In the volatile world of crypto trading, understanding the concepts of “Overbought” and “Oversold” can be your golden ticket to financial freedom. This article aims to demystify these often misunderstood terms and provide you with actionable strategies to thrive in any market condition. So, what exactly do “Overbought” and “Oversold” mean, and how can you use these indicators to your advantage? Let’s dive in.

Table of Contents

What is Overbought?

Definition

An “Overbought” condition occurs when an asset, such as a cryptocurrency, is traded excessively over a short period, leading to a significant price increase that is often unsustainable.

Technical Indicators for Identifying Overbought Conditions

RSI (Relative Strength Index)

- Range: 0 to 100

- Overbought Level: Above 70

Stochastic Oscillator

- Range: 0 to 100

- Overbought Level: Above 80

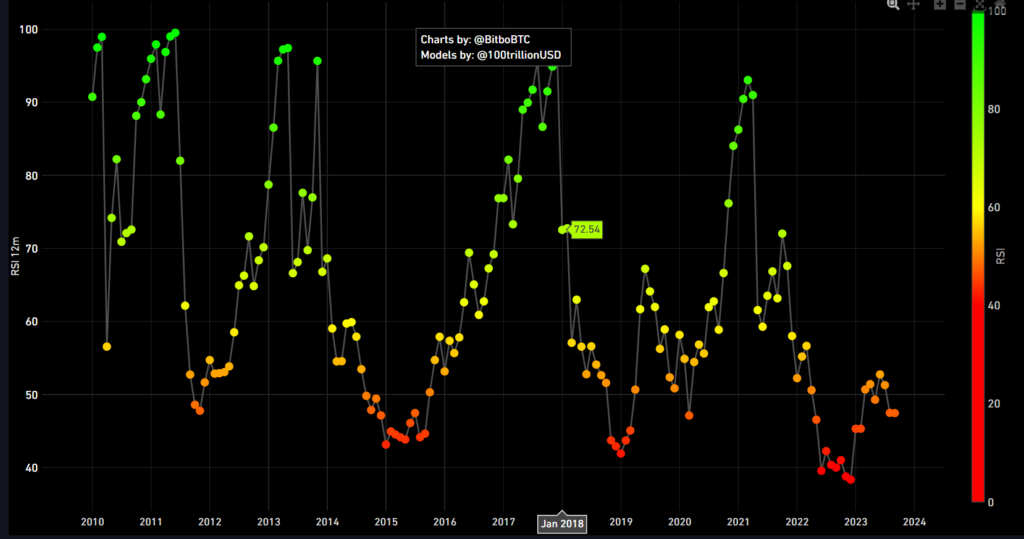

Real-world Examples in Crypto Trading

- Bitcoin reaching an RSI of 72 in January 2018

- Ethereum hitting a Stochastic Oscillator of 85 in May 2021

What is Oversold?

Definition

Conversely, an “Oversold” condition happens when there is a significant decline in the price of an asset due to excessive selling.

Technical Indicators for Identifying Oversold Conditions

RSI (Relative Strength Index)

- Range: 0 to 100

- Oversold Level: Below 30

MACD (Moving Average Convergence Divergence)

- Oversold Level: When the MACD line crosses above the signal line

Real-world Examples in Crypto Trading

- Bitcoin dropping to an RSI of 38 in Dec 2022

- Litecoin’s MACD line crossing above the signal line in September 2019

Overbought vs Oversold: The Differences

Understanding the nuances between overbought and oversold conditions is crucial for any trader. While both terms describe market extremes, they occur under different circumstances and imply different future price movements. Below, we’ll dissect these differences in greater detail.

Definition and Market Psychology

- Overbought: This term describes a scenario where an asset has been aggressively bought over a short period, pushing its price to levels that may not be sustainable. The market psychology here is often driven by “FOMO” (Fear of Missing Out), leading to inflated prices.

- Oversold: Conversely, an asset is considered oversold when it has been aggressively sold, driving its price down to levels that may be lower than its true value. The market psychology in this case is often driven by panic selling.

Technical Indicators

RSI (Relative Strength Index)

- Overbought: An RSI level above 70 usually indicates an overbought condition. It suggests that the asset may be getting overvalued and could be primed for a price correction or reversal.

- Oversold: An RSI level below 30 typically signals an oversold condition. This could mean the asset is undervalued, presenting a potential buying opportunity.

MACD (Moving Average Convergence Divergence)

- Overbought: When the MACD line is significantly above the signal line, it can be a sign that the asset is overbought.

- Oversold: Conversely, when the MACD line is significantly below the signal line, it can indicate that the asset is oversold.

