In the exhilarating world of cryptocurrency, understanding the nuances can make the difference between monumental gains and heart-wrenching losses. One such nuance, often overlooked but critically important, is crypto liquidations. But what are they, and why should every trader be wary of them?

Table of Contents

What is Crypto Liquidation?

Crypto Liquidation: Beyond the Basics

Crypto liquidation is a term that has gained significant attention, especially among traders who venture into the world of cryptocurrencies. But to truly grasp its implications, one must first understand its mechanics and the environment in which it operates.

The Essence of Liquidation

At its most fundamental level, crypto liquidation occurs when a crypto trader‘s position is forcibly closed. This can happen for a variety of reasons, but the most common is when the market moves against a position, especially one that’s leveraged, and the trader doesn’t have enough funds to maintain it.

Leverage and Its Role

Many crypto exchanges offer what’s known as “leverage” – essentially, borrowed funds that allow traders to take on larger positions than they could with their own capital alone. While this can amplify profits, it also amplifies risks. If the market moves against a leveraged position and crosses a certain threshold, the exchange may automatically close the position to prevent further losses. This action is what’s referred to as liquidation.

Margin and Maintenance

When trading with leverage, traders are required to hold a certain amount of funds in their account, known as the “margin.” This acts as collateral. If the market moves against their position and the value of their collateral drops below a certain point, known as the “maintenance margin,” liquidation can be triggered.

The Speed of Crypto Markets

What makes crypto liquidations particularly nerve-wracking is the sheer speed at which cryptocurrency prices can change. Traditional markets have trading hours and mechanisms like trading halts to manage volatility. In contrast, the crypto market operates 24/7, and its decentralized nature means there are fewer mechanisms in place to curb extreme price swings. This can lead to rapid and unexpected liquidations, especially for traders who aren’t prepared or are over-leveraged.

The Aftermath of Liquidation

Once a liquidation occurs, the trader’s position is closed, and their held margin is often lost. Depending on the exchange and the specifics of the trade, this can result in the loss of a portion or even the entirety of the funds in their trading account.

Causes of Crypto Liquidations: Unraveling the Triggers

The world of cryptocurrency trading is both exciting and unpredictable. While the potential for high returns attracts many, the risks associated with it are equally significant. One such risk is the dreaded crypto liquidation. But what exactly triggers these liquidations? Let’s explore the primary causes.

Margin Calls: The Silent Alarm

Understanding Margin in Crypto

In the realm of cryptocurrency trading, margin refers to the borrowed funds that traders use to open positions larger than their actual capital. This borrowed capital amplifies both potential profits and potential losses.

The Role of Margin Calls

A margin call is essentially a risk control mechanism. When the value of a trader’s position drops to a certain level, where their own funds (or margin) can no longer cover the potential losses, the exchange issues a margin call. If the trader fails to deposit additional funds to meet the required margin, their position is forcibly closed or liquidated to prevent further losses.

Extreme Volatility: The Unpredictable Storm

The Nature of Cryptocurrencies

Cryptocurrencies are inherently volatile. Factors such as regulatory news, technological advancements, market sentiment, and macroeconomic indicators can lead to rapid and significant price swings.

Volatility-Induced Crypto Liquidations

During periods of extreme volatility, even minor negative news can trigger panic selling, leading to a sharp decline in prices. Traders with leveraged positions can quickly find themselves in a situation where their margin is insufficient, leading to immediate liquidation.

Lack of Liquidity: The Desert Mirage

Liquidity Defined

Liquidity refers to the ease with which an asset can be bought or sold without causing a significant price change. A market is considered liquid if there are enough buyers and sellers to absorb large trades without drastic price fluctuations.

How Illiquidity Triggers Liquidations

In illiquid markets, large trades can cause disproportionate price changes. If a trader wants to exit a large position in an illiquid market, they might not find enough buyers, forcing them to sell at much lower prices. This can lead to rapid price declines, triggering crypto liquidations for other traders in the process.

