In the ever-evolving crypto landscape, Binance has long been the titan. But as the tides of the digital currency world shift, new challengers emerge, vying for the crown. WoolyPooly, with its authoritative grasp on the niche, has delved deep into these alternatives, bringing you a comprehensive review of the top contenders.

Table of Contents

Why Seek a Binance Alternative?

The decision to seek a Binance alternative can be influenced by a myriad of reasons, each varying based on individual preferences, regional implications, and evolving market dynamics.

Regulatory Concerns:

Binance has faced regulatory scrutiny in several countries, leading to restrictions or outright bans.

Implications

Traders in affected regions might find their accounts limited or closed, prompting the need for an alternative platform.

In 2021, the UK's Financial Conduct Authority (FCA) restricted Binance from conducting regulated activities in the country.

Diversification of Risk

Relying on a single exchange can be risky, especially if it faces technical issues, security breaches, or regulatory challenges.

Implications

By diversifying and using multiple platforms, traders can mitigate risks associated with any single platform’s potential downfall.

During high trading volumes, some exchanges can experience outages. Having an account on an alternative platform allows traders to continue their activities uninterrupted.

Fee Structures

Binance, while competitive, might not always offer the best fee structure for all types of trades or traders.

Implications

Traders might find better or more suitable fee structures on alternative platforms, especially for specific trading patterns or volumes.

Some exchanges might offer lower fees for maker trades or provide discounts for holding their native tokens.

User Experience and Interface

The user interface and overall experience can vary significantly between exchanges.

Implications

Some traders might prefer a different interface, tools, or features offered by alternative platforms.

A professional trader might seek advanced charting tools, while a beginner might prioritize a simple and intuitive interface.

Mandatory KYC Procedures

Binance has implemented Know Your Customer (KYC) procedures, requiring users to provide personal information.

Implications

Some users, valuing anonymity, might prefer platforms with less stringent KYC requirements.

Certain decentralized exchanges (DEXs) and even CEXs do not require KYC, offering more privacy to users.

Asset Offerings

While Binance boasts a vast array of cryptocurrencies, it might not list every token, especially newer or less-known ones.

Implications

Traders interested in specific tokens not listed on Binance would need to seek alternative exchanges.

Niche tokens or coins from emerging projects might be listed first on active listed exchange, smaller or regional exchanges. Binance, still, has not listed Kaspa Coin.

Customer Support

The quality and responsiveness of customer support can vary between exchanges.

Implications

Users facing issues might seek platforms known for superior customer service.

Some exchanges might offer 24/7 live chat support, while others might rely on slower ticket-based systems.

Factors to Ponder When Choosing an Alternative to Binance

| Factors | Description | Why It Matters | Examples/Considerations |

|---|---|---|---|

| Security | Measures taken by the exchange to protect user assets and data. | Ensures the safety of your investments and personal information. | – Encryption: Does the platform use advanced encryption techniques? – Cold Storage: What percentage of assets are stored offline? – Breach History: Has the platform ever suffered a security breach? |

| Fees | Costs associated with trading, depositing, and withdrawing on the platform. | Affects the profitability of your trades. | – Trading Fees: Are they competitive in the market? – Hidden Charges: Are there fees for deposits, withdrawals, or inactivity? – Comparison: How do the fees compare to Binance and other alternatives? |

| User Experience | The ease of use, design, and overall functionality of the platform. | Directly impacts the efficiency and enjoyment of trading. | – Platform Design: Is it intuitive for both beginners and experts? – Mobile App: Is there a well-reviewed mobile app available? – Customer Support: How responsive and helpful is the support team? |

| Available Cryptocurrencies | The range and variety of coins and tokens offered. | Determines the diversity of your portfolio. | – Coin Variety: Does it offer popular coins as well as emerging ones? – Unique Offerings: Are there coins not available on Binance? – Fiat Transactions: Can you buy crypto directly with fiat currencies? |

| Liquidity | The ease with which assets can be bought or sold without affecting the price. | Affects the speed and price at which you can execute trades. | – Trading Volume: A higher volume indicates more active trading. – Order Depth: Can large orders be filled without significant price changes? |

| Regulation and Compliance | The legal standing and adherence to local and international laws. | Ensures the longevity and trustworthiness of the platform. | – Mandatory KYC: Is Know Your Customer verification required for all users? – Regulation Issues: Has the platform faced any legal challenges or bans?- Licenses: What regulatory licenses does the exchange hold? |

