Intraday trading stands out as a strategy many traders employ to reap quick profits. By buying and selling assets within a single trading day, intraday traders aim to capitalize on small price fluctuations. But what makes intraday trading so appealing, and how can one master its intricacies? Let’s delve into the world of intraday trading and uncover its secrets.

Table of Contents

Basics of Intraday Trading

What is intraday trading?

Intraday trading, often referred to as day trading, involves executing trades within a single market day. Unlike long-term investments, intraday traders capitalize on short-term price movements, closing all positions before the market shuts.

Key terminologies to know

When diving into the world of intraday trading, there are several key terminologies that traders should be familiar with. Here’s a concise elaboration on some of the essential terms:

| Term | Description |

|---|---|

| Bull Market | Characterized by rising prices and optimism. Expectation of continued price rise. |

| Bear Market | Defined by falling prices and pessimism. Expectation of continued price drop. |

| Bid | The price a trader is willing to purchase a security. |

| Ask (or Offer) | The price a trader is willing to sell a security. |

| Volume | Number of shares/contracts traded during a given period. Indicates interest in an asset. |

| Stop-Loss Order | Order to buy/sell once a security reaches a certain price. Prevents large losses in volatile markets. |

| Limit Order | Order to buy/sell a security at a specific price or better. Ensures a set price but may not always get filled. |

| Leverage | Control a large position with a small amount of capital. Amplifies potential profits and losses. |

| Short Selling | Selling securities not owned, intending to buy back later at a lower price for profit. |

| Resistance | Price level where a stock/market tends to stop rising, possibly decreasing. |

| Support | Price level where a stock/market tends to stop falling, possibly rising. |

| Breakout | Price of a security moves above resistance or below support, indicating potential continued movement. |

| Margin | Capital required by a broker to maintain an open position. Allows for trading with borrowed money. |

Intraday Trading Strategies

Intraday trading strategies are specific approaches that traders use to capitalize on short-term price movements within a single trading day. These strategies are designed to help traders identify potential entry and exit points, manage risk, and maximize profits. Here’s a detailed elaboration on some of the most popular intraday trading strategies:

1. Momentum Trading

Definition:

Momentum trading, also known as trend following, involves identifying stocks or assets that are moving in a strong direction (upward or downward) and trading in that direction.

How it Works:

- Traders look for news or events that might trigger a significant move in a stock or asset.

- They then buy or sell the asset, hoping to ride the momentum until it starts to fade.

- Technical indicators, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), can be used to identify overbought or oversold conditions.

Pros:

- Can lead to significant profits if the momentum continues.

- Relatively straightforward to identify using technical indicators.

Cons:

- Momentum can reverse quickly, leading to potential losses.

- Requires constant monitoring to ensure timely exit.

2. Breakout Trading

Definition:

Breakout trading involves identifying key resistance or support levels and placing trades when the price breaks through these levels.

How it Works:

- Traders identify a range within which an asset is trading.

- A breakout occurs when the price moves above resistance (for a bullish breakout) or below support (for a bearish breakout).

- Traders enter the trade after the breakout, anticipating further price movement in the breakout direction.

Pros:

- Clear entry and exit points.

- Can lead to significant price movements.

Cons:

- False breakouts can result in losses.

- Requires a good understanding of support and resistance levels.

3. Reversal Trading

Definition:

Reversal trading, or mean reversion, is based on the idea that prices will revert to their mean or average level after a significant move.

How it Works:

- Traders identify assets that have deviated significantly from their average price.

- They then trade in the opposite direction, expecting the price to revert to its mean.

- Technical indicators like Bollinger Bands or RSI can help identify overextended conditions.

Pros:

- Can be profitable in range-bound markets.

- Clear criteria for identifying potential trades.

Cons:

- If the trend is strong, the asset might not revert to its mean, leading to losses.

- Timing the reversal can be challenging.

4. Scalping

Definition:

Scalping involves making a large number of small trades throughout the day, aiming to capture tiny price movements.

How it Works:

- Traders look for small price gaps created by bid-ask spreads or order flows.