Technical Glitches: The Unseen Saboteur

The Reliability of Trading Platforms

No technology is infallible, and this includes crypto trading platforms. While many are robust and secure, they can occasionally experience glitches, outages, or errors.

How Glitches Lead to Crypto Liquidations

Imagine a scenario where a platform erroneously displays incorrect price data or fails to execute stop-loss orders. Such glitches can result in traders being unable to close positions in time or having positions liquidated based on inaccurate data.

The Impact of Liquidations: Ripple Effects in the Crypto Ecosystem

Cryptocurrency liquidations, while a fundamental aspect of leveraged trading, can have profound consequences not just for individual traders but also for the broader crypto market. The aftermath of a liquidation event can be likened to the ripples caused by a stone thrown into a pond; the effects spread out, influencing various facets of the trading ecosystem.

On Individual Traders: The Personal Repercussions

Financial Implications

The most immediate and apparent impact of a liquidation is the financial loss. When a position is liquidated, a trader can lose a significant portion, if not all, of their invested capital. For those who have heavily leveraged their positions, the losses can exceed their initial investments.

Emotional and Psychological Toll

Beyond the tangible financial losses, crypto liquidations can have a severe emotional and psychological impact on traders. The sudden loss can lead to feelings of regret, frustration, and anxiety. Some traders might engage in “revenge trading” to recoup losses, often leading to further detrimental decisions.

On the Broader Crypto Market: The Wider Shockwaves

Chain Reactions and Cascading Crypto Liquidations

One significant liquidation can set off a domino effect. As one large position is liquidated, it can move the market price, potentially triggering other liquidations. This cascade can lead to rapid and dramatic price drops, even in the absence of any fundamental negative news.

Impact on Market Sentiment

Large-scale crypto liquidations can quickly turn a bullish market sentiment bearish. When traders witness massive liquidations, it can induce panic selling, further driving down prices. This shift in sentiment can deter new investors and traders from entering the market, leading to reduced liquidity and increased volatility.

Strain on Exchange Infrastructure

During massive liquidation events, trading platforms can experience unprecedented volumes. This surge can strain the infrastructure, leading to delays, outages, or even temporary shutdowns. Such technical issues can exacerbate the situation, preventing traders from managing their positions effectively.

Influence on Future Regulations

Repeated large-scale liquidation events can catch the attention of regulatory bodies. Concerns about market manipulation, investor protection, and financial stability can lead to increased scrutiny and potential regulatory interventions. While regulations aim to protect investors, they can also bring about changes that affect the trading landscape.

Major Liquidation Events in Crypto History: A Retrospective

The cryptocurrency market, known for its volatility, has witnessed several significant liquidation events over the years. These events have not only affected individual traders but have also had broader implications for the entire crypto ecosystem. Here’s a look at some of the most notable liquidation events:

Black Thursday (March 2020):

- Event Overview: On March 12, 2020, the crypto market experienced one of its most drastic crashes. Within 24 hours, Bitcoin’s price plummeted by over 40%, dragging other cryptocurrencies down with it.

- Cause: The crash was largely attributed to the global panic caused by the COVID-19 pandemic. As traditional markets tumbled, the crypto market followed suit.

- Impact: This event led to cryptocurrency liquidations worth over $1 billion across various exchanges.