Top 5 Binance Alternatives in 2025

| Exchange | Coins | Trading Modes | P2P | Copytrading | KYC |

|---|---|---|---|---|---|

| MEXC | 1685 | Spot + Futures | Yes (with KYC) | Yes | No (30 BTC per day) |

| OKX | 331 | Spot + Futures | Yes (with KYC) | No | No (10 BTC per day) |

| BingX | 535 | Spot + Futures | Yes (with KYC) | Yes | No (50K USDT per day) |

| Gate | 1758 | Spot + Futures | Yes (with KYC) | No | Yes |

| CoinEx | 737 | Spot + Futures | No | No | No (10K USDT per day) |

Each of these exchanges offers a unique blend of features, catering to different trader preferences and needs. While some prioritize a vast array of coin offerings, others might focus on specific trading modes or features like copy trading.

MEXC: Best Alternative to Binance

MEXC stands out as a leading Binance alternative, primarily due to its vast array of coin offerings, diverse trading modes, and user-centric features. With a whopping 1685 coins available, it provides traders with unparalleled choices, ensuring they don’t miss out on emerging opportunities. Additionally, its blend of Spot and Futures trading, coupled with a P2P platform that integrates KYC for enhanced security, makes it a holistic trading platform. The cherry on top is the copy trading feature, allowing novices to learn from seasoned traders by mimicking their trades.

Pros and Cons:

| Pros | Cons |

|---|---|

| Extensive coin offerings (1685 coins) | KYC required for P2P, which might deter privacy-focused users |

| Both Spot and Futures trading available | |

| P2P platform enhances direct trading opportunities | |

| Copytrading feature aids beginners | |

| Generous daily withdrawal limit without KYC (30 BTC) |

OKX: A Balanced Blend of Features

OKX, with its 331 coin offerings, provides a balanced mix for traders looking for mainstream and niche opportunities. The platform’s dual trading modes, Spot and Futures, cater to both immediate and future-focused trading strategies. Its P2P platform, integrated with KYC, ensures secure and direct trading. While it lacks a copy trading feature, its generous non-KYC withdrawal limit of 10 BTC daily makes it attractive for high-volume traders.

Pros and Cons:

| Pros | Cons |

|---|---|

| Dual trading modes: Spot and Futures | Fewer coin offerings compared to MEXC |

| P2P platform for direct trades | No copytrading feature |

| High daily withdrawal limit without KYC (10 BTC) | KYC required for P2P |

BingX: Tailored for the Modern Trader

BingX, with its 535 coin offerings, is tailored for the modern trader. It offers both Spot and Futures trading modes, catering to diverse trading needs. Its standout feature is the copy trading option, integrated with KYC, allowing users to mirror expert trades. However, its daily non-KYC withdrawal limit is capped at 50K USDT, which might be limiting for some.

Pros and Cons:

| Pros | Cons |

|---|---|

| Offers both Spot and Futures trading | Lower daily non-KYC withdrawal limit (50K USDT) |

| Copytrading with KYC integration | |

| Moderate coin offerings (535 coins) |

Gate.io: A Robust Contender

Gate, boasting 1758 coin offerings, is a robust contender in the crypto exchange arena. Its Spot and Futures trading modes cater to a wide range of traders. The platform integrates KYC with its P2P feature, ensuring secure transactions. However, it lacks a copy trading feature, which might be a drawback for some.

Pros and Cons:

| Pros | Cons |

|---|---|

| Massive coin offerings (1758 coins) | No copytrading feature |

| Dual trading modes for versatility | |

| P2P platform with KYC integration |

CoinEx: Simplified and Streamlined

CoinEx, with 737 coin offerings, provides a simplified and streamlined trading experience. It offers both Spot and Futures trading, catering to varied trading strategies. The platform stands out for its no-KYC requirement for withdrawals up to 10K USDT daily, making it a favorite among privacy-focused traders. However, it lacks both P2P and copy trading features.

Pros and Cons:

| Pros | Cons |

|---|---|

| Generous daily withdrawal limit without KYC (10K USDT) | No P2P platform |

| Both Spot and Futures trading available | No copytrading feature |

| Decent coin offerings (737 coins) |

Transitioning Safely to a New Exchange

Transitioning from one exchange to another, especially with valuable assets involved, requires careful planning and execution. Here’s a detailed guide on transitioning safely from Binance to MEXC:

Research and Due Diligence:

- Before initiating any transfers, thoroughly research MEXC’s reputation, security measures, user reviews, and any recent incidents or breaches.