- They aim to make a small profit from each trade, which can add up over many trades.

- Trades are typically held for a very short duration, sometimes just minutes or seconds.

Pros:

- Small, consistent profits.

- Less exposure to overnight risks.

Cons:

- Requires intense focus and quick decision-making.

- Trading costs can add up due to the high frequency of trades.

5. News-Based Trading

Definition:

This strategy involves trading based on the release of major news events or financial reports that can impact asset prices.

How it Works:

- Traders monitor economic calendars for significant news releases.

- They anticipate how the market will react and place trades accordingly.

- The strategy requires quick reactions as markets can move rapidly after news releases.

Pros:

- Can lead to significant price movements in a short time.

- Clear events to monitor.

Cons:

- Markets can be highly volatile after news releases, leading to potential losses.

- Predicting market reactions to news can be challenging.

Essential Tools for Intraday Trading

Intraday trading requires a combination of technical, fundamental, and logistical tools to make informed decisions, execute trades efficiently, and manage risk. Here’s a detailed elaboration on the essential tools for intraday trading:

1. Technical Analysis Tools

Charting Software:

- Provides visual representation of price movements.

- Allows traders to apply various chart types like candlestick, bar, and line charts.

- Examples: TradingView, MetaTrader, ThinkorSwim.

Technical Indicators:

- Mathematical calculations based on historical price, volume, or open interest information.

- Help in predicting future price movements.

- Common indicators: Moving Averages (MA), Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands.

Level II Quotes:

- Displays a ranked list of the best bid and ask prices from market participants.

- Helps traders understand supply and demand at different price levels.

2. Fundamental Analysis Tools

Economic Calendars:

- Lists upcoming economic events, data releases, and earnings reports.

- Helps traders anticipate market-moving events.

- Examples: Forex Factory calendar.

News Aggregators:

- Provide real-time news updates that can affect the markets.

- Essential for news-based trading strategies.

- Examples: Bloomberg Terminal, Reuters Eikon.

Earnings Reports:

- Quarterly and annual reports released by publicly-traded companies.

- Offer insights into a company’s financial health and future prospects.

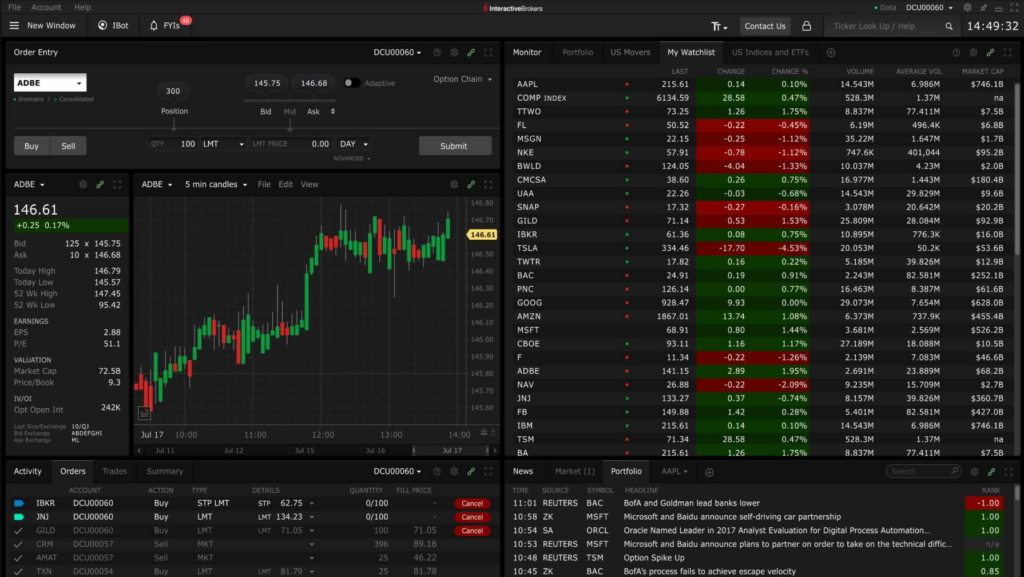

3. Trading Platforms and Software

Brokerage Platforms:

- Platforms provided by brokers to execute trades.