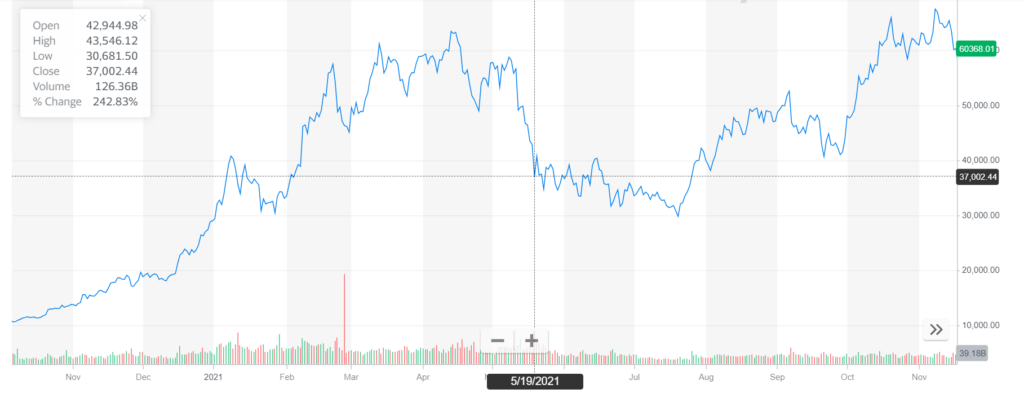

May 2021 Market Crash:

- Event Overview: May 2021 saw another significant market correction, with Bitcoin dropping from its all-time high of nearly $65,000 in April to below $30,000 by the end of May.

- Cause: Several factors contributed to this crash, including Elon Musk’s tweets regarding Tesla no longer accepting Bitcoin due to environmental concerns and China’s crackdown on crypto mining and trading.

- Impact: The rapid decline in prices triggered crypto liquidations worth over $8 billion in a single day.

DeFi Liquidations (2020-2021):

- Event Overview: Decentralized Finance (DeFi) platforms, which allow users to lend, borrow, and earn interest on their crypto holdings, experienced several liquidation events due to rapid price fluctuations.

- Cause: These crypto liquidations were often the result of rapid price drops in the underlying collateral assets or smart contract vulnerabilities.

- Impact: Some notable events include the liquidation of $89 million on the Compound platform in November 2020 and $24 million on the dForce platform in April 2020 due to a smart contract exploit.

BitMEX Liquidation (March 2020):

- Event Overview: Alongside the Black Thursday crash, BitMEX, one of the largest derivatives exchanges, faced a massive liquidation event.

- Cause: The rapid price drop combined with the platform’s auto-deleveraging system led to a cascade of crypto liquidations.

- Impact: In just a short span, over $500 million worth of long positions were liquidated on BitMEX.

How to Prevent and Mitigate the Risks of Liquidation: A Trader’s Guide to Safe Navigation

In the high-stakes world of cryptocurrency trading, liquidation is a looming threat that can wipe out investments in the blink of an eye. However, with the right strategies and a proactive approach, traders can significantly reduce the risk of facing such adverse events. Here’s a comprehensive guide on how to shield oneself from the perils of liquidation:

Effective Risk Management: The First Line of Defense

Understanding Your Risk Appetite

Before diving into trades, it’s essential to assess and understand your risk tolerance. Are you comfortable with high-risk, high-reward scenarios, or do you prefer a more conservative approach? Knowing this can guide your trading decisions.

Setting Stop Losses

One of the most effective tools in a trader’s arsenal, a stop loss is an order placed with a broker to buy or sell once the stock reaches a certain price. It’s a pre-determined exit point that can prevent massive losses during market downturns.

Diversifying Your Portfolio

Don’t put all your eggs in one basket. By diversifying your investments across various cryptocurrencies or even other asset classes, you can spread and mitigate potential risks.

Understanding Leverage: Taming the Double-Edged Sword

The Basics of Leverage

Leverage allows traders to amplify their position size using borrowed funds. While it can magnify profits, it equally magnifies potential losses.

Choosing the Right Leverage Ratio

It’s tempting to use the maximum leverage offered by platforms, but it’s not always wise. Depending on the market conditions and your risk appetite, adjust the leverage ratio. Sometimes, less is more.

Regularly Monitoring Margin Levels

Stay vigilant about the margin requirements of your positions. If the market moves against you, you might need to add more funds to avoid liquidation.