Market Trends

- Overbought: These conditions often occur during bullish trends when investor optimism is high. However, an overbought asset can still experience a price correction even in a strong uptrend.

- Oversold: These conditions are commonly seen during bearish trends when investor sentiment is low. However, even in a downtrend, an asset can experience a price bounce when it becomes oversold.

Trading Strategies

- Overbought: Traders often use strategies like short selling or setting stop-loss orders to capitalize on potential downward price movements.

- Oversold: In these conditions, traders might employ strategies like “buying the dip” or setting take-profit orders to benefit from potential upward price movements.

Risks

- Overbought: The risk here is that the market may continue to rise, causing losses for those who have shorted the asset.

- Oversold: The risk is that the market may continue to fall, causing losses for those who have bought the asset.

Comparative Table

| Aspect | Overbought | Oversold |

|---|---|---|

| Definition | Excessive buying leads to high prices | Excessive selling leads to low prices |

| Market Psychology | FOMO-driven | Panic-driven |

| RSI Range | Above 70 | Below 30 |

| MACD Trend | MACD above signal line | MACD below signal line |

| Market Trend | Usually bullish | Usually bearish |

| Trading Strategies | Short selling, stop-loss orders | Buying the dip, take-profit orders |

| Risks | Market may continue to rise | Market may continue to fall |

How to Trade Overbought Conditions

Trading overbought conditions can be a tricky endeavor, especially in the volatile crypto market. However, with the right strategies and risk management techniques, you can capitalize on these situations. Below are some detailed approaches to consider.

Strategies

Short Selling: The Counter-Intuitive Approach

- How it Works: Short selling involves borrowing an asset (in this case, a cryptocurrency) to sell at its current high price with the expectation of buying it back at a lower price in the future.

- When to Use: This strategy is best employed when technical indicators such as RSI and MACD confirm an overbought condition, and there is a bearish divergence or other reversal patterns on the chart.

- Risk Management: Use a stop-loss order to minimize potential losses. For instance, if you short Bitcoin at $50,000, you might set a stop-loss at $51,000 to limit your loss.

Using Stop-Loss Orders: The Safety Net

- How it Works: A stop-loss order is a predetermined price at which you’ll sell the asset to minimize losses. This is particularly useful if you already own the asset and suspect that its price may decline soon.

- When to Use: Use this strategy when you see signs of a potential price reversal but are not entirely sure. This allows you to stay in the trade but protects you from significant losses.

- Risk Management: The key is to set the stop-loss at a level that gives the trade room to breathe but is not so far away that it exposes you to high risk. For example, if you bought Ethereum at $2,000 and it’s now at $2,500 but showing overbought signs, you might set a stop-loss at $2,400.

Advanced Techniques

Using Trailing Stop-Loss Orders

- How it Works: Unlike a regular stop-loss, a trailing stop-loss moves with the price of the asset. This allows you to lock in profits while still giving the asset room to grow.

- When to Use: This is useful in volatile markets where the price can swing dramatically in a short period.

Pairing with Other Indicators

- How it Works: Use other indicators like Bollinger Bands or Fibonacci retracements to confirm overbought conditions.

- When to Use: When the market is showing mixed signals, and you need additional confirmation before entering a trade.

Risks and How to Mitigate Them

- Continued Bullish Trend: One of the biggest risks in trading overbought conditions is that the market may continue to rise. To mitigate this, always use stop-loss or trailing stop-loss orders.

- False Signals: Technical indicators can sometimes give false signals. To mitigate this risk, use multiple indicators and look for confirmations.

- Emotional Trading: The psychology of trading can often lead to poor decisions, such as entering or exiting trades based on emotions rather than analysis. Always stick to your trading plan and risk management strategies.

How to Trade Oversold Conditions

Trading in oversold conditions offers unique opportunities but also comes with its own set of challenges. The key is to identify genuine buying opportunities while avoiding “falling knives.” Here are some strategies and techniques to consider.

Strategies

Buying the Dip: The Classic Approach

- How it Works: Buying the dip involves purchasing an asset after a significant price decline, with the expectation that it will rebound.

- When to Use: This strategy is most effective when technical indicators like RSI and MACD confirm an oversold condition, and there are bullish reversal patterns on the chart.

- Risk Management: Use a stop-loss order to limit potential losses. For example, if you buy Bitcoin at $30,000, you might set a stop-loss at $29,000 to limit your risk.

Using Take-Profit Orders: Locking in Gains

- How it Works: A take-profit order is a predetermined price at which you’ll sell the asset to lock in profits. This is useful for capturing gains in a volatile market.