- Offer a range of tools for analysis, research, and trade execution.

- Examples: TD Ameritrade’s Thinkorswim, Interactive Brokers’ Trader Workstation.

Direct Market Access (DMA) Platforms:

- Allow traders to directly place orders with exchanges.

- Offer faster execution speeds, essential for high-frequency intraday trading.

Automated Trading Software:

- Allows traders to set predefined criteria for trade entries and exits.

- Executes trades automatically based on the set criteria.

- Examples: MetaTrader’s Expert Advisors (EAs), NinjaTrader.

4. Risk Management Tools

Stop-Loss and Take-Profit Orders:

- Automated orders that close a trade at predefined price levels.

- Help in managing losses and locking in profits.

Position Size Calculators:

- Determine the amount of capital to invest in a particular trade based on risk tolerance.

- Helps in ensuring that traders don’t overexpose themselves to a single trade.

5. Hardware and Infrastructure

Multiple Monitors:

- Allow traders to view multiple charts, news feeds, and other essential data simultaneously.

High-Speed Internet:

- Ensures quick data feed and trade execution.

- Reduces the risk of slippage or missed trades due to connectivity issues.

Reliable Computer System:

- A fast and reliable computer system ensures smooth operation without lags or crashes.

Backup Systems:

- Essential to ensure uninterrupted trading.

- Includes backup power sources, internet connections, and devices.

6. Educational and Research Tools

Trading Webinars and Courses:

- Offer insights into strategies, market analysis, and other essential trading topics.

- Examples: Webinars hosted by brokers, online platforms like Udemy or Coursera.

Trading Communities and Forums:

- Platforms where traders discuss strategies, share insights, and seek advice.

- Examples: StockTwits, Elite Trader, BabyPips (for forex traders), Reddit.

Intraday Trading Tips

Trading intraday, while offering opportunities for quick profits, also comes with its fair share of risks. Success in this domain requires a combination of discipline, knowledge, and strategy. Here’s a detailed elaboration on tips for successful intraday trading:

1. Have a Clear Trading Plan

- Purpose: A well-defined trading plan outlines your goals, risk tolerance, and specific criteria for entering and exiting trades.

- Benefits: It provides a roadmap, minimizes impulsive decisions, and ensures consistency in your trading approach.

2. Set Stop-Loss and Take-Profit Levels

- Purpose: These are predetermined price levels where you’ll close a trade, either to limit a loss (stop-loss) or to lock in a profit (take-profit).

- Benefits: They automate decision-making during volatile market conditions, protect your capital, and ensure you stick to your trading plan.

3. Keep Emotions in Check

- Purpose: Emotional trading can lead to rash decisions, such as chasing losses or becoming overly greedy.

- Benefits: Staying objective and not letting emotions drive your decisions can lead to more consistent results and fewer regrets.

4. Continuously Educate Yourself

- Purpose: The financial markets are dynamic, with evolving trends, technologies, and geopolitical events influencing them.

- Benefits: Regular research, attending webinars, and reading up on market news keeps you updated, allowing you to adapt your strategies accordingly.

5. Start Small and Scale Gradually

- Purpose: Especially for beginners, it’s wise to start with a smaller capital and gradually increase your exposure as you gain experience.

- Benefits: Reduces potential losses in the initial stages and allows you to learn without significant financial stress.

6. Monitor Markets Regularly

- Purpose: Intraday trading requires a keen eye on market movements and news events that might influence prices.

- Benefits: Staying updated in real-time allows you to react quickly to market changes, ensuring you don’t miss potential trading opportunities.

7. Diversify Your Trades

- Purpose: Don’t put all your capital into a single asset or sector. Spread your trades across different assets.

- Benefits: Diversification reduces the risk associated with the poor performance of a single asset or sector.

8. Use Reliable Trading Tools and Platforms

- Purpose: Efficient trading platforms and tools enhance your analysis and execution capabilities.