- Familiarize yourself with MEXC’s interface by exploring its demo or sandbox environment if available.

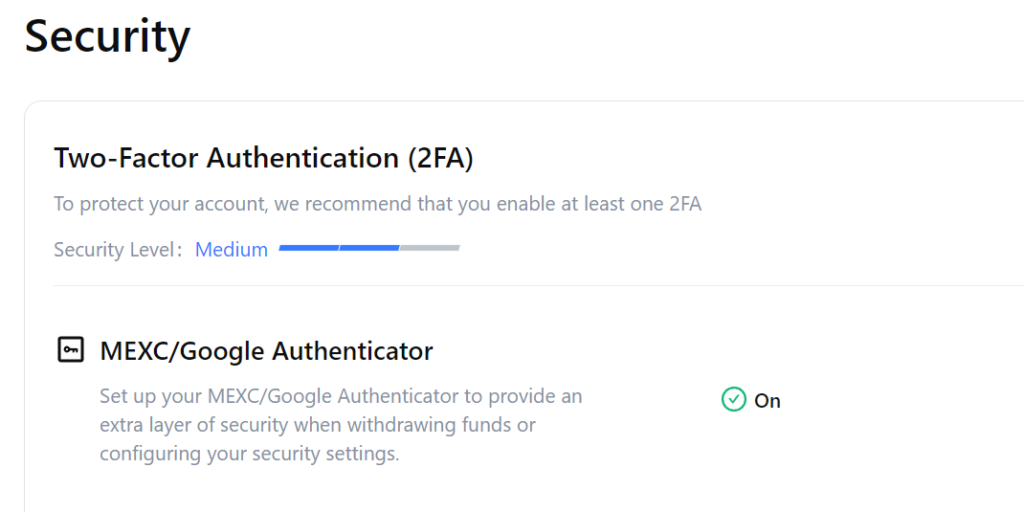

Secure Your MEXC Account:

- Create a strong, unique password for your MEXC account.

- Enable Two-Factor Authentication (2FA) immediately upon registration. Use authentication apps like Google Authenticator or Authy for added security.

- Ensure that the email linked to your MEXC account has 2FA enabled as well.

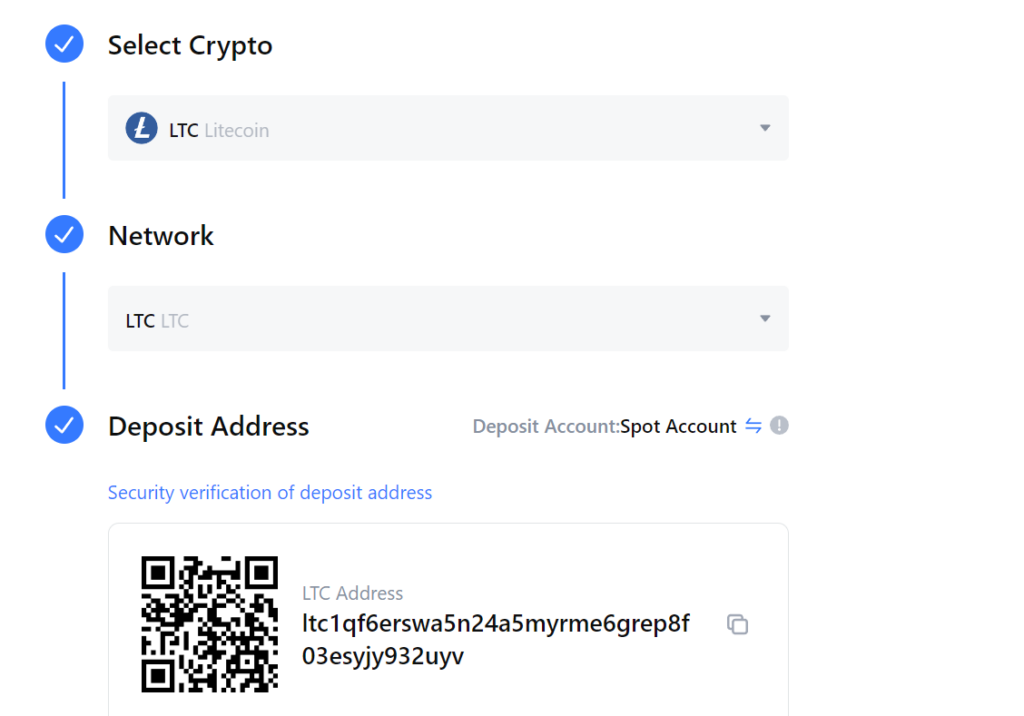

Start with a Test Transfer:

- Before transferring a significant amount, send a small test amount of a cryptocurrency (e.g., a tiny fraction of Litecoin or Ethereum) from Binance to MEXC.