- When to Use: Set a take-profit order when you have a specific profit target in mind and want to ensure you capture it.

- Risk Management: The key is to set the take-profit at a level that is realistic based on the asset’s volatility and your profit goals. For instance, if you bought Ethereum at $1,500 and it’s showing signs of a rebound, you might set a take-profit at $1,700.

Advanced Techniques

Dollar-Cost Averaging (DCA)

- How it Works: Instead of buying the entire position at once, you purchase a fixed dollar amount of the asset at regular intervals, regardless of its price.

- When to Use: This strategy is useful when the asset is in a prolonged oversold condition and you want to reduce the impact of volatility.

Pairing with Other Indicators

- How it Works: Use additional indicators like Bollinger Bands or Moving Averages to confirm oversold conditions.

- When to Use: When the market is giving mixed signals and you need more confirmation before making a trade.

Risks and How to Mitigate Them

- Continued Bearish Trend: The biggest risk in trading oversold conditions is that the market may continue to fall. Always use stop-loss orders to mitigate this risk.

- False Reversal Signals: Technical indicators can sometimes provide false signals. To mitigate this, use multiple indicators and look for confirmations.

- Emotional Decisions: The fear of missing out on a rebound can lead to impulsive decisions. Stick to your trading plan and risk management strategies to avoid this pitfall.

7 Proven Strategies to Master Overbought and Oversold Trading

Strategy 1: RSI Divergence

- Overbought: Look for lower highs in price but higher highs in RSI

- Oversold: Look for higher lows in price but lower lows in RSI

Strategy 2: Stochastic Oscillator Crossovers

- Overbought: Sell when the %K line crosses below the %D line and both are above 80

- Oversold: Buy when the %K line crosses above the %D line and both are below 20

Strategy 3: Bollinger Band Squeeze

- Overbought: Sell when price touches the upper Bollinger Band

- Oversold: Buy when price touches the lower Bollinger Band

Strategy 4: MACD Histogram Reversals

- Overbought: Sell when the MACD histogram starts declining after a bullish run

- Oversold: Buy when the MACD histogram starts rising after a bearish run

Strategy 5: Fibonacci Retracements

- Overbought: Use Fibonacci levels as potential sell points in an uptrend

- Oversold: Use Fibonacci levels as potential buy points in a downtrend

Strategy 6: Trend Line Breaks

- Overbought: Sell when an upward trend line is broken

- Oversold: Buy when a downward trend line is broken

Strategy 7: Volume Confirmation

- Overbought: Look for decreasing volume as a confirmation to sell

- Oversold: Look for increasing volume as a confirmation to buy

Common Mistakes to Avoid

Navigating overbought and oversold conditions requires a keen eye for detail and a disciplined approach to trading. However, even seasoned traders can fall into certain traps. Below are some of the most common mistakes to avoid.

Over-Reliance on Indicators: The False Sense of Security

- What it Means: Traders sometimes rely too heavily on technical indicators like RSI or MACD to make trading decisions.

- Why it’s a Mistake: No indicator is foolproof. Markets can remain overbought or oversold longer than you can remain solvent.

- How to Avoid: Always use multiple indicators and tools to confirm trading signals. Additionally, consider fundamental analysis and market sentiment.

Ignoring Market Trends: The Ostrich Approach

- What it Means: Some traders ignore overarching market trends, focusing solely on short-term indicators.

- Why it’s a Mistake: Ignoring the broader market context can lead to poor decision-making. For example, buying an oversold asset in a bear market can be risky if the overall trend is downward.

- How to Avoid: Always consider the bigger picture. Use trend analysis tools like moving averages or trend lines to understand the market direction.

Lack of Risk Management: The Gamblers’ Fallacy

- What it Means: Traders often neglect to set stop-loss or take-profit orders, thinking that they can outsmart the market.

- Why it’s a Mistake: Without proper risk management, you expose yourself to unnecessary risks, which can lead to significant financial losses.

- How to Avoid: Always have a trading plan that includes risk management strategies like stop-loss and take-profit orders.

Trading Based on Emotions: The Rollercoaster Ride

- What it Means: Emotional trading occurs when decisions are made based on feelings rather than analysis.

- Why it’s a Mistake: Emotional decisions are often impulsive and can lead to poor trading outcomes.

- How to Avoid: Stick to your trading plan, even when the market is highly volatile. If you find yourself becoming emotional, it might be best to step away and reassess.

Failing to Keep Records: The Forgotten Lessons

- What it Means: Some traders do not keep records of their trades, making it difficult to learn from past mistakes or successes.

