At Woolypooly, we’ve always been at the forefront of demystifying the complex world of cryptocurrency trading. Our trading category has consistently provided cutting-edge insights into this ever-evolving market. Today, we delve into the intriguing realm of crypto market makers, the silent architects of the cryptocurrency trading world.

Table of Contents

What is Crypto Market Making

Market Making Explained

Market making, in its essence, is a foundational activity in financial markets, and it’s no different in the world of cryptocurrency. It involves a market participant – the market maker – who consistently offers to buy and sell assets, thereby providing liquidity to the market. This role is crucial because it ensures that there’s always a counterparty for traders wanting to buy or sell, thus facilitating smoother and more efficient market operations. Market makers quote both a buy and a sell price in a financial instrument or commodity held in inventory, with the aim of making a profit on the bid-offer spread, or turn.

From Wall Street to Crypto Streets

The concept of market making isn’t new; it has been a cornerstone of traditional financial markets like stocks and commodities for decades. However, its adaptation to the crypto market brings a unique flavor to it. Unlike the more regulated and structured environment of Wall Street, the crypto markets operate 24/7 and are known for their high volatility and relatively lower liquidity. This environment presents both challenges and opportunities for crypto market makers. They must adapt their strategies (especially intraday trading strategies) to handle sudden market movements and the relatively nascent infrastructure of the crypto trading world, all while ensuring they maintain efficient market operations.

The Profit Paradigm

The primary way market makers earn their profits is through the bid-ask crypto spread. When a market maker buys an asset, they pay the bid price, and when they sell, they receive the ask price. The difference between these two prices, known as the spread, is the market maker’s potential profit. In the crypto world, where price fluctuations can be sudden and significant, managing this spread is both an art and a science. Market makers must carefully balance the risk of holding inventory against the potential profits from the spread, all while contributing to the market’s overall liquidity and stability.

In the crypto market, the role of market makers becomes even more significant due to the inherent volatility and emerging nature of this space. They not only help in price discovery but also in stabilizing the market, which can otherwise be prone to extreme fluctuations. By ensuring that there are always enough buy and sell orders, market makers help in creating a more orderly market where crypto traders can execute their trades more predictively and efficiently.

How Crypto Market Makers Work

A market maker’s primary function is to provide liquidity to the market. In practical terms, this means offering a steady supply of stablecoins (or other forms of liquidity) to facilitate smooth trading. This liquidity is essential in ensuring that trades can be executed quickly and efficiently, without significant price slippage.

Token Management

In exchange for providing liquidity, the market maker receives tokens from the project they are supporting. This exchange forms the basis of a symbiotic relationship between the market maker and the project. The market maker then manages this portfolio of tokens, applying their expertise to maximize its value.

Profit and Return of Tokens

The agreement between the market maker and the project typically includes a set duration, often around a year or as specified in the contract. During this period, the market maker utilizes their skills in trading and market analysis to generate profits from the token portfolio. At the end of the agreed term, the market maker returns the tokens to the project, retaining the profits earned during this period.

The Mechanics of Crypto Market Making

Key Components in Crypto Market Making

| Component | Description | Importance in Crypto Market Making | Example Tools/Strategies |

|---|---|---|---|

| Algorithmic Trading | Automated trading using algorithms | Essential for real-time market analysis and trade execution | Custom-built algorithms, AI-driven trading systems |

| Trading Bots | Software programs that execute trades based on set criteria | Automate trading, ensuring continuous market presence | Bots like HaasOnline, Gunbot |

| Risk Management Systems | Tools to monitor and mitigate financial risk | Crucial for managing the inherent volatility of the crypto market | Portfolio management tools, stop-loss mechanisms |

| Order Book Management | Continuous placement of buy and sell orders | Provides market depth, reduces price volatility | Depth of market (DOM) strategies, liquidity algorithms |

| High-Frequency Trading (HFT) | Executing a large number of orders at high speeds | Exploits minute price movements for profit | HFT algorithms, low-latency trading systems |

| Statistical Arbitrage | Exploiting price differences across markets | Takes advantage of inefficiencies in different exchanges | Arbitrage bots, cross-exchange analysis tools |

| Spread Management | Balancing the bid-ask spread | Directly impacts profitability and market liquidity | Spread analysis tools, dynamic pricing algorithms |

Crypto Market Making Strategy Unveiled

In the crypto market, market makers employ a variety of strategies to maintain liquidity and manage risk. These strategies can range from simple bid-ask spreads to more complex algorithmic trading. Some market makers use high-frequency trading (HFT) techniques to execute a large number of orders at extremely high speeds, capitalizing on minute price movements. Others may employ statistical crypto arbitrage, leveraging the price differences across various exchanges. The key is to maintain a balance between risk and reward, ensuring that their presence adds value to the market in terms of liquidity and price discovery.