Continuous Market Research: Staying One Step Ahead

The Importance of Staying Updated

The crypto market is influenced by a myriad of factors, from regulatory changes to technological advancements. Staying updated with the latest news can provide insights into potential market movements.

Utilizing Market Indicators

Tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can offer valuable insights into market trends and potential price reversals.

Engaging with Trading Communities

Joining trading forums, attending webinars, or following crypto influencers can provide diverse perspectives and insights that you might not have considered.

Using Reliable Trading Platforms: Building on Solid Ground

The Importance of Due Diligence

Before committing to a trading platform, research its track record. Look for reviews, any history of security breaches, and its policies during volatile market conditions.

| Platform | Pros | Cons |

|---|---|---|

| MEXC | User-friendly interface, wide range of cryptocurrencies, lowest crypto exchange fees, advanced trading features | Platform may be complex for beginners, slow customer service response times |

| Binance | Large number of cryptocurrencies, advanced trading features, high liquidity, user-friendly interface | Reports of delayed customer service responses, potential target for hackers |

| Gate.io | Wide range of cryptocurrencies, advanced trading features, user-friendly interface, educational resources for beginners | Higher trading fees, does not support fiat currency deposits or withdrawals |

| OKX | Large number of cryptocurrencies, advanced trading features, competitive fees, user-friendly interface, educational resources for beginners | Reports of account freezes without prior notice, slow customer service response times |

| BingX | Advanced trading features, high leverage, ability to copy trades from successful traders, user-friendly interface | Smaller selection of cryptocurrencies, less liquidity due to smaller user base |

Platform Features to Consider

Some platforms offer features like “negative balance protection,” ensuring that traders don’t lose more than their initial investment. Others might have more robust risk management tools or better user interfaces.

Security Protocols

Ensure that the platform uses state-of-the-art security measures like two-factor authentication, cold storage, and encryption protocols.

Conclusion

The realm of cryptocurrency trading, with its allure of significant returns, also brings with it a maze of complexities and risks. Among these, crypto liquidations stand out as one of the most daunting challenges that traders face. As the market’s volatility can turn investments into losses within mere moments, understanding the intricacies of liquidations becomes paramount.

Crypto liquidations, while a natural mechanism in leveraged trading, serve as a stark reminder of the delicate balance between risk and reward. They underscore the importance of not just technical knowledge, but also of discipline, continuous learning, and emotional resilience in trading. Every liquidation event in the market’s history offers lessons, often learned the hard way by many, about the significance of prudent risk management.

Moreover, as the crypto landscape continues to evolve with regulatory changes, technological advancements, and increasing mainstream adoption, the dynamics of liquidations will also transform. Traders, both seasoned and new, must stay abreast of these changes to navigate the market effectively.

In essence, while the world of cryptocurrencies offers a frontier of opportunities, it also demands respect for its volatility and unpredictability. Crypto liquidations, in this context, are not just a risk but also a teacher. They emphasize the age-old wisdom of trading: never invest more than you can afford to lose and always be prepared for the market’s ebbs and flows.

By internalizing the lessons from past liquidations and arming oneself with knowledge, strategy, and a clear mindset, traders can hope to turn potential pitfalls into opportunities for growth and success in the crypto journey.

FAQs

What are liquidations in crypto?

Liquidations in crypto occur when a trader’s leveraged position is forcibly closed by the exchange due to insufficient margin or collateral, especially when the market moves against the position. This ensures the trader doesn’t owe more than they’ve invested or borrowed.

What triggers a crypto liquidation?

Crypto liquidations are typically triggered when a trader’s position moves against them, especially in leveraged trades.

How can I prevent cryptocurrency liquidations?

Effective risk management, understanding leverage, continuous market research, and using reliable trading platforms are key.

Are all crypto traders at risk of liquidation?

While anyone can face liquidations, those who trade with high leverage or fail to set stop losses are at a higher risk.