- Benefits: Faster trade execution, accurate analysis, and real-time data can significantly improve your trading outcomes.

9. Review and Analyze Your Trades

- Purpose: At the end of each trading day or week, review your trades, both successful and unsuccessful.

- Benefits: This self-analysis helps identify mistakes, refine strategies, and reinforces good trading habits.

10. Maintain a Trading Journal

- Purpose: Documenting your trades, including the rationale behind each decision, results, emotions, and market conditions, can be invaluable.

- Benefits: A trading journal offers insights into your trading patterns, helps in strategy refinement, and provides a historical record to learn from.

11. Stay Disciplined and Patient

- Purpose: Not every day will present ideal trading opportunities. It’s essential to wait for the right conditions rather than force a trade.

- Benefits: Patience ensures you trade based on logic and strategy, not boredom or desperation.

12. Limit Leverage

- Purpose: While leverage can amplify profits, it can also magnify losses.

- Benefits: Using leverage judiciously ensures that you don’t expose yourself to undue risk, especially in highly volatile market conditions.

Intraday Trading in the Crypto World

Cryptocurrency day trading brings its own set of unique opportunities and challenges. Given the relatively nascent nature of the crypto market and its inherent volatility, trading strategies and considerations can differ from traditional markets. Here’s a detailed elaboration on intraday trading in the crypto realm:

1. Differences between Traditional and Crypto Intraday Trading

- 24/7 Market: Unlike traditional stock markets that have specific opening and closing times, cryptocurrency markets operate 24/7. This continuous operation offers more trading opportunities but also requires crypto traders to be vigilant at all times.

- Volatility: Cryptocurrencies are notoriously volatile. While this can lead to significant profit opportunities in intraday trading, it also comes with increased risk.

- Regulation: Traditional markets are heavily regulated, providing a certain level of protection and transparency for traders. In contrast, the crypto market is less regulated, which can lead to increased risks but also more freedom in trading strategies.

2. Popular Cryptocurrencies for Intraday Trading

- Bitcoin (BTC): Often referred to as ‘digital gold’, Bitcoin is the most widely recognized and traded cryptocurrency. With the advent of Bitcoin leverage trading, traders can now amplify their potential returns by controlling larger positions with a smaller amount of capital, though this also comes with increased risks.

- Ethereum (ETH): Known for its smart contract functionality, Ethereum often follows Bitcoin in market sentiment but can also have its own independent price triggers.

- Ripple (XRP), Litecoin (LTC), Kaspa Coin (KAS) and others: Many altcoins (alternative coins to Bitcoin) offer unique use cases and can have price movements based on factors independent of the broader crypto market sentiment.

3. Volatility in Crypto Markets

- Factors Driving Volatility: News about regulatory changes, technological advancements (like Bitcoin halvings or Ethereum upgrades), macroeconomic factors, and large-scale buying or selling by ‘whales’ can lead to sharp price swings.

- Opportunities and Risks: High volatility means higher profit potential, but it also means increased risk. Effective risk management strategies are crucial.

4. Strategies Tailored for Crypto Intraday Trading

Momentum Trading

Given the sentiment-driven nature of the crypto market, momentum trading can be particularly effective. Traders ride the wave of strong price movements, either bullish or bearish.

Scalping

Due to the rapid price movements in the crypto market, scalping can be a viable strategy. Traders make a large number of small trades throughout the day to capitalize on tiny price fluctuations.

News-Based Trading

Cryptocurrencies are highly sensitive to news, especially regulatory news. Traders can capitalize on significant price movements following major news events.

5. Risks and Rewards in Crypto Intraday Trading

Liquidity Concerns

While major cryptocurrencies like Bitcoin and Ethereum have high liquidity, some altcoins might not. This can lead to challenges in executing large trades without affecting the price.

Security Concerns

Cryptocurrency exchanges have been targets of hacks in the past. Ensuring the security of funds is paramount. Using reputable exchanges, enabling two-factor authentication, and not leaving large amounts on exchanges can mitigate risks.