Tools of the Trade

The tools and technology used by crypto market makers are sophisticated and varied. They often rely on advanced algorithms that can analyze market trends and execute trades automatically. These algorithms are designed to respond to market conditions in real-time, adjusting buy and sell orders to maintain optimal spreads. Trading bots are another crucial tool, automating the trading process based on predefined criteria. These bots can operate round the clock, which is essential in the 24/7 crypto market. Additionally, market makers use comprehensive risk management systems to monitor their exposure and mitigate potential losses.

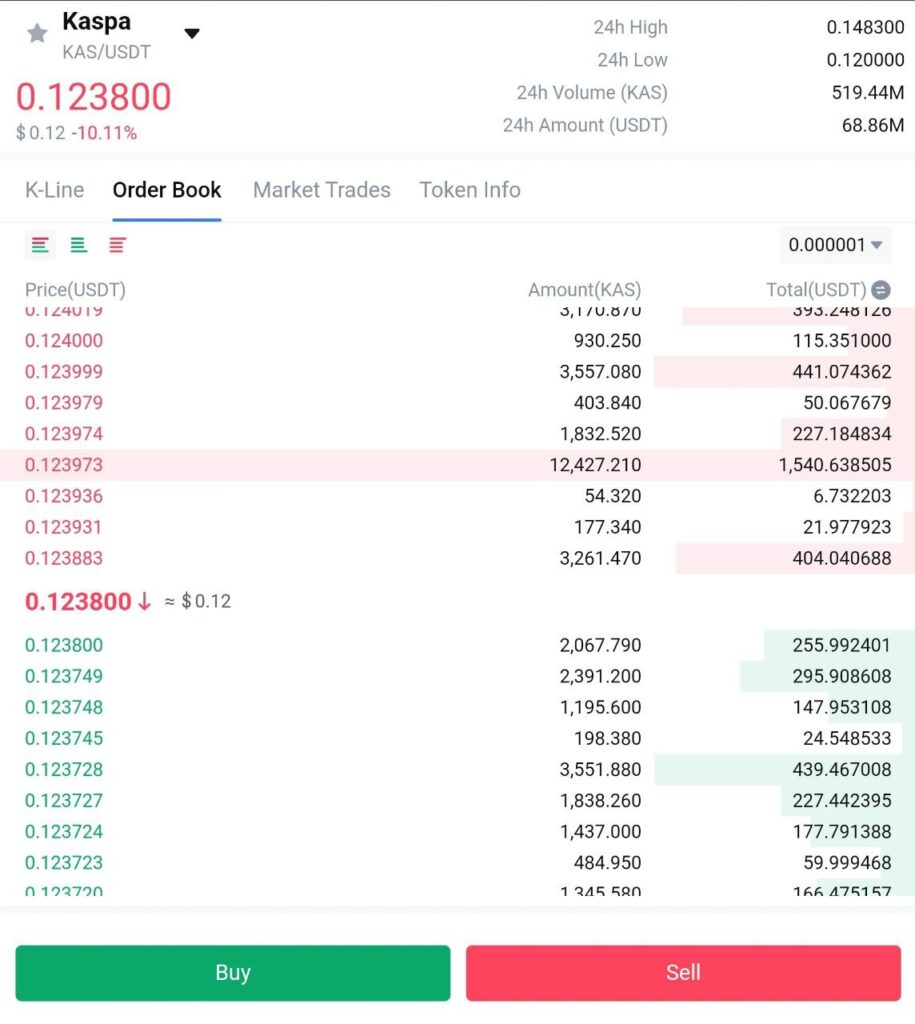

Order Book Dynamics

The order book is a fundamental element in the mechanics of market making. It’s a real-time list of buy and sell orders for a particular asset, showing the price and quantity that traders are willing to trade. Market makers play a crucial role in managing the order book by continuously placing buy and sell orders. Their activity helps to ‘thicken’ the order book, providing depth and reducing the likelihood of large, erratic price swings. Effective order book management by market makers leads to a more stable market with tighter spreads, benefiting all market participants.