- Confirm that the test transfer arrives safely in your MEXC wallet and that the amount is correct.

Use Correct Wallet Addresses:

- Always double-check the destination wallet address. Remember that transferring assets to the wrong address, especially cross-chain, can result in a permanent loss.

- If possible, use QR codes to scan addresses rather than copying and pasting, to avoid potential clipboard malware.

Check Withdrawal Limits and Fees:

- Understand the withdrawal limits on Binance, especially if you’re moving a large amount. Ensure you’re not exceeding daily or monthly limits.

- Be aware of the withdrawal fees on Binance.

Document the Transfer:

- Note down details of the transfer, including transaction IDs, timestamps, and the amount transferred.

- This documentation can be crucial if you need to raise a support ticket or track the transfer.

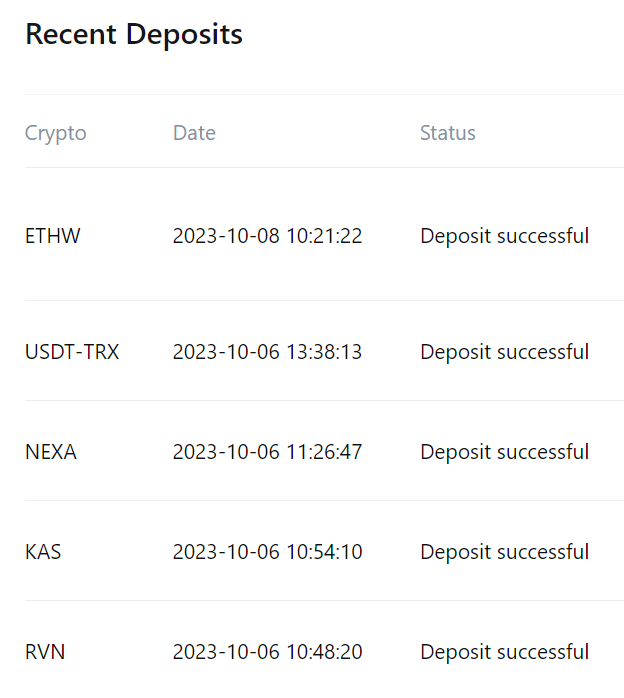

Monitor the Transfer:

- Use built-in deposit section or blockchain explorers (like Etherscan for Ethereum-based tokens) to monitor the progress of your transfer.

- Wait for the required number of confirmations on MEXC before considering the transfer complete.

Securely Store Recovery Information:

- Ensure you have securely stored any recovery phrases, backup codes, and other essential security information related to your MEXC account.

- Use physical means (like writing on paper) stored in a safe place, rather than digital methods that can be hacked.

Stay Updated:

- Join MEXC’s official communication channels, such as their Telegram group or Twitter feed, to stay updated on any maintenance, updates, or issues.

Repeat for Other Assets:

- Once you’re confident with your initial transfer, repeat the process for other cryptocurrencies or assets you wish to move from Binance to MEXC.

Conclusion

In the dynamic world of cryptocurrency, adaptability and informed decision-making are paramount. While Binance has long been a beacon for many in the crypto community, the evolving landscape presents both challenges and opportunities. As regulatory pressures mount and the crypto ecosystem diversifies, the quest for reliable Binance alternatives becomes not just a matter of choice but a strategic necessity.

MEXC, with its vast array of coin offerings and user-centric features, emerges as a frontrunner, offering traders a blend of security, flexibility, and innovation. But as we’ve explored, the crypto realm is rich with options. OKX, BingX, Gate, and CoinEx each bring unique strengths to the table, catering to varied trader preferences and needs.

Transitioning between platforms, especially in a domain as intricate as cryptocurrency, demands caution and diligence. Whether you’re considering a shift from Binance to MEXC or exploring other alternatives, the emphasis should always be on security, research, and understanding the nuances of the new platform.

In the end, the crypto journey is as much about the platforms we choose as it is about the strategies we employ and the visions we chase. As the crypto horizon expands, may your choices lead you to prosperous ventures and secure harbors.

FAQs

Which Binance alternative has the lowest fees?

Mexc exchange is currently leading in terms of low fees, but always check the latest rates.