- Why it’s a Mistake: Without a record, you miss the opportunity to review and improve your trading strategies.

- How to Avoid: Maintain a trading journal where you note down details of all your trades, including the strategy used, the outcome, and any lessons learned.

Overtrading: The Adrenaline Junkie’s Downfall

- What it Means: Overtrading happens when you make too many trades in a short period, often as a result of emotional decisions or a desire to recover losses quickly.

- Why it’s a Mistake: Overtrading can lead to significant transaction costs and can expose you to higher risks.

- How to Avoid: Stick to your trading plan and don’t trade just for the sake of trading. Quality always trumps quantity in trading.

Tools and Platforms for Analyzing Overbought and Oversold Conditions

There are several tools and indicators that traders commonly use for analyzing overbought and oversold conditions in the crypto market. Here are some of the key tools and platforms:

Trading View

- What it Offers: Trading View is one of the most popular platforms that provide a range of charting and analysis tools, including indicators like Moving Averages, RSI, and Bollinger Bands.

- Who it’s For: Both beginners and experienced traders can benefit from Trading View’s built-in trading strategies and custom indicators.

Moving Averages

- What it Offers: This is a simple yet effective indicator that helps smooth out price action by filtering out noise and highlighting the overall trend.

- Who it’s For: Traders who want to identify trend direction and forecast future price movements.

Relative Strength Index (RSI)

- What it Offers: RSI is a momentum indicator that uses the speed and direction of price movements to determine the health of an asset.

- Who it’s For: Traders looking to identify overbought or oversold conditions.

Bollinger Bands

- What it Offers: Bollinger Bands are a momentum indicator that uses standard deviation to determine the price trend.

- Who it’s For: Traders who want to measure volatility and identify potential reversals in price.

On-Balance-Volume (OBV)

- What it Offers: OBV is a volume-based indicator that can be used to identify buying and selling pressure.

- Who it’s For: Traders interested in understanding the relationship between price and volume.

Ichimoku Cloud

- What it Offers: This comprehensive technical analysis tool includes several indicators to help identify trend direction, strength, and potential areas of support and resistance.

- Who it’s For: Traders looking for a multi-faceted approach to market analysis.

On-Chain Metrics

- What it Offers: These are data points that provide insights into the underlying health and activity of a cryptocurrency or token.

- Who it’s For: Traders interested in fundamental analysis.

Conclusion

Navigating the volatile landscape of overbought and oversold conditions in the crypto market—or any financial market including stocks, for that matter—requires a blend of technical prowess, strategic thinking, and emotional discipline. As we’ve explored in this comprehensive guide, understanding these market conditions is not merely about recognizing an RSI above 70 or below 30. It’s about synthesizing multiple indicators, applying proven strategies, and adhering to a disciplined risk management plan.

Key Takeaways

- Multiple Indicators: One of the most crucial lessons is the importance of using multiple indicators for confirmation. This reduces the risk of false signals and enhances the reliability of your trading decisions.

- Fundamental Analysis: Don’t underestimate the power of fundamental analysis. Even in a technical setup, understanding the underlying factors affecting an asset can provide you with a significant edge.

- Risk Management: No strategy is complete without a robust risk management plan. Tools like stop-loss and take-profit orders are not optional; they are essential for long-term trading success.

- Time Frame Analysis: Markets can show different behaviors on different time frames. A holistic view that incorporates multiple time frames can offer a more nuanced understanding of market conditions.

- Emotional Discipline: Last but not least, emotional discipline is the cornerstone of any successful trading strategy. The ability to stick to a plan, especially in the heat of the moment, can be what separates a successful trader from a failed one.

Final Thoughts

Mastering the art of trading in overbought and oversold conditions is a continual learning process. The strategies and tools discussed in this article are not a guarantee for success but are foundational elements that can enhance your trading acumen. By applying these principles and continuously refining your approach based on real-world experience and outcomes, you can navigate the complexities of overbought and oversold conditions with greater confidence and efficacy.

So, whether you’re a novice trader looking to understand the basics or a seasoned pro aiming to refine your strategies, the key is to remain adaptable, disciplined, and ever-curious. The market is a tough teacher, but the lessons it offers can be invaluable.

FAQs

What is the best indicator for identifying Overbought and Oversold conditions?

There is no one-size-fits-all answer; it depends on your trading style and the market conditions.

How reliable are Overbought and Oversold indicators?

While they are useful, they should not be used in isolation. Always consider other factors like market trends and news.

Can I use these strategies for other types of trading?

Yes, the concepts of Overbought and Oversold are applicable to various markets, not just cryptocurrencies.