The Ripple Effect of Crypto Market Makers

Crypto market makers not only contribute to the technical aspects of the market but also play a crucial role in its overall health and growth. The real-world impact of market makers is a testament to their indispensable role in the cryptocurrency ecosystem, influencing everything from individual asset stability to the broader market dynamics.

| Impact Area | Description | Benefits | Examples |

|---|---|---|---|

| Liquidity Provision | Continuous buy and sell orders | Reduces slippage, facilitates faster trade execution | Increased trading volume in major cryptocurrencies like BTC and ETH |

| Price Stability | Narrowing the bid-ask spread | Reduces price volatility, lowers trading costs | More stable price trends in highly traded crypto assets |

| Market Maturity | Contributing to the orderly functioning of the market | Attracts institutional investors, enhances market credibility | Growth and stability in established cryptocurrencies |

| Support for New Cryptocurrencies | Providing liquidity for emerging coins | Aids in price discovery, encourages investor participation | Successful launches and initial growth phases of new altcoins |

| Crisis Management | Maintaining order during market stress | Prevents panic selling, stabilizes the market | Role in stabilizing markets during high volatility events |

Choosing the Right Market Maker

For traders and exchanges, choosing a market maker is a decision that hinges on several factors, including reliability, technology, and track record.

| Criteria | Description | Why It’s Important | Considerations |

|---|---|---|---|

| Liquidity Provision | Ability to provide continuous buy/sell orders | Ensures efficient trade execution, reduces slippage | Depth and consistency of order book |

| Technological Capabilities | Use of advanced trading algorithms and systems | Facilitates effective trading and risk management | Reliability, speed, and sophistication of technology |

| Track Record and Stability | Historical performance and market presence | Indicates experience and ability to handle market fluctuations | Performance during volatile market conditions |

| Regulatory Compliance | Adherence to financial regulations | Essential for legal operation and trust | Compliance with AML, KYC, and other relevant regulations |

| Transparency | Openness in operations and fees | Builds trust and aids in informed decision-making | Clarity in order execution, fee structure |

| Spread Management | Maintenance of competitive bid-ask spreads | Directly impacts trading costs and profitability | Consistency and fairness of spreads |

| Reputation and Trust | Industry standing and client feedback | Reflects reliability and ethical practices | Client testimonials, industry reviews |

| Customer Support and Service | Quality of client interaction and support | Enhances trading experience, resolves issues | Responsiveness, expertise, additional services |

| Asset Coverage | Range of cryptocurrencies and instruments covered | Important for diversification and risk management | Variety and breadth of assets handled |

| Innovation and Adaptability | Capacity to integrate new technologies and strategies | Keeps pace with market evolution | Approach to new trends, technologies, and market changes |

Top Crypto Market Makers

| Market Maker | Specialization | Technology/Approach | Services Offered | Unique Features |

|---|---|---|---|---|

| Acheron Trading | Advanced crypto market making | Innovative software engineering, algorithmic trading tools | Multiple exchange access, real-time analytics | Rigorous human oversight for accuracy |

| Algoz Crypto Market Maker | Algorithmic crypto trading | Automated algorithms, multiple exchange APIs | Customized trading strategies, backtesting | Integration with TradingView |

| Alpha Theta | Depth and liquidity in market | Better bid-ask spreads | Portfolio management, asset custody | Educational resources for traders |

| Gotbit | DEX and CEX market making | Advanced trading tools for continuous market reassessment | Constant performance tracking | Support for a wide range of both CEX and DEX |

| Antier Solutions | Quote-making and trading in crypto markets | Automated algorithmic platform | Multi Trades Analytics module | Specialized in capital management |

| Blue Sky Capital | Liquidity for digital asset industry | Proprietary algorithmic trading technology | Spot and derivatives markets execution | Strategic partner to exchanges, institutional clients |