Regulatory Risks

Sudden regulatory announcements can lead to sharp price drops. Being aware of the regulatory environment in various countries can help in anticipating such moves.

6. Essential Tools for Crypto Intraday Trading

Crypto Exchanges

| Platform | Pros | Cons |

|---|---|---|

| MEXC | User-friendly interface, wide range of cryptocurrencies, lowest crypto exchange fees, advanced trading features | Platform may be complex for beginners, slow customer service response times |

| Binance | Large number of cryptocurrencies, advanced trading features, high liquidity, user-friendly interface | Reports of delayed customer service responses, potential target for hackers |

| Gate.io | Wide range of cryptocurrencies, advanced trading features, user-friendly interface, educational resources for beginners | Higher trading fees, does not support fiat currency deposits or withdrawals |

| OKX | Large number of cryptocurrencies, advanced trading features, competitive fees, user-friendly interface, educational resources for beginners | Reports of account freezes without prior notice, slow customer service response times |

| BingX | Advanced trading features, high leverage, ability to copy trades from successful traders, user-friendly interface | Smaller selection of cryptocurrencies, less liquidity due to smaller user base |

Crypto Wallets

| Digital Wallet | Key Features | Link |

|---|---|---|

| Trezor Model T | High security, supports 14 cryptocurrencies, open-source software | Trezor Model T |

| Ledger Nano X | Secure cold storage, connects via Bluetooth or USB, supports over 5,500 cryptocurrencies | Ledger Nano X |

| Electrum | Customizable transaction fees, high security, only works for Bitcoin | Electrum |

| Exodus | Built-in exchange, good for beginners, supports cold storage | Exodus |

| MetaMask | A crypto wallet & gateway to blockchain apps, supports token exchange | MetaMask |

| Trust Wallet | Supports a wide range of tokens, built-in exchange, secure and private | Trust Wallet |

| Coinbase Wallet | Supports a wide range of tokens, secure and private, integrates with Coinbase | Coinbase Wallet |

| Tangem Wallet | Card-shaped self-custodial cold wallet, supports 6000+ coins and tokens | Tangem Wallet |

Technical Analysis Tools

Given the technical nature of the crypto market, tools like TradingView can be invaluable for charting and applying technical indicators.

Common Mistakes in Intraday Trading

Intraday trading, with its allure of quick profits, can sometimes lead traders into making errors that can be detrimental to their portfolios. Recognizing and avoiding these common mistakes is crucial for long-term success. Here’s a detailed elaboration on common mistakes in intraday trading:

1. Trading Without a Plan

- Description: Jumping into trades without a clear strategy or set criteria for entry and exit.

- Consequences: This can lead to impulsive decisions, driven by emotions rather than logic, often resulting in losses.

- Solution: Always have a well-defined trading plan that outlines your goals, risk tolerance, and specific criteria for entering and exiting trades.

2. Overleveraging

- Description: Using excessive leverage or borrowed money to amplify potential returns.

- Consequences: While leverage can increase profits, it can also magnify losses, potentially leading to significant financial setbacks or even account liquidation.

- Solution: Use leverage judiciously and understand the risks involved. Ensure you have enough margin to cover potential losses.

3. Ignoring Stop-Loss Orders

- Description: Not setting or adhering to stop-loss levels, hoping that a losing trade will eventually turn profitable.

- Consequences: This can lead to large losses if the asset’s price continues to move in the unfavorable direction.

- Solution: Always set a stop-loss level based on your risk tolerance and stick to it. It’s a protective measure to limit potential losses.

4. Overtrading

- Description: Engaging in excessive trading, either in terms of frequency or volume.

- Consequences: Overtrading can erode profits due to increased transaction costs and can also result from a compulsion to recover losses, leading to further losses.

- Solution: Trade based on clear signals and strategy, not emotions. Quality of trades is more important than quantity.

5. Failing to Conduct Proper Research

- Description: Entering trades based on hearsay, tips, or without adequate research.

- Consequences: Trading without proper research is akin to gambling and can lead to unpredictable outcomes.

- Solution: Always conduct thorough research and analysis before entering a trade. Stay updated with market news and trends.

