websites that impersonate legitimate exchanges or cryptocurrency projects. Always double-check URLs and email addresses to avoid falling victim to phishing attempts.

Conclusion

The world of no KYC crypto exchanges offers a unique blend of privacy, efficiency, and freedom for cryptocurrency traders. These platforms provide an alternative to traditional exchanges that require identity verification, allowing users to trade with greater anonymity. However, navigating the no KYC crypto exchange landscape requires careful consideration of factors such as security, regulatory compliance, and risk management.

After thorough research and evaluation, our choice for a no KYC crypto exchange is MEXC. MEXC stands out for several reasons:

- Extensive Cryptocurrency Offerings: With over 1650 projects listed, MEXC offers a diverse selection of cryptocurrencies, catering to both novice and seasoned traders.

- Robust Trading Modes: MEXC provides both spot and futures trading, allowing users to engage in a wide range of trading strategies.

- High Daily Limits: MEXC allows users to trade up to 10 BTC per day without KYC verification, offering a balance between privacy and trading flexibility.

- Security Measures: MEXC has implemented robust security protocols to safeguard users’ funds and personal information.

- Reputation and Trustworthiness: MEXC has established a solid reputation within the crypto community for its reliability, transparency, and user-friendly interface.

It’s essential to note that while MEXC offers no KYC trading up to certain limits, P2P trading and buying crypto with a credit card require KYC verification. This is in line with regulatory requirements and helps mitigate risks associated with fraud and money laundering.

In conclusion, no KYC crypto exchanges offer a unique trading experience for those seeking privacy and efficiency. MEXC, with its extensive offerings, robust trading modes, and high daily limits, stands out as a top choice for no KYC crypto trading. As always, traders should conduct their research, prioritize security, and stay informed about regulatory developments to navigate the world of no KYC crypto exchanges with confidence.

FAQs

What defines a no KYC crypto exchange?

A no KYC crypto exchange lets users trade cryptocurrencies without mandatory identity checks.

Are these exchanges legal everywhere?

The legality varies by country, with some embracing them and others imposing restrictions.

How can I bolster my security on non KYC crypto exchanges?

Adopt two-factor authentication, use dedicated hardware wallets, and update passwords regularly.