| NinjaPromo | Focused on token projects | Advanced data analytics in its market making program | Strategic initial assessment for market entry | Collaboration with entities like Y Combinator and Techstars |

| CLS Global | Liquidity in digital asset markets | Proprietary algorithms for order management | Bids and asks on exchanges and OTC desks | Fast order placement in milliseconds |

| Cumberland | Liquidity solutions for institutional investors | Price improvement technology, algorithmic strategies | Superior execution on large trades | Active price seeking for better deals |

| Empirica | Liquidity in crypto markets | Automated algorithms, machine learning | Spot and derivatives markets liquidity | 24/7 support, competitive fees structure |

| FalconX | Superior liquidity in global crypto markets | Proprietary technology for automated order execution | Automated order execution, low latency | Large order capacity |

| Flowdesk | Automated trading platform | AI-driven algorithm for trade matching | No order books or bid/ask spreads | Advanced analytics and predictive algorithms |

| GravityTeam | Market making for major exchanges | OTC trading services, liquidity management | Professional brokers, educational resources | Best prices in market trading |

| GSR Markets | Liquidity for digital asset trading platforms | Automated, algorithmic approach | Customized liquidity solutions, advanced trading strategies | Deep market insights and analytics tools |

| Jane Street | Algorithmic trading and market making for cryptocurrency | Proprietary algorithms for efficient execution | Liquidity management, risk management | Personalized service and advice |

| Jump Trading | Liquidity services for digital asset exchanges | Smart order routing, real-time algorithms | Liquidity for spot and derivatives markets | Customized API integrations |

| Kairon Labs | Automated liquidity solutions | Sophisticated algorithms, advanced analytics | Price discovery and execution services | Risk management tools |

| Keyrock | Easy access to cryptocurrency markets | Proprietary trading algorithms | Algorithmic trading tools, market data analysis | Automated portfolio management |

| Amber Group | Global reach covering, supporting over 150 countries | Proprietary execution algorithms designed to offer tight spreads and low fees | Liquidity solutions, validator, digital asset platform | Acts not just as a market maker but also as miners and validators |

| Pulsar Trading Cap | Bridging decentralized and traditional financial markets | Multi-algorithm execution engine | Tools and infrastructure for digital asset trading | Integrated risk management system |

| Virtu | Digital asset trading with automated arbitrage | Sophisticated algorithms for portfolio management | Real-time pricing, automated arbitrage trading | Profit generation in rising and falling markets |

| Wintermute | Liquidity in digital asset exchanges | AI algorithms in trading engine | Efficient, low-cost trading | Access to multiple exchanges simultaneously |

Acheron Trading

Acheron Trading leverages innovative algorithmic trading tools with human oversight to ensure seamless market making.

Pros & Cons

| Pros | Cons |

|---|---|

| Combination of algorithmic tools and human oversight | Human oversight may limit scalability |

| Innovative trading solutions | Balancing technology and human intervention can be challenging |

| Focus on seamless market integration | – |

Algoz

Algoz is equipped with advanced algorithmic tools that help traders and market makers analyze markets, create, and implement market making strategies.

Pros & Cons

| Pros | Cons |

|---|---|

| Advanced algorithmic analysis tools | Complexity of tools may require advanced understanding |

| Comprehensive market strategy development | Focused on strategy creation, which may need constant updates |

| Suitable for both traders and market makers | – |

Alpha Theta

Alpha Theta aims to create more efficient and secure trading markets by bringing more depth to order books and shortening bid-ask spreads.

Pros & Cons

| Pros | Cons |

|---|---|

| Enhances market efficiency and security | May need continuous market analysis for effective spread management |

| Focus on deepening order books | Focused on market efficiency, which may not suit all trading styles |

| Reduces bid-ask spreads | – |

Gotbit – Web3 Crypto Market Making

Since its inception in 2017, Gotbit has carved out a niche in both centralized and decentralized exchanges, supporting 70+ CEX and 50+ DEX platforms and serving 370+ live clients. Nowadays, Gotbit is one of the biggest market makers in crypto.

From an interview with a Gotbit representative, it emerges that they provide crypto market making services for projects that are beyond the 200th line in the CoinMarketCap rankings.