6. Letting Emotions Drive Decisions

- Description: Making trading decisions based on emotions like fear, greed, or hope rather than logic and analysis.

- Consequences: Emotional trading often leads to poor decisions, such as holding onto losing trades for too long or selling winning trades too early.

- Solution: Stay disciplined, stick to your trading plan, and avoid making decisions based on emotions.

7. Chasing the Market

- Description: Trying to jump into a trend too late or attempting to catch falling knives (buying assets that are rapidly declining in value).

- Consequences: Entering a trend too late can result in buying at the peak or selling at the bottom, leading to losses.

- Solution: Wait for clear signals and confirmation before entering a trade. Avoid the fear of missing out (FOMO).

8. Neglecting Fees and Costs

- Description: Overlooking the impact of transaction fees, brokerage commissions, and other trading-related costs.

- Consequences: High trading costs can significantly erode profits, especially in high-frequency intraday trading.

- Solution: Be aware of all associated costs and factor them into your trading strategy. Consider these costs when calculating potential profits and losses.

9. Over-reliance on Technical Analysis

- Description: Solely depending on technical analysis without considering fundamental factors or broader market sentiment.

- Consequences: While technical analysis is crucial, ignoring fundamentals can lead to missed signals or misinterpretation of market movements.

- Solution: Use a combination of technical and fundamental analysis. Stay informed about broader market news and events.

10. Lack of Continuous Learning

- Description: Assuming that past strategies will always work and not adapting to changing market conditions.

- Consequences: The market is dynamic, and strategies may need to be adjusted over time. Stagnation can lead to reduced profitability.

- Solution: Continuously educate yourself, review your trades, learn from mistakes, and stay updated with market trends.

Conclusion

Intraday trading, with its allure of rapid returns, stands as one of the most dynamic and challenging arenas within the financial world. The potential for significant gains is undeniable, but it’s equally matched by the risk of substantial losses. Success in this domain isn’t just about predicting market movements; it’s about discipline, continuous learning, and meticulous strategy execution.

The world of intraday trading, especially in the realm of cryptocurrencies, is ever-evolving. With markets operating 24/7 and influenced by a myriad of factors ranging from geopolitical events to technological advancements, traders must remain agile and informed. Tools and strategies that work today might need refinement tomorrow. It’s this constant evolution that makes intraday trading both exciting and demanding.

For those aspiring to venture into intraday trading or seeking to enhance their trading acumen, it’s imperative to remember that knowledge is the most potent weapon. Whether it’s through leveraging technical indicators like ATR, staying updated with market news, or learning from past mistakes, continuous growth is the key.

In the end, intraday trading is not just a test of market knowledge but also a test of character. It challenges patience, decision-making, and emotional resilience. But for those willing to navigate its complexities with diligence and discipline, the rewards, both financial and in terms of personal growth, can be truly gratifying.

How to use ATR in intraday trading?

The Average True Range (ATR) measures market volatility. For intraday trading, use ATR to set stop-loss levels by determining a multiple of the ATR value from your entry point. This helps manage risk based on current market volatility.

What time frame is best for intraday trading?

The best time frame varies based on strategy and personal preference. However, commonly used time frames for intraday trading are 5-minute, 15-minute, and 1-hour charts.

What is the best time for intraday trading?

Typically, the first and last hours of the trading day see the most volatility and volume.

Which app is best for intraday trading?

The “best” app can be subjective and varies by region and personal preference. Popular apps include Thinkorswim (TD Ameritrade), MetaTrader 4/5, and Interactive Brokers’ TWS. Always choose based on features, fees, and user reviews.

How to make money in intraday trading?

To make money in intraday trading, focus on a well-defined strategy, continuous research, risk management (like setting stop-losses), and disciplined execution. Regularly review and learn from both successful and unsuccessful trades.

How to select stocks for intraday trading?

Select stocks based on liquidity, volatility, news, and technical indicators. Look for stocks with strong price movements and volume. Using stock screeners and staying updated with market news can also help identify potential candidates.