Pros & Cons

| Pros | Cons |

|---|---|

| Advanced trading tools for continuous market reassessment | Listing tokens may come with a significant fee |

| Platform-based solutions catering to diverse client needs | Listing prerequisite of being on two smaller exchanges |

| Constant performance tracking, ensuring 24/7 operation | – |

| Monthly tips and utilities to enhance client performance | – |

| Versatile support for both DEX and CEX platforms | – |

Antier Solutions

Known for its innovative approach, Antier Solutions develops bespoke crypto market maker software that excels in mitigating risks of slippage by offering relevant bid-ask orders 24/7. The software supports multiple strategies and allows market makers to experiment with new strategies.

Pros & Cons

| Pros | Cons |

|---|---|

| Tailored solutions for specific market needs | May require customization for specific market conditions |

| 24/7 bid-ask order provision | Reliance on continuous innovation to stay competitive |

| Supports multiple trading strategies | – |

Blue Sky Capital

Blue Sky Capital specializes in providing liquidity for the digital asset industry through its proprietary algorithmic trading technology. They focus on execution in both spot and derivatives markets.

Pros & Cons

| Pros | Cons |

|---|---|

| Proprietary algorithmic trading technology | – |

| Spot and derivatives markets execution | – |

| Strategic partner to exchanges, institutional clients | – |

NinjaPromo

Specializing in token projects, NinjaPromo‘s market making program is designed to not only enhance market liquidity but also to strategically manage risks for maximized profitability.

Pros & Cons

| Pros | Cons |

|---|---|

| Strategic initial assessment for market entry | Specific supported tokens not disclosed |

| Continuous market analysis for sustained performance | Performance reliant on expert market insights and fluctuating market dynamics |

| Integration of advanced data analytics | – |

| Collaboration with renowned startup accelerators, ensuring credibility | – |

CLS Global

CLS Global offers liquidity solutions in digital asset markets, utilizing proprietary algorithms for efficient order management across exchanges and OTC desks.

Pros & Cons

| Pros | Cons |

|---|---|

| Proprietary algorithms for order management | – |

| Bids and asks on exchanges and OTC desks | – |

| Fast order placement in milliseconds | – |

Cumberland

Cumberland provides liquidity solutions tailored for institutional investors, employing price improvement technology and algorithmic strategies for superior execution on large trades.

Pros & Cons

| Pros | Cons |

|---|---|

| Price improvement technology, algorithmic strategies | – |

| Superior execution on large trades | – |

| Active price seeking for better deals | – |

Empirica

Empirica cryptocurrency market making firm specializes in providing liquidity in thin markets with its software package capable of effectively increasing the depth of order books.

Pros & Cons

| Pros | Cons |

|---|---|

| Effective in thin market conditions | Focused primarily on thin markets, may not be as effective in more liquid markets |

| Enhances order book depth | Requires continuous monitoring for optimal performance |

| Automated liquidity provision | – |

FalconX

FalconX offers substantial liquidity with low latency, large order capacity, and automatic trading execution.

Pros & Cons

| Pros | Cons |

|---|---|

| Low latency in order execution | May require significant infrastructure support |

| Capable of handling large orders | Focused on larger market players, possibly less suitable for smaller entities |

| Automated trading execution | – |

Flowdesk

Flowdesk is an automated trading platform that uses AI-driven algorithms for trade matching, eliminating the need for traditional order books or bid/ask spreads. Supports more than 80 CEXs and 20 DEXs.

Pros & Cons

| Pros | Cons |

|---|---|

| AI-driven algorithm for trade matching | – |

| No order books or bid/ask spreads | – |

| Advanced analytics and predictive algorithms | – |

GravityTeam

GravityTeam provides market making services for major exchanges, offering OTC trading services and liquidity management with a focus on securing the best prices in market trading.

Pros & Cons

| Pros | Cons |

|---|---|

| OTC trading services, liquidity management | – |

| Professional brokers, educational resources | – |

| Best prices in market trading | – |

GSR Markets

GSR aims to supply unwavering liquidity to cryptocurrency trading platforms, focusing on stability and continuous market presence.

Pros & Cons

| Pros | Cons |

|---|---|

| Automated, algorithmic approach | – |

| Customized liquidity solutions, advanced trading strategies | – |

| Deep market insights and analytics tools | – |

Jane Street

Jane Street is known for its algorithmic trading and market making in the cryptocurrency space, offering liquidity management and risk management services with a personalized approach.

Pros & Cons

| Pros | Cons |

|---|---|

| Proprietary algorithms for efficient execution | – |

| Liquidity management, risk management | – |

| Personalized service and advice | – |

Jump Trading

Jump Trading offers liquidity for spots and derivatives markets, facilitating the efficient execution of large orders without impacting the markets.

Pros & Cons

| Pros | Cons |

|---|---|

| Smart order routing, real-time algorithms | May not be as effective for small-scale trading |

| Liquidity for spot and derivatives markets | Large order focus could limit flexibility in rapidly changing markets |

| Customized API integrations | – |

Kairon Labs

Since 2019 Kairon Labs provides automated liquidity solutions using sophisticated algorithms and advanced analytics, focusing on price discovery and execution services with robust risk management tools.

Pros & Cons

| Pros | Cons |

|---|---|

| Sophisticated algorithms, advanced analytics | – |

| Price discovery and execution services | – |

| Risk management tools | – |

Keyrock

Keyrock offers easy access to cryptocurrency markets through its proprietary trading algorithms, providing algorithmic trading tools and market data analysis for automated portfolio management.

Pros & Cons

| Pros | Cons |

|---|---|

| Proprietary trading algorithms | – |

| Algorithmic trading tools, market data analysis | – |

| Automated portfolio management | – |

Amber Group

Beyond providing liquidity solutions, Amber Group plays a multifaceted role as miners and validators across over 150 countries. Their digital asset platform, WhaleFin, is tailored for individual investors, featuring proprietary execution algorithms designed to offer tight spreads and low fees. Amber Group is one of the largest crypto market makers with $1T+ traded volume and $500M return generated volume.

Pros & Cons

| Pros | Cons |

|---|---|

| Global reach, supporting over 150 countries | Investing products are subject to varying regulatory constraints |

| Catering to a diverse range of client sizes | – |

| Dual role as principal and designated crypto market maker | – |

Pulsar Trading Cap

Pulsar Trading Cap bridges decentralized and traditional financial markets with its multi-algorithm execution engine, offering tools and infrastructure for effective digital asset trading.

Pros & Cons

| Pros | Cons |

|---|---|

| Multi-algorithm execution engine | – |

| Tools and infrastructure for digital asset trading | – |

| Integrated risk management system | – |

Virtu

Virtu specializes in digital asset trading with automated arbitrage, utilizing sophisticated algorithms for real-time pricing and portfolio management, aiming to generate profits in both rising and falling markets.

Pros & Cons

| Pros | Cons |

|---|---|

| Sophisticated algorithms for portfolio management | – |

| Real-time pricing, automated arbitrage trading | – |

| Profit generation in rising and falling markets | – |

Wintermute

Wintermute utilizes an algorithmic cryptocurrency market maker that maintains liquidity across multiple markets and trading platforms.

Pros & Cons

| Pros | Cons |

|---|---|

| Maintains liquidity across various markets | Algorithmic focus may require frequent updates to stay relevant |

| Algorithmic approach for consistent performance | Broad market focus might not cater to niche market needs |

| Suitable for multiple trading platforms | – |

Navigating Challenges

Understanding crypto market making challenges is crucial for anyone involved in the market, as it sheds light on the complexities behind maintaining a stable and efficient trading environment in this dynamic and often unpredictable space.

| Challenge | Description | Impact | Mitigation Strategies |

|---|---|---|---|

| Market Volatility | Rapid and unpredictable price changes | Affects inventory value and profit margins | Use of hedging strategies, real-time analytics, and risk management tools |

| Regulatory Compliance | Evolving legal landscape and compliance requirements | Legal and operational risks | Staying informed about regulatory changes, implementing AML and KYC protocols |

| Technological Advancements | Need to keep up with fast-paced tech developments | Operational efficiency and security risks | Investing in advanced trading and security technologies, continuous innovation |

| Security Threats | Vulnerability to hacks and cyber-attacks | Potential loss of assets and reputation damage | Robust cybersecurity measures, regular security audits, secure trading practices |

| Liquidity Management | Maintaining sufficient liquidity in fast-moving markets | Risk of inventory depletion or excess | Dynamic liquidity management strategies, diversified asset holdings |

| Decentralization Challenges | Unique issues in a decentralized market | Operational complexities | Developing decentralized finance (DeFi) compatible tools, adapting to blockchain technology |

Looking Ahead: The Future of Crypto Market Making

Evolution of Technology and Strategies

The future of crypto market making is poised to be shaped significantly by advancements in technology and evolving trading strategies. As the crypto market matures, we can expect to see more sophisticated algorithms, enhanced machine learning capabilities, and greater integration of AI in market making. These technologies will not only improve the efficiency of market making but also help in better managing the complexities and volatility of the crypto markets.

Increased Institutional Participation

The entry of more institutional players into the crypto space is likely to bring about a shift in market dynamics. Institutional investors typically bring larger volumes, which could lead to increased liquidity and stability in the markets. However, their participation also demands higher standards of compliance, transparency, and risk management, pushing market makers to adapt accordingly.

Regulatory Landscape and Challenges

Regulation will play a pivotal role in shaping the future of crypto market making. As seen with the recent developments involving Jump Trading and Jane Street scaling back their operations in the U.S. due to increased regulatory scrutiny, market makers will need to navigate a complex and evolving regulatory environment. The heightened attention from regulators is driven by concerns over market manipulation, investor protection, and financial stability. Market makers will have to ensure strict compliance with regulatory requirements, adapt to new regulations, and possibly face operational and strategic changes in response to regulatory pressures.

Decentralized Finance (DeFi) and Market Making

The rise of DeFi presents both opportunities and challenges for market makers. Decentralized exchanges (DEXs) operate differently from traditional exchanges, and market making in these environments requires a different approach. The automated market maker (AMM) models in DeFi, for instance, offer a unique set of advantages and limitations compared to traditional market making. Market makers will need to adapt their strategies to capitalize on the growing DeFi space while managing the risks associated with it.

Global Expansion and Localized Strategies

Market makers are likely to expand their operations globally, adapting to different regional markets. This expansion will require localized strategies to cater to the unique characteristics and regulatory requirements of each market. Understanding local market dynamics, regulatory landscapes, and cultural nuances will be crucial for success in these diverse markets.

Sustainability and Ethical Practices

As the focus on sustainability grows, market makers will need to consider the environmental impact of their operations, especially in terms of energy consumption used for trading and blockchain operations. Ethical practices in trading, transparency, and fair market operations will also become increasingly important, influencing the reputation and long-term success of market makers.

Conclusion

As we look towards the horizon of crypto market making, it’s clear that the industry is at a pivotal juncture. The landscape is evolving rapidly, shaped by technological advancements, regulatory shifts, and the increasing involvement of institutional players. Market makers, at the heart of this ecosystem, are not just passive participants but active shapers of its future.

The challenges are significant, particularly in the realm of regulation, as exemplified by the recent strategic shifts of industry giants like Jump Trading and Jane Street in the U.S. market. This scenario underscores the delicate balance market makers must maintain between innovation and compliance. The future success of market makers will hinge on their ability to navigate these complexities, adapting to regulatory changes while continuing to provide liquidity and stability in increasingly diverse and sophisticated markets.

In conclusion, the world of crypto market making is poised for transformative changes. Those who can adeptly manage the interplay of technology, regulation, and market dynamics will not only survive but thrive in this dynamic environment. For traders, investors, and market participants, understanding these shifts is crucial for making informed decisions in a landscape that continues to redefine the boundaries of finance and technology.

FAQs

What exactly does a crypto market maker do?

Market makers help facilitate trading by providing liquidity through continuous buy and sell orders.

How do market makers make money?

They earn profits from the spread between the buy and sell prices.

Are crypto market makers different from traditional market makers?

While the core principles remain the same, crypto market makers open 24/7, operate in a more volatile and less regulated environment.

Can market makers manipulate the market?

While they have a significant impact on liquidity and price stability, outright manipulation is mitigated by market competition and regulatory frameworks.

How important are market makers in DeFi?

As DeFi grows, market makers are becoming increasingly crucial in providing liquidity to decentralized platforms.